With the gold price refusing to be knocked down below the $1,700/oz. level, it finished the weak above $1,750 [spot] and looks to be building a base, readying for its next leg higher. With continued monetary and fiscal malfeasance, showing no signs of abating anytime soon, it Is only a matter of time until new all-time highs in gold are reached. This will bode very well for the mining stocks. The trend higher is intact but the complex should get a boost once Q3 earnings are released, as most companies were impacted to some degree in Q2 due to suspension of operations.

$AXU, $CXB.TO, $CXBMF, $CLM.V, $SIOCF, $GLDX.V, $SSPXF, $GPL, $GRSL.V, $GRSLF, $LDG.TO, $LGDTF, $MKO.V, $MAKOF, $MTA, $OSK.TO, $OBNNF, $VGCX.TO, $VITFF, $VZLA.V, $VIZSF, $WPM

Alexco Resources: The company received its update water use license and further amended its silver streaming agreement with Wheaton Precious Metals and announced a positive production decision [with production of concentrate expected in Q4] along with a $26m financing to fill the remaining funding gap. The amended streaming is two-fold:

- During the initial two years [8m oz. pf payable silver production], Wheaton will retain its 25% silver stream; however, the silver production payment to Alexco will be adjusted such that the operation will be able to withstand extremes [to the downside] in pricing. Following the initial two years, the formula will be adjusted. The on-going purchase price is subject to a maximum and minimum of 90% and 10% of the prevailing spot price.

- Introduction production payment [first 2yrs]: 90 – ((Spot Price – 15) x 10). For example, if the prevailing spot price of silver is $18, the on-going payment in the first two years would be equal to: 90 – ((18 – 15) x 10) = 90 – (3 x 10 = 30) = 60 or 60% of the spot price = 60% x $18 = $10.80/oz.

- After the first 2 million silver ounces delivered to Wheaton Precious, the formula is adjusted as follows: 90 – ((18 – 13) * 8) = 90 – (5 x 8 = 40 = 90 – 40 = 50) or 50% of the spot price = 50% x $18 = $9/oz.

- The on-going purchase price bottoms at $23/oz. at 10% or $2.30/oz. For every $1/oz. increase in the silver price, the per oz. payment increases $0.10/oz.

Calibre Mining: One of my favorite junior producers continues to trade at a significant discount based on Net Asset Value and 2021E cash flow multiple, announced updated 2020 production and cost guidance as well an increased exploration drill program for the 2H 2020. Revised 2020 production is now projected to be 110-125k oz. Au at cash costs and AISC of $880-$920/oz. and $1,070-$1,100/oz. This is revised downward from 140-150k oz. Au in 2020 at AISC of $1,020-$1,060/oz. The increase in AISC is largely due to increased drilling of 13k meters as well as 20k meter infill drilling program. There is a clear path to 200k oz. Au at $900-$950/oz. by 2022 and plenty of capacity to increase production towards 250k oz.+ in 2023/2024.

With the current gold price, Calibre should be able to advance and develop higher-grade targets, such that 2023/2024 production could be materially higher. The company has announced some very significant drill results at Panteon, Limon Norte, Jabali underground and Amalia and together with the significant excess capacity, is the perfect recipe for organic production growth at lower costs. I continue to believe that a tie-up between Mako Mining and Calibre would make a lot of sense, providing the combined company with an additional producing mine by Q4 2020 [San Albino], which has AISC in the lowest decile on the industry cost curve and a very attractive development project. This would make the combined company the premier producer in Nicaragua with a very commanding land package.

Crystal Lake: Reported additional copper, gold, silver, zinc, and lead mineralization and the first high-grade gold mineralization intersected from its maiden diamond drill program that tested 3 target areas at Burgundy Ridge; and area within the greater Burgundy Trend of the company’s Newmont Lake property in the Golden Triangle of northwest BC, Canada. The Green Rock zone had the following highlights:

- 51.38m @ 0.46% Cu, 1.22% Zn, 0.17 g/t Au, 9.98 g/t Ag, and 0.16% Pb

- Trench sample that cut a continuous interval assaying: 37m @ 1.31% Cu, 2.97% Zn, 1.49% g/t Au, and 23.26 g/t Ag

Ridge Zone: Drill hole BR19-13 205m north of Green Rock intersected an interval of:

- 184.67m @ 0.21% Cu, 0.14 g/t Au, 3.70 g/t Ag, and 0.17% Zn

Ridge West Zone:

- 1.50m @ 15.05 g/t Au and 4.03 g/t Ag

- 1m @ 6.70% Cu and 60 g/t Ag

Gold X Mining: Gran Colombia missed out by withdrawing its bid to acquire the company once the Guyana Goldfields deal fell apart. Gold X has an excellent, moderately sized, low-cost, long-lived project in Toroparu, with $100m committed by Wheaton Precious Metals to go towards initial requirements. Gold X announced this week the serial successful entrepreneur was named non-executive chairman of Gold X. This is a big endorsement of Toroparu and should clear the way towards Gold X either developing Toroparu and bringing it into production itself or finding a buyer for the company.

Great Panther: The high-cost gold producer announced some high-grade intercepts at its flagship Tucano project. Gold is finally to a level where it will begin generating positive cash flow. With continued higher-grade intercepts, it should be able to bring all-in sustaining costs down significantly. The results from this news release are part of an on-going 55k meter resource definition drill program focused on both near-mine diamond and reverse circulation drilling at the Tapereba AB1 and AB3 open pits. Drilling rates are expected to advance when the dry season begins in July with an updated reserve and resource estimate due for release in Q4. Some drill highlights from the near-mind drill program include:

- 13.5m @ 15.99 g/t Au

- 10m @ 10.96 g/t Au

- 5.7m @ 8.06 g/t Au

- 4.5m @ 6.21 g/t Au

- 7.3m @ 6.55 g/t Au

GR Silver Mining: The company continues to have exploration success at its high-grade silver-gold project, Plomosas. The drill highlights in the press release are located in one of six priority areas. They illustrate high-grade silver and gold mineralized zones outside of the previously mines polymetallic mineralization in the Plomosas mine area. The results confirm continuity of the polymetallic mineralized zone down dip and along strike. Some highlights from the news release:

- 23.9m @ 3.6 g/t Au

- 5.4m @ 326 g/t Ag, 1.9 g/t Au, 0.70% Pb, and 1.2% Zn

- 7.5m @ 1,235 g/t Ag, 0.20 g/t Au, 0.80% Pb, and 1.90% Zn

- 3.7m @ 1,469 g/t Ag, 0.50 g/t Au, 2.2% Pb, and 3.20% Zn

Liberty Gold: Announced the discovery of third grade oxide gold zone (D-3) at the Black Pine project in Idaho. A third high grade oxide gold discovery (D-3 Zone) has been discovered in close proximity to the D-1 and D-2 zone discoveries made in 2019. The D-3 zone lies beneath the limit of shallow historical drilling in a stratigraphic unit that is modeled to underlie at least the southern two thirds of the Black Pine gold system. This stratigraphic horizon, the lowest in the 400-meter-thick carbonate sequence that hosts gold mineralization at Black Pine, is the primary host for gold mined in the historic CD pit, but has only been tested by shallow drill holes in two other locations on the property. Drill highlights from D-3 include:

- 33.5m @ 1.98 g/t Au

- 10.7m @ 1.07 g/t Au

- 30.5m @ 1.11 g/t Au

- 29m @ 1.60 g/t Au

Mako Mining: The company announced a 2-4-month delay in the start of production at San Albino due to delays associated with CV19 to Q4 2020. The project is more than 70% complete and will serve as a small but efficient cash cow as it will have exceptionally low all-in costs. Commercial production is now expected to commence in Q2 2021, if not sooner.

The company also announced continued excellent exploration results from the Bayacun Zone and the Las Conchitas area. The objective is to develop Las Conchitas into a second area of mining within its 200 sqkm mining district. Drilling continues to extend near surface, high-grade gold mineralization at Bayacun zone, highlighted by 4.3m @ 40.50 g/t and 4.5m @ 16.90 g/t. Since 2019, 65 shallow diamond drill holes have been completed totaling 4.35k meters within the Bayacun zone. A total of 15k meters from 197 holes have been drilled at Las Conchitas has been drilled since the start of the 2019-2020 drilling campaign. Since September 2019 40 holes have been reported to date from the Bayacun zone, 25 of which reported at least 1 assay greater than 15 g/t. A breakdown of the 40 holes reported is as follows:

- 22 holes with an interval average greater than 15 g/t

- 9 holes with an interval average ranging from 5-15 g/t

- 6 holes with interval averages ranging from 1-5 g/t

- 3 holes with values below 1 g/t

Metalla Royalty and Streaming: The junior royalty companies announced it made another royalty acquisition on a producing asset. It entered into agreements with Coeur Mining and third parties to jointly acquire an existing 1.3875% royalty interest on the operating Wharf mine in South Dakota for total consideration of $8m [$7m in existing Metalla shares from treasury and $1m in cash]. Metalla and Coeur will retain a 1.0% and a 0.3875% of the royalty for total consideration of $5.77m and $2.33m. The royalty is on a small operation [84k oz. Au in 2019] but it will likely have a relatively long mine life as it has been in operation for more than three decades and was acquired by Coeur from Goldcorp in early 2015.

The transaction is structures as follows: Metalla agreed to acquire a 1.3875% royalty for $8m. Metalla has agreed to sell a 0.3875% royalty to Coeur, satisfied through the transfer of 421.55k shares held by Coeur [value at $2.23m based on a $5.30/share].

Osisko Mining: The company report infill drilling continues to confirm high grade at Lynx. Highlights include:

- 2m @ 376 g/t Au

- 6.2m @ 23.8 g/t Au

- 4.3m @ 35.2 g/t Au

- 4.5m @ 27 g/t Au

Victoria Gold: The newest gold producer in the Yukon has been ramping up production with May output seeing the highest output levels to date and commercial production is expected in Q3. The company announced the start of its 2020 Dublin Gulch exploration campaign. It will focus on diamond drilling and surface trenching at the high-grade, near-surface gold at Raven and the Nugget intrusive rock as well as previously untested priority targets. Given early exploration results at Raven, Victoria Gold could see materially higher production rates in future years as grade appears like it will be higher than the current reserve grade at Eagle [0.65 g/t Au]. The following are some highlights from surface trenching and drills holes at Raven:

Trench Results:

- 10m @ 6.64 g/t Au

- 12m @ 7.91 g/t Au

- 124m @ 3.51 g/t Au

- 50m @ 4.15 g/t Au

Drill Highlights:

- 14.8m @ 2.05 g/t Au

- 15.9m @ 2.35 g/t Au

- 2.8m @ 7.72 g/t Au

- 42.4m @ 1.05 g/t Au

- 5.9m @ 4.48 g/t Au

- 7.7m @ 3.36 g/t Au

Lynx in another exploration target within the Potato Hills trend centrally located in the Dublin Gulch claim block. Some highlights of historic Lynx results include:

Trench Results:

- 3m @ 22.2 g/t Au

- 8m @ 4.40 g/t Au

Drill Results:

- 4.3m @ 7.04 g/t Au

- 3.4m @ 7.37 g/t Au

- 8.84m @ 2.88 g/t Au

Vizsla Resources: Released some impressive drill results from a new discovery at its Panuco project, Mexico. Five holes have been drilled to date and results have been received for the two holes:

- 108.6m @ 740 g/t Ag and 11.06 g/t Au

- 2.5m @ 453.8 g/t Ag and 9.20 g/t Au

- 5.1m @ 309 g/t Ag, 8 g/t Au, 2.22% Pb, and 4.75% Zn

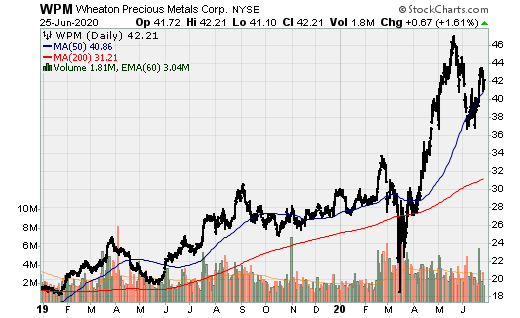

Wheaton Precious Metals: After a silent 2019 and many comments by the company that the pipeline of potential deals started to fill up late in 2019, picking up significantly pre and post CV19, the company announced a new, albeit relatively small streaming agreement. $WPM announced it signed a non-binding term sheet to acquire a precious metal stream from Caldas Gold’s Marmato underground expansion project. Per the precious metals purchase agreement, Wheaton will remit total cash consideration of $110m in exchange for a 6.50% gold stream [dropping down to 3.25% once 190k oz. have been delivered] and a 100% silver stream [dropping to 50% once 2.15m oz. Ag has been delivered]. $38m is payable upon closing, with the remaining portion payable during the construction of the MDZ project at Marmato. Average annual attributable will be approx. 10k AuEq oz. over an initial 16yr mine life.

While small, this is an excellent project with significant upside both in terms of mine life and production growth. The on-going purchase price will be equal to 18% of the spot price until company recoups its initial $110m investment, increasing to 22% thereafter. This will serve to boost intermediate production [approx. 2023] and diversify the company into a new country [Colombia]. It should be expected that Wheaton Precious make some larger streaming transactions over the next 12-months and this likely being the smallest deal it completes going forward. This acquisition can be easily paid off through just 2 months of cash flow generation. This is also a plus for Caldas Gold as it will launch debt financing up to $150m and a potential equity offering up to $50m. Further, this will also prove beneficial to Gran Colombia, which currently owns approx. 78% of Caldas Gold and spun Caldas Gold off such that it would retain production from the upper zone.