Many of my fellow analysts are keeping a close eye on the declining silver vault levels worldwide. Whether it's New York or London, vault inventories are falling, and while the circumstances are not yet at a crisis point, silver investors should begin to closely monitor the situation.

Before we begin, this caveat: At TF Metals Report, we've been watching the COMEX gold and silver vaults for over a decade. The amounts of physical metal, in both the registered and eligible categories, will always ebb and flow. Leading up to and immediately after the EFP Crisis in early 2020, the amount of vaulted gold and silver in the COMEX vaults more than doubled, so keep in mind that the levels you see reported in 2022 are still far greater than what the CME group was reporting as recently as 2019.

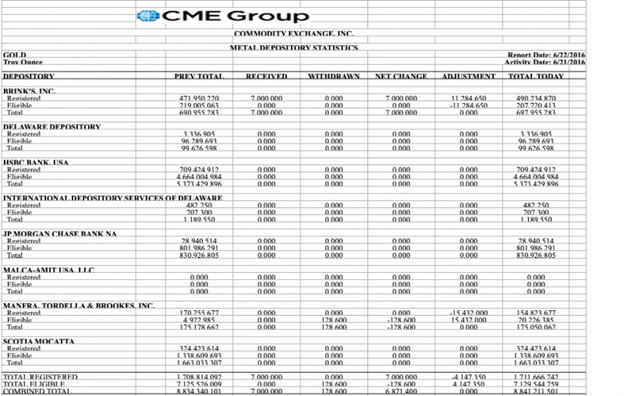

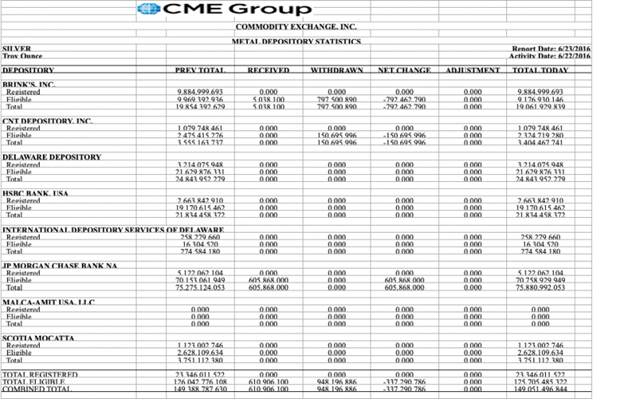

For example, here are two CME metal stocks reports from June 2016. Be sure to note the amount of registered, eligible, and total metal:

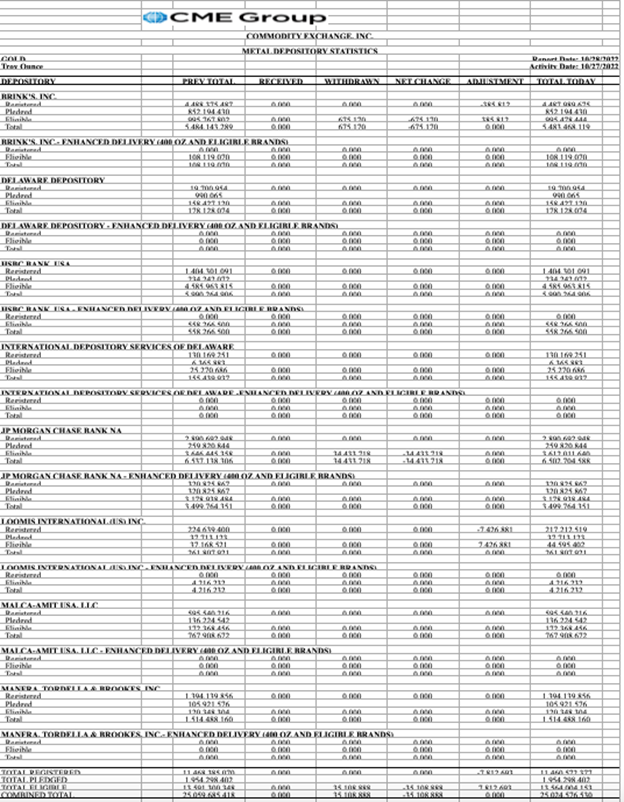

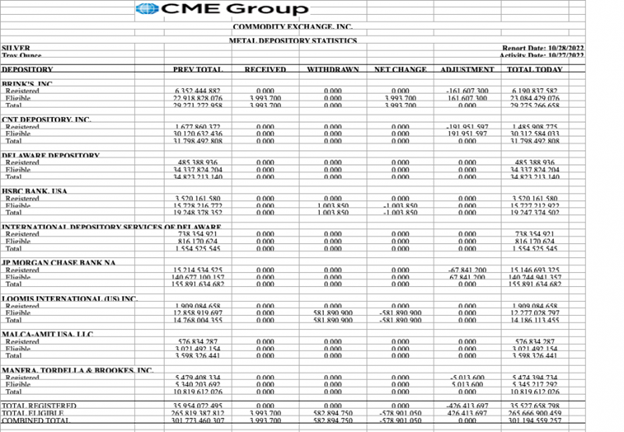

Now here are those same reports as of last Friday, October 28 (and if the print is too small to read, please use this link to download the tables for yourself: https://www.cmegroup.com/clearing/operations-and-deliveries/nymex-delivery-notices.html?redirect=/trading/energy/nymex-delivery-notices.html):

As you can see, total vault stocks are more than twice what they were six years ago, so what's the big deal? Well, let's start with this excellent report from Ronan Manly at BullionStar. Click this link to read about how total vaulted silver in the LBMA vaults of London fell by nearly 5% in July 2022 alone:

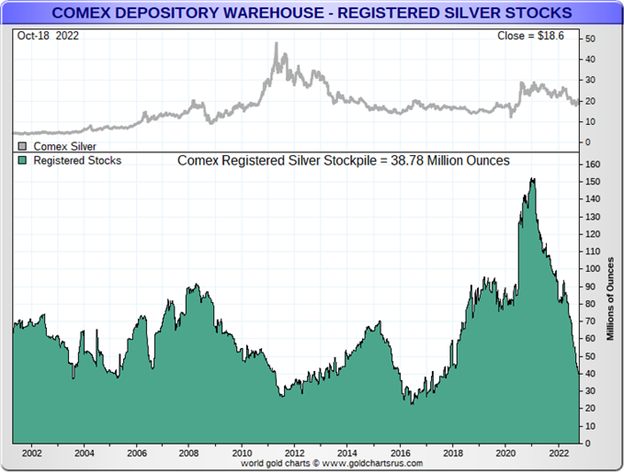

Next, consider the chart below from Nick Laird's GoldChartsRUs. Notice that the total amount of registered silver in the COMEX vaults is falling rapidly and is now back to the lowest level since June of 2016 (FYI: that 2016 CME silver stocks report posted above was the actual day when the registered vault hit its most recent low):

So now we're getting somewhere. LBMA silver vault levels are contracting sharply, and total registered silver on COMEX is too. In fact, the amount of registered silver on COMEX has fallen by nearly 70% over just the past 18 months.

Now here's where it gets interesting. As Ronan reported in the link above, the total amount of silver in the LBMA vaults that is NOT pledged to the various silver ETFs is only about 10,000 metric tonnes or about 300,000,000 ounces. Even if all of that was ultimately for sale—which is unlikely—that total is not even one third of annual global mine supply. If withdrawals continue at the pace seen in July (46,500,000 ounces), the total deliverable supply could be depleted by mid-2023.

And how about the COMEX? Yes, the registered stockpile is at its lowest since 2016 and, at 35,527,659 ounces, only enough silver to physically settle about 7,100 COMEX silver contracts. But can't the eligible silver be made available for delivery too? In theory, yes. However, much like that LBMA silver, not all of it is for sale.

Let's take a closer look at the JP Morgan COMEX silver vault and its 140,744,941 ounces of eligible silver. In this post from last week, Ronan asserts that most of that hoard is SLV silver and, therefore, untouchable:

https://www.bullionstar.com/blogs/ronan-manly/comex-deliverable-silver-…

However, I wrote about this same issue in 2018 and concluded that JPM's eligible vault is actually THEIR OWN silver, having aggressively and consistently accumulated silver through the COMEX delivery process ever since they hastily opened their vault in 2011:

https://www.sprottmoney.com/blog/jpmorgans-domination-of-comex-silver-c…

Whether Ronan is correct or I am correct hardly matters. What's important is that almost half of the total COMEX silver vault is very likely a supply of silver that is not now, nor at any time in the future, readily available for physical delivery. And if that's the case, the total COMEX vault is just about back to where it was in 2016—with just 150,000,000 ounces, of which just 35,000,000 is marked as registered and available for immediate delivery.

As we calculated with London, just how much is 150,000,000 ounces? That's enough silver to physically settle 30,000 COMEX silver contracts. And as noted above, more interesting is that the current 35,000,000 ounce registered stockpile is only enough silver to physically settle just 7,000 contracts.

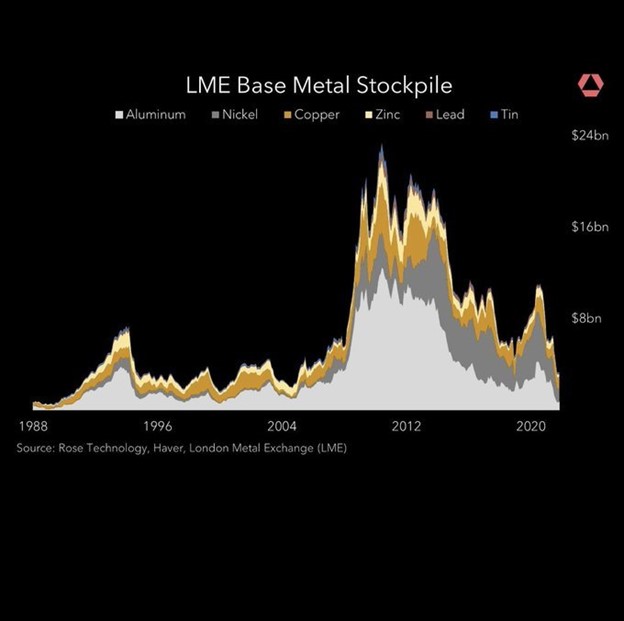

In summary and stating again: the total LBMA and COMEX silver supply is not yet at a crisis stage. Metal can be mined, refined, and shipped in large enough quantities to forestall any immediate crisis. But what about the months and years to come? There's currently a globally-recognized shortage of many other industrial metals, so this drain of global stockpiles could certainly continue into 2023. Read this report from The Financial Times regarding copper:

https://www.ft.com/content/d281665f-0444-4cd8-b616-5f5ddf2ab8a6

So look sharp, pay attention, and keep an eye on the silver market in the months ahead. The year 2023 was already shaping up to be interesting and volatile for the precious metals. Any physical supply shortages, which then lead to a disruption in the fractional reserve and digital derivative pricing scheme, could make the year historic and memorable as well.