Even with the successful breakout of the $50 level, silver is still cheap, as pointed out in the chart below.

Silver has recently come out of the bottoming pattern that started around 2014 when silver broke down below the channel. That bottoming pattern is very similar to the early 2000s bottoming pattern that started in October 2000 when silver broke down below the channel.

If this comparison is valid, then it is reasonable to consider silver prices as cheap while the price is still outside (below) the channel. There will come a time when silver could be considered expensive, but that will probably only be another $1000 or more higher. You can continue to track this chart on my premium blog.

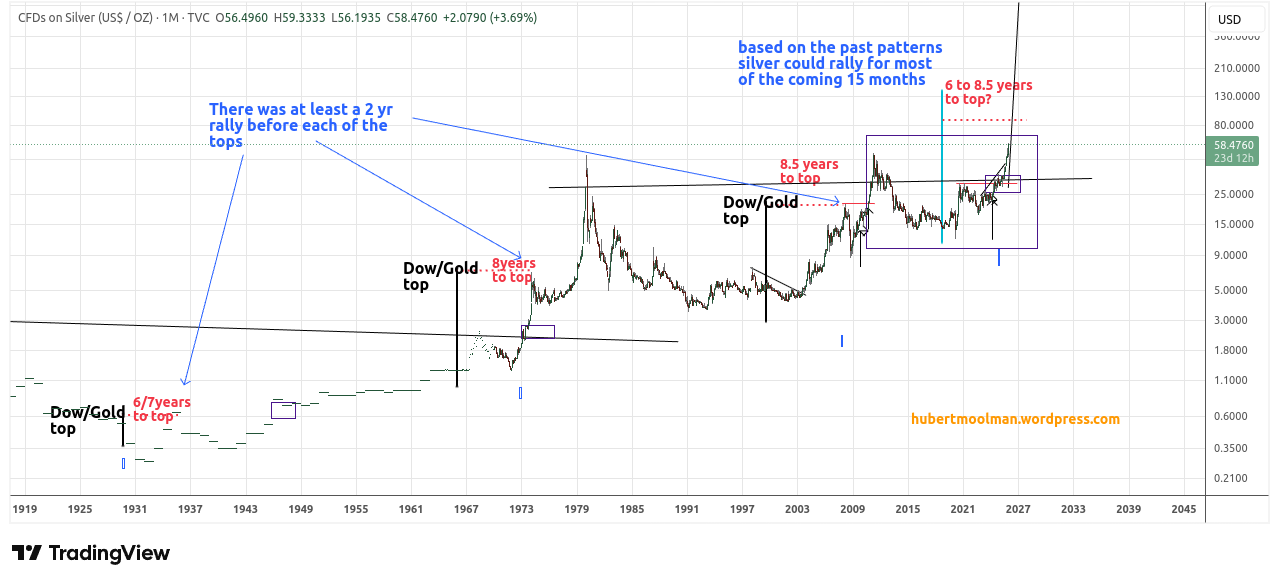

In a previous article I have shown how significant silver peaks occurred within 8.5 years after the Dow/gold ratio peak, with the Great Depression silver peak occurring the soonest (6 to 7 years after). Here is an updated chart of that post:

It is now 7 years and 2 months since the Dow/gold ratio peak of October 2018. In other words, there are still about 1 year and 3 months (15 months) left before we get to the 8.5 years since the Dow/gold peak.

Given that silver actually rallied on a sustained basis for at least 2 years before each of the previous post-Dow/gold peaks, silver is likely to rally for most of the coming 15 months.

Warm regards,

Hubert Moolman