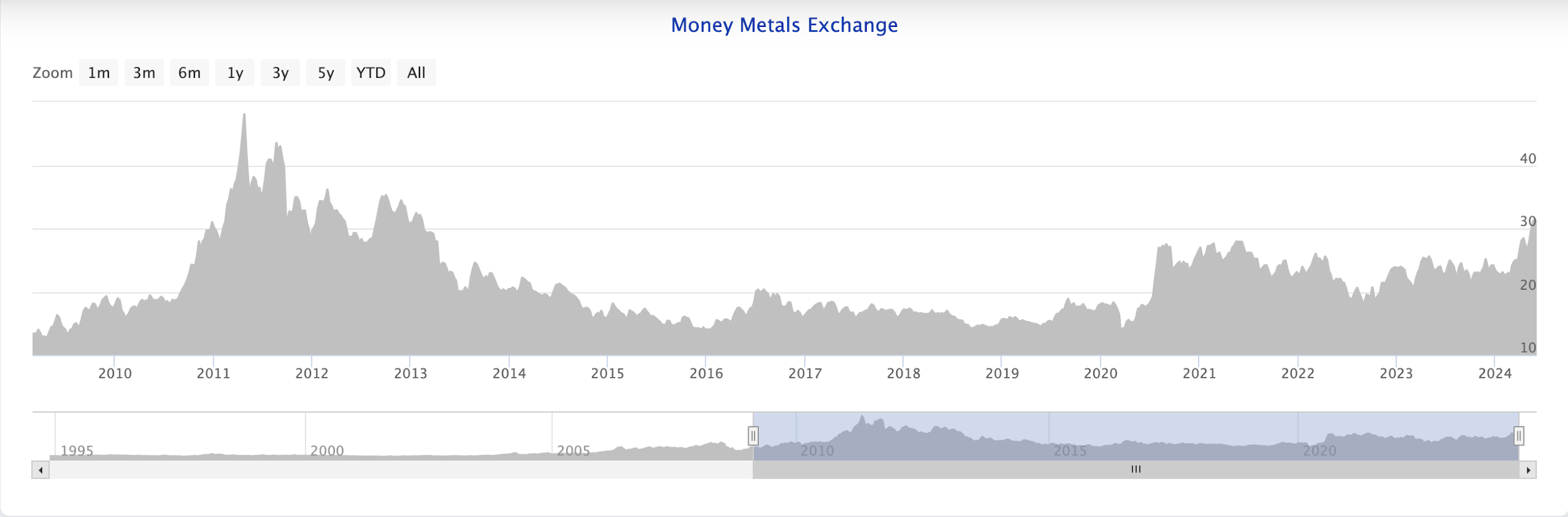

Last month, silver cracked the key resistance of $30 an ounce level for the first time in over a decade.

It’s been quite a bull run for silver, and Chen Lin thinks it has plenty of legs left.

Lin is the founder of Lin Asset Management, and during a recent interview with Kitco News, he focused on two factors that could see silver push toward record levels.

As Lin noted, the last time silver broke $30 (2011), after a minor consolidation, it quickly ran up to $50 an ounce.

Lin focused on two factors in place that could quickly drive the price of silver higher.

The first is the movement of silver from West to East, similar to the trend we’ve seen in gold.

Lin points out that silver stocks at the Shanghai Futures Exchange have fallen to a 10-year low.

Meanwhile, investment demand for silver in China exploded recently with the silver premium in the Shanghai market running about 10 percent over New York.

We saw a similar phenomenon for gold in China late in 2023, right before the big price rally in the yellow metal.

“That means massive silver will be going from the West to the East, just like gold and we should see a continued sharp rally in the silver price.”

Lin said Chinese investors are turning to gold and silver as a way to cope with negative real interest rates and sagging equity prices.

“Since the second half of last year, the Chinese buyer has been buying gold. We see the gold premium of Shanghai over New York, which means gold has been getting into China – smuggled into China. People smuggle gold into China right now as we are speaking. They have been consistent over the past year. Silver just got started. … I expect this to last for a very long time.”

China isn't the only Asian country with a growing appetite for silver. India imported more silver through the first four months of 2024 than it did in the entirety of last year due to higher solar panel demand and investor optimism.

A second factor is a global silver supply squeeze.

Silver demand outstripped supply for the third straight year in 2023, leading to a significant structural supply deficit of 184.3 million ounces. This came on the heels of a 2022 production shortfall that the Silver Institute called “possibly the most significant deficit on record.” It also noted that “the combined shortfalls of the previous two years comfortably offset the cumulative surpluses of the last 11 years.”

This silver supply shortage has continued into 2024.

Lin noted that the silver supply gap is as big or bigger than the one that occurred in the 1950s.

“If you recall what happened in 1960s, we ran out of silver, so we stopped minting the silver coin.”

Lin was referring to the removal of silver from U.S. quarters, dimes, and half dollars in 1965.

The current supply squeeze won’t likely abate any time soon. A boom in industrial demand driven by the solar sector is pushing overall demand higher at a rapid rate.

According to Lin's data, two years ago, the solar industry silver offtake was around 100 million ounces. In 2023, the sector consumed about 200 million ounces. Lin projects demand approaching 300 million ounces in 2024.

Chinese silver industrial demand rose by a remarkable 44 percent to 261.2 million ounces last year, primarily due to growth in demand for green applications.

According to a research paper by scientists at the University of New South Wales, solar manufacturers will likely require over 20 percent of the current annual silver supply by 2027. By 2050, solar panel production will use approximately 85–98 percent of the current global silver reserves.

Lin pointed out that Microsoft just went solar. The company needs a tremendous amount of power to run its rapidly expanding AI business. This could drive the silver deficit to as much as 500 million ounces, a number Lin called “scary.”

“If everybody follows Microsoft’s lead and turns to solar, we will have a much bigger deficit.”

As Lin describes it, we're heading into a period of high demand and short supply that could quickly push the price of silver even higher. Lin projects we could see silver surpass the record of $50 an ounce very quickly. And even if we don't see record prices in the coming months, the outlook for silver is positive.