The year 2023 is shaping up to be quite fun and interesting for precious metal investors after a year that was anything but. And now the potential of a China "re-open" makes the picture even more compelling.

Let's begin with the latest chart of Mar23 COMEX silver. We've been watching price trace out a bottom for months, and after leading gold and the mining shares lower for much of the year, silver has recently been showing the way out.

One of the more well-known and reliable technical formations is often called a "cup-and-handle", where a bowl-shaped low is traced out over time. A breakout then forms, but it's followed by a pullback. The whole picture then comes together to resemble a teacup. Can you see something similar on the chart below?

So, it certainly appears that COMEX silver prices have bottomed and are now set for a resurgence in 2023, mostly based upon an impending Fed pivot toward lower interest rates and an eventual resumption of QE.

There's another factor in play for 2023 that must be noted, and that's physical demand. We wrote about this four weeks ago, and if you missed it, you might review the article now:

But now there's an additional physical demand factor that must be noted.

If you've followed the news over the past week, you've no doubt seen the coverage of protests and defiance in China regarding the CCP's "Zero Covid" restrictions. This nonsensical policy has led to a sharp contraction in the Chinese economy and, with it, a drop in total Chinese commodity demand.

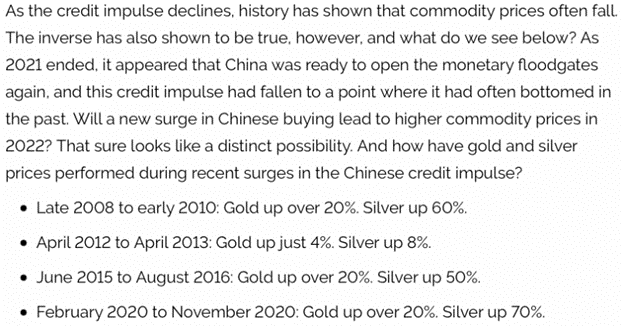

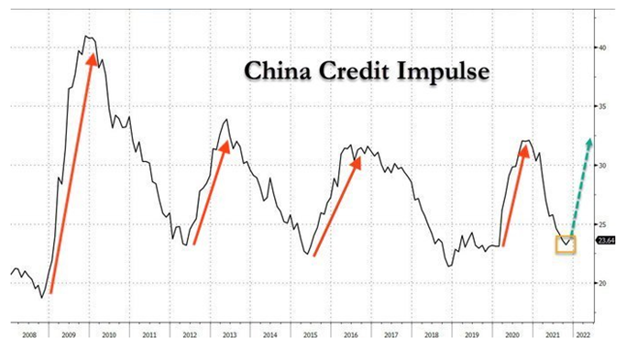

In our 2022 macrocast, written last January, we expected a 2022 Chinese re-open that would drive what's called the "credit impulse" to new highs. This, in turn, would serve to drive strong Chinese demand for all commodities, including silver.

However, China remained mostly closed and often "locked down" in 2022, and that expected commodity surge never developed. But could that be about to change in 2023?

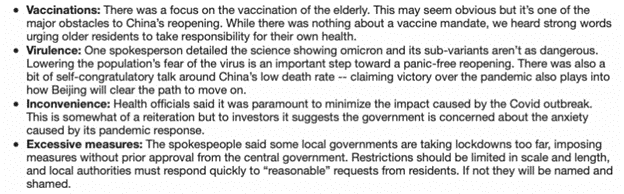

Those aforementioned protests have seemingly led to a change in official CCP policy and a possible easing of the restrictions. There are many news stories this week about this pending shift, and here's a ZeroHedge summary of some of what has been proposed:

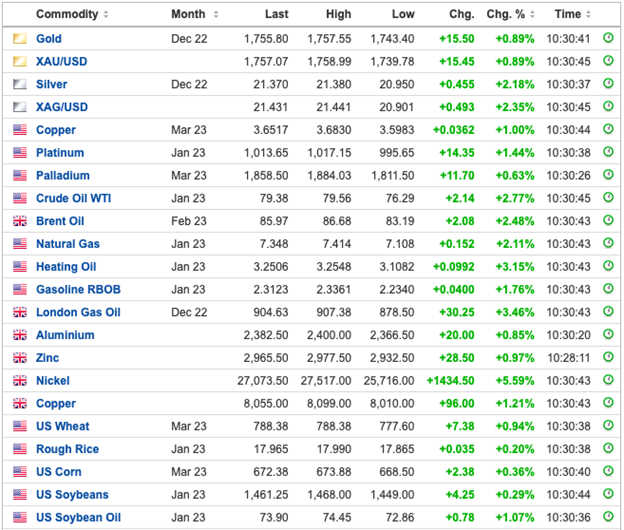

As I type on Tuesday, November 29, this potential easing of the Chinese Covid restrictions is the driving force behind an entirely green commodity board:

In summary, many of the macro factors that I expected to push COMEX gold and silver prices higher in the second half of 2022 have simply been postponed to the first half of 2023...and now it appears that we can add a resurgent "Chinese Credit Impulse" to that list as well.

It has been a difficult and challenging year, and the delay in our expected rally made it even more frustrating. However, it was just a delay. Policies are shifting at the central bank and government level, and we will all reap the rewards of significantly higher precious metal prices in 2023.