Gold's boomer rally at the 6:00 p.m. Globex open in New York on Thursday evening was brutally capped at the Shanghai open -- and was then engineered lower until around 10:35 a.m. China Standard Time on their Friday morning. It then had a broad and quiet up/down move centered around what looked like the 10:30 a.m. morning gold fix in London -- and ending at the noon GMT silver fix. London was supposed to be closed for the Boxing Day holiday, but maybe the precious metals markets were open out of absolute necessity. Its rally from that juncture ran into those pesky short sellers of last resort minutes after the 11 a.m. EST London close -- and that ensuing engineered sell-off ended around 12:35 p.m. in COMEX trading in New York. From that point it chopped quietly higher under what appeared to be strict supervision until the market closed at 5:00 p.m. EST.

The low and high ticks in gold were recorded as $4,518.00 and $4,584.00 in the February contract...an intraday move of $66.00 the ounce. The December/March price spread differential in gold at the close in New York yesterday was $23.60...February/April was $33.00...April/June was $33.10 -- and June/August was $32.80 an ounce.

Gold was closed in New York on Friday afternoon at $4,533.00 spot...up $54.40 and ounce/1.21% on the day -- and $15.80 off its Kitco-recorded high tick. Net volume was nothing special at around 159,500 contracts -- and there were around 21,500 contracts worth of roll-over/switch volume on top of that.

I saw that 263 gold, plus 140 silver contracts were traded in December yesterday and, as is always the case, it remains to be seen just how much of these amounts show up in tonight's Daily Delivery and Preliminary Reports further down in today's column.

![]()

Silver gapped up at the 6:00 p.m. Globex open in New York on Thursday evening -- and was finally brought under control shortly after Shanghai opened on their Friday morning. It wasn't allowed to do much from that point until it jumped up a bit more in the fifteen minutes leading up to the 10:30 a.m. morning gold fix in London. Its engineered price decline from that juncture ended at or shortly before the noon silver fix over there -- and then away it went...with all the feeble attempts to stop it, getting overrun in short order.

The low and high ticks in silver were reported by the CME Group as $72.72 and $79.70 in the March contract...an intraday move of $6.98 an ounce. I can hard believe that even typing such numbers! The December/March price spread differential in silver at the close in New York yesterday was an eye-watering 71.0 cents, a record high roll-over fee...March/May was a hefty 57.6 cents...May/July was 56.2 cents -- and July/September was 49.6 cents an ounce. I thought Wednesday's numbers were highway robbery, but these are even worse...especially December/March.

Silver finished the Friday trading session in New York at $79.274 spot...up $7.43 an ounce/10.34% on the day -- and 3.5 cents off its Kitco-recorded high tick. Net volume was past the moon once again at a bit under 158,000 contracts -- and there were a bit under 16,000 contracts worth of roll-over/ switch volume in this precious metal.

![]()

Platinum's multiple broad rally attempts in both Globex and COMEX trading on Friday ran into an equal number of bouts of not-for-profit selling by 'da boyz'. Heaven only knows what price it would have closed at if they hadn't been as aggressive as they were. As it was, platinum was closed at $2,451 spot...up $213/9.52% -- and 16 bucks off its Kitco-recorded high tick.

![]()

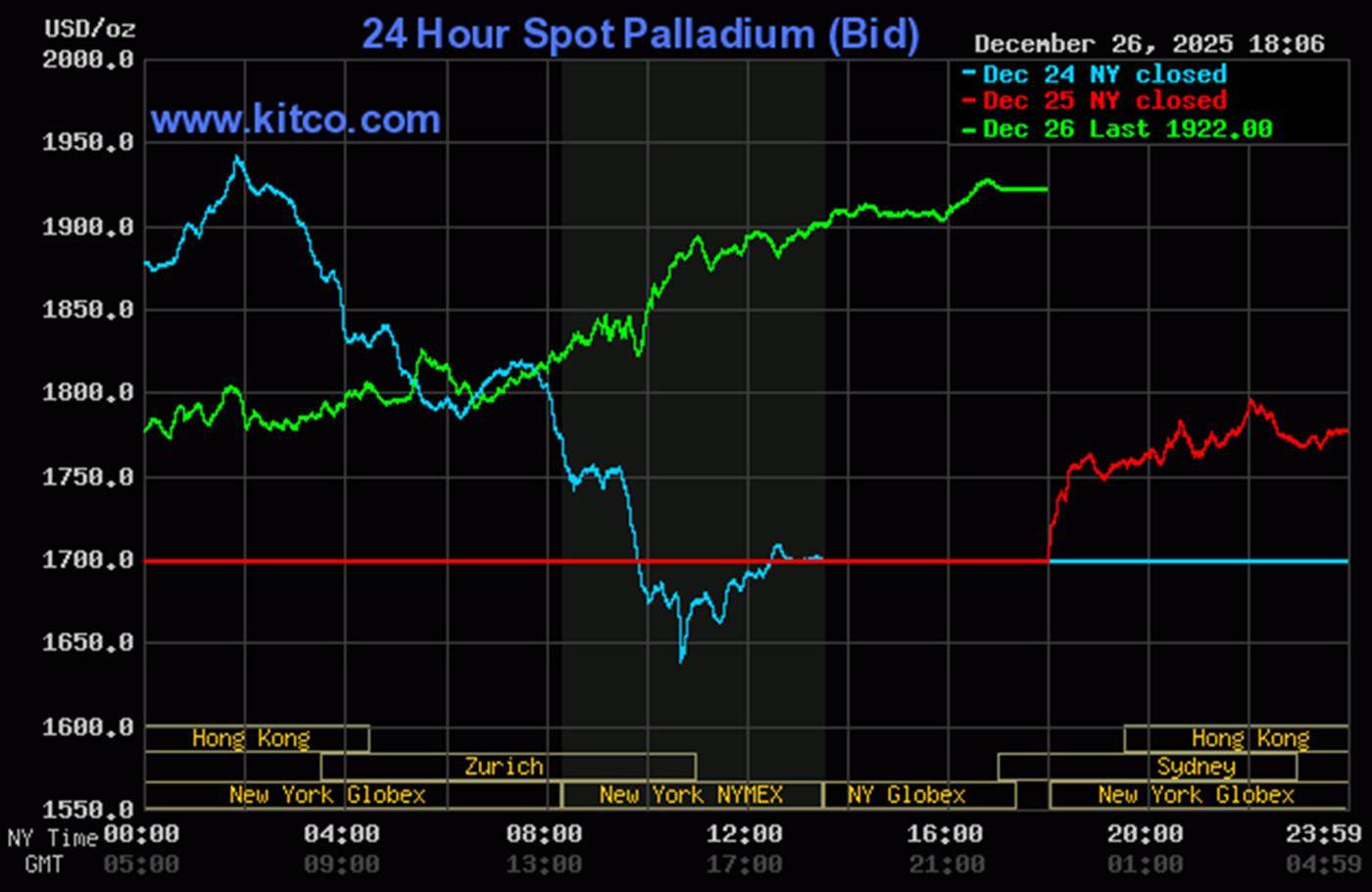

Palladium's Friday rally everywhere on Planet Earth on Friday did show the odd sign of price management, but what little there was, wasn't very effective. As a result, palladium closed at $1,922 spot...up $223 an ounce/13.13% from its close on Wednesday.

Based on the kitco.com spot closing prices in silver and gold posted above, the gold/silver ratio imploded to 57.2 to 1 on Friday...compared to 62.3 to 1 on Wednesday.

Here's the 1-year Gold/Silver Ratio chart from Nick -- and updated with this past week's data. Click to enlarge.

![]()

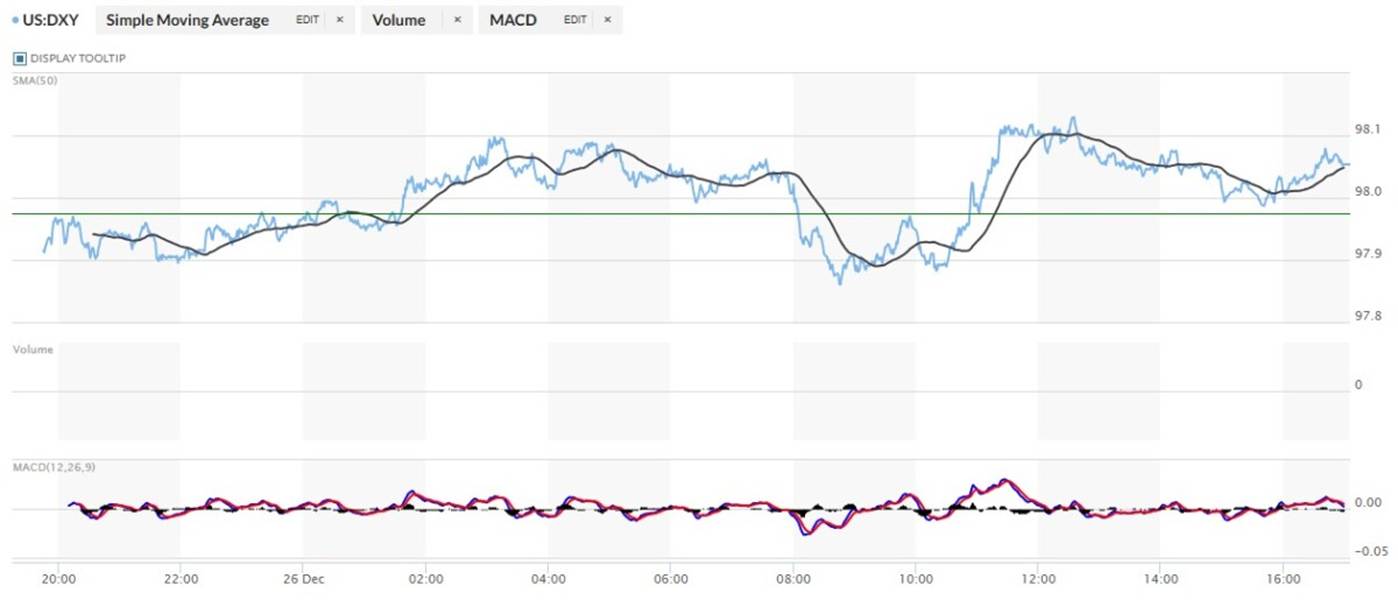

The dollar index closed very late on Thursday afternoon in New York at 97.98 -- and then opened lower by 6 basis points once trading commenced at 7:45 p.m. EST on Thursday evening...which was 8:45 a.m. China Standard Time on their Friday morning. From that point it wandered/chopped very quietly and unevenly higher until the market closed at 5:00 p.m. in New York on Friday afternoon.

The dollar index finished the Friday trading session in New York at 98.05...up 8 basis points from its close on Thursday.

Here's the DXY chart for Friday...thanks to marketwatch.com as usual. Click to enlarge.

![]()

Here's the 6-month U.S. dollar index chart...courtesy of stockcharts.com as always. The delta between its close...98.05...and the close on DXY chart above, was zero basis points. Click to enlarge.

![]()

As at has been for almost the entire year, what was happening in the currencies was irrelevant to what was going on the precious metal space.

U.S. 10-year Treasury: 4.1360%...0.0000/(0.00%)...as of the 1:59:54 p.m. CST close

The Fed spent a decent part of the Friday session ensuing that the ten-year yield didn't close up on the day.

For the week, the ten-year closed lower by 1.5 basis points -- and only did so because of the continuing intervention by the Fed.

Here's the 5-year 10-year U.S. Treasury chart from the yahoo.com Internet site -- which puts the yield curve into a somewhat longer-term perspective. Click to enlarge.

The 10-year hasn't been allowed to trade above its 4.92% high tick set back on October 15, 2023...but I still suspect that we've seen the 3.9482% low for this cycle...which was set back on October 22 of this year. QT came to an end a few weeks back -- and more rate cuts in 2026 are expected...as is the return of QE.

![]()

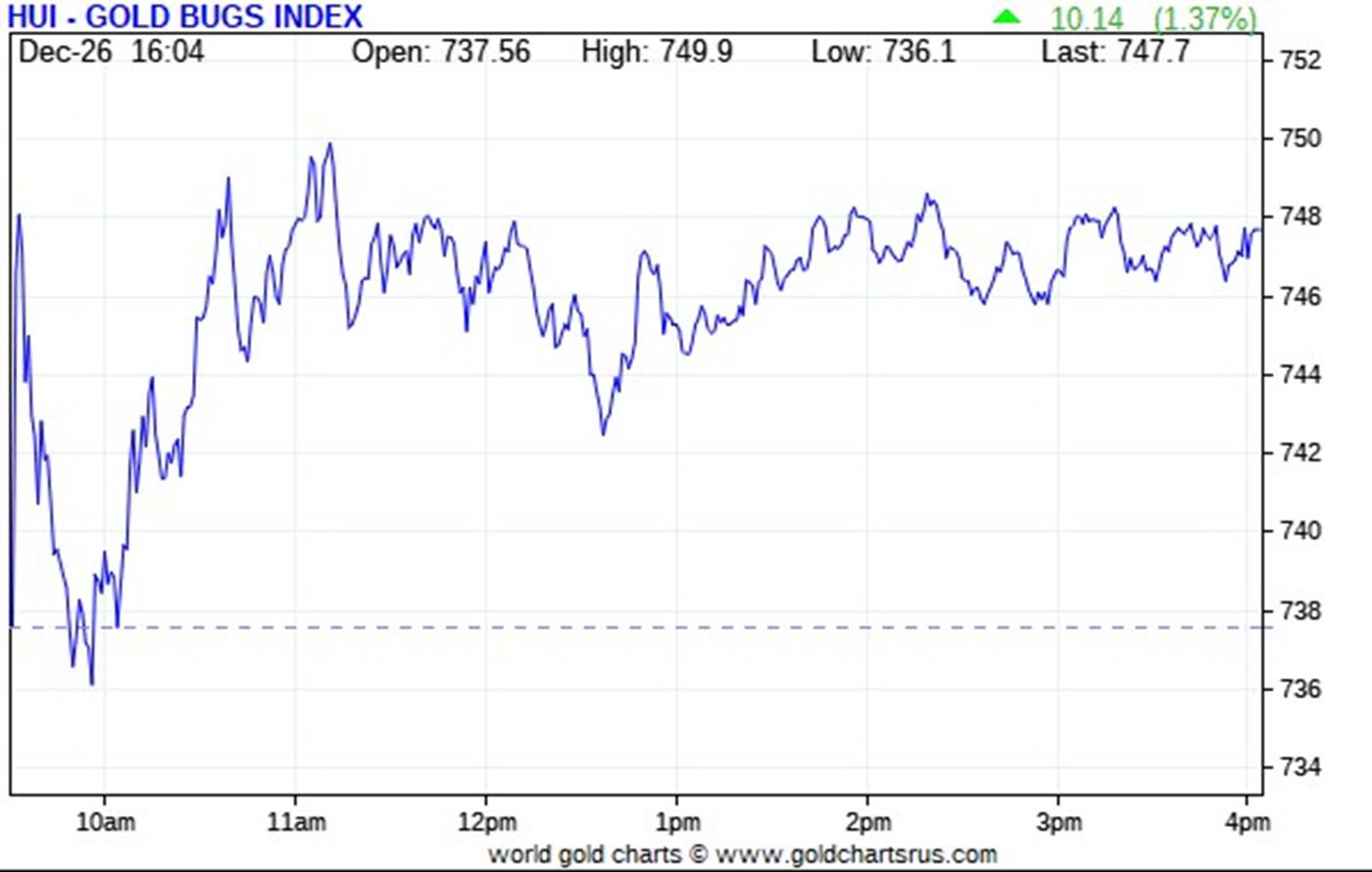

Not surprisingly, the gold shares jumped higher at the 9:30 opens of the equity markets in New York on Friday morning, but ran into not-for-profit selling immediately -- and were sold below the unchanged mark by the 10 a.m. EST. They then rallied until shortly after 11 a.m. EST -- and then had a slightly descending down/up move that lasted until trading ended at 4:00 p.m. The HUI closed up a miserable 1.37 percent.

![]()

Silver's record one-day gain was not allowed to manifest itself in its respective equities. I've been on the record for a very long time saying that the silver stocks were being actively managed -- and yesterday's price action was a textbook example of that.

With Toronto closed -- and four of Nick Laird's stocks in the Silver Sentiment Index being priced off that exchange, his data isn't of much use, so I'm not posting the daily chart. But SILJ...the Amplify Junior Silver Miners ETF... closed up a pathetic 2.28 percent. Every silver stock should have been up big double-digit amounts yesterday, but weren't. I'll have more on this in The Wrap.

The 'stars' yesterday were Silvercorp Metals and Pan American Silver, as those closed higher by 3.61 and 3.20 percent respectively. The biggest underperformer was First Majestic Silver, as it closed higher by only 1.22 percent -- and was actually down on the day briefly on it engineered sell-off at the 9:30 opens in New York on Friday morning.

I didn't see any news on the thirteen silver stocks that make up the above Silver Sentiment Index.

The silver price premium in Shanghai over the U.S. spot price on Friday was 10.13 percent.

The reddit.com/Wallstreetsilver website, now under 'new' and somewhat improved management, is linked here. The link to two other silver forums are here -- and here.

![]()

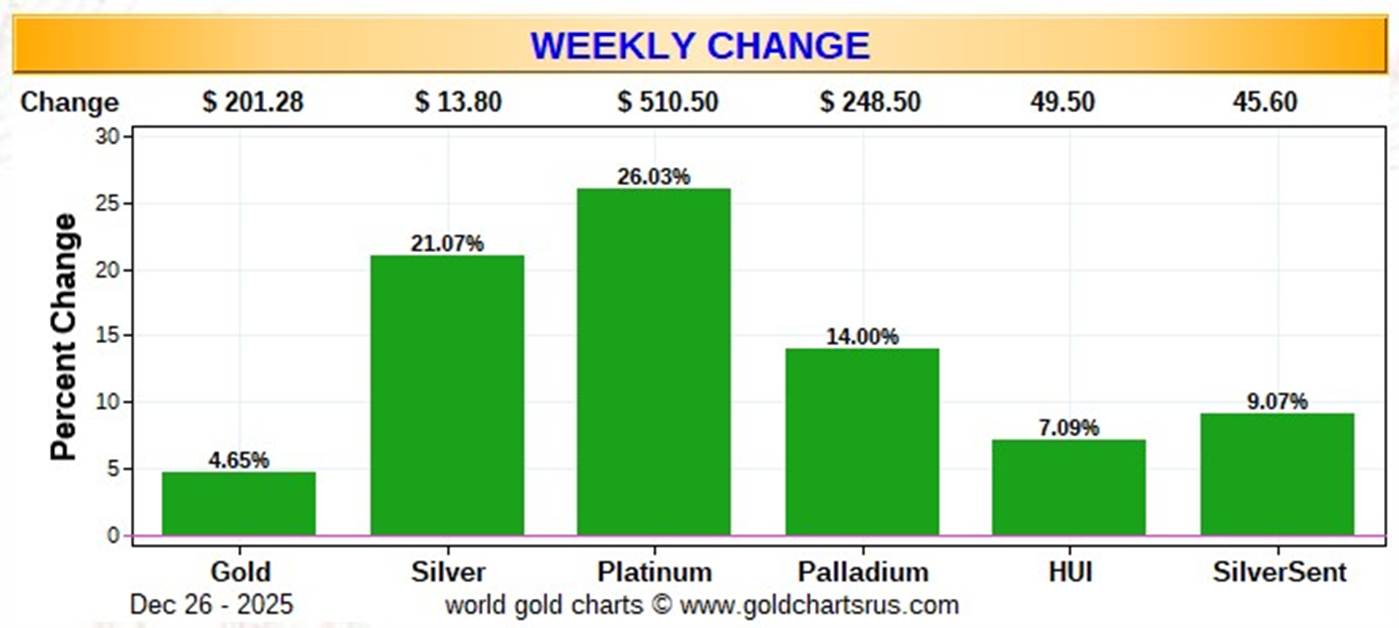

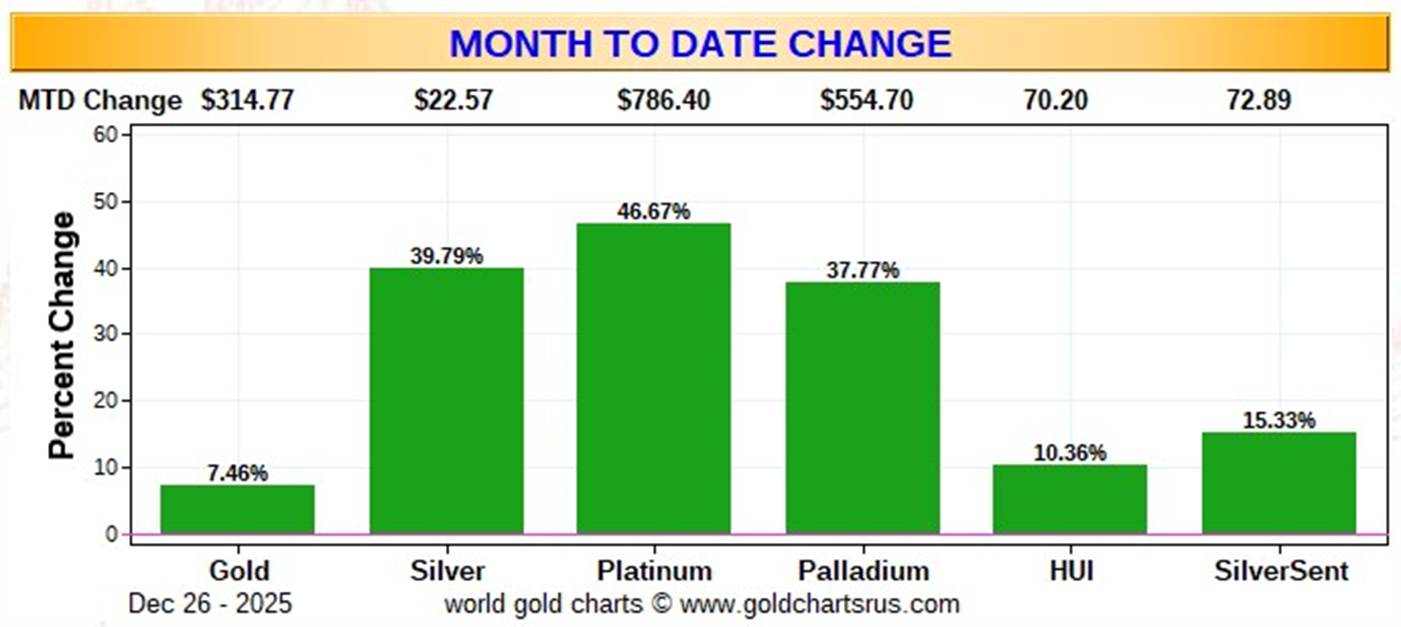

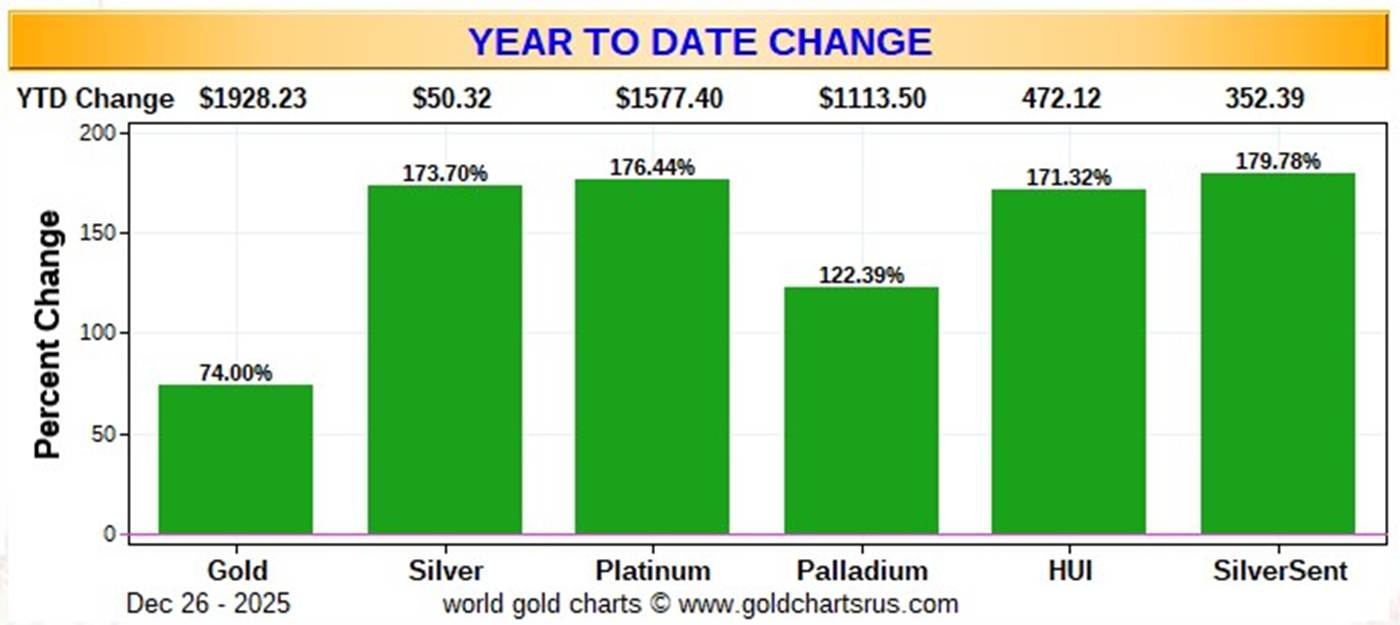

Here are the usual three charts that appear in this spot in every weekend missive. They show the changes in gold, silver, platinum and palladium in both percent and dollar and cents terms, as of their Friday closes in New York — along with the changes in the HUI and the Silver Sentiment Index.

Here's the weekly chart -- and it's not quite accurate because of Christmas Day. It includes the last five business days...which also includes the data from Friday, December 19. But I thought I'd post it anyway, so you can see just how poorly the silver equities have underperformed silver itself over that time period. On an absolute basis, it outperformed the HUI...but it wasn't even close on a relative basis. Click to enlarge.

Here's the month-to-date chart -- and the ongoing underperformance of the silver shares vs. the silver price is the standout feature here as well -- and even more pronounced. The underperformance of gold and its equities is also very noticeable -- and I'm surprised that it's been lagging the other three precious metals this much. Click to enlarge.

Here's the year-to-date chart -- and even though the silver price has outperformed the gold price by 2.35x on a relative basis year-to-date, its associated equities are barely ahead of the gains in the HUI. The silver equities should be priced at least double what they are now to be equal to the gains in the gold equities vs. the gold price itself year-to-date. That would put the Silver Sentiment Index at around 360...compared to the 180 its sitting at now. Click to enlarge.

Despite the fact that silver has now broken the $79 barrier...up 12 bucks on the week -- and the silver well in London is running close to empty...with very elevated lease rates...the gold/silver ratio remains at a farcical 57.2 to 1 as of the Friday's close. The 'normal' and historical ratio is around 15 to 1...which would put silver at about $302. And if priced at the ratio of 7:1 that it comes out of the ground at, compared to gold...that would put silver at around $650 an ounce. So a triple-digit silver price is in our future. As I say in this spot every Saturday...all that remains to be resolved is what that number will be -- and how soon 'da boyz' allow it to happen.

The CME Daily Delivery Report for Day 21 of December deliveries showed that 166 gold, plus 69 silver contracts were posted for delivery within the COMEX-approved depositories on Tuesday.

In gold, the two short/issuers were JPMorgan and ADM, issuing 127 and 39 contracts out of their respective client accounts. The three largest long/ stoppers were Wells Fargo Securities, picking up 67 contracts for its house account. They were followed by Canada's BMO [Bank of Montreal] Capital and the CME Group, stopping 34 contracts each -- and for their respective house accounts as well.

The CME Group immediately reissued theirs as 10x34=340 of those ten-ounce bar micro gold futures contracts -- and the only long/stopper that mattered for those was Advantage, picking up 330 of those bars for clients.

In silver, the two biggest short/issuers were ADM and Advantage, issuing 58 and 8 contracts out of their respective client accounts. There were six long/ stoppers in total -- and the three largest were ADM, the CME Group and Dutch bank ABN Amro, picking up 34, 13 and 12 contracts...the CME Group for their house account.

They immediately reissued them as 5x13=65 of those one-thousand ounce good delivery bar micro silver futures contracts -- and the two largest long/ stoppers for those were ADM and Advantage, picking up 46 and 16 contracts for their respective client accounts.

Copper deliveries haven't slowed, as another 633 were issued and stopped yesterday. Month-to-date there have been 472 million pounds of copper issued and stopped. The rush for copper in hand is just a frenzied as it is for silver and gold.

The link to yesterday's Issuers and Stoppers Report is here.

Month-to-date there have been 37,003 gold contracts issued/reissued and stopped -- and that number in silver is an amazing 12,776 COMEX contracts/ 63.880 million troy ounces. In platinum, it's only 18 contracts -- but in palladium it's 687.

Back on First Day Notice for December deliveries on November 26, there were 26,946 gold contracts still open -- and that number in silver was 9,866 COMEX contracts. So it's obvious that the rush for physical metal remains 'rapacious' ...as there have been considerable contracts added to the December delivery month every single business day since then.

The CME Preliminary Report for the Friday trading session showed that gold open interest in December fell by 263 contracts, leaving 218 still around...minus the 166 contracts out for delivery on Tuesday as per the above Daily Delivery Report. Wednesday's Daily Delivery Report showed that 339 gold contracts were actually posted for delivery on Monday, so that means that 339-263=76 more gold contracts were added to the December delivery month.

Silver o.i. in December rose by 32 contracts, leaving 72 still open...minus the 69 contracts out for delivery on Monday as mentioned a whole bunch of paragraphs ago. Wednesday's Daily Delivery Report showed that 19 silver contracts were actually posted for delivery on Monday, so that means that 32+19=51 more silver contracts were added to the December delivery month.

Total gold open interest in the Preliminary Report on Friday night increased by only 8,511 COMEX contracts. Total silver o.i. only rose by 2,375 contracts. There was obviously big short covering going on -- and we won't know how much until the January 2 Commitment of Traders Report next Friday.

[I checked the final total open interest number for gold for Wednesday -- and it fell by very little...from -3,138 contracts, down to -3,803 COMEX contracts. Final total silver o.i. for Wednesday increased by an inconsequential amount...from -871 COMEX contracts...up to -805 contracts.]

Gold open interest in January in the CME's Final Report on Friday morning rose by another hefty amount, this time by 622 contracts, leaving 4,672 still around -- and silver o.i. in January increased by 107 contracts, leaving 4,444 still open.

![]()

There was a further addition to GLD...the second in as many days...as an authorized participant deposited 91,957 troy ounces of gold -- and 39,589 troy ounces of gold was added to GLDM as well. But there were a further three truckloads/1,813,348 troy ounces of silver taken out of SLV...the third withdrawal in a row since the 17.13 million troy ounces were added to it on Monday.

The SLV borrow rate started the Friday session at 0.63% -- and closed at 0.58% ...with 10.0 million shares available to short by the end of the day. The GLD borrow rate began the day at 0.56% -- and also finished it at 0.56% ...with 7.3 million shares available. As I pointed out last week, absolutely nobody is interested in shorting these two ETFs -- and for obvious good reason.

In other gold and silver ETFs and mutual funds on Earth on Friday ...net of any changes in COMEX, GLD and SLV activity, there were a net 44,242 troy ounces of gold added -- and a net 1,178,105 troy ounces of silver were added as well...mostly thanks to the 700,000 troy ounces that went into Sprott's PSLV.

And nothing from the U.S. Mint of course.

![]()

The only activity in gold over at the COMEX-approved depositories on the U.S. east coast on Wednesday all happened over at Loomis International. They received 32,151.000 troy ounces/1,000 kilobars -- and shipped out 257.208 troy ounces/8 kilobars. There was no paper activity of any kind -- and the link to Wednesday's COMEX gold activity is here.

It was very busy in silver. There were only 19,615 troy ounces reported received -- and all of that amount ended up Loomis International. There were 1,644,571 troy ounces shipped out -- and the two largest amounts were the 1,190,701 troy ounces/two truckloads that left Asahi...plus the 434,254 troy ounces that departed Manfra, Tordella & Brookes, Inc.

There was decent paper activity, as 1,268,758 troy ounces were transferred from the Eligible category and into Registered...642,941 troy ounces at Loomis International -- and the remaining 625,816 troy ounces that made that same trip over at Asahi. I suspect these transfers were made in preparation for delivery in January.

The link to Wednesday's considerable COMEX silver action is here.

The Shanghai Futures Exchange updated their silver inventories as of the close of business on their Friday -- and it showed that a net 1,060,532 troy ounces/ 32.986 metric tonnes were removed... leaving their silver inventories at 26.346 million troy ounces/819.431 metric tonnes.

Because I didn't have a column on Christmas Day, I didn't pick up the silver data from the Shanghai Futures Exchange...but that was easy to compute. On Thursday...our Christmas Day...there were 959,483 troy ounces/29.532 tonnes of silver removed as well.

![]()

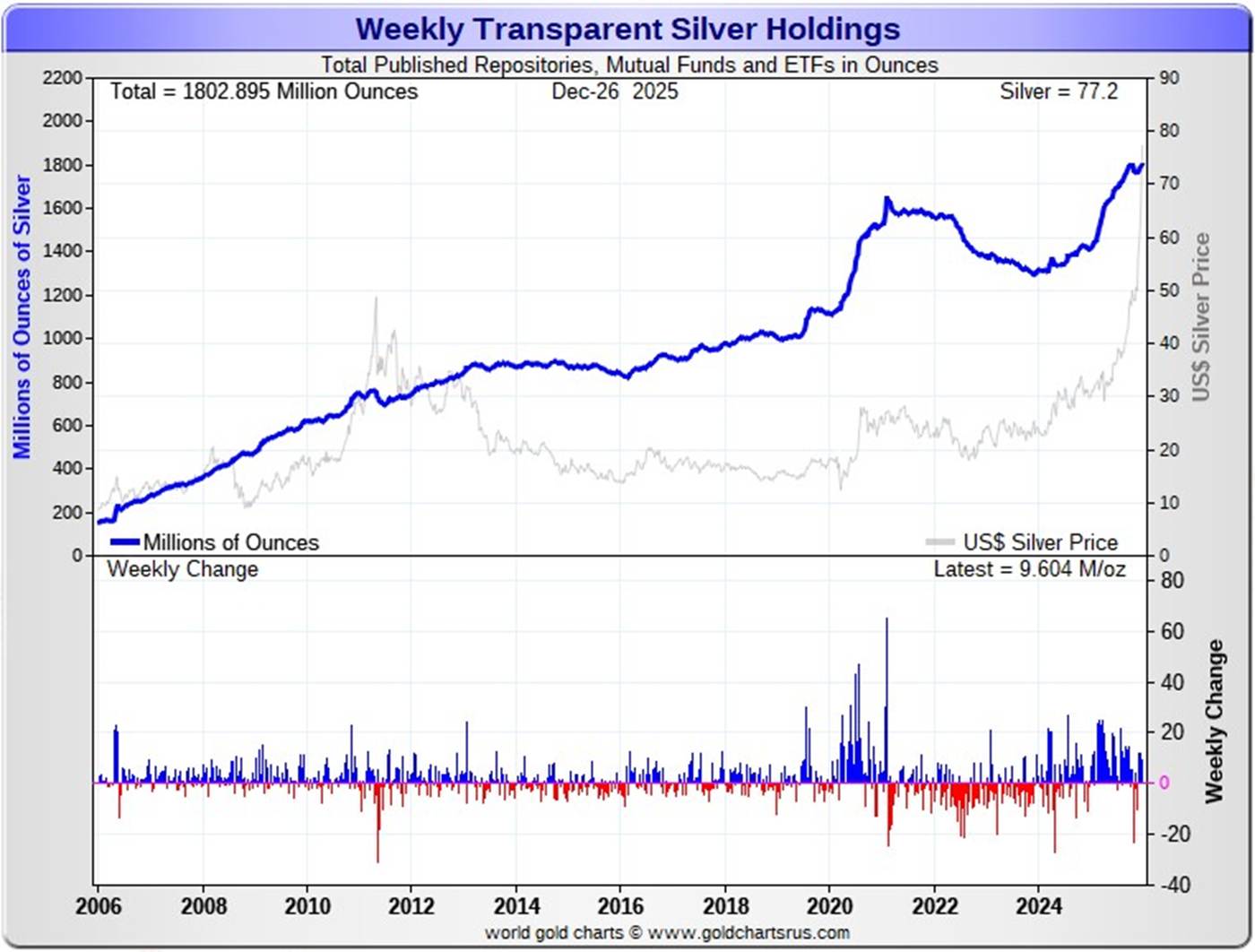

Here are the usual 20-year charts that show up in this space in every weekend column. They show the total amounts of physical gold and silver held in all known depositories, ETFs and mutual funds as of the close of business on Friday.

During the business week just past, there were a net 657,000 troy ounces of gold added -- and a net 9.604 million troy ounces of silver were added as well.

According to Nick Laird's data on his website, a net 2.070 million troy ounces of gold were added to all the world's known depositories, mutual funds and ETFs during the last four weeks. The two largest 'in' amounts were the 1.046 million troy oz. that went into GLD, followed by the 540,100 troy ounces into China's gold ETFs. The largest 'out' amount were the 165,900 troy ounces that left the COMEX.

The amount of gold in all the world's ETFs and mutual funds remains barely above its old all-time high of late 2020...but should be far higher, more than double its current amount, considering that gold is now some distance north of $4,500 the ounce...far more than twice the price it was back then. Why it isn't, is beyond me.

It should be noted that the amount of silver held in all these depositories, ETFs and mutual funds is a noticeable amount above its old all-time high inventory level of January 2021. But it should be far higher than it is as well, because silver is also handily more than double the price it was back then.

Back at its previous inventory peak in late January 2021, silver was around $27 an ounce. Now its fifty bucks higher. Why the precious metal ETFs aren't doing better is a mystery for which I have no answer. Maybe there's a lag time I'm not factoring in. But it's a given that the powers-that-be in the precious metals world are happy they aren't. However, having said that, the amount of silver being gobbled up by these ETFs and mutual funds is enormous...9+ million oz. per week on average...four days of weekly mine production. How long can this continue, without something blowing up?

A net 36.442 million troy ounces of silver were also added during that same 4-week time period.

The biggest 'in' amount over that four-week period were the 25.078 million troy ounces shipped into SLV...followed by the 8.543 million oz. into Aberdeen ...followed by the 4.708 million oz. into India's silver ETFs. The last really big deposit were the 4.200 million that went into Sprott's PSLV. The only 'out' amount that mattered were the 7.044 million that left the COMEX -- and mostly London bound.

Retail sales are doing much better -- and it's now obvious that some of the more popular products are getting hard to come by. Here in Canada, the price of a 1 oz. Canadian maple leaf is now around CAN$115...simply amazing.

Physical demand in silver at the wholesale level remains enormous/ rapacious. COMEX silver deliveries have been huge all year.

And, as mentioned further up in the Daily Delivery Report, there have been 3.700 million troy ounces of gold...plus 63.880 million troy ounces of silver issued and stopped so far this month, with new contracts being added to both every day...even though the end of the December delivery month is upon us.

The "rapacious" silver demand mentioned two paragraphs ago will continue until available supplies are depleted...which now appears imminent once more -- and we're also fast approaching the sixth year of a structural deficit in silver according to the ongoing reports from The Silver Institute.

The vast majority of precious metals being held in these depositories are by those who won't be selling until the silver price is many multiples of what it is today.

Sprott's PSLV is the third largest depository of silver on Planet Earth with 208.8 million troy ounces...up 700,000 troy ounces on the week -- and a great distance behind the COMEX, which has now been demoted to the second largest silver depository, where there are 449.7 million troy ounces being held...down 4.0 million troy ounces this past week...but minus the 103 million troy ounces being held in trust for SLV by JPMorgan.

That 103 million ounce amount brings JPMorgan's actual silver warehouse stocks down to around the 85 million troy ounce mark...quite a bit different than the 188.3 million they indicate they have...down a net and further 1.8 million troy ounces on the week.

PSLV remains a very long way behind SLV as well -- now the largest silver depository...with 527.0 million troy ounces as of Friday's close...up a further 10.5 million ounces from last week.

The latest short report [for positions held at the close of business on Monday, December 15] showed that the short position in SLV rose by 17.87%...from the 43.65 million shares sold short in the prior report...up to 51.45 million shares in this latest short report that came out this past Wednesday...8.82% of total SLV shares outstanding. This amount is grotesque, obscene -- and fraudulent beyond all description...as there is no physical silver backing any of it as the SLV prospectus requires.

BlackRock issued a warning five or so years ago to all those short SLV that there might come a time when there wouldn't be enough metal for them to cover. That would only be true if JPMorgan decides not to supply it to whatever entity requires it. However, we are far beyond that point now, as the short position in SLV will never be covered through the deposit of physical silver, as it just doesn't exit -- and never will. And if it does exist, it will only be available at a price far higher than what's being quoted in the public domain now. Those short SLV shares are in equal dire straits as those short silver in the COMEX futures market.

The next short report...for positions held at the close of trading on Wednesday, December 31 will be posted on The Wall Street Journal's website on Monday afternoon EST on January 12...a lifetime away in this market.

Then there's that other little matter of the 1-billion ounce short position in silver held by Bank of America in the OTC market...with JPMorgan & Friends on the long side. Ted said it hadn't gone away -- and he'd also come to the conclusion that they're short around 25 million ounces of gold with these same parties as well. Once the silver price approaches three digits, we'll see if they need to get bailed, like Bear Stearns did back in 2008 -- and for the same reason.

The latest OCC Report for Q2/2025 came out three months ago now -- and it showed that the precious metal derivatives held by the four largest U.S. banks only increased by $25.8 billion/4.89% from Q1/2025...which is nothing much at all -- and that's despite the fact that precious metal prices rose fairly substantially during that time period.

JPMorgan's precious metals derivatives rose from $323.5 billion, up to $358.5 billion in Q2/2025 -- and Citigroup's also rose, but not by much, from $142.8 billion...up to $150.7 billion. BofA's fell from $61.7 billion, down to 44.7 billion -- and the derivatives position held by Goldman Sachs is a piddling and immaterial $219 million -- down from the $269 million held in Q1/2025.

But with JPMorgan holding 64.7% of all the precious metals derivatives... Citibank holding 27.2% -- and Bank of America about 8% of the total of the four reporting banks, it's only JPMorgan and Citigroup that matter.

And as I keep pointing out in this spot every weekend, the OCC indicator is flawed for two very important reasons, as way back 10-15 years ago, this report used to include the top dozen or so U.S. banks -- and included the likes of Wells Fargo and Morgan Stanley, amongst others... that are card-carrying members of the Big 8 shorts. Now the list is down to just four banks...so a lot of data is hidden...which is certainly the reason why the list was shortened. On top of that, the list doesn't include the non-U.S. banks that are members of the Big 8 shorts: British, French, German, Canadian -- and Australian.

I just noted that the Q3/2025 Quarterly Report on Bank Trading and Derivatives Activities is now up on the OCC's website -- and I just don't have time to get into it tonight -- and will have it for you on Tuesday.

Because of the Christmas Day holiday, there was no Commitment of Report yesterday. It will come out on Monday -- and I'll have it for you in my Tuesday missive. I have a few more comments about this in The Wrap.

![]()

CRITICAL READS

The S&P500 gained 1.4% (up 17.8% y-t-d), and the Dow rose 1.2% (up 14.5%). The Utilities advanced 1.2% (up 13.8%). The Banks rose 1.8% (up 32.1%), and the Broker/Dealers added 1.3% (up 31.0%). The Transports increased 0.5% (up 11.0%). The S&P 400 Midcaps gained 0.7% (up 8.1%), and the small cap Russell 2000 added 0.2% (up 13.6%). The Nasdaq100 gained 1.2% (up 22.0%). The Semiconductors jumped 2.0% (up 44.7%). The Biotechs increased 0.7% (up 29.6%). With bullion jumping $194, the HUI gold index surged 4.3% (up 171.3%).

Three-month Treasury bill rates ended the week at 3.5425%. Two-year government yields were unchanged at 3.48% (down 76bps y-t-d). Five-year T-note yields were about unchanged at 3.70% (down 69bps). Ten-year Treasury yields slipped two bps to 4.13% (down 44bps). Long bond yields declined three bps to 4.80% (up 1bp). Benchmark Fannie Mae MBS yields fell four bps to 5.04% (down 81bps).

Italian 10-year yields declined three bps to 3.55% (up 3bps y-t-d). Greek 10-year yields dipped two bps to 3.44% (up 23bps). Spain's 10-year yields fell four bps to 3.29% (up 23bps). German bund yields slipped three bps to 2.86% (up 50bps). French yields fell five bps to 3.56% (up 37bps). The French to German 10-year bond spread narrowed about two to 70 bps. U.K. 10-year gilt yields dipped two bps to 4.51% (down 6bps). U.K.’s FTSE equities index slipped 0.3% (up 20.8% y-t-d).

Japan’s Nikkei 225 Equities Index jumped 2.5% (up 27.2% y-t-d). Japan’s 10-year “JGB” yields added two bps to 2.04% (up 94bps y-t-d). France’s CAC40 declined 0.6% (up 9.8%). The German DAX equities index added 0.2% (up 22.3%). Spain’s IBEX 35 equities index was unchanged (up 48.1%). Italy’s FTSE MIB index slipped 0.3% (up 30.5%). EM equities were mostly higher. Brazil’s Bovespa index rallied 1.5% (up 33.8%), and Mexico’s Bolsa index jumped 2.6% (up 32.6%). South Korea’s Kospi rose 2.7% (up 72.1%). India’s Sensex equities index was little changed (up 8.3%). China’s Shanghai Exchange Index advanced 1.9% (up 18.3%). Turkey’s Borsa Istanbul National 100 index declined 0.4% (up 14.9%).

Total money market fund assets (MMFA) added $7.5 billion to a record $7.673 TN - with a 21-week surge of $597 billion, or 20.7% annualized. MMFA were up $868 billion, or 12.7%, y-o-y - and ballooned a historic $3.042 TN, or 66%, since October 26, 2022.

This tiny commentary from Doug put in an appearance on his Internet site on Friday night sometime -- and the link to it is here.

![]()

Copper hit a fresh all-time high above US$12,000 a ton as severe mine outages and trade dislocations linked to U.S. President Donald Trump’s tariff agenda put the crucial industrial metal on course for its biggest annual gain since 2009.

Prices rose as much as 0.9% to US$12,031.50 a ton on the London Metal Exchange, extending a rally that has lifted prices by about 37% this year. The possibility that Trump will place tariffs on the metal has been a central factor driving prices higher, with a surge in U.S. imports through the year thrusting manufacturers elsewhere into a bidding war to keep hold of supplies.

The impact on global trade flows has been so extreme that prices have rallied even though underlying usage has deteriorated rapidly in China, which consumes about half the world’s copper. Investors often view copper as a barometer for global industrial activity, but the slowdown in China has done little to put the brakes on the rally. There’s a growing expectation that prices will keep ratcheting higher as traders ship even greater volumes of copper to the U.S. to front-run potential tariffs.

There have been severe disruptions on the supply side too, with outages at mines across the Americas, Africa and Asia prompting warnings that the market is on the cusp of a major deficit that will add further fuel to the rally. Deutsche Bank warns that output from the world’s largest miners will drop 3% this year, and could fall again in 2026.

Analyst at the bank said in a note that “2025 has been a heavily disrupted year, with several large mines experiencing significant operational challenges,” adding that “overall, we see the market in a clear deficit.”

This Bloomberg story from Wednesday was picked up by thedgesingapore.com Internet site -- and I found it on Sharps Pixley. Another link to it is here.

![]()

Gold and copper miner SolGold said today it had agreed to be acquired by its largest shareholder, Jiangxi Copper, in a deal valuing it at 867 million pounds ($1.17 billion).

The 28-pence-per-share deal represents an almost 43% premium to Ecuador-focused SolGold's closing price on November 19, the day before Jiangxi first approached the company for a deal.

SolGold's shares closed marginally higher at 25.65 pence in a holiday-shortened trading session on Wednesday.

The agreement gives Jiangxi control of SolGold's Cascabel project in Ecuador's Imbabura province, as miners race to secure copper supplies amid rising demand driven by electric vehicle and AI infrastructure investments.

The region is home to one of the world's largest undeveloped copper-gold deposits in South America.

This Reuters story appeared on their website on Wednesday -- and I found it in a GATA dispatch. Another link to it is here.

![]()

Silver breached the $75 mark for the first time on Friday, while gold and platinum hit record highs, buoyed by expectations of U.S. Federal Reserve rate cuts and geopolitical tensions that fueled safe-haven demand.

Spot silver jumped 4.5% to $75.20 per ounce, after hitting an all-time high of $75.62, marking a 161% year-to-date surge driven by supply deficits, its designation as a U.S. critical mineral, and strong investment inflows.

Spot gold was up 1.1% at $4,526.92 per ounce, after hitting a record $4,533.14 earlier. U.S. gold futures for February delivery added 1.3% to $4,559.

“Expectations for further Fed easing in 2026, a weak dollar and heightened geopolitical tensions are driving volatility in thin markets. While there is some risk of profit-taking before the year-end, the trend remains strong,” said Peter Grant, vice president and senior metals strategist at Zaner Metals.

Of course these rallies have nothing to do with interest rates or the currencies, as these are primarily short covering rallies. This news item was posted on the cnbc.com Internet site at 12:12 a.m. EST on Friday morning -- and I found it on Sharps Pixley. Another link to it is here.

![]()

For about a decade, whenever Jay Moorer wanted to add to his investment portfolio, he opened an app on his phone to buy stocks or cryptocurrencies. Now, he gets in his car.

The 33-year-old Arizona-based trucking manager began visiting local coin shops to buy physical silver about two months ago, inspired by YouTube videos and the surging price of the metal. His initial purchase totaled three ounces, costing roughly $150. Since then, he has used spare cash to accumulate about 60 ounces of trinkets and coins, which he stores in a home safe.

“I know right now the price is skyrocketing, but I have no plans of selling,” he said.

Moorer isn’t alone. This year’s rally in precious metals has extended beyond just gold, which has climbed to several new records in both nominal and inflation-adjusted terms. Silver has also soared, sweeping up legions of amateur investors, ranging from newly committed collectors to Reddit-inspired speculators trading in and out of exchange-traded funds that offer exposure to silver without having to store it.

Silver futures have climbed 145% this year to around $71 a troy ounce, blowing through a 45-year record in October and only picking up steam from there. Those gains have outpaced the rally in gold, which has risen 70% to nearly $4,500 an ounce. Shares of precious metal miners like Hochschild Mining and Coeur Mining have also more than doubled.

Silver prices have been rising in part because of constrained supply, with the world’s pure play silver deposits mostly exhausted. Demand has been strong from industrial buyers, especially global solar panel manufacturers. Everyday investors have helped fuel the rally, stockpiling metal that would have otherwise gone to industrial uses.

This silver-related article appeared on The Wall Street Journal's of all place on Friday -- and was picked up by msn.com. I thank Bill Moomau for pointing it out -- and another link to it is here.

![]()

Silver is on track for its best year since 1979 as a Chinese crackdown on exports helps fuel a huge price rally.

The precious metal jumped by 6.29pc on Friday to hit an all-time high of $76.37 (£56.59) per ounce.

Silver has now risen by 159pc since the start of the year, more than double the 70pc rise in gold prices recorded so far this year.

Precious metals are considered a safe-haven asset and investors have been hoarding them this year in response to fears about inflation, geopolitical tensions and government debt.

More recently, a looming crackdown on exports from China has also sparked a scramble to get hold of silver.

From Thursday January 1, China will require exporters of silver, tungsten and the chemical element antimony to obtain licenses from the Ministry of Commerce (Mofcom).

The rules are expected to mean that only large companies will be granted licenses and the measures are expected to tighten global access to the metal.

This silver-related story showed up in The Telegraph yesterday...yet another surprise...and was picked up by msn.com as well. I thank Bill Moomau for this one too -- and another link to it is here.

QUOTE of the DAY

![]()

The WRAP

"Understand this. Thing are now in motion that cannot be undone." -- Gandalf the White

![]()

Today's pop 'blast from the past' dates from 1983 -- and the title to it I though appropriate under the current circumstances. Neither the tune, nor the artist needs any introduction -- and the link to it is here. The only bass cover to this song I could find, wasn't worth linking.

Today's classical 'blast from the past' is one that I posted earlier this year -- and has appeared frequently in this space. I'm in the mood for it again today. It's Sergei Rachmaninoff's Piano Concerto No. 2 in C minor, Op. 18.

This is hands-down the most beloved piano work of the Romantic era of classical music -- and this performance of it will never be bested. The soloist and orchestra are as one, in what can only be described as a 'great fall upwards.' It is my desert island recording of this work -- and has been viewed 46+ million times...for good reason.

Here's Ukrainian-born concert pianist Anna Fedorova at the tender ago of 23 years performing at the Concertgebouw in Amsterdam on 13 September 2013. The Nordwestdeutsche Philharmonie accompanies -- and Maestro Martin Panteleev conducts. It doesn't get any better than this. The link is here.

“Music is enough for a lifetime, but a lifetime is not enough for music.” ― Sergei Rachmaninoff

![]()

The big rallies in three of the four precious metals on Friday was a combination of panic short covering -- and new speculative long positions being put on. As to what that ratio was, won't be known until the January 2 Commitment of Traders Report comes out...as yesterday's impressive gains -- and Wednesday's engineered price declines, happened after the Tuesday cut-off for Monday's COT Report. The reason the current one was delayed until Monday, was because of the Christmas Day holiday.

Silver went 'no ask' the moment that Globex trading began in New York on Thursday evening -- and was up about two bucks in seconds -- and 'da boyz' were forced to step in. The shorts that were covering in silver and the other precious metals for the remainder of the Friday session, were booking massive losses...not these 'unrealized' losses that they've been sitting on for weeks or months...or in some case, years...but real losses. Their blood was running in the streets all day yesterday.

As you know, I've been pi$$ing and moaning about the underperformance of the silver shares almost all year long -- and was of the opinion that they were being actively managed. What we were witness to yesterday, was certainly the bright shiny poster child for that. Not only were 'da boyz' active in the pre-market...but they either massively shorted the precious metal shares at the open of the equity markets in New York yesterday...or they dumped massive amounts of shares that they'd been accumulating over time.

Either way, the HUI should be priced about 25% higher than it currently is -- and the silver equities should be about double what they're sitting at now. In a free market, they would have had big double-digit gains yesterday, but that simply wasn't allowed.

But there was nothing they could do about SLV or PSLV...as the former closed higher by 9.05 percent on an eye-watering 137.3 million shares traded...3.24x normal volume. The latter closed up 8.68 percent on barely over 1x average daily volume.

Needless to say, SLV...plus a whole raft of other silver ETFs and mutual funds ...are going to be looking for copious amounts of physical silver to back all the new shares that were created yesterday -- and it remains to be seen if it's available. Or will their shares [SLV] be shorted in lieu of depositing physical metal? We won't know that until we see the next short report -- and that isn't due out until Friday, January 12.

Copper had a boomer of a day...as it closed up 28 cents/5.10% at $5.776/ pound...a new record high -- and 3.3 cents off its intraday high tick. The story about a copper deficit in the Critical Reads section should be noted.

Natural gas [chart included] closed higher by 16 cents at $4.40/1,000 cubic feet. WTIC got clubbed, as it got hammered by $1.45 -- and finished the Friday session at $56.90/barrel. It now back to being well below any moving average that matters.

Here are the 6-month charts for the Big 6+1 commodities...thanks to stockcharts.com as always -- and are definitely worth a look today...if you have the interest, that is. Click to enlarge.

At the close of trading on Friday, the CME Group raised margins on gold by 10% to $22,000 -- and silver by 13.6% to $25,000. I'm surprised that they waited this long to raise them.

This time a month ago, silver was sitting at $52 the ounce -- and closed at $79 and change yesterday...an eye-popping $27 dollar increase.

So if you're short one COMEX contract, your margin call requirements in that month worked out to $135,000 per contract...$27x5,000 troy ounces. That doesn't include the approximately 70 cent roll-over/switch charge per ounce from December into March that the CME imposes...so tack on a further $3,500 on top of that per contract. We're talking serious money here...especially if you're a smaller trader. The Big 8 commercial traders are short 59,180 contracts/295.900 million troy ounces -- and I'll let you do the math on that. It's a frightening number.

The icing on the cake for all the shorts...small, medium and large...was the margin call they got on that $7+ rally in silver yesterday.

These are the underpinnings of Ted's landmark essay..."The Bonfire of the Silver Shorts"...which is now in the process of unwinding...not just in silver, but in the other three precious metals as well.

Except for gold, the rallies in the other three are approaching the parabolic stage -- and I stated earlier this week -- and above the 6-month charts in today's missive...that these rallies are a combination of short covering and new speculative long positions being put on. All are also very far into overbought territory on their respective RSI traces -- and 'low hanging fruit' for the collusive commercial traders if they wish to go after it.

But if they do, the benefits of covering a few short positions will vanish very quickly, as they have to put them all back on -- and then some as these rallies continue. As you know, any attempt to step on these rallies by 'da boyz' recently have been overwhelmed within hours. They will be back where they started from on the short side -- and soon become worse off as prices continue to climb -- and the margin calls continue to roll in.

Even before we get a peek at Monday's Commitment of Traders Report for positions held at the COMEX close this past Tuesday, it's hopelessly 'yesterday's news' already. As Ted Butler said on many occasions over the years, there would come a time when what the COT Report showed wouldn't matter, as events elsewhere would override what the paper hangers in New York were doing.

That time has arrived.

As the title to today's column states...we are in terra incognita going forward, as this 50+ year Anglo/American/western price management scheme in the precious metals is in the process of breathing its last. It's been a long time coming -- and it's not possible to know over what time period this will play out, or what the end result will be. But far higher prices...plus permanent shortages in all four...is a certainty, as hoarding by nations in their own economic interests will become inevitable -- and the word 'unobtainium' will permanently enter the lexicon.

And I'll point out once more that it will be of more than passing interest as to how the west's political and financial power elite respond as precious metal prices continue to melt up -- and Ted's 'bonfire' finally goes supernova. As they continue to climb towards their true free-market prices, there's no doubt in my my mind that this unfolding scenario will have geopolitical and geostrategic repercussions that can only be imagined at going forward.

And with the silver price premium in Shanghai over the U.S. spot price on Friday now up to 10.13 percent. I'll be watching the 6:00 p.m. EST Globex open in New York on Sunday evening, with more than passing interest.

I'm done for the day -- and the week -- and I'm still "all in."

See you here on Tuesday.

Ed