Excerpt from this week’s: Technical Scoop: Israel Attack, Oil Fuel, Inflation Tick

Gold

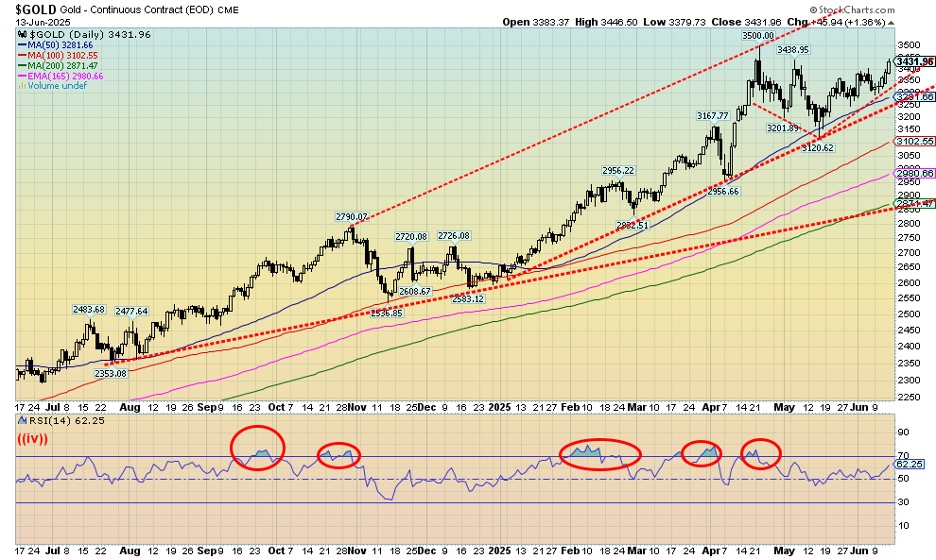

Source: www.stockcharts.com

Gold is the ultimate safe haven. The Iranian attack by Israel, growing tension and potential for violence in the U.S. over the conduct of the Trump administration, and growing loss of faith in government have gold, the ultimate safe haven, rising again. No, not Bitcoin, as Bitcoin actually fell at the outset of the attacks against Iran.

And it is not just the geopolitical tensions that are sparking gold as signs continue to suggest that central banks are still adding to their gold reserves, above what is being reported. Gold rose 3.7% this past week and is now just shy of new highs over $3,500, closing at $3,431. New highs could come early this week as the global and domestic situations worsen. Silver underperformed, rising only about 1%, but still made fresh 52-week highs. Platinum, too, made 52-week highs even as it faded on Friday rather than joining the gold rush. Platinum was up 3.1% on the week. The near precious metals didn’t fare as well as palladium, which fell 2.3%, and copper was off 1.3%. But the gold stocks responded with the Gold Bugs Index (HUI) up 3.0% and the TSX Gold Index (TGD) gaining 4.6%. New 52-week highs also beckon for the gold stocks.

We note that gold’s RSI is only at 62, so it has room to rise before going over 70 into overbought levels. As noted, new highs are highly probable this coming week. Once new highs are made, we have potential targets up to $3,900. For silver, we are targeting up to $44. No, they won’t reach those levels overnight, nor will it necessarily be a straight-up move. But, given all the tensions, gold remains the ultimate safe haven.

Copyright David Chapman 2025

Disclaimer

David Chapman is not a registered advisory service and is not an exempt market dealer (EMD) nor a licensed financial advisor. He does not and cannot give individualised market advice. David Chapman has worked in the financial industry for over 40 years including large financial corporations, banks, and investment dealers. The information in this newsletter is intended only for informational and educational purposes. It should not be construed as an offer, a solicitation of an offer or sale of any security. Every effort is made to provide accurate and complete information. However, we cannot guarantee that there will be no errors. We make no claims, promises or guarantees about the accuracy, completeness, or adequacy of the contents of this commentary and expressly disclaim liability for errors and omissions in the contents of this commentary. David Chapman will always use his best efforts to ensure the accuracy and timeliness of all information. The reader assumes all risk when trading in securities and David Chapman advises consulting a licensed professional financial advisor or portfolio manager such as Enriched Investing Incorporated before proceeding with any trade or idea presented in this newsletter. David Chapman may own shares in companies mentioned in this newsletter. Before making an investment, prospective investors should review each security’s offering documents which summarize the objectives, fees, expenses and associated risks. David Chapman shares his ideas and opinions for informational and educational purposes only and expects the reader to perform due diligence before considering a position in any security. That includes consulting with your own licensed professional financial advisor such as Enriched Investing Incorporated. Performance is not guaranteed, values change frequently, and past performance may not be repeated.