Excerpt from this week's: Technical Scoop: Cut Hint, Worse Consumer, Precious Point

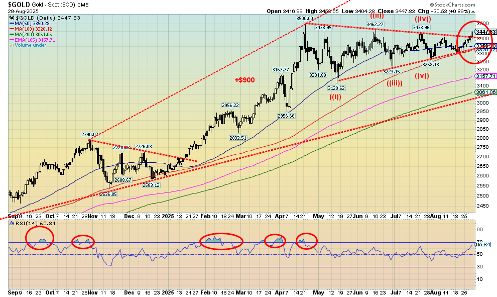

Gold

Source: www.stockcharts.com

Is this it? The long-awaited breakout for gold? This past week gold made a record high weekly close but remains just under its all-time high of $3,500. Our expectation is that this level could soon fall. The best part is that the breakout projects up to around $3,800. Gold’s seasonals remain positive, although a dip into mid-month would not surprise us. After that, there is usually a sharp rise into October/November before another dip into December. Once the December low (or thereabouts) is in, we usually experience a good rise into February before another correction gets underway.

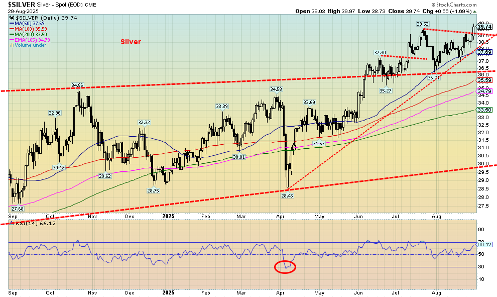

Silver is also breaking out and this past week we made new 52-week highs. With this breakout, the projection for silver is a rise to $42.50/$43.00. Meanwhile, the gold stocks just keep on rising, even as the mainstream still appears to not recognize that run-up. As we’ve noted, gold is the safe haven in time of geopolitical stress, domestic political stress, and economic stress. Right now, we have all three in spades. But what it all points to is the potential for a runaway move to the upside. Even the junior stocks are showing more signs of life. The TSX Venture Exchange (CDNX) made 52-week highs but remains down 75% from its all-time high seen in 2008, while the VanEck Junior Gold Miners (GDXJ) remains down 40% from its all-time high in 2011. Lots of room to move higher. If that happens, the gold bugs will be euphoric.

Source: www.stockcharts.com

On the week, gold rose 2.3%, silver was up, as noted, to new 52-week highs, up 2.2%, while platinum gained 1.2%. Of the near precious metals, palladium fell 0.9% while copper was up 1.6%. But the real excitement has been with the gold stocks where the Gold Bugs Index (HUI) rose 5.3% to new 52-week highs and the TSX Gold Index (TGD) was up 3.6% to record highs. Both have been on fire in 2025 with the HUI up 87.1% and the TGD up 81.0%. Yet they still feel unnoticed against the backdrop of the MAG7, AI, and Bitcoin. But MAGS, which represents the MAG7, is up only 9.9% in 2025 while Bitcoin is up 15.4%. High tech and AI still dazzle, but the gold stocks have been golden.

Gold is moving higher as the geopolitical stresses continue with Russia/Ukraine and Israel/Gaza, along with domestic political stresses, a slowing economy, rate cuts, and the President’s ongoing feuds with the Fed and just about everyone else who disagrees with him. The trouble is, the President is turning those feuds into potentially dictatorial leanings with troops in Washington and constant attacks on the Fed and others who disagree with him. Meanwhile, the House and Senate (Republican controlled) rubber stamp him, even as court rulings are often against him. That doesn’t seem to bother him as many rulings are going unheeded. Then what?

The currencies were quiet this past week with the US$ Index up a small 0.1%, the euro falling 0.3%, the Swiss franc up 0.2%, the pound sterling off 0.1%, and the Japanese yen flat. The Cdn$ was the star, up 0.8%.

Oil prices were up again on the growing realization that the Russia/Ukraine war is not going to be resolved. Add in the U.S. 50% tariffs on India over their buying oil from Russia. The biggest buyers of Russian oil, besides India, are China and Turkey. WTI oil rose 0.4% this past week although Brent crude fell 0.6%. Natural gas (NG) gained 11.9% although NG at the EU Dutch Hub fell 5.1%. The ARCA Oil & Gas Index (XOI) rose 2.9% while the TSX Energy Index (TEN) was up 1.2%. Energy stocks appear to be anticipating higher prices.

For gold, we await the breakout to new all-time highs above $3,500. It could occur this week. We would absolutely want gold to remain above $3,300. With an RSI at 65 we have lots of room to move higher. The gold stock indices are getting extended, but in a bull market it can remain that way for some time. And we believe that the full attention to gold is still not being given.

Read the FULL report here: Technical Scoop: Cut Hint, Worse Consumer, Precious Point

Disclaimer

David Chapman is not a registered advisory service and is not an exempt market dealer (EMD) nor a licensed financial advisor. He does not and cannot give individualised market advice. David Chapman has worked in the financial industry for over 40 years including large financial corporations, banks, and investment dealers. The information in this newsletter is intended only for informational and educational purposes. It should not be construed as an offer, a solicitation of an offer or sale of any security. Every effort is made to provide accurate and complete information. However, we cannot guarantee that there will be no errors. We make no claims, promises or guarantees about the accuracy, completeness, or adequacy of the contents of this commentary and expressly disclaim liability for errors and omissions in the contents of this commentary. David Chapman will always use his best efforts to ensure the accuracy and timeliness of all information. The reader assumes all risk when trading in securities and David Chapman advises consulting a licensed professional financial advisor or portfolio manager such as Enriched Investing Incorporated before proceeding with any trade or idea presented in this newsletter. David Chapman may own shares in companies mentioned in this newsletter. Before making an investment, prospective investors should review each security’s offering documents which summarize the objectives, fees, expenses and associated risks. David Chapman shares his ideas and opinions for informational and educational purposes only and expects the reader to perform due diligence before considering a position in any security. That includes consulting with your own licensed professional financial advisor such as Enriched Investing Incorporated. Performance is not guaranteed, values change frequently, and past performance may not be repeated.