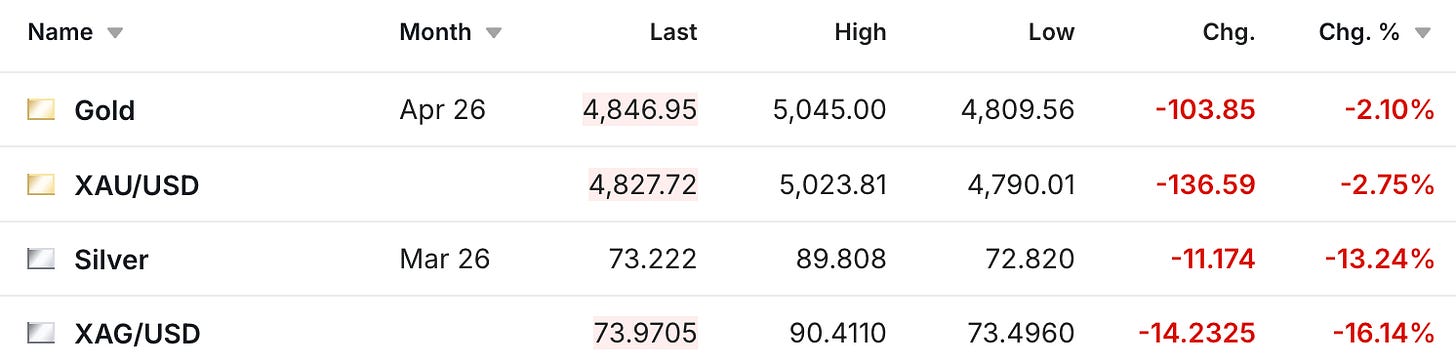

The gold and silver prices are down substantially on this past Thursday morning, although, as you might imagine, there’s plenty going on that’s affecting the markets.

As you can see, silver is down about 15% over the past 24 hours, after falling by over 30% on Friday. It’s still above the lows of this past Friday, but it’s another big move with a lot of hot money liquidation taking place right now, not only in the U.S., but also in China and other areas of the globe.

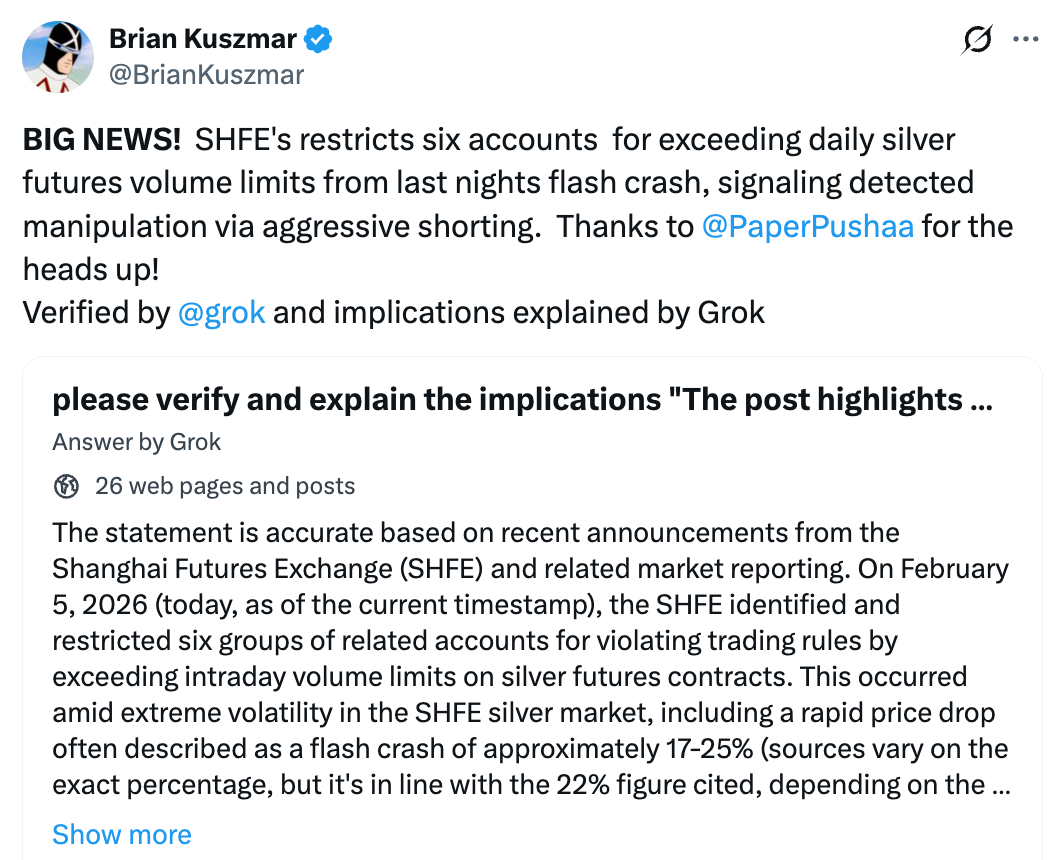

Although in terms of relevant events worthwhile to gold and silver investors today, for anyone who thought last Friday that Kevin Warsh’s nomination as Fed chairman was going to be a hawkish event, it looks like Trump basically confirmed that it will not be the case.

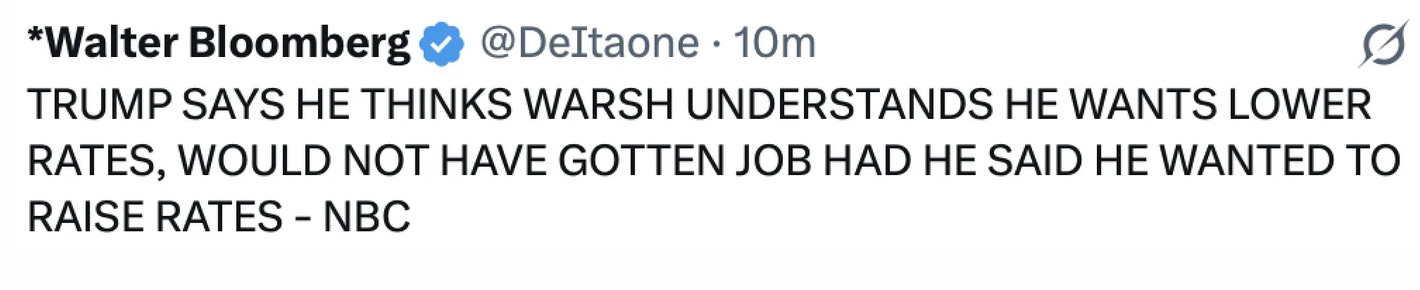

As a reminder, here’s what the futures market is currently pricing in on the interest rate curve.

That’s two 25-basis-point rate cuts over the next two years, while Trump, who has already said he thinks interest rates should be 1% or lower, now says that his pick for Fed chair understands that. Which makes it intriguing to imagine what the gold and silver prices will be doing in a few months if Warsh does indeed get confirmed, and then starts to indicate or implement taking rates down to 1% or lower.

I’m still stunned that the markets don’t seem to be pricing that in yet. Maybe something happens with Warsh’s confirmation, but if not, I continue to think that a few months from now, that could be the focus of the entire investment world.

There are also a handful of stories about China right now, including this note from Bloomberg that they saw record ETF outflows following last Friday’s selloff.

Mainland China’s four largest bullion-backed ETFs saw total net outflows of about 6.8 billion yuan ($980 million) on Tuesday, according to data compiled by Bloomberg. That marked a second straight day of declines for the Huaan Yifu, Bosera, E Fund and Guotai ETFs, just days after they notched record inflows last week.

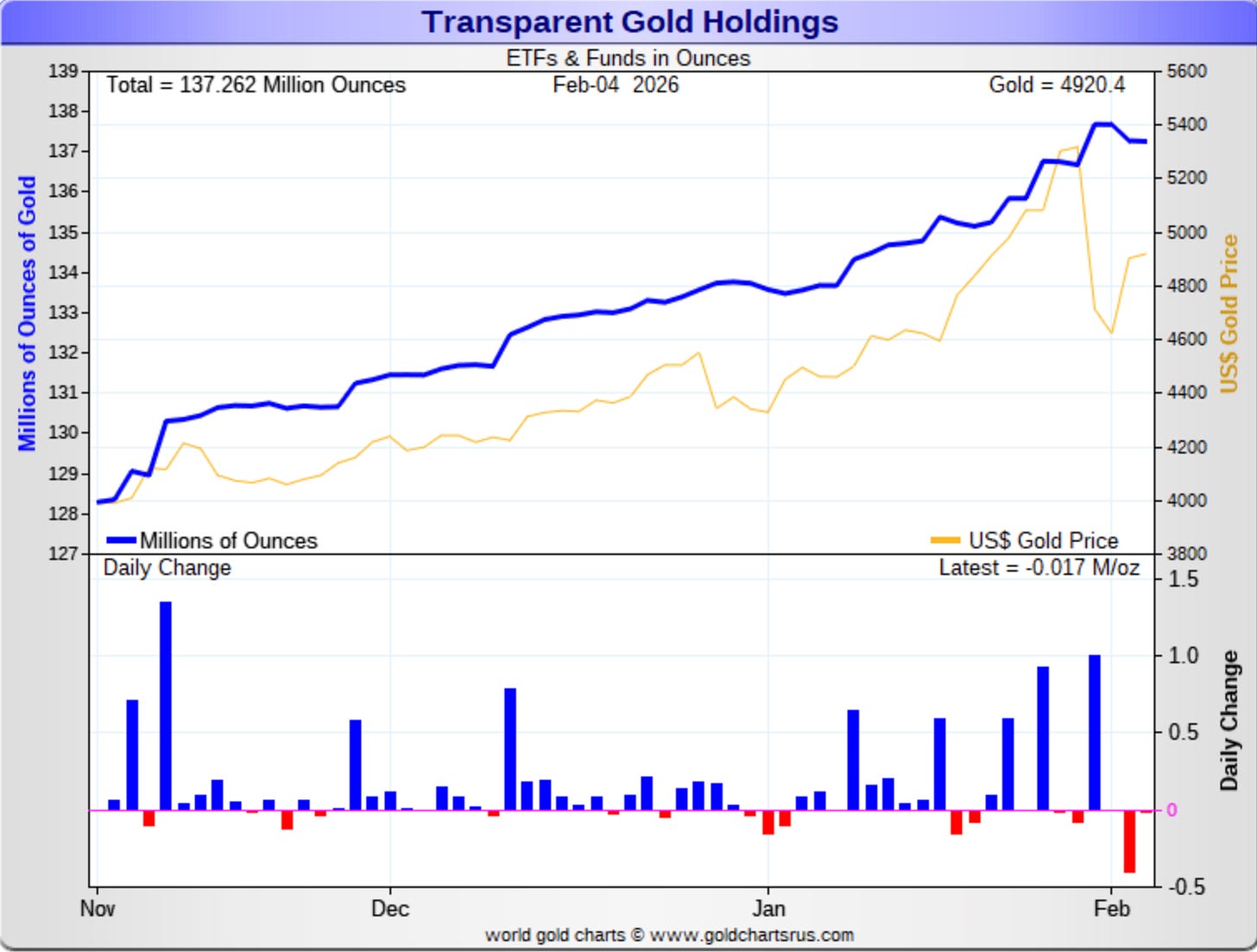

The global gold ETFs did show a significant outflow this week, although you can see in the blue line on the top part of the chart that gold has been getting added as the price has been rallying.

There are also reports coming out of China that a trader who made $3 billion during the recent rally has now established a large short position in silver.

A billionaire Chinese trader who made his name riding gold’s record-breaking rally has turned his sights to silver’s breakneck surge, with a bet on the metal’s collapse now worth almost US$300 million.

Bian Ximing, who avoids the limelight and spends much of his time in Gibraltar, has made nearly US$3 billion from bullish bets on Shanghai Futures Exchange gold contracts since early 2022. He has now built the bourse’s largest net short position in silver, according to Bloomberg analysis of exchange data and people with knowledge of his investments.

Yet on the other hand, we see that Fidelity, which sold some of its gold before the price decline, is getting ready to load up again.

Fidelity Fund, which sold a chunk of gold holdings days before the plunge, is watching for an opportunity to buy again, portfolio manager George Efstathopoulos told Bloomberg News.

“If we see another 5%, 7% correction, I’m buying up,” Efstathopoulos said in an interview Tuesday. “A lot of the froth has been taken out, and the structural sort of medium-term themes are very much in place” for gold to continue rallying.

Of course, while all of that’s happening, the race for critical minerals is officially on.

Yesterday, I shared the clip of mining executive Robert Friedland in the Oval Office, and now the Trump administration is doing the full press tour.

Here’s J.D. Vance’s thought on the matter, which I really implore you to listen to, as they’re telegraphing exactly what they’re going to do. Also interesting was his mention of price floors in some of these minerals, which, of course, includes silver.

‘The Trump administration is proposing a concrete mechanism to return the global critical minerals market to a healthier, more competitive state through a preferential trade zone for critical minerals protected from external disruptions through enforceable price floors.

We will establish reference prices for critical minerals at each stage of production pricing—that reflects real-world fair market value. And for members of the preferential zone, these reference prices will operate as a floor maintained through adjustable tariffs to uphold pricing integrity.

We want to eliminate that problem of people flooding into our markets with cheap critical minerals to undercut our domestic manufacturers. Because we know of course that as soon as they’ve undercut our domestic makers, the domestic makers leave the market, and the people who undercut them then jack up the price to a completely unfair level.

We’re going to fix that problem.

Together, we want members to form a trading block among allies and partners. One that guarantees American access to American industrial might, while also expanding production across the entire zone.

The benefits will be immediate and durable.

Regardless of how much material flows into the global market, prices within the preferential trade zone will remain consistent. Over time, our goal within that zone is to create diverse centers of production, stable investment conditions, and supply chains that are immune to the kind of external disruptions that we’ve already talked about.’

Towards the end of the clip, he also talked about how the Trump administration is recruiting other countries to join this trade zone, which lends credence to something Vince Lanci mentioned yesterday, but has been talking about for over a year.

Of course, Howard Lutnick didn’t want to miss his chance, and you can hear his comments here.

This still strikes me as one of those rare occasions where you can see what’s coming before it actually happens. Obviously, that’s not helping the silver price all that much today, but just like how when silver was confirmed as a critical mineral and the price was down that day, my suspicion is that the months and years ahead will smooth out the declines we’ve seen in the past week.

But try not to spend too much time checking your portfolio today, and we’ll see how everything looks..