Having long been a researcher of the gold and silver markets I have become familiar with the labels, “conspiracy theorist”, “gold bug”, “tin foil hat” and a host of others – less flattering. Over the years I have listened to a host mainstream economic commentators incredulously lament, “gold bugs actually believe that people meet – in rooms - and conspire to suppress the price of precious metals”. These same mainstream economic commentators frequently scoff, “if such activities were actually being undertaken, surely someone from “officialdom” would go rogue and out the perpetrators. They frequently cite the lack of such “outings” as concrete evidence that market manipulations on the part of or complicity with regulators as being “hearsay” or the product of delusionals.

Well ladies and gentlemen; conspiracy theorists are deluded no more.

On Oct. 22, in the year of our Lord 2019 – it was none other than former chairman of the CFTC [Commodities Futures Trading Commission] Christopher Giancarlo admitted in an interview with CoinDesk,

“One of the untold stories of the past few years is that the CFTC, the Treasury, the SEC and the [National Economic Council] director at the time, Gary Cohn, believed that the launch of bitcoin futures would have the impact of popping he bitcoin bubble. And it worked.”

Giancarlo elaborated,

[that] “bitcoin’s dramatic price run-up in December 2017 was the first major bubble following the 2008 financial crisis.”

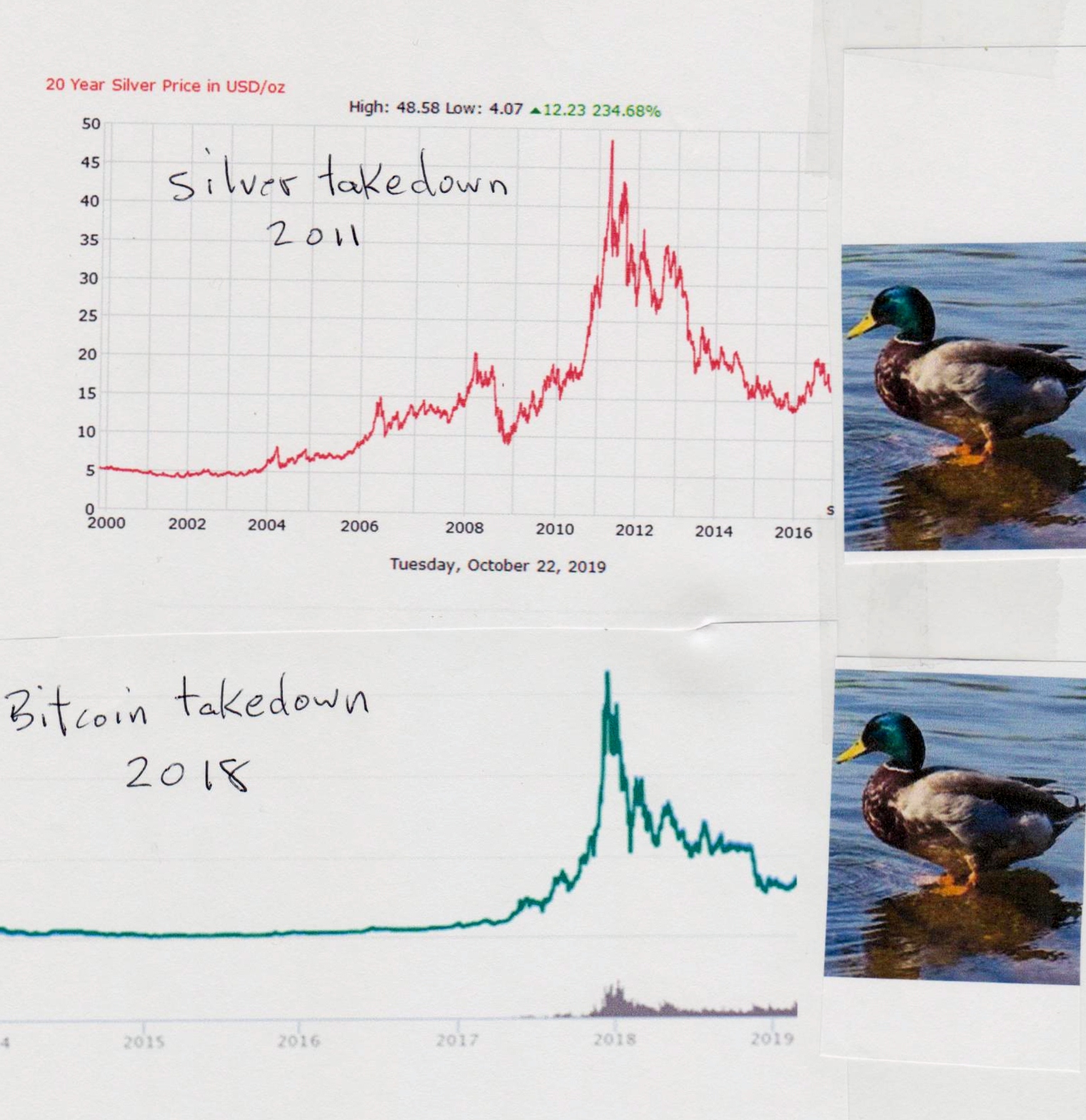

Not so fast Mr. Giancarlo; speaking of bubbles – may I direct your attention to the “run up” and collapse in silver prices circa 2011 and contrast that to the “run up” and collapse in bitcoin prices in 2018. Notice any similarities??? Have any of you ever heard the cliché, “birds of a feather fly together”? How about, “if it looks like a duck, it’s a duck”?

Quack, quack Mr. Giancarlo.

Here’s how Mr. Giancarlo further explained the rationale for the “take down” in bitcoin prices,

“Without shorts, a market has no pessimists. If you do believe it’s a ridiculous price but you don’t own, there’s no way to express that view,”

And if that wasn’t enough, he went on to add,

“If you don’t have that derivative, then all you’ve got are believers [and] it’s a believer’s market”

Are you a believer?

Just to underscore the degree of collusion and scope of conspiracy – Ole Giancarlo ended with this pearl,

“The CFTC staff handled it strictly on procedural grounds, but at the leadership level I communicated with Treasury Secretary [Steven] Mnuchin and NEC Director Gary Cohn, and we believed that, should bitcoin futures go forward, it would allow institutional money to bring discipline to the value of the cash market, and that’s exactly what happened.”

Well folks, here is what “procedurally occurred yesterday [Oct. 22/19] in what would be widely regarded as a non-descript , “normal day” in the silver market. 60 Thousand silver contracts were transacted on the COMEX exchange in New York. Each COMEX silver contract supposedly represents 5,000 ounces of silver. That means 300 million ounces of silver were sold in a 5 hour trading session. On Friday Oct. 25, 140 thousand silver futures were sold on COMEX in 5 hours – equating to 700 million ounces of silver sold in one trading session. Remember folks, the output of all silver mines in the world in one year is 855 million ounces.

“Gigolo” Giancarlo & Friends

I hereby rename St. Christopher of Giancarlo fame to that of “Gigolo” Giancarlo because of his penchant to “bleep” our Capital Markets. It seems he and his merry band of whore-meisters at the SEC and Treasury exhibit selective vision and amnesia when it comes to identifying and recounting “bubbles” and their defence of utilizing derivatives to produce desired outcomes, simply put by the Gigolo himself,

“..it shows the power of markets to bring discipline to prices.”

So there you have it ladies and gentlemen, when ANYTHING that stands as a credible monetary alternative to the almighty US dollar begins expressing itself or gaining widespread adoption – it is unmercifully ATTACKED by the derelict criminals who have debased the dollar. The criminals engaged in this activity – like Gigolo Giancarlo - literally “beat their chests” with a sense of accomplishment and pride in their dystopian handiwork. This amounts to high financial crimes against humanity and the perpetrators should be dragged into the World Court in the Hague by the scruffs of their necks and dealt with accordingly.

- Rob Kirby