Vancouver-based New Pacific Metals (NYSE-A: NEWP |TSX: NUAG) is set to deliver its second punch in a one-two-three combination of precious metal projects.

The young company is turning heads with its prized Bolivian properties.

In July, it was named one of the Top 10 Canadian Precious Metals Juniors by The Northern Miner magazine. The magazine points to New Pacific’s approximately $500- million (CAD) market cap, and noted that its flagship project Silver Sand has the potential to be one of the world’s largest silver mines.

Silver Sand certainly deserves recognition, with estimates of an openpit mine delivering 12 million ounces per year of high-grade silver for 14 years. That is about 168 million ounces of much-needed silver over the life of the mine, which is already in the permitting stage.

Now, New Pacific is set to release the inaugural mineral resource estimate (MRE) for its second project, Carangas. Like Silver Sand, Carangas is part of a freakish geological region in which high-grade silver rests nearly at the surface.

Initial results for the Carangas system have been promising. Since July 2021, 180 exploratory drill holes revealed a 1000m x 800m silver horizon nestled over a broad gold zone. After the initial discovery, finding additional mineralization has been relatively straightforward. Every one of the drill holes intercepted near-surface, high-grade silver. And drill holes in the Central Valley area continuously hit gold beneath the silver.

With NUAG’s share price hovering around the USD $2.30 mark, investor and mining Portfolio Manager John Feneck believes it is undervalued. He remembers being at a dinner in November 2022, with the company founder and CEO Dr. Rui Feng. Feng has been in the mining industry for more than a quarter-century, and has founded numerous successful companies.

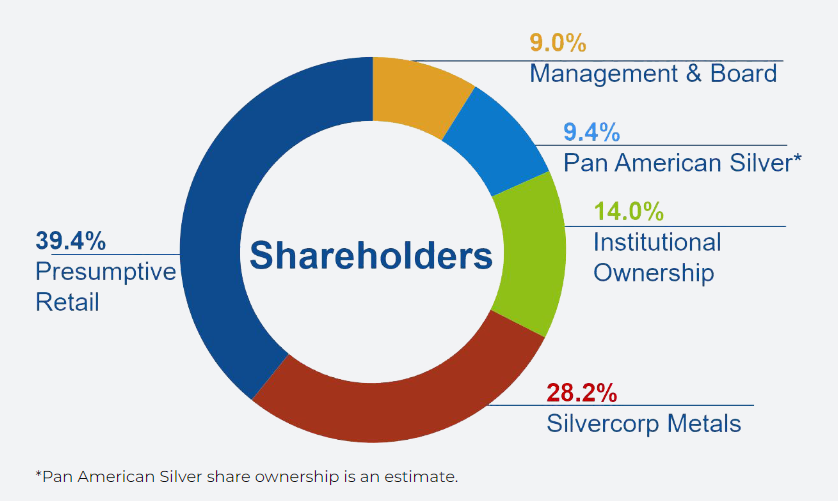

“I saw Dr. Feng had a 7% stake in the company. One of my other holdings, Pan American (PAAS), has a 9.4% share, and Silvercorp (SVM) has a 28% interest,” says Feneck. “So, that’s three pretty smart entities owning quite a lot of the shares outstanding. That always gets me interested.”

Management having skin in the game is just one of the reasons Feneck decided to put his own money into New Pacific. He says the company ticks all his boxes when it comes to deciding whether to invest – mineralization, management, and messaging.

Management having skin in the game is just one of the reasons Feneck decided to put his own money into New Pacific. He says the company ticks all his boxes when it comes to deciding whether to invest – mineralization, management, and messaging.

“I was looking for inexpensive silver companies with a lot of ounces in the ground, plus experienced management with proven success in making money for their shareholders, and the ability to communicate their message. When I get ghosted by a company – especially in a market like this – it’s a big red flag to me.”

“But the people at New Pacific are dialed in; they are engaging shareholders, they are getting back to people in a timely fashion.”

The third project in New Pacific’s three-punch Bolivian combo is Silverstrike, located near La Paz.

The 44.5-square-kilometre land package shows mineralization similar to Carangas – with gold underlying a solid silver deposit.

“The big project is Silver Sand, but they also have Carangas and Silverstrike that are getting no credit from the market,” Feneck says. “As a value manager, we like that. We like well-diversified stocks that fly under-the-radar.”

Feneck speculates that there may be hesitation among investors to fully embrace the projects because all three are in Bolivia, which has a reputation of being an unpredictable jurisdiction. He advises investors to do some research, though, as he did.

“I was pretty much wrong about Bolivia. It’s got risk, but it’s got less risk than I expected.”

Recent foreign investment echoes that sentiment. Since January, Bolivia has signed three major agreements with foreign companies, ready to tap into the country’s huge but largely undeveloped lithium resources. With alternative energy markets searching for mineral sources, Bolivia has a lot to offer – including a government willing to negotiate.

“I don’t mind investing in jurisdictions that are misunderstood,” Feneck adds. “When you’re looking for value, sometimes there is a discount because of the perception of a particular jurisdiction. I think it’s important for investors to do their own homework about Bolivia. It seems to be a supportive jurisdiction of mining companies.”

But it is a tough market these days. Global events such as the crash of three U.S. banks earlier this year, and the continuing war in Ukraine have shaken investors’ confidence worldwide. In August, another world event looms as state leaders of BRICS (Brazil, Russia, India, China, and South Africa) will meet in Johannesburg (August 22- 24). A push for an alternative currency to challenge the U.S. dollar’s domination will be on the table again.

“Why wouldn’t you want to get in ahead of that meeting?” Feneck says. He notes that it is difficult to know the perfect time to buy into a mining stock, but suggests with NPM it may simply be a case of buying more than once.

“It’s just that many investors buy a stock once or twice. Then they may forget about it, or want to complain about their original entry point. In our view, you have to buy something over and over again in this sector to get a reasonable blended cost. We believe in “buy low(er) and sell high(er).” We may never catch the lowest low and the highest high. That’s how you make money.”

The news of the Carangas MRE being released in Q3 2023 is another reason to get in now, Feneck says. Initial drill data certainly hint at exciting results, and with the rest of the world realizing Bolivia’s vast resources, it’s an ideal time to invest in New Pacific Metals.

Click here to view a drone video of New Pacific Metals’ three projects.

Click here to access drill results and additional information.