REMEMBER THIS

1. Silver investors outnumber the Silver riggers. Keep this in mind when reading this article.

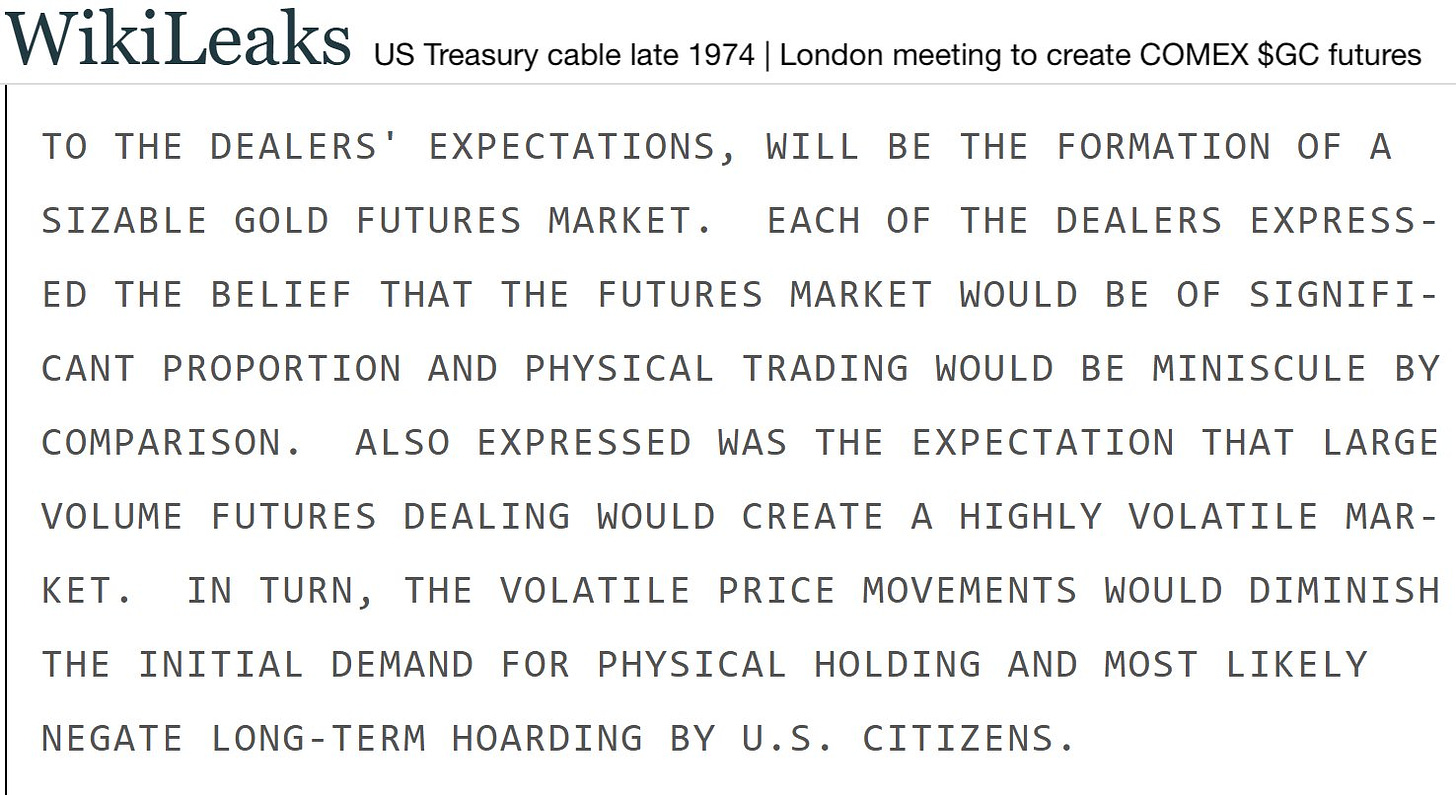

2.Keep in mind that gold futures market (and silver) was invented to demoralize Silver investors.

3. It was an intentional act to trick you into not buying silver.

If you have any competitive spirit or fight in you. This should make you want it more right?

Our Main Themes

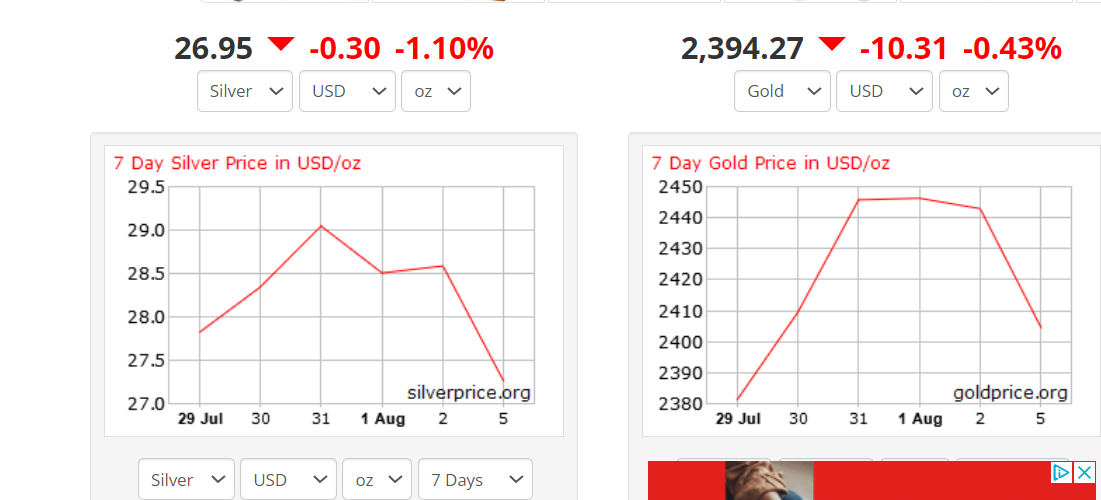

When Silver goes up, we cheer.

When Silver is under pressure, we not only cheer but also seize the opportunity of the discount. This is the silver squeeze, a testament to the working class's resilience and their ability to challenge market norms. It's about ordinary people taking control of their financial destiny, saying, "Be Unbanked," "Become your own bank," or "Fight the Fed with Silver."

The silver price is rigged by industrialists and bankers who trade on CRIMEX on COMEX, a paper market where one year of global mining volume can be transacted in a day.

We call this the paper-to-physical ratio.

So, for every ounce of physical Silver, there are often 400 paper versions of silver futures (no one has to stand for delivery).

The military-industrial complex devoured most of the World's Silver, as proven here (this is similar to why we have seen the Biden regime drain the Strategic Petroleum Reserve)

However, what sets Silver apart is its industrial significance. Its unique properties-ductility, malleability, reflectivity, corrosion resistance, thermal and antimicrobial properties-make it indispensable.

Notably, it's the top-ranked metal for CONDUCTIVITY, making it a crucial component in various industries.

Silver batteries are the preferred choice in space, air, and sea operations. Their ability to hold a potent charge for extended periods, coupled with their corrosion resistance and reliability, make them indispensable. After all, you can't just swap out a battery when you're thousands of feet underwater or orbiting in space.

You cannot switch out a battery when a torpedo or submarine is parked thousands of feet underwater or orbiting in space.

You can review our past archives (over 20 articles) to learn why the Department of Defense stopped reporting their silver use, drained the strategic stockpiles, and closed The US Bureau of Mines to cover up the entire scheme. (once is happenstance, twice a coincidence, third instance A PATTERN)

You can also learn about the USGS scam and the worthless template the Silver Institute and Metals Focus use to confuse investors.

It's also worth your time to research the Wikileaks cable, in which "inventors of the Silver futures trade" intentionally introduced volatility to demoralize investors and discourage silver investors from holding.

Silver was removed from coins because the military needed it, while the US Treasury and Federal Reserve had to debase the currency to fulfill their obligatory and historical role as Fiat overlords (with a monopoly on the money supply), infecting the villagers with inflation.

So it's like the Military Industrial sword cutting twice, it cuts on one side stealing Silver from the people, then cuts again to infect the villagers with inflation (the paper money paying for 251 wars since 1991)

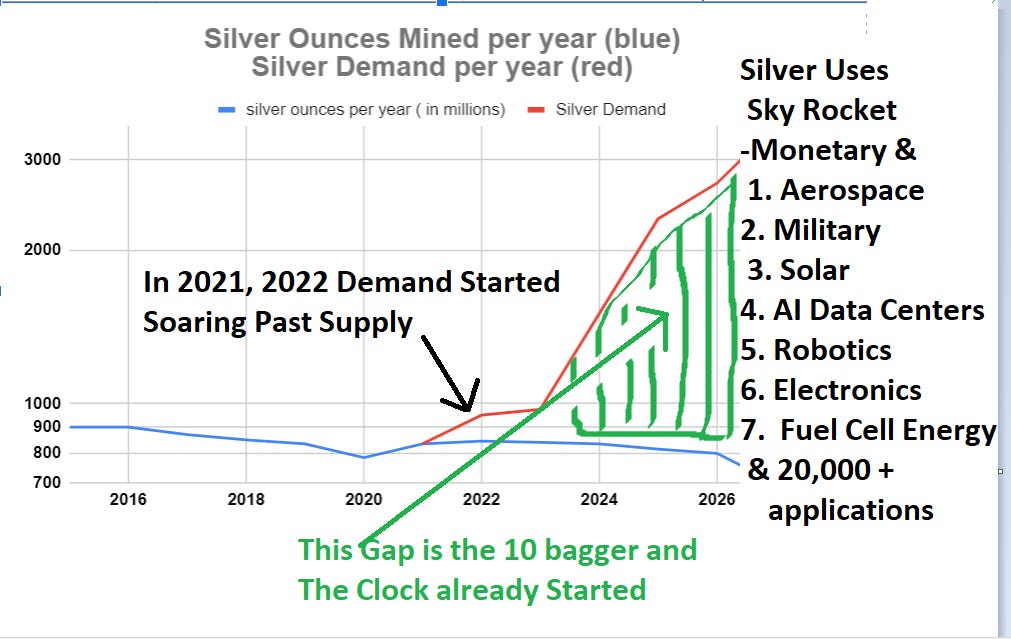

Many of these events happened decades ago, and since then, the supply-demand dynamics have intensified in favor of silver investors. This intensification underscores the urgent need for immediate action in the silver market.

- There have been no new significant silver discoveries.

- Meanwhile, industrial sectors are rapidly increasing (military, satellites, space stations, AI data centers, solar energy, EV, Fuel cell energy, robotics, and over 20,000 other applications)

- Since Silver is the #1 energy transmitter, it's crucial to understand that everything we do in the modern world requires Silver. This knowledge enlightens us about the indispensable role of Silver in our industries. Industrialists want low factory inputs, so they use their influence as bankers (dual role) while working 24/7 to maximize their profits by rigging their factory inputs to the downside.

- Because of the unintended consequences of Sanctions, they didn't anticipate this: The West has lost control of long-term prices.

- BRICS and Shanghai Gold Exchange becoming Jeff Christian's and the Silver Institute's worst nightmares.

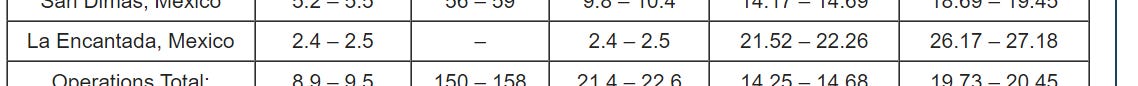

See how the cost of production is too close to spot price in this Mexico silver mine?

This is why we have warned you dozens of times to avoid Mexico for 2 reasons listed below

the last column shows AISC often above spot price of Silver meaning that Silver Supply will Crash to UNOBTANIUM BY 2025.

During this Black Monday Crash, our endorsements are holding in their ok.

All of our endorsements (for the year way above the S&P 500)

The Mexico Problem is playing out just like we told you it would!

Mexico is the #1 silver-producing country, but any fool can see that the cost of production in Mexico is too close to the spot price, which will put significant downward pressure on bringing new supply to a world where Silver is already on the Brink of Extinction.

- First Majestic's latest reports show that the All-in-Sustaining Cost at La Encantada Mexico Mine is way too high, often running above the spot price of Silver. Ouch.

- Also, Mexico's last two presidential administrations in Mexico are in serious talks about concrete steps under the philosophy that the mineral resources of Mexico belong to the people of Mexico (We were first to release the Fuerza Popular or Popular Force manuscript where the campesinos, laborers, intellectuals, activists and grassroots are called to be "Guardians of the Territory")

Even after the Silver bloodbath (rigged) over past few days our endorsements hanging in there fine and dandy.

Outcrop Silver endorsed by Silver Academy

Mexico Problem below, Endeavor Silver down 33% in past 5 days

Concluding thoughts

Mexico, the world's leading silver producer, has experienced a significant decline in production, with output dropping over 25% in the past 18 months.

This trend is expected to worsen due to high production costs in Mexico and Mexico dog whistling NATIONALIZE

Countries like US, Canada, Morocco, Columbia, Peru, and Bolivia (Andean Precious Metals relies on small-scale artisanal miners.) are much safer jurisdictions than Mexico and the Market is taking notice (see graphic above)

The silver market has been in a structural deficit for four consecutive years, and this situation is becoming more critical due to rapidly increasing demand.

Silver is essential for various high-tech industries, including solar energy, military applications, AI data centers, robotics, Fuel Cell Energy, space stations, satellites, and 5G technology.

With supply constraints and surging demand, silver is facing a serious shortage. The combination of declining production in Mexico and the metal's critical role in emerging technologies proves Silver is approaching a point of severe scarcity in the near future.

Further Reading

Read the manuscript titled “Guardians of the Territory” and Mexico’s Manifesto to Nationalize their Silver.

This is also why we picked Andean Precious Metals. Bolivia already nationalized (our emphasis)

Silver Mining: Morocco is Open for Business While Mexico is Teetering Towards Nationalizing

Aug 1