Excerpt from this week's: Technical Scoop: Volatile Reversal, Rate Angst, Bubble Liquidity

Source: www.stockcharts.com

So, we have talk of a peace deal between Russia/Ukraine, along with talk on whether the Fed will stand pat in December or lower rates. Talk of the Fed staying pat helped push gold prices down, while talk of an interest rate cut helped gold prices to rise. Also, there was the somewhat friendly jobs report that favoured the bearish camp. Prices rebounded on Friday, following suggestions from Fed officials that an interest rate cut might still be on. But, as a reminder, we have noted the Fed is divided for the first time in years.

On the week, gold fell 0.5% but remains up a healthy 53.8% on the year. Silver fell 1.4%, platinum was down 2.3%, and of the near precious metals, palladium was off 1.9% and copper fell 1.0%. The gold stocks naturally fell as well. The Gold Bugs Index (HUI) lost 3.4% while the TSX Gold Index (TGD) dropped 3.3%. A lousy week all around, but definitely not a disastrous week. Of concern is that gold fell from its high of $4,381, hitting a low of $3,886 before rebounding back up to $4,245. Given that it fell short of the previous high it’s a signal that we could now be on a C wave down. A break back under $3,886 could, in theory, project down to $3,400. That would be about a 13% correction. A reminder that, during the 2009–2011 gold bull market, gold fell twice around 13%–15% and three other times as well where the decline approached 10%. A correction of that nature is not unusual. Since this rally started in 2022, we’ve already had one correction of 13% and two other corrections of under 10%. We still expect a potential low into December before another up leg gets underway. Could the Fed at its December 9–10 meeting be the catalyst? We remember well the Fed meeting of December

2015 that ignited a strong gold rally into 2016. Could lightning strike twice?

Source: www.stockcharts.com

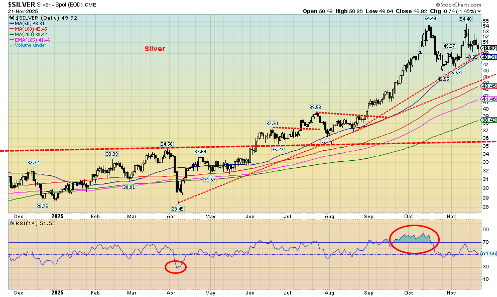

Silver, like gold, took it a bit under the chin this past week, given all the talk that the Fed won’t cut, then that the Fed will cut. Silver fell 1.4% but remains up 70.7% on the year. No matter how one looks at it, silver and the precious metals have had a good year. The gold/silver ratio is at 81.32, well off its high of 107.66 but still above a potential breakdown zone at 76 and especially under 75. Silver’s high was $54.49, and the recent rebound took it only to $54.40 before turning down again. Is it a double top? We don’t know yet. The neckline is near $48.30 and under $48 silver looks a bit shaky. If it is a double top, the breakdown could project a drop, down to $39.50 near the 200-day MA. There is interim support at $45 and $41/$42. The chart looks a bit negative with that potential double top. New highs would end any discussion of a double top.

Source: www.stockcharts.com

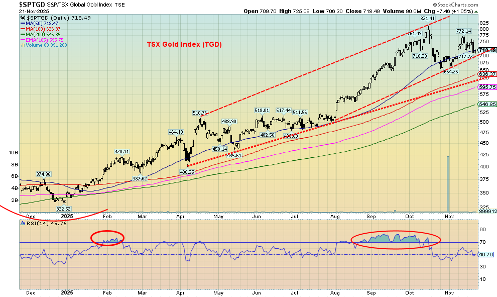

Given weakness in the broader stock market, it is probably no surprise that gold stocks have also been weak. Both gold and silver are also off their highs. In a down market, as in an up market, the gold stocks tend to lead. While gold was off 0.5% and silver down 1.4% this past week the gold stock indices fell more. The Gold Bugs Index (HUI) dropped 3.4% and the TSX Gold Index (TGD) fell 3.3%. Altogether, the HUI is down 14.3% and the TGD is down 12.5% from their respective all-time highs. That’s correction territory. As the chart of the TGD shows, we continue to hold above the 50-day MA, but will that last if the stock market continues to fall? A breakdown under 700 could suggest a fall to better support around 635. The recent rebound was well short of the recent all-time high. That’s a negative sign as only new highs tells us the low is in. The RSI is neutral. We await a fall for the RSI under 30 to suggest that a bottom may be in progress. The junior developer gold stocks have also been under a bit of pressure of late. That’s no surprise as they tend to fall faster in a down market, just as they rise faster in an up market.

Read the FULL story here: Technical Scoop: Volatile Reversal, Rate Angst, Bubble Liquidity

Copyright David Chapman 2025

Disclaimer

David Chapman is not a registered advisory service and is not an exempt market dealer (EMD) nor a licensed financial advisor. He does not and cannot give individualised market advice. David Chapman has worked in the financial industry for over 40 years including large financial corporations, banks, and investment dealers. The information in this newsletter is intended only for informational and educational purposes. It should not be construed as an offer, a solicitation of an offer or sale of any security. Every effort is made to provide accurate and complete information. However, we cannot guarantee that there will be no errors. We make no claims, promises or guarantees about the accuracy, completeness, or adequacy of the contents of this commentary and expressly disclaim liability for errors and omissions in the contents of this commentary. David Chapman will always use his best efforts to ensure the accuracy and timeliness of all information. The reader assumes all risk when trading in securities and David Chapman advises consulting a licensed professional financial advisor or portfolio manager such as Enriched Investing Incorporated before proceeding with any trade or idea presented in this newsletter. David Chapman may own shares in companies mentioned in this newsletter. Before making an investment, prospective investors should review each security’s offering documents which summarize the objectives, fees, expenses and associated risks. David Chapman shares his ideas and opinions for informational and educational purposes only and expects the reader to perform due diligence before considering a position in any security. That includes consulting with your own licensed professional financial advisor such as Enriched Investing Incorporated. Performance is not guaranteed, values change frequently, and past performance may not be repeated.