New Pacific Metals Corp. share price has reached a four-year low, creating a once in decade opportunity for investors seeking to gain exposure to the silver market. At the current share price of C$2.33 the company has a market value of just C$366.95 million, the last time the stock has such an attractive entry point was June 2019.

Significant Progress Made in Four Years

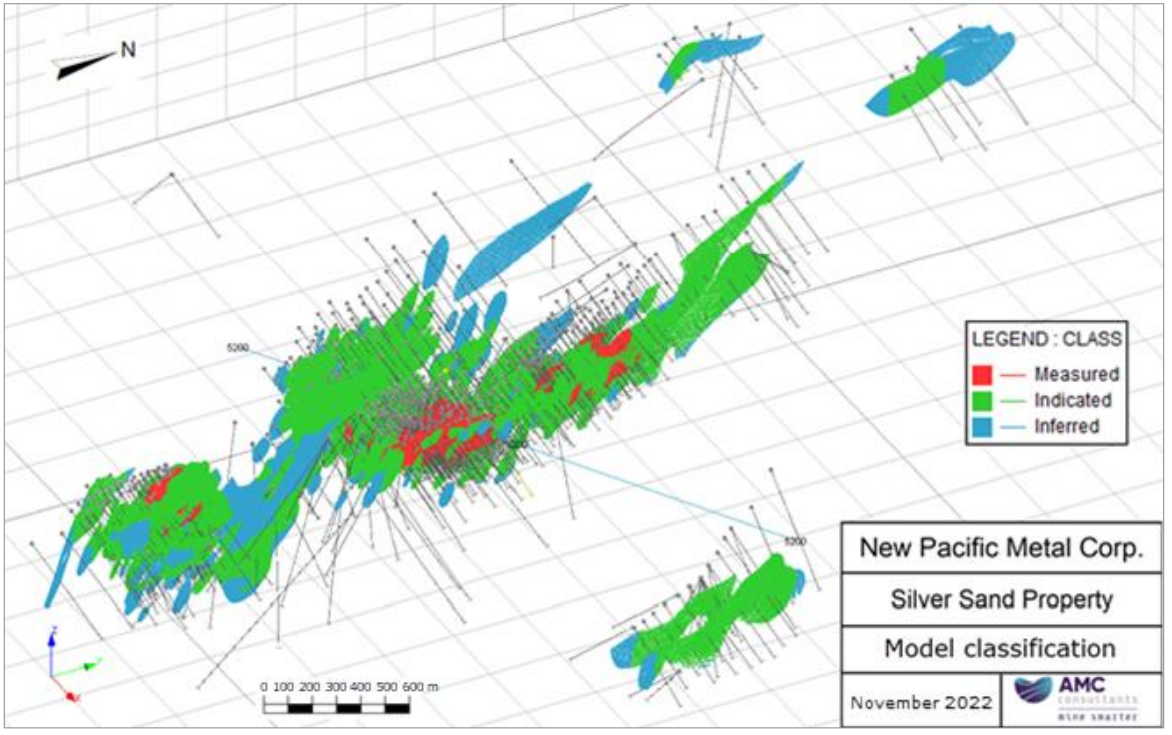

Since the last time the share price was this low, the Company has taken the Silver Sand Project from grass-roots exploration stage to a 214.8-million-ounce silver resource estimate (Figure 1) and completed a preliminary economic assessment (PEA), which defined a post-tax net present value (NPV5%) of US$726 million with a post-tax internal rate of return (IRR) of 39%. These economics used a silver price of $22.50/oz, in line with the current silver price.

Figure 1: Mineral Resources Estimate for the Silver Sand Project

Source: New Pacific Metals Corp.

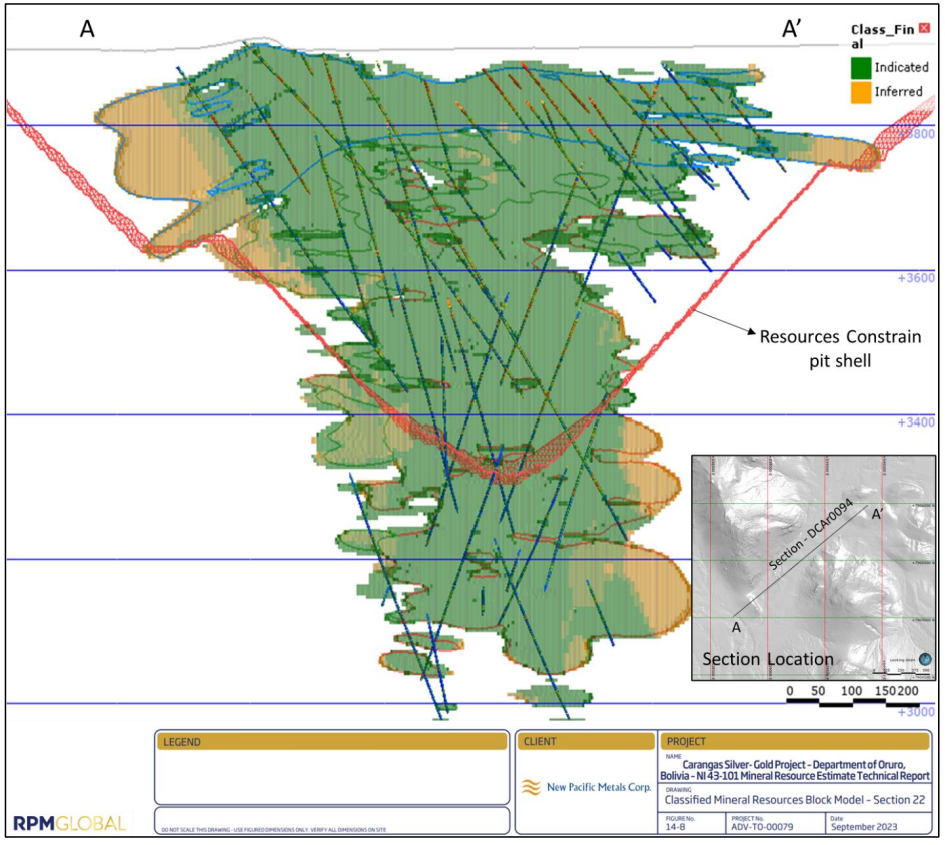

If this was not enough, New Pacific also acquired the Carangas Silver Project, also located in Bolivia, then rapidly made a significant discovery, and advanced this project through to a maiden total mineral resource estimate of 253 million ounces of silver (Figure 2).

Figure 2: Mineral Resources Estimate for the Carangas Silver Project

Source: New Pacific Metals Corp.

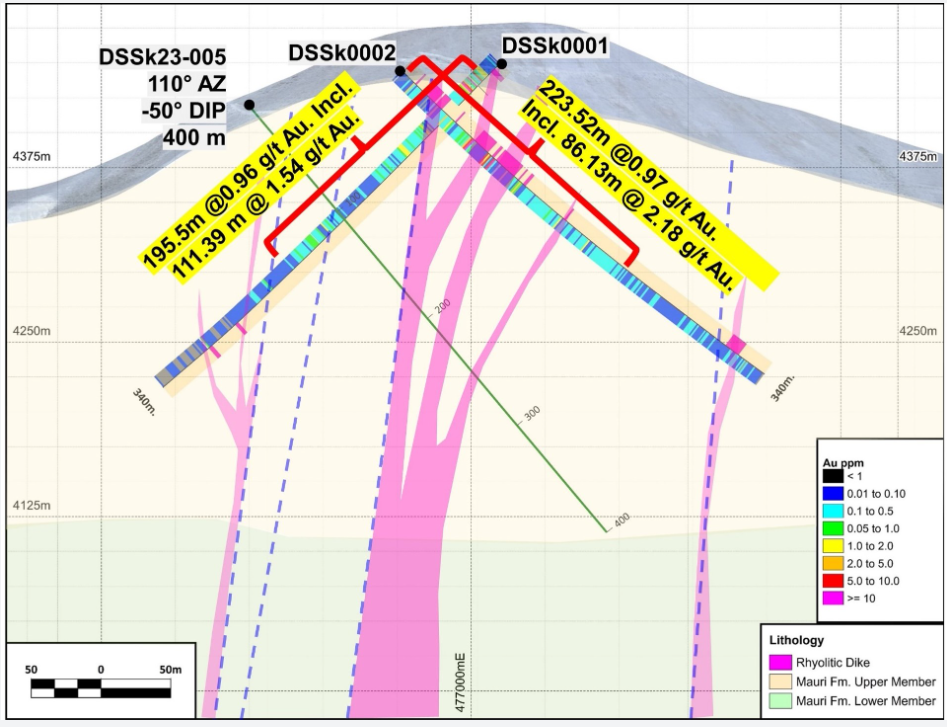

In addition, during the past four years, New Pacific also acquired the Silverstrike Silver Project, also located in Bolivia, for US$1.35 million and has completed an initial 6,000-meter discovery drill programme intersecting broad intersections of gold-silver mineralization in the first two holes.

Figure 3: Initial Drill Results for the Silverstrike Silver Project

Source: New Pacific Metals Corp.

In the intervening four years since the share price was last at this level, New Pacific has completed over 172,000 meters of drilling across its three projects, defined 468 million ounces of silver, as well as graduating from the TSX-V to the TSX stock exchange and dual listed on the NYSE American exchange.

To achieve all this, New Pacific has raised over C$97 million over this four-year period at an average share price of C$3.61 per share, which is well above the current share price of C$2.33.

The Opportunity

This means investors have an opportunity to take advantage of almost a hundred million Canadian Dollars’ worth of exploration and development work and a four-year development time horizon without having to pay or wait for it, as the price currently sits at June 2019 levels.

During the second quarter of 2020, shortly after publishing its maiden resource estimate for the Silver Sand Project, New Pacific’s share price reached a C$6.48 before continuing to raise to an all time high of C$8.50 in early-2021. Since this time the share price has since been dragged down by negative market sentiment to its current level (Figure 4).

Figure 4: New Pacific Metals Corp. Share Price Chart

Source: Google Finance

New Pacific currently trades at 78 cents per ounce of silver in defined resources, which represents extraordinary value, considering that historically the Company has traded at multiples an order of magnitude higher, at around C$6.80 per ounce silver in defined resource.

Fully Funded to Continue to Develop its Projects

New Pacific has just closed a C$35 million brought deal at a price of C$2.65, a significant achievement in a difficult market, and is now well funded to continue to advance its projects. The transaction was supported by existing shareholders and silver mining powerhouses, Silvercorp Metals Inc. and Pan American Silver Corp., which now hold 39% of New Pacific share capital between them.

New Pacific is preparing a pre-feasibility study (PFS) for the Silver Sand Project and moving towards a preliminary economic assessment (PEA) at the Carangas Silver Project, and we expect the company to continue to add value to its world class asset base into 2024.

To read more information on New Pacific’s projects, please visit www.newpacificmetals.com/welcome

Disclaimer

This newsletter has been published by Mining and Metals Research Corporation (“the Company”). The information used to compile the article has been collected from publicly available sources and the Company cannot guarantee the 100% accuracy of those sources. This communication is intended for information purposes only and does not constitute an offer, recommendation, solicitation, to make any investments. Nothing in this communication constitutes investment, legal accounting or tax advice, a personal recommendation for any specific investor. The Company do not accept liability for loss arising from the use of this communication. This communication is not directed to any person in any jurisdiction where, by reason of that person's nationality, residence or otherwise, such communications are prohibited. The Company may derive fees from the production of this newsletter.