With government imposing mandatory suspensions of non-essential business in some places around the world, the majority of the mining sector continues to operate uninterrupted with the exception of adhering to CV19 protocols. Meanwhile, the gold price continues to hold strong at or above $1,800/oz. and has been very buoyant after sell-offs. Additionally, silver seems to be confirming the breakout and the time is nearing where silver will outperform gold, as we've seen the start with a contracting gold-to-silver ratio. But beware and put together a shopping lists/put in stink bids for company’s you may want to take a position in, should we see a sell-off before gold and silver move materially higher.

$AGI, $AUN.V, $BTG, $CGC.V, $EXK, $AG, $FSM, $GORO, $GCM.TO $KNT.V, $KGC, $KTN.V, $LGD.TO, $MUX, $NGD, $NUAG.V, $NSR.TO, $NEE.V, $OGC.TO, $OSK.TO, $SVM, $VGCX.TO $WM.TO, $WDO.TO, $AUY

Alamos Gold: Announced the Phase III expansion study at Island Gold, which will be the company’s future cornerstone asset in Ontario, Canada. At the time Alamos acquired Richmont, it looked as if the company overpaid for the company but it is now looking like the Alamos executed a brilliant deal. Alamos has already increased output, lowered costs, and greatly expanded its reserve and resource base. Following the expansion, the operation will be of material scale, with cash costs in the lowest quartile on the industry cost curve, in a tier-I mining jurisdiction with plenty of exploration potential.

Per the Study, assuming a long-term gold price deck of $1,450/oz., the project yields an after-tax IRR of 17% and an NPV of $1.02b, which increases to $1.45b at $1,750/oz. Au. The mine life will double to 16yrs [based on a mineable resource of 3.2m oz. Au @ 10.45 g/t]. Average annual production will increase by 60%+ to 236k oz. and cash costs and AISC will fall 19% and 30% (vs. the mid-point of 2020 guidance) to $403/oz. and $534/oz. beginning in 2025. The mine life could be extended given the exploration potential.

The company evaluated five different scenarios for the Phase III expansion, with the company deciding the best use of capital is a shaft expansion to 2ktpd [currently a ramp @ 1.2ktpd] and the addition of a paste plant. This will require various infrastructure investments totaling $500m [installation of a shaft, paste plant, and an expansion of the mill and tailings facility]. Following the completion of the shaft construction in 2025, the operation will transition from trucking ore and waste to skipping ore and waste to surface through the new shaft.

Alamos is positioned for growth, not only with Island Gold but its Turkish development projects [construction has commenced on Kirazli as $32m of $152m of initial capital investment has been incurred but the company’s concessions expired in late 2019 and it is working with the Turkish Department of Energy and Natural Resources on securing renewal]. It is likely the company will be building both projects at some point in the next couple of years. Following completion of these projects, the company plans to build out Lynn Lake.

Aurcana: Announced a non-brokered private placement of up to C$10.5m by issuing 21m units at C$0.50/unit. Each unit will consist of one common share and one full common share purchase warrant, with each warrant entitling the holder thereof to purchase one common share at a purchase price of C$0.75 for a 3yr period. The proceeds will be focused on continuing to advance its Virginius Silver Mine in Colorado.

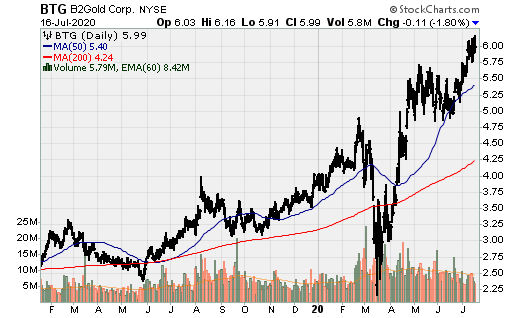

B2Gold: Unlike so many companies, B2Gold didn’t realize any mining suspensions in Q2 and produced 241.6k oz. Au, remaining on track to achieve full year production guidance of 1m-1.055m oz. With strong production and higher gold prices, the company has record quarterly revenue of $442m.

Caldas Gold: Following the announcement of the Pre-feasibility study (PFS) for the Marmato expansion and securing $110m via precious metals stream financing, the company announced a C$45m bought deal private placement of special warrants. A syndicate of underwriters have agreed to purchase, on a bought deal private placement basis, 20m special warrants of Caldas Gold at an issue price of C$2.25/warrant to raise aggregate proceeds of C$45m. The underwriters have the option, at any time up to 48 hours prior to closing date to purchase up to an additional 2.22m special warrants at the issue price for additional gross proceeds of approx. C$5m. Each special warrant entitles the holder to receive one unit of Caldas Gold upon the exercise of the special warrant, with each unit consisting of one common share and one common share purchase warrants. Each warrant will be exercisable at C$2.75/share.

Given the quality of the asset, the fact gold is in bull market makes be believe funding for the expansion could have been sourced more efficiently. Stream financing is great for companies which don’t stream its primary metal, but not so much for those streaming the primary metal. In addition to the stream financing [which isn’t too dilutive in and of itself], the issuance of these proposed special warrants [which it should have been able to negotiate better terms], the company also announced it will look into debt financing via gold linked notes, which will cost the company more as the gold price rises. Regardless, this is a very good asset with much exploration upside potential in the MDZ.

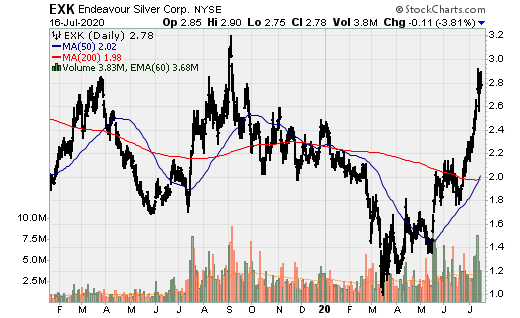

Endeavour Silver: On Monday, the company released an updated Pre-Feasibility Study (PFS), which is more robust relative to the 2018 PFS. Using spot prices for silver and gold at July 8th, 2020 [$18.49/oz. Ag & $1,812/oz. Au], the project has an NPV5 of $230m and IRR of 45.70%. Life of mine cash costs and mine-site AISC (net of byproduct gold) of negative (-$4.15/oz.) and ($2.06/oz.). With an initial 10yr mine-life and initial capital investment of $99.1m, Terronera will produce average payable Ag and Au production will be 3m oz. and 33k oz. using a 1.6ktpd plant.

The operation will have plant capacity of 1.6tpd but there is significant exploration upside as well as expansion potential. The company will evaluate utilizing a 2ktpd plant, which will increase output and have a big impact on the overall value of the project. This could be a phased process, first to 1.6ktpd then to 2ktpd. At 2ktpd, average annual production would increase to 3.75m oz. Ag and >40k oz. Au, which in all likelihood will be reached, if not exceeded.

First Majestic Silver: Q2 production totaled 3.5m AgEq oz. and updated 2020 guidance. Q2 production consisted of 1.8m oz. Ag and 15.76k oz. Au. Being solely focused on Mexico, it was well known First Majestic would be hit hard due to mandated mining suspensions during the quarter. Production was actually a bit higher than expected due to a slower than expected ramp-down at San Dimas. YTD, the company has produced 9.7m AgEq oz., consisting of 5m oz. Ag and 47.97k oz. Au. As at quarter end the company held 970k oz. Ag of inventory in anticipation of higher silver prices in the 2H 2020.

New guidance for 2020, which isn’t all that different from previous guidance; 21.4-to-22.9m AgEq oz. [Assumed gold price of $1,700/oz., up from $1,450/oz, increase AgEq production from the gold-to-silver ratio and due to other smaller adjustments]. In the 2H 2020, silver and gold production is expected to be 6.1-6.6m oz. and 58-65k oz. Au. Full year 2020 production is now forecast to be 11-11.7m oz. Ag and 106-113k oz. Au. @ AISC of $12.29-$13.45/oz. [10.57-$12.49/oz in the 2H].

Fortuna Silver: Production for Q2 from its two operating mines, San Jose and Caylloma. The company produced 1.3m oz. Ag and 7.1k oz. Au, bringing the 1H 2020 total to 3.1m oz. Ag and 17.2k oz. Au. Production was substantially lower due to a nearly 2-month period of suspended operations at what is currently its largest mine, San Jose. This was further augmented by lower grades (220 g/t Ag and 1.42 g/t Au vs 273 g/t Ag and 1.68 g/t Au in Q2 2019).

The company reported the successful completion of commissioning of the primary and secondary crushing circuits and the start of stacking ore on the leach pad. This is an important milestone for both Fortuna and Lindero, which will greatly increase free cash flow generation when production is achieved and ramped up to design capacity. Ore irrigation and leaching of the heap is planned to begin at the end of August, with the first gold pour planned for the end of Q3 2020.

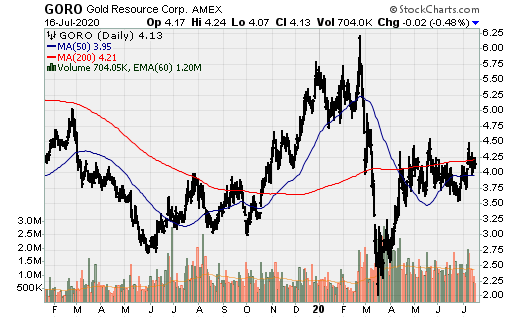

Gold Resource Corp: Produced 7.65k oz. Au and 191k oz. Ag in Q2. Gold production from its Nevada Mining Unit (NMU) totaled 5.21k oz., a 41% increase over Q1 during the Isabella Pearl mine’s on-going production ramp-up. Through the 1h 2020, The NMU produced 8.9k oz. Au. Gold production from the NMU will really ramp up production in Q4 when it accesses the high-grade Pearl deposit. Production in 2021 from the NMU is projected to increase to 40k oz. Production from its Oaxaca Mining Unit (OMU) was hit by almost two months of mining operations being suspended but will rebound in Q3.

Gran Colombia: Q2 production totaled 48.23k oz. Au, with June gold production of 17.5k oz. 1H 2020 production reached 104.48k oz. [vs. 118.48k oz. in the 1H 2019]. Lower output reflects the impact on the company’s operations of the CV19 national quarantine in Colombia on March 25th, 2020 and which remains in effect. Both its mines continue to operate and the company expects to update its 2020 full year guidance when it reports Q2 results in August. At Segovia, the company has been more successful in keeping production levels in May and June closer to normal and expect it will continue to do so if conditions remain as they are now. At Marmato, it has been more challenging getting access to workers during the quarantine. At June 30th, 2020, after paying income tax installments of approximately $32m in Q2, Gran Colombia’s cash position stood at approx. $73m.

K92 Mining: The company announces the latest high-grade drill results at Kora. Drill highlights from this press release include:

- 4.58m @ 24.81 g/t Au, 11 g/t Ag, and 0.28% Cu – K2 Vein

- 1.68m @ 5.36 g/t Au, 628 g/t Ag, and 8.39% Cu – K3 Vein

- 4.04m @ 45.98 g/t Au, 136 g/t Ag, and 7.39% Cu – K2 Vein

- 22.8m @ 11.31 g/t Au, 26 g/t Ag, and 1.40% Cu

- 4.99m @ 34.31 g/t Au, 6 g/t Ag, and 0.17% Cu – K1 Vein

- 4.66m @ 26.77 g/t Au, 117 g/t Ag, and 2.99% Cu – K2 Vein

- 4.39m @ 13.59 g/t Au, 47 g/t Ag, and 2.41% Cu – K2 Vein

- 3.77m @ 18.23 g/t Au, 10 g/t Ag, and 0.72% Cu – K1 Vein

- 3.04m @ 15.85 g/t Au, 7 g/t Ag, and 0.67% Cu – Kora Link

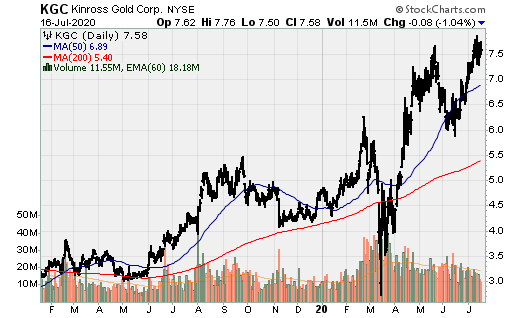

Kinross Gold: Announced the results of the Lobo-Marte pre-feasibility study in Chile. This would be a future cornerstone asset as it is expected to start production after the conclusion of mining at the company’s La Coipa project. The PFS envisions total life of mine production of 4.5m oz. Au with cash costs and AISC expected to average $545/oz. and $745/oz. The project will have an initial 12yrs of mining followed by 3yrs of residual processing. Kinross anticipates construction starting in 2025, followed by production in 2027. Initial capital costs are estimated at $1b.

Kootenay Silver: Reported results from an additional 5 drill holes from the high-grade Columba property. The holes are step outs along strike and to depth from high-grade intercepts reported in the Phase II drill campaign. The F vein is showing good continuity for 700m of strike length of strike lengths and depths to 240m. Having established at least one well mineralized shoot within the F vein over a sizeable area, Kootenay will now focus on testing other veins on the property. High priority areas include the J-Z vein where last year a hole returned 25.85m @ 200 g/t Ag. Kootenay will revert its focus back to the F vein after other veins have been explored. Highlights from the additional 5 holes in this press release include:

- 4.08m @ 279 g/t Ag within 7.53m @ 199 g/t Ag

- 11m @ 175 g/t Ag and 3m @ 496 g/t Ag within 34m @ 116 g/t Ag

- 5m @ 158 g/t Ag and 1.8m @ 319 g/t Ag within 25m @ 57 g/t Ag

- 4m @ 171 g/t Ag

Liberty Gold: Released additional RC drill results at Black Pine. On June 23rd, a third high grade gold discovery (D-3 Zone) was identified in close proximity to the D-1 and D-2 zone discoveries made in 2019. The D-3 Zone lies beneath the limit of shallow historical drilling that is modeled to underlie at least the southern two thirds of the Black Pine gold system. Eight additional holes have extended mineralization over 400m. D-3 remains open for expansion in all directions. Highlights from drilling at D-3 include 67.1m @ 1.20 g/t Au. 9.1m @ 1.43 g/t Au, 6.1m @ 6.33 g/t Au, among others. This new drilling illustrates that D-3 is a significant new discovery.

McEwen Mining: Announced Q2 production and exploration results. The company has been disappointing over the last couple of years, as it has had elevated costs at many of its assets. But with the gold pricing currently trading between $1,775-$1,825/oz., even these high-cost mines should generate modest cash flow. Q2 production was greatly impacted by temporary mining suspensions at all four of its operations, along with operational issues at several mines. McEwen produced 15.7k oz. Au and 359k oz. Au during the quarter. The biggest operational issues continue to be at the Gold Bar mine and throughout May and June the mine only operated on day shift as work progressed for the updated resource model, new mine plan and addressing engineering design deficiencies. Pit optimizations are ongoing and detailed mine planning is underway. Completion of a new resource estimate, mine plane, and 2020 forecast will be released in Q3.

There are some bright spots as development of the access to the Froom deposit at Black Fox is on track, having advanced 30% of the way to the orebody. The plan is to reach the orebody in Q2 2021, develop and commence production from Froome in Q4 2021.

New Gold: Q2 production totaled 98k oz. AuEq [64.3k oz. Au, 134k oz. Ag, and 16m lbs. Cu]. Rainy River produced 49.6k AuEq oz. while New Afton produced 48.45k oz. During the quarter, the company entered into an agreement with Artemis Gold to divest its Blackwater Project for C$190m in cash, an 8% gold stream, and a C$20m equity stake in Artemis. The company also completed a $400m senior notes offering yielding 7.50% due in 2027, which along with cash on hand, was used to fund the full redemption of its outstanding 6.25% senior notes due in 2022. The company will announce updated guidance together with Q2 financial results on July 30th, 2020.

New Pacific Metals: Announced assay results from the four in-fill drilling holes at Silver Sands. They were drilled to obtain representative samples for detailed metallurgical work required by a preliminary economic assessment (PEA). These included: 71.3m @ 149 g/t Ag, 121.9m @ 180 g/t Ag, 282m @ 104 g/t Ag, and 105m @ 152 g/t Ag.

Nomad Royalty: Entered into an agreement with The Bank of Nova Scotia, Royal Bank of Canada, and Canadian Imperial Bank of Commerce for a $50m revolving credit facility with the option to increase to $75m. The facility has an 18-month term, extendable through mutual agreement. Nomad only recently went public, with a nice portfolio of royalties and streams and is already the 7th largest precious metal royalty and streaming company. The company is looking to grow aggressively and as it will be generating attributable production of approx. 24-25k AuEq oz. in 2021, a $50-$75m credit facility is reasonable.

Northern Vertex: Announced record production of 11.37k oz. Au for its fiscal Q4 quarter, generating record revenue of $18.2m. Realized gold and silver prices during the quarter were $1,716/oz. and $16.84/oz. After a slow ramp-up period, it looks like the company has achieved stead state production (or very near). Even though the company is small producer, it has started to generate robust cash flow due to higher production, lower costs, and of course, higher gold prices. The company has $6.8m of cash on hand at quarter end. The company, at least in the very near-term will look to pay down debt via excess cash generation and execute on its exploration initiatives. With the Moss Mine now operating at or near design capacity and generating free cash flow, Northern Vertex should be looking at various way to increase production, which might include M&A.

Oceana Gold: Announced the PEA for the Waihi district study in New Zealand. Using a long-term price deck of $1,500/oz, the project will generate a 51% internal rate of return and an NPV5 of $665m. LOM cash costs and AISC are to be $557/oz. and $627/oz. This will extend the mine life to 2036 from multiple sources of mill feed. Capital Investment is estimated at $447m over 8yrs for four deposits. The company also increase the resource for the Martha pit to 260k oz. Au (indicated) and 290k oz. (inferred). The steady state production profile beginning in 2021 production will commence, initially at 75-100k oz. p.a., through 2023, after which time [due to another deposit coming online], production will increase to 110-120k oz. Au for the next two years, increasing to 270-300k oz. from 2026-2031, after which time production will fall to 90k oz. Au until 2036. This will likely change assuming the company had just moderate exploration success either by increasing the size of each deposit and/or through discovering additional deposits.

Osisko Mining: The two most exciting high-grade exploration/development projects in Canada are arguably Great Bear Resource’s Dixie Project and Osisko’s Windfall project. Osisko continued infill drilling at Lynx, which confirms its high-grade nature. The company has provided new drilling results from the ongoing definition and expansion drill program. Twenty-two drills are active at Windfall (including 16 on surface and 6 underground), all currently focused on the Lynx deposit. Select results from 40 intercepts in 16 drill holes and 5 wedges include:

- 5m @ 199 g/t Au

- 2.7m @ 103 g/t Au

- 6.2m @ 31 g/t Au

- 2.4m @ 44 g/t Au

- 2.6m @ 28.2 g/t Au

- 2.6m @ 44.6 g/t Au

- 2.2m @ 31.2 g/t Au

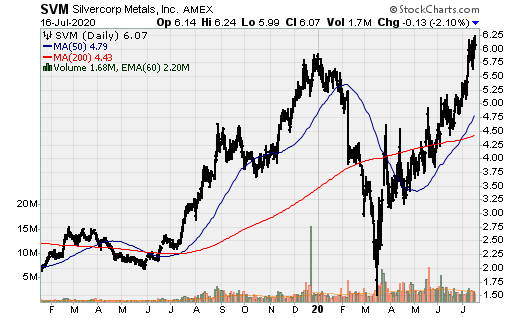

Silvercorp Metals: Reported production and for its Q1 of fiscal year 2021. The company produced 1.8m oz. Ag, 20.1m lbs. Pb, and 7.5m lbs. Zn. The company remains on track to produce 6.2-6.5m oz. Ag, 66.1-68.5m lbs. Pb, and 24.5 – 26.7m lbs. Zn in FY 2021. Silvercorp is flush with cash, had no debt, will be generating far more robust cash flow with higher silver prices and a valuable investment portfolio (due to its sizeable interest in New Pacific Metals). Silvercorp is on the hunt for acquisitions, whether it be silver or gold, as seen through its failed bid to acquire Guyana Goldfields.

Victoria Gold: 2020 being a transition year for the company, Victoria achieved commercial production at Eagle on July 1, 2020 and subsequently provided inaugural guidance for the 2H 2020. The company expected to produce between 85-100k oz. Au at AISC of $950-$1,100/oz. The company is still ramping up to full capacity over the 3rd and 4th quarter, with the goal of being fully ramped up in Q4. It is anticipated that AISC will be towards the upper end of cost guidance [AISC $1,050-$1,100], then falling to the lower end in Q4, with further improvements in 2021, which per the FS, will be $775-$825/oz.

Wallbridge Mining: Reported the first assay results received since the resumption of exploration activities after the suspension thereof due to CV19. Highlights include:

- 18.95m @ 4.88 /t Au – Serrano Zone

- 6.80m @ 5.84 g/t Au – Serrano Zone

- 51.7m @ 4.06 g/t Au including 19.15m @ 8.41 g/t – Tabasco-Cayenne

- 9.75m @ 4.44 g/t Au - Tabasco-Cayenne

- 3m @ 15.73 g/t Au – Andromeda Zone

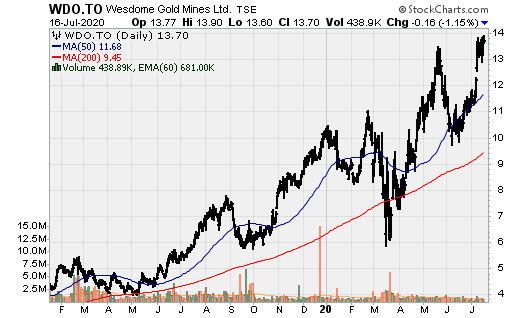

Wesdome: Announced Q2 2020 production numbers. Wesdome produced 25.14k oz. Au, bringing 1H production to 50.26k oz. and it remains on track to achieved full year guidance of 90-100k oz. Au. Output was better than anticipated due to mining higher grade ore from the 303 zone, partially negated from CV19 protocols; operating the mine at reduced capacity.

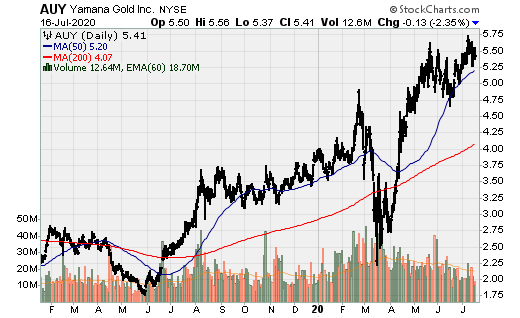

Yamana Gold: Q2 production totaled 164k oz. Au and 2.01m oz. Ag for 183.58k oz. AuEq. The quarter was highlighted by excellent operating performances, which exceeded planned production targets at El Penon, Canadian Malartic, Jacobina, and Minera Florida. In line with guidance, production and cash flow are expected to sequentially increase over the third and fourth quarters of the year. Guidance was revised on April 30th, 2020, to reflect temporary suspensions at Canadian Malartic and Cerro Moro. The company continues to deleverage, with $769m in net debt at quarter end.