Excerpt from this week's: Technical Scoop: New Highs, Precious Accumulation, Due Debt

Over at the other side, gold continues to baffle and confuse. Gold bugs can’t figure out why, but with the background we have, gold is not at record prices. Well, it did make a record high back in December on a spike overnight that by morning had washed away completely. Silver, the gold stocks, platinum? All are so far away from their all-time highs that we have trouble seeing where the old high was. Silver remains 54% under its all-time high, the Gold Bugs Index (HUI) is 67% away, the TSX Gold Index (TGD) remains down 46%. Platinum is still down 60% from its high way back in 2008. The junior mining dominated TSX Venture Exchange (CDNX) is down 84% from its all-time high back in 2007. Ouch!

Gold gained 1.3% this past week, but silver gave back following its strong up week last week, losing 2.1%. Platinum was off 0.4%, palladium gained 3.8%, and copper was up 1.6%. We consider copper a leader, so watch it. The HUI lost 0.7% and the TGD fell 1.9%. All this against a backdrop of the currencies doing little as the US$ Index fell 0.3% and the euro was up 0.4%. The rest were just mixed. Speaking of currencies, we keep reading Bitcoin is going to overtake and replace the U.S. dollar (don’t count on it). Bitcoin is within 26% of its all-time high even as it fell 1.1% this past week. But Bitcoin is still a big winner in 2024, up 21.5%.

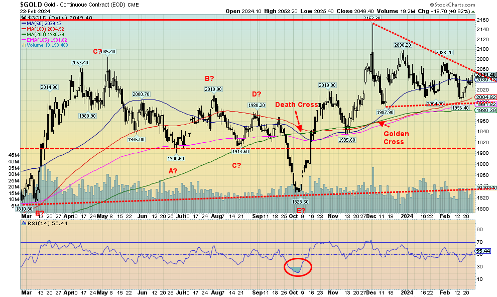

What worries us about gold is the forming of what appears to be a descending triangle. Naturally, we don’t want to see that, but if that bottom end near $2,000 falls out, the fall could be a drop to $1,835. The upside breakout is near $2,060 and projects up to $2,225. If the former happens, it should be the last hurrah for a drop but it will shake the market to the bone. Sentiment would fall swiftly and maybe this time the gold bugs will leap out of windows. Whatever, it would be final shakeout. We’d prefer not to see a drop but recognize we shouldn’t dismiss the potential nasty descending triangle. Once that low is made, a major rally should get underway as the background remains too compelling to ignore gold. And, no Bitcoin is not the same as gold.

“Be prepared” seems to be a motto for both stock markets and gold markets.

Source: www.stockcharts.com

Copyright David Chapman 2024