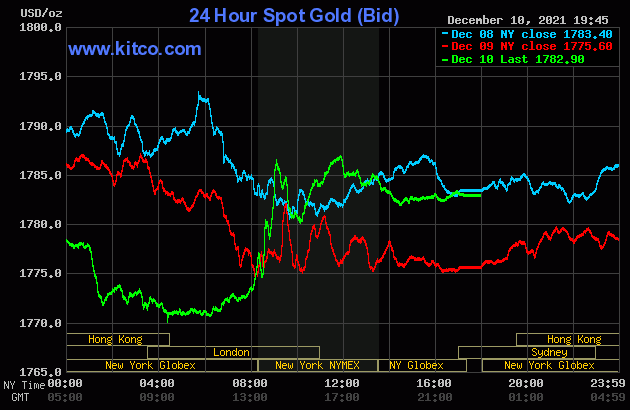

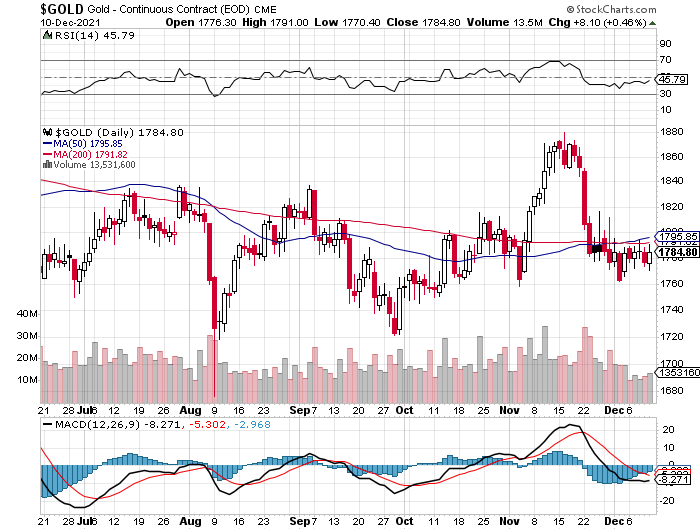

The gold price had a quiet up/down move in morning trading in the Far East on their Friday. That ended around 2 p.m. China Standard Time when it got kicked downstairs a bit -- and its low tick of the day was set around 9:20 a.m. in London. It flat-lined for a couple of hours before crawling higher until about fifteen minutes before the COMEX open in New York. Its attempt to blast higher from there ran into "all the usual suspects" -- and its high tick was printed at 9:01 a.m. EST. It was capped an turned lower at that juncture, but began to rally shortly after the 10 a.m. EST afternoon gold fix in London. That lasted until a couple of minutes before 12 o'clock noon EST -- and it was sold quietly lower until 2:30 p.m. in after-hours trading. From there it crawled a bit higher until trading ended at 5:00 p.m.

The low and high ticks were reported as $1,770.40 and $1,791.00 in the February contract. The December/February price spread differential in gold at the close yesterday was only $1.90...February/April was $2.20 -- and April/June was $2.10 an ounce.

Gold was closed on Friday afternoon in New York at $1,782.90 spot, up $7.30 on the day. Net volume was very quiet at a bit under 128,000 contracts -- and there was a bit under 15,000 contracts worth of roll-over/switch volume on top of that.

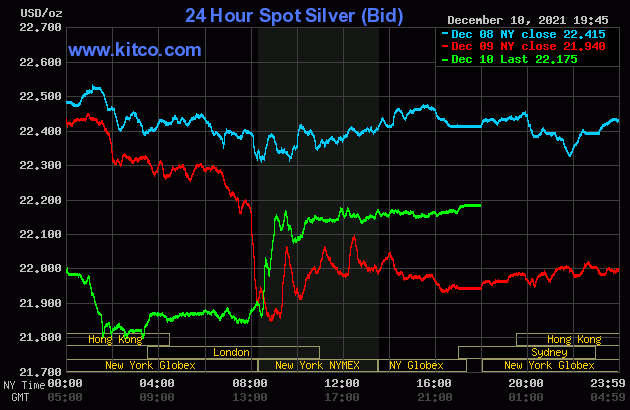

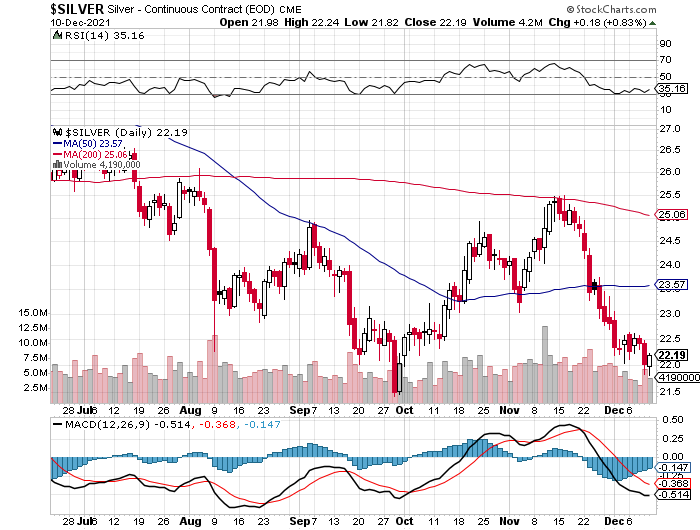

The silver price action in Far East trading on their Friday was virtually the same as it was for gold, with silver's low tick coming around 2:35 p.m. China Standard Time. And try as they may, the commercial traders couldn't get the price any lower than $21.80 spot, which means that no one in the non-commercial/small trader was willing to sell more longs, or go further short. It rallied a bit shortly after the London open -- and then flat-lined until a few minutes before 1 p.m. GMT/8 a.m. in New York. Its price path after that was mostly the same as it was for gold...not free-market at all.

The low and high ticks in silver were recorded by the CME Group as $21.815 and $22.24 in the March contract. The December/March price spread differential in silver at the close yesterday was only 3.5 cents...March/May was 3.0 cents -- and May/July was 3.3 cents an ounce.

Silver was closed in New York on Friday afternoon at $22.175 spot, up 23.5 cents on the day. Net volume was nothing special at a bit under 41,400 contracts -- and there was a bit over 3,100 contracts worth of roll-over/switch volume in this precious metal.

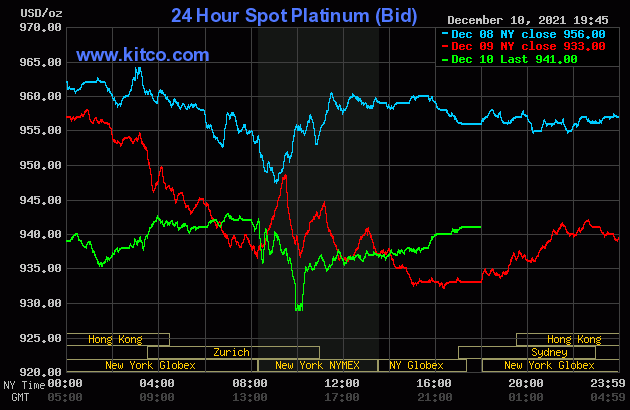

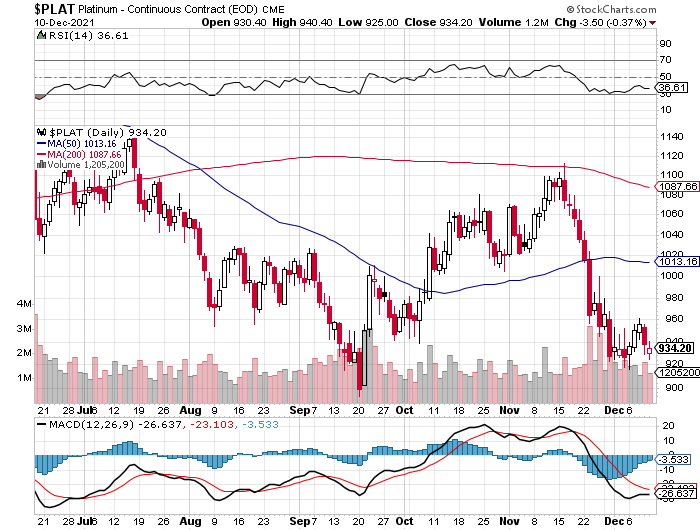

The platinum price rallied quietly until around 11:40 a.m. China Standard Time on their Friday morning -- and then had a quiet down/up move centered around 2:30 p.m. CST -- and ending at 10 a.m. in Zurich. It traded quietly sideways until the COMEX open in New York -- and then got smacked lower going into the 10 a.m. EST afternoon gold fix in London. It jumped up a bit from there, before creeping quietly higher until trading ended at 5:00 p.m. EST. Platinum was closed at $941 spot, up 8 dollars on the day.

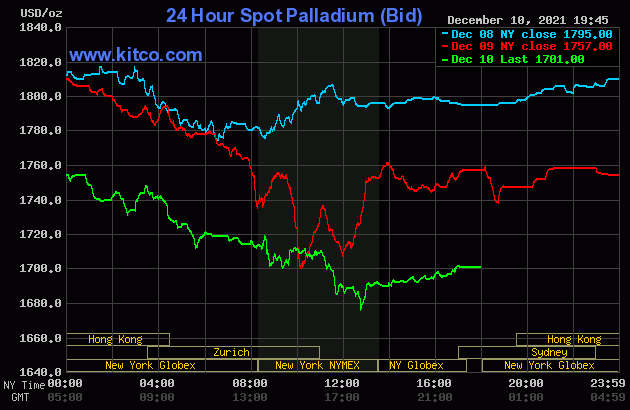

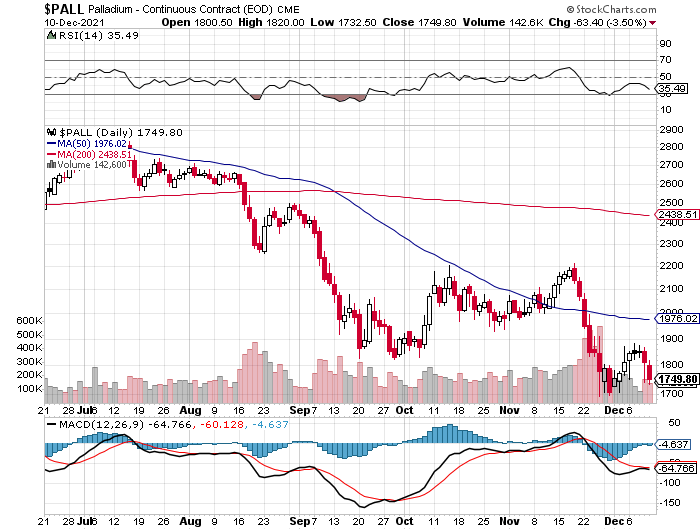

Palladium traded quietly and unevenly sideways until minutes before 2 p.m. in Shanghai -- and from there it was quietly down hill until the low tick was set minutes before 1 p.m. in New York. Like platinum, it jumped a bit higher from there, before crawling quietly higher until the market closed at 5:00 p.m. EST. Palladium was closed at $1,701 spot, down 56 bucks from Thursday -- and 27 dollars off its Kitco-recorded low tick of the day.

Based on the kitco.com spot closing prices in silver and gold posted above, the gold/silver ratio worked out to 80.4 to 1 on Friday...compared to 80.9 to 1 on Thursday.

Here's Nick's 1-year Gold/Silver Ratio chart, updated with the last five days worth of data. Click to enlarge.

![]()

The dollar index closed very late on Thursday afternoon in New York at 96.271 -- and then opened lower by about 5.5 basis points once trading commenced around 7:45 p.m. EST on Thursday evening, which was 8:45 a.m. China Standard Time on their Friday morning. After a brief tick higher, it was sold lower until a 'rally' developed starting at exactly 11 a.m. CST. That topped out at 10:50 a.m. in London -- and after a quiet down/up move, fell like a stone starting at 8:28 a.m. in New York. It got saved minutes later -- and then 'rallied' anew until 9:48 a.m. EST -- and it was then down hill until the low tick of the day was set around 1:12 p.m. From that juncture it had a quiet up/down move until the market closed at 5:00 p.m. EST.

The dollar index finished the Friday trading session at 96.097...down about 17.5 basis points from its close on Thursday -- and about 5 basis points above its indicated spot close on the DXY chart below.

Here's the DXY chart for Friday, thanks to Bloomberg as always -- and the above-mentioned discrepancy should be noted. Click to enlarge.

And here's the 5-year U.S. dollar index chart that appears in this spot in just about every Saturday column...courtesy of the good folks over at the stockcharts.com Internet site. The delta between its close...96.10...and the close on the DXY chart above, was a very tiny fraction of 1 basis point yesterday. Click to enlarge as well.

Heaven only know how far the dollar index would have fallen if the usual gentle hands hadn't appeared at 8:30 a.m. in New York when the CPI numbers hit the tape. It was more than obvious that the currencies and precious metals were being actively managed...starting with that DXY 'rally' in Far East trading.

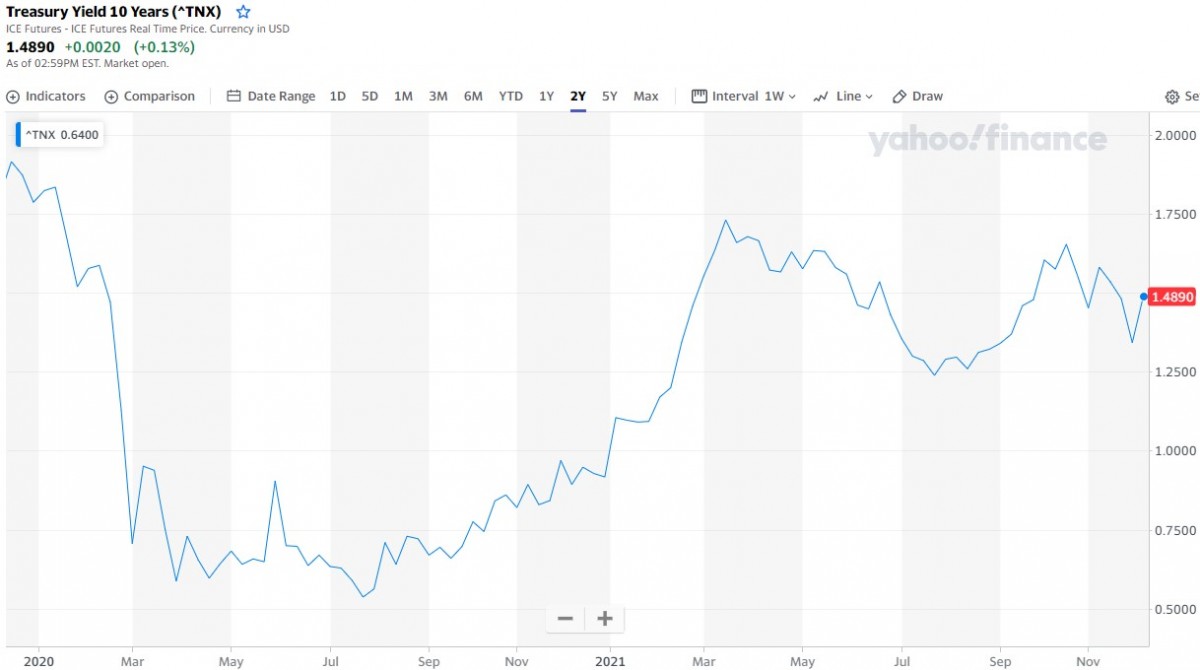

U.S. 10-Year Treasury: 1.4890%...up 0.0020 (+0.13%)...as of 02:59 p.m. EST.

Here's the 2-year 10-year U.S. Treasury chart, courtesy of yahoo.com as always -- and as I keep pointing out, you can see where the Fed began yield curve control in March of this year. Click to enlarge.

As I -- and Gregory Mannarino keep pointing out, who in their right minds would be buying debt instruments at these yields and in this inflationary environment? Only central banks, that's who.

![]()

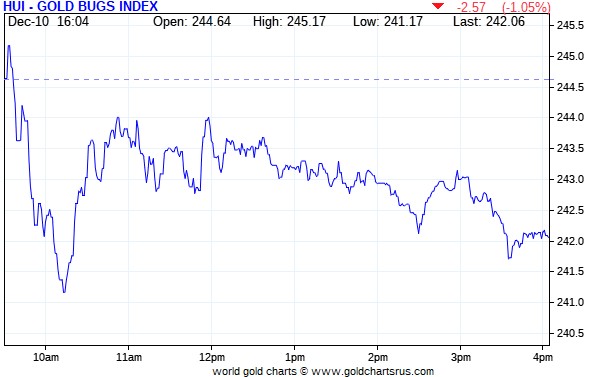

The gold stocks ticked a bit higher at the open -- and then were sold down hard until gold began to head higher very shortly after 10 a.m. in New York trading. They rallied a bit from there, but turned lower anew when gold's price was capped and turned lower starting at noon EST. They continued to sell off quietly until about twenty minutes before the markets closed at 4:00 p.m. EST. The HUI closed down a disappointing 1.05 percent.

Computed manually, Nick Laird's Intraday Silver Sentiment/Silver 7 Index closed lower by 1.08 percent.

And here's Nick's 3-year Silver Sentiment/Silver 7 Index chart, updated with Friday's candle. Click to enlarge.

Despite the decent gain in silver yesterday, all the Silver 7 shares were closed lower. It dawned on me just now that maybe the quiet accumulation in the gold and silver equities up until Thursday was just 'da boyz' loading up in order to bomb the market so they wouldn't show a positive close on the CPI numbers...something I've seen on more than one occasion in the past -- and which I've mentioned before as well.

The latest silver eye candy from the reddit.com/Wallstreetsilver crowd is linked here -- and they've been very busy buyers lately.

![]()

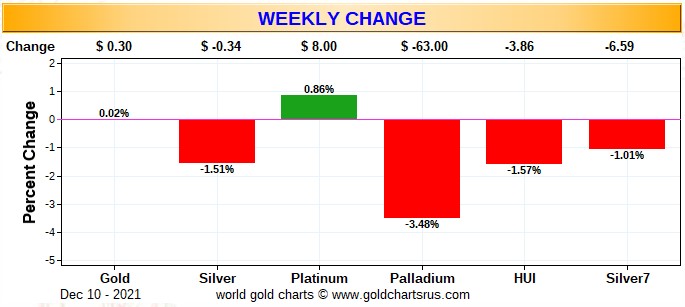

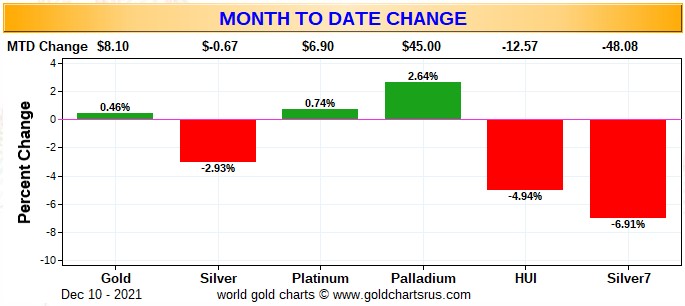

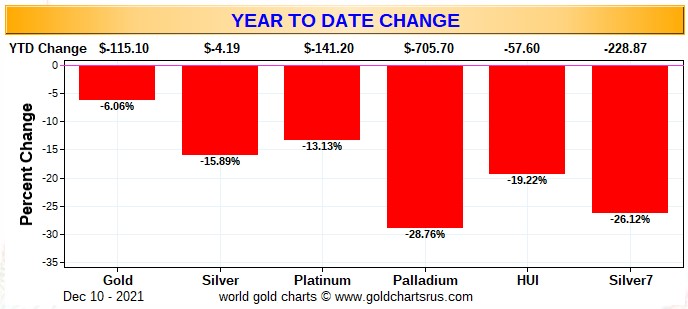

Here are the usual three charts that show up in every Saturday missive. They show the changes in gold, silver, platinum and palladium in both percent and dollar and cents terms, as of their Friday closes in New York — along with the changes in the HUI and the Silver 7 Index.

Here's the weekly chart -- and thanks to the commercial traders of all stripes, it's mostly a sea of red again this week, except for platinum -- and gold, which ended the week unchanged. This is just a portrait of their handiwork. Most of the price damage in all things precious metal-related occurred on Thursday. Click to enlarge.

Here's the month-to-date chart -- and it's not much better. The precious metal equities have really taken it in the neck since Wednesday of last week when the new month started. One would have to think that there's a lot of tax loss selling going on. Click to enlarge.

And here's the year-to-date chart -- and it's even more butt-ass ugly than it was last week...there's no other word for it. There's no way to put lipstick on this pig of a chart once again. And as I said in this spot last week, one has to wonder how the precious metal mining companies will spin their annual reports looking at returns like these. Of course, there will be almost no mention of the real reason why this chart looks the way it does. Click to enlarge.

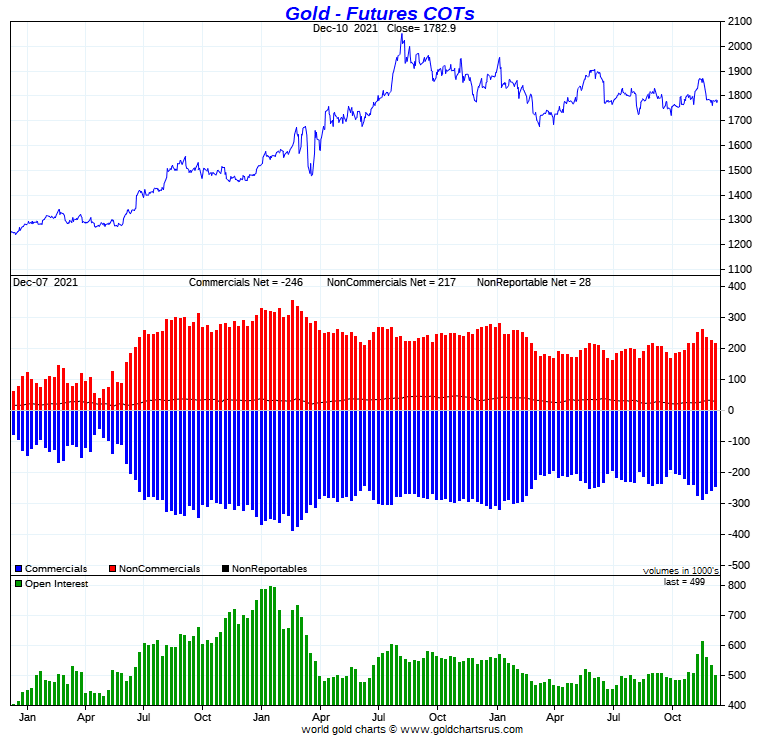

In the Commitment of Traders Report data below, there were the expected decreases in the commercial net short positions in both gold and silver -- and they were pretty decent, particularly in silver. And if one subtracts out Ted's gold whale's now 40,000 contract long position, the short position in gold is pretty bullish. Silver is now back to being very bullish...especially after the new low close on Thursday -- and the new intraday low on Friday. It remains to be seen whether or not the commercial traders of whatever stripe can continue to engineer their respective prices lower. If they can, there's not much meat left on the bones of the non-commercial/small traders -- and the law of diminishing returns will set it almost immediately...if we're not already there.

![]()

The CME Daily Delivery Report showed that 534 gold and zero silver contracts were posted for delivery within the COMEX-approved depositories on Tuesday.

In gold, the largest short/issuer was Citigroup, with 484 contracts out of its house account. They were followed by Advantage and Marex Spectron, with 32 and 18 contracts out of their respective client accounts. Of the eight long/toppers in total, the only one that really mattered was BofA Securities, as they stopped 500 contracts for their own account. ADM was in very distant second place with 17 contracts for clients.

In palladium, there were 2 contracts issued and stopped.

The link to yesterday's Issuers and Stoppers Report is here.

So far this month there have been 33,196 gold contracts issued/reissued and stopped -- and that number in silver is 8,450 contracts. In platinum and palladium respectively, there have been 33 and 151 and COMEX contracts issued and stopped.

The CME Preliminary Report for the Friday trading session showed that gold open interest in December rose by 208 COMEX contracts, leaving 718 still around, minus the 534 contracts mentioned a few paragraphs ago. Thursday's Daily Delivery Report showed that 312 gold contracts were actually posted for delivery on Monday, so that means that 208+312=520 more gold contracts were just added to the December delivery month. Silver o.i. in December dropped by 22 contracts, leaving 618 contracts still open. Thursday's Daily Delivery Report showed that 23 contracts were posted for delivery on Monday, so that means that 23-22=1 more silver contract was added to December.

Total gold open interest at the close yesterday increased by 3,571 COMEX contracts -- and total silver o.i. rose by 633 contracts.

![]()

There were no reported changes in GLD yesterday, but an authorized participant removed 1,017,504 troy ounces of silver from SLV.

In other gold and silver ETFs and mutual funds on Planet Earth on Friday, net of any changes in COMEX, GLD & SLV inventories, there was a net 152,081 troy ounces of gold withdrawn -- and that's because of the 162,701 troy ounces that was taken out of Deutsche Bank/XAD5. There was a net 427 troy ounces of silver removed as well.

There was no sales report from the U.S. Mint yesterday.

Month-to-date the mint has sold 27,000 troy ounces of gold eagles -- and 8,000 one-ounce 24K gold buffaloes -- and zero silver eagles.

I would be very surprised if we see any more sales from the U.S. Mint for the remainder of the 2021 calendar year. Even the sales they reported this past week were unexpected.

![]()

There was no in/out movement in gold over at the COMEX-approved depositories on the U.S. east coast on Thursday. There was a bit of paper activity, as 46,211 troy ounces was transferred from the Registered category and back into Eligible...30,585 troy ounces at Brink's, Inc. -- and the remaining 15,625.386 troy ounces/486 kilobars made that same trip over at JPMorgan. The link to this is here.

And much to my amazement, there was no in/out activity in silver, either -- and that included paper activity. I don't recall a time when there was no physical activity in both gold and silver on the same day...ever.

But there was activity over at the COMEX-approved gold kilobar depositories in Hong Kong on their Thursday. They reported receiving 600 of them -- and shipped out 925 kilobars. Except for the 162 kilobars that arrived at Loomis International, the remainder of the in/out activity, as always, was at Brink's, Inc. The link to that, in troy ounces, is here.

![]()

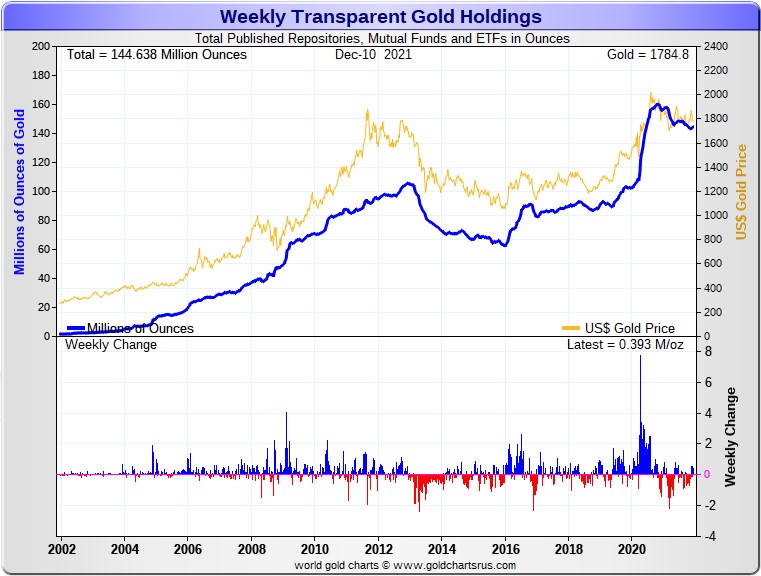

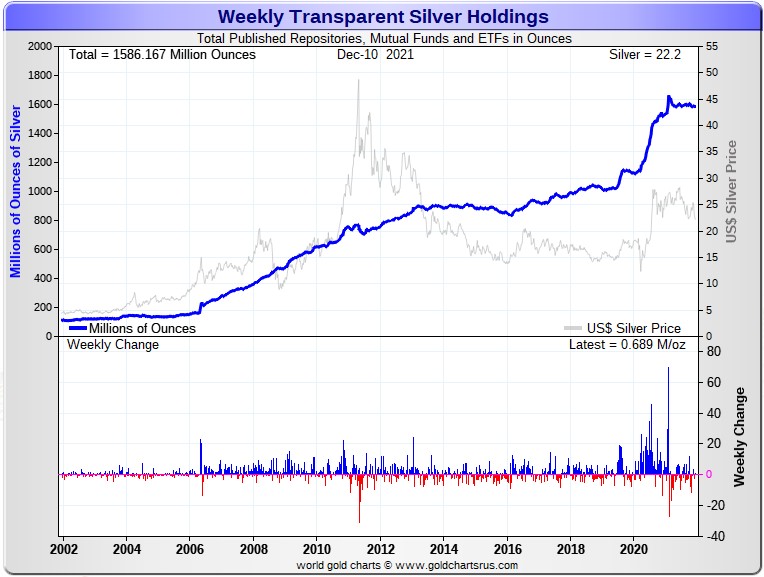

Here are the usual two 20-year charts that show up in this space every Saturday. They show the total amount of physical gold and silver held in all know depositories, ETFs and mutual funds as of the close of business on Friday.

For the week just past, there was a net 393,000 troy ounces of gold added -- and there was a net 689,000 troy ounces of silver added as well. Click to enlarge.

As I point out every week, looking at the above two charts, one would never know the price pressure that these precious metals have been under since mid June...especially in silver...although as time as gone along, you can see the signs of it in gold now, but it's not excessive. It's quite the opposite in silver.

And considering the price activity over that time period, the above charts continue to show how tightly held the physical precious metals are...especially silver -- and that's despite the punishment handed out by the commercial traders over the last five months or so...including this past week.

You have to ask yourself where all the physical silver is going to come from to deposit into all these various and sundry ETFs and mutual funds once the next silver rally is allowed to begin.

Ted is of the opinion that this why 'da boyz' are holding silver below its 200-day moving average at the moment. But they can't keep it down forever...or in gold, either.

![]()

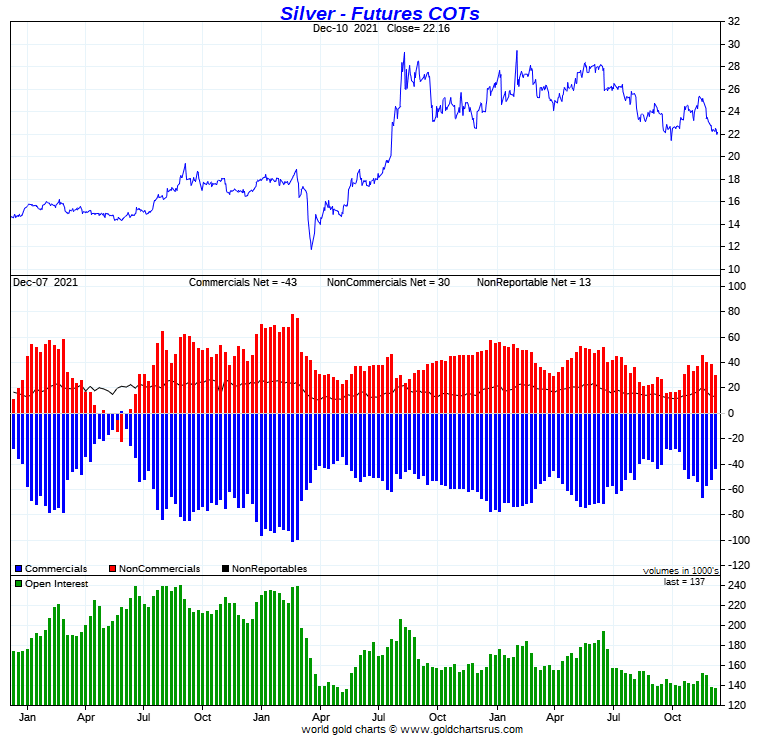

The Commitment of Traders Report, for positions held at the close of COMEX trading on Tuesday, December 7 showed the expected declines in the commercial net short positions in both gold and silver...particularly the latter.

In silver, the Commercial net short position dropped by 8,861 COMEX contracts, or 44.3 million troy ounces.

They arrived at that number by reducing their long position by 738 contracts -- and also reduced their short position by 9,599 COMEX contracts. It's the difference between those two numbers that represents their change for the reporting week.

Under the hood in the Disaggregated COT Report it was all Managed Money traders and a bit more, as they decreased their net long position by 9,859 COMEX contracts...mostly by adding a hefty 8,401 contracts to their gross short position. I'll have more on this in my remarks under the COT chart for silver. The Nonreportable/small traders also decreased their net long position, them by a tiny amount...260 contracts. The Other Reportables bucked the trend, as they increased their net long position by 1,258 COMEX contracts.

Doing the math: 9,859 plus 260 minus 1,258 equals 8,861 COMEX contracts, the change in the Commercial net short position.

The Commercial net short position in silver now sits at 215.7 million troy ounces...down from the 260.0 million troy ounces that they were short in last week's COT Report.

The Big 8 are short 320.9 million troy ounces in this week's COT Report, exactly unchanged from the 320.9 million troy ounces they were short in last Friday's COT Report.

But since the headline number showed a decrease in the commercial net short position of 44.3 million troy ounces, it was Ted's raptors, the small commercial traders other than the Big 8 that were the sole buyers of long positions during the reporting week...the entire amount of 44.3 million troy ounces...8,860 COMEX contracts.

Don't forget that despite their small size, Ted's raptors are still commercial traders in the commercial category -- and their purchasing of long positions during this past reporting week had the mathematical effect of decreasing the Commercial net short position. A fact that was 'in your face' this week.

There's much more on this in the 'Days to Cover' discussion further down.

The Big 8 are short 320.9/215.7 equals 149 percent of the Commercial net short position in silver, up from the 123 percent they were short in last week's COT Report.

Here's the 3-year COT chart for silver, courtesy of Nick Laird as always and the change is worth noting. Click to enlarge.

Although there are still two more reporting days left...Monday and Tuesday of next week...before the cut-off for the next COT Report, it's safe to say the there's been further improvement in the Commercial net short position in silver as of Friday's close.

Without much doubt, it will prove to be further raptor/small commercial trader buying and Managed Money short selling that will be responsible for that improvement, as the Big 4/8 shorts appear to be content to just sit there as corks in the silver price bottle -- and let the small commercial traders run the price up and down within a range.

But the key take-away from what happened in silver was the fact that the Managed Money traders increased their gross short position as much as they did...8,401 COMEX contracts...because last week they had decreased their gross short position by a meaningful amount. Ted and I agree that they're probably short much more after Thursday's engineered price decline.

The other two categories also increased their gross short positions in this week's report, but only by insignificant amounts...the Other Reportables by 452 contracts -- and the Nonreportable/small traders by only 404 COMEX contracts. Nothing to see here, please move along.

I'm not sure how much blood is left in the silver stone from a price perspective after Thursday's smash to the downside. The Managed Money and small traders are pretty much done selling any long positions they would wish to -- and only the Managed Money traders appear eager to add to their short positions. They did again on Thursday...but that may be the end of it...unless Ted's raptors can engineer silver's price lower from here, as the Big 4/8 shorts appear to be standing on the sidelines.

But the long and the short of it is that we're back into an extremely bullish market structure in silver from a COMEX futures market perspective.

![]()

In gold, the commercial net short position dropped by 12,980 COMEX contracts, or 1.298 million troy ounces of gold.

They arrived at that number by reducing their long position by 15,620 contracts, but also reduced their gross short position by 28,600 COMEX contracts -- and it's the difference between those two numbers that represents their change for the reporting week.

Under the hood in the Disaggregated COT Report, it was mostly Managed Money traders that made up for the change during the reporting week, as they reduced their net long position by 11,344 COMEX contracts. [They reduced their gross short position in the process -- and I'll get into that a bit further down] The Nonreportable/small traders also reduced their net long position, them by 4,305 contracts. Like in silver, the Other Reportables increased their net long position by 2,669 COMEX contracts.

Doing the math: 11,344 plus 4,305 minus 2,669 equals 12,980 COMEX contracts, the change in the commercial net short position.

The commercial net short position in gold now sits at 24.56 million troy ounces, down from the 25.86 million troy ounces they were short in last week's COT Report.

The short position of the Big 8 traders is 23.77 million troy ounces, down only 430,000 troy ounces from the 24.20 million troy ounces they were short in last week's COT Report.

But the headline commercial net short position showed a decrease of 1,298,000 troy ounces, so that means that Ted's raptors, the small commercial traders other than the Big 8, had to have bought 1,298,000 minus 430,000 equals 868,000 troy ounces/8,680 long contracts to make these numbers balance -- and that's what they did.

Like in silver, their buying had the mathematical effect of decreasing the commercial net short position.

Also like in silver, despite their small size, Ted's raptors are still commercial traders in the commercial category.

From the above numbers, the Big 8 traders are short 23.77/24.56 equals about 97 percent of the commercial net short position in gold...up a bit from the 94 percent they were net short in last week's COT Report, which means that Ted's raptors are net short the difference for the seventh week in a row now.

Here's Nick Laird's 3-year COT chart for gold, updated with Friday's data. Click to enlarge.

Despite the improvement in yesterday's COT Report, we are still some distance from being in a bullish configuration in gold.

However, there is the not-so-little matter of the gold 'whale' that Ted figures in John Paulson -- and it's his opinion that he added around 2,000 or so more contracts to his already big long position in the COMEX futures market, which he now calculates to be around 40,000 contracts.

And since John is in it for the long term -- and a very big score somewhere down the road, this amount can be removed from the calculation of the commercial net short position in gold, which takes it down to around the 20,000 contract market, which certainly puts the COMEX futures market structure back into bullish territory once more. But as to how bullish that is, is Ted's area of expertise.

And as mentioned further up, even though the Managed Money traders decreased their net long position in gold during the reporting week, unlike in silver, they managed to reduce their gross short position by a further 1,035 contracts. Not a lot, but better than the 8,400 contracts they added to their gross short position in silver this week.

As far as the traders in the Other Reportables and Nonreportable/small traders are concerned, they did virtually nothing on the short side...the former decreasing their gross short position by 2 contracts -- and the latter increasing their gross short position by a piddling 6 contracts.

So except for the big jump in the Managed Money gross short position in silver, the rest of the speculative traders in both silver and gold, studiously avoided going back on the short side by any great amount...if at all...especially in gold.

This makes the situation for the Big 4/8 shorts all that more precarious.

![]()

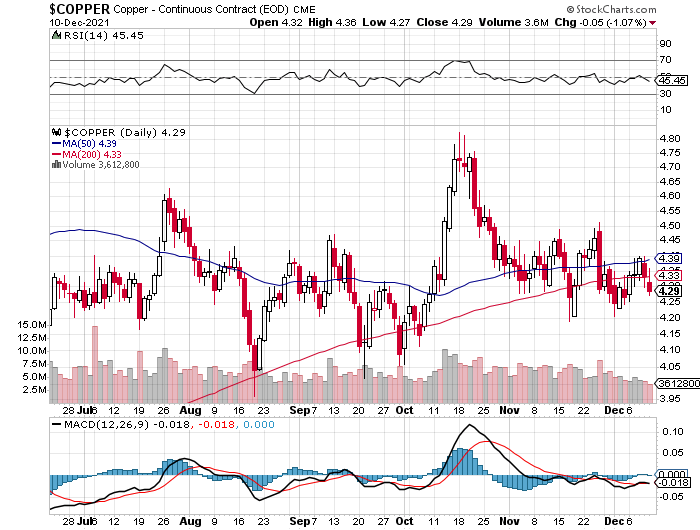

In the other metals, the Managed Money traders in palladium decreased their net short position by a further 295 COMEX contracts during the last reporting week -- and are now net short the palladium market by 2,352 COMEX contracts. The two groups of commercial traders are now the only ones that are net long palladium. In platinum, the Managed Money traders decreased their long position by a further 4,155 contracts during the reporting week -- and are now net short the COMEX futures market by 4,082 COMEX contracts. The Producer/Merchant category is also net short platinum at the moment, the only other category that is. In copper, the Managed Money traders decreased their net long position by a further but tiny 687 COMEX contracts -- and are net long copper by 13,719 COMEX contracts...about 343 million pounds of the stuff -- and about 8 percent of total open interest...up from the 4.5 percent they were short in last week's COT Report. The reason the percentage went up was because total open interest fell by quite a bit.

![]()

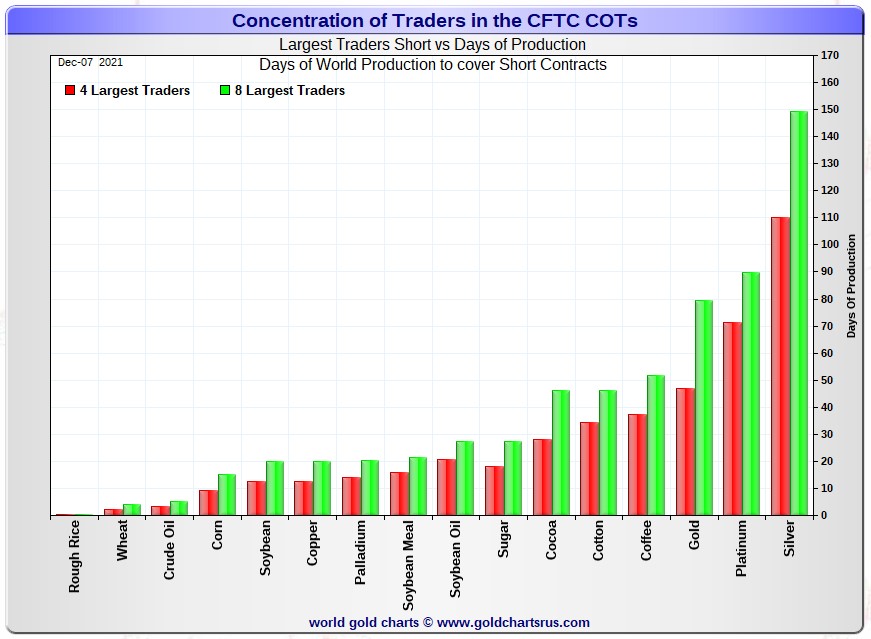

Here’s Nick Laird’s “Days to Cover” chart, updated with the COT data for positions held at the close of COMEX trading on Tuesday, December 7. It shows the days of world production that it would take to cover the short positions of the Big 4 — and Big '5 through 8' traders in each physically traded commodity on the COMEX.

I consider this to be the most important chart that shows up in the COT series -- and it deserves a minute of your time. Click to enlarge.

In this week's 'Days to Cover' chart, the Big 4 traders are short about 110 days of world silver production, up about 1 day from last week's COT Report. The ‘5 through 8’ large traders are short an additional 39 days of world silver production, down about 1 day from last week, for a total of about 149 days that the Big 8 are short, obviously unchanged from last week's report. [In last week's COT Report, they were short 149 days of world production.]

[Note: Since the Commercial net short position was precisely unchanged from a week ago, it's obvious that the days of world silver production they are short didn't change either. The only things that did were internally...the Big 4 added a day -- and the Big '5 through 8' dropped a day.]

That 149 days that the Big 8 are short, represents about five months of world silver production, or 320.9 million troy ounces of paper silver held short by the Big 8.

In the COT Report above, the Commercial net short position in silver was reported by the CME Group at 215.7 million troy ounces. As mentioned in the previous paragraph, the short position of the Big 4/8 traders is 320.9 million troy ounces. So the short position of the Big 4/8 traders is larger than the Commercial net short position by 320.9-215.7=105.2 million troy ounces...up 44.3 million troy ounces from last week's COT Report.

It was the raptor buying of that 44.3 million troy ounces/8,860 COMEX contracts that made up for the entire change in the commercial net short position in silver in the above COT Report.

The reason for the difference in those numbers two paragraphs ago is that these raptors, the small commercial traders other than the Big 8, are net long silver by 105.2 million troy ounces/21,040 COMEX contracts.

As per the first paragraph above, the Big 4 traders in silver are short around 110 days of world silver production in total. That's 27.5 days of world silver production each, on average...up a tiny bit from Monday's report. The traders in the '5 through 8' category are short 39 days of world silver production in total...a bit under 10 days of world silver production each on average -- down a tiny bit from last Friday's COT Report.

The Big 8 traders are short 47.0 percent of the entire open interest in silver in the COMEX futures market, which is up from the 46.5 percent they were short in the last COT report. And once whatever market-neutral spread trades are subtracted out, that percentage would certainly be over the 50 percent mark. In gold, it's 47.6 percent of the total COMEX open interest that the Big 8 are short, which is up a decent amount from the 45.5 percent they were short in yesterday's COT Report -- and certainly over the 50 percent mark once their market-neutral spread trades are subtracted out.

In gold, the Big 4 are short 47 days of world gold production, down about 1 day from the prior week's COT Report. The '5 through 8' are short 33 days of world production, unchanged week over week...for a total of 80 days of world gold production held short by the Big 8 -- obviously down 1 day from last week's COT Report. Based on these numbers, the Big 4 in gold hold about 59 percent of the total short position held by the Big 8...about unchanged from the prior COT Report.

The "concentrated short position within a concentrated short position" in silver, platinum and palladium held by the Big 4 commercial traders are about 74, 79 and 70 percent respectively of the short positions held by the Big 8...the red and green bars on the above chart. Silver is up about 1 percentage point from last week...platinum is down about 1 percentage point from a week ago -- and palladium is unchanged week-over-week.

The Big 4/8 traders are still very firmly stuck on the short side in both gold and silver -- and did nothing of substance to improve their lot during the reporting week.

As I've pointed out before -- and will mention again now, it's my firm belief that the Big 4/8 shorts will never be able to extricate themselves fully from the short side -- and at some point are going to have eat the lion's share of the short positions that they currently hold. The only way that can do that is to go into the market and buy longs.

And the moment the rest of the traders in the COMEX futures market sees that, the 'ask' will disappear -- and prices will explode...unless the powers-that-be at the CFTC and CME Group have something nefarious up their sleeves.

The situation regarding the Big 4/8 shorts in silver, gold [and platinum] continues to be beyond obscene, twisted and grotesque -- and as Ted correctly points out ad nauseam, its resolution will be the sole determinant of precious metal prices going forward.

As always, nothing else matters.

![]()

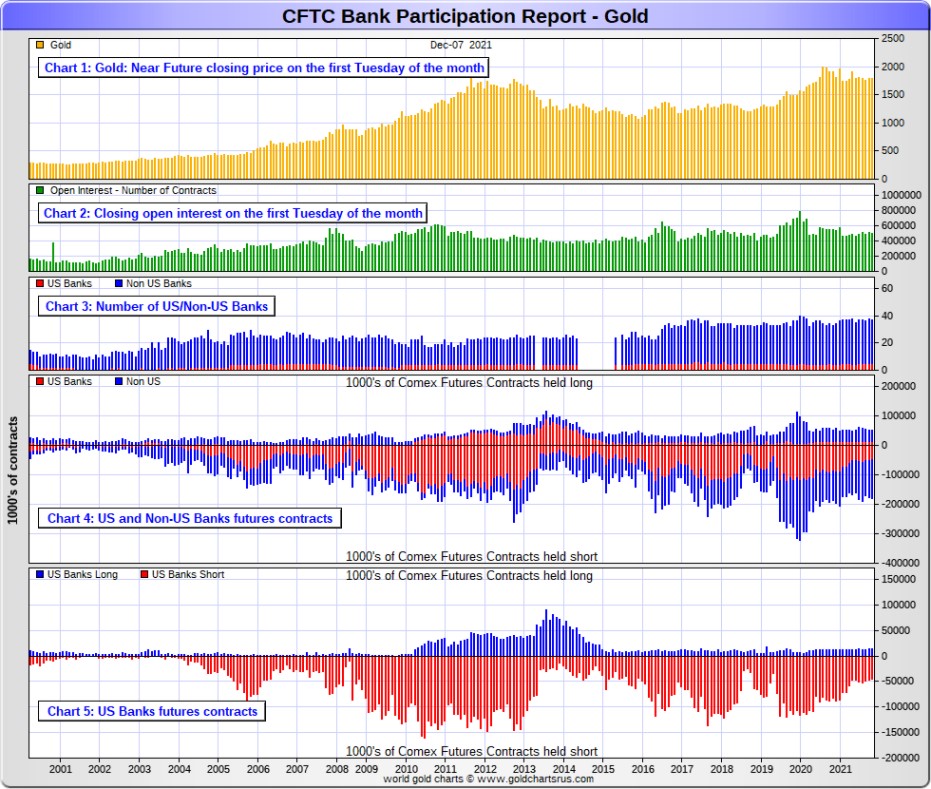

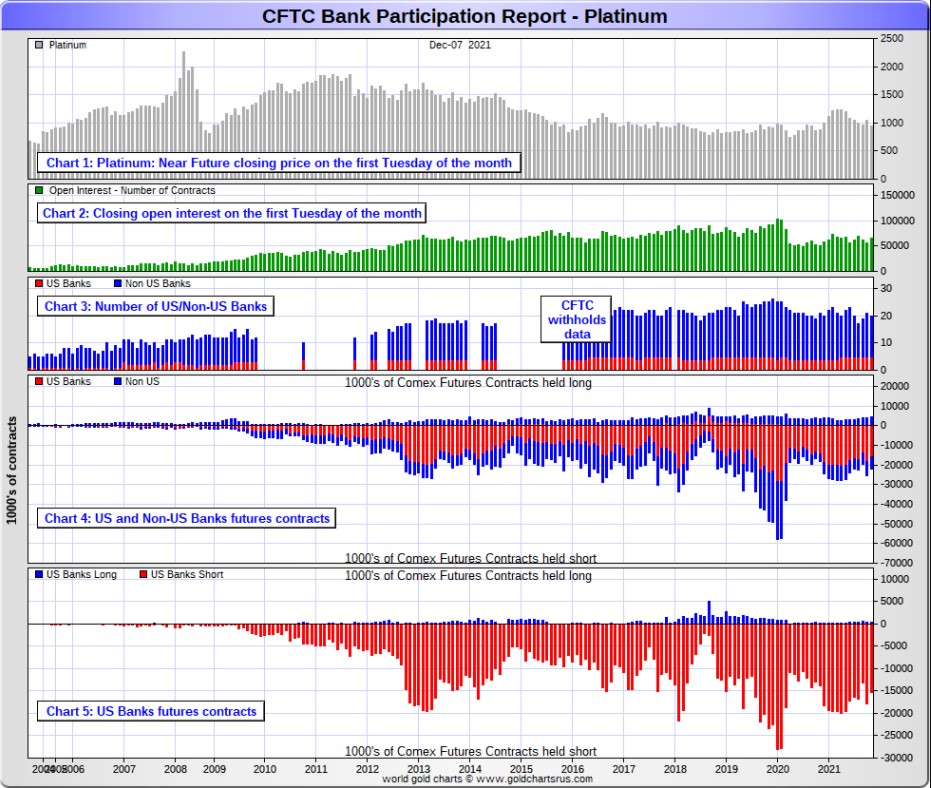

The December Bank Participation Report [BPR] data is extracted directly from yesterday's Commitment of Traders Report. It shows the number of futures contracts, both long and short, that are held by all the U.S. and non-U.S. banks as of Tuesday’s cut-off in all COMEX-traded products. For this one day a month we get to see what the world’s banks are up to in the precious metals. They’re usually up to quite a bit -- but only in platinum this month.

[The December Bank Participation Report covers the time period from November 2 to December 7 inclusive.]

In gold, 5 U.S. banks are net short 32,049 COMEX contracts in the December BPR. In November’s Bank Participation Report [BPR] these same 5 U.S. banks were net short 33,734 contracts, so there was a decrease of a smallish 1,685 COMEX contracts month over month.

However, this is the lowest short position in gold that the U.S. banks have held since August 2018.

Citigroup, HSBC USA, Bank of America and Morgan Stanley would most likely be the U.S. banks that are short this amount of gold. I still have my usual suspicions about the Exchange Stabilization Fund, although if they're involved, they are most likely just backstopping these banks.

Also in gold, 32 non-U.S. banks are net short 99,328 COMEX gold contracts. In November's BPR, 33 non-U.S. banks were net short 93,492 contracts...so the month-over-month change shows a further increase of 5,836 COMEX contracts. This is the largest short position in gold that the non-U.S. banks have held since March 2020.

At the low back in the August 2018 BPR...these same non-U.S. banks held a net short position in gold of only 1,960 contacts -- and they've been back on the short side in an enormous way ever since.

I suspect that there's at least three large banks in this group, HSBC, Barclays and Deutsche Bank. I also have my suspicions about Scotiabank/Scotia Capital, Dutch Bank ABN Amro, French bank BNP Paribas, plus Australia's Macquarie Futures as well. Other than that small handful, the short positions in gold held by the vast majority of non-U.S. banks are immaterial and, like in silver, have always been so.

As of this Bank Participation Report, 37 banks [both U.S. and foreign] are net short 26.3 percent of the entire open interest in gold in the COMEX futures market, which is up a bit from the 24.1 percent that 38 banks were net short in the November BPR.

Here’s Nick’s BPR chart for gold going back to 2000. Charts #4 and #5 are the key ones here. Note the blow-out in the short positions of the non-U.S. banks [the blue bars in chart #4] when Scotiabank’s COMEX short position was outed by the CFTC in October of 2012. Click to enlarge.

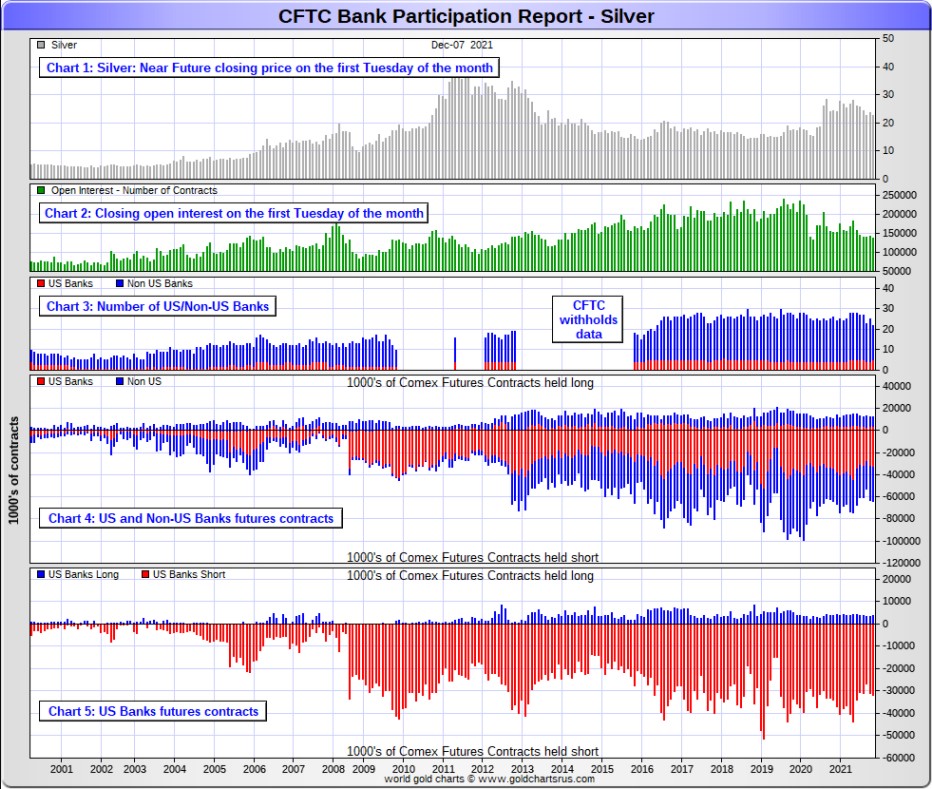

In silver, 5 U.S. banks are net short 28,215 COMEX contracts in December's BPR. In November's BPR, the net short position of 4 U.S. banks was 27,646 contracts, so the short position of the U.S. banks increased by less than 600 contracts month-over-month.

As in gold, the four biggest short holders in silver of the five U.S. banks in total, would be Citigroup, HSBC USA, Bank of America and most likely Morgan Stanley...and NOT Goldman Sachs or JPMorgan. And, like in gold, I have my suspicions about the Exchange Stabilization Fund's role in all this...although, also like in gold, not directly.

Also in silver, 17 non-U.S. banks are net short 23,407 COMEX contracts in the December BPR...which is virtually unchanged from the 23,516 contracts that 21 non-U.S. banks were short in the November BPR.

I would suspect that HSBC and Barclays holds a goodly chunk of the short position of these non-U.S. banks...plus some by Canada's Scotiabank/Scotia Capital still. I'm not sure about Deutsche Bank. I also suspect that a number of the remaining non-U.S. banks may actually be net long the COMEX futures market in silver. But even if they aren’t, the remaining short positions divided up between these other 15 or so non-U.S. banks are immaterial — and have always been so.

As of December's Bank Participation Report, 22 banks [both U.S. and foreign] are net short 37.8 percent of the entire open interest in the COMEX futures market in silver—up a bit from the 36.2 percent that 25 banks were net short in the November BPR. And much, much more than the lion’s share of that is held by Citigroup, HSBC, Bank of America, Barclays -- and Scotiabank -- and possibly one other non-U.S. bank...all of which are card-carrying members of the Big 8 shorts.

I'll point out here that Goldman Sachs has no derivatives in the COMEX futures market in any of the four precious metals.

Here’s the BPR chart for silver. Note in Chart #4 the blow-out in the non-U.S. bank short position [blue bars] in October of 2012 when Scotiabank was brought in from the cold. Also note August 2008 when JPMorgan took over the silver short position of Bear Stearns—the red bars. It’s very noticeable in Chart #4—and really stands out like the proverbial sore thumb it is in chart #5. But as of March of 2020...they're out of their short positions, not only in silver, but the other three precious metals as well. Click to enlarge.

In platinum, 5 U.S. banks are net short 14,918 COMEX contracts in the December Bank Participation Report, which is down a decent amount from the 17,481 COMEX contracts that these same 5 U.S. banks were short in the November BPR.

At the 'low' back in July of 2018, these U.S. banks were actually net long the platinum market by 2,573 contracts. So they have a long way to go to get back to just market neutral in platinum...if they ever intend to, that is.

Also in platinum, 15 non-U.S. banks are net short 2,356 COMEX contracts in the December BPR, which is down a decent amount from the 3,911 COMEX contracts that 16 non-U.S. banks were net short in the November BPR.

[Note: Back at the July 2018 low, these same non-U.S. banks were net short only 1,192 COMEX contracts in platinum.]

And as of December's Bank Participation Report, 20 banks [both U.S. and foreign] are net short 26.5 percent of platinum's total open interest in the COMEX futures market, which is down big from the 37.8 percent that 21 banks were net short in November's BPR.

But it's the U.S. banks that are on the short hook big time -- and the real price managers. They have little chance of delivering into their short positions, although a very large number of platinum contracts have already been delivered during the last year and a bit. But that fact, like in both silver and gold, has made no difference whatsoever to their short positions held. The situation for them in this precious metal is as equally dire in the COMEX futures market as it is with the other two precious metals...silver and gold...particularly the former.

The reason that they'll never improve their short positions in a big way is the same reason as in gold and silver...the Managed Money traders flatly refuse to go short big time like they used to in the past...although they are net short around 4,000 COMEX contracts at the moment, which is nothing out of the ordinary on an historical basis.

Here's the Bank Participation Report chart for platinum. Click to enlarge.

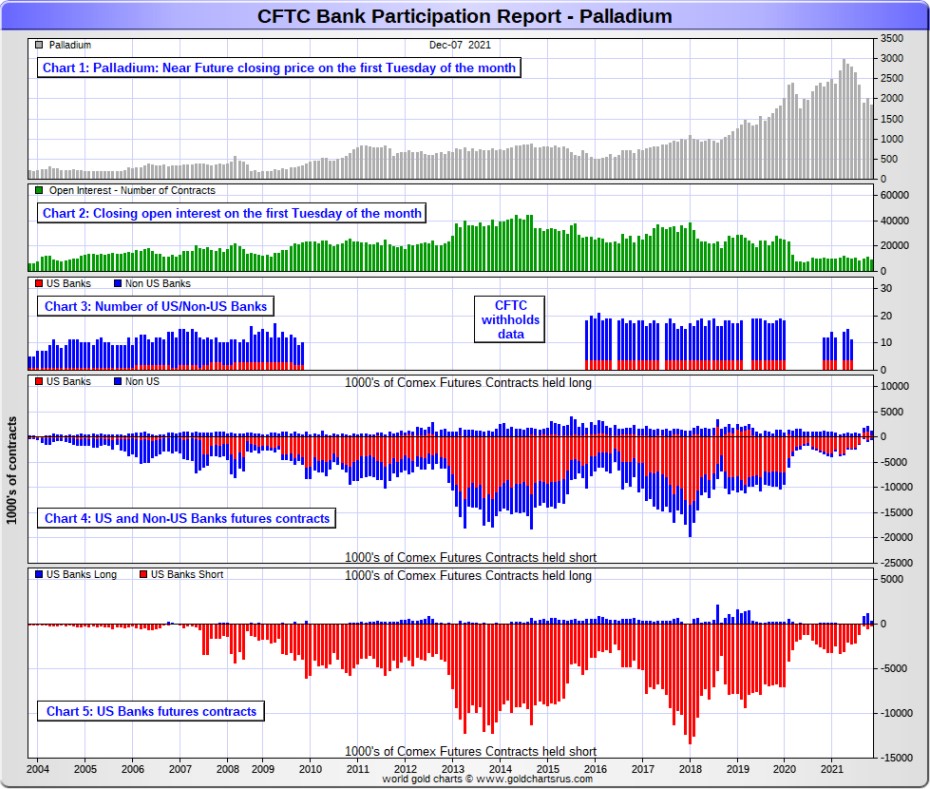

In palladium, '3 or less' U.S. banks are net long 185 COMEX contracts in the December BPR, which is down an inconsequential amount from the 665 contracts that these '3 or less' U.S. banks were net long in the November BPR.

Also in palladium, '12 or more' non-U.S. banks are net long 365 COMEX palladium contracts—also down an inconsequential amount from the 623 contracts that '9 or more' non-U.S. banks were net long in the November BPR. These non-U.S. banks have been net long by a bit in palladium for the last twenty-three months in a row -- and have now been joined by the U.S. banks on the long side for the third month in a row.

And as I've been commenting for almost forever now, the COMEX futures market in palladium is a market in name only, because it's so illiquid and thinly-traded. Its total open interest at Tuesday's cut-off was only 9,253 contracts...compared to 65,134 contracts of total open interest in platinum...136,52 in silver -- and 499,307 COMEX contracts in gold.

As of this Bank Participation Report, 15 banks [both U.S. and foreign] are net long 5.9 percent of the entire COMEX open interest in palladium...compared to the 11.8 percent of total open interest that 12 banks were net long in November's BPR.

And because of the small numbers of contracts involved, along with a tiny open interest, these numbers are pretty much meaningless.

But, having said that, for the last twenty-three months in a row, the world's banks have not been involved in the palladium market in a material way -- and for the third month in a row, they are now net long in unison in this precious metal.

Here’s the palladium BPR chart. Although the world's banks are now net long, it remains to be seen if they return as big short sellers again at some point like they've done in the past. Click to enlarge.

Excluding palladium now -- and for obvious reasons, only a small handful of the world's banks/investment houses, most likely four or so in total -- and mostly U.S-based, except for HSBC, Barclays and maybe Deutsche Bank...continue to have meaningful short positions in the other three precious metals. It's a near certainty that they run this price management scheme from within their own in-house/proprietary trading desks...although it's pretty much a given that some of their their clients are short these metals as well.

The futures positions in silver and gold that JPMorgan holds are immaterial -- and have been since March of last year. It's the new 7+1 shorts et al. that are on the hook in everything precious metals-related.

And as has been the case for over a year now, the short positions held by the Big 4/8 traders/banks is the only thing that matters -- and how it is ultimately resolved [as Ted said earlier] will be the sole determinant of precious metal prices going forward.

The Big 8 shorts continue to have an iron grip on precious metal prices -- and nothing has changed in that regard over the last month. They are the cork in the price bottle.

That situation will persist until they either voluntarily give it up...or are told to step aside, as it now appears that there's no chance that they will ever get overrun. If that possibility had ever existed in reality, it would have happened already. However, considering the current circumstances, I suppose one shouldn't rule it out entirely.

I don't have all that many stories, articles and videos for you today.

![]()

CRITICAL READS

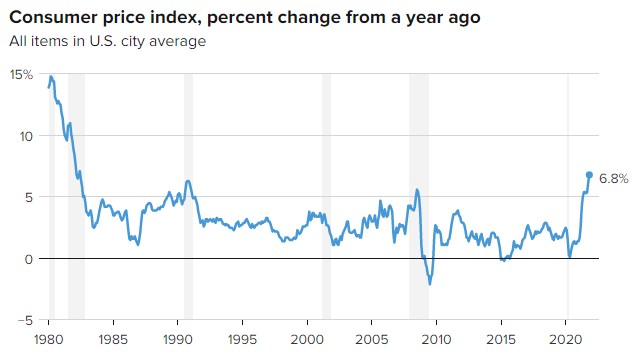

Inflation surged 6.8% in November, even more than expected, to fastest rate since 1982

Inflation accelerated at its fastest pace since 1982 in November, the Labor Department said Friday, putting pressure on the economic recovery and raising the stakes for the Federal Reserve.

The consumer price index, which measures the cost of a wide-ranging basket of goods and services, rose 0.8% for the month, good for a 6.8% pace on a year over year basis and the fastest rate since June 1982.

Excluding food and energy prices, so-called core CPI was up 0.5% for the month and 4.9% from a year ago, which itself was the sharpest pickup since mid-1991. Click to enlarge.

Price increases came from familiar culprits.

Energy prices have risen 33.3% since November 2020, including a 3.5% surge in November. Gasoline alone is up 58.1%.

Food prices have jumped 6.1% over the year, while used car and truck prices, a major contributor to the inflation burst, are up 31.4%, following a 2.5% increase last month.

The Labor Department said the increases for the food and energy components were the fastest 12-month gains in at least 13 years.

Shelter costs, which comprise about one-third of the CPI, increased 3.8% on the year, the highest since 2007 as the housing crisis accelerated.

This news item appeared on the cnbc.com Internet site at 8:31 a.m. EST on Friday morning -- and was updated about five hours later. I thank Swedish reader Patrik Ekdahl for sending it along -- and another link to it is here. The Zero Hedge spin on this is headlined "Prices Climb at Fastest Pace Since 1982... But it Could Have Been Worse" -- and I thank reader B.R. for pointing it out.

![]()

Spending without taxing: now we’re all guinea pigs in an endless money experiment

Today, citizens are unwitting participants in a covert policy experiment. It embraces the idea of higher government spending without the necessity of increased taxes.

While modern monetary theory (MMT), the doctrine, has obvious appeal for politicians, irrespective of economic religion, the long-term consequences may prove problematic.

A state, MMT argues, finances its spending by creating money, not from taxes or borrowing. As nations cannot go bankrupt when they can print their own currency, deficits and debt don’t matter. Accordingly, governments should spend to ensure full employment, guaranteeing a job for everyone willing to work. Alternatively, though not formally part of MMT, governments can fund universal basic income (UBI) schemes, providing every individual an unconditional flat-rate payment irrespective of circumstances.

While no government or central bank overtly advocates MMT, since the 2008 global financial crisis and, more recently, the pandemic, policymakers have adopted many of its tenets by stealth. Popular one-off payments and increased welfare entitlements, which could become permanent, increasingly support economic activity. As the graph below highlights, central banks now buy a high percentage of new government debt, effectively financing this additional spending by money creation.

MMT is actually a melange of old ideas: Keynesian deficit spending; the post gold standard ability of nations to create money at will; and quantitative easing (central bank financed government spending) pioneered by Japan. However, there are several concerns about MMT.

First, the source of useful, well-compensated work is unclear. While MMT suggests taxes can be used to direct production, government influence over businesses that create jobs is limited. The impact of labour-reducing technology and competitive global supply chains is glossed over. Getting one person to dig a hole and another to fill it in creates employment, but it is of doubtful economic and social value. The woeful record of postwar centrally planned economies, where people pretended to work and the government pretended to pay them, highlights the issues.

This right-on-the-money opinion piece showed up on theguardian.com internet site just after midnight on Friday morning -- and comes to us courtesy of Swedish reader Patrik Ekdahl. Another link to it is here.

![]()

Soon the Federal Reserve will manufacture a central bank digital currency that will be internationally sanctioned, different than Bitcoin and private cryptos, says G. Edward Griffin, author of Creature from Jekyll Island and founder of the Red Pill University.

The Federal Reserve has become so powerful over the years that its originally intended roles have completely reversed, he says. Griffin believes the Fed will morph into something completely unrecognizable where, "the government doesn't control the banks, the banks control the government."

Griffin believes that most present-day cryptocurrency traders are not buying assets for currency, but simply for profits, saying that, "if there wasn't a chance to make big money, I don't think most people would be in the cryptocurrency market right now."

This worthwhile 25-minute interview with 'The Creature From Jekyll Island' author G. Edward Griffin was posted on the youtube.com Internet site back on 21 October -- and I thank reader Doug Owen for sharing it with us. Another link to it is here. There was no video commentary from Gregory Mannarino on FridayDoug Noland: Two Developments -- and the Q3 2021 Z.1

China – in an about-face - implemented policy easing measures, cutting reserve requirements and announcing a loosening of property finance. This was to get ahead of an unfolding Evergrande default and rapidly deteriorating developer financing conditions. Developer bonds rallied modestly, with an index of Chinese high-yield dollar bonds ending the week down 170 bps to 20.1% (back to where they began the month).

While one can debate the longer-term ramifications of this week’s two key developments, they were undoubtedly decisive for speculative Bubble markets. With next Friday the quarterly “quadruple witch” expiration of options and other derivatives, negative developments this week (i.e. severe Omicron symptoms or an Evergrande default spurring market dislocation) could have unleashed a self-feeding downside dislocation exacerbated by derivatives hedging-related sell programs (selling by those on the wrong side of derivatives protection written).

While they rose somewhat this week, U.S. market yields remain absurdly low in the context of highly elevated inflation (November CPI up 6.8% y-o-y!). In a world of fragile Bubbles, I understand the safe haven aspect of Treasury market pricing. But, mainly, the introduction of QE – and inevitably entrapped central bankers – fundamentally distorted U.S. and global bond markets. Liquidity over-abundance, ultra-low yields and central bank backstops unleashed the greatest period of Credit and speculative excess the world has ever experienced.

Review the incredible growth in the Federal Reserve’s balance sheet, Treasury and Agency Debt, the Financial Sector, Bank Assets/Liabilities, Total Debt Securities, Total Securities and Household Net Worth - and surging spending and inflation are not difficult to explain. We have an interesting Fed meeting coming next week. If the market rally holds through Wednesday, it will be difficult for the Fed not to upsize taper and talk “hawkish pivot.” Meanwhile, the type of volatility experienced throughout global markets is stealthily at work impairing liquidity. Especially as the Fed and others begin winding down QE programs, the liquidity backdrop ensures acute vulnerability to “risk off” de-risking/deleveraging episodes.

Doug's weekly commentary was posted on his website in the very wee hours of Saturday morning PDT -- and another link to it is here.

What Putin Really Told Biden -- Pepe Escobar

Russian and U.S. leaders dropped their respective rhetorical gauntlets but nobody really expects Russia to invade Ukraine...

So Russian President Vladimir Putin, all by himself, and U.S. President Joe Biden, surrounded by aides, finally had their secret video link conference for two hours and two minutes – with translators placed in different rooms.

That was their first serious exchange since they met in person in Geneva last June – the first Russia-U.S. summit since 2018.

For global public opinion, led to believe a “war” in Ukraine was all but imminent, what’s left is essentially a torrent of spin.

Now for what really matters: the red line.

What Putin diplomatically told Team Biden, sitting at their table, is that Russia’s red line – no Ukraine on NATO – is unmovable. The same applies to Ukraine turned into a hub of the Pentagon’s Empire of Bases, and hosting NATO weaponry.

Washington may deny it ad infinitum, but Ukraine is part of Russia’s sphere of influence. If nothing is done to force Kiev to abide by the Minsk Agreement, Russia will “neutralize” the threat in its own terms.

The root cause of all this drama, absent from any NATOstan narrative, is straightforward: Kiev simply refuses to respect the February 2015 Minsk Agreement.

According to the deal, Kiev should grant autonomy to Donbass via a constitutional amendment, referred to as “special status”; issue a general amnesty; and start a dialogue with the people’s republics of Donetsk and Lugansk.

Over the years, Kiev fulfilled less than zero of these commitments – while the NATOstan media machine kept spinning that Russia was violating Minsk. Russia is not even mentioned in the agreement.

This commentary from Pepe showed up on the Zero Hedge website on Thursday -- and I thought it best to wait for my Saturday column. Another link to it is here. A follow-on story to this from Zero Hedge yesterday is headlined "As NATO Offers Russia a Meeting, East European Allies Infuriated At Biden Overtures" -- and I thank reader B.R. for that one.

Eric Sprott: The Upside Down Year in Gold and Silver

After a frustrating year where many things that would typically send precious metals higher had the opposite effect, what should an investor do? Host Craig Hemke sits down with special guest Eric Sprott to break down all the gold and silver news you need to navigate an upside down market.

In this edition of The Yearly Wrap-Up, you’ll hear:

- Why gold is down YTD even as real rates are the lowest in history

- Words of advice for new stackers

- Plus: where we go from here

This audio interview runs for about 45 minutes -- and was posted on the sprottmoney.com Internet site on Friday sometime. Another link to it is here.

![]()

The Photos and the Funnies

Here are the next four shots from our rather brief stop at Beacon Hill Park in Victoria on December 29. The first photo is the 'money shot' of that grey squirrel featured in my Friday column. The second photo is another one of the pond -- and most of the photos taken in this park were within a handful of meters of it. The third photo is of a bunch of ducks grazing just beside the pond. The only reason I took this particular photo is because I'd never seen an American Widgeon on dry land before. Up until that point, I'd only seen them on water -- and this is my only shot of the whole bird. The last photo is of a herring gull minding its own business. Click to enlarge.

![]()

The WRAP

Today's pop 'blast from the past' dates from 1983 -- and I've toying with the idea of using it in my column for six months now -- and today's the day. Composed by Brazilian musician and bandleader Sérgio Mendes and sung by Joe Pizzulo and Leeza Miller. It was a smash hit just about everywhere on Planet Earth -- and described by record producer Rick Beato as "the most complicated hit song of all time". The link is here. Of course there's a bass cover to this -- and that's linked here.

And if you're interested in why Rick thinks it's the most complicated hit song of all time, his 20-minute deconstruction of the lead guitar part is linked here -- and I've watched it three times, as it's that amazing.

Today's classical blast from past I've featured before...but only once. There isn't much in the classical music repertoire for the viola -- and this piece by Hector Berlioz is about the only one that's ever programmed in any classical concert series -- and it's done rarely.

Berlioz originally composed it for Italian virtuoso violinist Nicolo Paganini to exhibit his considerable skill on the viola. He initially refused to perform it, because he "wasn't playing all the time".

Paganini did not hear the work he had commissioned until 16 December 1838; then he was so overwhelmed by it that, following the performance, he dragged Berlioz onto the stage and there knelt and kissed his hand before a wildly cheering audience and applauding musicians. A few days later he sent Berlioz a letter of congratulations, enclosing a bank draft for 20,000 francs.

Here's the Frankfurt Radio Symphony Orchestra, with Paris-born Antoine Tamesit as soloist, recorded on 24 June 2018. The link is here.

![]()

The commercial traders of whatever stripe had the precious metals as low as they could possibly get them by the time the CPI numbers hit the tape at 8:30 a.m. in New York on Friday morning. And with little volume in either gold or silver, they had little trouble keeping their respective rallies from getting out of hand.

Silver hit a slight new intraday low price on Friday -- and only platinum was allowed to close higher on the day.

All four precious metals have been kept below any moving average that matters for the last thirteen or fourteen days in a row, so the iron grip of the Big 4/8 shorts remains in place. Someday it won't be there, but it wasn't yesterday.

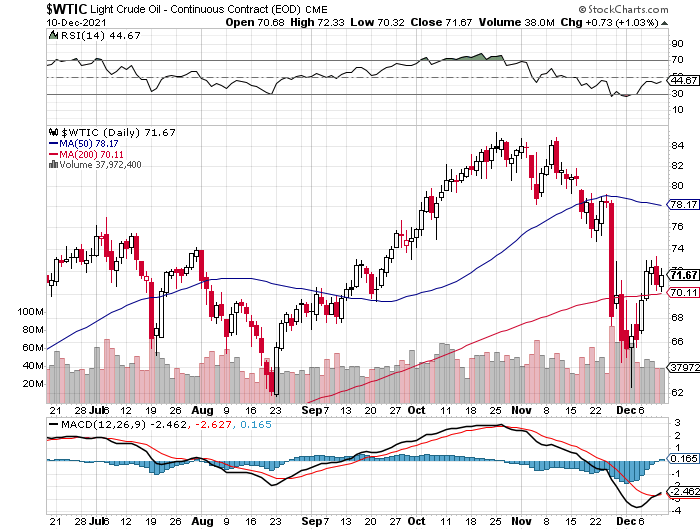

Copper closed down 5 cents a pound -- and is now back below any moving average that matters once again. WTIC closed higher by 73 cents a barrel.

Here are the 6-month charts for the Big 6 commodities, courtesy of stockcharts.com as always. Click to enlarge.

I continue to watch what's going on in the U.S.A. -- and elsewhere, with the usual sense of alarm that gets stronger with each passing week.

The destruction of the American Republic has been a work in progress for the last hundred years, but it's now advancing at Warp speed. G. Edward Griffin spelled it out chapter and verse in his brilliant tome..."The Creature From Jekyll Island: A Second Look at the Federal Reserve" -- and goes into this a bit in his interview in the Critical Reads section further up.

And every time I bring up this subject, I'm always reminded of the two chilling quotes from David Rockefeller from very late in the last century...

He may have passed from our sight, but the organizations he either founded or was associated with, have been around for longer than any of us have been alive. Only the names within these organizations have changed over the years, but their mission of the destruction of the nation state and the rise of a New World Order and One World Government, hasn't changed at all.

Both Gregory Mannarino and I, amongst a whole host of others, have been pointing this out for decades now.

This virus thingy that will never be allowed to end -- and now the rise of no-longer-transitory inflation, are their final acts before the whole system is allowed to collapse in a heap at some point down the road...a time that is unknown to us.

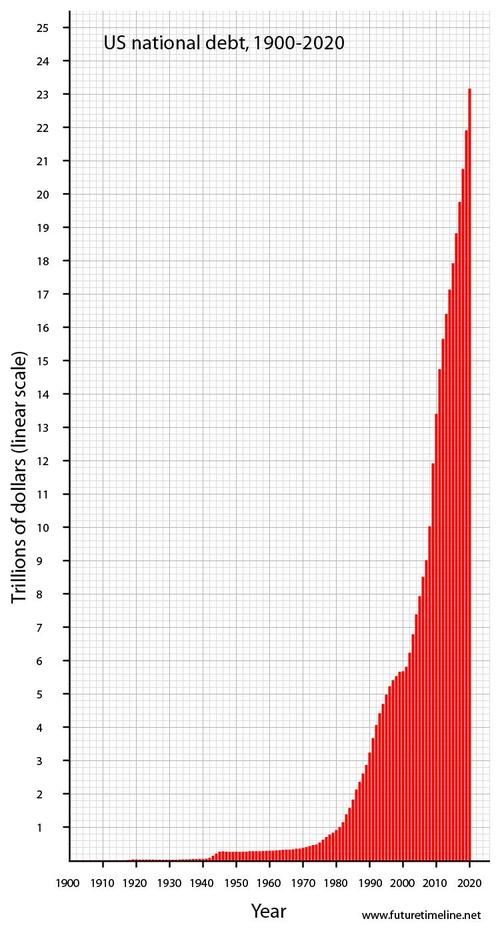

Here's a chart I borrowed from somewhere a couple of weeks ago -- and you have to ask yourself how long this parabolic trend in debt can continue before the U.S. dollar begins to cave. Like the precious metals -- and the U.S. bond and stock markets, the powers-that-be have managed to keep the dollar index 'strong'...but only through brute force intervention by the Fed et al.

This is just the U.S...as other so-called 'Western' countries have debt charts that are staring to take on this parabolic shape as well. Destruction of the purchasing power of their associated currencies will come at some point...especially when inflation really gets a grip -- and the central banks of the world, all parts of the New World Order crowd, will eagerly fan those flames.

I was intrigued by the mea culpa of NBC's Brian Williams the other day after he gave his final news broadcast on that network, when he said the following...amongst other things...

"I believe in this place. And in my love of my country, I yield to no one.

But the darkness on the edge of town has spread to the main roads and highways and neighborhoods. It is now at the local bar, and the bowling alley, the school board, and the grocery store. And it must be acknowledged and answered for.

Grown men and women who swore an oath to our Constitution, elected by their constituents, possessing the kinds of college degrees I could only dream of, have decided to join the mob and become something they are not, while hoping we somehow forget who they were.

They’ve decided to burn it all down with us inside."

"I will wake up tomorrow in the America of the year 2021, a nation unrecognizable to those who came before us and fought to protect it, which is what you must do now..." [emphasis mine - Ed]

Brian has at least one foot in the New World Order camp -- and has for decades -- and if this isn't a warning to us all, I don't know what is.

There's nothing we can do to stop what is now inevitable, except save ourselves and those closest to us -- and thatcan only be done "by owning what central banks cannot print"...to quote Willem Middelkoop in an interview he did recently.

Virtually all of the wholesale grade gold and silver bullion is already owned by someone and locked away in various and sundry depositories, ETFs and mutual funds...not to mention the gold squirreled away in the vaults of the world's central banks. Those precious metals are in the strongest of hands.

And not to be forgotten is the 25+ million ounces of gold and 1.2 billion ounces of silver that Ted Butler says that JPMorgan has tucked away out of sight.

All that's left are the meagre scraps that one can find at your local bullion dealer -- and none of them have anywhere near full inventories -- and haven't had for a very long time. Most items they normally stock are very frequently on back order from various mints.

The retail bullion supply lines are stretched to extreme -- and even at the best of times it's always miles long and wide, but only an inch or so deep. At the moment, it is none of these things -- and made worse by the incessant retail demand that has appeared in the last year, with a hat tip to the 'apes' over the reddit.com/Wallstreetsilver website. They've been on a rampage lately.

It's pretty much a given that the moment the powers-that-be allow gold and silver to rally back above their respective 50 and 200-day moving averages by any decent amount, that physical supply from the wholesale bullion market will be an issue almost immediately -- and that's particularly true in silver, as everyone knows.

So the question becomes as to how long the Big 4/8 traders in the COMEX futures market can keep the lid on their respective prices. The answer is that nobody knows -- and if they say they do, one should check the length of their nose.

Of course there's this Basel III thingy that will come into effect in the City of London starting on January 1....which is less than three weeks away now -- and it remains to be seen what effect that will have. Nobody has the answer to that, either. It was supposed to be a game-changer when it first implemented earlier this year -- and the lunatic fringe had a field day with it back then, only to have it turn out to be a non-event. Discussion vanished, without an apology from any quarter.

Now the hype is on again -- and even more shrill from some quarters. My attitude back then is the same as it is now...let's see what happens, as I am not a prophet, although there are some who think they are. In any case, I'm not one to relish being wrong at the top of my voice, which is why I didn't put a stake in the ground on this when it first appeared.

But having said all of the above, getting ones precious metal affairs in order as quickly as possible with all that is unfolding around us would make perfect sense, especially considering the bargain basement prices that the commercial traders have provided us with.

And buying large quantities of "what central banks can't print"...especially precious metals...seems like the best Christmas gift you could give yourself...or to others.

And, as always, I'm still "all in".

See you Tuesday.

Ed