On Monday, the dollar rose from 1.16 grams silver, to 1.26g.

Conventional monetary thinkers believe that the dollar can be measured either in terms of the euro, pound, yuan, etc. Or in terms of consumer prices.

But these are not units of measure.

And that’s because consumer prices are subject to huge forces pushing them both up (rising costs of compliance) and down (falling interest rates, and rising efficiency).

Using consumer prices to measure the value of the unit of exchange is like using the height of a seagull (or a flock of them) to measure the elevation of a boat that’s tossing in the waves, while slowly sinking.

The other currencies are dollar-derivatives. You wouldn’t use GOOG December call options to measure GOOG, would you? You wouldn’t try to literally lift yourself by your own bootstrap.

Yet it’s fashionable to sagely nod that “the dollar went up” on a day when the peripheral currencies fell.

This Topsy-Turvy World

In the regime of irredeemable currencies, up is down, war is peace, and ignorance is bliss.

Did we mention stocks are at a record high and GDP is forecast to approach the Panglossian Best of All Possible Worlds by 2021?

The Sun, not the Earth, is at the center of the solar system. And gold, not the dollar, is at the center of the economic value system (and silver is gold’s younger cousin).

And Now, The Silver Market

For the sake of simplicity of expression in a world dominated by dollar thinking, we’ll say that the price of silver dropped around 7.5% on Monday.

A rise in the dollar from 1.163 to 1.257 is a gain of 8.1%. This is mathematically the same as saying silver fell 7.5%.

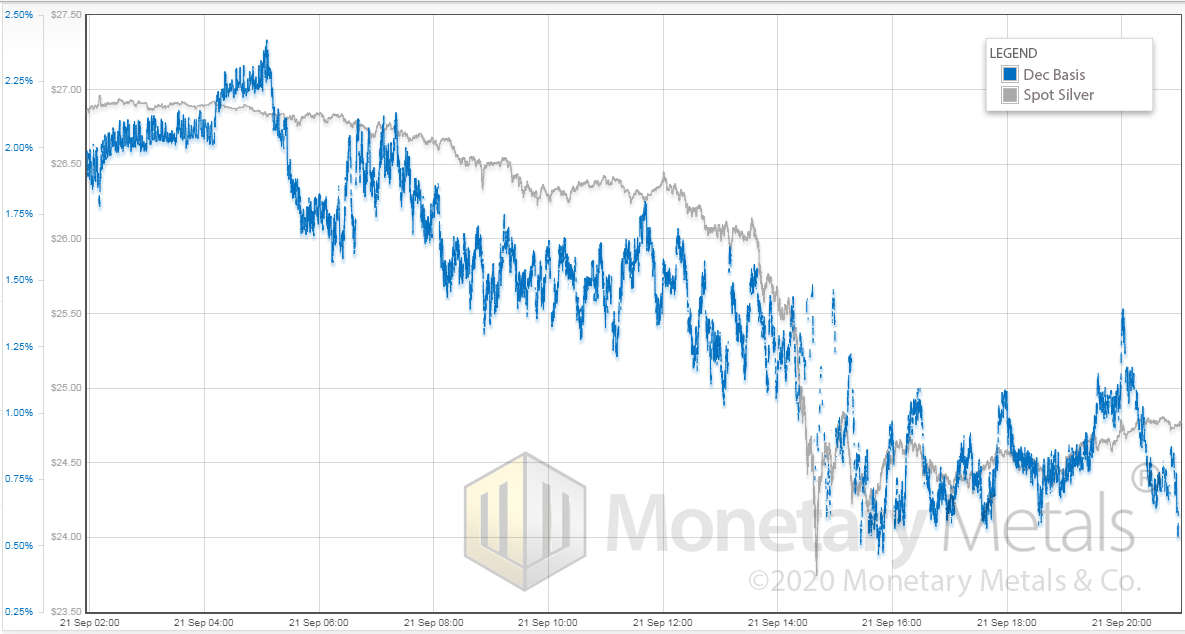

To understand why, let’s look at the intraday chart of the silver price overlaid with the (December) basis.

The first feature is the rise in the basis after 2:00am (London time) to around 5:00. The basis goes up from around 1.9% to 2.4%. This is during a period when the price fell slightly.

A rising basis with falling price means that physical is being sold.

Then, the price begins falling, gradually at first. And gets steeper until the full-blown crash beginning around 13:30.

During the action most of the day (after the early morning anomaly), the basis correlates with the price. That is, the selling is led by the futures market. The day began with a basis around 1.9% and ended around 0.6%.

The Key Question

So what’s the follow-through?

If the price stays down and the basis goes back up, that’ll be a bearish signal. If the basis stays down, that means the silver market is markedly tighter at $24.50 than it was at $26.75.

Meanwhile, Monetary Metals' clients continue to earn interest on their silver - paid in silver! - regardless of market fluctuations.

© 2020 Monetary Metals