After experiencing a small build of inventory over the past few months, silver warehouse stocks at the Shanghai Futures Exchange are now back on the decline. Matter-a-fact, Shanghai Future Exchange (SHFE) silver stocks fell 11 metric tons today, nearly 10% in just one day.

Silver warehouse stocks at the SHFE bottomed in September at 81 metric tons (mt), and then slowly increased to a peak in November….. this can be seen in the chart below:

By the end of October, silver warehouse inventories at the SHFE increased to 120 mt and then peaked on November 11th at 138 mt. In just the past two weeks, 20 mt were removed from the exchange. The chart below shows the weekly change of silver inventory at the SHFE over the past two months:

(NOTE: There is no Oct 3rd inventory figure as the Chinese markets were closed due to the week-long holiday)

On October 10th, the SHFE had 95 mt of silver on hand. Inventories increased slowly over the next five weeks until there was a significant one-day build of 14 mt on November 11th, reaching a high of 138 mt. Then in the past two weeks there were several small withdrawals until today.

As I mentioned before, there was a large 11 mt withdrawal today bringing the total down to 108 mt. While this is higher than the all-time low of 81 mt in September, it seems as if the overall trend has now reversed leading to a continued decline of silver inventory at the SHFE.

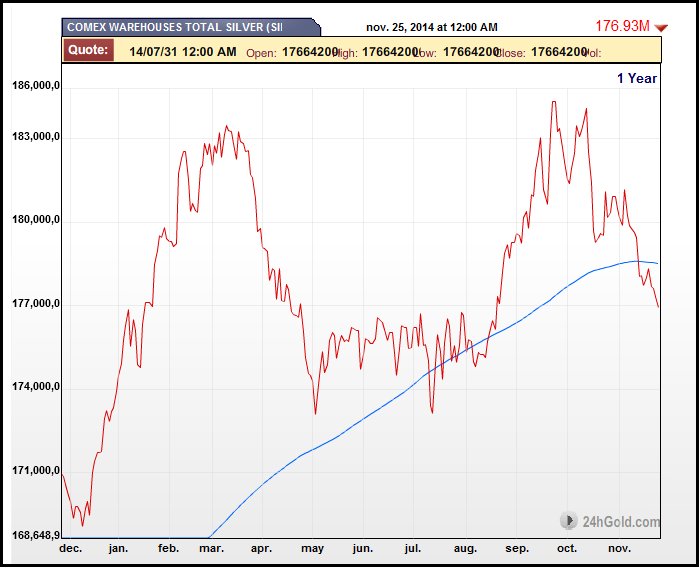

If we compare the first chart showing the 2013 & 2014 Shanghai Silver Stocks to the 1 year COMEX silver inventories, there are some interesting relationships. You will notice that silver inventories increased from the beginning of the year in 2014 on both exchanges.

The COMEX silver warehouse stocks increased from approximately 170 million oz in January 2014 to 183 million in March. The SHFE experienced a build during the same time rising from 425 mt at the end of 2013 to a high of 575 mt in February 2014.

Furthermore, warehouse stocks on both exchanges declined into the summer. The COMEX bottomed earlier in August at 175 million oz, while the SHFE continued to experience a draw-down until it hit a low of 81 mt in September. Then both exchanges saw their silver warehouse stocks increase over the next few months. However, the COMEX peaked in the middle of October, while the SHFE did so a month later on Nov 11th.

We must remember, the Shanghai Futures Exchange is more of a physical delivery system while the COMEX is more of a paper price setting (RIGGING) mechanism. This is probably why the SHFE has experienced a 95% reduction of its silver inventory since its peak of 1,143 mt March 2013… RIGHT BEFORE THE HUGE TAKE-DOWN IN THE PRICE OF SILVER.

Important Implications In the Silver Market

In my prior article titled, BREAKING: Significant Drawdown Of U.K. Silver Inventories Due To Record Indian Demand, it was reported by GFMS, one of the official sources on the silver market, that massive Indian demand caused a serious decline in U.K. silver inventories:

Meanwhile demand for silver bars and coins has soared in recent weeks as bargain hunting retail investors returned to the silver market after a disappointing first half of the year. Nowhere is this more evident than in India where imports of silver are up by 14% year-on-year for the January to October period and set for an annual record. With imports in the first ten months totalling a massive 169 Moz many vaults in the UK, traditionally the largest supplier to India, have seen significant drawdowns, leading to more supply flowing from China and Russia.

Basically, GFMS stated that the “massive” Indian silver demand caused a large draw-down of U.K. silver inventories this year forcing India to acquire silver from Russia and China. I would imagine the decline of Shanghai silver stocks after the peak of 575 mt in February of this year was due in a large part from Indian demand.

So what does this all mean? Huge demand for silver started after the April 2013 paper price smash resulting in a 95% reduction of warehouse stocks at the Shanghai Futures Exchange. Also, this continued into 2014 as the U.K. (known as the global hub for physical silver delivery), experienced a draw-down of silver inventories as well.

While the COMEX has seen a decline over the past month or so, overall silver inventory is higher than it was at the beginning of 2014. Which also proves that the COMEX is more of a paper price setting exchange than either the LBMA or SHFE.

It will be interesting to see how developments play out over the next several months and into the first quarter of 2015. If the U.K. and SHFE silver inventories have already been draw-down significantly… where is supply going to come from if we see continued strong demand or how about a LARGE PLAYERS requesting actual delivery from the COMEX.

The continued draw-down of silver inventories in China and the U.K. may have something to do with the SET-UP in this chart. This chart was put together by Bo Polny of Gold2020Forecast.com, who I spoke on the phone yesterday on some of the details.

I do not follow Technical Analysis as it’s become worthless in a rigged market, however professional traders still use it as a tool for setting up positions in the market. According to Bo, the Silver Chart represents the Mother of a Descending Triangles. Normally a descending triangle that is forming a bottom results in a huge reversal and SPIKE HIGHER.

You will also notice in the chart the MASSIVE increase in trading volume. At first it was assumed that all the volume (on netdania.com) was 5,000 oz contracts, but this is not the case. The SHFE has 15 kilogram silver contracts and the SGE – Shanghai Gold Exchange has 1 kilogram silver contracts. The SHFE is approximately 482 troy ounces and the SGE is 32 troy ounces. So, the 1 trillion ounce silver trading volume is much less, but still OFF THE CHARTS prior to 2011.

Furthermore, trading volume on the SHFE has now surpassed the COMEX. This part of the reason why overall trading volume has increased nearly exponentially since 2011. As we can see from the chart, trading volume during the $49 silver price peak and decline in 2011 did not increase all that much… basically it was a flat line until the middle of 2012.

While it’s impossible to figure the actual silver trading volume in ounces (due to the different sized contracts around the world), we can plainly see PAPER TRADING has picked up substantially during the TAKE-DOWNS in early 2013 and Oct-Nov 2014.

Lastly… yeah I get it. We are all wondering why the price of silver continues to decline if inventories are falling in the major silver delivery markets such as China and the U.K. Unfortunately, we don’t really understand what is taking place in the silver market as the majority of trading takes place in the opaque OTC- Over-the-counter derivatives market.

That being said, at some point in time the world will wake up to the fact that the U.S. Dollar and highly inflated Stocks and Bonds are not stores of wealth, but rather a massive leveraged paper ponzi scheme. Ironically, this public realization will probably occur right at the same time when the silver inventories at these exchanges are nearly depleted.

Got silver?

Please check back for new updates and articles at the SRSrocco Report.