- Results received from three holes at the Main Fault target.

- The first hole of the 2025 program extended mineralization 90 m downdip from 2024 discovery intersections.

- 5 additional holes to be reported.

Vancouver, BC – TheNewswire - November 17, 2025 – Silver North Resources Ltd. (TSX-V: SNAG, OTCQB: TARSF) “ Silver North ” or the “ Company ”) announces that the Company has received results from the first three holes completed during the 2025 exploration program at its flagship Haldane Silver Property in the historic Keno Hill Silver District, Yukon. Results include 3.2 metres averaging 2014 g/t silver, 1.72 g/t gold, 4.73% lead and 1.1% zinc within a larger 13.15 metre intersection of 818 g/t silver, 1.39 g/t gold, 2.54% lead and 0.98% zinc. A total of eight holes (totalling 1,759.5 metres) were completed in the 2025 program. The road-accessible 8,579 hectare Haldane Property is located 25 km west of Keno City, YT, adjacent to Hecla Mining’s producing Keno Hill Silver Mine property, and hosts numerous occurrences of silver-lead-zinc-bearing quartz siderite veins resembling the ore-bearing veins being mined at Keno Hill.

“We are extremely pleased with the results of the 2025 program so far, highlighted by the 90 m downdip step out from last year’s discovery holes at the Main Fault,” stated Jason Weber, P.Geo., President and CEO of Silver North. “The width and grades of the mineralized portion of the structure at the Main Fault continue to impress: HLD25-31 is the best hole drilled on the property to date. We saw some indication of higher gold grades with some portions of the mineralized structure in 2024. With this downdip hole, we are seeing consistent high-grade silver with significantly higher gold concentrations than seen at other targets on the property.”

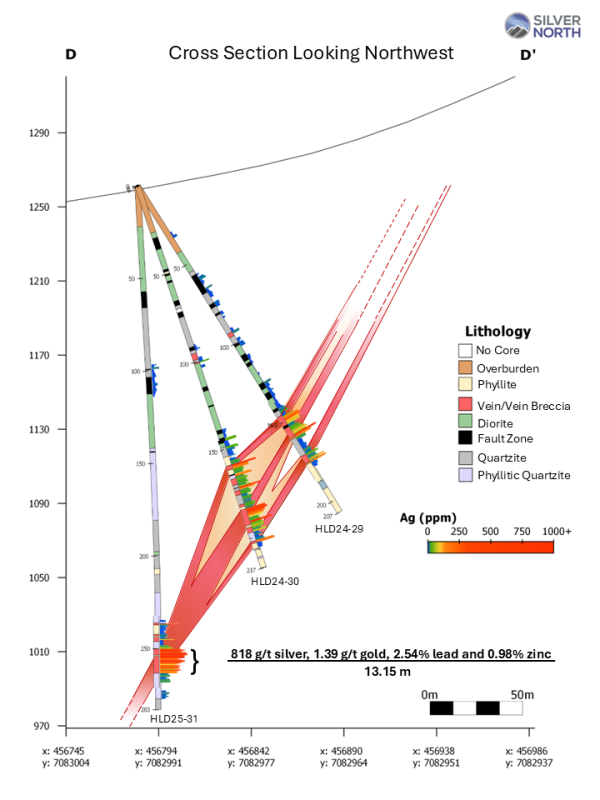

HLD25-31 was drilled from the same pad as the 2024 discovery holes at the Main Fault (see news release dated November 14, 2024). The hole intersected the Main Fault approximately 90 m downdip from HLD24-30, yielding a 13.15 m mineralized intersection averaging 818 g/t silver, 1.39 g/t gold, 2.54% lead and 0.98% zinc from 249.9 metres down hole. A sub-interval of this mineralization averaged 2014 g/t silver, 1.72 g/t gold, 4.73% lead and 1.1% zinc over 3.2 m from 251.8 m, while another sub-interval starting at 256.1 m averaged 1112 g/t silver, 4.61 g/t gold, 7.11% lead and 1.51% zinc over 1.25 m. The HLD25-31 intersection appears to indicate a steeping of the structure versus the apparent dip in holes HLD24-29 and 30. Additionally, the elevated gold grades observed in the hanging wall intersection of HLD24-30 are observed throughout the entire 13.15 m interval. As with other intersections at the Main Fault and elsewhere on the Haldane property, mineralization consists of siderite +/- quartz, galena and sphalerite veins and breccias, as well as strongly faulted and ground up vein and vein breccia material.

Table 1: 2025 Drilling – Significant Results

|

Hole |

From (m) |

To (m) |

Interval (m) |

Ag (g/t) |

Au (g/t) |

Pb (%) |

Zn (%) |

Silver Eq1 |

|

HLD25-31 |

249.90 |

263.05 |

13.15 |

818 |

1.39 |

2.54 |

0.98 |

896 |

|

incl |

251.80 |

255.00 |

3.20 |

2014 |

1.72 |

4.73 |

1.10 |

2055 |

|

incl |

256.10 |

257.35 |

1.25 |

1112 |

4.61 |

7.11 |

1.51 |

1446 |

|

|

|

|

|

|

|

|

|

|

|

HLD25-32 |

153.00 |

175.65 |

22.65 |

160 |

0.23 |

0.75 |

0.80 |

187 |

|

incl |

165.10 |

171.60 |

6.50 |

326 |

0.19 |

0.81 |

1.30 |

346 |

|

and incl |

169.00 |

169.80 |

0.80 |

1438 |

0.51 |

2.78 |

1.60 |

1428 |

|

|

|

|

|

|

|

|

|

|

|

HLD25-33 |

193.49 |

199.05 |

5.56 |

176 |

0.11 |

1.33 |

1.96 |

224 |

|

incl |

195.35 |

197.80 |

2.45 |

311 |

0.17 |

1.51 |

3.27 |

376 |

1 Silver-equivalent values are calculated assuming typical recoveries based on metallurgical studies conducted on a range of analogous epithermal vein deposits and are not necessarily reflective of metallurgy on the property. No metallurgical work has been reported on the property. The recoveries used are 92% silver, 70% gold, 88% lead and 70% zinc. The silver – equivalent formula: using the formula: ((35 * silver (g/t)*0.92 / 31.1035) + (3000 * gold (g/t)*0.70 / 31.1035) + (1.00 * 2204 * lead %*0.88/100) + (1.20 * 2204 * zinc %*0.70/100)) *(31.1035 / 35). Metal price assumptions are US$35/oz silver, US$3,000/oz gold, US$1.00/lb lead and US$1.20/lb zinc. True widths are unknown.

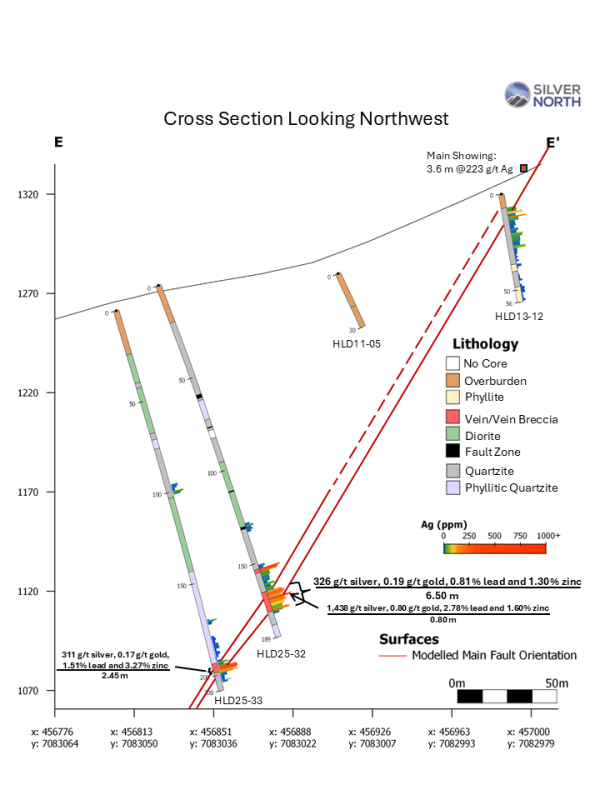

HLD25-32 and 33 were drilled to test the Main Fault on a section 50 metres to the northeast of the HLD24-29 and 30, and HLD25-31 section. These holes successfully extended the breadth of silver-lead-zinc mineralization. HLD25-32 intersected 6.5 metres averaging 326 g/t silver, 0.19 g/t gold, 0.81% lead and 1.3% zinc from 165.1 metres including 0.80 m averaging 1,438 g/t silver, 0.51 g/t gold, 2.78% lead and 1.6% zinc. This is hosted within a broad 22.65 metre-wide mineralized zone averaging 160 g/t silver, 0.23 g/t Au, 0.75% lead and 0.80% zinc from 153.0 metres down hole.

HLD25-33 intersected the Main Fault approximately 45 m downdip of HLD25-33, yielding 2.45 m of 311 g/t silver, 0.17 g/t gold, 1.51% lead and 3.27% zinc within a 5.56 m interval of 176 g/t silver, 0.11 g/t gold, 1.33% lead and 1.96% zinc from 193.49 m down hole.

Table 2: 2025 Drilling – Collar Location Data (NAD83, UTM Zone 8)

|

Hole |

Depth (m) |

Easting (m) |

Northing (m) |

Elevation (m) |

Azimuth |

Dip |

|

HLD25-31 |

282.9 |

456783 |

7082994 |

1261 |

104 |

-86 |

|

HLD25-32 |

189.0 |

456829 |

7083057 |

1274 |

130 |

-68 |

|

HLD25-33 |

208.4 |

456783 |

7082994 |

1261 |

63 |

-67 |

|

HLD25-34 |

203.0 |

456762 |

7082948 |

1258 |

105 |

-54 |

|

HLD25-35 |

207.0 |

456762 |

7082948 |

1258 |

105 |

-71 |

|

HLD25-36 |

210.0 |

456762 |

7082948 |

1258 |

63 |

-55 |

|

HLD25-37 |

171.0 |

456729 |

7082904 |

1263 |

104 |

-62 |

|

HLD25-38 |

220.3 |

456776 |

7082990 |

1265 |

125 |

-74 |

The Company is now waiting for the analytical results from the five remaining holes completed in the 2025 program. The five remaining holes tested the Main Fault on sections 50 and 100 metres southwest of the hole 29/30/31 section.

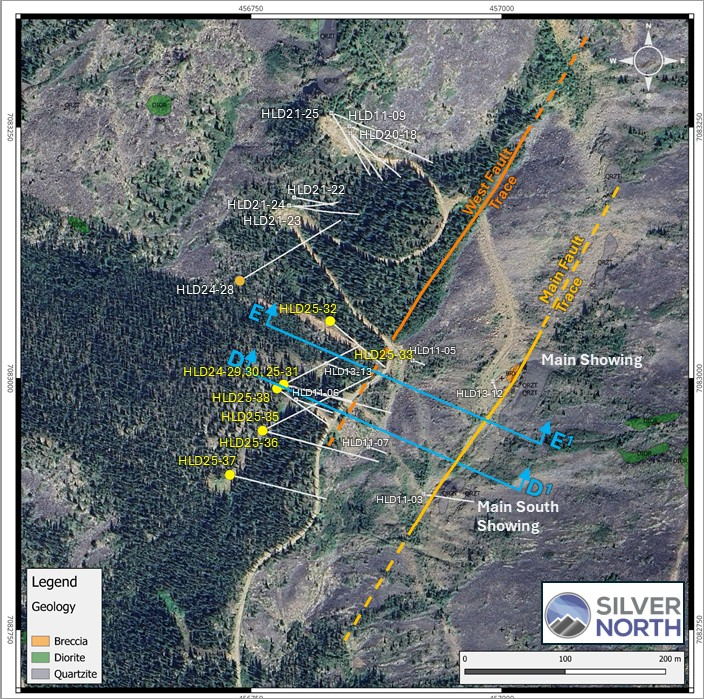

Figure 1: Drill Hole Plan Map

Figure 2: Section D-D’

Figure 3: Section E-E’

Quality Assurance / Quality Control and Sampling Procedures

All diamond drill core from the 2025 program at the Haldane project was logged, photographed, and sawn in half using a diamond blade core saw. One half of the core was submitted for geochemical analysis, while the other half was retained in secure storage for reference. Sampling intervals were determined based on geological boundaries and typically ranged from 0.3-1.5 metres. Control samples comprised approximately 20% of all samples submitted, including certified reference standards, analytical blanks, field duplicates, preparation duplicates and analytical duplicates. QA/QC results were reviewed in real time, and all data have been verified as meeting acceptable thresholds for accuracy, precision, and contamination before inclusion in this release.

During the field program, all samples were secured on site and delivered to ALS Minerals in Whitehorse, Yukon. All samples were prepared at ALS Minerals in Whitehorse before being transported to the ALS laboratory (an independent ISO/IEC 17025 certified laboratory) in North Vancouver, British Columbia for analysis.

Samples are dried, weighed, and crushed to at least 70% passing 2mm, and a 250 g split is pulverized to at least 85% passing 75 μm (PREP-31). All samples are analyzed using a four-acid digestion and ICP-MS methods (ME-ICP61 and ME-MS61). Over-limit analyses for silver (>100 ppm), lead (>10,000 ppm), and zinc (>10,000 ppm) are re-assayed using an ore-grade four-acid digestion and ICP-AES (ME-OG62). Samples with over-limit silver assays > 1500 ppm are analyzed by 30-gram fire assay with a gravimetric finish (Ag-GRA21). Gold is assayed by 30-gram fire assay and AAS (Au-AA23).

About Silver North Resources Ltd.

Silver North’s primary assets are its 100% owned Haldane Silver Project (next to Hecla Mining Inc.’s Keno Hill Mine project), the Tim Silver Project (under option to Coeur Mining, Inc. in the Silvertip/Midway District, BC and Yukon) and the GDR project also in the Silvertip/Midway district. Silver North also plans to acquire additional silver properties in favourable jurisdictions.

The Company is listed on the TSX Venture Exchange under the symbol “SNAG”, trades on the OTCQB market in the United States under the symbol “TARSF”, and under the symbol “I90” on the Frankfurt Stock Exchange.

Mr. Jason Weber, P.Geo., President and CEO of Silver North Resources Ltd. is a Qualified Person as defined by National Instrument 43-101. Mr. Weber supervised the preparation of the technical information contained in this release and approved the news release.

For further information, contact:

Jason Weber, President and CEO

Sandrine Lam, Shareholder Communications

Tel: (604) 807- 7217

Fax: (888) 889-4874

To learn more visit: www.silvernorthres.com

X: https://X.com/SilverNorthRes

LinkedIn: https://www.linkedin.com/company/silvernorth-res-ltd/

NEITHER THE TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN THE POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE. STATEMENTS IN THIS NEWS RELEASE, OTHER THAN PURELY HISTORICAL INFORMATION, INCLUDING STATEMENTS RELATING TO THE COMPANY'S FUTURE PLANS AND OBJECTIVES OR EXPECTED RESULTS, MAY INCLUDE FORWARD-LOOKING STATEMENTS. FORWARD-LOOKING STATEMENTS ARE BASED ON NUMEROUS ASSUMPTIONS AND ARE SUBJECT TO ALL OF THE RISKS AND UNCERTAINTIES INHERENT IN RESOURCE EXPLORATION AND DEVELOPMENT. AS A RESULT, ACTUAL RESULTS MAY VARY MATERIALLY FROM THOSE DESCRIBED IN THE FORWARD- LOOKING STATEMENTS.

Silver North has made significant new silver discoveries in the famous Keno Hill Silver District of the Yukon, including Silver North’s Haldane Project, where high grade silver has been identified in drilling at two target areas. The Company also holds the Tim silver property in southern Yukon, where partner-funded exploration has identified high-grade silver mineralization just 19 km from the Silvertip mine.

Silver North has made significant new silver discoveries in the famous Keno Hill Silver District of the Yukon, including Silver North’s Haldane Project, where high grade silver has been identified in drilling at two target areas. The Company also holds the Tim silver property in southern Yukon, where partner-funded exploration has identified high-grade silver mineralization just 19 km from the Silvertip mine.