Presenting Problem: What Silver Price Manipulation Looks Like (30-minute snapshot)

- 23,600,000 oz paper SILVER traded in 15mins did the damage. (see the screenshot where the volume is concentrated in 15 15-minute time window)

- Each contract is 5,000 ounces of Silver

- 4,720 x 5,000 = 23,600,000 ounces

- This gives the illusion that Silver is selling off but no physical silver is exchanged

Reddit Apes call this:

- A Tamp Dance or

- Tamppety Tamppety

- Tamp Me Harder Daddy

- Tampy Tamp Tamparoo

- or Mr. Slammy

Silver Stackers believe the following:

When the price goes up (we’re happy)

When the price goes down (we buy more because it’s on sale)

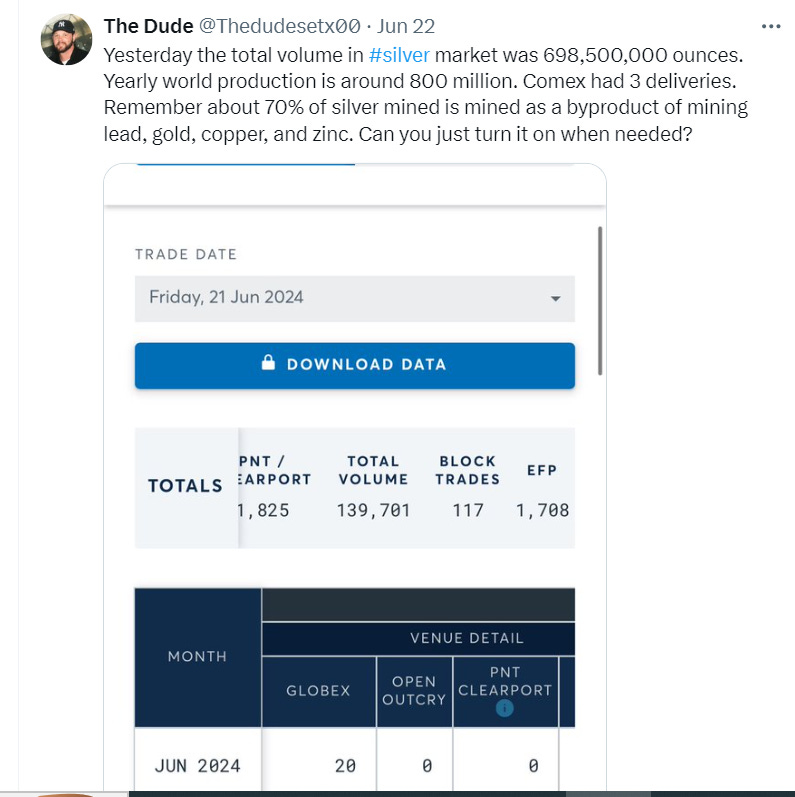

Let’s break this tweet:

- A very typical day in Comex.

- Paper transactions 698.5 Million ounces.

- Remember that annual mining is around 800 million ounces.

- The Dude’s astute observation that 70% of silver mined is a by-product of extracting lead, zinc, copper, and gold. (indicating all the work in exploration, testing, mining, processing, sorting, refining, minting)

- You can’t just flip on a light switch and expect Silver to show up

What does this have to do with Julian Assange?

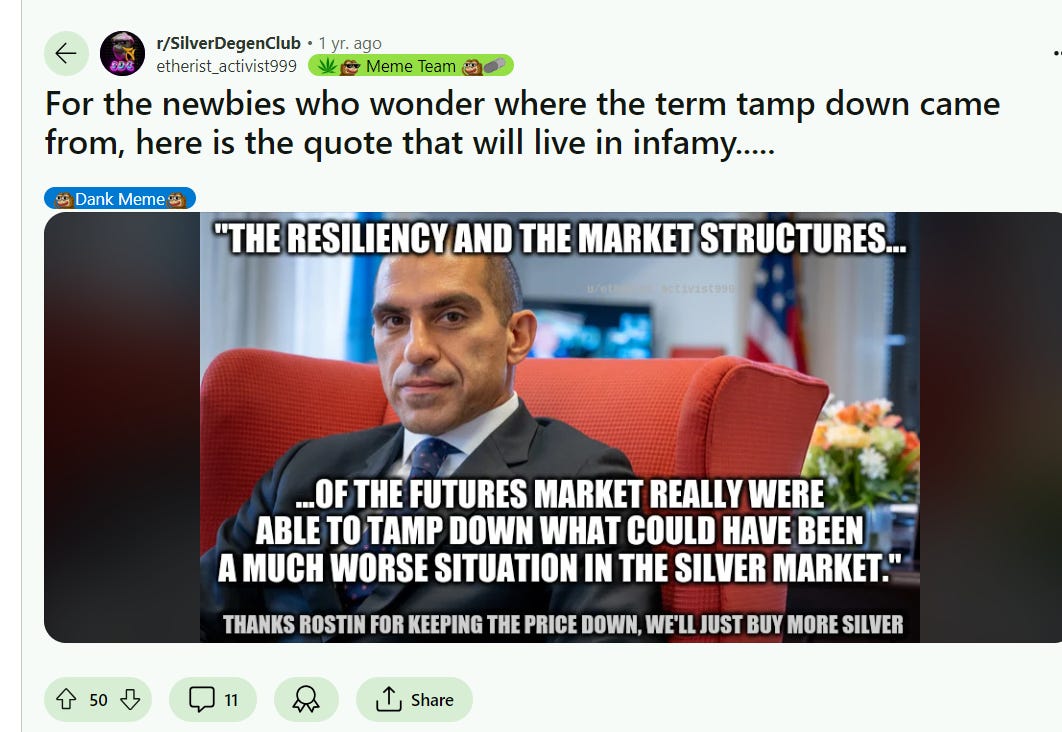

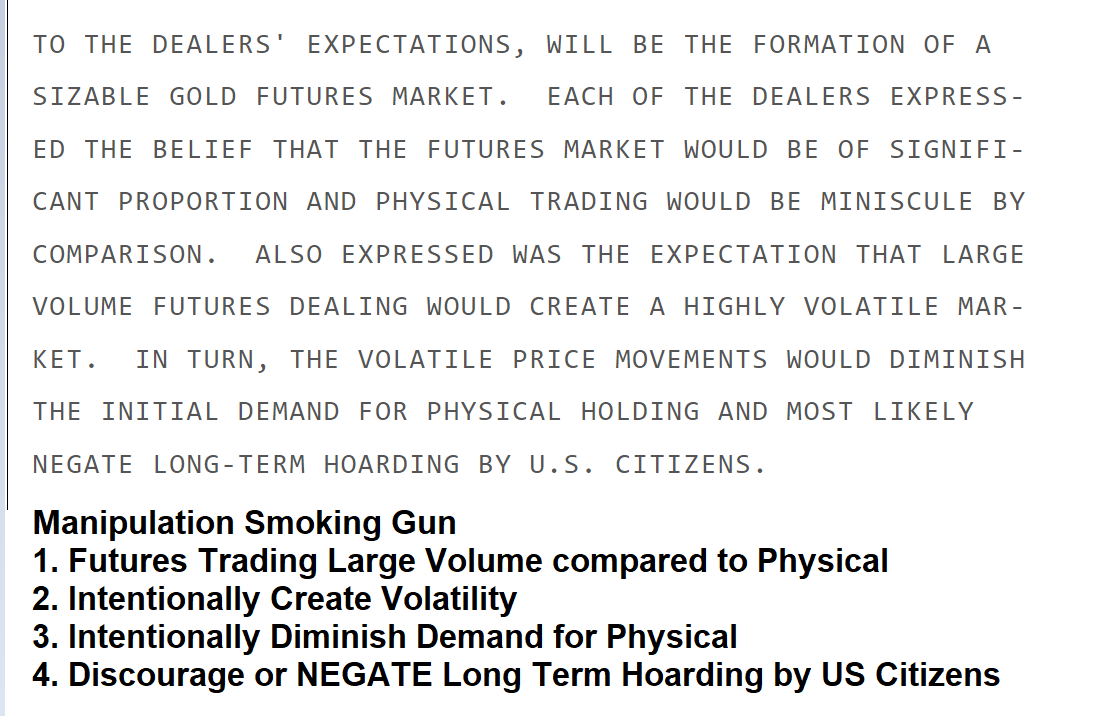

Source: WikiLeaks 1974 Fractional reserve Future’s Exchange

Motive: By Allowing Naked Shorts and Paper Transactions where no delivery takes place this 1.) Deters the public's physical bullion demand. 2.) Negates long-term enthusiasm or “Hoarding” by US Citizens. 3.) Intentionally creates volatility. 4.) Admission that paper trades would overwhelm less than 1% of physical deliveries

WikiLeaks Source Link: https://wikileaks.org/plusd/cables/1974LONDON16154_b.html (See section 4)

Commodity prices are managed by selling a “virtual” representation of the commodity. Need to drop the price? Then sell more virtual silver (SLV). Need to raise the price? Let the constant natural heavy global hoarding demand take the stock price up.

But if you are in the inside club like Jeff Christian or The Silver Institute and you know tomorrow’s newspaper today then you make money walking it up and down and they’ve been doing this for the past 30 years.

REVIEW and Next Steps

Shanghai Gold Exchange Legit vs Comex (which is now SGE’s Source for Cheap Metal)

The physical delivery process on the Shanghai Gold Exchange (SGE) differs significantly from COMEX in terms of requiring actual deposits of physical metal upfront and facilitating the transfer of ownership of that metal upon contract expiration. Here are the key differences:

Shanghai Gold Exchange (SGE)

- To trade gold and silver futures on SGE, traders must first deposit an equivalent amount of physical bullion as collateral with SGE's designated vaults.

- The amount of metal a trader can buy is limited by how much they have deposited with the exchange.

- At contract expiration, physical delivery takes place where ownership of the pre-deposited metal is transferred between the buyer and seller.

- SGE acts more like a physical spot market, facilitating the actual transfer of bullion between parties.

COMEX aka CRIMEX

- Traders on COMEX do not need to deposit any physical gold or silver to trade futures contracts.

- COMEX contracts are predominantly cash-settled, with physical delivery being rare (less than 1% of contracts). - LOLOL

- For the few traders opting for physical delivery on

COMEXCRIMEX they must notify the clearinghouse and meet additional margin requirements by the First Notice Day. COMEXCRIMEX does not necessarily hold enough physical inventory to meet simultaneous delivery obligations on all open contracts.

In essence, SGE requires traders to back their trades with pre-deposited physical metal and facilitates the transfer of that metal at expiration, while COMEX CRIMEX is a "paper" market where most contracts are cash-settled without actual metal changing hands.

Conclusion and Recommendations:

- Get your hands on as much physical Silver as you can afford.

- You are not “buying silver”, you are exchanging the Federal Reserve Note for Real Money

- For Silver Leveraged buy the Dip with these 4 companies endorsed by the Silver Academy (we turn down miners every week that do not have good chances at bringing metal to market or have shaky fundamentals such as ore grade, political risk, under funded, etc)