Gold had a decent week, crossing $1,800/oz. then backing down. But can it maintain momentum and convincingly pass that level? It seems like some consolidation is is in order for the metal(s) and mining stocks. Whether or not that takes places from a higher level remains to be seen, but be prepared for a pullback. Regardless, unlike the most industries in the world where companies are struggling to maintain past levels of profitability, the gold miners are seeing a great margin expansion and generating significant excess cash and is really the only growth industry [in 2020].

$AR.TO, $ARNGF, $CGC.V, $ALLXF, $CDB.V, $EDV.TO, $EDVMF, $FSX.V, $FSXLF, $HRT.TO, $HRTFF, $IRV.CN, $IRVRF, $KL, $MAG, $MGR.V, $MGLQF, $VGCX.TO, $VITFF, $VOX.V, $WGO.V, $WHGOF

Argonaut Gold: The merger with Alio Gold was completed, giving the new Argonaut a nice increase in production and providing two development assets. Florida Canyon will increase company-wide production for a couple years until one of its mines in Mexico becomes depleted but provides time to develop and additional project(s). While I think Ana Paula should be the front-runner in terms of next mine to be developed, its isn’t looking that way.

Ana Paula is an extremely high-return project. Per the pre-feasibility study, the after-tax IRR and NPV @ $1,250/oz. Au is 34% and $223m. At current metal prices [>50% IRR], both metrics are considerably higher, not to mention there is still exploration upside on the property in the highly prospective GGB in Mexico, located adjacent to Equinox Gold’s and Torex Gold’s Los Filos and ELG complex. While not an overly large project, the initial capital investment in reasonable at $138m for an operation that will produce an average of 115k oz. Au with cash costs and AISC of $489/oz. and $524/oz. over an initial 7.5yr mine life.

Argonaut also announced an updated life of mine plan for Florida Canyon. Under the new plan, the mine will produce an average of 77k oz. p.a. with all-in sustaining costs (AISC) of $1,040/oz. for 9.5yrs. Using a $1,700/oz. gold price deck, this yield and NPV5% of $232m [generation $326m of free cash flow over the period] and an NPV5% of $357m at $2,000/oz. gold [generation of $491 of free cash flow over the period]. This project is highly leveraged to the gold price as the NPV5% decreases to $85m at $1,350/oz. Au.

Caldas Gold: There are a lot of wheels turning in the company at it is raising capital to advanced development of its flagship Marmato expansion [$110m stream financing, up to $150m in debt financing (not completed), and up to $50m in equity financing ($10m of which has been completed)] as well as acquiring the Juby Project in Abitibi greenstone belt in Ontario and a 25% JV interest in certain claims adjoining the Juby project. The Marmato expansion is estimated at US$270m and the acquisition costs total $10m. The company will likely need to raise $180-$190m from the aforementioned debt financing and through issuing additional equity.

Caldas Gold completed a non-brokered private placement of 7m shares with for C$2/share for gross proceeds for C$14m. Gran Colombia has control of 37.547m shares [and 7.5m warrants]. The 37.547m shares represents 74.4% of the total number of outstanding common shares of Caldas and should the warrants be exercised; Gran Colombia would control 77.7% of the total number of outstanding shares on a partially diluted basis.

Cordoba Minerals: The company completed a fully subscribed C$21.50m rights offering. The company’s share structure if very sloppy as it has to issue 430m shares to raise the C$21.50m. This represents 100% of the maximum number of rights shares under the rights offering. Following the capital raise, the company has 891.51m shares. With the proceeds, Cordoba completed the final US$13m option payment require to gain a 100% interest in the Alacran mineral title. The PEA for the project outlines a project with robust economics. The projected generated an after-tax NPV8% and IRR of $210m and 20.30%, although this was using a considerably lower gold price. A pre-feasibility study is underway.

Endeavour Mining: The acquisition of SEMAFO by Endeavour Mining was completed mid-week and creates the leading West African producer and a top-15 global producer, with estimated 2021 production of 1-1.1m oz. and a pipeline full of development projects [having following the acquisition] and a large number of high-priority greenfield projects. In a couple of years, if Endeavour can’t convert resources to reserves and exploration drilling comes up with nothing, the mine will be depleted in 2023 or so. This is plenty of time to develop the Kalana or Fetekro project, to replace production and lower costs. Regardless, there should come a time in the next couple of years when Endeavour will look to divest another asset as it continues its strategy of increasing the quality of its portfolio over time and isn’t stuck managing to many operations.

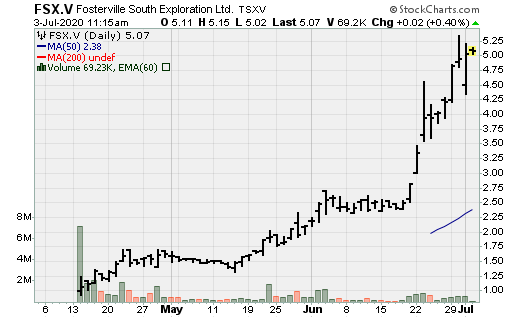

Fosterville South: The company announced a $7.5m overnight marketed private placement by selling up to 1.875m units at a price of $4/share. Each unit will consist of one common share and one-half of one common share purchase warrant. Each whole warrant will entitle the holder to purchase a common share at an exercise price of $4.95 for a period of 24 months. The company also announced it has accelerated drilling at its Golden Mountain project, located in Victoria, Australia. Diamond drilling has commenced and is designed to test main target area. A second diamond drill rig, purchased by Fosterville South, has been added to the program.

Harte Gold: Announced a financing package to permit mine restart of the Sugar Zone. It has entered into a binding term sheet with Appian Capital Advisory LLP for up to $30m. The proposed transaction is comprised of: 1) a private placement of 9.5m series B special shares of the company at a price of $1.00/special share for aggregate proceeds of $9.5m; 2) a $18.5m non-revolving credit facility; and 3) a 0.50% NSR royalty in exchange for $2m. With planning now complex, the company is targeting the following production levels upon mine restart:

- 2020 production: 20-24k oz. Au

- 2021 production: 60-65k oz. Au

Beyond 2021, combined production from the Sugar and Middle Zones is expected to provide sufficient throughput to achieve 1,200tpd.

Irving Resources: Announced it reached an agreement on a non-brokered private placement with a new strategic investor, Sumitomo, for gross proceeds of $2.5m through the issuance of 1.28m shares. This is a big vote of confidence by what is considered one of the most respected companies in Japan. The proceeds will be used for exploration on the company’s Omu project in Hokkaido, Japan ($2.25m), and $250k for the formation of an alliance between Irving, its Japanese subsidiary and Sumitomo, whereby the parties will work together with Newmont Exploration to jointly exploit those mineral exploration opportunities throughout Japan which are designated by Newmont Exploration.

Kirkland Lake Gold: The company put out some exciting exploration results from Detour Lake, extending mineralization at the main pit and the higher-grade 58N zone. The Saddle zone has a lower strip ratio and the majority of drill results for the open-pit are above the reserve grade of 0.97 g/t Au and the potential underground component is increasingly likely:

Saddle zone [identified broad zones of mineralization at attractive open-pit grades with higher-grade intervals at depth]:

- 121m @ 1.41 g/t Au including 3.5m @ 16.33 g/t Au

- 138m @ 1.23 g/t Au including 24m @ 4.11 g/t Au

- 65m @ 1.25 g/t Au

- 37m @ 1.77 g/t Au including 3m @ 14.73 g/t Au

58N Zone: intersects high grades 175m west of current underground mineral resources:

- 5m @ 14.6 g/t Au

- 13m @ 11.7 g/t Au

- 8m @ 5.9 g/t Au

- 3m @ 8.6 g/t Au

Drilling at North Pit extends mineralization to depth and along strike of current mineral resource:

- 9m @ 1.1 g/t Au

- 5m @ 1.76 g/t Au

- 4m @ 1.8 g/t Au

- 3m @ 1.82 g/t Au

Kirkland also re-issued 2020 guidance, which for the most part was only marginally impacted. Initial guidance was:

- Gold Production: 1.47-1.54m oz.

- Cash costs and AISC: $450-$470/oz. & $820-$840/oz.

- Growth capital and exploration: $70-$80m & $150-$170m.

New guidance:

- Gold production: 1.35-1.4m oz.

- Cash costs and AISC: $410-$430/oz. & $790-$810/oz. [lower due to the removal of the Holt Complex, which is higher cost]

- Growth capital and exploration: $95-$105m & $130-$150m

MAG Silver: The company announced a US$50m at the market equity offering. This was expected as the last equity issuance didn’t seem like enough to meet the cash calls [given the temporary suspension of operations] but this will provide the company with more than enough capital, especially if there is another mandated suspension of operations. I would have liked to see either a $50m credit facility of combination of equity and debt to reduce dilution but given the recent strength in its share price, this will only amount to roughly 3.6m shares.

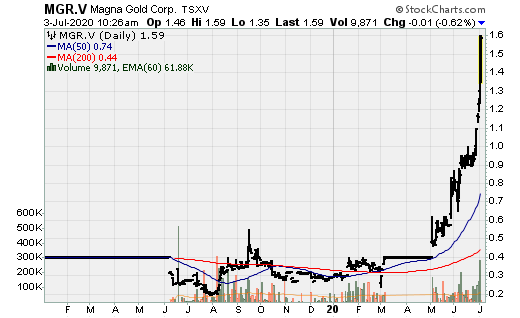

Magna Gold: The company announced it entered into a definitive agreement with Peal de Mexico to settle the existing arbitration proceedings between Peal and Molimentales in relation to the company’s San Francisco gold mine in Sonora, Mexico. Per the terms of the agreement, Magna will pay Peal $6.355m through the issuance of 11m common shares and $3.495m in cash by the end of Dec, 2021.

Victoria Gold: Announced it has achieved commercial production at its flagship asset, Eagle on July 1st. The ramp-up was slowed due to reduction of mining activities to the bare minimum and following CV19 protocols but the company has now achieved an important milestone and should see free cash flow begin to skyrocket, weighted towards back half of the quarter, with the hope of reaching an annual run-rate of approx. 16-17k oz. Au late in the quarter, if not Q4. Victoria remains a very attractive takeover target by another mid-tier producer [likely larger mid-tier producer] given its production profile, cost structure, being in a tier-I mining jurisdiction and exploration upside. The exploration upside potential, notably the potential to increase grades and mine life has been seen at Raven and the Nugget Intrusive stock. With a reserve grade of 0.65 g/t Au at Eagle, Raven drill highlights such as 14.8m @ 2.05 g/t Au, 42.4m @ 1.05 g/t Au, 16m @ 2.35 g/t Au, illustrate the potential to both increase production and potentially lower costs. The 2020 exploration program will shed more light on this potential.

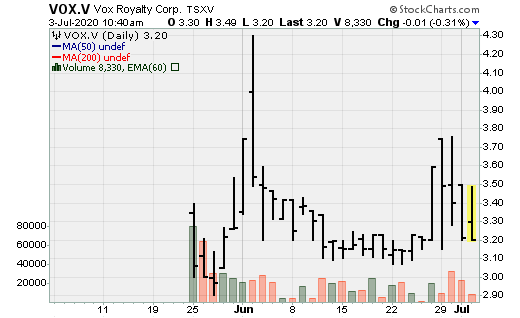

Vox Royalty: Entered into a binding agreement to acquire advanced exploration stage gold royalty [1.0% NSR] on part of the Bulong Gold Project for A$750k [A$400k cash and A$350k in Vox shares]. The Bulong project is owned and operated by Black Cat and located 25km east of Kalgoorlie in Western Australia. The proximity to Kalgoorlie provides Bulong with excellent infrastructure, including a sealed road and mains power which run the projects. The feasibility study is targeted for completion in September 2020.

White Gold: Drilling has commenced on the Titan project in the White Gold District, Yukon. This marks the initiation of the company’s fully funded 2020 exploration program backed by Agnico-Eagle and Kinross on its extensive 420k hectare land package in the Whit Gold District.