Silver has been trading in $2650-$2880 (price per 100 troy ounces of silver) wider range. Comex silver July futures are expiring towards the end of the month. Everyone is bullish on silver and expect silver price to near $3500 and more. Technical are also bullish for silver.

Let’s take a technical view first. We will discuss other factors later.

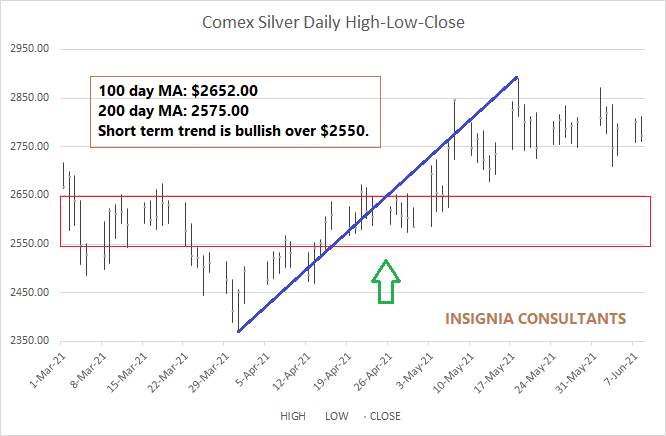

Silver is trading over Key Moving Averages

- Fifty day moving average: $2667.50*

- One hundred day moving average: $2652.00

- Two Hundred day moving average: $2575.00

- Three hundred day moving average: $2356.00

(*price per 100 troy ounces of silver)

Verdict based on moving averages: Silver is bullish in the short term as long as it trades over $2575. Silver is bullish in the long term as long as it trades over $2356.00.

Other Technical View

- Convergence or reduction of gap between 50 day MA and 100 day MA suggest boom or bust silver in the short term.

- If the gap between 100 day MA and 200 day reduces over the coming weeks, then silver can crash first followed by a move to $40.00 and more.

The above view is based on experience.

SILVER PRICE FORECAST

- Immediate resistance is at $3035.00

- Bullish case: Silver needs to break and trade over $3035.00 to rise to $3450.60 and $4111.60.

- Overall silver is bullish (in the short term) as long as it trades over $2652.

- Till first of September silver has to trade over $2575 to continue its bullish trend.

- Bearish case scenario: Failure to break $3035.00 and break and trade over $3035 by 5TH July will result in a sell off to $2459.10, $2356.00 and $2128.00. (I am not trying to scare you off. This my technical view in the event of a crash.

Why will silver crash? (in case)

Short term silver traders will get tired on their silver investment. They will close long positions and switch to gold. Some will wait for more correction or a sell off and reinvest in silver.

Fundamentals are very bullish silver. Silver demand in solar panels, silver demand in electric vehicles, silver demand in 5G mobile technology and the list is endless. Physical silver will be shortage for industrial users over the coming years (if not this year).

I will prefer to use pullbacks, corrections, flash crashes by whatever name or phrase one calls to invest in silver for the medium term and long term. Only day traders and jobbers need to remain on the sidelines.

How about buying a silver call option for December 2022 with a strike price $100. Seems weird? This will be very good investment option. One should buy silver call options with a strike price of $50.00 for January 2022.

Very short term traders and very short term investors of silver have to be careful in silver.

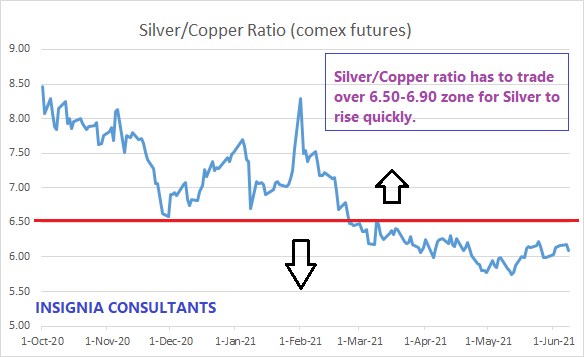

India is talking of ratio trading. Gold-silver is used by one and all. I will prefer look at silver to copper ration to get alternate view on silver. Silver and copper are industrial metals and in some cases substitutes as well.

SILVER TO COPPER RATIO (comex futures)

- The above graph is from 1st October 2020 (closing price) to 8th June 2021 (closing price).

- Big copper rally started from October 2020. Silver-copper ratio has been declining since then.

- Average silver-copper ratio (from 1st October 2020 to 8th June 2021) is 6.88.

- 2021 average is 6.49.

- Silver-Copper Ratio needs to trade over 6.49 for the rest of the year for silver to continue its short term bullish trend.

- If this ratio falls to 5.00 and below I will prefer to aggressively buy silver as a long term bottom will be near. (My experience is that copper price has a history of always falling more than silver).

- One always needs to use trailing stop losses on all investment dependent on risk appetite and other factors at the time of taking a position.

In ratio trading (a) The pace of rise or pace of fall of two different metals or energies are not the same. (b) We play on the pace of price moves in different metals. (c) The ratios will not see an overnight big change unless there are some compelling reasons. (d) Profit are less than naked future trading/investment. Last brokerage will be very high as you need to do four trades to close a trade.

MCX SILVER FUTURES TECHNICAL VIEW

Key Moving Averages

- Fifty day moving average: Rs.69575.00

- One hundred day moving average: Rs.68615.00

- Two hundred day moving average: Rs.66367.00

- Three hundred day moving average: Rs.61744.

- Four hundred day moving average: Rs.57491.

Other Technical View

MCX silver futures are trading over key moving averages. However it needs to trade over 50 day MA of Rs.69575 to be in a short term bullish zone.

Convergence of 50 day MA and 100 day MA suggests that a sell off (if any) will be very swift with Rs.61744 as price target. MCX silver near term futures have to trade over Rs.68615-Rs.66367 to be in a short term bullish zone.

MCX SILVER PRICE FORECAST

Bullish case: Key resistance is at Rs.74766. Silver has to break and trade over Rs.74766 before 30th June to rise to Rs.77993 and Rs.83465. Overall corrections upto Rs.66367 (two hundred day moving average) will be a part and parcel of the bullish trend.

Bearish case scenario: Failure of MCX silver futures to break past Rs.74766 by 5th July will result in a crash to Rs.65085, Rs.61744 and Rs.59613.

Day traders and very short term traders need to remain on the sidelines in silver. Silver is a buy on sharp dips in MCX futures for Diwali and Christmas.

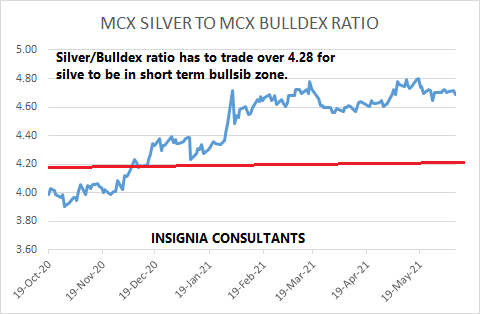

RATIO TRADING: MCX SILVER TO MCX BULLDEX TRADING

Points to Ponder on the above ratio

- Silver/Bulldex Ratio has to trade over 4.20-4.30 zone for the rest of the year for MCX Silver near term future to be in a bullish zone.

- Ratio trading is only for the short term to medium term.

- In my view one can get the trend of gold and silver using ratio with MCX bulldex futures. But it is not easy to do high speed trading for tiny profit using MCX bullex with MCX gold futures and MCX silver futures.

- Calculate the cost of brokerage with your broker before you opt for ratio trading with MCX Bulldex.

- You have to pay four times broking. Two buys and Two sells. Even a cost to cost trade will result in higher brokerage cost (than naked futures).

Silver is bullish. Corrections and crashes will be part and parcel of the long term bullish trend. Coronavirus will only increase the global per capital usage of silver. The pace of rise of silver can test our patience. I am happy being a hardcore silver bull