Excerpt from this week's: Technical Scoop: Haven Highs, Gassy Prices, USD Tank

Source: www.stockcharts.com

What a week for gold and the precious metals. Or maybe we should say it’s just another day at the office. It seems that when President Trump opens his mouth the precious metals leap again. He’s having that effect on them.

The long-predicted $5,000 for gold is within grasp. We broke out of that rising consolidation pattern solidly this past week as gold gained 8.4%, now up 15.5% on the year. Keep that up and we’ll rise almost 100% in 2026. Naturally, gold made all-time highs. But then along came silver and it blew gold away, rising 14.3%. It is now up almost 44% in 2026. Not to be left behind, platinum surged 18.4% and is now up 35% in 2026. The gold indices kept up with the Gold Bugs Index (HUI), up 10.3%, and the TSX Gold Index (TGD), up 7.9%. By comparison, the gold stocks seemed reluctant to rise higher. Still, they are up 26.1% and 24.1% so far in 2026. What a time to be a gold bug.

The ascending triangle that formed from October to just recently suggests a target up to at least $5,200. At this rate we’ll be there by January 31. No, don’t count on this every week. Overbought may be just a state of mind but corrections do happen, often suddenly. Has gold moved from being a safe haven to a highly speculative asset like Bitcoin? It’s difficult to say, but if Bitcoin is the comparison, then we have a lot further to rise. The mass of retail is still not in, and many portfolio managers still have a low exposure to gold in their portfolios. They are still not talking endlessly about gold on CNBC. When the talking heads are frothing about gold, the top is probably nearby.

Source: www.stockcharts.com

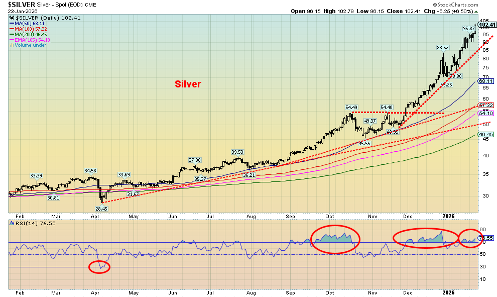

Silver crossed $100 this past week (close $102.41), a level called for by many analysts over the years that nobody believed would ever happen. Not even what appeared to be an outside day key reversal on December 29, 2025, has stopped the rise. The downside lasted for a couple of days before the upswing continued.

“Silver bugs are gold bugs on steroids, methamphetamines, Red Bull, and

Jack Daniels...” (anonymous)

(Thanks, Mike, good quote)

We’re overbought. But we were overbought in September and October 2025 before a correction set in. Then we were overbought again through December before that reversal set in. As my colleague Mike Ballanger (GGM Advisory Inc.) says, overbought doesn’t seem to matter much these days. It’s just a state of mind. But don’t get complacent. A correction could start anytime. Nonetheless, hitting over $100 is momentous. Now the silver bugs are ardently calling for $200, $300, $500. Some things you do have to take with a grain of salt. Yes, they could be right, but when and how long will it take to get there? To the silver bugs, that could be tomorrow. Yes, supply shortages continue and silver is an important (critical?) industrial metal

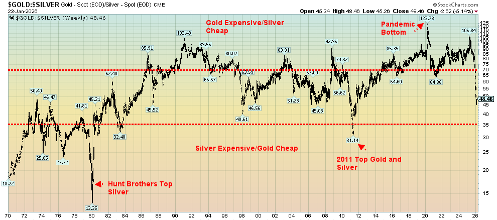

After years of the gold:silver ratio at levels where gold was favoured, the tide has turned. The gold:silver ratio peaked at 123.78 during the pandemic. Now it is at 48.46 and falling in favour of silver. Could we break down to that 1980 low at 13.35? Silver bugs will feel their heads explode. At that ratio and keeping gold at its Friday close of $4,979, silver would be $372. Even at that 2011 low of 31.14, silver would be $160. Suddenly, $300 silver doesn’t seem so impossible after all.

Gold/Silver Ratio 1970–2026

Source: www.stockcharts.com

Source: www.stockcharts.com

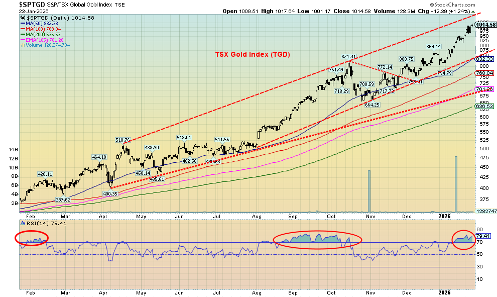

We’d call the TSX Gold Index (TGD) the seventh wonder of the world, but the title is already taken, mostly by a group of ancient wonders. Nonetheless, it is impossible to ignore the rise of the gold stocks over the past year. In 2025 the TGD gained almost 143%. It’s only three weeks into 2026 but the TGD is already up 24%. And we may be just getting underway. The TSX Venture Exchange Metals & Mining Index is up 182.6% in the past year, compared to a gain of 87.1% for the TSX Venture Exchange (CDNX). The junior miners’ rise is, we believe, just getting underway. The all-time high for the CDNX is over 3000 vs. 1000 today.

This past week the TGD gained 7.9% while the Gold Bugs Index (HUI) was up 10.3%. The CDNX gained 5.8% and is now up 16.9% in 2026. For the gold stocks it has been a golden year. The gold bugs are running around bug-eyed with glints in their eyes. Can this continue? We’re overbought. Overbought is, however, just a state of mind. We were overbought from August to October, but we just kept going higher. The bull channel breaks under 830 (50-day MA). So, it’s a level to keep in mind. That break level rises as we go higher. Both the TGD and HUI printed all-time highs this past week while the CDNX made 52-week highs.

Corrections will come, but at this stage we do not see any major top forming. The trend is solidly to the upside. However, profit-taking along the way is wise. Beware of complacency setting in.

Read the FULL report here: Technical Scoop: Haven Highs, Gassy Prices, USD Tank

Disclaimer

David Chapman is not a registered advisory service and is not an exempt market dealer (EMD) nor a licensed financial advisor. He does not and cannot give individualised market advice. David Chapman has worked in the financial industry for over 40 years including large financial corporations, banks, and investment dealers. The information in this newsletter is intended only for informational and educational purposes. It should not be construed as an offer, a solicitation of an offer or sale of any security. Every effort is made to provide accurate and complete information. However, we cannot guarantee that there will be no errors. We make no claims, promises or guarantees about the accuracy, completeness, or adequacy of the contents of this commentary and expressly disclaim liability for errors and omissions in the contents of this commentary. David Chapman will always use his best efforts to ensure the accuracy and timeliness of all information. The reader assumes all risk when trading in securities and David Chapman advises consulting a licensed professional financial advisor or portfolio manager such as Enriched Investing Incorporated before proceeding with any trade or idea presented in this newsletter. David Chapman may own shares in companies mentioned in this newsletter. Before making an investment, prospective investors should review each security’s offering documents which summarize the objectives, fees, expenses and associated risks. David Chapman shares his ideas and opinions for informational and educational purposes only and expects the reader to perform due diligence before considering a position in any security. That includes consulting with your own licensed professional financial advisor such as Enriched Investing Incorporated. Performance is not guaranteed, values change frequently, and past performance may not be repeated.