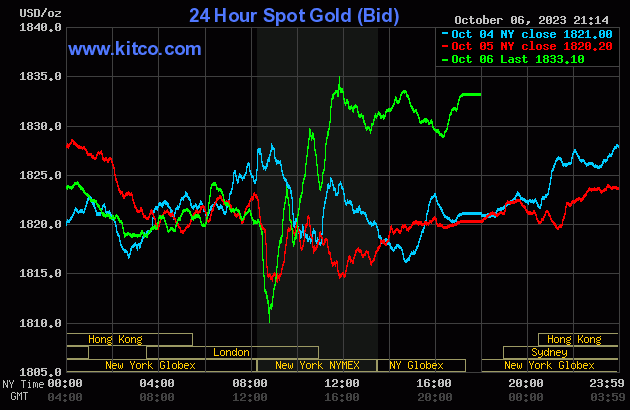

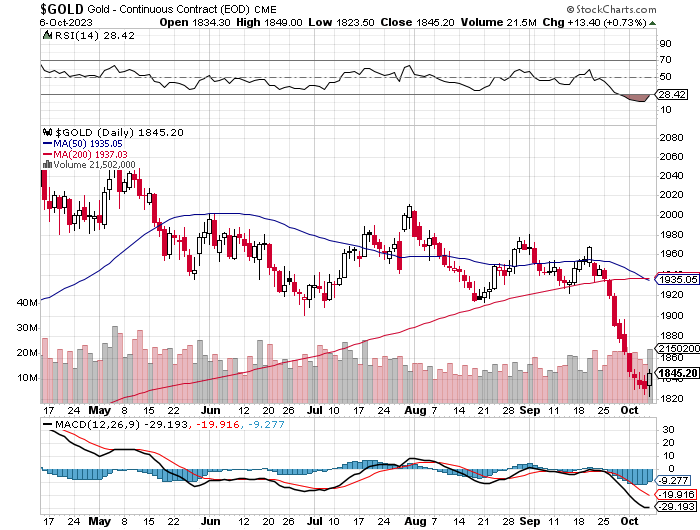

The gold price wandered quietly and unevenly higher in GLOBEX trading overseas on Friday -- and that lasted until around 12:25 p.m. China Standard Time on their Friday afternoon. It then had a down/up move that ended around 11:15 a.m. in London. It was sold a bit lower from there until the jobs number hit the tape at 8:30 a.m. in New York -- and gold's low tick of the day was set about fifteen minutes later. Then away it went to the upside...running into 'something' twice during its rally, which was capped at 11:30 a.m. EDT in COMEX trading. It had two down/up moves after that...neither of which was allowed above its 11:50 a.m. high tick.

The low and high ticks, both of which were set in COMEX trading in New York, were reported as $1,823.50 and $1,849.00 in the December contract. The October/December price spread differential in gold was $15.00...December/ February was $19.20...February/April was $18.50 -- and April/June was $18.70 an ounce.

Gold was closed in New York on Friday afternoon at $1,833.10 spot, up $12.90 on the day. Net volume was extremely heavy at a bit under 214,000 contracts -- and there were a bit over 17,000 contracts worth of roll-over/switch volume out of December and into future months.

Judging by the fact that another 390 gold contracts were traded in October yesterday, one has to suspect that more gold contracts were added to October deliveries.

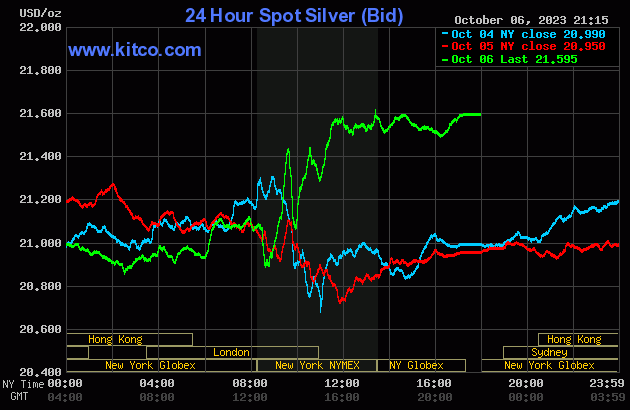

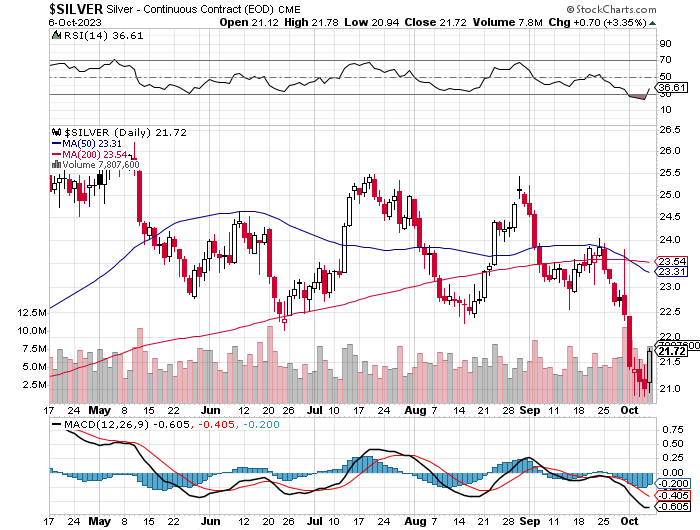

In all respects that mattered, the price action in silver was the same as gold's...including its COMEX rally getting capped at 11:30 a.m. in New York. All its quiet rally attempts after that were turned aside as well.

The low and high ticks in silver at the close in New York on Friday were recorded by the CME Group as $20.94 and $21.78 in the December contract. The December/March price spread differential in silver at the close in New York yesterday was 32.9 cents...March/May was 23.0 cents -- and May/July was 22.1 cents an ounce.

Silver was closed on Friday afternoon in New York at $21.595 spot, up 64.5 cents from Thursday. Net volume was certainly on the heavier side at a bit under 78,000 contracts -- and there were a bit over 6,600 contracts worth of roll-over/switch volume out of December and into future months in this precious metal...almost all into the first three scheduled delivery months of the New Year.

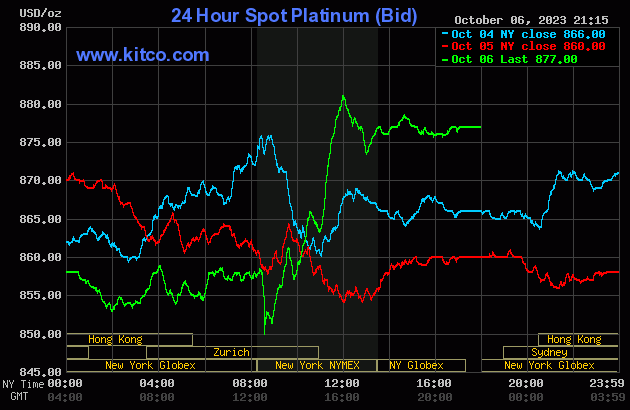

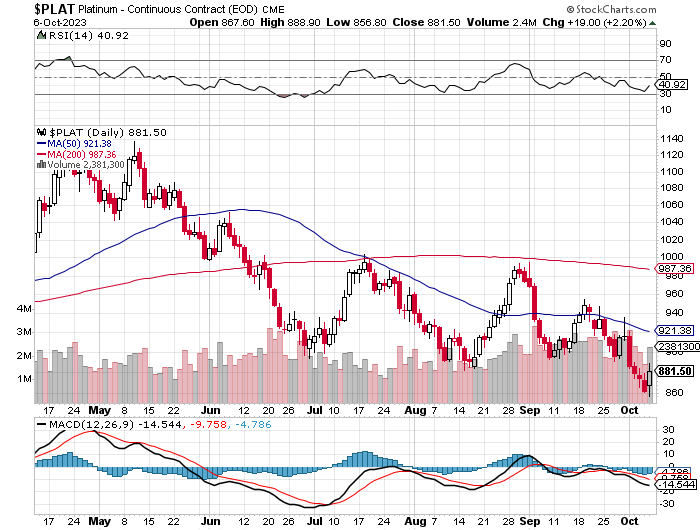

Platinum had a very broad and very uneven but quiet down/up move from the time that GLOBEX trading commenced on Thursday evening in New York -- and until 8:30 a.m. EDT on Friday morning. It was blasted lower at that point -- and it took off like a scalded cat moments after that. Its price was capped at precisely noon in EDT -- and it was sold unevenly lower from the until the market closed at 5:00 p.m. EDT. Platinum was closed at $877 spot, up 17 dollars on the day.

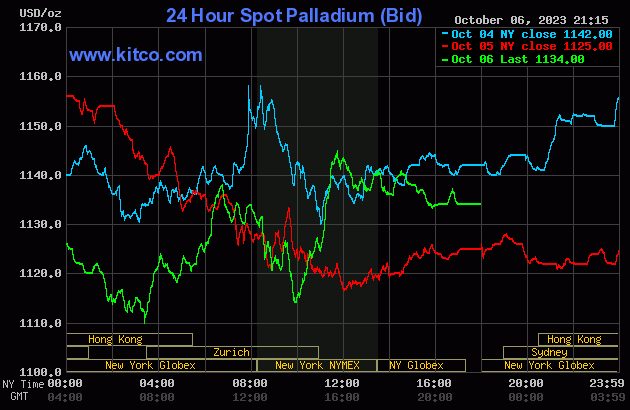

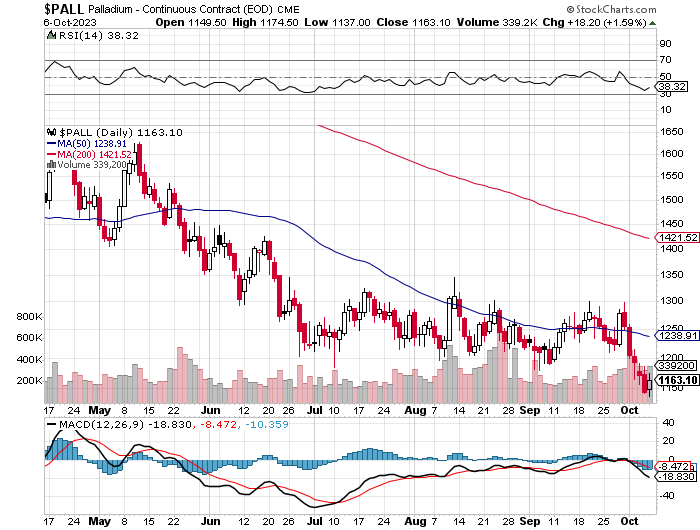

The palladium price had a quiet and shallow down/up move that lasted until around noon China Standard Time on their Friday -- and it was then sold lower until around 9:15 a.m. in GLOBEX trading in Zurich. Its ensuing rally was capped around 11:50 a.m. CEST -- and it was sold lower anew until the 10 a.m. EDT afternoon gold fix in London. Its rally from there ran into 'something' around 11:45 a.m. EDT in New York -- and from that juncture was sold quietly and unevenly lower until 4 p.m. in the very thinly-traded after-hours market. It didn't do much after that. Palladium was closed at $1,134 spot, up 9 bucks from Thursday.

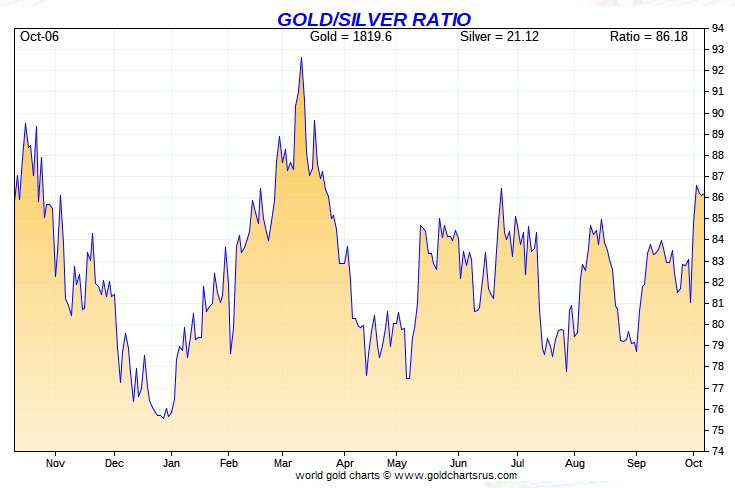

Based on the kitco.com spot closing prices in silver and gold posted above, the gold/silver ratio worked out to 84.9 to 1 on Friday...compared to 86.9 to 1 on Thursday.

Here's Nick Laird's 1-year Gold/Silver Ratio chart, updated with this past week's data and, for whatever reason, Friday's gold/silver ratio data point is not on it. Click to enlarge.

![]()

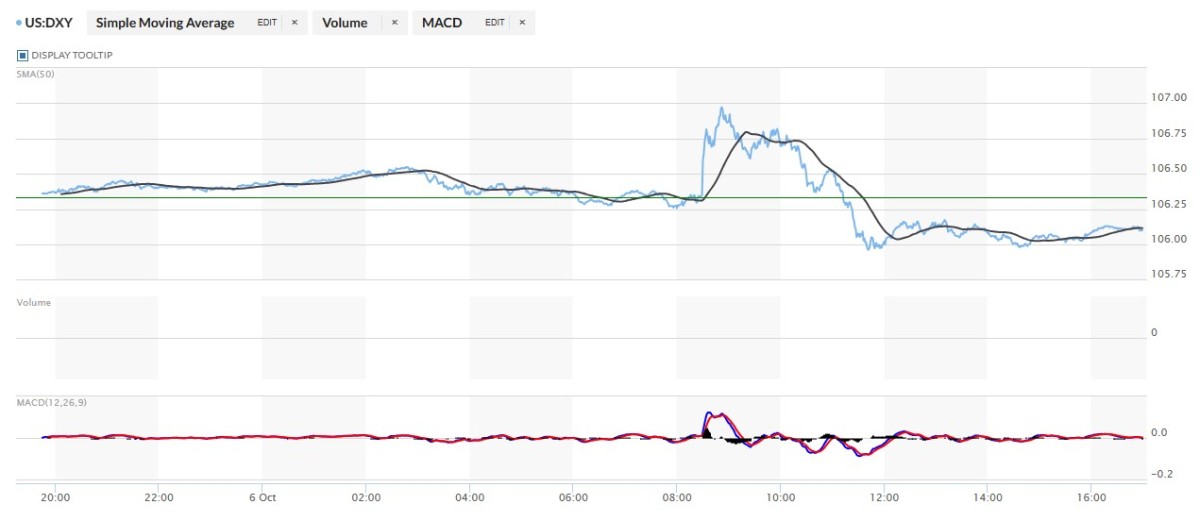

The dollar index closed very late on Thursday afternoon in New York at 106.33 -- and then opened higher by 3 basis points once trading commenced at 7:45 p.m. EDT on Thursday evening, which was 7:45 a.m. China Standard Time on their Friday morning. From there it crept very quietly higher until around 2:45 p.m. CST...fifteen minutes before London opened. It was sold quietly and a bit unevenly lower from there until a minute or two before the jobs number hit the tape at 8:30 a.m. in New York -- and its high tick was set at 8:52 a.m. EDT. It took three steps lower from there until its low tick was set around 11:42 a.m. -- and it then proceeded to wander very quietly higher until about an hour or so before the market closed at 5:00 p.m. EDT.

The dollar index finished the Friday trading session in New York at 106.10...down 23 basis points from its close on Thursday.

Here's the DXY chart for Friday, thanks to marketwatch.com as usual. Click to enlarge.

And here's the 5-year U.S. dollar index chart that appears in this spot every Saturday, courtesy of stockcharts.com as always. The delta between its close...105.78...and the close on the DXY chart above, was 32 basis points below its spot close. Click to enlarge.

There certainly was correlation between the dollar index and precious metal prices in COMEX trading yesterday, although it was far from precise -- and looked to me that it came about more by design, than free-market forces at work.

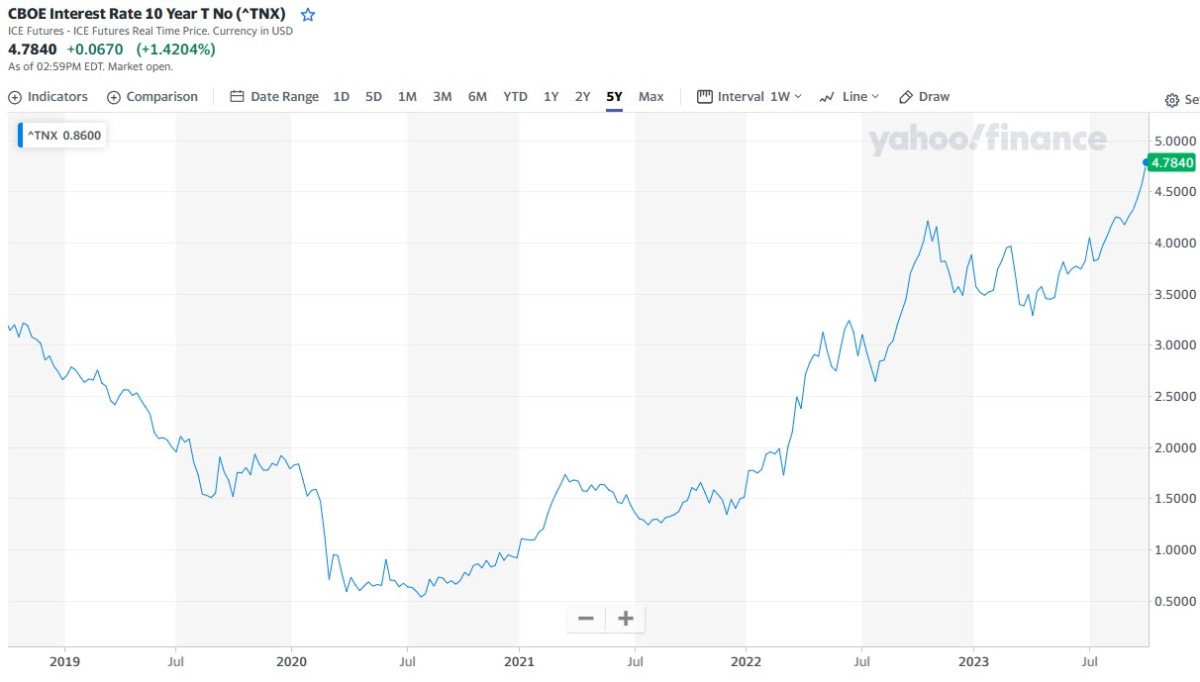

U.S. 10-year Treasury: 4.7840%...up 0.0670 (+1.4204%)...as of 02:59 p.m. EDT

The ten-year hit 4.8770...up 16 basis points...at its 8:52 a.m. EDT high tick, which came at the precise time of the high tick in the DXY. So it was obvious that the Fed stepped in at that point in both markets.

And here's the 5-year 10-year U.S. Treasury chart from the yahoo.com Internet site -- which puts the yield curve into a somewhat longer-term perspective. Click to enlarge.

Although the Fed is obviously active in the treasury market, it's with a light hand at the moment...relatively speaking that is -- and Mr. Bond continues to send out some pretty ugly financial signals...something which the equity markets ignored on Friday.

![]()

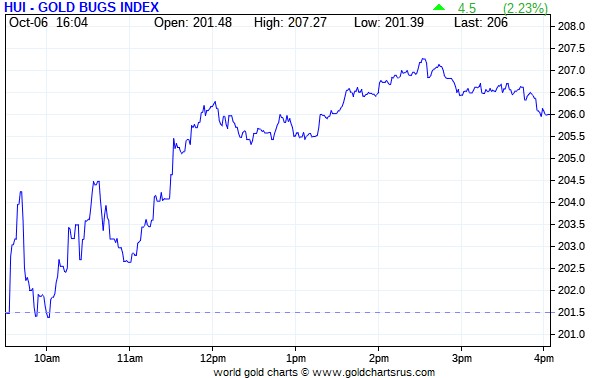

The gold stocks worked their way very unevenly higher until 2:30 p.m. EDT in trading in New York -- and were sold a bit lower, along with the gold price, until the markets closed at 4:00 p.m. The HUI closed up 2.23 percent.

Computed manually, the new Silver Sentiment/Silver 12 Index finished finished higher by 2.71 percent.

Here's Nick's old 1-year Silver Sentiment/Silver 7 Index chart, updated with Friday's candle. Click to enlarge.

The two stars were Hecla and Coeur Mining, as they closed up 4.71 and 4.27 percent respectively -- and the biggest underperformer was Pan American Silver as it finished the day up only 0.29 percent...most likely on this news.

The reddit.com/Wallstreetsilver website, now under new management, is linked here. The link to two other silver forums are here -- and here.

![]()

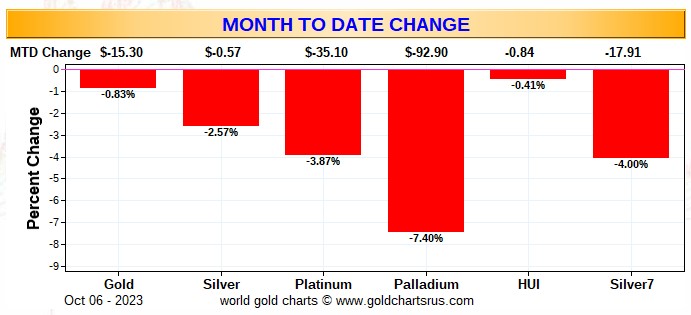

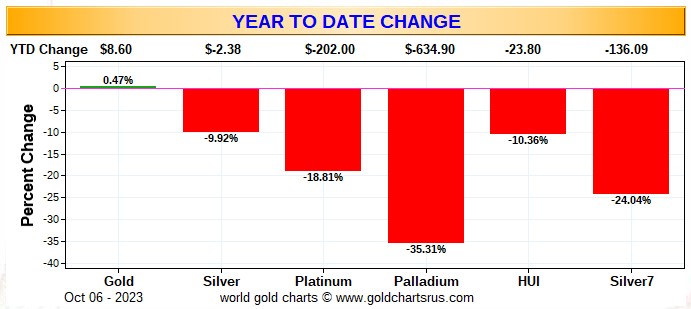

Here are two of the usual three charts that appear in every weekend missive. They show the changes in gold, silver, platinum and palladium in both percent and dollar and cents terms, as of their Friday closes in New York — along with the changes in the HUI and the old Silver 7 Index.

For this one week only, the weekly chart is the same as the monthly chart -- and that's posted below. The weekly chart will be back in this spot next Saturday.

Here's the month-to-date -- and despite the gains on Friday, it's still wall-to-wall red after the pounding that everything took during the prior four days of trading, with palladium being the biggest underperformer. Click to enlarge.

Here's the year-to-date graph -- and only gold is up on the year...albeit barely, with the silver equities continuing to under perform badly vs. the gold shares...although their performance is pretty brutal as well. This chart should be no surprise, as both silver and gold are about the most oversold they've been in about a year. Click to enlarge.

Of course -- and as I mention in this spot every Saturday -- and will continue to do so...is that if the silver price was sitting within 10 percent or so of its old high of $50 the ounce...like gold is currently within 10 percent or so of its old high of around $2,080...it's a given that the silver equities would be outperforming their golden cousins by an absolute country mile. That day obviously still lies in our future...but is most certainly coming.

The current 'wash, rinse, spin' cycle, courtesy of the commercial traders of whatever stripe appears to be pretty much done after noting yesterday's price action -- and as far as yesterday's COT Report is concerned, it was all that one could ask for...wildly bullish in both silver and gold.

![]()

The CME Daily Delivery Report for Day 7 of October deliveries showed that 182 gold -- and 9 silver contracts were posted for delivery within the COMEX-approved depositories on Tuesday.

In gold, the largest short/issuer by far was Australia's Macquarie Futures, as they issued 152 contracts out of their client account. Canada's Scotia Capital/ Scotiabank and Advantage issued the remaining 20 and 10 contracts respectively...the former from their house account. The only one of the three long/stoppers that mattered was British bank HSBC, as they picked up 173 contracts for their client account.

In silver, Advantage issued all 9 out of its client account -- and ADM and JPMorgan picked up 7 and 2 contracts for their respective client accounts as well.

In platinum, there were 30 contracts issued and stopped.

The link to yesterday's Issuers and Stoppers Report is here.

So far in October there have already been a very hefty 9,237 gold contracts issued/reissued and stopped -- and that number in silver is 461 contracts. In platinum it's 338 -- and in palladium it's 2 contracts.

The CME Preliminary Report for the Friday trading session showed that gold open interest in October rose by 3 contracts, leaving 512 still open, minus the 182 contracts mentioned a few paragraphs ago. Thursday's Daily Delivery Report showed that 320 gold contracts were actually posted for delivery on Monday, so that means that 320+3=323 more gold contracts got added to October deliveries.

Silver o.i. in October declined by 105 COMEX contracts, leaving 29 still around, minus the 9 contracts mentioned a bunch of paragraphs ago. Thursday's Daily Delivery Report showed that 118 silver contracts were actually posted for delivery today, so that means that 118-105=13 more silver contracts just got added to October deliveries.

Total gold open interest at the close on Friday rose, but only by 1,044 COMEX contracts -- and total silver o.i. actually declined by 768 contracts! Could Ted's dream scenario be a unfolding as he had hoped? More on this in The Wrap. Both these numbers are subject to some revision by the time the final figures are posted on the CME's website later on Monday morning CDT.

![]()

There was yet another withdrawal from GLD yesterday, as an authorized participant removed 55,653 troy ounces of gold. There were also another 9,918 troy ounces of gold taken on out of GLDM as well and, for once, there were no reported changes in SLV.

But in other gold and silver ETFs and mutual funds on Planet Earth on Friday, net of any changes in COMEX, GLD, GLDM and SLV inventories, there were a net 145,698 troy ounces of gold removed -- and a net 2,537,588 troy ounces of silver were taken out as well. The two biggest 'out' amounts... 2,361,166 and 339,701 troy ounces...left SSLV and SVR respectively.

There was no sales report from the U.S. Mint.

So far in October, the mint has reported selling 44,000 troy ounces of gold eagles ---13,500 one-ounce 24K gold buffaloes -- and 785,000 silver eagles.

As I said on in my Tuesday column when the mint added to their September sales totals on Monday, I suspected that they moved a very decent chunk of that into October, so as not to make September look that great.

![]()

There was a bit of activity in gold over at the COMEX-approved depositories on the U.S. east coast on Thursday. Nothing was reported received, but 36,973.650 troy ounces/1,150 kilobars were shipped out...all of which left Brink's, Inc. All of the paper activity involved Brink's, Inc. as well. They transferred 86,494 troy ounces from the Registered category and back into Eligible...most likely to save save on storage charges, as it's obvious that its owner is not planning on parting with it anytime soon. The link to Thursday COMEX activity in gold, is here.

There was some activity in silver, as 488,355 troy ounces were reported received -- and 158,936 troy ounces were shipped out.

In the 'in' category, the largest amount were the 484,365 troy ounces that were dropped off at CNT -- and the remaining 3,990 troy ounces/4 good delivery bars ended up at Delaware.

In the 'out' category, the largest amount there were the 148,926 troy ounces that departed Brink's Inc. -- and the remaining ten good delivery bars/10,010 troy ounces left CNT.

There was no paper activity -- and the link to this is here.

Once again -- and despite the week-long holiday in China, they had to open the doors at the COMEX-approved gold kilobar depositories in Hong Kong on their Thursday. They reported receiving 2,355 kilobars -- and shipped out 458 of them. Except for the 100 kilobars that left Loomis International, the remaining in/out activity took place over at Brink's, Inc. as always. The link to this, in troy ounces, is here.

![]()

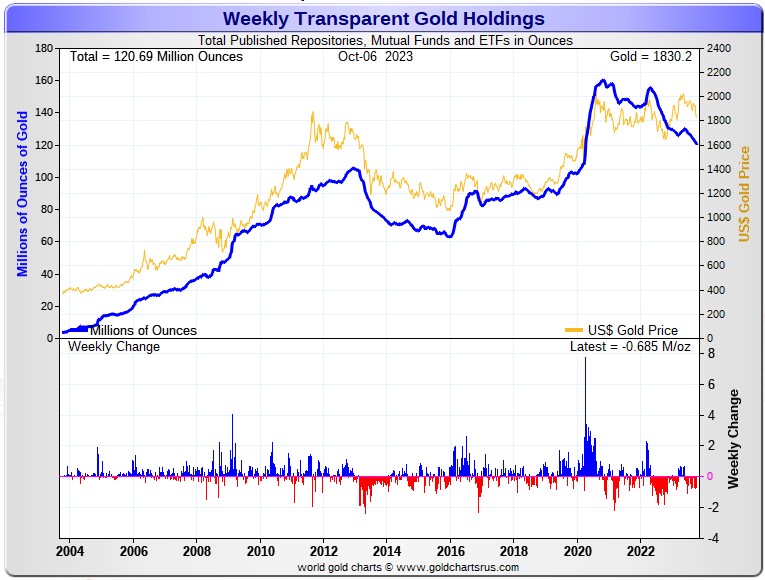

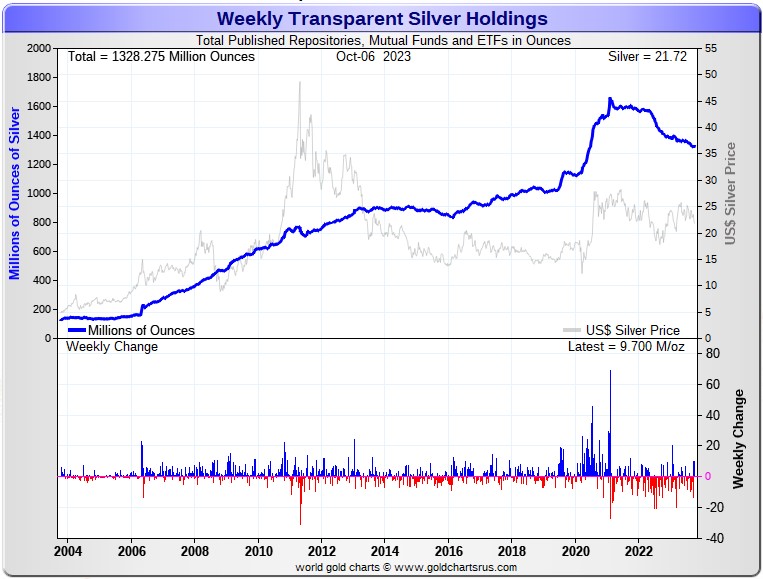

Here are the usual 20-year charts that show up in this space in every Saturday column. They show the total amounts of physical gold and silver held in all know depositories, ETFs and mutual funds as of the close of business on Friday.

During the week just past, there were a net 685,000 troy ounces of gold removed -- but a net 9.700 million troy ounces of silver were added during the reporting week...most of which ended up in SLV. Click to enlarge for both.

According to Nick Laird's data on his website, there have been a net 2.432 million troy ounces of goldremoved -- but a net 5.747 million troy ounces of silver has been added to all the world's known depositories, mutual funds and ETFs during the last four weeks.

In gold, there are still no ETFs or mutual funds has show a net deposit...only net withdrawals. The two largest 'out' amounts by far were the 651,000 troy ounces that left GLDM...followed by the 621,000 troy ounces that departed iShares/IAU. After them were the 465,000 troy ounces that left the COMEX -- and the 297,000 troy ounces out of iShares/SGLN. The list goes on and on...

In silver, the two largest showing net inflows were the 11.400 million ounces into iShares/SLV -- and 1.250 million troy ounces into iShares/SVR. The largest 'out' amount were the net 2.219 million troy ounces that left Source/SSLV. In second spot were the 1.983 million troy ounces taken out of Sprott's PSLV. In third place were the 1.400 million troy ounces taken out of the COMEX. And lastly were the 693,000 troy ounces removed from SIVR -- and the net 612,000 troy ounces that departed ZKB.

Retail bullion sales still remain comatose for the most part. That situation will exist until the next buying frenzy commences...which may already be underway to a certain extent. When investment demand really gets serious this time, we will be back to shortages/back orders and high premiums in very short order. And that's not taking into account the mind-boggling quantities of silver that will be absorbed by all the silver ETFs and mutual funds.

Where will all this physical metal come from in the face of this ongoing and accelerating physical shortage, one wonders? It's one of the things that the powers-that-be fear most I suspect, as it just won't be there at some point ...although JPMorgan & Friends are sitting on a goodly amount of the stuff according to Ted -- and appeared to be supplying it to various mutual funds and ETFs when required.

The physical demand in silver at the wholesale level continues unabated. Most of what's left in the various public ETFs and mutual funds is not available for sale...including the COMEX, where new silver has to be brought in from other sources [JPMorgan?] to meet the ongoing rabid demand for physical metal. How long this will continue before available supplies are depleted is unknown ...but is getting closer to zero with each passing day.

The vast majority of precious metals being held in these depositories are by those who won't be selling until the silver price is many multiples of what it is today. That's particularly true of shareholders in PSLV...but the recent withdrawals over the last few months have come as a surprise...with the 1.983 million troy ounces taken out a week ago, being the latest.

Sprott's PSLV is the third largest depository of silver on Planet Earth with 172 million troy ounces -- and some distance behind the COMEX, where there are 273 million troy ounces being held. However, as Ted Butler has mentioned from time to time, it's most likely that 103 million troy ounces of that amount is actually held in trust for SLV. But PSLV is light years behind SLV, as they are the largest silver depository, with 451 million troy ounces as of Friday's close.

The latest short report from last Tuesday, September 26th showed that the short position in SLV rose by only 1.29%...up to 29.14 million shares held short. If you remember, BlackRock issued a warning a couple of years ago to all those short SLV, that there might come a time when there wouldn't be enough metal for them to cover.

The authorized participants are obviously shorting SLV shares in lieu of depositing physical metal as the prospectus demands -- and that's most likely because that quantity of physical metal can't be had without driving the silver price to the moon in the process of acquiring it. It's a 'catch-22" situation in spades...with real-world repercussions that can only be imagined.

But it should be remembered that 8.80 million troy ounces were added to SLV just about three weeks ago now -- and another 9.2 million this past week. Where they got it from, or how much they had to pay to get it, is unknown.

The next short report will be posted on The Wall Street Journal's website on Tuesday, October 10 -- but those 9.2 million ounces added this past week, won't be included, as it was all deposited after the cut-off for this next report, which I've already stated, was deliberate.

Then there's that other little matter of the 1-billion ounce short position in silver held by Bank of America in the OTC market...with JPMorgan & Friends on the long side. Ted says it hasn't gone away -- and he's also come to the conclusion that they're now short around 37 million ounces of gold with these same parties as well...up 12 million oz. from the 25 million they were short in the March OCC Report. You can read Ted's commentary about it linked here.

The latest report from the OCC for Q2/2023 came out a couple of weeks ago now -- and this is what silver analyst Ted Butler had to say about it..."Bank of America’s total precious metals position declined by 20%, from $101 billion to $82 billion, the first decline I can recall over the past few years, since BofA suddenly emerged as a big player in OTC precious metals derivatives.

Unfortunately, because the OCC report is so (intentionally) opaque, it’s impossible to uncover much as to the details of BofA’s, or for that matter, any bank’s positions. My sense is that the billion oz. silver short position I’ve attributed to BofA is largely intact and would only account for $23 billion of BofA’s $82 billion total precious metals position as of June 30. I would conclude that Bank of America may have finally awoken to the potential financial disaster it created for itself, but far too late to do much good."

![]()

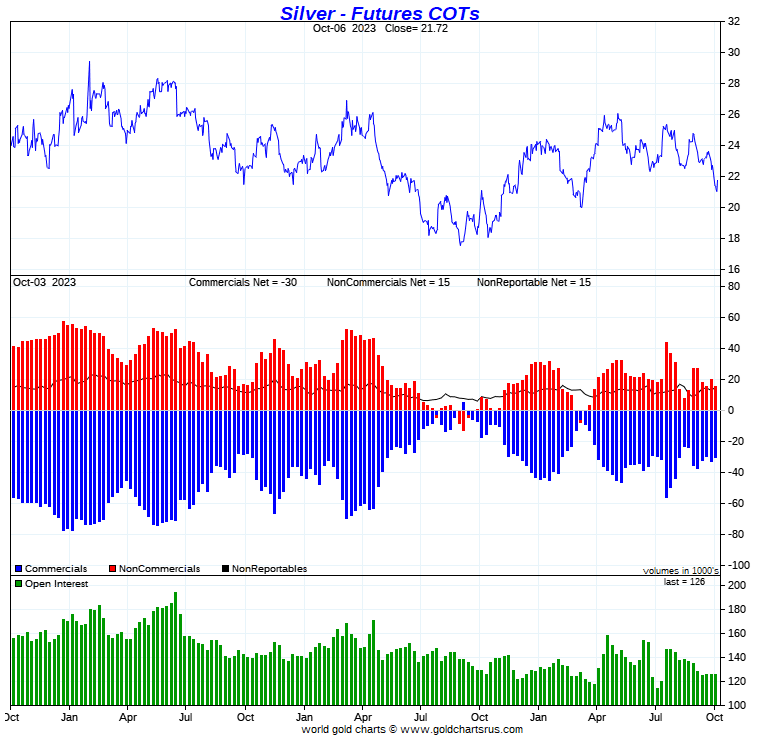

The Commitment of Traders Report, for positions held at the close of COMEX trading on Tuesday, showed the expected declines in the commercial net short positions in both silver and gold...but both sets of numbers are now somewhat compromised by the fact that there are now Managed Money traders with short positions that puts them firmly in the Big 4 category in silver -- and in the Big '5 through 8' category in gold. For that reason a lot of these numbers will be 'best guesses'.

In silver, the Commercial net short position dropped by only 2,722 COMEX contracts, or 13.610 million troy ounces.

They arrived at that number by reducing their long position by 2,577 contracts [which I'll get into the reason for this a bit later] -- and decreased their short position by 5,299 COMEX contracts. It's the difference between those two numbers that represent their change for the reporting week.

Under the hood in the Disaggregated COT Report, it was all Managed Money traders, and then some, as they reduced their net long position by 7,517 COMEX contracts. They accomplished this by reducing their long position by 3,298 contracts -- and also added 4,219 short contracts. The Managed Money traders are now net short silver by 2,250 COMEX contracts -- and are certainly more short since the Tuesday cut-off.

And one more thing about these Managed Money traders before I move on, is that their gross long position is the smallest that I can remember, at only 29,421 COMEX contracts...down another 3,298 contracts during the reporting week -- and I suspect that Ted will have something to say about this later today...amongst other things that we didn't get around to talking about.

Of course the fact these Managed Money traders were such big sellers, meant that the traders in the Other Reportables and Nonreportable/small traders category had to have been big buyers during the reporting week -- and they were. The former category increased their net long position by 2,756 COMEX contracts -- and the latter by 2,039 contracts.

Doing the math: 7,517 minus 2,756 minus 2,039 equals 2,722 COMEX contracts, the change in the Commercial net short position.

The Commercial net short position in silver now stands at 30,358 COMEX contracts/151.790 million troy ounces...down those 2,722 contracts from the 33,080 COMEX contracts/165.400 million troy ounces they were short in the September 29 COT Report.

The Big 4 shorts increased their short position by 2,036 contracts, to 38,635 contracts, up from the 36,599 contracts they were short in last week's COT Report.

But Ted is of the opinion that the Managed Money trader that has now appeared in this category, has a short position of around 6,500 COMEX contracts...so that has to be subtracted out. But it still means that the Big 4 shorts cover a lot of their short positions during the reporting week -- and the approximate number that they did is also something that I forgot to ask Ted about...but it's many thousands.

The '5 through 8' big shorts also increased their net short position, but only by a piddling 84 contracts -- and are currently short 14,598 COMEX silver contracts in total...which is still an ultra-low number for them. But, considering the price action during the reporting week, it was a big surprise that they increased their short position at all.

The Big 8 shorts in total increased their net short position from 51,113 contracts, up to 53,233 COMEX contracts week-over-week...an increase of 2,210 COMEX contracts -- and that's almost entirely due to the net increase in the Big 4 short position. But you have to subtract that 6,500 contracts that the Managed Money traders holds short -- and that reduces the Big 8 commercial short position down to around the 47,000 contract mark. That's a position so small, that I don't have records going back far enough to show when it was less...but it's certainly well over 10 years since it was this small. I'm sure that Ted will have the actual number in his weekly review later today.

The other and surprising big sellers this week were Ted's raptors, the small commercial traders other than the Big 8. I mention at the top that the commercial traders had reduced their long position by 2,577 contracts during the reporting week -- and all of that had to be raptor selling, as the Big 8 commercial traders wouldn't have done it, as they were the big buyers.

Normally the raptors are also big buyers of long positions on these engineered price declines. But Ted was of the opinion that they bought their previous long positions on margin -- and then got blown out on that 3 dollar engineered price decline because they couldn't or wouldn't meet a margin call. As Ted said, nobody including them, was expecting the silver price to be engineered as low and as quickly as it was -- and some of them became collateral damage along the way.

Their selling had the mathematical effect of decreasing the amount of the improvement in the Commercial net short position in silver.

Don't forget, that despite their small size, they're still commercial traders in the commercial category -- and all in the Swap Dealers category. Their current long position is now around 16,000 contracts, at most.

Here's Nick's 3-year COT Reportfor silver, updated with the above data. Click to enlarge.

So, from a straight numbers point of view, this COT Report is 'not suitable for framing', because the Big 8 commercial short position is now contaminated by that one Managed Money trader that now inhabits the Big 4 short category. That was further compounded by the unexpected long selling by Ted's raptors, plus the fact that the Big '5 through 8' shorts did virtually nothing during the reporting week.

But the headline numbers belies the real truth of the matter.

Because, as per what was stated in Friday's column, which I'll repeat again here for good measure..."In his mid-week commentary for his paying subscribers on Wednesday headlined "The Last Price Smash?"...Ted had this to say about today's COT report..."In some ways, I’m not overly concerned about the level of managed money selling in that by price action and trading volumes, it has the feel of maximum such selling, almost regardless of what the report indicates.""

He was 100 percent correct about that.

Of course there has been even more improvement since the Tuesday cut-off -- and to say that the current set-up for a price explosion in silver is beyond white-hot incandescent, is an understatement.

![]()

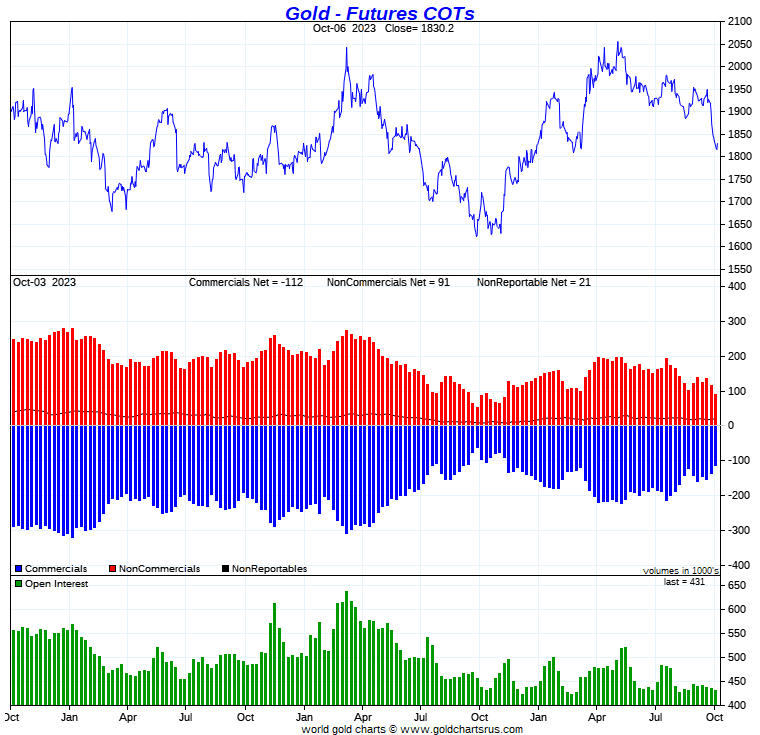

In gold, the commercial net short position fell by 22,854 COMEX contracts, or 2.285 million troy ounces of the stuff.

They arrived at that number by reducing their long position by 178 contracts, but also reduced their short position by 23,032 COMEX contracts. It's the difference between those two numbers that represents their change for the reporting week.

Under the hood in the Disaggregated COT Report, it was all Managed Money traders, plus a bunch more...as they reduced their net long position by 30,999 COMEX contracts. They accomplished this by selling 14,168 long contracts and 16,831 short contracts. In the process, the Managed Money traders switched from a net long position, to a net short position in gold in the COMEX futures market...to the tune of 7,564 contracts -- and are undoubtedly short more as of the Tuesday cut-off.

And, like in silver, this meant that the Other Reportables and Nonreportable/ small traders were net buyers during the reporting week...with the former increasing their net long position by 6,410 COMEX contracts -- and the latter by 1,735 contracts.

Doing the math: 30,999 minus 6,410 minus 1,735 equals 22,854 COMEX contracts, the change in the commercial net short position which, as always, it must do.

The commercial net short position in gold now sits at 111,982 COMEX contracts/11.198 million troy ounces of the stuff...down those 22,854 contracts from the 134,836 COMEX contracts/13.484 million troy ounces they were short in the September 29 COT Report.

The Big 4 shorts decreased their net short position by a hefty 10,004 contracts, from 136,784 contracts, down to 126,780 COMEX contracts.

But the Big '5 through 8' shorts decreased their net short position from the 72,749 contracts they held short in the September 29 COT Report, down to 71,152 contracts held short in the current COT Report...a smallish decrease of 1,597 COMEX contracts.

There has always been a question mark over the last few weeks as to whether or not there was a Managed Money trader in the Big '5 through 8' category. But now it's a certainty that there is -- and Ted's estimate of this one Managed Money trader holding 15,000 contracts is based on the fact that the gross Managed Money short position increased by 16,831 COMEX contracts during the current reporting week -- and there was no increase in the number of traders in that category.

The Big 8 shorts in total decreased their net short position from 209,533 COMEX contracts, down to 197,932 contracts/19.793 million troy ounces...a drop of 11,601 COMEX contracts...from which has to be that 15,000 contract short position held by the smallest Managed Money trader in the Big '5 through 8' category.

And because of that 15,000 contract short position held by that Managed Money trader, the long position of Ted's raptors, the commercial traders other than the Big 8...which calculated out at 85,950 COMEX contracts...is overstated by that amount -- and is actually around 71,000 contracts, if not a bit less. It doesn't appear that they did much during the reporting week... which was also a surprise.

Don't forget that despite their small size, they are great in number. These raptors in gold are still commercial traders in the commercial category -- and [like in silver] in direct competition with the Big 4/8 shorts on the buy side...although they weren't this past week for whatever reason.

Here's Nick Laird's 3-year COT Report chart for gold, updated with the above data. Click to enlarge.

It was an excellent report in gold -- and the fact that the Managed Money traders are back on the short side made it even more bullish. One has to suspect that, like in silver, they're even more short since the Tuesday cut-off.

So the set-up for a major rally in gold from a COMEX futures market perspective is baked in the cake -- and is just about as extreme as it is in silver.

All we await now is the event that will be allowed to set it off because, as I keep saying, when this price management scheme is finally allowed to breath its last, it won't be in a news vacuum.

We're locked and loaded more than we've ever been -- and it's now just a waiting game.

![]()

In the other metals, the Managed Money traders in palladium decreased their net short by a further 583 COMEX contracts. They are still net short palladium by a monstrous 8,817 contracts...48 percent of total open interest. The commercial traders remain very net long palladium in both categories...especially the Swap Dealers. The traders in the Other Reportables and Nonreportable/small trader categories remain net short palladium by smallish amounts.

In platinum, the Managed Money traders increased their net short position by 7,893 contracts during the reporting week -- and are now net short platinum by 10,177 COMEX contracts. These guys are getting their faces ripped off by the commercial traders of whatever stripe in this precious metal, as they keep getting whipsawed in and out of their long positions. The Producer/Merchant category is the only other category net short platinum at the moment -- and they are mega net short to the tune of 20,109 contracts -- and are mostly U.S. bullion banks as per Friday's Bank Participation Report. The rest of the categories are net long by very decent amounts.

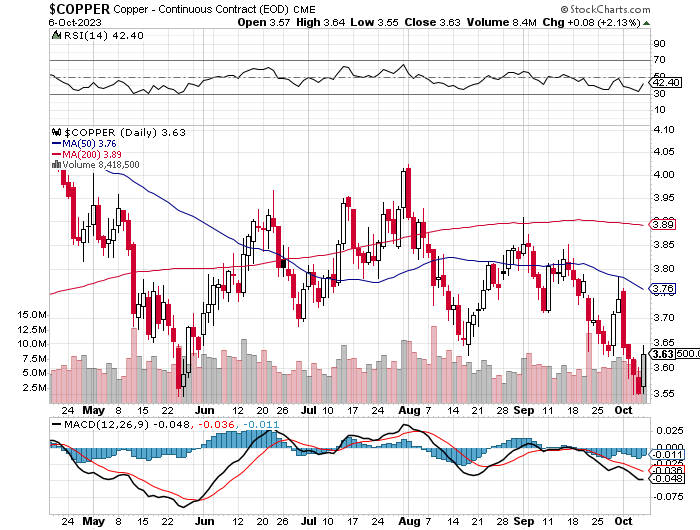

In copper, the Managed Money traders decreased their net short position by 8,333 contracts during the reporting week -- and are now net short 13,044 COMEX copper contracts...about 326 million pounds of the stuff as of the September 29 COT Report...compared to the 534 million pounds they were net short in last week's report. I was expecting an increase in Managed Money shorting, but that didn't happen because of its 2-day rally that touched its 50-day moving average at the start of the reporting week. Their short position is certainly larger since the Tuesday cut-off.

Copper, like platinum, continues to be a wildly bifurcated market in the commercial category. The Producer/Merchant category is net short 8,711 contracts -- and the Swap Dealers are net long 27,663 COMEX contracts.

Whether this means anything or not, will only be known in the fullness of time. Ted says it doesn't mean anything as far as he's concerned, as they're all commercial traders in the commercial category.

In this vital industrial commodity, the world's banks...both U.S. and foreign... are net long 11.4 percent of the total open interest in copper in the COMEX futures market in yesterday's October Bank Participation Report...exactly unchanged from what they were net long in September's. At the moment it's the commodity trading houses such as Glencore and Trafigura et al., along with some hedge funds, that are still net short copper by a bit in the Producer/ Merchant category, as the Swap Dealers are mega net long, as pointed out above.

![]()

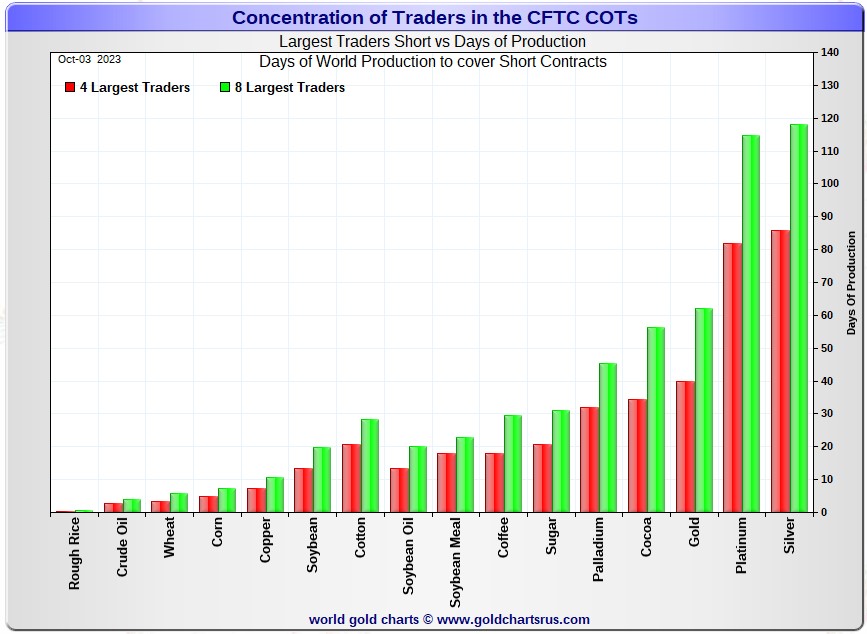

Here’s Nick Laird’s “Days to Cover” chart, updated with the COT data for positions held at the close of COMEX trading on Tuesday, October 3. It shows the days of world production that it would take to cover the short positions of the Big 4 — and Big '5 through 8' traders in every physically traded commodity on the COMEX. Click to enlarge.

In this week's data, the Big 4 traders are short about 86 days of world silver production...up 5 days from last week -- and all because of that Managed Money trader that appeared in that category. The ‘5 through 8’ large traders are short an additional 32 days of world silver production ...and, not surprisingly, unchanged from last week, for a total of about 118 days that the Big 8 are short...and obviously up 5 days from last week's report.

Those 118 days that the Big 8 traders are short, represents a bit under 4 months of world silver production, or 226.17 million troy ounces/53,233 COMEX contracts of paper silver held short by these eight traders. Several of the largest of these are now non-banking entities, as per Ted's discovery in last December's Bank Participation Report. October's Bank Participation Report continues to confirm that this is still the case -- and not just in silver, either.

Normally the Big 8 are all commercial traders, but there is now that one Managed Money trader in the Big 4 category that is short around 6,500 COMEX contracts -- and that muddies the water by a bit.

Ted's raptors, the small commercial traders other than the Big 8, reduced their long position down to something less than 17,000 contracts...net of that Managed Money trader. At this point in the current 'wash, rinse & spin' cycle, they hold a very small long position, relatively speaking, so they won't have all that many longs to sell when the price turns higher, like it did on Friday. It's a good bet that some of them were selling for a profit during that rally.

Since the raptors rarely go short, it won't be long before they're out of long positions to sell -- and we'll find out pretty quick if the Big 4/8 shorts are going to step in once more as this budding rally in silver progresses from here.

In gold, the Big 4 are short about 40 days of world gold production...down 3 days from last week's COT Report. The '5 through 8' are short 22 days of world production, down 1 day from last week...for a total of 62 days of world gold production held short by the Big 8 -- and down 4 days from last week.

The Big 8 commercial traders are short 42.3 percent of the entire open interest in silver in the COMEX futures market as of yesterday's COT Report, up a noticeable amount from the 40.5 percent that they were short in the September 29 COT Report. And once whatever market-neutral spread trades they have on are subtracted out, that percentage would be around the 50 percent mark. In gold, it's 45.9 percent of the total COMEX open interest that the Big 8 are short, down a noticeable amount from the 48.1 percent they were short in the September 29 COT Report -- and something under the 55 percent mark once their market-neutral spread trades are subtracted out.

And as also mentioned earlier, Ted is still of the opinion that Bank of America is short about one billion ounces of silver in the OTC market, courtesy of JPMorgan & Friends. He's also of the opinion that they're now short 37 million troy ounces of gold, as of the March OCC Report...with the same bunch of JPMorgan & Friends crooks on the long side. That's up 12 million ounces from the 25 million that they were short in the December OCC Report. And as mentioned above, and with the June OCC Report in hand for Q1/2023, Ted feels that BofA's current short position in silver remains "mostly intact".

And as reported last week, the short position in SLV rose from 28.77 million shares, up to 29.14 million shares in the September 26 short report -- an increase of 1.29%. The next short report is due out this coming Tuesday, October 10.

The situation regarding the Big 4/8 commercial short positions in silver and gold are still obscene...but vastly improved over the last couple of months -- and obviously even more improved since the Tuesday cut-off.

As Ted has been pointing out ad nauseam forever, the resolution of the Big 4/8 short positions will be the sole determinant of precious metal prices going forward -- which should be obvious to everyone by now... except those whose so-called 'reputations' depend upon them not seeing it.

![]()

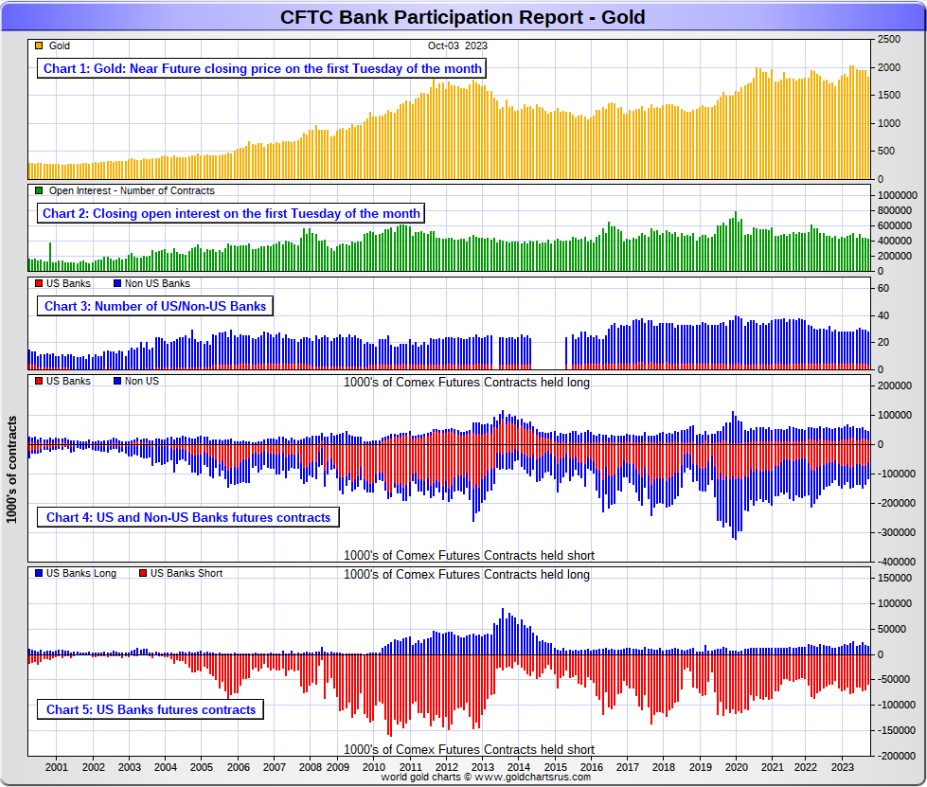

The October Bank Participation Report [BPR] data is extracted directly from yesterday's Commitment of Traders Report. It shows the number of futures contracts, both long and short, that are held by all the U.S. and non-U.S. banks as of Tuesday’s cut-off in all COMEX-traded products.

For this one day a month we get to see what the world’s banks have been up to in the precious metals. They’re usually up to quite a bit -- and this month was no exception in gold, silver or platinum.

[The October Bank Participation Report covers the four-week time period from September 5 to October 3 inclusive]

In gold, 4 U.S. banks were net short 42,337 COMEX contracts, down 9,056 contracts from the 51,393 contracts that 5 U.S. banks were short in September's BPR.

Also in gold, 24 non-U.S. banks were net short 26,781 COMEX contracts, down 8,612 contracts from the 35,393 contracts that these same 24 non-U.S. banks were short in September's BPR.

At the low back in the August 2018 BPR...these same non-U.S. banks held a net short position in gold of only 1,960 contacts -- so they've been back on the short side in an enormous way ever since.

Although some of the largest U.S. and foreign bullion banks are in the Big 8 short category in gold, some of the hedge fund/commodity trading houses are short equally if not more grotesque amounts of gold than the banks...as mentioned further down. The possibility also exists that the BIS could be short gold in the COMEX futures market as well.

As of October's Bank Participation Report, 28 banks [both U.S. and foreign] are net short only 16.1 percent of the entire open interest in gold in the COMEX futures market...down from the 19.8 percent that 29 banks were net short in the September BPR.

That 16.1 percent is a very small number.

But it should be pointed out that the Big 8 in gold are short 45.9% of total open interest...so that leaves some non-banking entities short the remaining [45.9 minus 16.1] 29.8 percentage points....which is even more obscene than the short positions held by the largest banks.

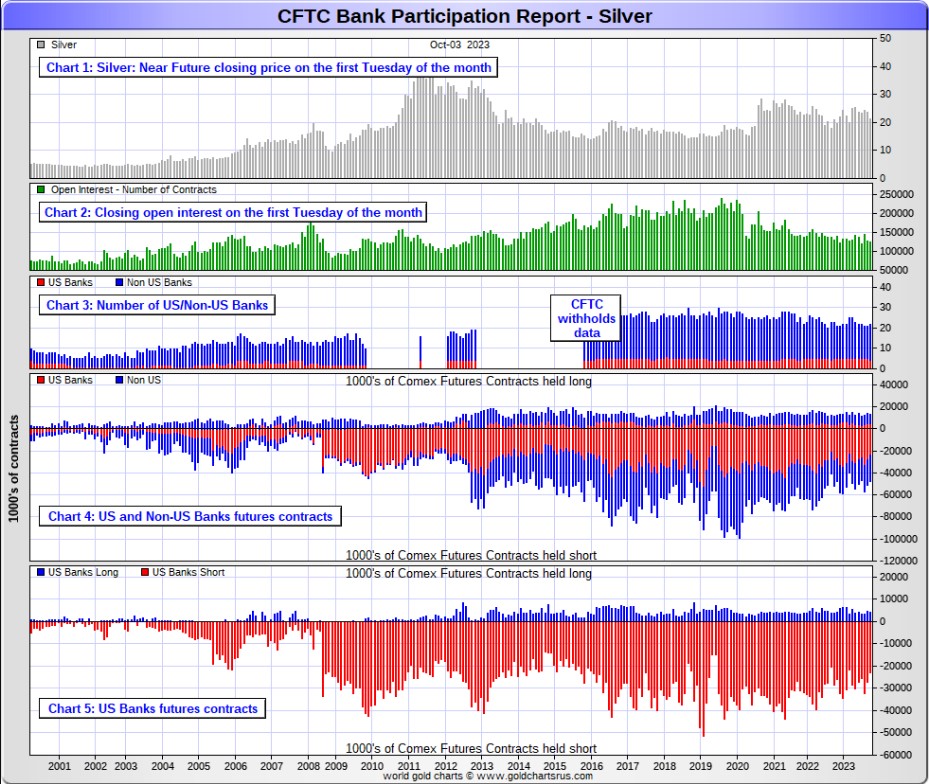

Here’s Nick’s BPR chart for gold going back to 2000. Charts #4 and #5 are the key ones here. Note the blow-out in the short positions of the non-U.S. banks [the blue bars in chart #4] when Scotiabank’s COMEX short position was outed by the CFTC in October of 2012. Click to enlarge.

In silver, 4 U.S. banks are net short 18,488 COMEX contracts, down 4,214 contracts from the 22,702 contracts that 5 U.S. banks were short in the September BPR.

The biggest short holders in silver of the five U.S. banks in total, would be Citigroup, Wells Fargo, Bank of America, Morgan Stanley...and maybe Goldman Sachs -- and also JPMorgan from time to time.

And, like in gold, I have my suspicions about the Exchange Stabilization Fund's role in all this...although, also like in gold, not directly.

Also in silver, 18 non-U.S. banks are net short 15,597 COMEX contracts, up 1,375 contracts from the 14,222 contracts that 16 non-U.S. banks were short in the September BPR. That was an unexpected and equally unpleasant surprise -- and one would have to think that those two extra banks that showed up in this reporting period were the ones that went short.

I would suspect that HSBC, Barclays and Standard Chartered hold by far the lion's share of the short position of these non-U.S. banks...as does Canada's Scotiabank/Scotia Capital still. The remaining short positions divided up between the other 15 or so non-U.S. banks are immaterial — and have always been so. The same can be said of most of the 24 non-U.S. banks in gold as well.

As of October's Bank Participation Report, 22 banks [both U.S. and foreign] are net short 27.1 percent of the entire open interest in the COMEX futures market in silver — down from the 28.8 percent that 21 banks were net short in the September BPR.

That 27.1 percent is a larger number than the 16.1 percent in gold. The Big 8 are short 42.3 percent of the total open interest in silver...so the hedge funds and trading houses are only short [42.3-27.1=15.2 percentage points] between them, which is still a decent amount.

Here’s the BPR chart for silver. Note in Chart #4 the blow-out in the non-U.S. bank short position [blue bars] in October of 2012 when Scotiabank was brought in from the cold. Also note August 2008 when JPMorgan took over the silver short position of Bear Stearns—the red bars. It’s very noticeable in Chart #4—and really stands out like the proverbial sore thumb it is in chart #5. Click to enlarge.

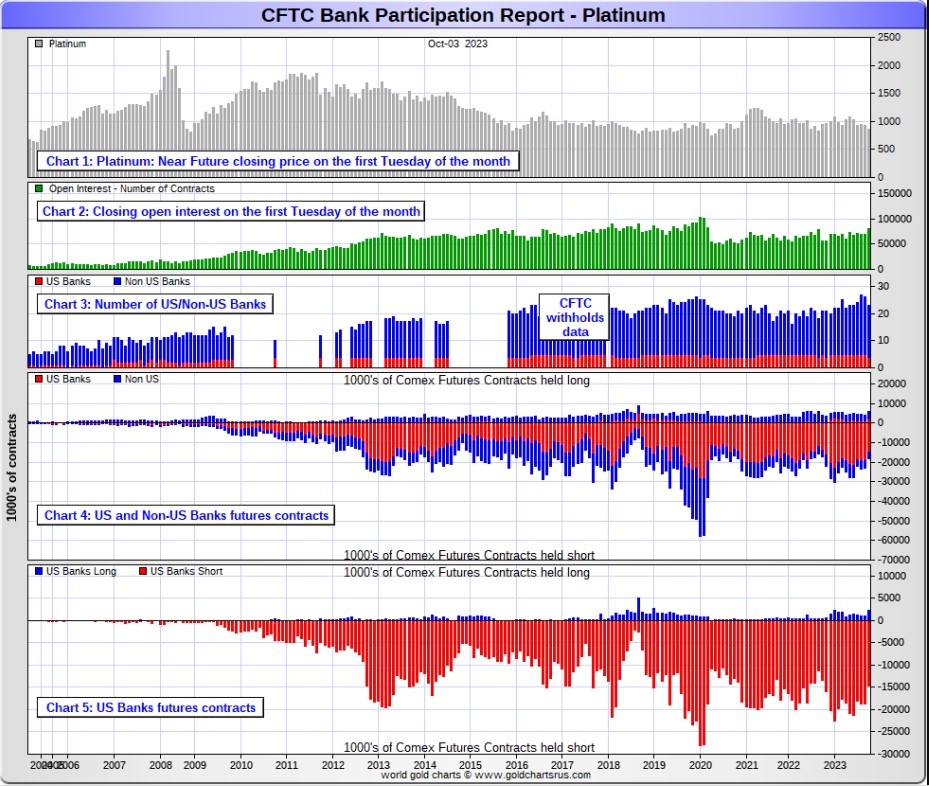

In platinum, 4 U.S. banks are net short 12,287 COMEX contracts in the October BPR, down 5,356 contracts from the 17,643 contracts that 5 U.S. banks were short in the September BPR.

At the 'low' back in September of 2018, these U.S. banks were actually net long the platinum market by 2,573 contracts. So they have a very long way to go to get back to just market neutral in platinum...if they ever intend to, that is. They look permanently stuck on the short side to me, a fact that I point out regularly.

Also in platinum, 19 non-U.S. banks are net short a piddling 109 COMEX contracts, down 1,370 contracts from the 1,479 contracts that 21 non-U.S. banks were net short in the September BPR...an insignificant change. I was hoping that this report would show them net long platinum...but alas.

On average each of these non-U.S. banks are market neutral...just like for most of the non-U.S. banks in silver and gold as well. That compares to the average 3,071 contracts that each of the 4 U.S. banks are short platinum.

Platinum remains the big commercial shorts No. 2 problem child after silver... but a very distant No. 2 down the list. How it will ultimately be resolved is unknown, but most likely in a paper short squeeze, as the known stocks of platinum are minuscule compared to the size of the short positions held -- and that's just the short positions of the world's banks I'm talking about.

And here's the kicker...just like it was in last month's report.

The Big 8 in platinum are short 38,481 COMEX contracts...of which those 4 U.S banks hold 12,287 contracts of that amount...31.9%. The difference between those two numbers [26,194 COMEX contracts] is held by only 4 hedge funds or commodity trading houses in total...which means their average short positions are even more grotesque than those held by the four U.S. banks...more than double.

And as of October's Bank Participation Report, 23 banks [both U.S. and foreign] were net short 15.2 percent of platinum's total open interest in the COMEX futures market, which is down big from the 27.9 percent that 26 banks were net short in September's BPR.

Here's the Bank Participation Report chart for platinum. Click to enlarge.

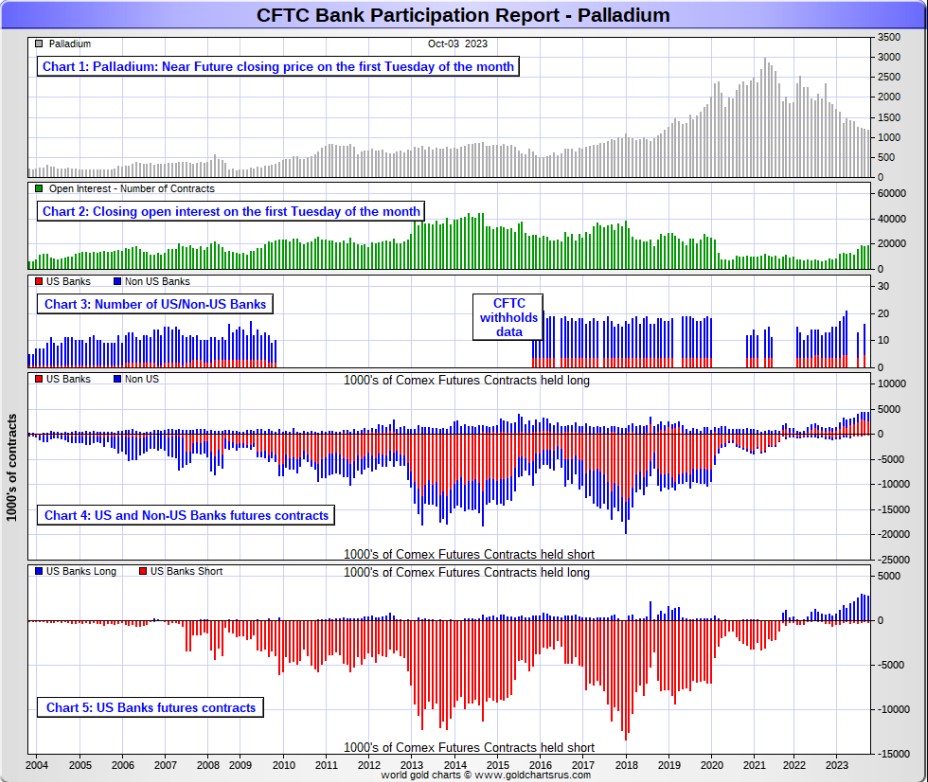

In palladium, '3 or less' U.S. banks are net long 2,540 COMEX contracts in October's BPR, down from the 2,702 contracts that 5 U.S. banks were net long in the September BPR.

Also in palladium, '13 or more' non-U.S. banks are net long 1,526 COMEX contracts, up from the 1,425 contracts that 11 non-U.S. banks were net long in the September BPR.

It should be noted that these are record or close to record high numbers for all the banks -- and also represent a decent chunk of total open interest...22 percent.

But as I've been commenting on for almost forever, the COMEX futures market in palladium is a market in name only, because it's so illiquid and thinly-traded. Its total open interest in yesterday's COT Report was only 18,421 contracts...compared to 81,529 contracts of total open interest in platinum ...125,846 contracts in silver -- and 431,226 COMEX contracts in gold.

As I say in this spot every month, the only reason that there's a futures market at all in palladium, is so that the Big 8 commercial traders can control its price. That's all there is, there ain't no more.

As of this Bank Participation Report, 16 banks [both U.S. and foreign] are net long 22.0 percent of the entire COMEX open interest in palladium ...down from the 23.4 percent of total open interest that 16 banks were net long in the September BPR.

For the last 3+ years, the world's banks have not been involved in the palladium market in a material way. And with them now net long by record amounts, it's all hedge funds and commodity trading houses that are left on the short side. The Big 8 commercial traders, none of which are banks, are short 45.5 percent of total open interest in palladium as of yesterday's COT Report.

Here’s the palladium BPR chart. Although the world's banks are now net long at the moment, it remains to be seen if they return as big short sellers again at some point like they've done in the past. Click to enlarge.

Excluding palladium for obvious reasons, and the non-U.S. banks in platinum, plus almost all of the non-U.S.. banks in gold and silver...only a small handful of the world's banks, most likely no more than 5 or so in total -- and mostly U.S.-based, except for HSBC, Barclays and maybe Standard Chartered... continue to have meaningful short positions in the precious metals. It's a near certainty that they run this price management scheme from their in-house/ proprietary trading desks.

As I pointed out above, the world's commodity trading houses and some hedge funds are also mega net short the four precious metals...far more short than the U.S. banks in some cases. They have the ability to affect prices if they choose to exercise it...which I'm sure they're doing at times. But it's still the big bullion banks at Ground Zero of the price management scheme... especially in silver.

And as has been the case for years now, the short positions held by these Big 4/8 traders/banks, is the only thing that matters...especially the short positions of the Big 4 -- and how this is ultimately resolved [as Ted said earlier] will be the sole determinant of precious metal prices going forward.

The Big 8 commercial traders, along with Ted's raptors...the small commercial traders other than the Big 8 commercial shorts...continue to have an iron grip on their respective prices -- until they don't.

But considering the current state of affairs of the world's banking and financial system as it stands today -- and the physical shortage in silver and platinum -- and maybe in gold and copper as well, the chance that these big bullion banks and commodity trading houses could get overrun at some point, is not zero -- and certainly within the realm of possibility if things go totally non-linear.

However, as Ted keeps reminding us from time to time, if they do finally get overrun...it will be for the very first time.

I have about an average number of stories and articles for you today...two of which I've been saving for today's column because of length or content reasons...or both.

Doug Noland is at conference -- and won't have his weekly commentary up on his website until later today -- and I'll post it in Tuesday's column. However, the link is here, if you wish to check as the day progresses. Gregory Mannarino was also a 'no show'.

![]()

CRITICAL READS

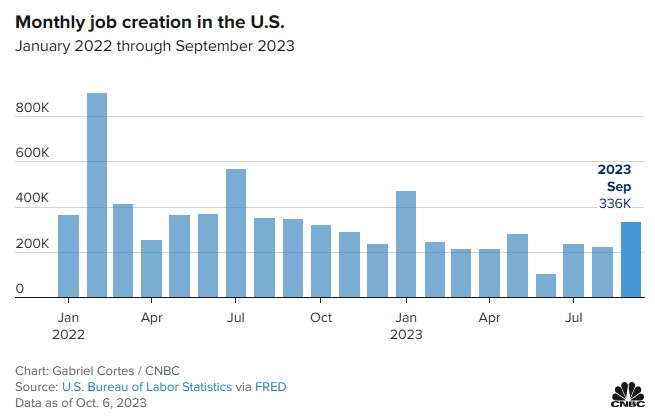

Payrolls soared by 336,000 in September, defying expectations for a hiring slowdown

Job growth was stronger than expected in September, a sign that the U.S. economy is hanging tough despite higher interest rates, labor strife and dysfunction in Washington.

Non-farm payrolls increased by 336,000 for the month, better than the Dow Jones consensus estimate for 170,000 and more than 100,000 higher than the previous month, the Labor Department said Friday in a much-anticipated report. The unemployment rate was 3.8%, compared to the forecast for 3.7%. Click to enlarge.

Stocks initially fell after the report but turned around through the morning. The Dow Jones Industrial Average accelerated more than 150 points after two hours of trading, while Treasury, though still positive on the session, eased as the 10-year note yielded 4.77%, up about 0.05 percentage point.

The payrolls increase was the best monthly number since January.

“Slowdown? What slowdown? The U.S. labor market continues to exhibit amazing strength, with the number of new jobs created last month nearly twice as large as expected,” said George Mateyo, chief investment officer at Key Private Bank.

Investors have been on edge lately that a resilient economy could force the Federal Reserve to keep interest rates high and perhaps even hike more as inflation remains elevated.

This news item put in an appearance on the cnbc.com Internet site at 8:31 a.m. EDT on Thursday morning -- and was updated about three hours later. I thank Swedish reader Patrik Ekdahl for today's first story. Another link to it is here. The Zero Hedge spin on this, courtesy of Brad Robertson, is headlined "Inside Today's Jobs Report: 885,000 Full-Time Jobs Lost, 1.127 Million Part-Time Jobs Added, Record Multiple Jobholders" -- and linked here.

![]()

Chapter 11 Filings By Businesses Soar 61% So Far This Year

Updates to Retail Dive’s bankruptcy tracker have been numerous in 2023 so far, with the all-important holiday quarter left to go.

A wide array of U.S. businesses have struggled this year. In the first nine months of 2023, commercial Chapter 11 bankruptcies have soared 61% year over year to 4,553, according to Epiq Bankruptcy, which provides U.S. bankruptcy filing data.

Small business filings in that time rose 41% to 1,419, according to the research, released by Epiq and the American Bankruptcy Institute. In all, considering every type of bankruptcy, filings in the commercial sector rose 17% to 18,680.

After recent declines thanks in part to pandemic-era financial support, consumer filings also rose this year, up 17% to 313,458, per the report.

High-profile retail filings in the first nine months of the year have included David’s Bridal, Bed Bath & Beyond and Party City, and 11 more retailers may be on the brink.

While the numbers of both commercial and individual filings remain below pre-pandemic levels, the increase so far this year is a sign that challenges, including expanding debt, are building, according to American Bankruptcy Institute Executive Director Amy Quackenboss.

This article was posted on the Zero Hedge website at 9:15 a.m. on Friday morning EDT -- and I thank Brad Robertson for sending it our way. Another link to it is here.

![]()

Why the Fed will again have to slash rates to zero and relaunch QE -- Ambrose Evans Pritchard

The U.S. economic expansion is being kept afloat only by extreme fiscal stimulus and war-time deficits, an astonishing state of affairs at the top of the cycle.

The federal government is unable to fund this scale of borrowing from U.S. domestic savings, and global creditors are no longer willing to fund it either at bearable cost.

The violent spike in U.S. Treasury yields over the last two months has nothing to do with inflation, which has been falling faster than markets expected.

Real rates are rocketing, driven by a sudden jump in the "term premium." Think of it as a credit crunch being imposed upon a feckless political class in Washington by global bond vigilantes.

This interesting and worthwhile commentary from Ambrose showed up on The Telegraph's website on Friday -- and I found it embedded in a GATA dispatch. Another link to it is here.

![]()

The Report from Iron Mountain -- Bill Bonner

Truth emerges, often, in unexpected places. The “Report from Iron Mountain” may have been a spoof, designed only to elicit a knowing chuckle from the cynical cognoscenti, but it reveals the real cause of war better than any group of federal hacks ever could.

The supposed background is that a 15-member group of pipe smokers got together in a Special Study Group to speculate on the consequences of ‘peace.’ They met in a nuclear-secure bunker under Iron Mountain.

They came to the conclusion that government is incompatible with ‘peace.’ It can’t exist without war. Nation states only exist so they can make war.

There was nothing new about this insight.

“War is the health of the state,” said Randolph Bourne. War is not just useful to government; it is government. The defining difference between the U.S. government and the Catholic Church, Kiwanis Club or Walmart is that the former uses force to get what it wants. The latter do not. Without the use of force – police, jails, wars – the ‘state’ would have no reason to exist.

Tune in Monday…for more on why war is inevitable…and why the U.S. will probably lose it.

This worthwhile commentary from Bill was posted on his Internet site late on Friday morning EDT -- and I thank Roy Stephens for pointing it out. Another link to it is here.

![]()

The End of the Road for the Dollar -- Alasdair Macleod

With the Asian hegemons undoubtedly able to introduce gold standards, where does that leave the dollar?

This article describes just how precarious the fiat dollar’s position has become.

For now, the dollar appears to be buoyed up by rising bond yields. However, as they rise further portfolio losses for foreign investors are likely to increase, leading to dollar liquidation. It is not generally realised how many dollars and dollar securities are owned by foreigners, the bulk of them being held outside the U.S. banking system. And the quantity of foreign currency owned by Americans to absorb this selling is very small in comparison.

Higher interest rates and bond yields also threaten to destabilise the banking system, a problem equally faced by the Eurozone, the U.K., and Japan. But how can the U.S. Government protect itself from this danger?

The only answer is to admit to the end of the fiat era and put the dollar back onto a gold standard. However, the U.S. Government does not have the mandate to take the required actions and officially at least is still in denial over the need to stabilise the currency. The legal position referring to the constitution is briefly touched upon, because laws will have to be considered to secure the dollar’s future.

Unfortunately, the U.S. Treasury’s gold holdings are almost certainly compromised. Furthermore, since the Asian hegemons have accumulated substantial holdings of bullion in addition to their official reserves, there is bound to be a strong reluctance to hand economic power to Russia and China by endorsing a return to gold standards.

My conclusion is that the era of the fiat dollar based global currency system is rapidly ending, and for America and the dollar there can be no Plan B. It will almost certainly lead to the end of the fiat dollar, and the end of the U.S. hegemony.

Another short novel from Alasdair. This one appeared on the schiffgold.com Internet site back on 28 September -- and I found it on Sharps Pixley. Another link to it is here. Gregory Mannarino didn't have a post market close rant on Friday...nor a pre-market open commentary, either.

![]()

Using Armenia to Destroy the International North South Transportation Corridor

Efforts to light geopolitical fires across Russia’s underbelly have been relentless in recent years (with a failed color revolution in Kazakhstan in January 2022, a renewed color revolution effort in Georgia in March of this year, clashes between neighboring Kyrgyzstan-Tajikistan in 2022, ongoing threats of color revolution in Serbia, threats to blow up Transnistria in Moldova, and the obvious fire in Ukraine).

Amidst all of these arson attempts, one thing is certain, the technocrats managing the collapsing western death cult are obsessed with kicking over the chess board using every dirty trick in the book.

Introducing The International North South Transportation Corridor

Until recently, the primary trade route for goods passing from India to Europe has been the maritime shipping corridor passing through the Bab El-Mandeb Strait linking the Gulf of Aden to the Red Sea, via the highly bottle-necked Suez Canal, through the Mediterranean and onward to Europe via ports and rail/road corridors.

Following this western-dominated route, average transit times take about 40 days to reach ports of Northern Europe or Russia. Geopolitical realities of the western technocratic obsession with global governance have made this NATO-controlled route more than a little unreliable.

On top of that, Russia remains one of the most important global suppliers of oil, natural gas, fertilizers and grain – but with the NATO/E.U. clown show increasingly sabotaging access to Russian goods, new connections are desperately needed to avoid plunging the world into a chain reaction collapse.

This opinion piece showed up on theduran.com Internet site on Tuesday -- and for content reasons it obviously had to wait for today's column. I thank Roy Stephens for sharing it with us -- and another link to it is here.

![]()

Asia gold: India premiums spike as jewellers stock up for festive season

Physical gold demand improved in some Asian hubs this week as a dip in prices attracted buyers, with premiums in India hitting a 17-month high as jewellers stocked up ahead of the festival season.

The higher demand allowed dealers in India to charge premiums of up to $5 an ounce over official domestic prices, inclusive of 15% import and 3% sales levies, up from last week’s $4 premiums.

“Retail and wholesale demand is improving because of the price correction. We have been witnessing good traction in the last few days,” said a Mumbai-based bullion dealer with a private bank.

Local gold prices fell to 56,075 rupees per 10 grams this week, and were hovering near their lowest levels since March hit last week.

Jewellers were making purchases anticipating a price correction would boost retail demand during the upcoming festival season, said a New-Delhi based bullion dealer.

This very worthwhile gold-related news item from Reuters was posted on their website around 8:30 a.m. EDT on Friday morning -- and I thank gold expert John Brimelow for bringing it to our attention. He also had this to say in a Tweet regarding this story -- and headlined "Indian Floor: premiums at 17-month of $5"..."Gold was starting its first decent rally since the post-vaccine slide. Premiums this high suggest some shortages: buying must be very strong. China out of course, back Monday: HK and Singapore premiums steady but Japan slightly firmer. Since has settled in NY c.$45 below last Friday's Indian close, their buying should sustain today's and eventually push gold further." Another link to this Reuters story is here.

![]()

The Photos and the Funnies

As I mentioned yesterday, our encounter with this black bear cub on our descent down to Seton Lake was about to get started. It ran away at first, but was obviously wanted to be fed. What happened to its mother was unknown, but it was the scrawniest, unkempt and emaciated bear we'd ever seen -- and so we fed it everything we had in the car...including what was left over from our earlier breakfasts -- and the Danishes that my daughter had bought before we left Lillooet earlier that morning. He liked the hand-outs, but would also run away to eat them far from us. More photos of our encounter on Tuesday.

![]()

The WRAP

"Understand this. Things are now in motion that cannot be undone." -- Gandalf the White

![]()

Today's pop 'blast from the past' dates from 1973 -- and finished in 47th place on Billboard's Hot 100 of that year. It was recorded by the American R&B vocal group The Spinners -- and it's hard to believe that this tune is already 50 years young. The link is here. Of course there's a bass cover to it -- and that's linked here.

Only J.S. Bach was in the same category as Mozart as far as a body of work is concerned -- and one of those is today's classical 'blast from the past'. It's his Concerto for two violins in D minor BWV 1043...a concerto of the Late Baroque era, which he composed around 1730. It is one of the composer's most successful works.

And his most popular as well, because all I had to do was type two words into my computer's search engine and that was 'Bach' and 'violin' -- and it was the first thing that popped up.

Here's the Netherlands Bach Society doing the honours in a performance exactly seven years ago to the day...07 October 2016. Shunske Sato and Emily Deans are the two soloists. It's beautifully shot and recorded. The link is here.

![]()

I was certainly happy to see the robust rallies in gold, silver and platinum yesterday...as were you, I'm sure. However I had some concern as to whether it might be short covering by the Managed Money traders. But as Ted pointed out on the phone, with all three so far below any moving averages that matter, it was doubtful that the Managed Money traders did much...although he did admit that some of them, especially in silver and gold, may have cut and run...being ultra sensitive to the fact that they've always lost money when they're short big.

What Ted was suspecting/hoping, was that it was his raptors, the small commercial traders other than the Big 8, selling some of their long positions for a quick profit on that most likely equally engineered 'rally'...with the Big 4/8 shorts scarfing them up.

As you know, this has been his dream scenario for years -- and although it hasn't happened yet, there would have been no better window of opportunity than yesterday to pull it off. Of course whether or not this has come to pass won't be known, one way or the other, until we see next Friday's COT Report.

But then on Friday night, once I saw only a tiny increase in total open interest in gold -- and a surprising and equally tiny decline in silver open interest, despite the big rallies and associated volumes, the chance that Ted finally got his wish is much closer to being a reality. Because if the Managed Money traders had been buying long positions, total open interest would have increased.

Looking at yesterday's price action in gold in some detail, I noted that the commercial traders of whatever stripe set a new intraday low in gold before it was allowed to rally -- and despite its gain, it still remains a whopping 90 bucks below both its 50 and 200-day moving average. It also remains a bit oversold on its RSI trace as well.

In silver -- and after three consecutive attempts to break it below $20.85 in the December contract, 'da boyz' didn't put much effort into breaching that price on Friday. It closed up 70 cents in its current front month [December] -- and has jumped up above the oversold mark by a bit.

The commercial traders also set a new intraday low in platinum -- and it was up $19 in its current front month, which is January. They also set a new intraday low in palladium as well.

All of this was carried out behind the smokescreen of that more than suspicious dollar index 'rally', which looked custom designed for what the Big 4/8 shorts may have been up to in the precious metals.

Copper had a big gain on Friday, tacking on 8 cents, as it finished the day at $3.63 spot and, like all four precious metals, remains far below any moving averages that matter.

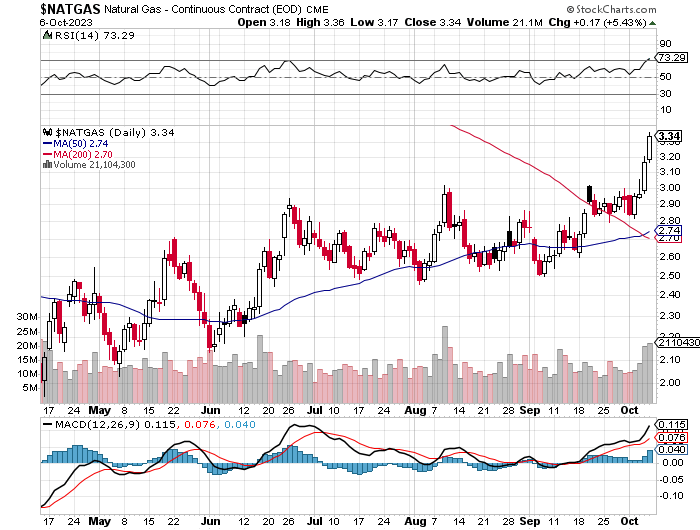

Natural gas [chart included] had a second big 'up' day in a row, closing higher by 17 cents at $3.34/1,000 cubic feet -- and now miles above any moving average that matters. The most likely reason why it's been on a tear recently is in this Zero Hedge story from yesterday linked here.

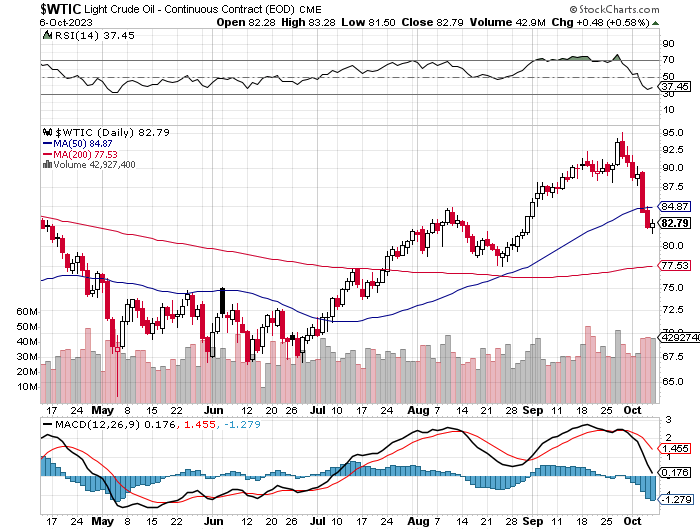

And after being on a losing streak all week and part of last, WTIC managed to tack on a 48 cent gain, closing at $82.79/barrel...but not before the commercial traders set a new intraday low in it as well. These guys are shameless.

Here are the 6-month charts for the Big 6+1 commodities, thanks to stockcharts.com as usual and, if interested, their COMEX closing prices in their current front months on Friday should be noted. Click to enlarge.

Everything I read, watch or listen to as time goes along, keeps getting darker and more desperate -- and seems to be occurring at an ever-increasing rate, which is something that you may have noticed as well.

Whether it be political, economic, financial or monetary, everything is starting to come unglued. Along with that is the increasing failure of law, order and the judiciary -- and the quiet unraveling of the social fabric in the West...especially in the U.S.

The continuing mantra from all of the main stream media in the west and mostly elsewhere, remains the same...everything is fine and there are no causes for concern. Or as Gregory Mannarino so correctly points out...."look here, not over there". This is pure propaganda. They have lulled the masses to sleep -- and they are blissfully unaware of the approaching Armageddon.

It reminds of that quote by Joseph Goebbels...“If you tell a lie big enough and keep repeating it, people will eventually come to believe it. The lie can be maintained only for such time as the State can shield the people from the political, economic and/or military consequences of the lie. It thus becomes vitally important for the State to use all of its powers to repress dissent, for the truth is the mortal enemy of the lie, and thus by extension, the truth is the greatest enemy of the State.”

The new world order crowd/deep state...call them what you will...are following Goebbels play book to the letter.

But a lot of people in this world are on to them -- and whether it turns out the way they expect when it all comes down, remains to be seen.

But one thing is for sure -- and that is that the current state of affairs will not continue for much longer -- and as I've stated on many occasions in the past, the end will come by design, rather than by circumstance...a fact that will be lost on the sheeple.

And as I've also stated before, one of the main casualties of this 'great reset'...which is what it will be, if you wish to dignify it with that name...will be the price management scheme in all hard assets that has been in place since shortly after Nixon took the U.S. [and by extension, the world] of what was left of the gold exchange standard back in 1971.

Although I hate to drag it out once again, I feel that those three paragraphs from British economist Peter Warburton are very apropos as we head into the end of all things as we've know them all our lives.

I remember reading this essay when it first came out 22 years ago -- and it still hangs over my head like the sword of Damocles to this day. It just never goes away -- and is just as profound and on the money now as it was way back then. In his landmark essay entitled "The Debasement of World Currency: It's inflation, but not as we know it"...he had this to say...

"What we see at present is a battle between the central banks and the collapse of the financial system fought on two fronts. On one front, the central banks preside over the creation of additional liquidity for the financial system in order to hold back the tide of debt defaults that would otherwise occur. On the other, they incite investment banks and other willing parties to bet against a rise in the prices of gold, oil, base metals, soft commodities or anything else that might be deemed an indicator of inherent value. Their objective is to deprive the independent observer of any reliable benchmark against which to measure the eroding value, not only of the US dollar, but of all fiat currencies. Equally, they seek to deny the investor the opportunity to hedge against the fragility of the financial system by switching into a freely traded market for non-financial assets.

It is important to recognize that the central banks have found the battle on the second front much easier to fight than the first. Last November I estimated the size of the gross stock of global debt instruments at $90 trillion for mid-2000. How much capital would it take to control the combined gold, oil, and commodity markets? Probably, no more than $200 billion, using derivatives. Moreover, it is not necessary for the central banks to fight the battle themselves, although central bank gold sales and gold leasing have certainly contributed to the cause. Most of the world's large investment banks have over-traded their capital [bases] so flagrantly that if the central banks were to lose the fight on the first front, then the stock of the investment banks would be worthless. Because their fate is intertwined with that of the central banks, investment banks are willing participants in the battle against rising gold, oil, and commodity prices. [Check the Bank Participation Report posted further up for confirmation of this. - Ed]

Central banks, and particularly the U.S. Federal Reserve, are deploying their heavy artillery in the battle against a systemic collapse. This has been their primary concern for at least seven years. Their immediate objectives are to prevent the private sector bond market from closing its doors to new or refinancing borrowers and to forestall a technical break in the Dow Jones Industrials. Keeping the bond markets open is absolutely vital at a time when corporate profitability is on the ropes. Keeping the equity index on an even keel is essential to protect the wealth of the household sector and to maintain the expectation of future gains. For as long as these objectives can be achieved, the value of the U.S. dollar can also be stabilized in relation to other currencies, despite the extraordinary imbalances in external trade."

This 50+ year price management scheme is one of the truths that governments and the main stream media have hidden from the people for the last 50+ years...along with a whole host of other things as well. It's demise will be sudden -- and violent...particularly in silver.

With the 'everything bubble' very long in the tooth -- and with inflation by no means contained, the world's bond markets...especially the U.S. 10-year treasury note...are painting a horrid picture of what lies in store.

The commercial traders of whatever stripe have been moving heaven and earth to get as minimum short as possible in the COMEX futures market, particularly in the precious metals and copper, over the last couple of weeks -- and now that it is "mission accomplished"...all we can do is sit back and wait to see if this is now the time that the powers-that-be decide to pull the pin.

Of course we've been at the brink before quite a number of times before over the past few years and nothing has happened -- and whether things are different this time remains to be seen. But as each of these times has come and gone, the underlying fundamentals in everything continues to deteriorate and degrade further -- and we are long past the point of no return.

Now it's just a waiting game once again.

But for me personally, from an emotional, psychological and spiritual position...I'm as ready as I'm ever going to be for whatever the powers-that-be have in store for us and, figuratively speaking that is, I already have my fingers in my ears.

Of course, I'm still all in and, as always, will remain that way to whatever end.

I'm done for the day -- and the week -- and I'll see you here on Tuesday.

Ed