$RZZ.V, $ATBYF, $GOLD, $ABX.TO, $ELY.V, $ELYGF, $EDV.TO, $EDVMF, $EQX, $GORO, $GCM.TO, $TPRFF, $GBR.V, $GTBAF, $GUY.TO, $GUYFF, $SVM, $SVM.TO, $IPT.V, $ISVLF, $KTN.V, $KOOYF, $MKO.V, $MAKOF, $MTA, $MTA.V, $NSR.V, $NVO.V, $NSRPF, $PGM.V, $LRTNF, $SAND, $SKE.V, $VOX.V, $WDO.V, $WDOFF

With the exception of a few countries, which in the worst case have mandated mines operate at reduced levels [only essential personnel]. Most mining operations around the world have started to ramp back up. There are also select companies which have voluntarily decided to suspended mining operations despite a greatly reduced number of new cases reported, but aside from this small select few, everything is getting back to normal and most mining operations will be fully ramped up by the end of the second quarter. This not only means mining operations but brownfield and greenfield exploration as well.

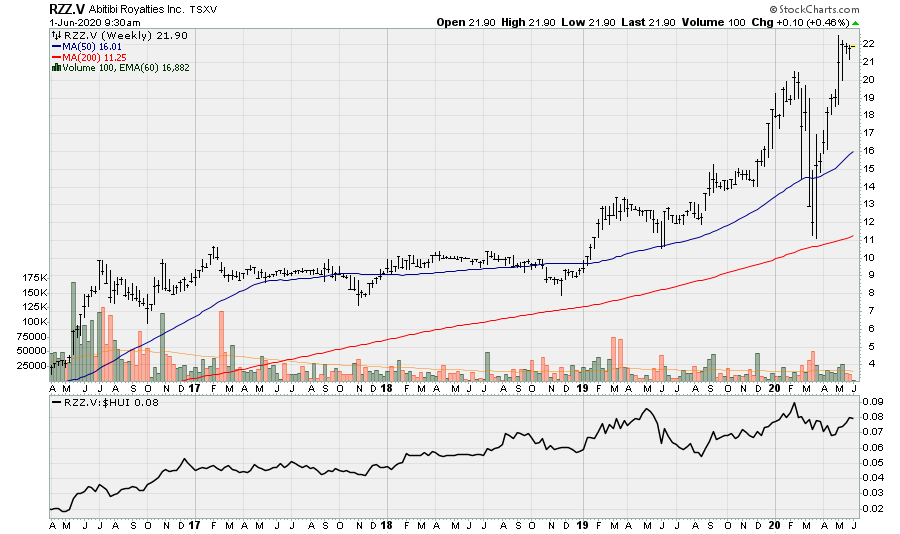

Abitibi Royalties: Announced it entered into a series of agreements to acquire a package of royalties south of the Canadian Malartic Mine and southeast of the Goldex Mine. The agreements also entitle the company to 15% of the gross proceeds should the underlying properties be sold or joint ventured. The royalties are located immediately south of the Canadian Malartic Mine and 3km southeast of the Goldex Mine. The purchase price by the company total C$36k, paid in cash upon closing.

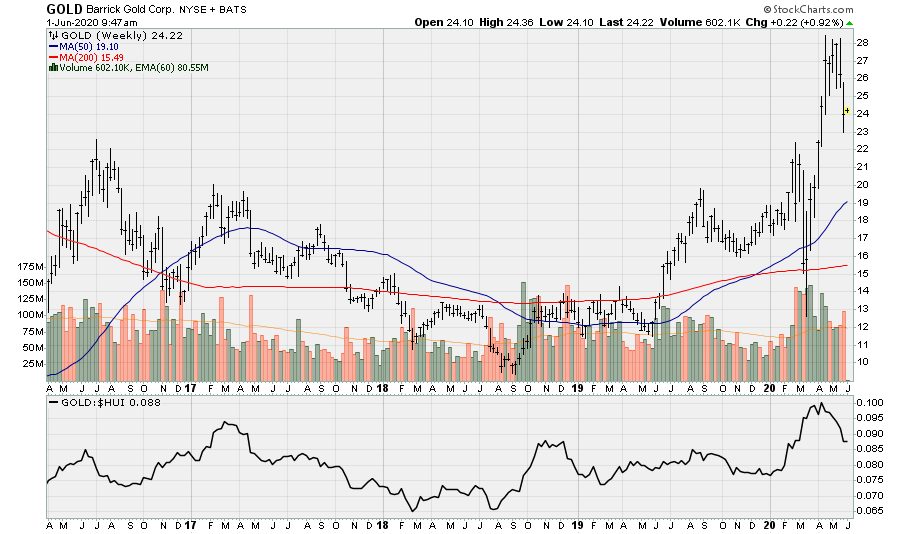

Barrick Gold: Settled the majority of the North Mara legacy land claims and paid the first tranche of the $300m settlement it agreed with the Tanzanian government to resolve the disputes it inherited from Acacia Mining. Barrick views this as a breakthrough although Tanzania isn’t an ideal location for mining operations given the political risk. As for the framework with the government, the shipping of some 1,600 containers of concentrate stockpiled from Bulyanhulu and Buzwagi resumed in April and the first $100 million received from the sale has gone to the government. Barrick said all material issues had been dealt with or were being finalized. This initial payment will be followed by five annual payments of $40 million each.

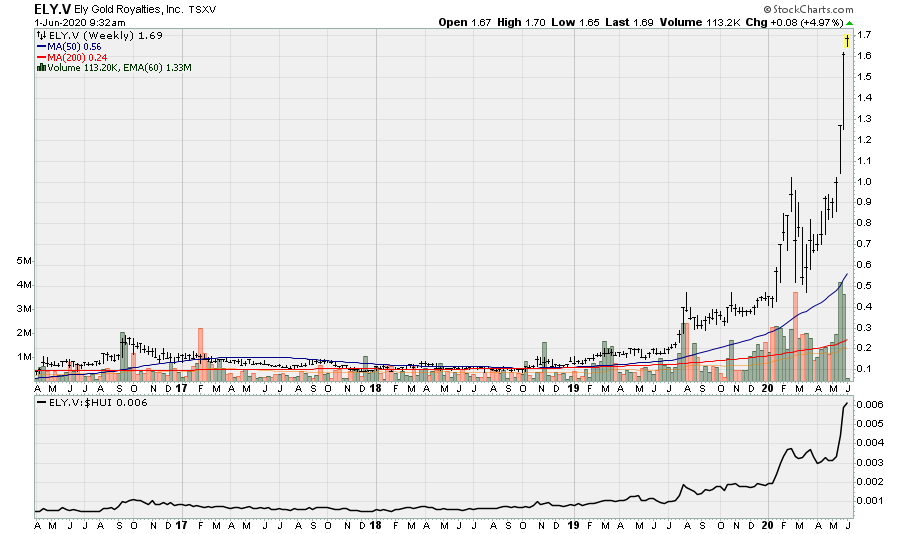

Ely Gold Royalties: The company continues to aggressively build up its royalty war chest, this time purchasing 0.40% of a 2.0% NSR royalty on the Borden Lake Gold mine. The Borden Lake Gold Mine (“The probe royalty – 2.0% NSR”) is subject to a buy-down option pursuant to which Newmont is entitled to buy it down from 2% to 1% for $1m. But this will only apply to the vendor’s portion, such that the 1.60% NSR can be bought down to 0.60% while Ely retains the 0.40% NSR. Ely will pay C$300k in cash, 100k Ely Gold shares issued at $1.15 per share, and 80k Ely Gold non-transferable purchase warrants to purchase additional shares for a 5-year term at an exercise price of $1.37/share.

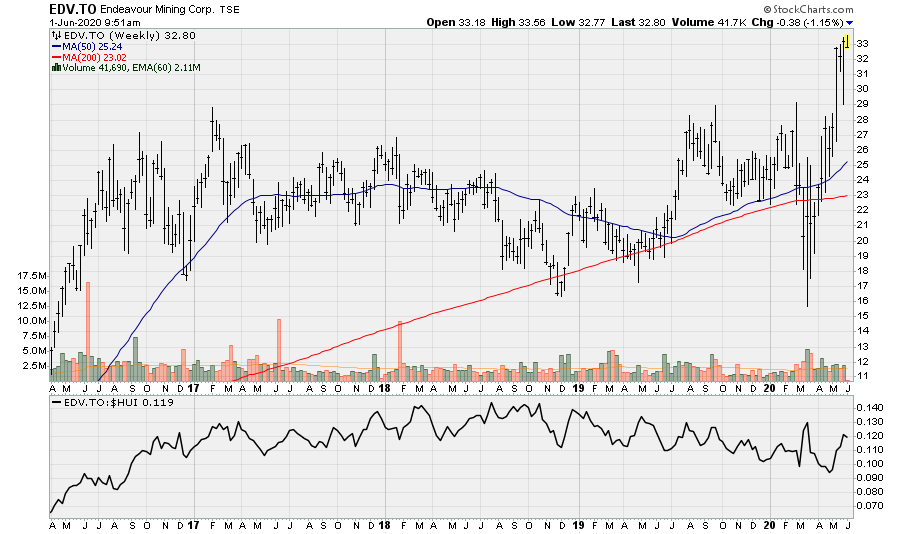

Endeavour Mining: Both sets of shareholders [Endeavour] and [SEMAFO] overwhelmingly voted in favor of the special resolution pursuant to which Endeavour will indirectly acquire all of the SEMAFO shares on the bases of 0.1422 of an Endeavour common share for each SEMAFO common share. Upon completion, this will create the leading West African gold producer, with output in excess of 1m oz. Au in 2021, driven by four cornerstone assets and six producing mines with multiple development projects.

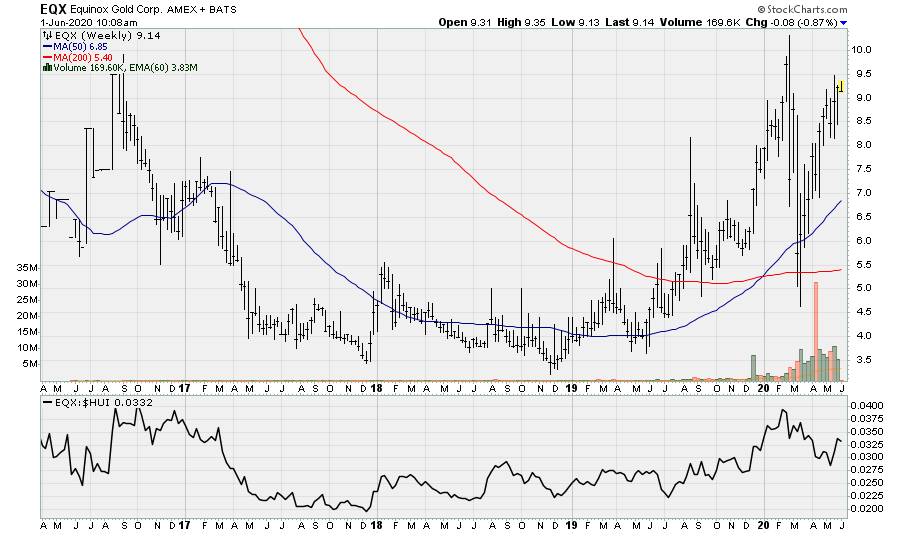

Equinox Gold: The company continues to build up its available liquidity and improve its balance sheet, this time through the expected cash inflow of $145m due to warrants being exercised. The company now has 238.1m shares outstanding, with a cash balance of more than $480m as of May 26th. This should be expected to increase to $500-$520m by the end of Q2. As it advances its growth projects and achieves production or higher output rates [Castle Mountain Phase I, Los Filos Expansion, and Santa Luz], the company can begin rapidly paying down debt.

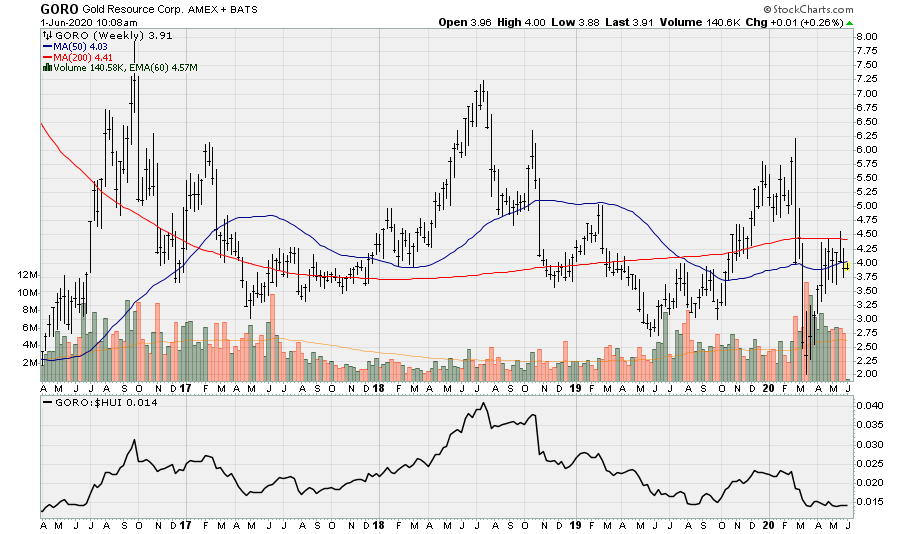

Gold Resource Corp: The company has been granted the approval to restart operations at its Oaxaca Mining Unit (OMU). Q2 should see a cash outflow for the company due to a suspension of mining activities at the OMU and its Nevada operations continuing to mine lower grade ore, increasing as each quarter passes and not hitting the 40k oz. annual run rate until sometime in Q4. The company is well financed enough such that this marginal cash outflow will have no material impact on the company’s financial position.

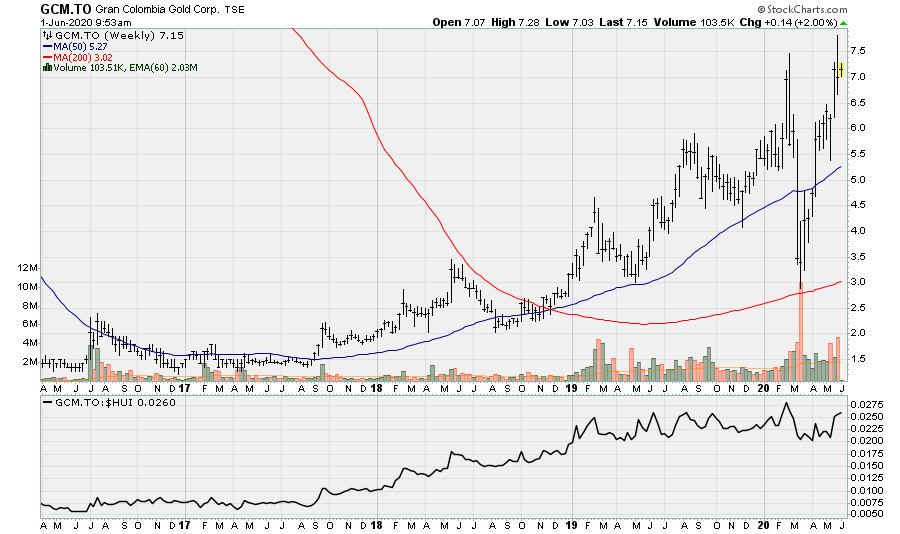

Gran Colombia: Following the failed bid for Guyana Goldfields after Silvercorp upped its bid, the company announced the termination of arrangement with Gold-X Mining Corp. I believe this will ultimately prove a mistake barring the company from finding and making a more accretive acquisition or the company being acquired itself. Toroparu is long-lived, low-cost asset of moderate scale and would have increased Gran Colombia production profile [to approx. 400k oz. p.a], while at the same time reducing all-in sustaining costs, companywide. The company still has the option to re-acquire Caldas gold after its been further de-risked and the Marmato expansion is complete.

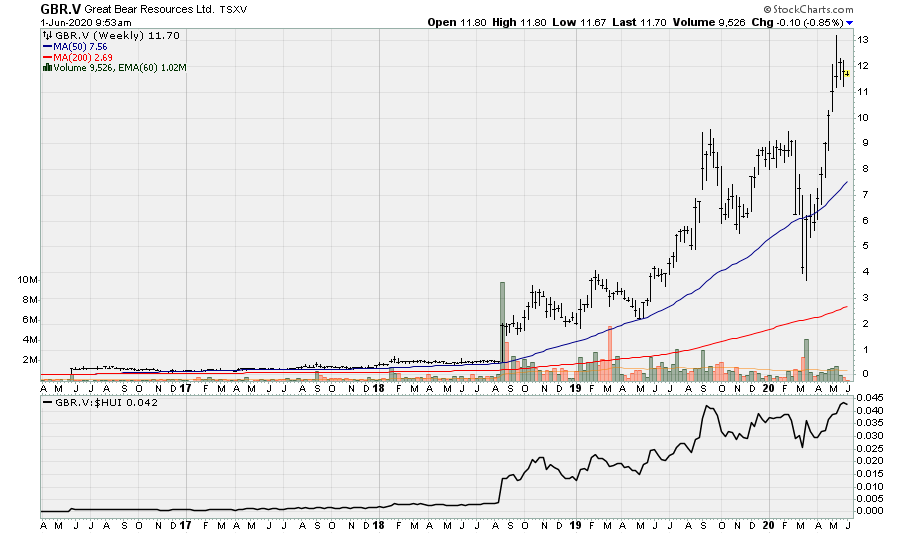

Great Bear Resources: Announced it entered into an Exploration Agreement with Wabauskang First Nation [WFN] and Lac Seul First Nation [LSFN] in relation to Great Bear’s exploration activities on its mining properties within the WFN and LSFN traditional territories. The Exploration Agreement took effect on April 28th, 2020 and establishes the framework for a cooperative and mutually beneficial relationship between the parties to support Great Bear’s exploration activities and the interests of WFN and LSFN in the region.

The Exploration Agreement defines the protocol for meaningful communications and engagement between the parties to understand and accommodate each other’s interests in relation to Great Bear’s exploration activities. Through this cooperative approach, the parties seek to build a strong, positive foundation for Great Bear to proceed with its exploration activities in a manner that is informed by and respects the interests of WFN and LSFN.

As part of the accommodation to LSFN and WFN under the Exploration Agreement, Great Bear issued an aggregate of one-hundred thousand (100,000) common shares in its capital stock to LSFN and WFN at a deemed price of $11.55 equal to the market price on May 4, 2020 the date of issue, such shares to be divided equally between LSFN and WFN.

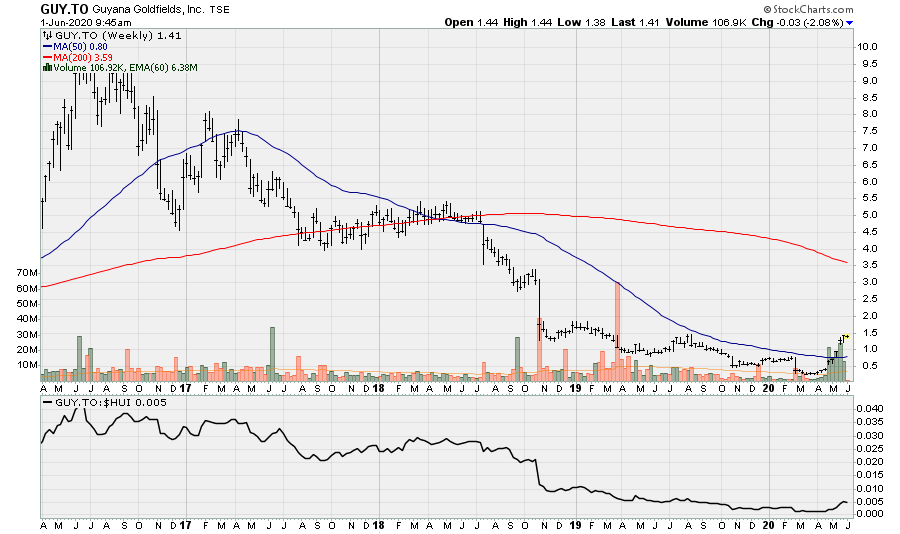

Guyana Goldfields: The company reported its Q1 2020 financial and operating results, which are essentially inconsequential as the company has moved to put the Aurora O/P mine on care and maintenance while it closes the transaction with Silvercorp Metals. Q1 production totaled 28.1k oz Au and 24.2k oz. Au sold with AISC of $1,352/oz. Mining rates decreased by 62% vs. the 2019 comparable period. The company’s cash position was $6.6m lower relative to Q1 2019 at $15.5m.

On March 18th, the company suspended underground development due to a funding gap and issues relative to CV19. On May 7th, the company announced the next phase of mine development, including both open-pit and underground would not proceed and originally planned, resulting in the operation being placed on care and maintenance. The mill will continue to process ore from Rory’s Knoll Phase IV and low-grade stockpiles until depleted in Q2. This should result in 1H production of 45-50k oz. Au. The acquisition by Silvercorp Metals is expected to close in early July 2020, after which time, the next steps to develop the Aurora underground Mine will be known. It is reasonable to expect that completion of the underground mine will take through the end of 2020 and into 2021, with production expected to be achieved in Q2-Q3. It is again worth noting that Silvercorp could unlock tremendous value and become an emerging mid-tier precious metal producer [6-6.5m oz. Ag and 160-180k oz. Au]. Should the gold price continue to rise, which is likely, Silvercorp should be able to generate a minimum of a $800/oz. AISC margin at Aurora.

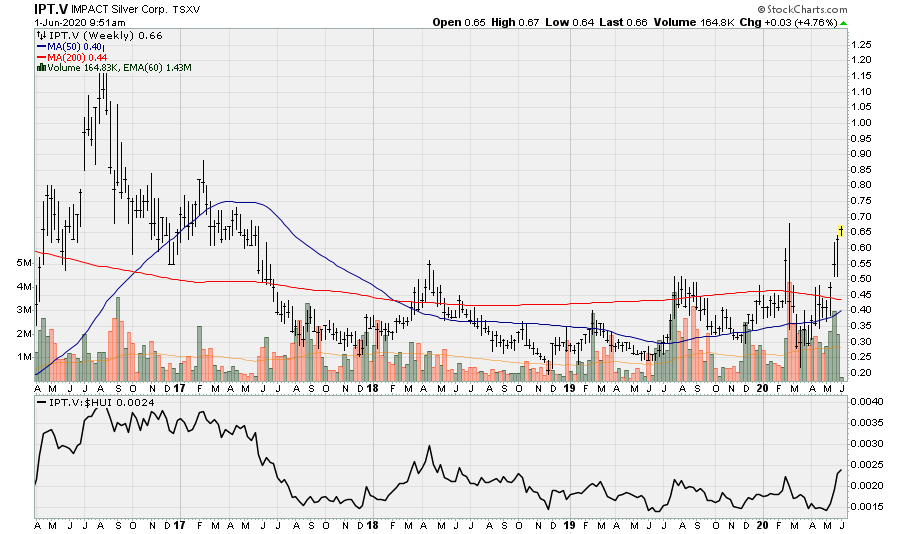

Impact Silver: The tiny silver producer announced Q1 operating and financial results. Silver production increased to 179k oz. [vs. 163.6k oz. Ag in Q1 2019] due to higher grades. Operating cash flow was $0.7m vs. cash flow outflow of $1m in Q1 2019. Impact will see cash outflows in Q2 due to the mandated suspension of operations for three months and will resume operations on June 1st. Due to weakness of its balance sheet, the company obtained financing of $2m. Impact isn’t a quality company with very marginal assets but should silver prices continue to rise after June 1st, the stock price should react well as the higher-cost lesser quality companies almost always outperform when there is a breakout in silver, in this case first past $18.50/oz. and again should it break $21.50/oz.

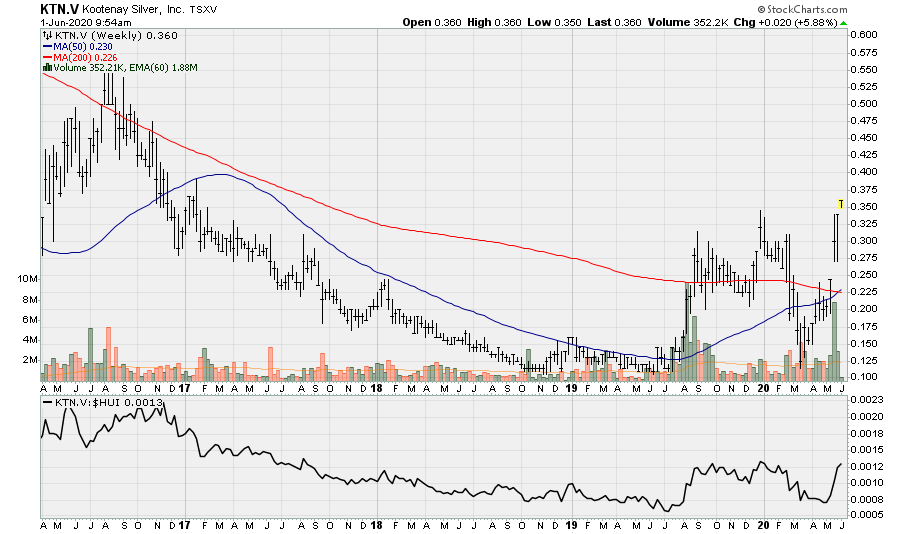

Kootenay Silver: Following up on some robust initial drill results at its Columba project last week, the company reported some additional intercepts, which continue to illustrate some high-grade areas of this project. The following are the remaining 4 of 10 holes completed from the 2020 drill program prior to the COVID shutdowns.

- 1.06m @ 259 g/t Ag in the hanging-wall structure

- 7m @ 124 g/t Ag in the F vein structure

- 2.8m @ 762 g/t Ag in the hanging-wall vein

- 4.4m @ 209 g/t Ag in the F vein structure

- 6m @ 317 g/t Ag in the hanging-wall structure

- 4.36m @ 317 g/t Ag in the F vein structure

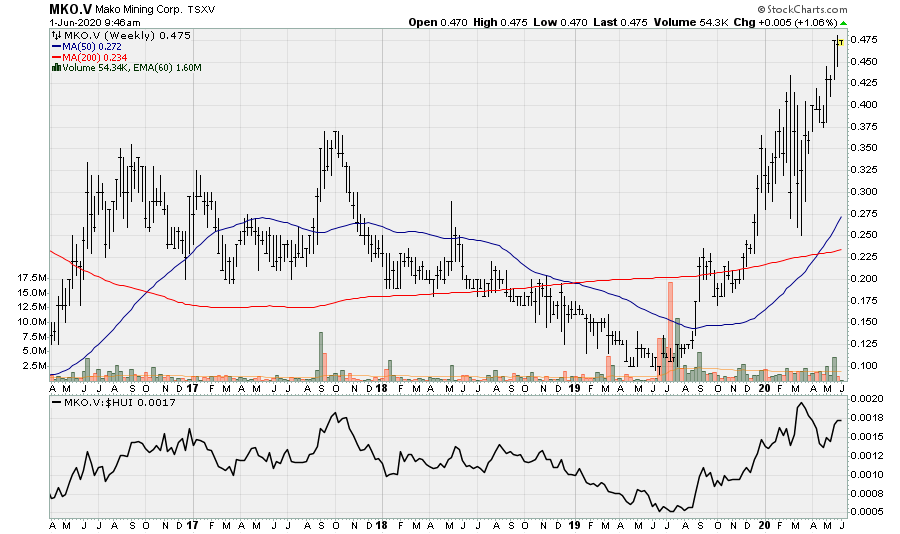

Mako Mining: The company continues to successfully drill out at its San Albino project, with infill drilling complete. This drilling is highlighted by intercepts of 70 g/t Au over 1.8m and 47.9 g/t Au over 2.6m. The company has hired MDA to update the resource estimate in the PEA. Based on exploration success, the mine life will likely be extended. It seems as though an eventual tie-up between Calibre-Mining and Make Mining would make a lot of sense, which would create an emerging mid-tier producer in Nicaragua. This would create a company with significant organic growth [Calibre and a material of unused capacity and a large land package and San Albino] and very competitive costs as San Albino would serve to great lower companywide AISC.

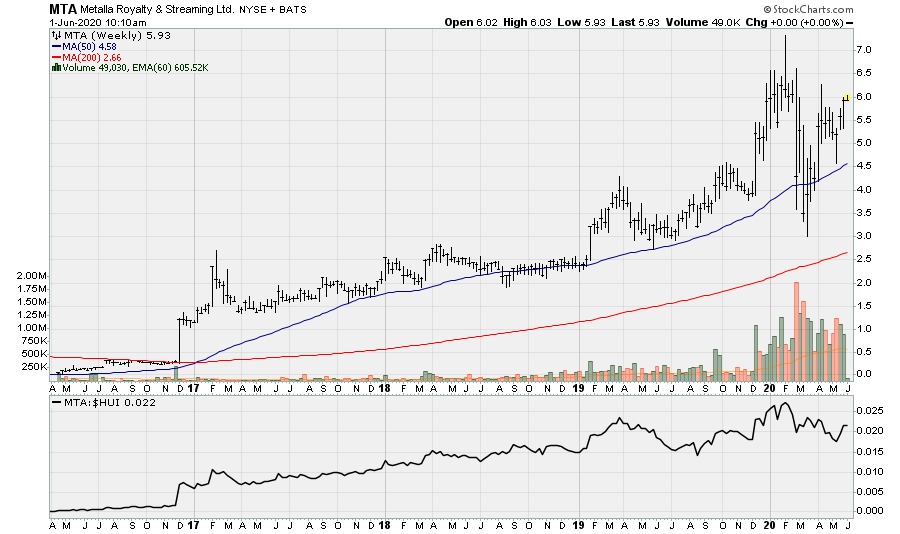

Metalla Royalty & Streaming: The small royalty and streaming vehicle with some excellent development assets continues to add small albeit high quality royalties to its portfolio. Further to the April 27th announcement, it has completed the acquisition of 100% of the issued and outstanding shares of Idaho Resources Corporation (IRC), a private Nevada Corporation, for $2m in cash and 357k shares. IRC’s assets include a 0.50% gross overriding royalty on Nevada Gold Mine’s Anglo/Zeke claim in Eureka County, Nevada, located on a trend to the southeast of the Cortez operations and Goldrush project owned by Nevada Gold Mines [ a joint venture between Barrick and Newmont]. IRC also holds a 1.50% gross overriding royalty covering the NuLegacy Gold Corporation’s Red Hill project in Eureka county, Nevada, which is contiguous to the southeast of the Anglo/Zeke claims. The company has built up a nice stable of royalty assets with production in the near to medium term, as well as some small royalties on larger-longer-term assets. In addition to the recently acquires royalty, the company also holds:

- 2% NSR on the Santa Gertrudis gold project in Mexico.

- 1% and 3% NSR on the Fifteen Mile Stream Mine.

- 2% NSR on Pan-American’s Joaquin Mine.

- 1.50% NSR on Pan-American’s COSE Mine.

- 2% NSR [which covers 8% of tons of the La Fortuna deposit] at NuevaUnion, one of the largest. undeveloped copper-gold projects in the America’s.

- 2% NSR on the Hoyle Pond Ext.

- 15% Ag stream on the New Luika Mine.

- 100% Ag stream on the Endeavor Mine

- 1.50% NSR [subject to a 0.75% buyback) on Pan-American’s Timmins West Ext.

Nomad Royalty Corp: The last junior royalty and streaming company to go public with sizeable and cash flowing portfolios was Maverix Metals until Friday [May 29th], when Nomad Royalty Company [NSR.V] started trading. It has a great start after having acquired a royalty and streaming portfolio from both Orion and Yamana Gold. The company will initially have a very sloppy share structure with 511m shares issued and outstanding. This will likely remain the case until it acquires another couple sizeable royalty or streaming interests, or should it want to up-list to a US exchange for greatly increased liquidity and most likely, a lower cost of capital, at which time it would likely undertake a 5 or 10:1 reverse split.

Highlights from its asset portfolio include:

- South Arturo [Ag stream] - Producing

- Premier [Ag stream] - Producing

- Blyvoor [Au stream] - Development

- Woodlawn [Ag stream] - Development

- Bonriko [Au stream] - Producing

- RDM Mine [1% Au NSR] - Producing

- Suruca [2% NSR Oxides & Sulphides] - Development

- Gualcamayo [2% NSR Oxides/1.50% NSR DCP] – Producing

In 2021, with select asset ramp-ups complete and new assets coming on-line, deliveries are estimated at 17k oz. Au and 675k oz. Ag or 25k AuEq oz. [79:1 GSR].

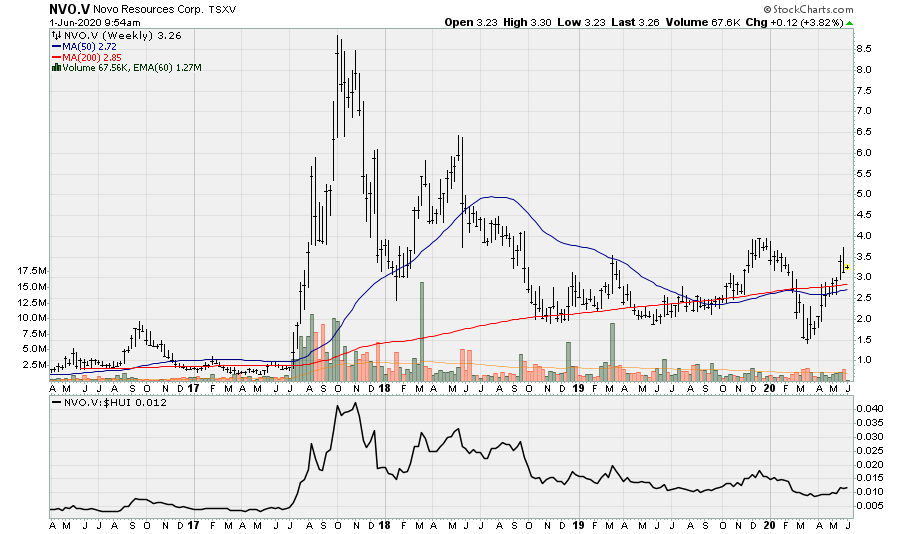

Novo Resources: The company announced it has discovered a broad gold bearing swale in the northwestern part of its Egina mining lease. This discovery is situated a few hundred meters west of the swale that was subject to extensive work in 2019. Identification of gold-bearing gravels comes from processing approx. 1-ton bulk sample using Novo’s “MAK” test plant. This new discovery ties in well with the interpretation of gold distribution in the great Egina area. This is a very unique system and it seems as though Novo will soon identify and implement the quickest pathway toward production.

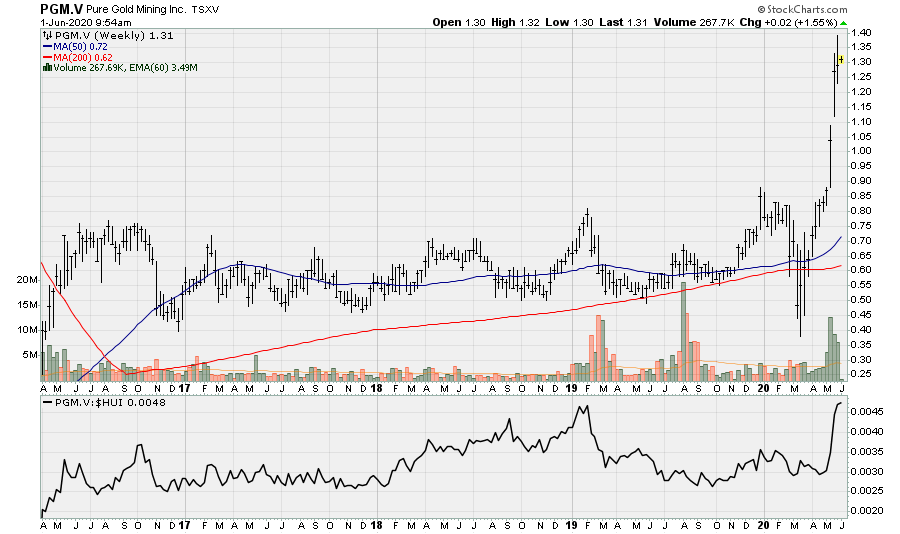

Pure Gold Mining: The company remains on track to achieve production before year end 2020. While this will be the first new gold mine to come online in Red Lake in quite some time, production, development, and exploration activities have really picked up in this historic high-grade district over the last couple of years and it is my view that there will be considerable consolidation in the district over the coming 12-36 months. Its principal asset is the Madsen-Red Lake gold project is just large enough to be acquired by another junior or smaller mid-tier producer. Per the FS, the project will produce 1m oz. Au over 12.2 years. Peak production will be 125k oz. Au with average annual production between years 3-7 of 102k oz. The mine will be low-cost with AISC just under $800/oz., making it a very high margin project at current gold prices.

The company has also completed a PEA on two satellite deposits, which could add an additional 4-year of production or be included in the mine plan and marginally increase average annual output. Over a 3.7yr period, these deposits would add production by 210k oz. at AISC just under $720/oz. The company was already very well financed with more than enough capital to reach production with potential cost-overruns and provide sufficient working capital. Its treasury got even stronger with an inflow of $12.3m through warrants being exercised.

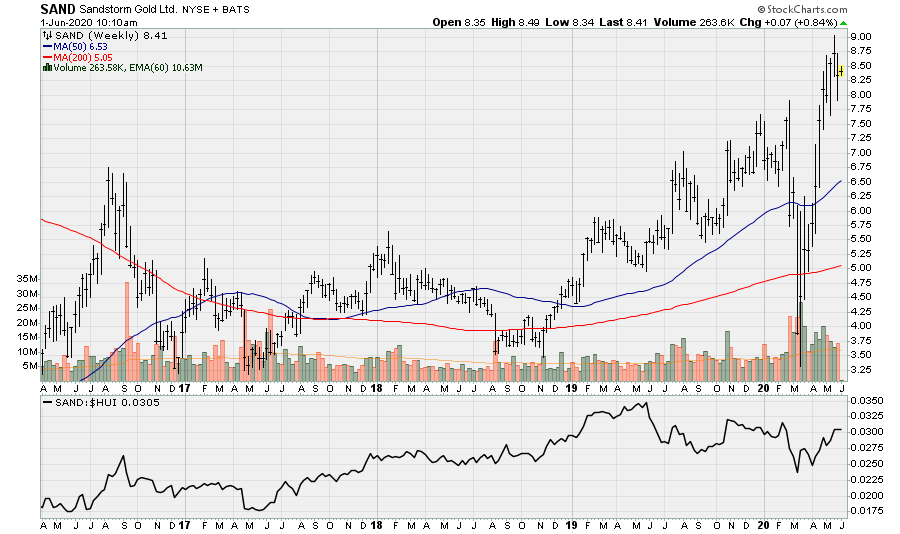

Sandstorm Gold: The company entered into a $2.155m financing package with Pacton Gold, which includes the purchase of royalties by Sandstorm on all of Pacton’s mineral properties. The company will undertake a 10:1 reverse-split, reducing the total shares issued and outstanding to 23,973,795 shares. The private placement will consist of up to 7.143m shares post-consolidation at $0.70/share for total gross proceeds of up to $5m. Sandstorm has agreed to subscriber for 2.65m shares post-consolidation for total gross proceeds of 1.855m and an additional $300k in consideration for it granting Sandstorm:

- NSR’s of either 0.50% or 1.0%, depending on the individual properties, on all mineral claims owned by the company in the Red Lake District;

- NSR’s of either 0.50% or 1.0%, depending on the individual properties, on all mineral claims in which the company is currently earning and operation in the Red Lake District;

- 1% NSR royalties on all tenements the company owns in Australia

Although Sandstorm is an emerging mid-tier royalty and streaming company [>=100k AuEq oz.], smaller deals such as this can create value as these royalties are on highly prospective areas, namely Red Lake in Canada and in the district-scale Pilbara gold rush in Western Australia. We still expect Sandstorm to be one of the participants in the upcoming spree of royalty and streaming financing.

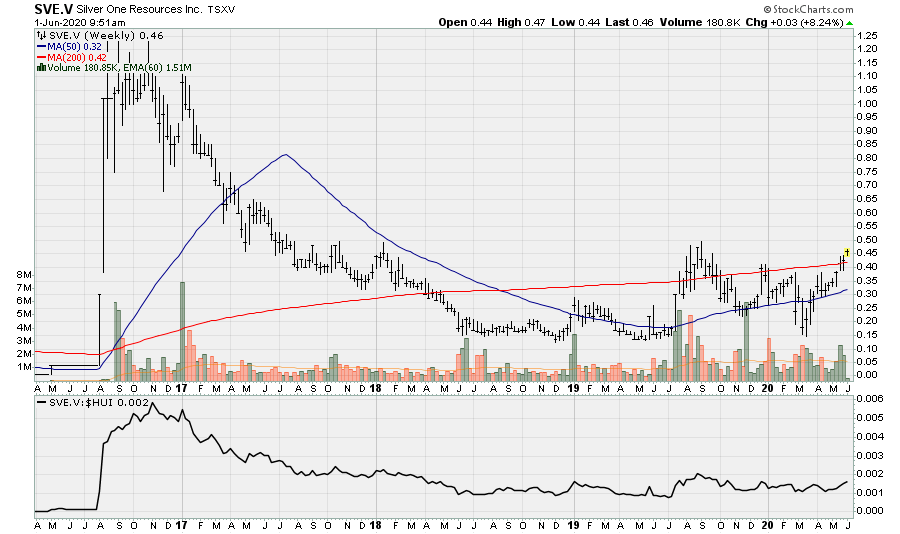

Silver One Resources: Drilling continues to expand down-dip, high-grade silver mineralization at Candelaria, Nevada. The company reported the results for the final four drill holes of the diamond drill program recently completed at its Candelaria project. Highlights include:

- 8m @ 237 g/t Ag and 0.79 g/t Au

- 19.4m @ 152 g/t Ag and 0.26 g/t Au

- 27.6m @ 350 g/t Ag and 0.45 g/t Au

- 16.56m @ 318 g/t Ag and 0.58 g/t Au

- 25.6m @ 172 g/t Ag and 0.31 g/t Au

Vox Royalty: Vox royalty announced successful commencement of trading and provides guidance on potential Q2-2020 acquisitions. The company announced the commencement of trading following the successful closing of the brokered private placement of subscription receipts for gross proceeds of approx. $13.75m. The offering was completed in connection with the reverse takeover [RTO] transaction between Vox and AIM3 Ventures. The company also announced it has four royalty acquisition opportunities under exclusive LOI’s. These potential transactions include two producing or near-production assets, one at the feasibility level and one earlier stage exploration stage royalty. It also Entered into a binding royalty sale and purchase agreement pursuant to which VOX will acquire a royalty on select tenements within RNC Minerals’ Higginsville gold operations for a payment of A$650k [A$350k cash and A$300k in stock]. This transaction represents one of the four royalty acquisitions opportunities under the exclusive LOI’s.

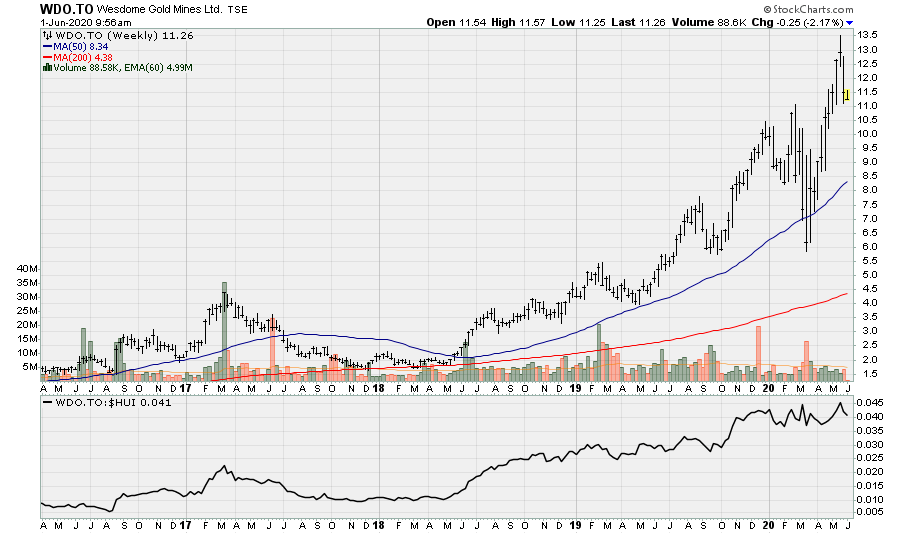

Wesdome: The company delivered a long-awaited PEA on its high-grade development project at the Kiena Complex in Val d’Or, Quebec, which yields an after-tax IRR of 102%. Per the PEA, with limited initial capital investment [$35m] and a long-term gold price deck of $1,532/oz., AISC of US$512/oz., and average diluted grade of 10.65 g/t Au, the after-tax NPV is $416m. The stock has been trading with a hefty price tag relative to underlying value and continues to do so. I expected output to be higher [95-100k oz.] and in turn an NPV closer to $470m but there is time to unlock additional value as it advances the pre-feasibility study. To increase average annual output and the life of mine, successful drilling at Kiena Deep will need to be achieved where the M&I resource grade is in excess of 18 g/t. The project will have an initial mine life of 8-years and approx. 86k oz. Au of annual production [the mine life would be 16-yrs if Inferred resources are included and converted]. While this alone outlines a project with amazing returns, it only includes 5 out of 13 zones that comprise the Kiena property [due to the proximity to the mill] and there remains material exploration upside. Wesdome, along with a couple other junior/small mid-tier Canadian producers will be acquired but given the valuation it may take some time.