Precious metals and mining stocks are in a strong, confirmed uptrend, and now is the time to let your winners run and ignore the naysayers.

Since precious metals and their miners are in strong, confirmed uptrends, now is the time to align yourself with the trend and tune out the noise.

There is still plenty of negativity from the usual peanut gallery, the same voices who failed to see this bull market coming and have remained bearish the entire way up.

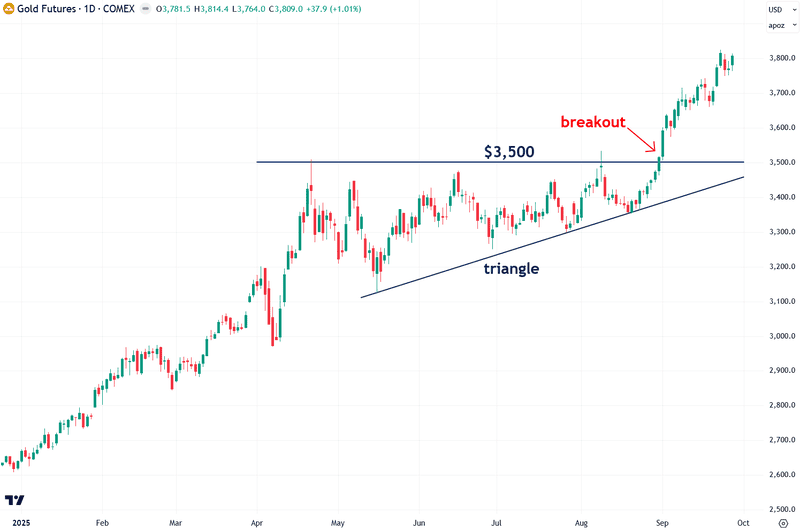

So let’s take a look at where precious metals stand, starting with gold in the form of COMEX futures. Gold has been on a tear ever since it broke out of its summer triangle consolidation pattern, and it has continued setting fresh all-time highs almost daily over the past month.

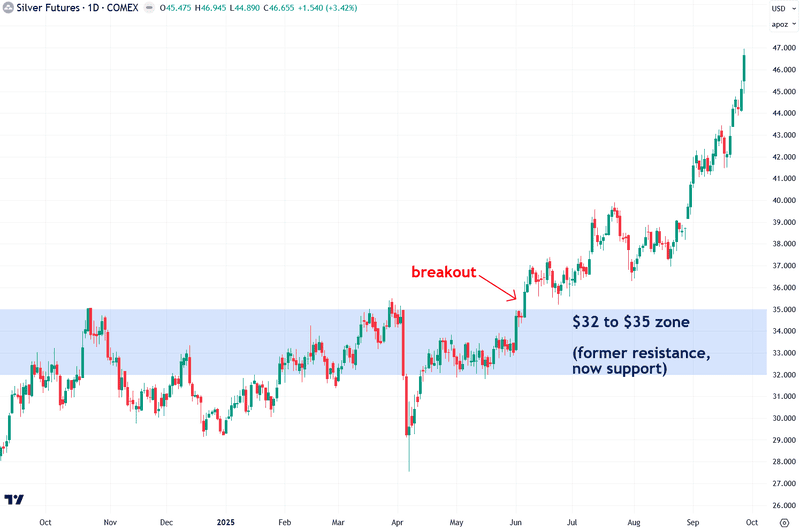

Now let’s turn to silver in the form of COMEX futures. Silver has been in a confirmed bull market since breaking above its former resistance zone between $32 and $35, which now acts as support.

It is currently trading around $47, its highest level in more than 14 years, and is gaining strong momentum. Silver is well-positioned to break through the $50 level and continue much higher in the near future.

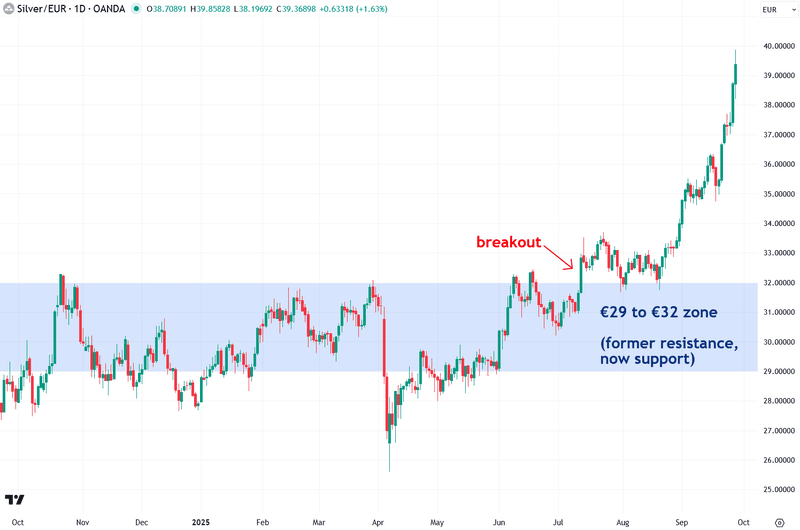

I also monitor silver priced in euros because it strips out the effects of U.S. dollar fluctuations, and it has remained in a confirmed bull market since breaking above the €29 to €32 resistance zone, which now acts as support.

This is a textbook breakout and rally, and at this point, there’s little to do but let it unfold. I believe it still has plenty of room to rise, especially given how long it spent consolidating over the past year.

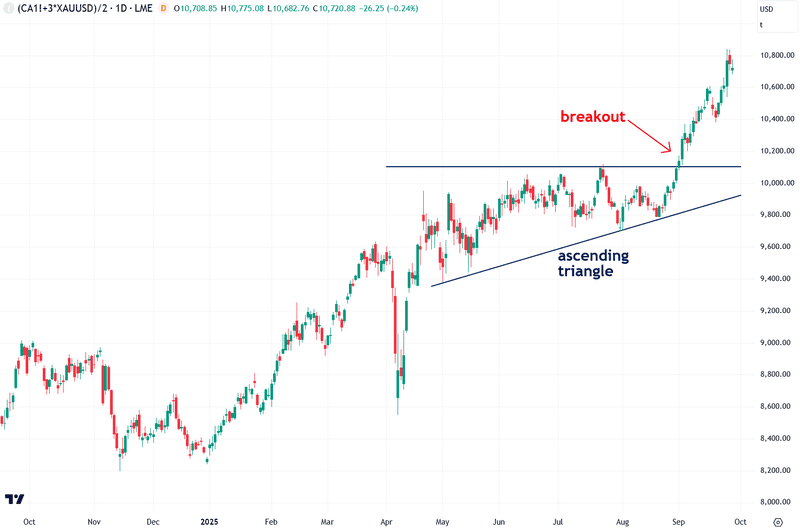

The Synthetic Silver Price Index (SSPI), a proprietary indicator I developed to help determine whether silver’s moves are genuine or merely noise or manipulation, broke out of its ascending triangle pattern earlier this month.

This breakout signals that both the SSPI and silver are now entering powerful new phases of their bull markets.

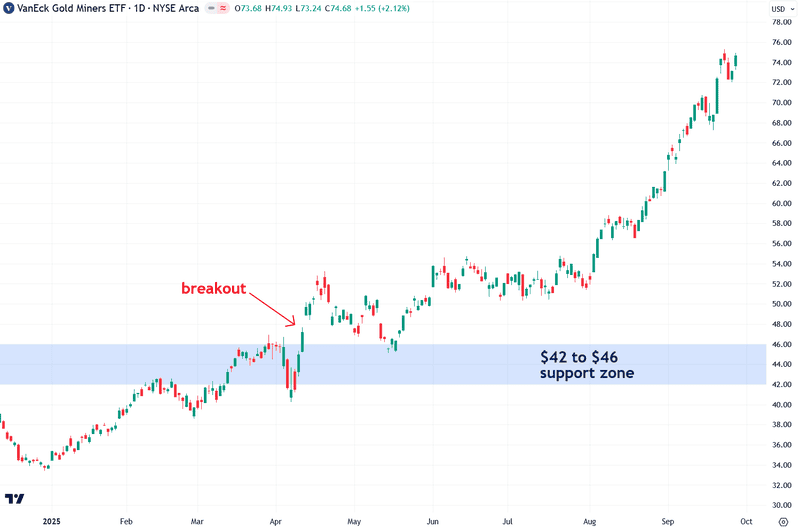

Gold mining stocks have been on a tear, and they remain in a very strong bullish position. While I’m extremely bullish on them over the intermediate and long term, I don’t believe now is the best time to jump in, as they’ve already run well beyond their breakout levels and could be due for a short-term pullback.

That’s why it’s so important to enter positions as they’re breaking out, not after the move is well underway. Still, a consolidation phase will likely come at some point, offering another attractive reward-to-risk entry opportunity.

The large-cap gold miner ETF GDX is in a strong technical position and continues to hold above the $42 to $46 support zone I’ve highlighted for many months, including in the report linked above.

That’s a bullish sign, and I believe this is a time to hold and let the bull market unfold. However, since GDX is now well extended above that breakout level, I don’t view this as an ideal time for a first-time entry.

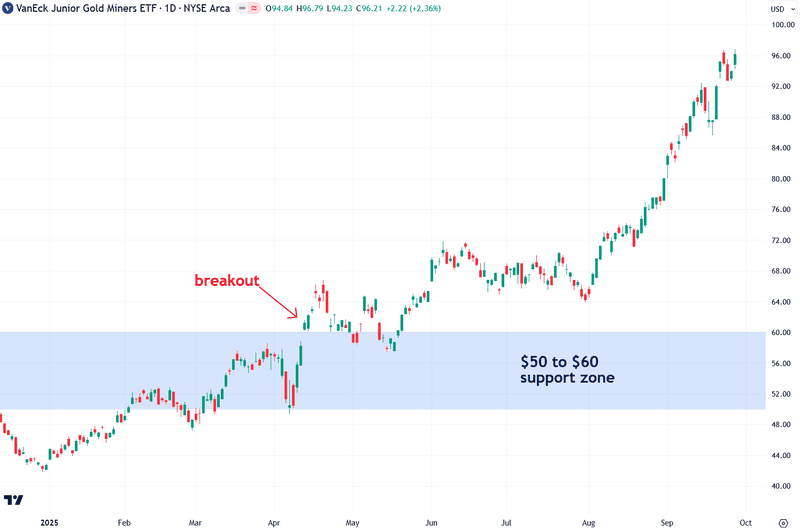

The GDXJ junior gold mining ETF is in a nearly identical position to its larger sibling, GDX, and remains well extended above its $50 to $60 support zone.

That’s not a concern for those already in from lower levels, but I don’t believe it’s wise to chase it here. A better entry point may come after a period of consolidation.

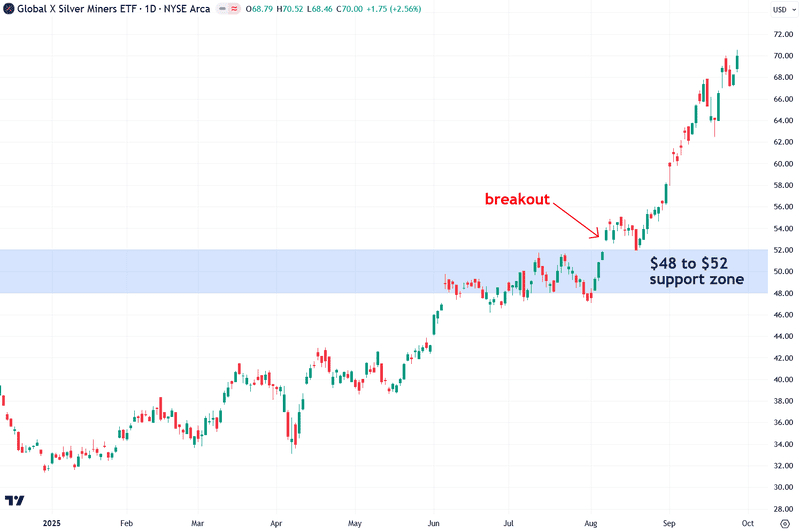

The SIL silver miners ETF is also in a strong position, holding well above its $48 to $52 support zone that I’ve frequently shown over the past six months.

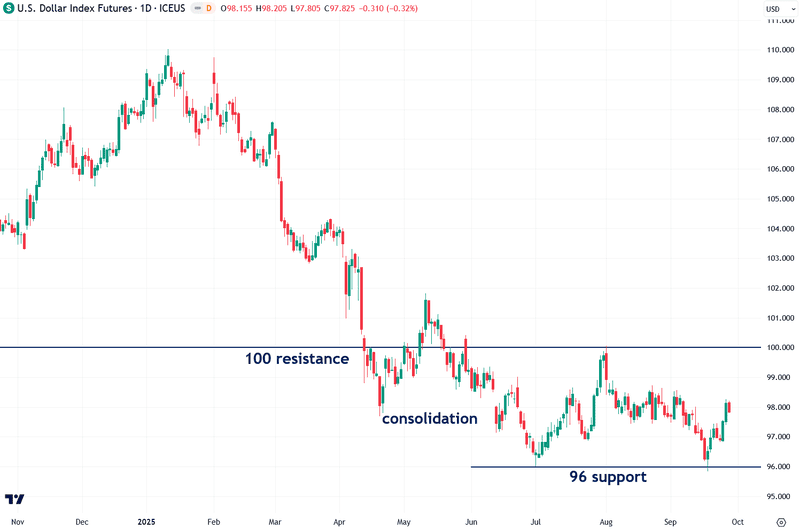

I also monitor the U.S. Dollar Index for clues about the direction of precious metals, since it tends to move inversely to them. The index has been consolidating since it broke below the key 100 level in April.

The 96 level is a critical support zone to watch because a breakdown below it would likely signal further declines in the dollar, which would be bullish for precious metals.

Although the dollar bounced last week on stronger-than-expected economic data, the overall bias remains to the downside due to technical factors and because the dollar is still significantly overvalued relative to other major currencies.

This is an important setup to watch, and I’ll be keeping a close eye on it.

To summarize, it’s a pleasure to report that gold, silver, and mining stocks are in a strong position, currently experiencing their most powerful bull market in recent memory.

And it’s still early. We are less than two years into this move, and secular precious metals bull markets typically last 10 to 15 years.

That’s why this remains my primary focus, and I have no interest in selling or worrying about downside until much later in the cycle.

Precious metals investors have endured a difficult thirteen years, but now is our time to thrive. Bull markets like this don’t fade away quickly. I hope you’re all benefiting from this powerful trend, and as always, I’ll continue to keep you updated on what I’m seeing.