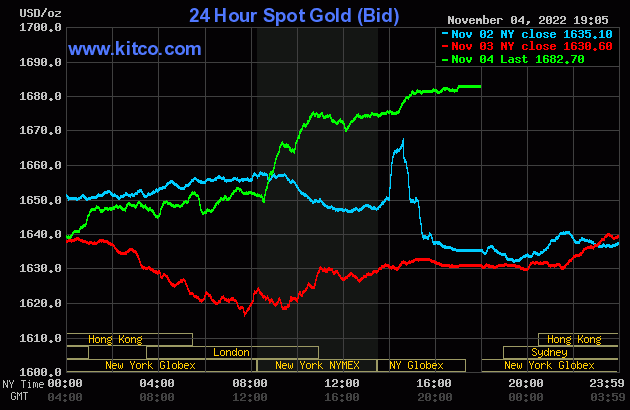

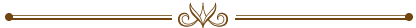

The gold price didn't do much of anything until around 9:30 a.m. China Standard Time in GLOBEX trading on their Friday morning. At that point it began to head higher at a decent clip, although that rate of ascent moderated considerably starting around 1 p.m. CST -- and it continued to chop very quietly higher until about a minute after the non-farm payroll number hit the tape. It began to head sharply higher from there -- and appeared to run into some 'resistance' along the way. It continued to power a bit higher in after-hours trading as well -- and finished on its high tick of the day.

The low and high ticks in gold were reported as $1,631.10 and $1,686.40 in the December contract. The December/February price spread differential in gold at the close in New York yesterday was $14.00...February/April was $15.10 -- and April/June was $15.00 an ounce.

Gold finished the Friday trading session at $1,682.70 spot, up $52.10 on the day. Net volume was extremely heavy at a bit under 270,000 contracts -- and there was a bit over 25,000 contracts worth of roll-over/switch volume on top of that...mostly into February, but with a bit in to April and June as well.

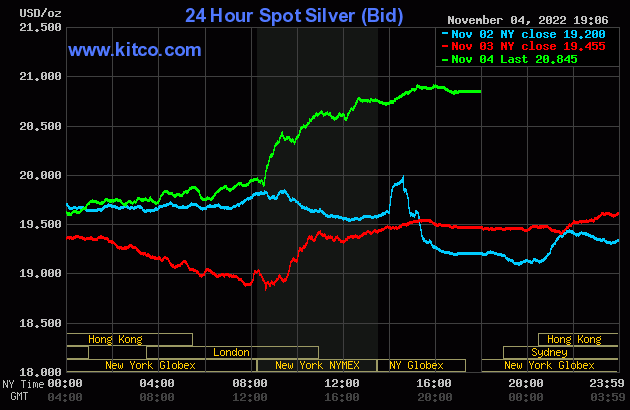

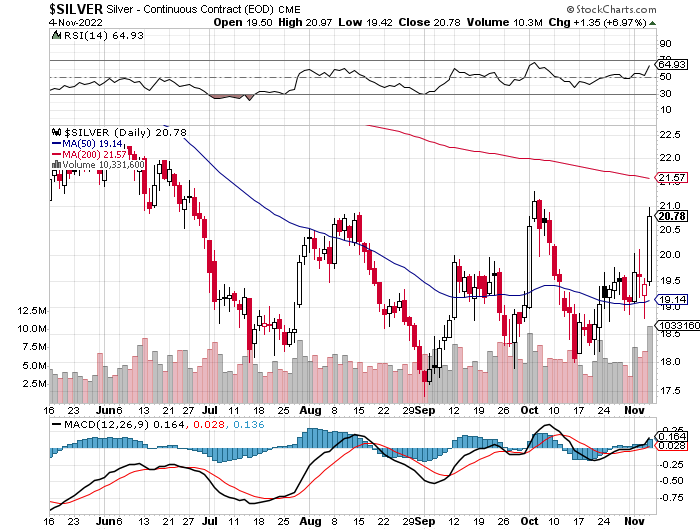

Silver's price path on Friday was mostly similar to gold's, although it was closed off its high tick of the day by about 7 cents the ounce.

The low and high ticks in it were recorded by the CME Group as $19.425 and $20.965 in the December contract. The December/March price spread differential in silver at the close on Friday was only 11.6 cents, a big drop from Thursday...March/May was 9.8 cents -- and May/July was 12.9 cents an ounce.

Silver was closed on Friday afternoon in New York at $20.845 spot, up $1.39 from Thursday. Net volume was pretty monstrous at a hair under 104,000 contracts -- and there was 10,200 contracts worth of roll-over/switch volume in this precious metal...mostly into March.

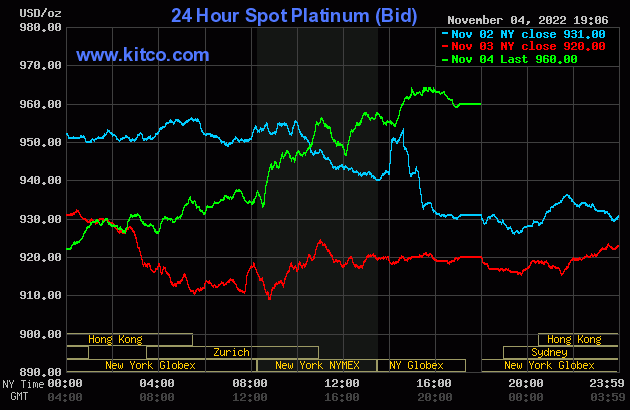

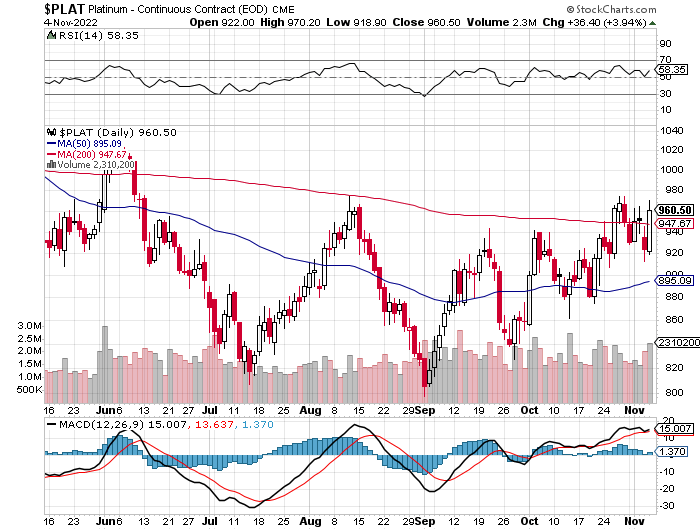

Platinum's price path was very similar to both silver and gold's...but a lot more uneven, as it looked like there was some 'resistance' to its rally as well, especially during the COMEX trading session. It was closed at $960 spot, up 40 bucks on the day.

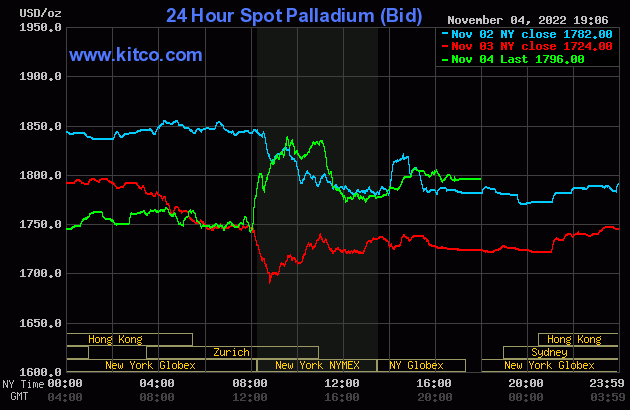

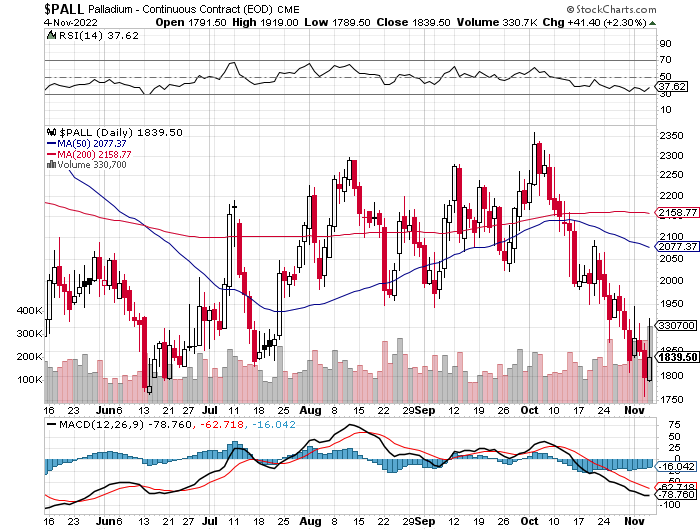

The palladium price crept quietly and a bit unevenly higher until around 10:20 a.m. CEST in GLOBEX trading in Zurich. From there it was sold quietly lower until 2 p.m. CEST/8 a.m. in New York. Away it went to the upside from there, but was obviously capped around 9:35 a.m. EDT in COMEX trading. Once Zurich closed at 11 a.m. EDT, it was sold lower until noon EDT -- and from that juncture it crawled quietly higher until 3 p.m. in the very thinly-traded after-hours market. It was sold a few dollars lower from there until trading ended at 5:00 p.m. EDT. Palladium was closed at $1,796 spot, up 72 dollars on the day -- and 53 bucks off its Kitco-recorded high tick.

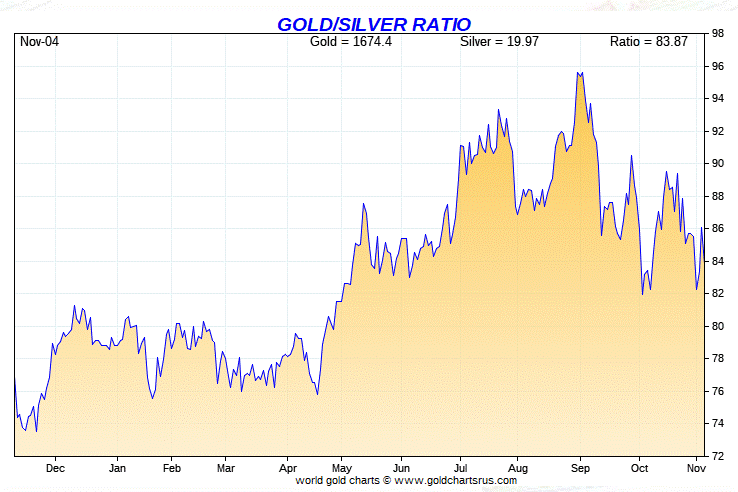

Based on the kitco.com spot closing prices in silver and gold posted above, the gold/silver ratio worked out to 80.7 to 1 on Friday...compared to 83.8 to 1 on Thursday.

And here's Nick Laird's 1-year Gold/Silver Ratio Chart, updated with this past week's data and, as always, the Friday data point of 80.7 to 1 is not on it. Click to enlarge.

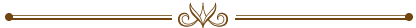

The dollar index closed very late on Thursday afternoon in New York at 112.93 -- and then opened higher by 4 basis points once trading commenced at 7:45 p.m. EDT on Thursday evening, which was 7:45 a.m. China Standard Time on their Friday morning. From that juncture it crawled quietly lower until around 12:55 p.m. in London. It rallied a bit from there until the non-farm payroll numbers hit the tape at 8:30 a.m. in Washington. It took two big steps lower from there until around 10:26 a.m. EDT -- and then rallied a bit starting around 10:50 a.m. That rally ended a few minutes after 12 o'clock noon EDT -- and it then headed quietly lower until 3:45 p.m. It didn't do a thing after that.

The dollar index finished the Friday trading session in New York at 110.79...down 214 basis points on the day -- and the biggest one-day move in the DXY in either direction that I can remember, which is hardly fitting for the world's reserve currency.

Here's the DXY chart for Friday, thanks to marketwatch.com once again. Click to enlarge.

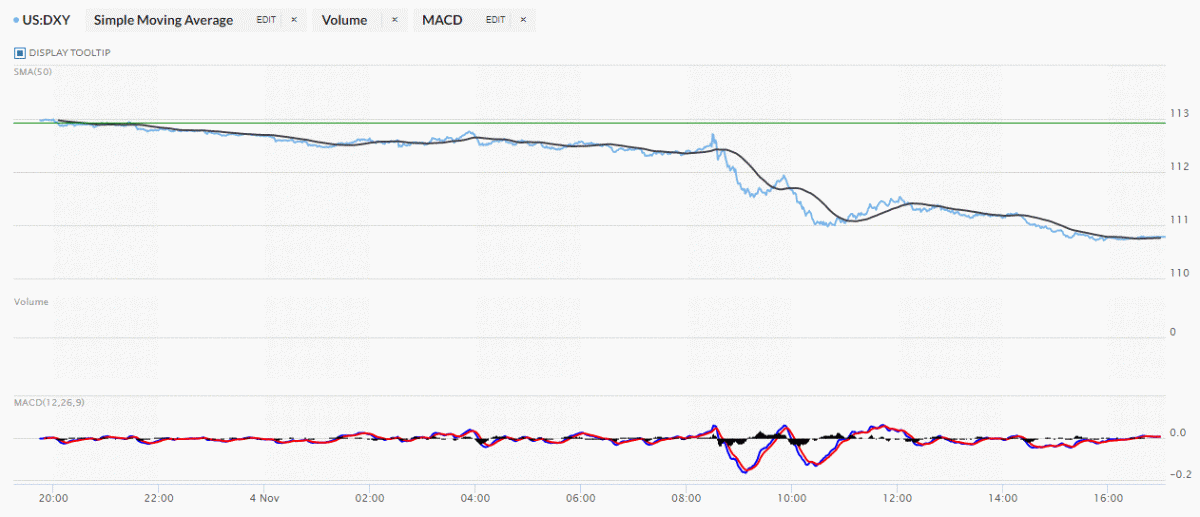

And here's the 5-year U.S. dollar index chart that appears in this spot in every Saturday column...courtesy of stockcharts.com as always. The delta between its close...110.77...and the close on the DXY chart above, was about 2 basis points below its indicated spot close on Friday. Click to enlarge.

For once, there was a direct correlation between what was happening in the currencies -- and what was going on in the prices of both silver and gold.

U.S. 10-year Treasury: 4.1560%...up 0.0320 (+0.78%)...as of 02:59 p.m. EDT. It was up 8.5 basis points at its high of the day, which was set at 8:40 a.m. EDT in New York.

Here's the 5-year 10-year U.S. Treasury chart from the yahoo.com Internet site -- and it puts the yield curve into a somewhat longer-term perspective. Click to enlarge.

And as I stated in this space last Saturday...it's too soon to tell whether the Fed is about to go full Japanese...or they're just supporting the treasury market until after the mid-term elections, now only a few days away. We'll find out soon enough, I suspect.

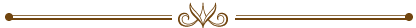

Not surprisingly, the gold shares gapped up over five percent at the 9:30 opens in New York on Friday morning -- and from that point they wandered quietly higher until the market closed at 4:00 p.m. EDT. The HUI closed on its absolute high tick of the day...up 10.32 percent -- and the biggest one-day move I can remember.

Computed manually, Nick Laird's Intraday Silver Sentiment/Silver 7 Index closed up only 8.67 percent -- and for a reason that I'll get into a bit further down.

Once again Peñoles wasn't included in the above calculation, as it didn't trade yesterday, which I found surprising...so the index was computed based on the six silver mining companies that did.

Here's Nick's 1-year Silver Sentiment/Silver 7 Index chart, updated with Friday's candle -- which was dragged down further by the fact that Peñoles didn't trade yesterday.

Except for Pan American Silver, virtually all of the Silver 7 shares closed up double-digits on the day...so they were all stars.

Pan American Silver, along with Agnico Eagle Mines, made a take-over bid for Yamana Gold yesterday -- and their shares suffered as a result of that. At one point during the Friday trading session, PAAS was down 10 percent, but in the last two hours of trading, it cut its losses on the day down to only 1.97 percent.

There's a Reuters story about this that I found in a GATA dispatch -- and it's headlined "Gold Fields target Yamana catches eyes of Agnico Eagle, Pan American" -- and linked here.

The latest silver eye candy from the reddit.com/Wallstreetsilver crowd is linked here.

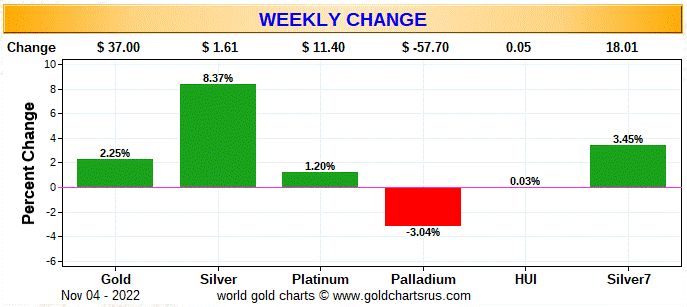

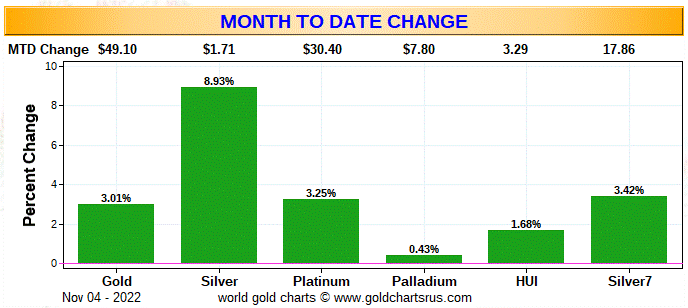

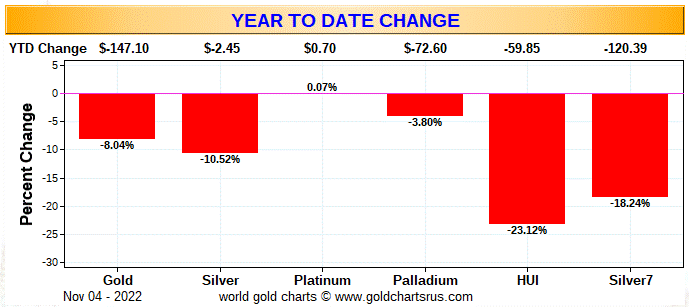

Here are the three usual three charts that show up in every weekend missive. They show the changes in gold, silver, platinum and palladium in both percent and dollar and cents terms, as of their Friday closes in New York — along with the changes in the HUI and the Silver 7 Index.

Here's the weekly chart -- and with the exception of palladium once again, it's wall-to-wall green for the second week in a row...albeit the HUI by only a hair. The equities continue to vastly underperform their respective underlying precious metals.

Here's the month-to-date chart, which doesn't include Monday's data, because that was October 31 -- and it looks a little better than the weekly chart above, but continues to show how badly the precious metal equities are underperforming. That will change at some point. Click to enlarge.

Here's the year-to-date chart -- and only platinum is up a hair. Here, as has been the case for most of the year, the silver equities continue to 'outperform' on both a relative and absolute basis -- and will continue to do so if these budding rallies are allowed to run free to the upside. Click to enlarge.

And although I beat this to death every Saturday, what happens going forward continues to be in the hands of the Big 4/8 commercial shorts...mostly the Big 4 now, as they alone...as you know all too well...either directly or indirectly control the prices of everything precious metals-related...until they don't. And whether yesterday was the first sign that they were losing their grip...or giving it up...remains to be seen. I doubt very much that we'll have long to wait to find out.

The CME Daily Delivery Report for Day 6 of November deliveries showed that 305 gold -- and 7 silver contracts were posted for delivery within the COMEX-approved depositories on Tuesday.

In gold, the three short/issuers were JPMorgan, Advantage and Marex Spectron, as they issued 280, 20 and 5 contract out of their respective client accounts. The four largest long/stoppers started off with Citigroup, as they picked up 151 contracts in total...136 for their house account -- and the other 15 for clients. Next was JPMorgan, as they stopped 83 contracts for their client account...followed by Canada's BMO Capital, as they picked up 24 contracts for their own account. The last of the big four was Advantage, as they stopped 20 contracts for clients. And the list goes on and on...

In silver, the two short/issuers were Canada's Scotia Capital/Scotiabank, as they issued 5 contracts out of their house account...they never had a client account. The remaining 2 contracts came courtesy of Morgan Stanley's client account. The two long/stoppers were ADM and Citigroup, as they picked up 6 and 1 contracts for their respective client accounts.

The link to yesterday's Issuers and Stoppers Report is here.

So far in November, a non-scheduled delivery month, there have been an astonishing 4,858 gold contracts issued/reissued and stopped already -- and in silver, that number is only 161 contracts. There have been zero contracts issued and stopped in both platinum and palladium so far this month.

The CME Preliminary Report for the Friday trading session showed that gold open interest in November fell by 654 COMEX contracts, leaving 1,937 still around, minus the 305 contracts mentioned a bunch of paragraphs ago. Thursday's Daily Delivery Report showed that 686 silver contracts were actually posted for delivery on Monday, so that means that 686-654=32 more gold contracts were added to November deliveries. Silver o.i. in November increased by 16 COMEX contracts, leaving 123 still open, minus the 7 contracts mentioned a bunch of paragraphs ago. Thursday's Daily Delivery Report showed that zero silver contracts were posted for delivery on Monday, so that means that 16 more silver contracts just got added to November deliveries.

Total gold open interest at the close on Friday actually fell by 7,977 COMEX contracts. What! I was expecting it to blow out big time -- and total silver o.i. dropped as well, it by 387 contracts. It looks like there was some decent short covering going on yesterday -- and one has to wonder whether the big commercial shorts were buying longs directly from the raptors. That's over my pay grade -- but is one of Ted's pet theories, so I'll leave it to him -- and I have more about this in The Wrap. Both numbers are subject to some revision by the time the final figures are posted on the CME's website later on Monday morning CDT.

There was another fairly heft withdrawal from GLD yesterday, as an authorized participant removed 148,953 troy ounces of gold. There were no reported changes in SLV.

After yesterday's big rallies in both silver and gold, it will take a day or two for that to be reflected as deposits in either of the above ETFs.

In other gold and silver ETFs and mutual funds on Planet Earth on Friday, net of any changes in COMEX, GLD, and SLV inventories, there was a net 112,075 troy ounces of gold removed -- but a net 788,698 troy ounces of silver was added...thanks to the 999,809 troy ounces that was deposited in Sprott's PSLV yesterday.

There was no sales report from the U.S. Mint yesterday -- and nothing month-to-date.

There was a bit of activity in gold over at the COMEX-approved depositories on the U.S. east coast on Friday. Nothing was reported received -- and only 66,752 troy ounces was shipped out.

The largest 'out' amount was the 32,247.460 troy ounces/1,003 kilobars that left Brink's, Inc. That was followed by the 24,641 troy ounces that was shipped out of Manfra, Tordella & Brookes, Inc. The remaining 9,863 troy ounces departed Delaware.

There was very decent paper activity, as 102,431 troy ounces was transferred -- and every troy ounce made that trip from the Registered category and back into Eligible. The largest amount was the 37,275 troy ounces that made that trip over at Manfra, Tordella & Brookes, Inc...followed by the 35,108.892 troy ounces/1,092 kilobars that was transferred in that same direction over at Loomis International. The remaining 17,747.352 troy ounces/552 kilobars and 12,298 troy ounces were transferred in that direction over at Brink's, Inc. and JPMorgan respectively.

The link to all of Thursday's COMEX activity in gold, is here.

There was pretty big activity in silver, as 1,200,528 troy ounces was reported received, but only 24,172 troy ounces was shipped out.

In the 'in' category, the biggest truckload was the 600,801 troy ounces that arrived at HSBC USA...followed by the second truckload...599,726 troy ounces...that was dropped off at Loomis International.

In the 'out' category, there was 20,222 and 3,950 troy ounces that left CNT and Brink's, Inc. respectively.

There was no paper activity -- and the link to all the COMEX action in silver on Thursday is here.

There wasn't much activity over at the COMEX-approved gold kilobar depositories in Hong Kong on their Thursday. They reported receiving 417 kilobars -- and shipped out 58 of them. Except for the 20 kilobars that were dropped off at Loomis International, the remaining in/out activity was at Brink's, Inc. as always. The link to that, in troy ounces, is here.

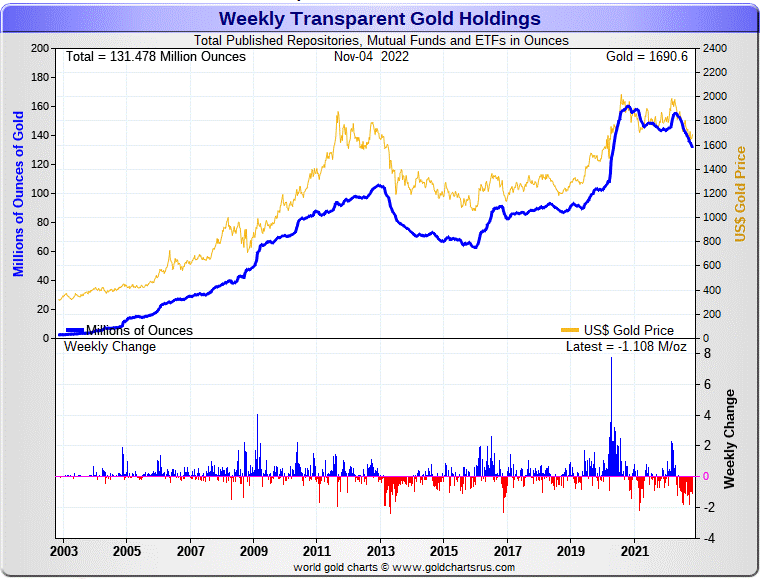

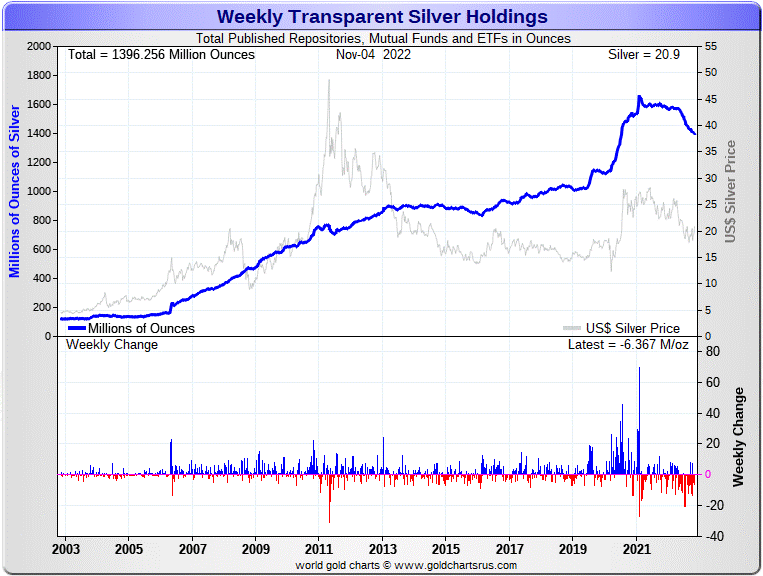

Here are the usual 20-year charts that show up in this space in every Saturday column. They show the total amount of physical gold and silver held in all know depositories, ETFs and mutual funds as of the close of business on Friday.

During the week just past, there was a net 1,108,000 troy ounces of gold removed -- and a net 6,367,000 troy ounces of silver was taken out as well.

Here are Nick's two charts showing the above changes. Click to enlarge for both.

According to Nick Laird's data on his website, there has been a net 3.844 million troy ounces of gold -- and a net 11.763 million troy ounces of silver removed from all the world's known depositories, mutual funds and ETFs during the last four weeks.

In silver...11.561 million troy ounces net came out of the COMEX, mostly JPMorgan -- and a net 0.517 million troy ounces was removed from SLV. Lastly was the net 0.315 million troy ounce that was added to the rest of the world's ETFs and mutual funds combined over that time period.

The lion's share of the in/out activity in the ROW ETFs was represented by the 2.370 million troy ounces taken out of SIVR, balanced out by the 3.202 million troy ounces that has been added into Sprott over that same time period.

In gold over the last month, the withdrawals were mostly JPMorgan-related at the COMEX...1.390 million troy ounces. GLD/GLDM accounted for 1.141 million troy ounces -- and the rest...1.313 million troy ounces, from the other ETFs and mutual funds.

The physical shortage in silver appears to be even more extreme this week than it was last week -- and shows no signs whatsoever of abating.

And one has to wonder just how much of these silver withdrawals we've witnessed these past weeks and months are industrial user-related...or conversion of shares for physical metal. It certainly appears that a lot of these conversions of shares for physical are heading overseas to India and China... especially the former, as the whisper number for September is 1,702 metric tonnes/54.72 million ounces.

The official import data for India should become available sometime during the coming week -- and you'll be the first to know when it does.

Then there's the amount of silver that has been transferred from the Registered category and back into Eligible that's been going on for many months now -- and has picked up a bit this past week. What is to be made of that?...or the continuing decline in silver holdings at the LBMA. All of this data points to extreme physical demand at the wholesale level.

And yet the silver price hasn't been allowed to reflect that...although yesterday may have been the start.

Retail silver demand continues at an enormous rate, as silver investors are buying this dip with more than the usual amount of enthusiasm -- and there are shortages at the retail level just about everywhere now. As Ted correctly pointed out, the average retail investor over at Wallstreetsilver has lost their fear of what the big shorts are doing. The group-think over there is amazing.

Their big silver raid started today, on the anniversary of Guy Fawkes day in England -- and you should be cheering them on -- and participating if possible.

From what I've seen from the various precious metal websites I lurk at, the growing shortage of all kinds of retail product continues. Most dealers are running close to empty on most coin and small bar sizes, according to those posting over at the Wallstreetsilver website -- and the e-mails I've had replies to from the contacts I still have in the retail business.

But the real shortage that will matter will manifest itself in the wholesale good delivery bar market when the serious money starts flowing into the world's various and sundry depositories, ETFs and mutual funds...especially SLV, SIVR and Sprott...when the next big rally is allowed to begin, which was yesterday, hopefully. When that happens, where on earth are all those tens/hundreds of millions of ounces of silver to satisfy that demand going to come from? Just asking.

Of course not to be forgotten about SLV is this not so little matter of the 51+ million troy ounces/shares currently sold short in this ETF. That's up a couple of million ounces from the previous short report. The reason that number remains stubbornly high is certainly because the physical metal doesn't exist to deposit without driving the silver price to the moon...if it's even available in good delivery bar form at all, that is.

The next short report comes out on Wednesday, November 9 -- and I'll be more than interested in what's in it, as will Ted.

Then there's still that other little matter of the 1-billion ounce short position held by Bank of America...with JPMorgan & Friends on the long side...that Ted cottoned on to some time ago.

And in closing here, I'll mention as I do every week, that it's a certainty that all of the precious metals in these funds are held by the strongest of hands -- and it's equally certain that this applies to every troy ounce that has been withdrawn or converted from them as well.

This just in from Nick Laird: The withdrawals from the Shanghai Gold Exchange for October showed that 98.483 tonnes/3.17 million troy ounces of gold was taken out, plus 246.825 tonnes/7.94 million troy ounces of silver was withdrawn as well. Charts in Tuesday's column.

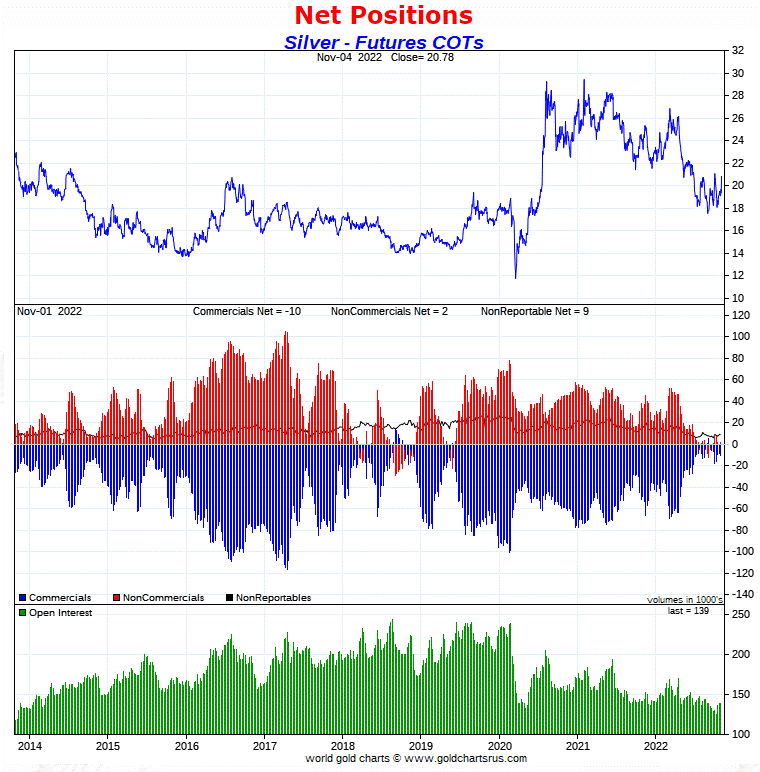

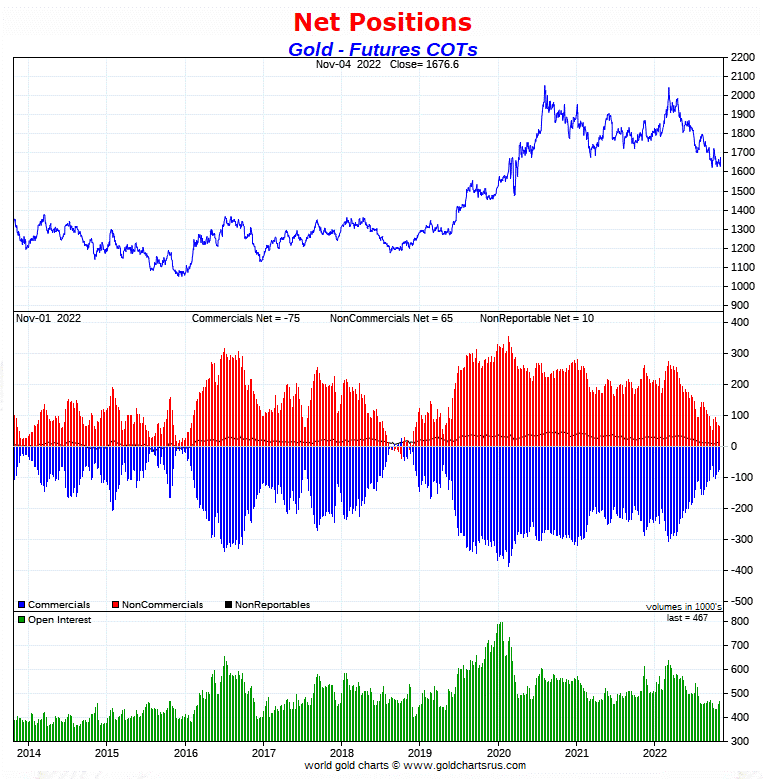

The Commitment of Traders Report, for positions held at the close of COMEX trading on Tuesday came in about as expected, with a decrease in the commercial net short position in gold -- and smallish increase in the Commercial net short position in silver.

In silver, the Commercial net short position rose, but only by 1,506 COMEX contracts...7.53 million troy ounces. It could have been far worse.

They arrived at that number by decreasing their long position by 1,150 contracts -- and also added 356 short contracts. It's the sum of those two numbers that represents their change for the reporting week.

Under the hood in the Disaggregated COT Report, the changes were pretty tiny as well. The Managed Money traders did all the buying, as the decreased their net short position by 2,283 COMEX contracts -- and the Other Reportables and Nonreportable/small traders were sellers of small amounts of contracts, as the former reduced their net long position by 658 contracts -- and the latter by 119 contracts.

Doing the math: 2,283 minus 658 minus 119 equals 1,506 COMEX contracts, the change in the Commercial net short position.

Don't forget that the commercial traders can only buy what these non-commercial and small traders are prepared to sell, which wasn't much this week. There may have been huge changes on each day of the reporting week, but it all netted out to what you see here.

Before proceeding further, I'll point out that the Managed Money traders were net short short 7,718 COMEX contracts in last Friday's COT Report -- and in yesterday's report they're now net short the COMEX futures market by only 5,435 contracts...an decrease of those 2,283 contracts mentioned a couple of paragraphs ago.

The Commercial net short position in silver now sits at 51.82 million troy ounces in this week's report. That's up from the 44.29 million troy ounces that they were net short in last week's COT Report...an increase of 51.82-44.29=7.53 million troy ounces/1,506 COMEX contracts -- and a negligible amount in the overall. That change is obviously the headline number mentioned further up.

The Big 8 short position is 315.2 million troy ounces on a gross basis -- and Ted says that the 'commercial only' component of that amount is around 235 million troy ounces...up 10 million ounces from last week. The rest of the Big 8 short position is held by the Managed Money traders that continue to inhabit that category.

The Big 4 short position is 215.3 million troy ounces on a gross basis -- and Ted says that the 'commercial only' component of that is 150 million troy ounces...up 10 million ounces from the the prior week, with the rest of the total Big 4 short position being Managed Money traders.

That means that it was the Big 4 that did what little short selling there was in the commercial category.

Ted's raptors, the small commercial traders other that the Big 8, hold about 36,500 COMEX contracts on the long side...about 182.5 million troy ounces. That's a lot -- and up 7.5 million troy ounces from last week. The vast majority of them are holding on for much higher prices -- and $21 at the top of the last rally during the first couple of days of October didn't entice many of them to sell. One has to wonder what the silver price will have to rise to, before they do -- and the higher the better, of course.

One wonders how much they sold during Friday's big rally, if anything...as silver wasn't allowed to top the $21 spot mark. But that won't be known until next Friday's COT Report -- and there are still two more reporting days left in that.

Here's the 9-year COT chart for silver that puts thing in a longer-term perspective...courtesy of Nick Laird as always. Click to enlarge.

So, was yesterday's rally the start of Ted's "Big One"?

Who knows, but all the ducks are lined up as they should be for a major price move higher -- as the the drumbeat of the ongoing physical shortage in silver at both the wholesale and retail levels, grows ever louder by the day.

In gold, the commercial net short position decreased by a further 5,431 COMEX contracts, or 0.54 million troy ounces of the stuff.

They arrived at that number by increasing their long position by 2,604 COMEX contracts -- and also reduced their short position by 2,827 contracts. It's the sum of those two numbers that represents their change for the reporting week.

Under the hood in the Disaggregated COT Report, all three categories got the 'sell' memo, as the Managed Money traders increased their net short position by a further 2,613 COMEX contracts, while the Other Reportables and Nonreportable/small traders decreased their net long positions by 796 and 2,022 COMEX contracts respectively.

Doing the math: 2,613 plus 796 plus 2,022 equals 5,431 COMEX contracts, the change in the commercial net short position.

In last week's COT Report, the Managed Money traders were net short 38,788 COMEX contracts/3.88 million troy ounces of gold. As of yesterday's COT Report, these same Managed Money traders are now net short 41,401 COMEX contracts/4.14 million troy ounces and, after Friday's price action, it's a given that they're not net short anywhere near that amount now.

The commercial net short position in gold sits at 7.48 million troy ounces, down 0.54 million troy ounces from the 8.02 million troy ounces they were short in last Friday's COT Report. That 0.54 million troy ounce number is the change in the headline number mentioned earlier.

The short position of the Big 8 traders works out to 17.24 million troy ounces -- and Ted figures that the 'commercial only' component of that figure is 11.2 million troy ounces, down 0.3 million troy ounces from last week. The rest of the short position by the Big 8 is owned by the Managed Money traders that currently inhabit that category.

The short position of the Big 4 traders is 10.42 million troy ounces -- and Ted figures that the 'commercial only' component of that number is 5.7 million troy ounces...down from the 6.0 million ounce that the 'commercial only' component was in last week's COT Report. Like in the Big 8, the remaining ounces held short is by the one Managed Money traders that inhabits this category. And as of the COMEX close yesterday, he may or may not be there anymore.

Ted said that it appears that his raptors, the small commercial traders other than the Big 8, added about 2,000 contracts/0.20 million troy ounces to their long position during the reporting week -- and now hold a long position of around 3.7 million troy ounces/37,000 COMEX contracts. That number pales in comparison to the 182.5 million troy ounces/36,500 COMEX contracts that these same raptors are long in silver.

One has to wonder just how much of that they sold on Friday for big profits. That won't be known until next Friday...a lifetime away in this environment.

Here's Nick Laird's 9-year COT chart for gold, updated with Friday's data. Click to enlarge.

As mentioned above in silver, one wonders if yesterday's price action is the start of Ted's "Big One".

And like for the ducks in silver, the stars are all aligned for a moon shot to the upside in gold as well...if the powers-that-be allow it.

Of course the $64,000 question is always the same...will the big commercial shorts appear in force as these rallies develop?

We'll know for sure in both of them in very short order one would think.

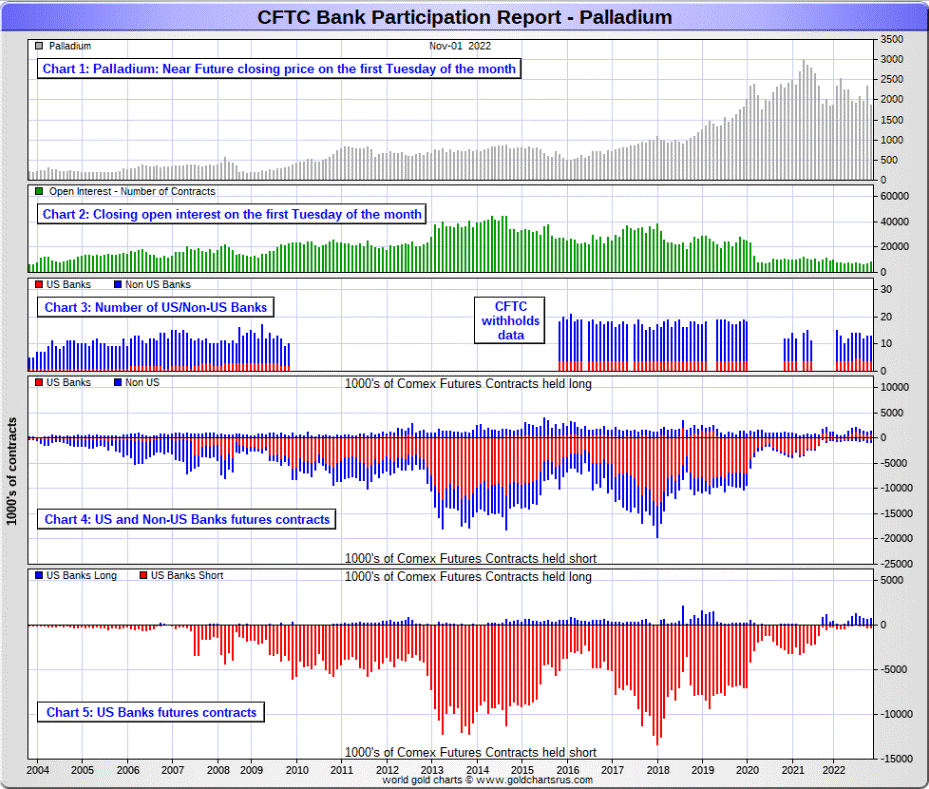

In the other metals, the Managed Money traders in palladium increased their net short position by a further 371 COMEX contracts -- and are now net short palladium by 1,262 contracts. The Producer/Merchants and the Swap Dealers are the only two categories that are net long palladium in the COMEX futures market at the moment. In platinum, the Managed Money traders increased their net long position by a further 5,370 COMEX contracts -- and are now net long platinum in the COMEX futures market by a hefty 13,411 contracts.

Platinum, like silver, is a bifurcated market in the commercial category, with the Producer/Merchants mega net short -- and the Swap Dealers net long by a decent amount.

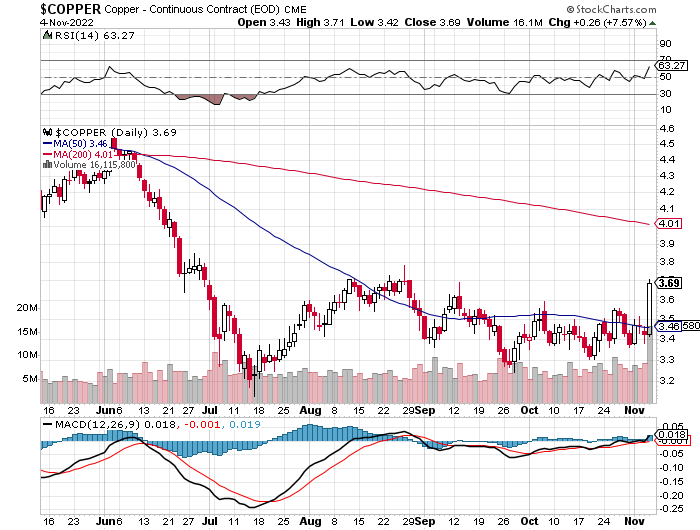

In copper, the Managed Money traders decreased their net short position by 8,377 COMEX contracts -- and are now net long copper by 5,089 COMEX contracts...about 127 million pounds of the stuff, which is small potatoes. And, like in platinum and silver, copper is a totally bifurcated market in the commercial category. The Producer/Merchants are net short copper by a very decent amount -- and the Swap Dealers are mega net long.

Whether these bifurcated markets mean anything or not, will only be known in the fullness of time. Ted says it doesn't mean anything as far as he's concerned, as they're all commercial traders in the commercial category.

In this vital industrial commodity, the world's banks...both U.S. and foreign...are net long 9.9 percent of the total open interest in copper in the COMEX futures market as of yesterday's Bank Participation Report...down from the 13.1 percent they were net long in October's. At the moment it's the commodity trading houses such as Glencore et al., along with some hedge funds, that are mega net short copper.

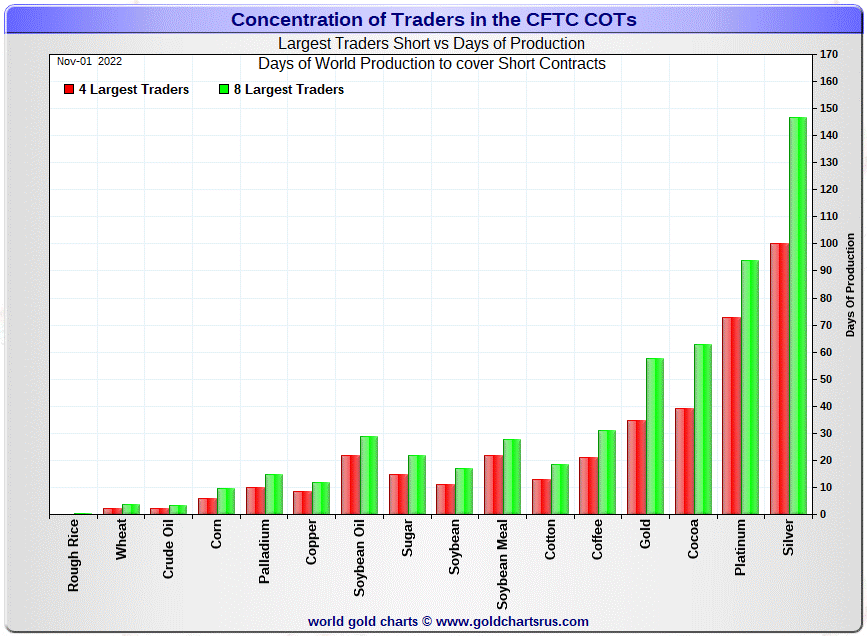

Here’s Nick Laird’s “Days to Cover” chart, updated with the COT data for positions held at the close of COMEX trading on Tuesday, November 1. It shows the days of world production that it would take to cover the short positions of the Big 4 — and Big '5 through 8' traders in each physically traded commodity on the COMEX.

I consider this to be the most important chart that shows up in the COT series -- and it always deserves a moment of your time...but continues to come with a big caveat attached -- and mentioned in the next paragraph.

Although still important, it must be remembered that the Big 4/8 commercial short categories in the four precious metals...along with a bunch of other commodities, including copper and WTIC...are contaminated by the short positions of Managed Money traders that are embedded in each, so this chart is not at all accurate. The take-away here is that the short positions/days of world production of a lot of these COMEX-traded commodities is far less than what this chart indicates.

For that reason, it should be viewed for its 'entertainment value' only -- although the overall 'shape' of the chart would be about right...just not the number of day short held in each by the commercial traders. Most are a lot less than shown...as you'll see in silver below. Click to enlarge.

But the information that follows is accurate, as I'm able to compute this data manually.

In this week's 'Days to Cover' chart, the Big 4 traders are short about 100 days of world silver production, up about 2 days from last week's COT Report. The ‘5 through 8’ large traders are short an additional 47 days of world silver production, down about 2 days from last Friday's report, for a total of about 147 days that the Big 8 are short -- and obviously unchanged from last week's COT Report.

[Note: As of last week's report, Ted says there was at least two Managed Money traders in the Big 8 short category. This fact distorts the numbers you see above -- and the distortions in silver are now so great, that I'm not going to bother doing much in the way of calculations...just approximations.]

That 147 days that the Big 8 traders are short, represents just under 5 months of world silver production, or 315.2 million troy ounces/63,049 COMEX contracts of paper silver held short by these eight traders...at least two of which are Managed Money traders.

Ted said that the 'commercial only' component of this number was around 235 million troy ounces, which works out to about 109 days of world silver production held by these Big 8 commercial traders...up 4 days from last week -- and a lot different that the 147 days that's shown on the 'Days to Cover' chart posted above. He also said that the Big 4 commercial traders are short around 150 million troy ounces -- and that works out to about 70 days of world silver production, up 5 days from last week, which is hugely different from the 100 days on the chart above.

Ted said that his raptors, the 27-odd small commercial traders other than the Big 8 shorts, are net long silver by around 182.5 million troy ounces...up about 7.5 million troy ounces from the 175 million they were long in last week's COT Report...a very big number.

Of course that number has decreased somewhat after Friday's trading session as some of the sold their long positions for a profit yesterday. Just how much they sold, won't be know until next Friday's COT Report.

In gold, the Big 4 are short 35 days of world gold production, up 1 day from last Friday's COT Report. The '5 through 8' are short 23 days of world production, unchanged from last week...for a total of 58 days of world gold production held short by the Big 8 -- and obviously up one day from last Friday's COT Report.

The reason that there was an increase in days in gold, despite the fact that the Big 4 shorts covered 5,431 short positions during the reporting week, was the simple fact that they were replaced by an equal number [plus more] short contracts by the Managed Money trader that inhabits that same category.

So, like for silver, the days of world production held short by the commercial traders in gold is a very decent amount less than shown in the previous paragraph and, for the same reason, this applies to platinum and palladium as well...plus copper and WTIC.

The Big 8 traders are short 45.4 percent of the entire open interest in silver in the COMEX futures market, which is virtually unchanged from the 45.5 percent they were short in the last COT report. And once whatever market-neutral spread trades are subtracted out, that percentage would be a bit over the 50 percent mark. In gold, it's 36.9 percent of the total COMEX open interest that the Big 8 are short, down a hair from the 37.1 percent they were short in last Friday's COT Report -- and something over the 40 percent mark once their market-neutral spread trades are subtracted out.

And as Ted always and correctly points out, we won't know that the lows are in until we see them in the rear-view mirror. So far, we've been fooled more than several times since these engineered declines commenced starting at the blow up in the LME nickel market back on March 8.

But after yesterday's price action, I'll be happy to bet that proverbial ten bucks on the fact that the lows placed in both gold and silver on Thursday, will never be seen again.

As I keep reminding you in this spot every Saturday, the circumstances in silver have been altered by an unimaginable [and monstrously bullish] amount by Ted's discovery of the 1 billion troy ounce physical short position in silver that Bank of America holds in the OTC market, courtesy of JPMorgan & Friends...along with the big increase in Goldman's derivatives position in silver in that market. They've increased even more in the latest OCC Report for Q2/2022... which Ted figures is a long position. And not to be forgotten is the 51+ million troy ounce short position in SLV...as of the latest short report last week.

The situation regarding the Big 4/8 concentrated commercial short positions in silver, gold is still obscene -- but not nearly as obscene as it was back on March 8...the 2022 highs in both gold and silver. After Friday's price action, its only a guess if they added to their short positions on those big rallies in both.

As Ted has been pointing out ad nauseam forever, the resolution of the Big 4/8 short positions will be the sole determinant of precious metal prices going forward...with that resolution currently obviously still a work in progress at the moment...but more and more looking like the end is in sight, if not upon us already.

And, as always, nothing else matters -- and I certainly look forward to what he has to say in his weekly review later this afternoon EDT.

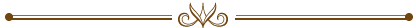

The November Bank Participation Report [BPR] data is extracted directly from yesterday's Commitment of Traders Report. It shows the number of futures contracts, both long and short, that are held by all the U.S. and non-U.S. banks as of Tuesday’s cut-off in all COMEX-traded products. For this one day a month we get to see what the world’s banks have been up to in the precious metals. They’re usually up to quite a bit -- and they certainly were again last month.

[The November Bank Participation Report covers the time period from October 4 to November 1 inclusive.]

In gold, 5 U.S. banks are net short 38,100 COMEX contracts in the November BPR. In October’s Bank Participation Report [BPR] these same 5 U.S. banks were net short 45,546 contracts, so there was an decrease of 7,446 COMEX contracts month-over-month. One would have to go back to January of this year to a smaller net short position in gold held by these U.S. bullion banks.

Citigroup, HSBC USA, Bank of America and Morgan Stanley would most likely be the U.S. banks that are short this amount of gold...plus one other. I still have my usual suspicions about the Exchange Stabilization Fund, although if they're involved, they are most likely just backstopping these banks.

Also in gold, 24 non-U.S. banks are net short 26,626 COMEX gold contracts. In October's BPR, 23 non-U.S. banks were net short 32,761 contracts...a decrease of 6,135 contracts. This is the smallest short position held by the non-U.S. banks since December 2018 -- and whether that means anything or not, remains to be seen.

At the low back in the August 2018 BPR...these same non-U.S. banks held a net short position in gold of only 1,960 contacts -- so they've been back on the short side in an enormous way ever since.

I suspect that there are at least three large banks in this group, HSBC, Barclays and Standard Chartered. I still harbour suspicions about Scotiabank/Scotia Capital, Dutch Bank ABN Amro, French bank BNP Paribas, plus Australia's Macquarie Futures. Other than that small handful, the short positions in gold held by the vast majority of non-U.S. banks are immaterial and, like in silver, have always been so.

As of this Bank Participation Report, 29 banks [both U.S. and foreign] are net short 13.9 percent of the entire open interest in gold in the COMEX futures market, which is down big from the 17.9 percent that 28 banks were net short in the October BPR.

Although the largest U.S. and foreign bullion banks dominate the Big 4/8 short category in gold, there are some hedge fund/trading houses that are short grotesque amounts of gold as well.

Here’s Nick’s BPR chart for gold going back to 2000. Charts #4 and #5 are the key ones here. Note the blow-out in the short positions of the non-U.S. banks [the blue bars in chart #4] when Scotiabank’s COMEX short position was outed by the CFTC in October of 2012. Click to enlarge.

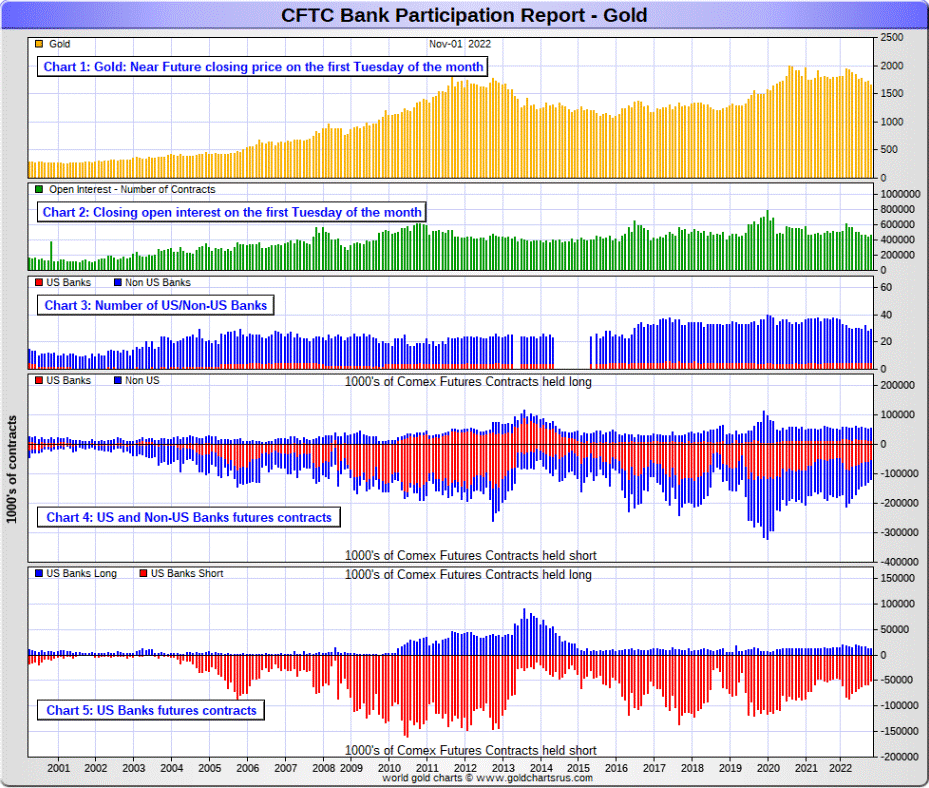

In silver, 5 U.S. banks are net short 21,630 COMEX contracts in November's BPR. In October's BPR, the net short position of these same 5 U.S. banks was 24,531 contracts, which is down 2,901 COMEX contracts from the prior month.

You only have to go back to September's BPR to find a U.S. bullion bank short position smaller than that.

The biggest short holders in silver of the five U.S. banks in total, would be Citigroup, HSBC USA, Bank of America, Morgan Stanley...and maybe Goldman Sachs...but not JPMorgan according to Ted. And, like in gold, I have my suspicions about the Exchange Stabilization Fund's role in all this...although, also like in gold, not directly.

Also in silver, 16 non-U.S. banks are net short 13,858 COMEX contracts in the November BPR...which is down 2,606 contracts from the 16,464 contracts that 18 non-U.S. banks were net short in the October BPR.

I would suspect that HSBC and Barclays hold a goodly chunk of the short position of these non-U.S. banks...plus some by Canada's Scotiabank/Scotia Capital still. I'm not sure about Deutsche Bank... but now suspect Australia's Macquarie Futures. I'm also of the opinion that a number of the remaining non-U.S. banks may actually be net long the COMEX futures market in silver. But even if they aren’t, the remaining short positions divided up between the other 11 or so non-U.S. banks are immaterial — and have always been so.

As of November's Bank Participation Report, 21 banks [both U.S. and foreign] are net short 25.6 percent of the entire open interest in the COMEX futures market in silver — down a very decent amount from the 31.7 percent that 23 banks were net short in the October BPR. And much, much more than the lion’s share of that is held by Citigroup, HSBC, Bank of America, Barclays, Scotiabank -- and possibly one other non-U.S. bank...all of which are card-carrying members of the Big 8 shorts.

I'll point out here that Goldman Sachs, up until late last year, had no derivatives in the COMEX futures market in any of the four precious metals. But they did show up in the last three OCC Reports. Ted thinks they're long silver in the OTC market. I shan't bother talking about the 1 billion troy ounce short position that Bank of America is short in the OTC market...thanks to JPMorgan & Friends, as I've already covered that ground further up.

Here’s the BPR chart for silver. Note in Chart #4 the blow-out in the non-U.S. bank short position [blue bars] in October of 2012 when Scotiabank was brought in from the cold. Also note August 2008 when JPMorgan took over the silver short position of Bear Stearns—the red bars. It’s very noticeable in Chart #4—and really stands out like the proverbial sore thumb it is in chart #5. But, according to Ted, as of March 2020...they're out of their short positions, not only in silver, but the other three precious metals as well. Click to enlarge.

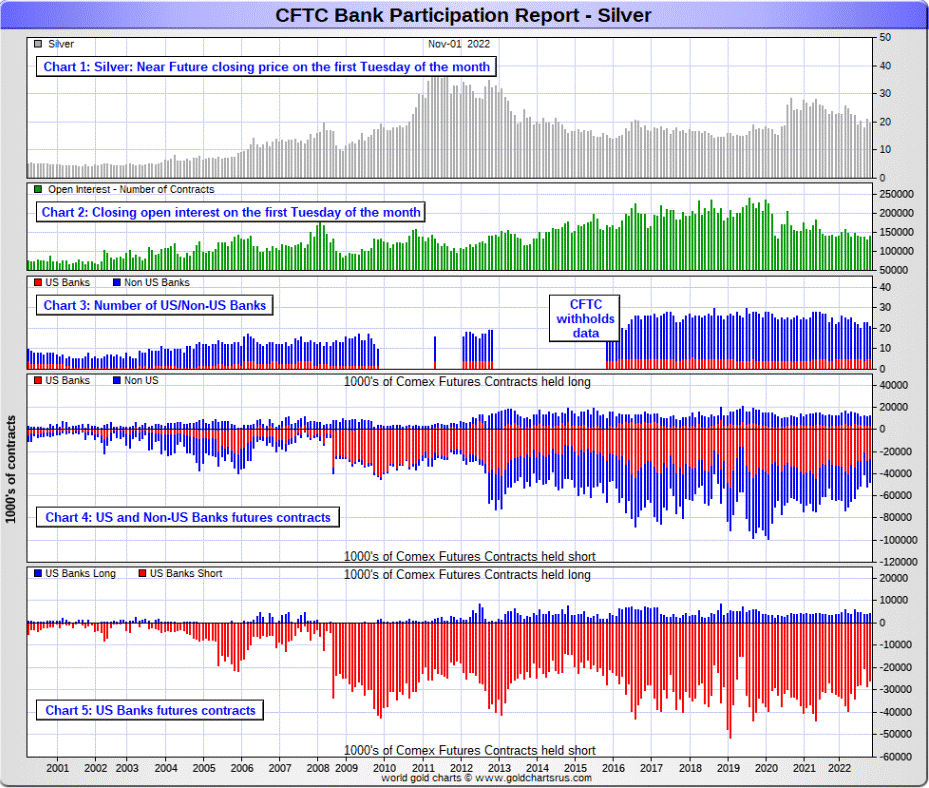

In platinum, 4 U.S. banks are net short 15,481 COMEX contracts in the November Bank Participation Report, which is up 2,526 contracts from the 12,955 COMEX contracts that 5 U.S. banks were short in the October BPR.

At the 'low' back in September of 2018, these U.S. banks were actually net long the platinum market by 2,573 contracts. So they have a very long way to go to get back to just market neutral in platinum...if they ever intend to, that is.

Also in platinum, 17 non-U.S. banks are net short 2,991 COMEX contracts in the November BPR, which is up 2,845 contracts from the piddling 146 contracts that 16 non-U.S. banks were net short in the October BPR. This is the the second month in a row that these non-U.S. banks have been net short since April. It's only a tiny amount, although I don't like the trend.

And as of November's Bank Participation Report, 21 banks [both U.S. and foreign] are net short 32.7 percent of platinum's total open interest in the COMEX futures market, which is up huge from the 23.5 percent that these same 21 banks were net short in October's BPR -- and the 12.6 percent that 18 banks were net short in September's BPR.

So the higher the platinum price has risen, the more the world's bullion banks have been going short over the last few months.

But it's the U.S. banks that are on the short hook big time -- and the real price managers. They have little chance of delivering into their short positions, although a very large number of platinum contracts have already been delivered during the last couple of years. But that fact, like in both silver and gold, has made no difference whatsoever to their paper short positions. The situation for them [the U.S. banks] in this precious metal is as almost as equally dire in the COMEX futures market as it is with the other two precious metals...silver and gold...particularly the former.

Platinum remains the Big commercial shorts' No. 2 problem child after silver. How it will ultimately be resolved is unknown, but most likely in a paper short squeeze, as the known stocks of platinum are minuscule compared to the size of the short positions held -- and that's just the short positions of the world's banks I'm talking about here.

Here's the Bank Participation Report chart for platinum. Click to enlarge.

In palladium, 4 U.S. banks are net long 486 COMEX contracts, up 169 contracts from the 317 COMEX contracts that these same 4 U.S. banks were net long in October's BPR.

Also in palladium, 9 non-U.S. banks are net short 35 COMEX contracts in the November BPR, down 27 contracts from the 8 contracts that these same 9 non-U.S. banks were net short in September.

These palladium numbers held by the bullion banks of the world are piddling and meaningless in the grand scheme of things.

As I've been commenting on for almost forever, the COMEX futures market in palladium is a market in name only, because it's so illiquid and thinly-traded.

Its total open interest in yesterday's COT Report was only 8,372 contracts... compared to 56,534 contracts of total open interest in platinum...138,875 contracts in silver -- and 467,276 COMEX contracts in gold.

The only reason that there's a futures market at all in palladium, is so that the Big 8 commercial traders can control its price. That's all there is, there ain't no more.

As of this Bank Participation Report, 13 banks [both U.S. and foreign] are net long 5.4 percent of the entire COMEX open interest in palladium... compared to the 4.4 percent of total open interest that these same 13 banks were net long in October's BPR.

And because of the small numbers of contracts involved, along with a tiny open interest, these numbers are pretty much meaningless.

But, having said that, for the last almost three years in a row now, the world's banks have not been involved in the palladium market in a material way. And with them now net long by a microscopic amount, it's all hedge funds and commodity trading houses that are left on the short side.

Here’s the palladium BPR chart. Although the world's banks are now net long at the moment, it remains to be seen if they return as big short sellers again at some point like they've done in the past. Click to enlarge.

Excluding palladium for obvious reasons -- and platinum in the non U.S. bank category...only a small handful of the world's banks, most likely four or so in total -- and mostly U.S.-based, except for HSBC, Barclays and maybe Standard Chartered...continue to have meaningful short positions in the precious metals. It's a near certainty that they run this price management scheme from within their own in-house/proprietary trading desks...although it's a given that some of their their clients are short these metals as well.

The futures positions in silver and gold that JPMorgan holds are immaterial -- and have been since March of 2020...according to Ted Butler. And what net positions they might hold, would certainly be on the long side of the market. It's the new 7+1 shorts et al. that are on the hook in everything precious metals-related.

And as has been the case for years now, the short positions held by the Big 4/8 traders/banks, is the only thing that matters...especially the short positions of the Big 4 -- and how this is ultimately resolved [as Ted said earlier] will be the sole determinant of precious metal prices going forward.

The Big 8 shorts, along with Ted's raptors...the small commercial traders other than the Big 8 commercial shorts...continue to have an iron grip on their respective prices -- until they don't. And it's a fair question to ask whether or not Friday's price action was a sign that they were about to loosen it.

But a big one-day rally is not a trend. We'll see what the lay of the land is a week from now.

Considering the current state of affairs in the world today -- and the physical shortage in silver -- and maybe in gold as well, the chance that these big bullion banks could get overrun at some point is certainly within the realm of possibility if things go non-linear.

I have an average number of stories, articles and videos for you today.

CRITICAL READS

U.S. payrolls surged by 261,000 in October, better than expected as hiring remains strong

Job growth was stronger than expected in October despite Federal Reserve interest rate increases aimed at slowing what is still a relatively strong labor market.

Non-farm payrolls grew by 261,000 for the month while the unemployment rate moved higher to 3.7%, the Labor Department reported Friday. Those payroll numbers were better than the Dow Jones estimate for 205,000 more jobs, but worse than the 3.5% estimate for the unemployment rate.

Although the number was better than expected, it still marked the slowest pace of job gains since December 2020.

Average hourly earnings grew 4.7% from a year ago and 0.4% for the month, indicating that wage growth is still likely to serve as a price pressure as worker pay is still well short of the rate of inflation. The yearly growth met expectations while the monthly gain was slightly ahead of the 0.3% estimate.

“There has been some signs of cooling. Bur are seeing a pretty strong labor market,” said Elise Gould, senior economist at the Economic Policy Institute.

“We did see a substantial increase in jobs. But there’s been a slowdown in the rate of increase. You would expect that as we get closer to full employment.”

Today's first story, courtesy of Swedish reader Patrik Ekdahl, was posted on the cnbc.com Internet site at 8:31 a.m. on Friday morning EDT -- and was updated about three and a half hours later. Another link to it is here. The Zero Hedge commentary on this is headlined "Something Has Snapped: Unexplained 2.3 Million Jobs Gap Emerges in Broken Payrolls Report" -- and is linked here. I thank Brad Robertson for that one.

German factory orders fall a bigger-than-expected 4% in September

New orders in Germany’s manufacturing sector fell sharply and by more than forecast in September reflecting weakening external demand for goods in a context of rising input costs and high energy prices.

Factory orders fell 4.0% on month, data from the German statistics office Destatis showed Friday. The decrease was considerably steeper than forecast by economists polled by The Wall Street Journal, who expected orders to fall by 0.5%.

The German statistics office revised new orders data for August. Following the revision, orders fell 2.0% on month, instead the 2.4% decline first estimates showed.

Domestic orders increased by 0.5% while foreign orders were down 7.0% on month. New orders from the eurozone decreased 8.0%, while new orders from other countries fell by 6.3% compared with August, Destatis’ data showed.

The producers of capital goods recorded a decrease of 6.0% month-on-month and producers of intermediate goods saw a fall in new orders of 3.4%. Regarding consumer goods, orders rose by 7.2% on month, Destatis said.

This news item appeared on the marketwatch.com Internet site at 3:16 a.m. EDT on Friday morning -- and was updated about forty minutes later. I thank Patrik Ekdahl for sending it along. Another link to it is here.

Powell Building Credibility -- Doug Noland

The guy sounds like a discerning traditional central banker. Powell is an admirer of Paul Volcker’s fortitude, and he’s clearly drawing inspiration from the legendary Fed Chairman. Markets are growing impatient.

It was a misstep for the FOMC to have inserted new language into its post-meeting statement: “In determining the pace of future increases in the target range, the Committee will take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments.”

Stocks rallied a quick 1% on the statement, assuming a newfound focus on “cumulative tightening” and “lags” signaled a shift in the committee’s thinking. Inklings of such a turn had already been offered by Fed officials, including Bullard, Daly, Evans and Kashkari. Markets could take comfort that the Fed was in sync with other central banks, with recent market instability forcing a reassessment of aggressive tightening. Importantly, relieved markets were seeing confirmation that the beloved - but estranged - “Fed put” was back in play. Now they just needed to hear it delivered from the lips of Jay Powell.

Powell’s head was elsewhere, perhaps drawing inspiration from the resolve Paul Volcker had demonstrated some 40 years earlier. I respect and admire Powell. His Fed has made historic mistakes, but he’s determined to try to make amends. The Chair is doing what he knows is in our nation’s best interest. He’s willing to take the heat.

Distinguishing himself from his predecessors (back to Greenspan), the Fed Chair is not kowtowing to the financial markets. A further departure from the past: Powell’s a straight-shooter. He probably planned on a balanced approach, though the more Powell earnestly answered questions, the more his inner Volcker came through.

I have some serious disagreement with Doug as to how he's picturing Powell...like he's some sort of hero...a reborn Paul Volcker. Nothing could be further from the truth. But you can make up your own mind on this. Another link to it is here. Gregory Mannarino's almost always "ADULT" rated post market close rant for yesterday is linked here -- and I thank Brad Robertson for sharing it with us.

The Great Unwind: Part II -- Alasdair Macleod

With price inflation rising out of control and interest rates rising strongly, the trading environment for commercial banks has fundamentally changed. With bad debts looming and bond prices in entrenched downtrends, procrastination is now the enemy of bankers.

We are at the beginning of The Great Unwind, and this article elaborates on my first article for Goldmoney on the subject published here.

The imperative for bankers to respond to these conditions overrides all other matters if their businesses are to survive these changed conditions. We are entering a cyclical downdraft of the bank credit cycle which promises to be cataclysmic. And the monetary policy planners at the central banks can do nothing to stop it.

After outlining the scale of the problems faced by each global systemically important bank, this article looks at the future for the $600 trillion derivatives mountain. It was born out of the long-term decline in interest rates from the mid-eighties, which ended last year. It is almost entirely distributed through banks and shadow banks.

The question to address is, what is the future for the derivative mountain, now that the long-term trend for falling interest rates is over? And what are the economic consequences?

This short novel from Alasdair put in an appearance on the goldmoney.com Internet site on Wednesday -- and for obvious length reasons, had to wait for today's column. I found it on the gata.org website. Another link to it is here.

Gold Fields target Yamana catches eyes of Agnico Eagle, Pan American

Agnico Eagle Mines Ltd and Pan American Silver Corp swooped in with a joint bid for Yamana Gold on Friday, in an attempt to scupper Gold Fields' planned acquisition of the Canada-listed gold miner.

The cash and stock offer, valuing Yamana at around $4.8 billion, would see Agnico and Pan American split Yamana's mines between them. Yamana shareholders would receive $1.0406 in cash, 0.0376 of an Agnico Share and 0.1598 of a Pan American Share for each share held.

But a slump in its shares after the deal was announced dented the valuation and at Thursday's close the all-stock offer valued Yamana at just north of $4 billion.

Yamana, whose shares were up 15% after news of the rival bid, said it had informed Gold Fields that the new offer was a "superior proposal". Gold Fields has five business days to make a new offer should it wish to.

This Reuters story, which was also linked further up in today's column, appeared on their Internet site at 12:40 p.m. PDT on Friday afternoon -- and I found it embedded in a GATA dispatch. Another link to it is here.

India’s Massive Silver Demand Cutting World’s Warehouse Stocks

Indian silver consumption is forecast to surge by around 80% to a record this year, as traders draw down inventories in warehouses from London to Hong Kong after two Covid-riddled years.

Indians bought historically low amounts of silver in 2020 and 2021 as supply chains and demand were hit by virus outbreaks. While consumers rushed to jewelry stores to buy gold in last year’s final quarter when pandemic restrictions eased, pushing sales to an all-time high, silver demand grew by less than 25%.

This year, silver sales are back on track. Local purchases may surpass 8,000 tons in 2022 from about 4,500 tons last year, said Chirag Sheth, principal consultant at Metals Focus Ltd. That’s up from an April estimate of 5,900 tons.

“We are seeing a jump in purchases among retail customers, similar to what we saw in gold last year, because of pent-up demand,” Sheth said.

Imports during the January to August period were 6,370 tons compared to just 153.4 tons during the year-before period, according to the latest data from the nation’s trade ministry. For 2021, the country shipped in only 2,803.4 tons.

India imports about half of its silver from the U.K., mainland China and Hong Kong. Buying is mainly from London Bullion Market Association-accredited warehouses, with inventories in those vaults now falling, according to Sheth.

That massive increase in demand has not been allowed to be reflected in the current silver price, at least not yet. This very worthwhile Bloomberg story was posted on the bnnbloomberg.com Internet site very early on Friday morning -- and I found it on Sharps Pixley. Another link to it is here.

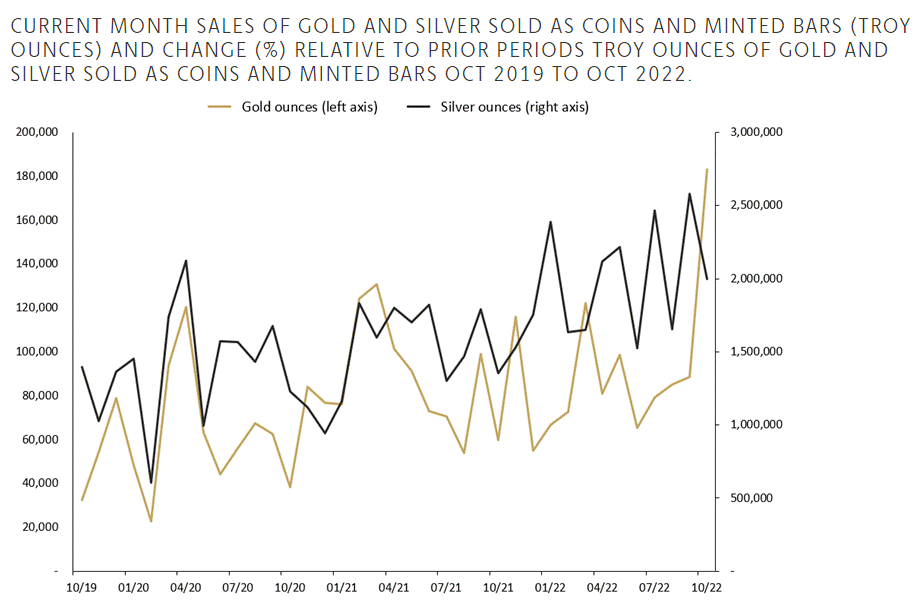

The Perth Mint reports all-time record for ounces sold as gold coins and minted bars

The Perth Mint sold 183,102oz of gold and 1,995,350oz of silver in minted product form during October. Click to enlarge.

General Manager Minted Products, Neil Vance identified late September as the start of significantly elevated demand for Australian gold bullion products.

“The spike continued throughout October, resulting in our best month on record for the number of ounces sold in coin and minted bar format,” he said.

“Demand from clients in the USA and Germany was incredibly strong.”

For maximum efficiency, the Mint’s production facility is currently focused on three of its most popular product lines – Australian Kangaroo 1 oz and 1/4 oz gold coins, and 1 oz minted bars.

Meanwhile, silver bullion products chalked up another extremely strong month with Neil Vance reporting that wholesale demand again accounted for the month’s total output of silver coins.

This precious metals related story put in an appearance on the perthmint.com Internet site on Thursday -- and I found it on Sharps Pixley. Another link to it is here.

The Photos and the Funnies

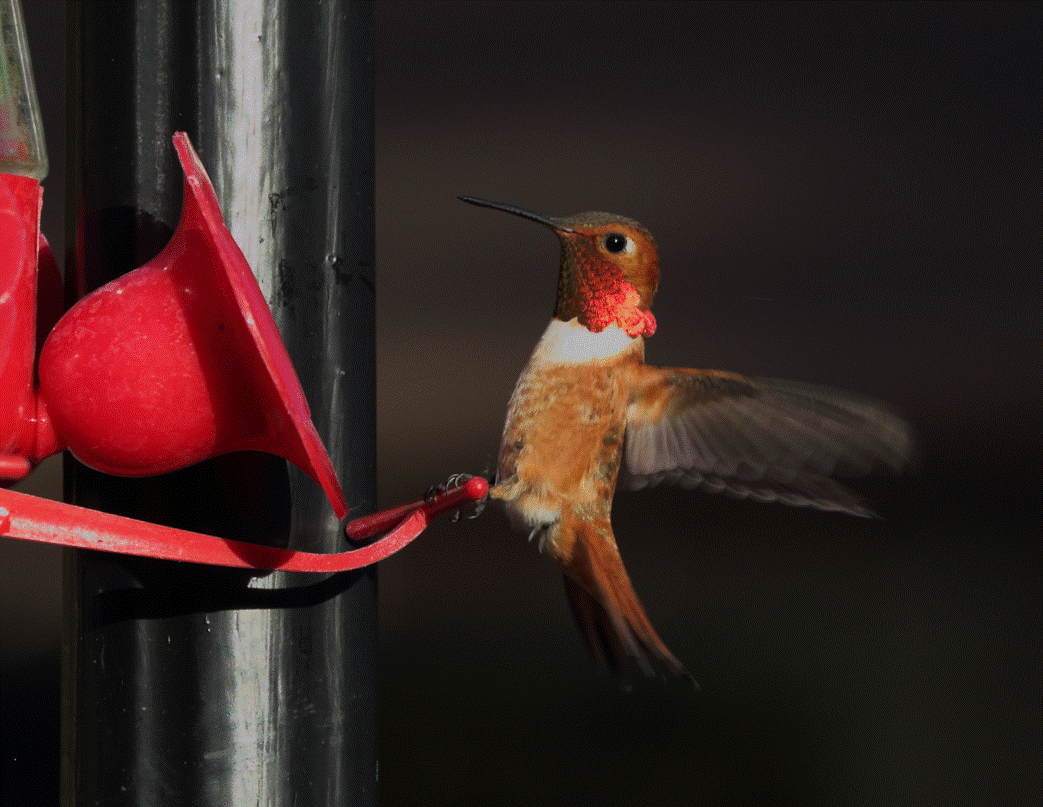

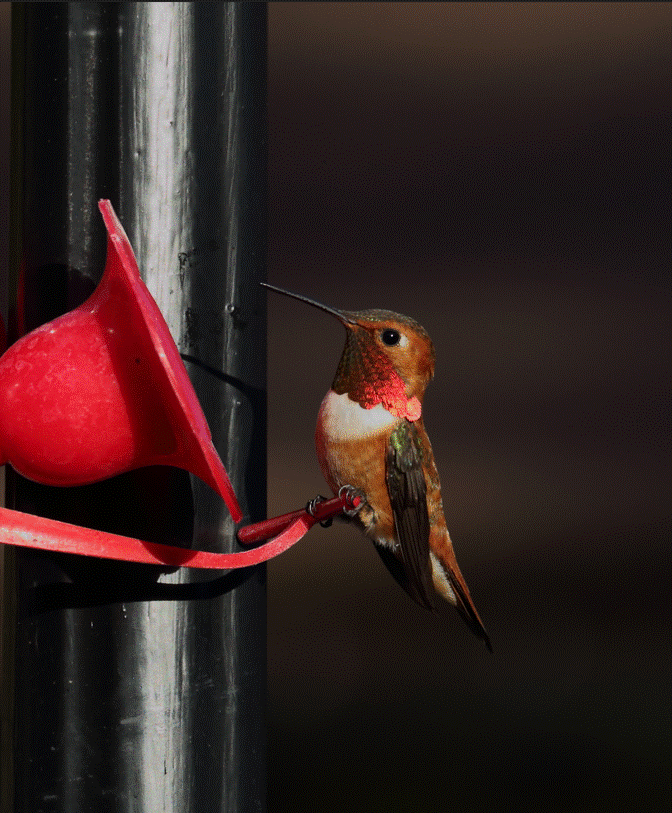

Here are the last four photos of hummingbirds that I took when we were staying at the Canyon Alpine Motel on May 21...a few minutes north of Boston Bar on B.C. Highway 1. With the exception of the female ruby-throated hummingbird in the second shot...the only one we saw, they're all male rufous hummingbirds. There were just so many of them. We spent most our time just standing quietly within a metre or so of the feeders just watching them come and go. They may be tiny in size, but these males have attitudes as big as all outdoors. Click to enlarge.

The WRAP

"Understand this. Things are now in motion that cannot be undone." -- Gandalf the White

Today's pop 'blast from the past' dates from 1978....44 years ago if that's possible. It was released as the first single from this American rock band's debut album -- and it should be recognizable to most right from the opening piano riff. The link is here. Of course there's a bass cover to this -- and that's linked here.

Today's classical 'blast from the past' is Mozart's Piano Concerto No. 21 in C major, K. 467 which he completed on 09 March 1785...just four weeks after his previous D minor piano concerto, K. 466.

The second movement was featured in the 1967 Swedish film Elvira Madigan -- and as a result, the piece has become widely known as the Elvira Madigan concerto.

The soloist is the world renowned Maurizio Pollini. La Scala Philharmonic Orchestra accompanies -- and the equally renowned Maestro Riccardo Muti conducts. The performance is from sometime in 2004 -- and the link is here.

Whether the big rallies in gold and silver were caused by the jobs report, a fall in the DXY, a short covering rally...or a combination of all three, is open to debate. But whatever the root cause, gold was closed precisely on its 50-day moving average when trading ended at 5:00 p.m. on Friday afternoon.

The 6-month chart for gold below, which shows the price action up to the 1:30 p.m. COMEX close, shows that the gold price traded above its 50-day moving average during that time -- and if it did so, it was only for a microsecond, as there's no trace of it on the New York Spot Gold [Bid] chart.

Silver's rally was equally impressive, but also ran into 'resistance' during the COMEX trading session -- and I couldn't help but notice that it wasn't allowed above $21 spot, or above that mark in its current front month, which is December.

Although I must admit that I was not happy to see the monstrous volumes in both silver and gold yesterday, the fact that total open interest in both were actually down on the day, was a huge surprise. Normally on big volume up days, total open interest blows out by an eye-watering amount. Not this time.

I was wondering out loud further up whether or not one of Ted's long-held pet theories that at some point the Big 4 shorts would arrange for their raptor counterparts, the small commercial traders other than the Big 8, to sell their long contracts to them so they could cover some or all of their remaining short positions.

And as I also said, this was way above my pay grade -- and I'll be more than interested in what he has to say about this, if anything, in his weekly review for his paying subscribers this afternoon.

Even though silver had a monster move yesterday, it traded between its 50 and 200-day moving averages all day long, as they're $2.43 apart! That's how much damage the Big 4 shorts have done to the silver price since the start of their short covering crusade back on March 8.

Platinum blew through and closed above its 200-day moving average for the second time in as many weeks. But it was more than obvious that there was someone fooling with the palladium price, as it was closed 79 bucks off its high tick.

Like the other three precious metals, palladium would have closed at some fantastically high price if there hadn't been some 'interference' in all of them yesterday. It was just the most blatant in palladium.

Copper closed up 26 cents...the biggest one-day price move I've ever seen -- and was obviously the result of short covering in the COMEX futures market. It closed 23 cents above its 50-day moving average in the process.

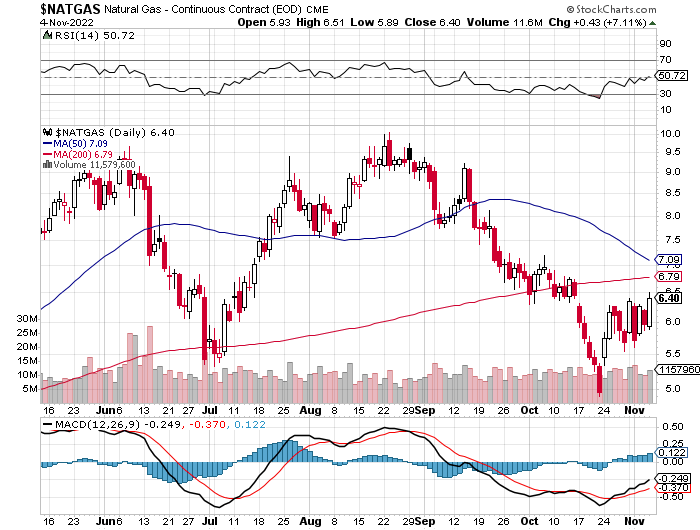

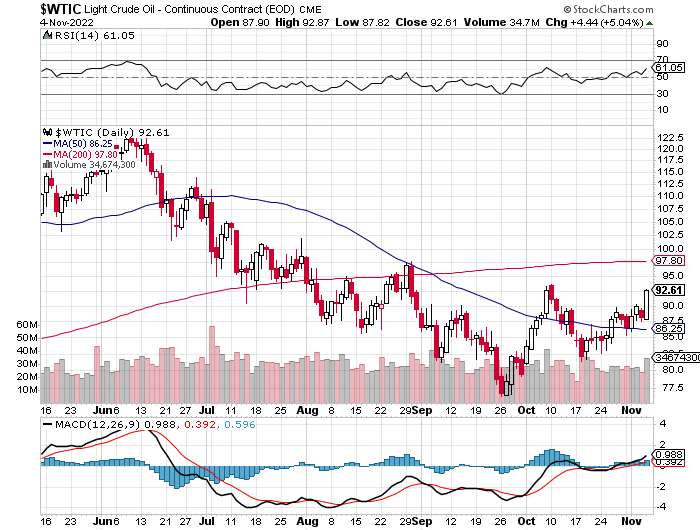

Natural gas [chart included] continues it frantic yo-yo price moves, as it closed higher yesterday by 43 cents/7.11 percent on Friday, but is still below any moving average that matters. WTIC closed up a hefty $4.44 at $92.61/barrel -- and is currently in no-man's land between its 50 and 200-day moving averages.

Here are the 6-month charts for the Big 6+1 commodities, with thanks to the good folks over at stockcharts.com as always -- and yesterday's COMEX closing prices should be noted. And for that reason, all of the considerable price action that took place after the COMEX close, doesn't appear on their respective candles below. Click to enlarge.

So, here we are on the cusp of something.

As Nick Laird pointed out in an e-mail to me just now, gold has put in a triple bottom since the end of September -- and added to that is the fact that it was closed right on its 50-day moving average at 5:00 p.m. in New York on Friday afternoon...an event that has never happened before.

And, along with silver, the COMEX continues to bleed gold...along with the continuing transfers from the Registered category and back into Eligible.

That, coupled with the sudden mystery central bank purchases of 300 tonnes of gold last month -- and the massive deliveries of gold in the COMEX futures market over the last many months...in scheduled delivery months, or otherwise...means that something big is coming our way in the not-to-distant future.

Of course what's going with gold pales in comparison to the current state of the silver market...physical or paper...which towers above all else by several orders of magnitude.

Of course everything depends on what the Big 4 shorts in the four precious metals have planned. We are back at the brink of a major price explosion in all of them...but only if they allow it.

In my conversation with Ted yesterday, he could see no reason why, with the current COMEX futures market set-up the way it is, they would put their heads back in the lion's mouth one more time...especially considering the state of the physical and paper markets in both silver and gold, principally the latter.

So we wait some more...but time is clearly running out -- and our wait will be measured in days, if not hours once the markets open in New York at 6:00 p.m. EDT on Sunday evening.

The current state of the monetary, financial and economic systems of the world continue to hang by that thin thread -- and remains in that state at the whim of the central banks of the world, as they continue to push the world further into economic ruin.

As John Williams over at shadowstats.com said on Wednesday..."Today’s fourth consecutive rate hike of 75 basis points was as expected, with more rate hikes promised, all designed to intensify an already ongoing and rapidly deepening, but not yet formally recognized “Recession” -- unfolding “Depression” -- with purported expectations of killing extraordinary, economic inflation pressures, which are monetary by nature, instead.

With headline inflation driven by explosive Money Supply growth and various Pandemic issues, not by the Fed’s “overheating” economy scapegoat, the economy already is in what should become recognized as a deepening recession."

He would be right about that -- and it's something that Gregory Mannarino has been going on about for a very long time now as well.

Add into the mix the current situation in Ukraine -- and the most divisive mid-term elections in our memory -- and it paints a very dark picture for the future of the American Republic -- and for the rest of the world's current order as well...as it's ripe for one or more false flag events, as you very well know.

Of course all of this is unfolding exactly as G. Edward Griffin pointed out in his classic tome: "The Creature From Jekyll Island: A Second Look at the Federal Reserve" -- and I can feel the breath of the New World Order/one world government crowd on the back of my neck as I type this.

As Yoda said: "Do not underestimate the power of the dark side of The Force."

I'm not -- and neither should you.

And it's for that very reason that I'm still "all in" -- and will remain so to whatever end.

I'm done for the day -- and the week -- and I'll see you here on Tuesday.

Ed