Major news in mining this week was the large number of announced and completed equity financing's. Eric Sprott was involved in many of these. Gold and silver had another strong week but a consolidation period can happen at any time. It isn’t uncommon see retrenchments of 15-25% [in the mining equities], which could happen tomorrow or several months down the line but it will happen. Time will tell. Gold and Silver have massive tailwinds and there are countless potential catalysts in the second half of this year alone.

Aside from those financing's mentioned below, the following are other financing's announced: HighGold Mining announced an $8m bought deal private placement. Euro Manganese announced a $3.85m private placement. Decade Resources announced $1.2m over-subscribed private placement, with Eric Sprott to purchase 10m units. Allegiant Gold announced the closing of a $3m non-brokered private placement and Cabral Gold announced second closing of over-subscribed private placement. Filo Mining Corp announced a $20m financing and Rupert Resources announced equity financing totaling $22.3m. Eclipse Gold announced the closing of a $12m bought deal public offering. Banyan Gold announced a $4.3m financing, Spanish Mountain up-sized its private placement to $4m, and Brigadier Gold announced a $2.5m non-brokered private placement. Idaho Champion, Strikepoint Gold, Grande announced private placements of $3.5m, $1.955, and $3.15m, with the latter two being led by Eric Sprott. Mountain Boy Minerals and Teuton Resources also completed financing's, with Eric Sprott taking 4m units and 2m shares.

$AGI, $AR.TO, $CGC.V, $ALLXF, $CXB.TO, $DPM.TO, $EMX, $EGO, $EDV.TO, $EDVMF, $EXK, $ERD.TO, $F.V, $FVL.TO, $FGOVF, $GBR.V, $GPL, $GRSL.V, $GRSLF, $JAG.TO, $KNT.V, $KL, $LUG.TO, $BMK.V, $NSR.TO, $RGLD, $ROXG.TO, $SAND, $SVE.V, $TXG.TO, $TML.TO, $TUD.V, $VGCX.TO, $VITFF, $VZLA.V, $WDO.TO

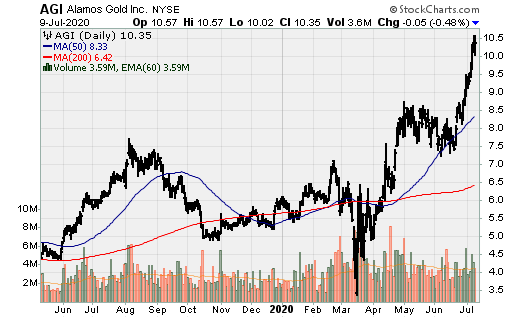

Alamos Gold: Announced it completed the lower mine expansion at its long-lived cornerstone asset, Young-Davidson in Canada. The company is in the process of transitioning from a period of high-capital investment to one where the company generates material free cash flow. In addition to higher-output and lower costs at Young-Davidson, low-cost production from Island Gold [and a Phase III expansion expected soon and elimination of 3% NSR royalty], recommencement of production from Mulatos [the 5% NSR royalty has ceased] and higher gold prices, will drive cash flow higher in the near-term. The company is waiting for its next growth project to get the go ahead, Kirazli, as $32m of the estimated $152m capital investment already spent. This is on hold for the time being as it is awaiting the renewal of concessions to restart construction. Alamos is working with Turkish department of energy and natural resources on securing renewal. Kirazli, when in production, will increase production by 100k oz. and have costs in the lowest 10% on the industry cost curve with AISC of $373/oz.

This will be followed by the Lynn Lake project in Canada [with a construction decision expected in 2022], which using a $1750/oz. gold price, has an IRR and NPV of approx. 30% and >$400m on avg. production of 170k oz. Au with AISC of $745/oz. Alamos could set itself up to become a senior producer [>=1m oz. p.a.] by 2023/2024 should it acquire an asset like Brucejack. Alamos trades with a premium NAV multiple relative to its size due to its cornerstone assets and a development project being in Canada.

Argonaut Gold: Q2 production totaled 31.5k AuEq oz. and increased its cash position $23m. The company also updated guidance, incorporating the addition of Alio Gold’s Florida Canyon mine. The company is now expected to produce 210-230k AuEq oz. and anticipates generating $62-$87m of free cash flow in 2020 [assuming a $1,700/oz. gold price]. In Q2, Argonaut’s existing Mexican operations generated $23m in free cash flow. The company ended the quarter with $65m in cash and $7m drawn on its revolving credit facility. The company also announced a C$110m bought deal financing. The funds will be used to advance the company’s Magino project.

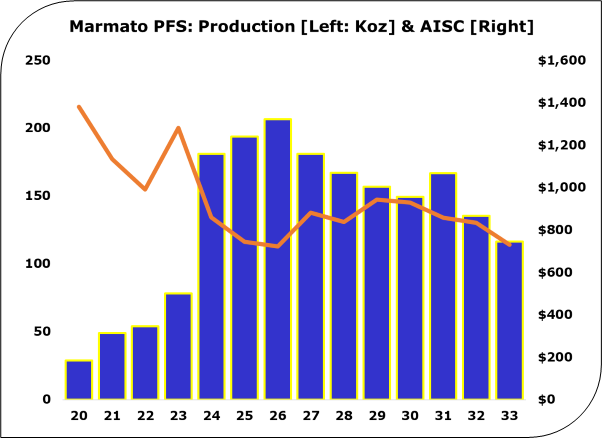

Caldas Gold: The company announced the results of the Pre-feasibility study (PFS) for the expansion of its Marmato project in Colombia. The PFS is similar to the PEA but production in during the peak years will be higher. In all likelihood, because both the upper mine and MDZ have significant exploration upside, production during the peak years will likely last a longer period of time. There is also material upside assuming the company can upgrade M&I and Inferred resources to reserves, which total 6.2m oz. contained, up from 5.35m oz. from the 2019 resource estimate. The current LOM plan is based on reserves of 2m oz. Au, and it is reasonable to expect both increased production and mine life extension.

Using a long-term gold price of $1,400/oz. and initial capital costs of $270m ($160m net of the stream financing provided by Wheaton Precious Metals) and a 5% discount rate, the project has a 20.1% after-tax IRR and NPV of $264m. The expansion is estimated to be completed in 2023 and output per the PFS is expected to average 165k oz. from 2024-2033. Again, this is likely to either be increased and/or maintained for a longer-period of time. LOM cash costs and AISC will average $772/oz. and $872/oz. Further, since the PEA, the company updated its plan for the upper mine, incorporating an expansion of the existing 1.2ktpd processing plant to 1.5ktpd for approx. $11m and increase expected gold production to 50k oz. beginning in 2021. The following is a production schedule over the initial 14yr mine life.

Calibre Mining: announced preliminary operating results as of end of Q2. The company voluntarily suspended mining operations for 10-weeks. This led to a weak quarter production wise but the company has commenced the phased restart of operations. In Q2, the company produced 6k oz. Au and sold 9.4k oz. and issued revised 2020 guidance. Gold production is now expected to total 110-125k oz. Au at total cash costs of $880/oz.-to-$920/oz. The company ended the quarter with $25m of cash on hand, a significant reduction relative to Q1 (of approx. $42m). During the quarter, the company reported some exciting drill results and in turn increased its exploration drilling program by 30% to 60k meters. The company also initiated an unbudgeted 20k meter infill drill program, targeting a material increased in Indicated resources as at year end.

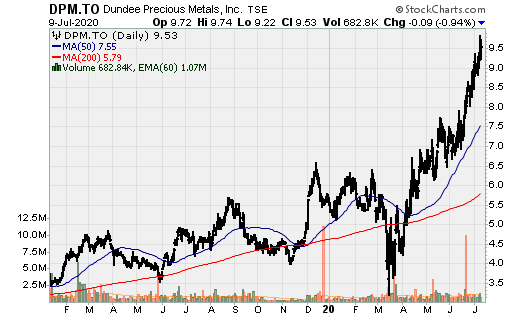

Dundee Precious Metals: Reported another solid quarter from both its mines in Q2 2020 and remains on track to achieve its 2020 guidance as each of three operations. Payable gold production in concentrate sold at Chelopech and Ada Tepe in Q2 were 36.7k oz. (along with 8.5m lbs. Cu) and 34.1k oz. for a total of 70.8k oz. Au. This brings total 1H 2020 production to 139.1k oz. Au (75.5k oz. from Chelopech and 63.6k oz. from Ada Tepe). At its Tsumeb smelting operation, complex concentrate smelted was 58.5Kt and 123.5kt for the 1H 2020.

EMX Royalty: Executed a purchase agreement for a portfolio and property interests from Canadian prospector and entrepreneurship Perry English for C$3m. The portfolio consists of over 60 properties, including 52 projects optioned to third parties, of which 39 include provisions for NSR royalty interests. The portfolio will generate cash flow to EMX from option payments of more than C$2.5m over the next 3.5yrs, as well as share-based payments valued at C$800k at current market prices. EMX could create much more shareholder value if it would focus on acquiring either new NSR royalties or those already held by third parties with near-term cash flow. It has a deep portfolio of long-term royalties and continues to generate new royalties, which has been its strategy but given the current environment, cash flowing royalties would likely have a bigger positive impact on its share price. It also does have material growth in the near-term, with its flagship royalty, a 0.50% NSR royalty on Timok, coming online in 2022.

Eldorado Gold: Reported stronger Q2 production results. The company produced 137.8k oz. Au, a 50% increase relative to the comparable period in 2019. This was largely driven by a 130% increase in production from Kisladag as a result of higher grade and tons of stacked ore and increased solution grades due to drier weather in June. This was also driven by a 159% increase in production at Olympias over the past year to increase underground development and backfilling. Companywide production would have been higher but Lamaque saw production remain flat due to a suspension of operations in April, partly negated by higher grades and an increased tons mined per day.

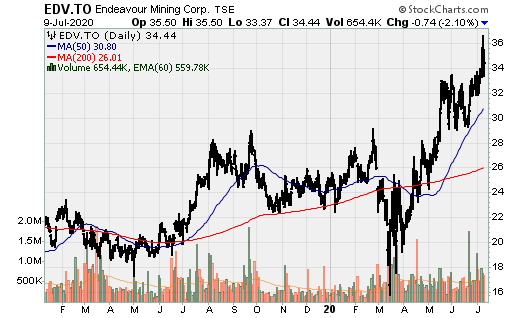

Endeavour Mining: Awarded a mining permit for the full Kari Area, which hosts the Kari Pump, Kari Center, and Kari West higher grade discoveries. Mining activities commenced at the high-grade Kari Pump deposit, with over 60k meters of grade control drilling completed in Q2 2020. As a result, production from its flagship Hounde mine in Burkina Faso is now expected to reach the upper range of the 230-250k oz. Au guidance provided earlier in the year. An updated Kari area resource estimate is expected to be published in the coming weeks incorporating 1H 2020 drilling. If history is any clue, this will likely surprise on the upside. The company will remain focused exploring the Kari area over the next 12-24 months the higher-grade nature will make it easier to maintain higher levels of production beyond the next couple of years. The company is also continuing to make additional discoveries such as Kari Gap and Kari South targets. The Kari area has been permitted as an extension of the main Hounde mining permit [which benefits from the 2003 mining code], which includes a corporate tax-rate of 17.50%, a free 10% free-carried state interest, and a royalty based on a 3%-5% sliding scale linked to the gold price.

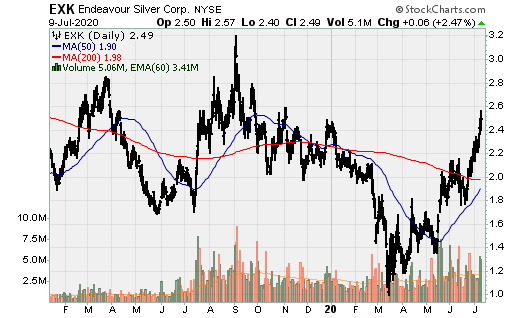

Endeavour Silver: Q2 production was 596k oz. Ag and 5.8k oz. Au. This represented just one month of production due the mandated CV19 related mine suspensions. In Q2, the company released positive drill results at both Guanacevi and Bolanitos. Endeavour also entered into a sales agreement with a syndicate of banks to raise up to $23m through the issuance of common shares to advance the Terronera project.

Erdene Resources: The company released drill results from its Bayan Khundii Gold Project. The company is moving the project ahead quickly with a feasibility study for the project due out in the coming weeks. Erdene discovered high-grade gold zone at surface, southeast of the main Midfield orebody, with 5.5m of 126 g/t Au including 1m of 581 g/t Au. Beginning 11.5m down hole, drilled 15m of 25.6 g/t Au. The company hit gold mineralization in 16 of 18 holes, all within 25m from surface.

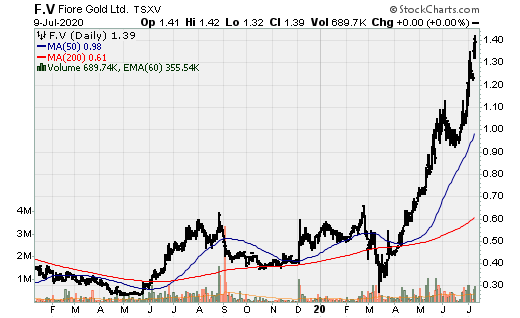

Fiore Gold: Reported record production of 12.8k oz. and saw its cash position increase significantly in Q2 2020. This was the second successive quarter of record gold production and saw a lower strip ratio of 1.3:1. The company ended the quarter with $17.3m cash, an $8.2m increase relative to March 31, 2020. During the quarter, the company released a preliminary economic assessment (PEA) on its Gold Rock project, which is another step in the right direction towards achieving its long-term objective of becoming a 150k oz./yr. producer.

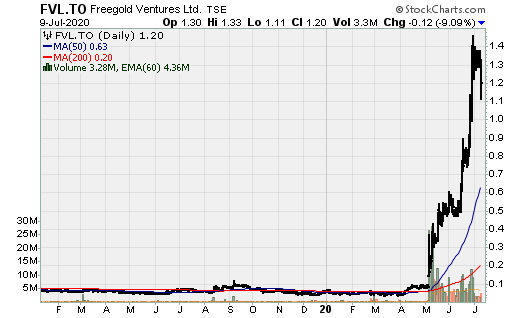

Freegold Ventures: On the back of some very exciting exploration results recently, the company announced a C$30m private placement. Paradigm Capital will act as a sole agent on the private placement of subscription receipts. Each subscription receipt will be issued at a price of C$1.10/share for gross proceeds up to C$30m. Each unit will consist of one common share and one-half warrant, with a 2yr maturity date and $1.65 strike price. Eric Sprott has agreed to invest up to C$420m in the private placement. His interest, upon conversion of his subscription receipts into units, will increase to approximately 35%.

Great Bear Resources: Released more drill results at the LP fault. It expanded the LP fault gold system at depth: 31m @ 10 g/t Au withing 80m @ 4 g/t Au. The other highlight is 3.95m @ 57 g/t Au, within 53m @ 7.26 g/t Au. Given the size of Dixie project and the LP fault, there is still a lot left to be drilled and the company is funded through its 2021. The company expected to release a maiden resource estimate sometime in 2021 and regardless of its size, it will undoubtably grow as this is truly a district scale property.

Great Panther: Another company which only saw Q2 production marginally impacted as its flagship asset, Tucano in Brazil. The company did see its small silver mines in Mexico take a hit, which was largely negated by Tucano production of 38.54k AuEq oz., including record monthly production in June of 15.39k oz.

GR Silver Mining: Released some exploration results and extends the San Juan Ag-Au system at Plomosas to 1km with a 600m step-out. Highlights include: 2.4m @ 15.1 g/t Au, 45 g/t Ag, 3.1% Pb and 0.90% Zn and 21.8m @ 1 g/t Au, 2% Pb and 1% Zn.

Jaguar Mining: Reported Q2 production results, including record production at its Pilar Mine. Q2 production totaled 23.48k oz. Au. The company’s near-term gold is to maintain sustainable production of 25k oz. Au per quarter, which it should achieve in the near future should production continue uninterrupted. Q2 production saw a 28% increase over Q2 2019 and the fifth consecutive quarter of increased production. Both Pilar and Turmalina saw gold production similarly increase 28% over Q2 2019 to 13.45k oz. and 10.03k oz. The company maintains a strong treasury as of the end of Q2, with cash of $30.1m vs. $12.1m at the end of Q1.

K92 Mining: While the majority of mining companies saw Q2 production be interrupted as a result of CV19 and resulting mining suspensions and protocols, K92 achieved record AuEq production of 26.85k oz., a 37% year over year increase. The stage 2 expansion, which will double throughput from 200ktpa to 400ktpa, in expected to be complete by the end of Q3. The company is currently evaluating a 3rd expansion, with a PEA to be completed in Q3. The phase III expansion should allow for a material jump in average output as the company released an updated resource estimate in May, which saw M&I and Inferred resources increase to 3.9m AuEq oz. and 1.3m AuEq oz. [5.2m oz. total vs. 3.1m oz. total at year end 2018].

Kirkland Lake Gold: Despite having to curtail operations at Detour Lake and Macassa in Q2, companywide production results were still very solid at 329.8k oz. Au. In the first half of the year, the company produced a total of 660.6k oz. Au., an increase of 48% relative to the 1H 2019. Detour Lake produced 132k oz. in Q2 despite CV19 disruptions. Fosterville’s production remained strong at 155k oz. and 1H 2020 production of 315k oz. The biggest disruption to production (on a relative basis) was production from the company’s Macassa mine with Q2 production of 41.87k oz. This was as a result of fewer tons processed and lower average grade. Kirkland’s cash position didn’t increase as much as one might think as the company paid $133m in taxes in Australia during Q2 2020 representing the final tax installment for the 2019 tax year and $50m used to repurchase 1.346m common share through its NCIB, bringing total share repurchases this year to $11.06m shares for $380m.

Lundin Gold: Operations have resumed at its Fruta Del Norte gold mine in Ecuador and resumption of regular shipping of concentrate to the port. The mill is currently processing ore from stockpile and the mine at a rate of 2.8tpd and is expected to ramp up to 3.5ktpd by early September. Gold production in the 2H 2020 is forecast to be 150-170k oz. 2H 2020 estimated production plus that which occurred prior to the suspension of operations is estimated to be 220-220k oz. AISC in the 2H 2020 is expected to be $770-$850/oz. Costs should fall in the 1H 2021 vs. 2H 2020 as throughput and recovery rates will increase and exclude some costs to be incurred in the 2H 2020.

Macdonald Mines: Extended the Scadding gold system as it drilled 22.4m of 1.5 g/t Au and 1.46m of 5.2 g/t Au. The company also announced a flow-through private placement of up to C$2m.

Nomad Royalty: Announced preliminary gold and silver deliveries from its royalties, streams, and gold loans for Q2 and the 1H 2020. Gold production (attributable) was 4.14k oz. and 8.26k oz., while silver production was 56.25k oz. and 100.2k oz. The company expected to begin receiving 1k oz. Au per quarter from the Premier gold loan over next twelve quarters. The company’s immediate objective is to execute additional streaming and royalty transactions for near and medium-term growth. The company has organic growth from development stage assets such as the Blyvoor gold stream (South Africa), Woodlawn silver stream (Australia), and a 2% NSR royalty on oxides and sulphides at Suruca (Brazil) but the majority of growth will be realized in 2021, with little after that.

In 2021, attributable AuEq production is estimated at 25k oz., increasing to 27-28k oz. over the medium-term as development assets come-online. Nomad’s primary competitor, base on the what size deals it will look to add [$10-$40m] is Maverix Metals. While the company has a nice base from which to launch what is the 7th largest publicly traded royalty and streaming company, it does have a higher degree of political risk with one of its cornerstone assets being South Africa.

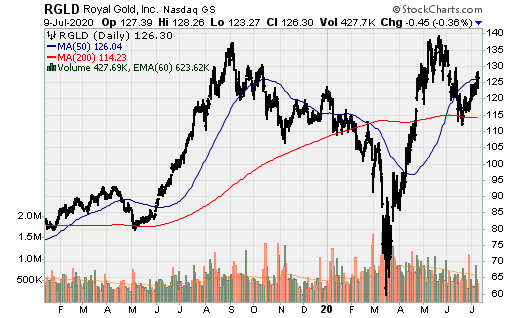

Royal Gold: For its FY 2020 Q4, the company sold 51k AuEq oz. from 44k oz. Au, 450k oz. Ag, and 800t Cu related to its streaming agreements. This was in-line with previous guidance of 50-55k AuEq oz. At quarter end [6/30/2020], there was 25k AuEq oz. in inventory from 19k oz. Au, 475k oz. Ag, and 300t Cu, which was higher than guidance as a result of the timing of deliveries. The company has a number of small-to-moderately sized growth assets as well as organic growth at existing operations coming on-line over the next couple of years, which will, in part negate declining production at Mt. Milligan, which will also start in another couple of years.

Roxgold: Produced 32.8k oz. Au in Q2 at an average grade of 8.2 g/t, bringing output in the 1H 2020 to 65.2k oz. The company set record quarterly throughput of 1.39ktpd, exceeding the nameplate capacity of 1.1ktpd. The company maintained the upper end of annual gold production guidance of 120-130k oz. The feasibility study for its key development asset, Seguela, is on track for early 2021, to be followed by a construction decision.

Sandstorm Gold Royalties: While the company, like so many others, was hit by mining suspensions in Q2 due to CV19, the company managed 10.9k AuEq oz. sold (attributable) to the company, generating $18.7m of revenue and operating margins of approx. $1,460/AuEq oz. All of its producing assets have resumed operations and the company will benefit from increased output beginning in Q4 2020 as it will begin receiving fixed gold deliveries from its Relief Canyon fixed deliveries and stream/royalty agreement, ramp up of production at Fruta Del Norte, higher production from Endeavour’s Hounde mine as a result of its mining Kari Pump. Further, cash flow should see a material increase vs. Q1, due to higher attributable production and substantially higher gold prices.

We hope to see Sandstorm make an accretive streaming or royalty acquisition(s) within the next nine or so months, before the gold (or silver price) moves substantially higher as it is looking primed to do. Further, this could we one of the times the company can acquire material growth [given its capacity to do a $250-$350m deal or a couple $75-$150m deals. Regardless, Sandstorm arguably has the deepest pipeline of royalties and streams on the near term [1-3yrs] and medium term [4-8yrs] including its flagship asset Hot Maden [2% NSR & 30% Interest], an option to acquire a 10% gold stream on Agua Rica, Hugo North extension [0.42% - 5.62%] copper, gold, and silver stream, Bayan Khundii [1% NSR], Heruga [0.42%-4.26%] copper, gold and silver stream, medium-term upside at Aurizona [Royalty increases to a 5% NSR at $2k/oz. gold or higher], New Afton [2% NSR select claims], Newman-Madsen [0.50% NSR on certain parts of the project], Hackett River [2% NSR], among other significant optionality in its portfolio.

Silver One Resources: The company announced a fully subscribed $9m non-brokered private placement at a price of $0.45/unit. Eric Sprott, through 2176423 Ontario Ltd. Intends to subscribe for $5m of the offering. Each unit costs of one common share and one-half purchase warrant with 3yrs until maturity at a strike price of $0.65/share.

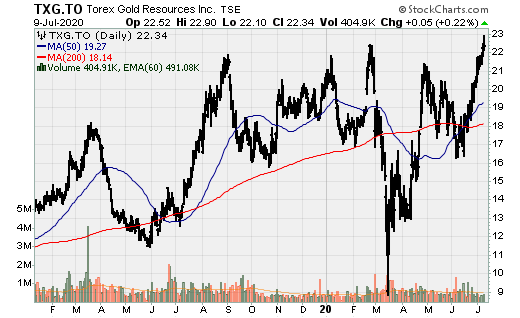

Torex Gold: Announced Q2 gold production, which is significantly lower relative to previous quarter and understandably so. Due to the suspension of mining operations in April and most of May, the company really had just one quarter of full-scale production in June. Q2 production totaled 59.5k oz. Au, with 38.9k oz. of that coming in June and gold sold of 63k oz. With the ELG complex back at expected run-rates together with higher gold prices, 2H 2020 should see record cash flow generation.

Treasury Metals: Closed a $11.52m bought deal private placement of 32m subscription receipts at a price of $0.36 per subscription receipt. The proceeds of the financing will fund the completion of a combined Goliath-Goldlund economic study before year end advance key engineering and environmental baseline data on Goldlund, and complete 25k meters of infill and expansion drilling on the combined projects.

Tudor Gold: The company announced it drilled the best intercept at Treaty Creek of 973m @ 0.845 AuEq g/t including 217.5m @ 1.40 AuEq g/t. Drilling is progressing well on the Goldstorm system, which is on-trend from Seabridge’s massive KSM project, located 5km southwest of Goldstorm. The company also closed a private placement with Eric Sprott for gross proceeds of C$9.3m.

Victoria Gold: After declaring commercial production on July 1st, the company reported June Gold production, which came in very strong at 13.83k oz. Au. Through the first half of the year, gold production totals 39.9k oz. Au. The company had a slowed ramp up of production until June due to CV19 restrictions, having not produced more than 8k oz. in a single month until last month. While June was a strong month, it won’t be until Q3 that Victoria Gold will move to quarterly production and financial reporting.

Vizsla Resources: The company put out some more exciting drill results, highlighted by 6m @ 1808 g/t Ag, 66.8 g/t Au, 3% Pb, and 3.30% Zn and 10.65m @ 134 g/t Ag, 1.34 g/t Au, 0.49% Pb, and 0.91% Zn. The stock price soared on the news (+60%) and the following day the company announced a C$25m bought deal private placement the following day and the stock price was up another >10%.

Wesdome Gold Mines: Exploration drilling at the Eagle River mine returned 6m @ 314 g/t Au and confirmed down plunge extension of the Falcon zone to the Mine 7 zone. Recent drilling also had some other highlights including 2.1m @ 44.7 g/t Au and 2.1m @ 64.7 g/t Au. The company now believes the Falcon 7 zone extends from surface approx. 1,000m down plunge and part of the up-plunge extension of the 7 zone currently being mines near 1,000m elevation.