By Stephan Bogner (CEO of Elementum International AG) on January 31, 2021

What has happened over the last few days, and especially over the weekend, is unprecedented in history. Investors worldwide are buying virtually all the available silver they can get.

What makes this silver rush so special is that there are not just investors who have been buying silver for many years and are now stacking up, but also many rich young guns ("millennials") who have never heard of silver as an investment before, let alone had ever bought silver before.

Under the hashtag #SilverSqueeze, social media platforms such as Twitter, Facebook or LinkedIn are running so hot that more and more people are becoming aware of silver and are actually also buying extremely large quantities of physical silver. However, this is taking on dramatic, almost biblical proportions and supply shortages are already being experienced around the world. A sharp rise in silver prices could be imminent.

The origin of the biggest silver buying frenzy is the WallstreetBets community from the social news aggregator Reddit and its user WallstreetBets causing a worldwide sensation during this past week, when he and his community managed to trigger a huge short squeeze in the Gamestop Corp. stock. Last week, about 920 million shares of the company traded in the U.S. alone, and the stock exploded to $483/share. In early January, the stock was trading below $25, a handsome gain of up to 1832%. But many of his followers didn't buy stock in the open market, they bought leveraged call options that made them a lot more money. Before, Gamestop was one of the most heavily shorted stocks in the U.S., the reason why the community wanted to trigger a so-called "short squeeze" – and had great success so far (i.e. shorters were forced to close their short positions and cover them by buying shares in the open market).

And now the next attack of the WallstreetBets community is underway: This time, however, it's not a stock, but silver. The reason? Silver is known to be one of the most heavily shorted markets in the world! Add to that the fact that at the end of last year it became known, or rather officially confirmed, that JPMorgan manipulated the precious metals markets and was ordered to pay a fine of $920 million.

The goal of the #SilverSqueeze community is to trigger a short squeeze due to the huge short positions in the silver market in order to force the shorters to cover their positions.

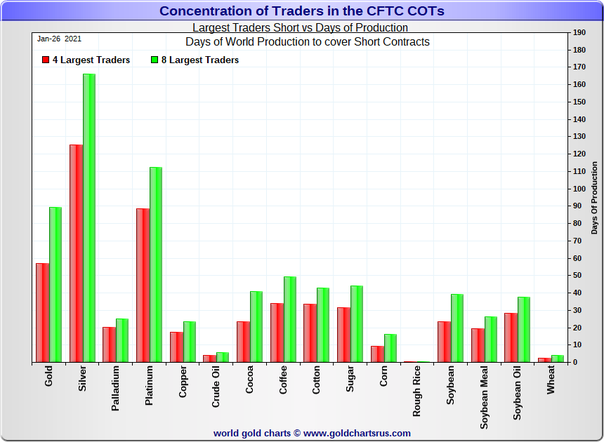

As the chart below shows, silver is the most heavily shorted commodity market (at least within this selection): The 8 largest traders have such big short positions that it would take hundreds of million ounces of silver – nearly half of silver's annual world production – to cover:

Source / Source: GoldChartsRus

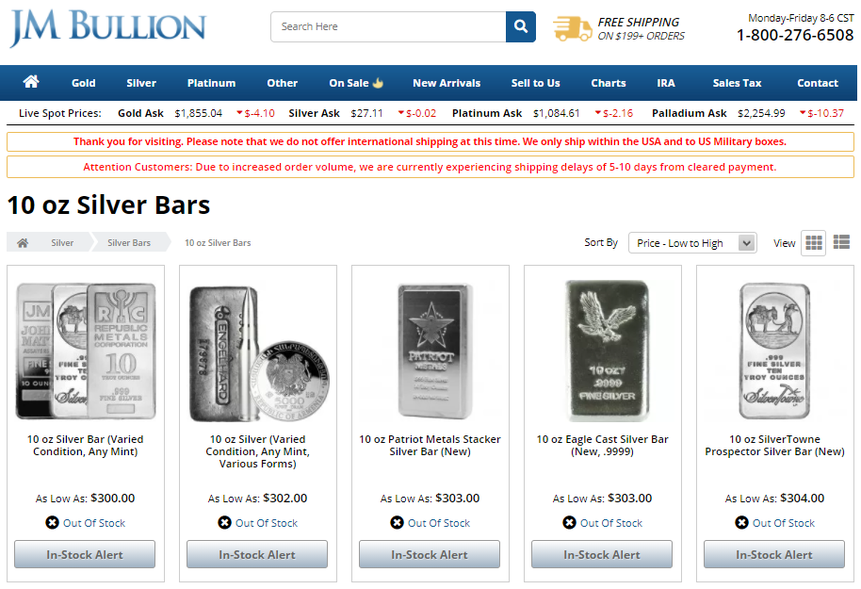

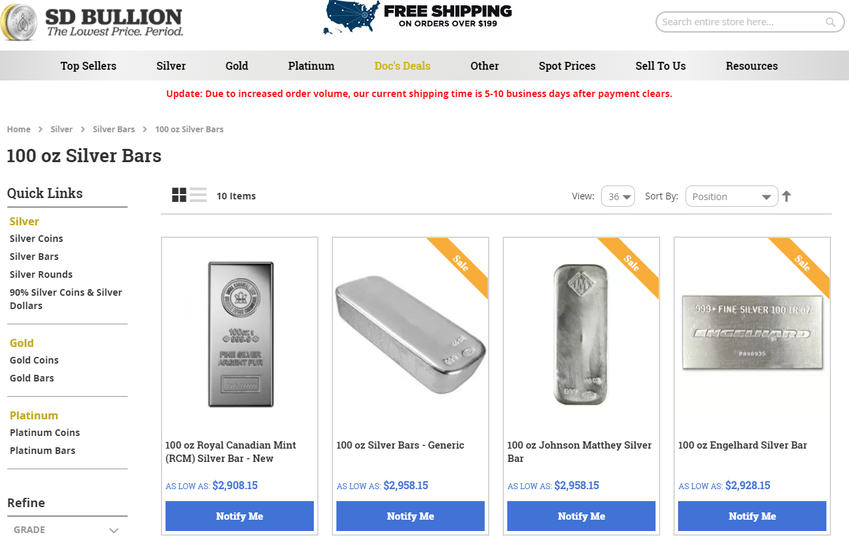

It remains to be seen whether the community will be successful again and this time triggering a short squeeze in silver. But one thing is already crystal-ball clear: It was already extremely difficult to get hold of physical silver last year due to supply bottlenecks worldwide (caused by COVID-19). Thanks to the extremely strong increase in demand for physical silver we are witnessing at the very moment, a serious problem is now looming: Virtually all online precious metal dealers in North America can no longer deliver most silver products and are sold out, as the following pictures show:

Full size / Source: JM Bullion

Full size / Source: SD Bullion

At other major precious metal dealers – like Kitco, APMEX or MoneyMetals – the same picture: Mostly sold out!

In Europe, this buying frenzy might also take on devastating features next week and major supply bottlenecks may occur.

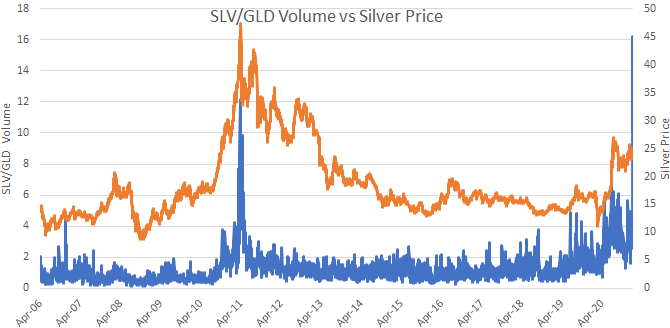

The extent of the biggest buying spree in the history of the silver market is also indicated by the following charts. The U.S. ETF "SLV" recorded an inflow of almost $1 billion on Friday – almost twice as much as the previous record from 2013:

Trading volume in the SLV ETF on Friday was 10 times higher than in the gold ETF "GLD" – this has never been achieved before in history:

About $943 million flowed into the SLV ETF on Friday, representing about 38 million ounces of silver and possibly triggering a sharp silver price spike during the coming days and weeks:

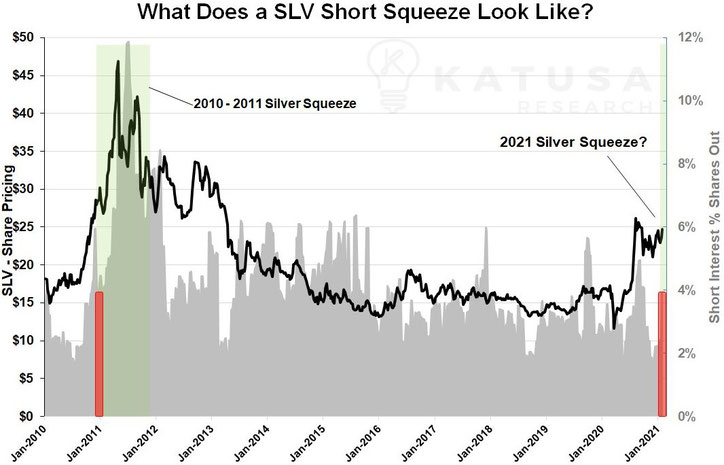

Katusa Research visualizes how the current short squeeze attempt may cause a strong price increase in silver and that the $50 level could be reached within a very short time – similar to 2011:

Since WallstreetBets is making a splash around the globe and across the board of all social media platforms, the number of his followers have exploded within very short time to more than 7 million followers alone on Reddit. An unprecedented huge silver buying wave is piling up under the hashtag #SilverSqueeze. As such, we at Elementum are glad that our customers have been able to accumulate a silver treasure over the last years as it may prove up once again that physical silver stored in a safe place is a safe bet. In case you still want to buy more silver, you should contact us as soon as possible or make a corresponding bank transfer to your storage place, because even we do not know what will happen next week and whether there is any physical silver left at suppliers. At the moment, we are still able to source and deliver freshly minted LBMA-hallmarked silver bullion from our suppliers Umicore and Heraeus.

Source: YouTube-Video "Is a WallStreetBets Silver Squeeze Possible?“

https://www.elementum-international.ch/en

Disclaimer: The comments herein do not constitute a recommendation to buy or sell. The author, Stephan Bogner, is the CEO of Elementum International AG; a Swiss company specializing exclusively in the storage of physical precious metals in the high security vault facility in the St. Gotthard mountain range in central Switzerland. Elementum International's Board of Directors and its Management have been selected solely on the basis of their professional skills and many years of experience in relation to precious metals markets. As these persons may have other professional activities in addition to their activities at Elementum International AG, the company has no influence on their activities and respects the general freedom of opinion in this context as well. Therefore, the opinions expressed by persons working for Elementum AG do not automatically reflect the opinions of Elementum International AG. Investments in the field of precious metals are subject to high risks. In addition to general investment risks, they are also subject to certain risks emanating from the structure of this market. Therefore, we ask you to read our risk information carefully. For investments, respective contractual documents and risk notices contained therein are authoritative. Neither the author nor the companies Elementum International AG and Elementum Deutschland GmbH assume any liability for the consequences of actions taken on the basis of the information contained in the electronic publications or on the websites of the companies or elsewhere. Investments are always associated with various forms of risk. Past profits are no guarantee of future profits. It is recommended that you always seek the assistance of trained and legally registered financial advisors when making investments or seek individual advice according to your personal financial background. Before investing, it is recommended that you determine exactly what your financial goals are, rank them in order of relevance, and then determine what level of risk you are willing to take so that a complete financial plan can then be prepared by a registered financial advisor. Please be sure to consult such a financial advisor before investing and carefully read the full disclaimers on the websites of Elementum International AG and Elementum Deutschland GmbH.