With another week of consolidation in the books, it is looking increasingly likely we will see a break soon. Whether this is to the upside or downside remains to be seen. If it is to the downside, it will be short-lived and could present the last opportunity before the train really leaves the station. Beyond the very-short term, precious metal prices are headed higher, much higher.

There are a number of potential catalysts for the price of precious metals over the coming months including the US election, likely additional QE measures to be undertaken by the Fed, another stimulus bill, which could be very significant, and of course the inflationary measures that other countries will be implementing.

Note: We have launched the GoldSeeker subscription service and will keep introductory pricing for the next 6 or so weeks. You get a 30-day trial period to decide whether this service benefits you and your investing needs. If not, sign up for our free letter @ GoldSeeker.com.

$USAS, $BTG, $GBR.V, $HIGH.V, $KL, $LGD.TO, $MAG, $ME.TO, OIII.V, $OGC.TO, $ROXG.TO, $SKE.TO, $WM.TO, $AUY

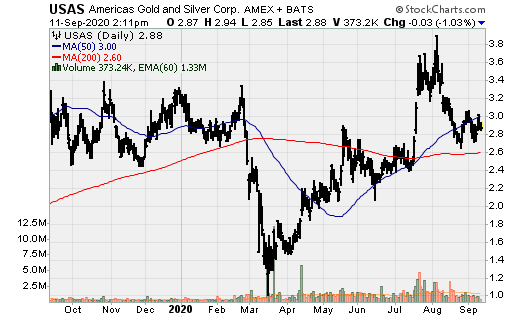

America’s Gold & Silver: Provided an update regarding the ramp-up of its flagship asset, Relief Canyon. After placing ore on the 6W leach pad in early August, leach solution grade from the pad has increased substantially. This should continue and improve the consistency of the heap performance and reduce operating costs. The company is still targeting Q4 for commercial production to be achieved. There have been some start-up issues at Relief Canyon but it looks as if things are getting back on track.

https://goldseek.com/article/gold-seeker-report-30-week-mining-multiple-catalysts-horizon

September 12, 2020