Many of the base/industrial metals have been surging of late, and copper appears to be next. What impact, if any, can we eventually expect this to have on the price of COMEX silver?

Let's start by recognizing that the ongoing bull market in commodities is a real thing. With the rapid acceleration of fiat currency debasement since the onset of the Covid Crisis, hard assets have surged as shortages have developed. As you can see below, the Bloomberg Spot Commodity Index recently hit a new all-time high, eclipsing the levels seen in 2008 and 2011.

And within the sector, individual commodities have taken turns soaring toward new multi-year or all-time highs. Consider the base/industrial metals below, but also recall that 2021 has seen massive rallies in other items such as iron ore, cold-rolled steel, and lumber.

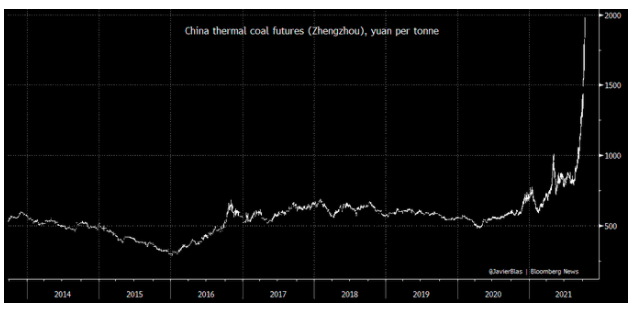

Next, you've likely heard (and felt) that energy prices are at multi-year highs, too. Crude oil and natural gas have been trading at levels not seen since at least 2014. And check Chinese coal. Holy moly!

Which brings us to copper...silver's cousin. Copper prices have also surged of late, but copper is not yet at the same multi-year high levels as other base/industrial metals, and it has certainly not yet seen the type of explosive move to new highs witnessed in some of the other commodities this year. It is, however, very close to making new all-time highs, as you can see below:

A surge to new all-time highs? Copper trading at $6 or $7? Does this sound crazy to you?

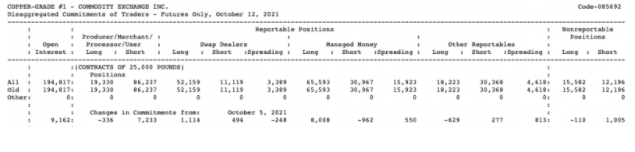

Well, what if I showed you the most recent Commitment of Traders report for copper? Look below at the disaggregated report from last week. What do you see?

I'll tell you what I see. Notice that BOTH the swap-dealing Banks AND the managed money hedge funds are net long COMEX copper contracts. The only side net short is the producer/hedgers. So if price suddenly spikes through $5.00, from where will the new contracts be issued to contain price? Maybe a few producers will hedge a bit more, but what incentive would The Banks or the funds have to step in the way and sell or short? None. Therefore, things could soon get disorderly in copper, and those $6 and $7 levels could come into focus quite quickly.

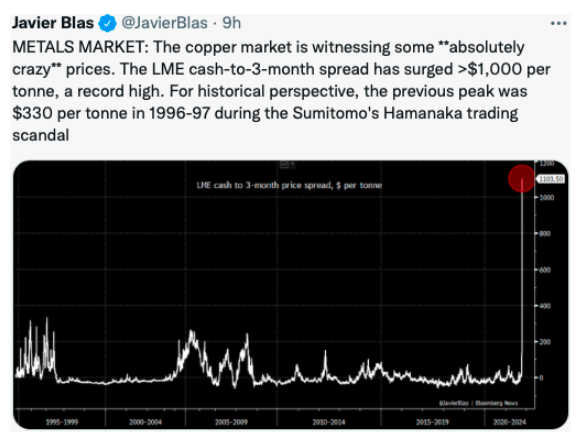

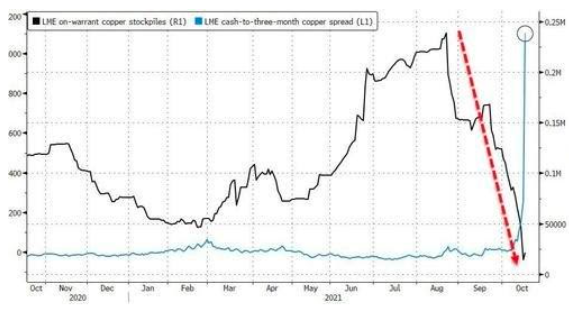

We may already be seeing signs of this appearing in London this week. While this may be a short-term anomaly, it also could be a clear signal of things to come.

And this brings us back to COMEX silver. Recall that many of us who stack physical silver do so because we still think of it as a monetary metal. But we are in the distinct minority! Almost the entire investment world thinks of silver as a base/industrial metal instead. Here's just one example:

So...

- Loose fiat monetary policy is leading to rallies in nearly every commodity.

- The energy sector is soaring, and this will lead to even higher inflation levels.

- Many base/industrial metals have surged to new all-time highs.

- Copper appears poised to stun the investment world with a spike toward $6, $7, or even higher.

- An eventual spillover rally is almost a certainty.

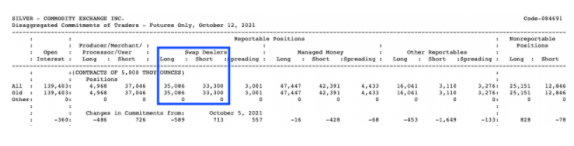

And let's check the Commitment of Traders report for silver, too. Look below and you'll see that the swap-dealing Banks are currently NET LONG for the first time since late 2018. Oh, and what happened in late 2018? COMEX silver bottomed near $14 right before The Fed's most recent "policy error" overwhelmed the markets, sent the stock market reeling, and led to a formal change in June of 2019.

In short, if copper eventually follows the base metals and the energy sector to new all-time highs, it is highly likely that COMEX silver will tag along for the ride since it's considered a "base metal", too. COMEX silver may not immediately extend to its own new all-time highs, but if copper is seen trading with a $6 or $7 handle, silver's not going to be at $23. I can assure you of that.

So go forth and prepare accordingly. Keep a close eye on ole "Dr. C" and watch for new all-time highs. Once that occurs, don't be surprised by what happens next.