Precious metals are back in the spotlight in 2023 as signs of economic slowdown continue to surface and cause uneasiness among investors, in turn driving up the appeal of safe havens.

This week’s US labour market data shows that the economy has only been getting worse, with job openings plunging to a two-year low for the month of February, while private sector payrolls grew by less than expected.

A cooling labour market, plus earlier data revealing a decline in factory orders and slowing manufacturing activity, are all signaling that the US economy is closer to a recession than a recovery. Fears of these economic woes escalating have contributed to what could be another major rally in gold and silver, the go-to hedge for when things go south.

This week, the price of gold shot up by nearly 2% to its highest in a year at around $2,020 an ounce, just $50 shy of an all-time high. Silver also rode on the back of this rally, up 3.7% for the week.

Adding further support for the metals, the decision by OPEC+ to reduce oil production has fed into the narrative that more interest rate hikes will be required, which would accelerate a recession. Even without further hikes, bullion would still maintain its appeal as it typically benefits from looser monetary policy.

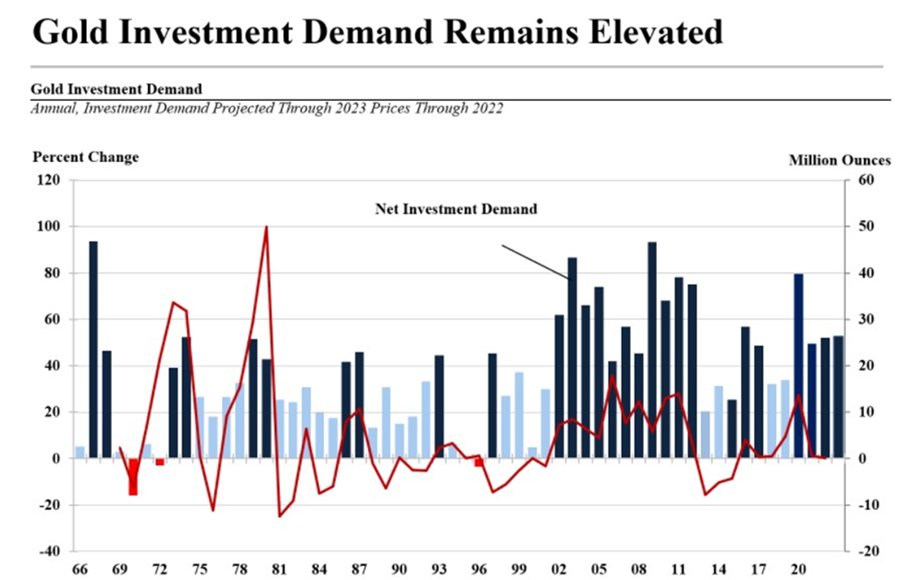

CPM Group’s Jeffrey Christian, a renowned commodities analyst, believes gold demand will stay elevated as the world economy enters a recession, which is likely to occur as soon as the fourth quarter of 2023, and certainly by next year.

Source: CPM Group

Source: CPM Group

“The recession will most likely hit the industrialized nations more so than the emerging economies, similar to 2007 and 2011,” he noted, comparing last month’s US banking fiasco to the collapse of Bear Stearns in 2008, calling it the “foothills of a bigger crisis that will arrive in nine months, which is why we’re likely to see higher gold prices in 2024 and 2025.”

The safe-haven boost will also trickle down to silver, despite most of the metal’s demand being from industrial activities. “Silver has historically delivered gains of close to 20% per annum in years inflation is high,” ABC Bullion’s managing director said.

The latest surge in gold and silver prices serves as an indication that the investment community is indeed bracing for what could happen within the next 12-18 months. In fact, demand for gold, as AOTH predicted, already took off towards the second half of 2022, almost matching the record set in 2011, according to data compiled by the World Gold Council.

Source: World Gold Council

Source: World Gold Council

With that in mind, we take a look at the various players driving the demand for safe-haven metals and ways in which they have contributed to their price rally:

Central Banks

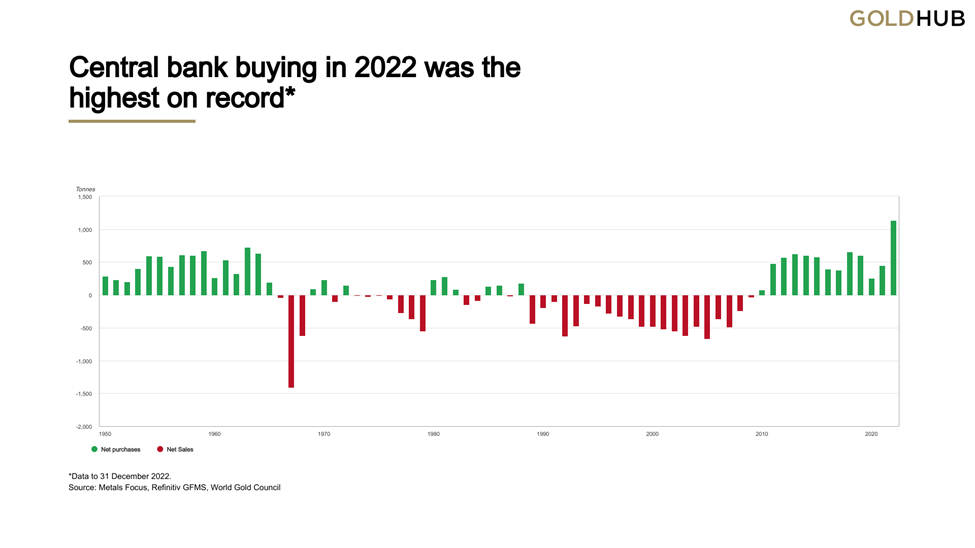

One of the biggest driving forces behind gold’s rising demand is the global central banks, which hold the physical metal (i.e. bullion) as part of their monetary reserves. This is because gold, like currency, is a safe, liquid asset, and would offer the benefit of diversification.

For the last decade, these institutions have stacked up on gold to meet their financial obligations. Bloomberg reported that central banks have been buying the most gold since the United States abandoned the gold standard in 1971, with total purchases setting a new 50-year record in 2022.

Source: World Gold Council

Source: World Gold Council

World Gold Council data shows that net purchases of the yellow metal by central banks last year rose by 1,136 tonnes valued at some $70 billion. Most of the purchases were made during the second half, which saw 862 tonnes purchased. The top gold buyer in 2022 was the central bank of Türkiye, followed by Uzbekistan, India, and Qatar.

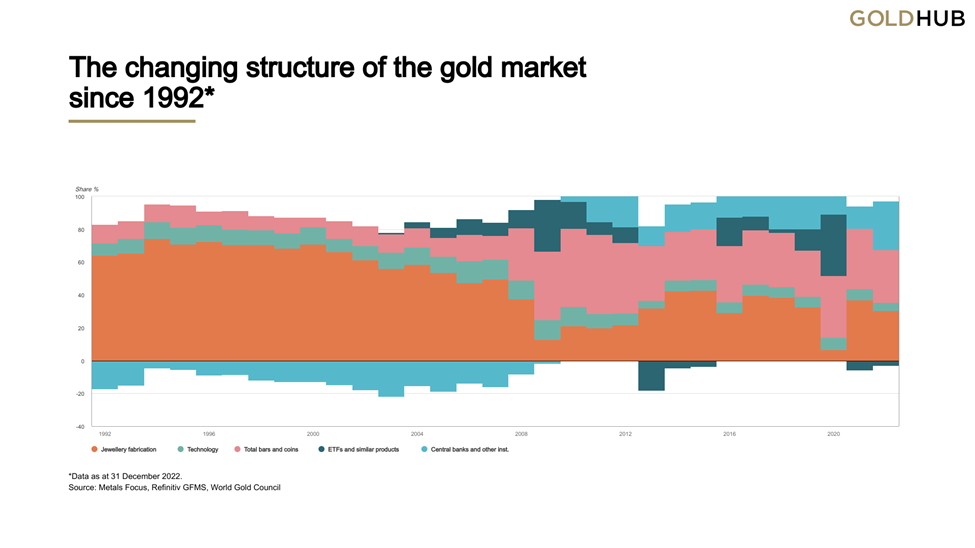

This data, according to WGC, underlines a shift in attitudes towards gold since the 1990s and 2000s, when central banks, particularly those in Western Europe that own a lot of bullion, sold hundreds of tonnes a year.

Since the financial crisis of 2008-09, European banks have stopped selling (gold), and a growing number of emerging economies such as Russia, Turkey and India are now becoming major buyers.

Source: World Gold Council

Source: World Gold Council

“This is a continuation of a trend,” said WGC analyst Krishan Gopaul. “You can see those drivers feeding into what happened last year. You had on the geopolitical front and the macroeconomic front a lot of uncertainty and volatility.”

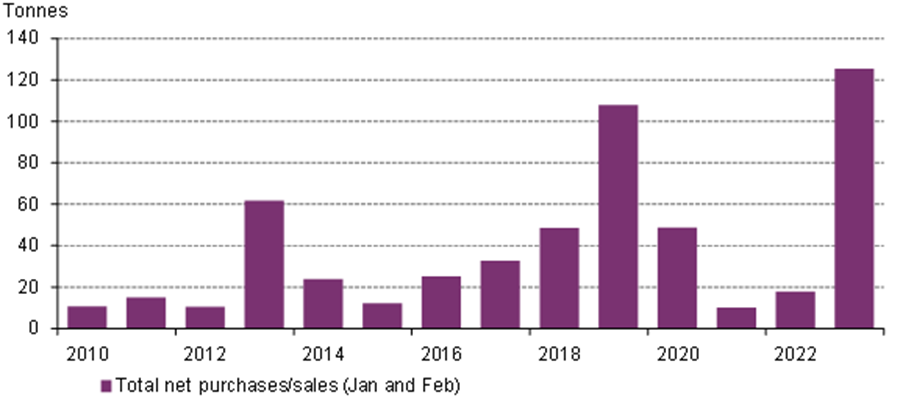

There’s no sign of slowing down in 2023 either. Recent WGC data shows central banks added another 125 tonnes during the first two months, the strongest start to a year since becoming net buyers in 2010. The countries with the largest purchases during the January-February period were Singapore, Turkey, China, Russia and India.

Source: World Gold Council

Source: World Gold Council

Commenting on the latest data, the WGC said it expects net central bank gold buying to continue through 2023, as emerging market banks will remain relatively under-allocated to gold.

Retail Buying

Joining the global central banks, retail investors have been snapping up physical metal out of concern that inflation may be more persistent than professional money managers believe, according to WGC.

Compared to most commodities, gold and silver are much more accessible to the average investor; anyone can buy the metals, whether in bar or coin form, from a dealer or, in some cases, from a bank or brokerage.

Last year, global demand for bars and coins improved on an already healthy 2021 total, gaining 2% to 1,217 tonnes, WGC data shows.

The second half of the year was particularly strong, achieving two successive quarters of demand in the region of 340 tonnes for the first time since 2013. The need for wealth protection in the global inflationary environment remained a primary motive for gold investment purchases, says WGC.

Jewelry

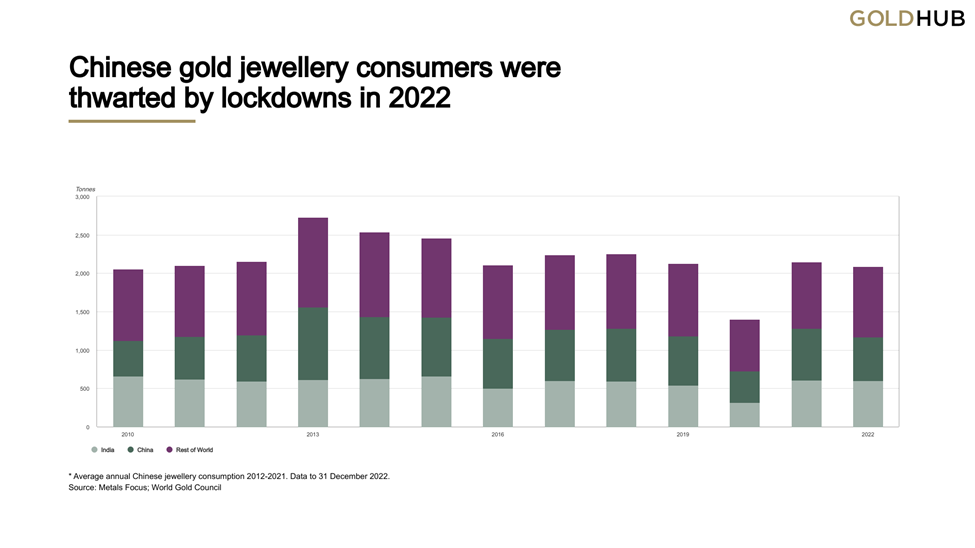

Another way to gain exposure to the physical metal is through buying jewelry, a practice deeply rooted in many cultures for centuries. The biggest buyers of gold jewelry have been China and India.

While purchases in both countries slowed down in 2022 due to higher gold prices and, in the case of China, Covid-related lockdowns, the global demand for jewelry remained resilient. WGC data shows that total annual jewelry demand had a modest decline of 3% at 2,086 tonnes, despite China buying 102 tonnes less than the previous year.

Source: World Gold Council

Source: World Gold Council

Looking ahead, WGC expects jewelry demand to capitalize on a resilient 2022, driven primarily by the reopening of China. Bloomberg’s median forecast sees China’s 2023 GDP growth significantly higher at 4.8%, which the Council believes should spell an improvement in gold jewelry demand.

Meanwhile, demand for silver jewelry — the much cheaper alternative — has been exploding. According to Metals Focus, a record 235 million ounces of silver jewelry were purchased globally in 2022, up 29% from the previous year.

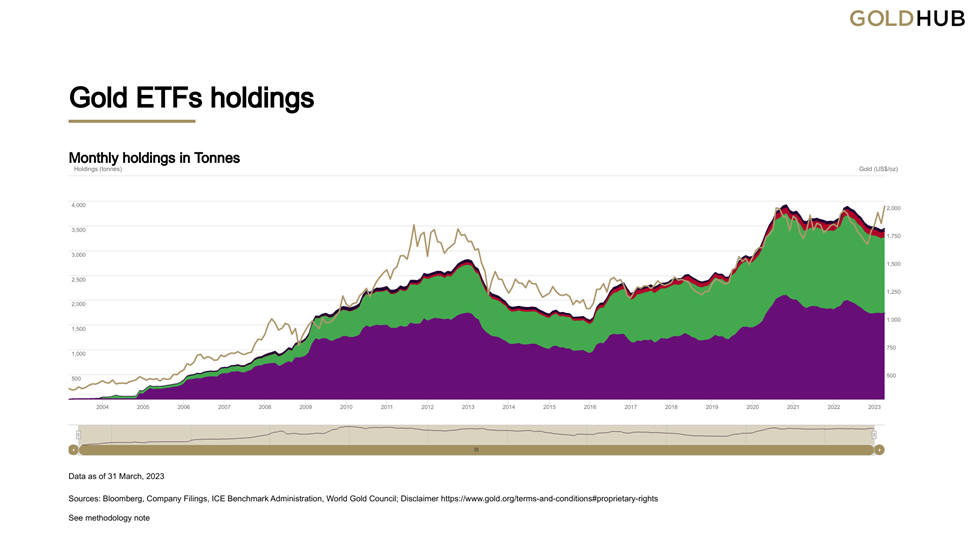

Gold-backed ETFs and similar products now account for a significant part of the gold market, with institutional and individual investors using them to implement many of their investment strategies.

Besides the price difference, there also seems to be a growing artistic appeal to silver amongst modern consumers. “Some clients prefer the color, whilst others are attracted to the price point,” the director of a fine jewelry and watches retailer told The New York Times. “Silver is an edgier, more modern way to wear jewelry — especially for younger clients.”

Exchange-Traded Funds

Those wishing to sidestep the hassle of owning physical gold and silver also have the convenience of buying financial instruments that replicate the price movement of these metals, the most popular being exchange-traded funds (ETFs).

Source: World Gold Council

Source: World Gold Council

After 10 straight months of capital outflows in favor of stronger alternatives in the dollar and Treasuries, investors are beginning to shift back to these products following the recent banking crisis. New WGC data shows global gold-backed ETFs saw inflows of $1.9 billion (32 tonnes) last month on heightened safe haven demand.

“With a US recession still on the cards, growing systemic risk adds to gold’s case,” the World Gold Council said, adding that the March inflows were the highest since 2019.

iShares Physical Gold ETC led the way with $1.1 billion (18 tonnes) of inflows in Europe, while SPDR Gold Shares, the world’s largest ETF, also added $855 million (13 tonnes) to lead the North America region.

By the end of March, global gold ETFs’ total assets under management reached the highest in eight months, helped by these inflows and the rising gold price, WGC said.

Likewise, silver-backed ETFs also saw a sizable increase in inflows, with the largest fund iShares Silver Trust gaining $1 billion in AUM during March, exchange data shows.

Richard (Rick) Mills

aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.