Looks like Silver Wheaton struck it rich with its newest silver streaming agreement with Glencore. According to the deal, Silver Wheaton paid Glencore $900 million for future silver production from its share of its Antamina copper mine in Peru. Silver Wheaton receives silver from this Glencore deal at 20% of the silver spot price.

Which means, Silver Wheaton currently pays about $2.85 per silver ounce at the current market price of $14.26. That’s not a bad deal, especially when your cost is only 20%. I would imagine any of the primary silver mining companies would die to produce silver at a 20% cost.

Which means, Silver Wheaton currently pays about $2.85 per silver ounce at the current market price of $14.26. That’s not a bad deal, especially when your cost is only 20%. I would imagine any of the primary silver mining companies would die to produce silver at a 20% cost.

Peru’s copper Antamina mine (picture), is owned by Glencore (33.75%), BHP Billiton (33.75%), Teck Resources (22.5%) and Mitsubishi Corporation (10%). It produced a third of Peru’s copper production in 2013.

According to the Bloomberg article, Glencore Raises $900 Million By Selling Future Output:

Glencore Plc sold a share of its future silver output in a deal that includes a $900 million upfront payment, as the trading and mining company works to cut its $30 billion debt pile by about a third amid tumbling commodity prices.

The deal includes Silver Wheaton Corp. paying 20 percent of the spot price per delivered ounce, the Vancouver-based company said in a statement Tuesday. Silver Wheaton will receive an amount equal to 34 percent of silver production at the Antamina mine in Peru until the delivery of 140 million ounces and the equivalent of 23 percent of silver production thereafter, Baar, Switzerland-based Glencore said in a statement.

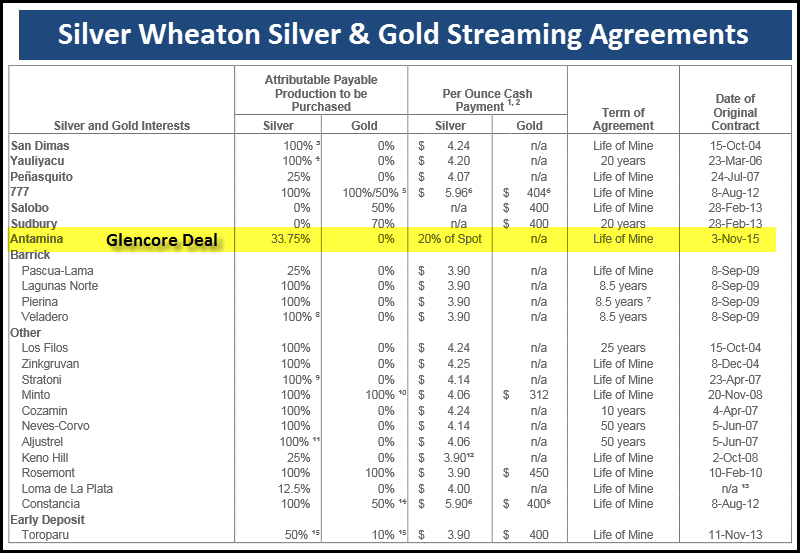

This newest silver streaming deal with Glencore provides Silver Wheaton with the cheapest price per ounce (based on the current market price) compared to all its other agreements. If we look at Silver Wheaton’s Silver & Gold Streaming Agreements below, we can see the different prices and time spans for these different agreements:

Silver Wheaton will receive 5.1 million oz (Moz) of silver from Glencore for the first several years at an estimated cost of $15.3 million a year based on a $15 market price of silver. They will sell that silver at $76.5 million, netting a cool $61 million margin. Of course, I am making this quite simple as there are more company costs involved, but this is how you take advantage of a company when the chips (and prices) are down.

Now, I am not criticizing Silver Wheaton here. They run a good business model and I would imagine the board at Glencore wasn’t forced at gunpoint to take this agreement. However, this goes to show how more future silver production is sold forward at a fraction of the market price.

Furthermore, I highly doubt Glencore would have sold their silver production from their share in the Antamina mine when the price of copper was $3.50 and silver at $30 back in 2012. But now that the base metal prices are in the toilet as the price of copper is trading at $2.15, this does wonders for the balance sheets of companies with a great deal of debt.

If we do some simple back of the envelope calculations, this is how good of deal Silver Wheaton will get for part of the agreement which provides 140 Moz of silver at 20% cost (based on average price of $15):

Silver Wheaton Cost = 140 Moz X $3 = $420 million

Silver Wheaton Sales = 140 Moz X $15 = $2.1 billion

Silver Wheaton Margin = 140 Moz X $12 = $1.68 billion

Of course the market price of silver will not remain at $15 for the next 28-30 years of the agreement, however, I had to put some sort of current value to the deal. When the price of silver revalues higher in the future, Silver Wheaton will be laughing all the way to the bank.

The Silver Steaming Model May Come Under Stress In The Future

While Silver Wheaton is currently doing much better than the primary silver mining industry, this may change in the future. Let me explain Silver Wheaton to those who may be new to precious metal industry. Silver Wheaton is not a mining company. They do not extract and process any ore or produce any metal.

What they are is a company that provides capital to another company for a share of their future silver or gold production. They have a very small staff for the amount of sales they generate compared to the typical mining company. Which means, their costs are low.

However, the situation may not be as bright in the future when global oil production begins to decline in earnest. As I have stated in many articles and interviews, peak silver will occur first in the base metal mining industry as demand for copper, zinc and lead declines due to declining Global GDP on the back of falling energy production.

This isn’t speculation.. it’s just a matter of time. And I don’t believe we have much time on our side with the price of oil bracing to fall into the $30 range. Peak oil will not occur because of high oil prices, but rather due to low prices that will kill production.

As Global GDP falls, the world will need less base metals. This will put severe stress on the base metal mining industry, including those silver stream agreements. While these agreements have protective clauses if the company shuts down production or goes bankrupt, trying to squeeze blood out of a debt ridden turnip may become increasing difficult when the Fan hits the crapper.

This is why I believe the best assets to own besides physical gold and silver are some of the primary silver mining companies. I would not recommend putting a large portion of one’s wealth in these mining stocks, but a small percentage is acceptable, especially when silver bullion becomes impossible to acquire once the world’s Greatest Financial Ponzi Scheme finally collapses.

Please check back for new articles and updates at the SRSrocco Report. You can also follow us at Twitter below: