It has been a remarkable year for gold and silver prices, and there are myriad reasons to expect the gains to extend into 2026. For our final post of 2025, let's look at how Bullion Bank positioning has changed over the past few months and what that might imply going forward.

Debunking the J.P. Morgan Silver Position Rumors

Let's start with this: All the reports you've seen regarding J.P. Morgan "closing their short position in silver" are nothing but speculation. No one knows for certain if any one bank is buying or selling. The CFTC doesn't report specific positions, and no bank will ever come out and tell you directly what they're doing. As such, we can speculate, guess, and use our accumulated experience to make assumptions, but we cannot make declarative statements.

Additionally, after the most recent U.S. government shutdown, the CFTC is still attempting to get caught up on their reporting. They're getting close, however, and that allows us to create this post, but we won't have an up-to-date Commitment of Traders report until New Year's Eve.

Understanding the Bank Participation Report and Its History

While we wait, let's focus our attention this week upon the once-per-month Bank Participation Reports, which were updated as of December 2.

First, what is this report? It's a summary of bank and bullion bank positioning, broken out by U.S. Banks and non-U.S. Banks.

I kept hard copies of each Bank Participation Report in the gold market from 2014-2022. Why did I stop keeping track? Because it never changed! Yes, the combined Bank position would shift from time to time, but it was ALWAYS NET SHORT. ALWAYS.

I kept hard copies of each Bank Participation Report in the gold market from 2014-2022. Why did I stop keeping track? Because it never changed! Yes, the combined Bank position would shift from time to time, but it was ALWAYS NET SHORT. ALWAYS.

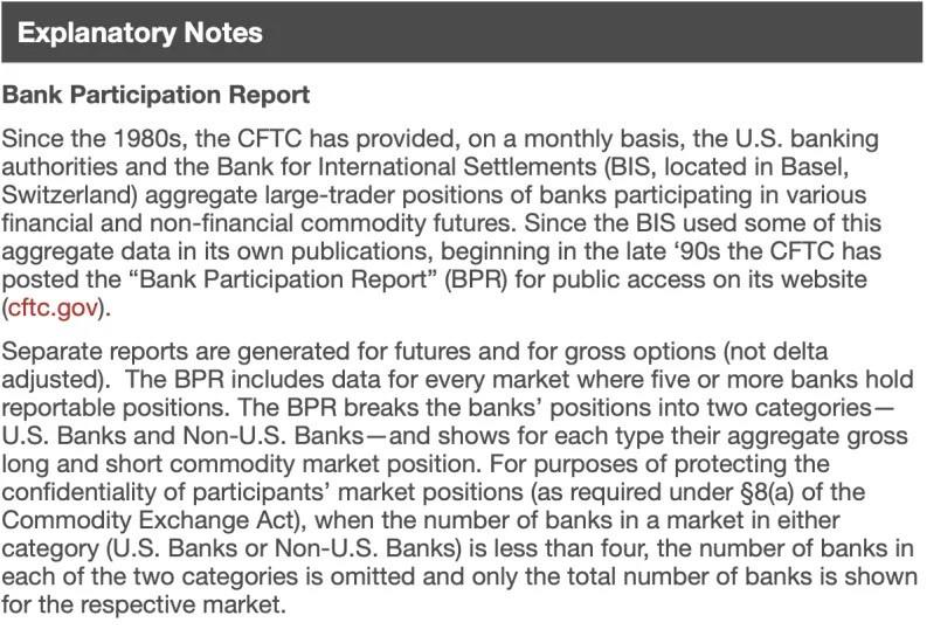

For example, in September of 2018, the combined net short position reached a low of just 23,694 gold contracts, but by September of 2019, it was right back up to 220,671 contracts as The Banks simply added new shorts to the market as the price rose. See below:

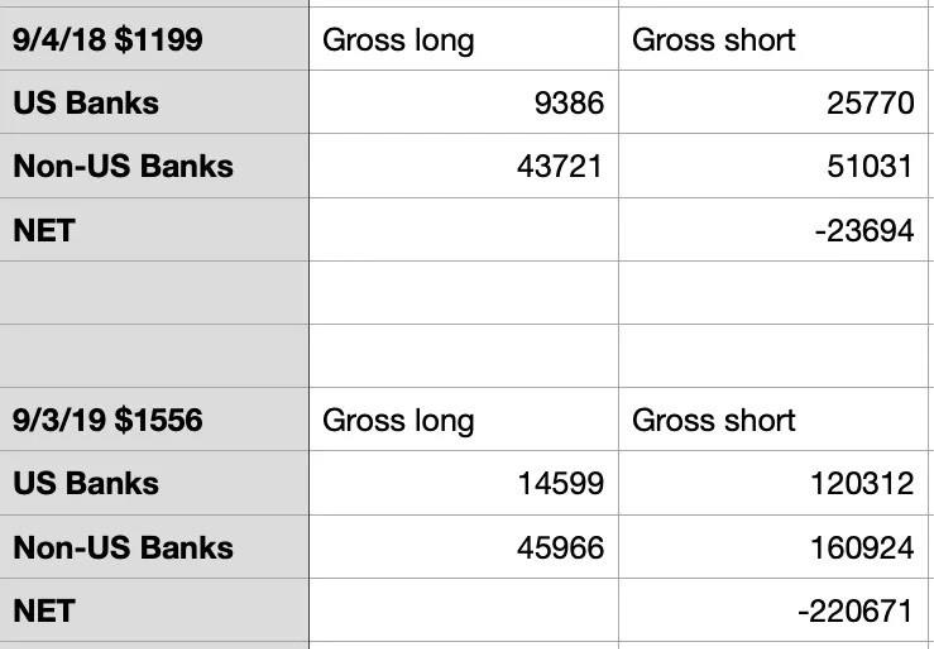

Fast forward to the most recent report that was surveyed on December 2, and what has changed? Not much!

Fast forward to the most recent report that was surveyed on December 2, and what has changed? Not much!

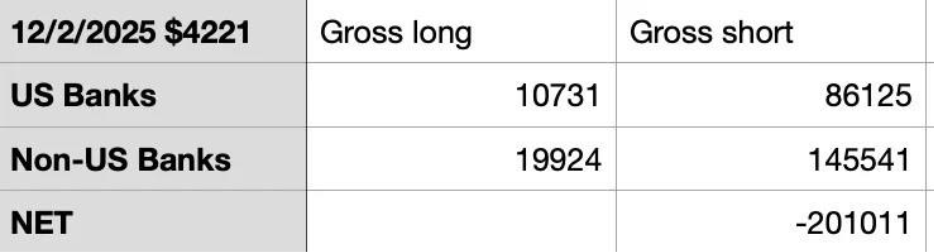

What's the point? Let's contrast this to COMEX silver, where, just like COMEX gold, the combined positioning has been NET SHORT for both the U.S. Banks and non-U.S. Banks since time immemorial. For example:

What's the point? Let's contrast this to COMEX silver, where, just like COMEX gold, the combined positioning has been NET SHORT for both the U.S. Banks and non-U.S. Banks since time immemorial. For example:

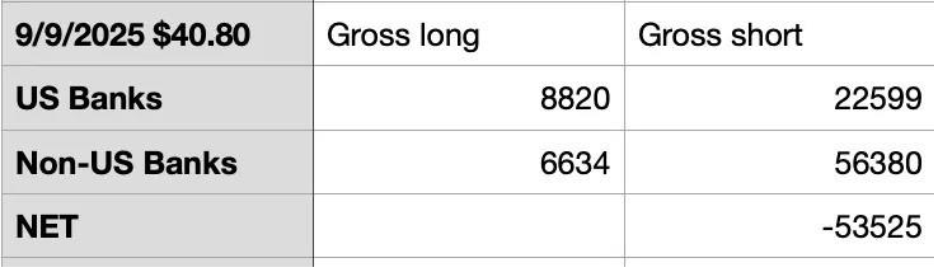

Even as recently as early September of this year, the report looked like this:

Even as recently as early September of this year, the report looked like this:

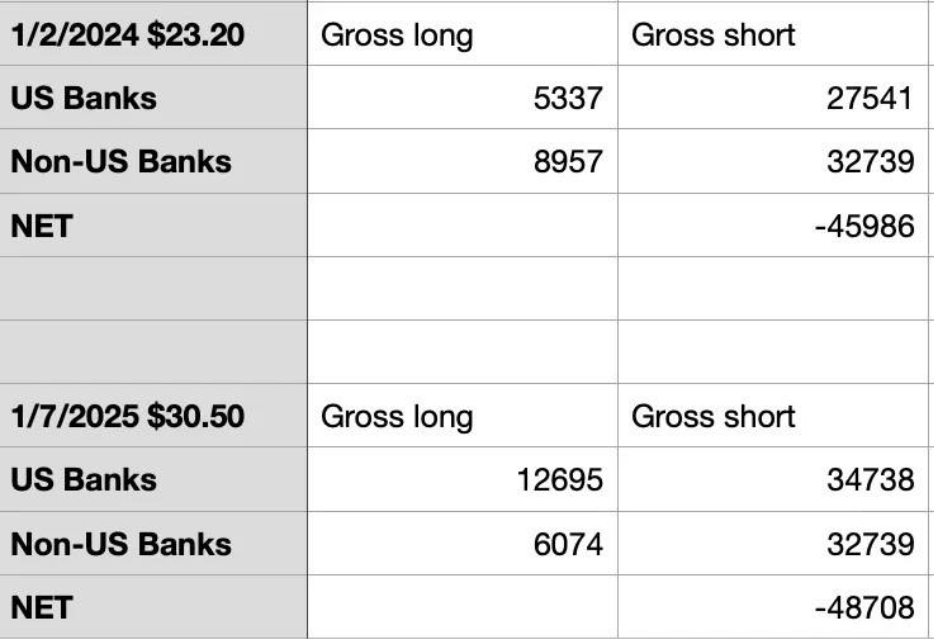

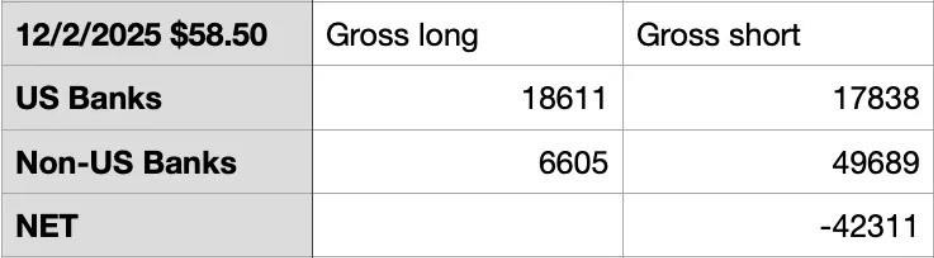

Again, the most recent and now up-to-date report was surveyed three weeks ago, on December 2. As I showed you earlier, the combined Bank position in gold had barely changed. However, as the silver price moved from $41 in early September to $58 in early December, take a look at the silver positioning. What do you notice?

Again, the most recent and now up-to-date report was surveyed three weeks ago, on December 2. As I showed you earlier, the combined Bank position in gold had barely changed. However, as the silver price moved from $41 in early September to $58 in early December, take a look at the silver positioning. What do you notice?

While the combined silver position of the 22 Banks in the survey remains 42,311 NET SHORT, be sure to note that the U.S. Banks are now NET LONG for the first time that I can recall.

What Bullion Bank Positioning Means for 2026 Silver Prices

What can we infer from this?

Well, you may have noticed that total contract open interest remains relatively low near 150,000 and that price has often rallied during COMEX hours the past few weeks. Is this because the U.S.-based Banks have been reluctant to add new shorts while at the same time increasing their longs as price has moved higher? It would certainly seem so.

Again, though, these are summary positions, and no one can accurately deduce which Bank "has covered all their shorts" and is now net long. The CFTC doesn't provide that information. However, as we wait for the Commitment of Traders reports to catch up, these Bank Participation Reports seem to indicate an unwillingness of U.S. Bank trading desks to get in front of the freight train that silver has become.

What does this mean for price in 2026? That remains to be seen as the net position of The Banks continues to shift from week to week. But if The Banks become increasingly cautious in creating and adding new shorts, then price will have to rise to a point each day where sellers of existing contracts appear. This would undoubtedly lead to more volatility and further gains.

How much further? I'll have more on that in early January when I publish my annual "macrocast". Until then, Merry Christmas and Happy New Year!!