Ticker- TSX; EDV.TO, OTC; EDVMF

52-Week Range; CAD $15.68-$36.62, US $11.02-$27.60

Shares Out; 163.077m shares

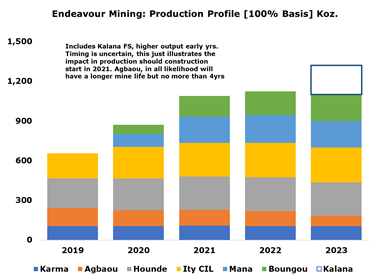

Endeavour Mining is a West African focused gold producer. Following a recent acquisition, it is now the leading West African producer with an excellent stable of assets and run by a very capable management team. The company recently completed a strategic acquisition [SEMAFO], in which it paid a fair price. Endeavour’s business model is based around M&A or buy-and-build. If you look back over the past 5yrs, this is clearly illustrated. The company started off with a couple small-to-moderately sized, higher-cost assets, acquiring producing and development companies or assets, optimizing and building out new mines. Over time, as Endeavour acquired assets or companies and/or completed new mine builds and if often tended to divest assets with either marginal production, high-cost, or those which had a short mine life.

Much of the company, at least in the early days was started and led by Frank Giustra and CEO of Neil Woodyer [along with a handful of other executives who also went to Leagold], both of whom went on to found and build Leagold in 2016, which was subsequently acquired in 2020 by Equinox Gold. Endeavour just entered the ranks of a senior gold producer, with a run rate beginning this quarter [Q3] of 1m oz. annually [100% basis]. Endeavour now ranks amongst the top 15 gold producers globally. Although Endeavour has grown significantly [production wise] over the past 5yrs, Endeavour has a deep pipeline of brownfield and greenfield exploration and development projects. Further, in 2020-2022, Endeavour is expected to have a cost structure (AISC) in the bottom 1/3rd on the industry cost curve.

This acquisition fits in well with Endeavour’s business model, in that it has been successfully upgrading its portfolio over the past 5yrs, with the divestment of Tabakoto and Nzema, while building its two largest and most profitable cornerstone assets in Hounde and Ity [CIL] and acquiring Mana, and Boungou, three of which comprise its cornerstone assets.

An abbreviated history of Endeavour’s buy and build strategy:

- 2014: Agbaou Mine Build: [+110-160k oz.]

- 2016: Acquired True Gold: Karma Mine [+95k-110k oz.]

- 2017: Hounde Mine Build [+220-250k oz.]

- 2017: Acquired Anvel: Kalana Development project [+150k oz. – Likely to be Next Mine]

- 2017: Nzema divested: [95-105k oz.]

- 2018: Ity HL ended: [60-70k oz.]

- 2018: Tabakoto divested: [140-160k oz.]

- 2019: Ity CIL Build [+220-260k oz.]

- 2020: SEMAFO acquired: Mana [+190k oz.] and Boungou [+150k oz.]

The company still maintains a tight share structure relative to its size with 163.077m shares outstanding fully-diluted. Endeavour [following the SEMAFO acquisition] has approx. 11m oz. Au of reserves, an additional 10.5m oz. of M&I resources, and 6.3m oz. inferred [total resource base of 27.8m oz.]. Over the next year or so, the company’s primary objective is to de-leverage and given its cash flow generation abilities, it will be done quickly.

Beyond that, there are several projects that have exploration upside including all of its cornerstone assets, its Fetekro and Kalana development projects, in addition to its recently acquired Bantou and Nabanga development projects. Lastly, there are countless greenfield exploration projects in its portfolio on the same trend as existing operations and other targets in the Ivory Coast, Mali, Niger, Guinea as well as its JV agreement with Barrick Gold. Endeavour will maintain its aggressive exploration program and continue to create value for shareholders and it should bring two more mines online by 2025.

Endeavour has made a previous attempt to create an emerging senior producer, first with the failed attempt bid for Centamin [and its large, long-lived Sukari mine in Egypt], which would have propelled companywide production to 1.2m oz. Au. The two companies couldn’t come to terms.

Endeavour and SEMAFO talked several times in the recent past about a possible merger and it took a bit of time for the two parties to come to a mutually agreed upon arrangement, whereby existing Endeavour shareholders would own 70% of the new company as of the announcement and SEMAFO shareholders would own the remaining 30%. Endeavour could take another go at Centamin and its Sukari Mine in an attempt to add a true top tier cornerstone asset. Should Endeavour undergo a market re-rate as it becomes more marketable for institutions and banks and to buy.

Endeavour completed the ramp up production at its flagship Ity CIL project, having fairly recently completed the upsizing its processing capacity from 4mtpa to 5mtpa [+25%]. Mining rates have been ramping up supplemented by historical leach dumps. Q3, if not Q4 should illustrate Ity CIL operating at new design capacity for a full quarter.

Hounde will soon start to see marginal increases in production from Kari Pump, which has a resource grade +48% higher relative to the mine grade. Further, two areas, Bakatouo and more notably Le Plaque, will increase the overall feed grade to the Ity mill as these deposits have a resource grade which are +42% and +50% higher relative to the mine grade. 2021 will be an interesting year as it will see a full year of production from the SEMAFO assets and a full year of contributions from higher grade feed at both Hounde and Ity.

Endeavour has some geographic diversity, with exposure primarily to Burkina Faso and Côte d’Ivoire, with development projects in several other countries such as Mali. Endeavour has been very successful in its exploration efforts with very low discovery costs. In Q1 2020, Hounde and Ity saw exploration expenditures of $6m each, $3m spent at Fetekro, and $1m on other greenfield assets.

The rest of 2020 will be focused (operationally) on integrating and optimizing the SEMAFO assets, completing the PEA at Fetekro, increasing reserve and resource estimates at select deposits, and completing an upsized pre-feasibility study at its Kalana development project. Whatever project yields the highest returns between Fetekro and Kalana, will likely be the next project to be developed into a mine. I believe it will be Kalana as additional drilling and resource expansion at Fetekro would allow for a larger, longer lived project but that will take much more time to advance. The company will focus on debt reduction and it won’t take very long to full repay its debt, notably pay-down the portion of convertible notes it is permitted to do such that additional and unnecessary dilution won’t occur.

At the time the acquisition of SEMAFO was announced, it was immediately accretive on all financial metrics, which have only increased with the continued increase in the gold price [the day the deal was announced on March 23rd 2020, the gold price closed at $1,567/oz.]. It increased Net Asset Value/share by 7.20%, cash flow per share [2020E] by 3.40% and [2021E] by 9.70%.

Leadership –

Serbastien de Montessus; The CEO and President of London based Endeavour Mining. He was previously the Chief Executive Officer of the La Mancha Group since 2012, and under his leadership La Mancha doubled its production through optimization efforts before undergoing a portfolio restructuring, which enabled the Sawiris family to become the main shareholder of Evolution Mining, a leading Australia gold miner, and of Endeavour Mining in November 2015.

Mark Morcombe; The Chief Operating Officer and Executive VP. Prior to joining Endeavour, Mark was Chief Operating Officer of Centamin Plc, operator of the Sukari Mine in Egypt, and before this, he held the same role at Acacia Mining. Between late 2010 and April 2016, he held several senior roles at AngloGold Ashanti, including Senior Vice President, Planning and Business Development and Senior Vice President Ghana, during which he led the Obuasi gold mine turnaround project.

Michael E. Beckett; The Chairman and Non-executive director has more than 40-years experience in the mining sector and has been involved in the development of some of the largest gold mines in Africa and Papua New Guinea; As a former chair of Ashanti Goldfields Ltd. and former Managing Director of Consolidated Gold Fields plc, Mr. Beckett has extensive knowledge of mining in Africa.

The rest of Endeavour’s management team also has an extensive track record in the mining industry and working in Africa. As a result, this management and BOD is very well resumed and its performance speaks for itself, at least operationally. Endeavour has underperformed its peer group since the June 2019 breakout in the gold price, but with this recent acquisition, it should get re-rated.

Cornerstone Assets;

Hounde (Burkina Faso, Production) – This low-cost open-pit cornerstone asset was Endeavour’s first asset that could produce in excess of 200k oz. Au at low cash costs and AISC, coming online in 2017. The project currently has a 10yr mine life, however, Endeavour’s cornerstone assets, at least Hounde and Ity both have high exploration upside as we’ve already seen over a brief period of time. It recently added over 500k oz. Au from the Kari area with another increase in resources to be published in the 2H. Hounde now has nearly 5m oz. of total resources.

Through its first two full years of production, Hounde has produced 277k and 223k oz. Au [at AISC of $564/oz. and $862/oz.], with 2020 guidance of 230-250k oz. [at AISC of $860-$890/oz.]. Through the discovery and development of the high-grade Kari Pump, Endeavour will look to maintain production of 240-250k oz. over a 10yr period, and ideally longer. It will need to increase reserves by 1.1m oz. Au to achieve this which can easily be achieved by from M&I resource conversion. The conversion rate wouldn’t need to be exceptionally, approximately 45% +/- 5%. But we know the company has been very successful in the Kari Area, with a lot more drilling planned in the future.

Endeavour will achieve a 240-250k oz. annual run rate via delineating higher-grade reserves [which it has done so far at Kari]. Over the first 4-years AISC is forecast to be roughly $620/oz. and $750/oz. over the life of mine. But if Endeavour is able to maintain production of 240k+ oz. p.a. and continue to identify higher grade satellite deposits, AISC over the life of mine should be lower. The exploration upside at Hounde is very robust, which has been illustrated through new discoveries made over the last couple of years, Further, two of these targets have seen very high-grade intercepts (for an open-pit).

Endeavour has commenced mining at the higher-grade Kari Pump (reserve grade of 3.01 g/t and resource grade of 2.70 g/t), which is higher relative to the reserve and resource grade of 2.06 g/t and 2.01 g/t, which is lower if you strip out Kari), which should show through higher output in the 2H of 2020. Endeavour has a 5yr discovery target of 2.5-3.5m oz. In addition to the Kari Area, the company will also focus on Dohoun and Sia/Sianikoui and Vindaloo.

The company will focus on increasing reserve and resources from Kari [Kari Pump, Kari West and Kari Center] in 2020.The most recent news-flow regarding Hounde include the aforementioned 500k oz. increase in M&I from the Kari area and Endeavour receiving the permit to commence mining at the higher-grade Kari Pump deposit. Endeavour has a 5yr discovery target of 2.5-3.5m oz. In addition to the Kari Area, the company will also focus on Dohoun and Sia/Sianikoui and Vindaloo. The company has had an average 5-year discovery cost at Hounde <$15/oz. This also compares favorably to the average discovery cost of the average company [$149/oz.] and average West African peers[1].

|

Category |

Tonnage (Mt) |

Grade |

Contained oz. (Au Koz.) |

|

Reserves |

32.6 |

2.06 |

2,164 |

|

M&I Resources |

41.9 |

1.85 |

2,283 |

|

Inferred |

6.9 |

2.07 |

481 |

|

Total |

67.3 |

2.05 |

4,928 |

Ity CIL (Cote d’Ivoire, Producing) – Endeavour’s second flagship asset reached production in 2019. It was initially producing via a heap leach operation for many years but at much lower production rates. Endeavour expanded the project and built a CIL plant transforming this asset into one similar to Hounde from a production point of view, though at lower costs. The company initially built the plant to process 4Mtpa but was subsequently expanded to 5Mtpa in 2020. The 240-250k oz. Au of annual production was based on a 4Mtpa, so it is possible we could see one or more years upwards of 300k oz. output but we will should assume an average of 250k oz. p.a. until the update life of mine plan is published. It would have been closer to 210-220k oz. p.a. if not for the discovery of Le Plaque. The reserve grade at Le Plaque is 2.34 g/t Au and the resource grade is 3.20 g/t. This compares very favorably to the overall reserve and resource grade of 1.57 g/t and 1.53 g/t.

Production from 2016 (when it was a heap leach operation) through 2019 was 76k oz. Au, 59k oz. Au, 85k oz. Au, and 190k oz. Au. 2020 production guidance is for 235-255k oz. Au @ AISC of $630-$675/oz. Throughout the rest of 2020, plant feed is expected to continue to be sourced from the Bakatouo and Daapleu pits, supplemented by lower grade historic heap dumps.

Like Hounde, Endeavour’s goal for Ity is 10yrs of production upwards of 250k oz. [excluding the expansion but including Le Plaque]. To achieve 10yrs of 250k oz./yr., Endeavour only needs to add 500k oz. of reserves. This could be achieved by the conversion of existing resources or through Ity’s extensive land package and large number of drill targets. Drilling had increased the Le Plaque resource, as announced in early July by 43% to 690k oz. It will likely see another increase in Le Plaque resources in the not too distant future. We have yet to see Ity operates a full quarter at the new design capacity, and we will see it this year but 2021 will provide a clearer picture of what to expect in the future as it will stop processing low-grade heap dumps. In fact, an updated technical and mine place is expected to published mid-year, which could surprise with higher average annual output.

The company has a 5-year discovery target at Ity of 4-6m oz. [with a higher average grade of 2.0-3.5 g/t] The average discovery cost at Ity has been <$20/oz. Le Plaque has had discovery costs of $15/oz., Daapleu of $4/oz., Colline Sud of $13/oz. and Bakatouo of $10/oz. Of all its assets, Ity has the most attractive near-mine and regional exploration targets. Le Plaque remains open at depth in multiple directions with mineralization confirmed by step-out drilling. The mining permit for Le Plaque is expected in Q3 and an updated reserve estimate is expected as well. Of all its assets, Ity has the highest potential to grow via production and mine life, though additional exploration will be needed to confirm this.

|

Category |

Tonnage (Mt) |

Grade Au g/t |

Contained Koz. |

|

2P Reserves |

62.1 |

1.57 |

3,144 |

|

M&I Resources |

16.3 |

1.62 |

920 |

|

Inferred |

18 |

1.33 |

782 |

|

Total |

96.4 |

1.51 |

4,846 |

Mana (Burkina Faso, Producing) – The largest asset in the SEMAFO acquisition isn’t as low cost as its other cornerstone assets, but at current prices, it generates tremendous cash flow. The mine in located on the northern part of Hounde greenstone belt. It has been in production since 2008 and has produced 2.1m oz. Au. It is comprised of mining from several open-pits and as of 2020, the Siou underground component. This should allow the mine to more consistently produce 180-215k oz. Au. Over the last two years, the operation has produced 181k oz. Au and 136k oz. Au @ AISC of $1,056/oz. and $1,095/oz. 2020 production is estimated at 185-205k oz. Au @ AISC of $1,050-$1,120/oz. Going forward it would be reasonable to assume AISC of $1,025-$1,125/oz. +/- $25/oz.

With an initial 8yr mine life based on reserves, in 2019, a total of 19.2k meters were drilled at Mana, primarily at Pompoi and Fofina Sud. At Fofina Sud, significant mineralization was obtained on every section and the zone remains open along strike and at depth. Additional drill will be required to close off the zone and establish a preliminary resource estimate. For 2020, a $2m has been budgeted to follow up targets by the geological review carried out last year. The bulk of the 3,800m RC drill campaign will focus on three areas around Siou. An underground drill program will be carried out to test if the mineralization extends at depth below the existing underground reserves. As you can see below, Endeavour could significantly extend the mine life solely from resource conversion with a global resource over 4.9m oz. For valuation purposes, an 8yr mine life is assume, but If the company can achieve a 33% conversion rate of resources to reserves, this would increase the mine life to 12-13yrs.

|

Category |

Tonnage (Mt) |

Grade Au g/t |

Contained Koz. |

|

2P Reserves |

15 |

2.91 |

1,407 |

|

M&I |

42.7 |

2.18 |

2,732 |

|

Inferred |

8.9 |

2.66 |

766 |

|

Total |

66.6 |

2.4 |

4,905 |

Boungou (Burkina Faso, Producing): This is a relatively new mine, reaching first production in 2018 when it produced 64k oz. Au. So far, it has had one full year of production when it produced 205k oz. Au @ AISC of $497/oz. 2020 production is forecast to be 130-150k oz. Au @ AISC of $680-$725/oz. 2020 production is lower because the mine was placed on care and maintenance in November 2019 and restarted processing stockpiles in February. On average, going forward, over an initial 7-years (based on reserves), production should average 155-175k oz. p.a. at low costs.

Q1 production was just 32k oz. Au as the processed grade decreased as there were no mining activities to supplement the stockpiles and in turn AISC increased due to lower head grades and lower gold sales. It was still low at $550/oz. Production will remained subdued in 2020 and should average 35-40k oz. per quarter as mining isn’t expected to resume until Q4.

The 2019 drill program was focused to the Boungou Nord sector, exploring near surface splays of the Boungou shear zone. Further drilling was completed in the Boungou Nord area to better define existing soil sampling anomalies. The results illustrated the potential four outlining significant resources to enhance the future mine plan. Compilation of results is underway with the objective of isolating potential areas for near surface resource estimate. Like its other cornerstone assets, there is plenty of exploration upside.

|

Category |

Tonnage (Mt) |

Grade Au g/t |

Contained Koz. |

|

2P Reserves |

9.2 |

3.76 |

1,109 |

|

M&I |

4.2 |

4.20 |

590 |

|

Inferred |

1.3 |

2.98 |

126 |

|

Total |

14.7 |

3.96 |

1,825 |

Tier-II Assets:

Agbaou (Cote d’Ivoire, Producing) – At one time, prior to Hounde and Ity (CIL) mine buildouts, Agbaou was Endeavour’s largest and most profitable operation. Coming online in 2015, Agbaou produced >175k oz. Au over the first 3yrs, but production sequentially declined beginning in 2017. Along with lower output came higher costs. In its first 3yrs of operation AISC was $576/oz, $534/oz., and $647/oz. In 2019 it was $796/oz. and is forecast to increase to $940-$990/oz. in 2020. Production is also expected to fall to 115-125k oz. Au. Assuming little resource conversion, Agbaou likely has 2-3yrs of mine life remaining after this year assuming no additional exploration is successful.

Endeavour’s goal at Agbaou is to find 500k-1.5m oz. Au over 5yrs, which could greatly extend the mine life. There are 5 priority targets from the 2017-2018 campaign. These include 1) Agbaou North Pit area at depth, 2) MPN Extension, 3) Agbaou South, 4) Beta Extension, and 5) Mbazo area. The 5-year average discovery cost at Agbaou has been <$25/oz. A $2m exploration program has been planned for 2020 with the aim of continuing to test target located along extensions of known deposits and on parallel trends.

|

Category |

Tonnage |

Grade Au g/t |

Contained Koz. |

|

2P Reserves |

6.3 |

1.58 |

321 |

|

M&I |

1.3 |

2.18 |

519 |

|

Inferred |

0.7 |

1.59 |

37 |

|

Total |

8.3 |

2.06 |

877 |

Karma (Burkina Faso, Producing) – Endeavour obtained this asset through the acquisition of True Gold via acquisition in March 2016. It is a smaller gold operation averaging 95-110k oz. p.a. @ AISC of $850-$1,000/oz. Reserves and resources were re-categorized in 2019, which gives Karma a rather short-mine life based on reserves, but realistically it much longer. The company just needs to convert resources to reserves and this is a long-lived asset. In 2020 mining is expected to continue at the Kao North pit at GG1 throughout the remainder of the year. Processed grades are expected to decrease due to a reduction of Kao North ore stacked as production from GG1 increases during the year. 2020 production and costs are estimated at 100-110k oz. Au @ AISC of $980-$1,050/oz. For 2020 an exploration program up to $2m has been planned for infill drilling and testing extensions of known deposits. Although Karma has over 2.7m oz. Au in total resources and only produces 100k oz. +/- 10k oz. annually, for valuation purposes I will apply a 6yr mine life.

|

Category |

Tonnage |

Grade Au g/t |

Contained Koz. |

|

2P Reserves |

9.2 |

0.99 |

293 |

|

M&I Resources |

43.4 |

1.23 |

1,749 |

|

Inferred |

15.7 |

1.35 |

681 |

|

Total |

68.3 |

1.24 |

2,723 |

Development Projects:

Kalana (Mali, Development) – Endeavour acquired this asset in 2017 through the acquisition of Avnel. The previous owner had already advanced the projects to a feasibility level (FS). Endeavour would have likely fast-tracked the updated and expanded feasibility study much more quickly if Endeavour weren’t concentrated on the Hounde ramp-up followed by the commencement of construction on Ity CIL. At the time, Endeavour didn’t have deep pockets as it does today so it made sense from a financial point of view. While Endeavour hasn’t declared this its next project to be developed, as it awaiting the PEA and the potential at Fetekro. Either of the two highest priority development projects would both increase its geographic diversity, and specifically with Kalana, exposure to Mali. Per the Anvel 2016 feasibility study, at a $1,250/oz. gold price, average annual production would be 101k oz. over 18yrs, with AISC of $730/oz. and for relatively low initial capital investment of $171m. Under these parameters, the NPV5 and IRR is $321m and 50%. In all likelihood, Kalana will be the next mine build.

The gold price is significantly higher, so even based on the old FS, the NPV and IRR would likely be closer $450-$500m and 70-75%. But part of the updated FS and optimization study [to be released in 2H 2020] includes increases the plant size and incorporating the nearby Kalanako deposit, which should allow the asset to produce on average approx. 150-175k oz. p.a., with higher output in the early years. It already has a long initial mine life so exploration isn’t a priority at this time. As mentioned, the Avnel PEA envisions an 18yr mine life based on reserves, but the company also has almost 1.3m oz. of M&I resources

Endeavour will re-design the current feasibility study to increase processing capacity. The Kalana Main deposit is still fully open at depth and a high-grade satellite deposit has been identified in the Kalanako target (currently hosts an indicated resource estimate of 119k oz. Au at 3.34 g/t). This would also shorten the mine life but it will still remain robust at 12yrs barring any exploration success and/or resource conversion.

The previous resource estimate in 2016 by Avnel was updated following a rebuild of the model using a more conservative approach to incorporate tighter model controls for the high-grade nugget effect, stocked vein sets and dilution. Kalana’s land package is quite prospective and like Ity both an updated FS will be published along with an optimization study to include other deposits.

Not much exploration has taken place since the acquisition of Kalana but it already has a sufficient resource base to support more substantive production. In 2019, a $2m drilling campaign of 20.5k meters, was conducted on targets located nearby the main deposit, which is currently be analyzed. In May 2020, an exploration budget of up to $2m has been planned to follow-up on nearby targets once the 2019 have been properly analyzed.

Through its exploration efforts, Endeavour discovered the Kalanako deposit. Rather limited exploration has taken place with 13,304m drilled at Kalanako, and this isn’t due to it not being a high-priority target, rather Endeavour has been focused over the last 3-4yrs on completing two milestone buildouts for its two largest assets, Hounde and Ity CIL, and the recent acquisition of SEMAFO. Only part of the Kalanako deposit is on its property but there are several licenses under negotiation with private owners. Over the last 4yrs, Endeavour has been in a period of heavy capital investment, which is now over and it will begin generating tremendous free cash flow.

Fetekro (Cote d’Ivoire, Development/Exploration): Endeavour’s most advanced greenfield project, was generated organically. While minimal drilling has taken place, a relatively robust maiden resource estimate was published in late 2018 based on only 32k meters. Since then nearly 35k meters were drilled, growing the indicated resource by 141% to 1.2m oz. The discovery cost per ounce is very low at $9/oz. Like most of its operations, Fetekro is amenable to open-pit mining as mineralization starts at surface. Early metallurgical tests have also been encouraging with recovery rates in excess of 95%, a large portion of which recoverable by gravity.

There should be some more great news released over the course of the year, including an exploration program of $6m for 2020, $3m of which was incurred in Q1 2020. The program mainly focused on the Lafigue deposit and initial drilling on the Iguela target. In mid-2020, an updated Lafigue resource estimate will be published and given the updated resource increase, the PEA study will be revised to include the larger resource base before publishing.

The Lafigue deposit clearly remains open in various directions. High-grade mineralization was intercepted outside the current resource boundary at hole FRCDD-19 and 200m away at hole LFRC19-666, suggesting the mineralized areas could be significantly larger. High-grade mineralization was also intercepted with step-out drilling at both Lafigue North and Center. Further drilling is needed.

|

Category |

Tonnage (Mt) |

Grade |

Contained [Koz.] |

|

Reserves |

- |

- |

- |

|

M&I Resource |

14.6 |

2.54 |

1,190 |

|

Inferred |

0.9 |

2.17 |

60 |

|

Total |

15.5 |

2.52 |

1,250 |

Bantou (Burkina Faso, Exploration): Obtained through the SEMAFO acquisition, it is located on the Hounde Greenstone belt. It currently consists with diverse mineralization styles and grades. The inferred resource is comprised of three main areas with the majority of tons and ounces centered around the Bantou and Bantou Nord Zones. The Bantou Nord Zone was discovered in 2019 at totals 1.1m oz. of pit constrained inferred resources with a pit-shell strip ratio of 1:1 and located 1.5km north of the Bantou Zone. In 2019 a total 96.7k meters were drilled at Bantou. Bantou Nord alone accounted for 15k meters which was part of an effort to rapidly outline the extent of the mineralized zone and allow for a preliminary resource calculated. For 2020, a budget of $4m has been allocated to test prospective areas outside of the existing resources with the aim of achieving a resource goal of 2.5-3m oz. by year end 2020.

|

Category |

Tonnage (Mt) |

Grade |

Contained [Koz.] |

|

Inferred |

51.1 |

1.37 |

2,245 |

The company also has some greenfield projects that might be meaningful going forward. Nabanga has a resource of 841k oz. @ 7.69 g/t Au. This was part of the SEMAFO acquisition, which released a PEA in late 2019. Per the study, the LOM gold production is 571k oz. Au @ AISC of $760/oz. and 92% recovery rates during the 8yrs of operations. Initial capital investment is low at $84m. Using a $1,300/oz. gold price, the NPV5 is $100m with an IRR of 22.6%. Of course, these numbers are considerably higher in today’s gold price environment. Mining would be both open-pit and underground. There are opportunities to improve returns through an increase in resources and cost saving measures.

There is also the JV with Barrick on Sissedougou / Mankono. This project has the potential to be rather sizeable because Barrick is now too large to spend money on a project that could only produce 200-250k annually, especially through a JV agreement. Some drill highlights include 34.6m @ 2.08 g/t Au, 18.8m @ 2.30 g/t Au, and 23m @ 2.14 g/t. There are also the its exploration assets in Guinea, the Endeavour Siguiri property. Lastly, aside from numerous additional exploration targets is the Kofi area, which is on the same trend as the massive Loulo-Gounkoto mine and exploration license of Kofi wasn’t sold in Tabakoto sales process. The goal is to attain additional license around Kofi North/Netekoto.

Valuation:

The assumed mine life at Hounde and Ity are each 9.5yrs, though Hounde and Ity is likely to be longer given the prospective land packages. Production of 240-250k oz. Au at Hounde and Ity isn’t assumed to be 10yrs, which is Endeavour’s objective, rather production begins to slowly tail-off after 3.5yrs. Ity could very well increase average annual output beyond 250k oz., which we will see via an updated life of mine plan, which will include Le Plaque, and the 25% expansion from 4mtpa to 5mtpa.

There is no assumed mine life at any other asset that includes any conversion of resource or exploration success except for Karma. It has a large resource base of just over 2.7m oz. Au but we will assume a 6yr mine life vs. 3yrs based solely on reserves. This assumes M&I conversion rates of just 10-15%. With regard to Kalana, we assume the feasibility levels outlined by Avnel vs. what will be assuredly be a much more valuable project which will be released later this year. As mentioned, it is under-going two studies, one of which will increase the plant size and increase average annual output by an estimate 50%, with the second an optimization study which could look at an even larger plant and/or the incorporation of nearby deposits such as Kalanako.

At Fetekro, M&I resources are valued at $40/oz. and Inferred of $20/oz. Bantou, which has inferred resources of 2.245m oz. Au is valued at $20/oz. [valued at just under $45m]. A PEA has been published for Nabanga at much lower gold prices but we applied the NPV6.5 of $100m. Other expenses, such as greenfield exploration and G&A off balance sheet total $131.50m. It is important to note that Endeavour has been very successful with the drill bit and extending the life of operations. It is in the best position to continue to this given its dominant land position and large number of exploration targets. A 1.40x NAV multiple is appropriate and still on the conservative side, especially in a bull market. Endeavour isn’t trading at a deep discount as it has a few times over the last 3yrs but today’s current price represents a fair value proposition.

|

NAV: $1,750/oz. Au @ 6.50% |

||

|

Asset |

NAV |

1.40x NAV |

|

Hounde (90%) |

$1,118,747,452 |

$1,566,246,432 |

|

Ity [CIL] (85%) |

$1,184,257,327 |

$1,657,960,258 |

|

Mana (90%) |

$608,768,970 |

$852,276,558 |

|

Boungou (90%) |

$593,685,817 |

$831,160,144 |

|

Karma (90%) |

$288,593,929 |

$404,031,501 |

|

Agbaou (85%) |

$129,219,505 |

$180,907,307 |

|

Kalana (80%) |

$451,951,457 |

$632,732,040 |

|

Fetekro |

$48,800,000 |

$68,320,000 |

|

Bantou |

$44,900,000 |

$62,860,000 |

|

Nabanga |

$100,000,000 |

$140,000,000 |

|

Cash |

$452,000,000 |

$452,000,000 |

|

Other Expenses |

($131,501,564) |

($131,501,564) |

|

Debt |

($814,000,000) |

($814,000,000) |

|

Shares Out |

$163,077,115 |

$163,077,115 |

|

Total |

$4,075,422,894 |

$5,902,992,677 |

|

VPS |

$24.99 |

$36.20 |

|

NAV Sensitivity: Changes in the Gold Price & Discount Rate |

||||

|

$24.99 |

5.0% |

6.0% |

6.5% |

7.0% |

|

$1,400 |

$16.30 |

$15.56 |

$15.21 |

$14.88 |

|

$1,550 |

$20.75 |

$19.84 |

$19.40 |

$18.99 |

|

$1,700 |

$25.20 |

$24.11 |

$23.59 |

$23.10 |

|

$1,850 |

$29.65 |

$28.38 |

$27.78 |

$27.21 |

|

$2,000 |

$34.11 |

$32.66 |

$31.98 |

$31.32 |

|

$2,150 |

$38.56 |

$36.93 |

$36.17 |

$35.43 |

|

$2,300 |

$43.01 |

$41.21 |

$40.36 |

$39.54 |

|

1.40x NAV Sensitivity: Changes in the Gold Price & Discount Rate |

||||

|

$36.20 |

5.0% |

6.0% |

6.5% |

7.0% |

|

$1,400 |

$24.03 |

$23.00 |

$22.51 |

$22.04 |

|

$1,550 |

$30.26 |

$28.98 |

$28.38 |

$27.79 |

|

$1,700 |

$36.49 |

$34.96 |

$34.24 |

$33.55 |

|

$1,850 |

$42.72 |

$40.95 |

$40.11 |

$39.30 |

|

$2,000 |

$48.96 |

$46.93 |

$45.98 |

$45.05 |

|

$2,150 |

$55.19 |

$52.92 |

$51.84 |

$50.81 |

|

$2,300 |

$61.42 |

$58.90 |

$57.71 |

$56.56 |

There are no other 1m+ oz. producers trading at Net Asset Value, which is cheap for a senior producer in a bull market but Endeavour is trading right around that level at $1,750/oz. Au. On a P/CF basis, it’s trading well below its peer group which is trading at 8-11x 2021 CF. Endeavour meanwhile is trading just over 5.2x.

[1] SNL Metals & Mining