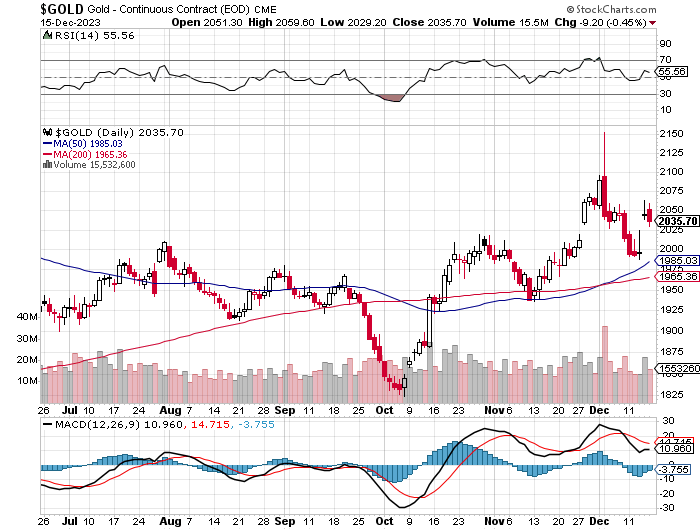

After a brief sell-off in early Globex trading on Thursday evening in New York, the gold price began to edge quietly higher -- and that lasted until the 10:30 a.m. morning gold fix in London. From that point it traded sideways to a bit lower until the commercial traders of whatever stripe kicked it downstairs at exactly 8:30 a.m. in COMEX trading in New York. It then had quiet and ascending up/down move centered around 10:15 a.m. EST...until 'da boyz' appeared once more about fifteen minutes before the 1:30 p.m. COMEX close...where it got booted downstairs anew. That engineered price decline lasted until around 2:35 p.m. in after-hours trading -- and it crept quietly higher from there until the market closed at 5:00 p.m. EST.

The high and low ticks in gold were recorded as $2,059.60 and $2,029.20 in the February contract. The December/February price spread differential in gold was $14.60...February/April was $19.50...April/June was $19.40 -- and June/ August was $17.20 an ounce.

Gold was closed on Friday afternoon in New York at $2,019.90 spot, down $16.30 on the day. Net volume was nothing special at a bit under 159,500 contracts -- and there were a bit under 13,000 contracts worth of roll-over/ switch volume on top of that.

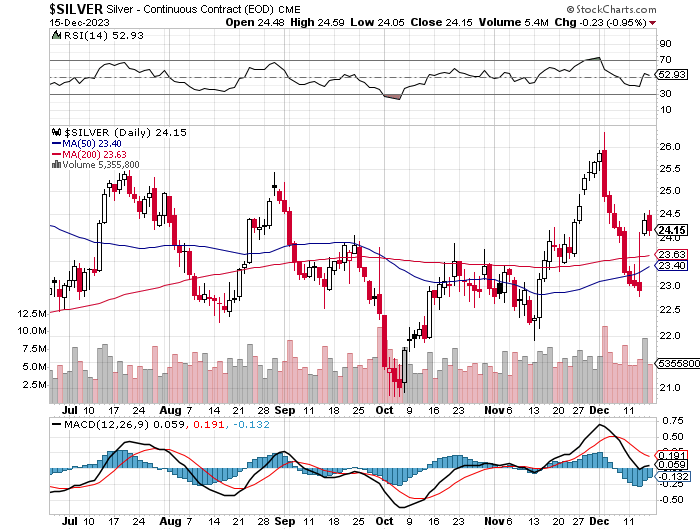

Silver's managed price path in both Globex and COMEX trading was a carbon copy of gold's in every respect...so I'll spare you the play-by-play on this.

The high and low ticks in it were reported by the CME Group as $24.59 and $24.05 in the March contract. The December/March price spread differential in silver at the close in New York yesterday was 28.4 cents...March/May was 22.7 cents...May/July was 21.7 cents -- and July/September was 21.4 cents an ounce.

Silver was closed in New York on Friday afternoon at $23.87 spot, down 27 cents from Thursday. Net volume was nothing at all special either at around 54,200 contracts -- and there were just about 2,800 contracts worth of roll-over/switch volume in this precious metal.

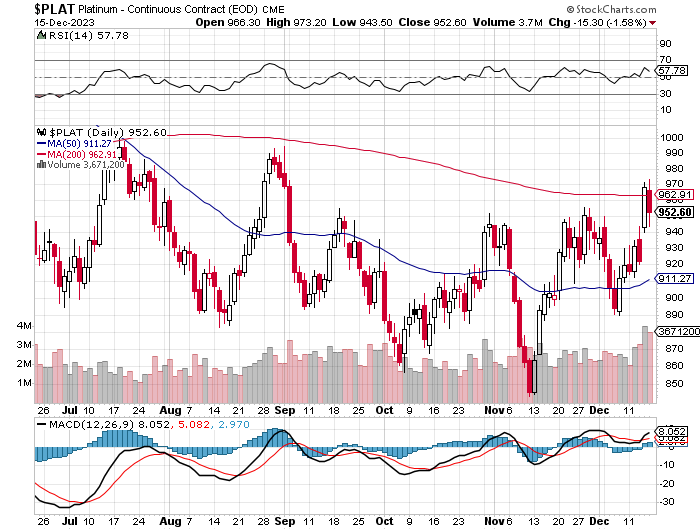

Platinum wandered very quietly sideways to a hair higher until around 10:20 a.m. in Zurich -- and from there it traded sideways until price pressure appeared around 1:15 p.m. CET. It was engineered lower from that juncture until around 9:35 a.m. in COMEX trading in New York -- and every time it attempted to rally after that, it was immediately sold lower. Platinum was closed at $940 spot, down 20 bucks from Thursday.

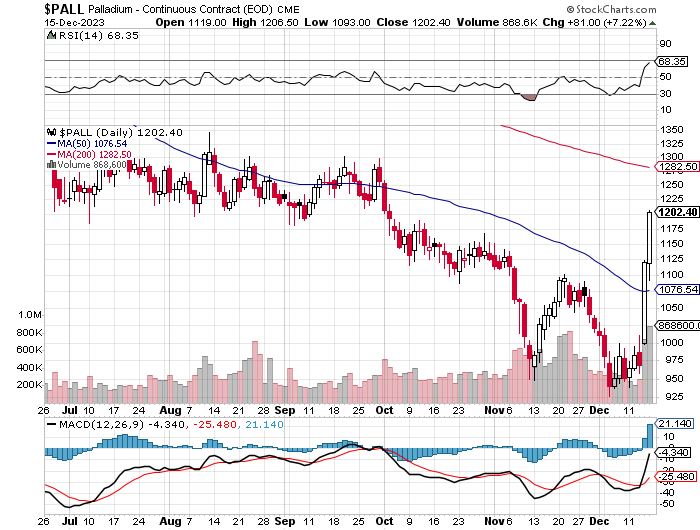

The palladium price took two very quiet and broad steps lower until the 2:15 p.m. afternoon gold fix in Globex trading in Shanghai on their Friday afternoon -- and its ensuing rally was rolled over starting around 12:45 p.m. in Zurich. That lasted until very shortly before 9 a.m. in COMEX trading in New York -- and the rally that commenced from there was capped at 1 p.m. EST. It was sold a bit lower over the next hour -- and didn't do a thing after that. Palladium was closed at $1,164 spot, up another 66 dollars.

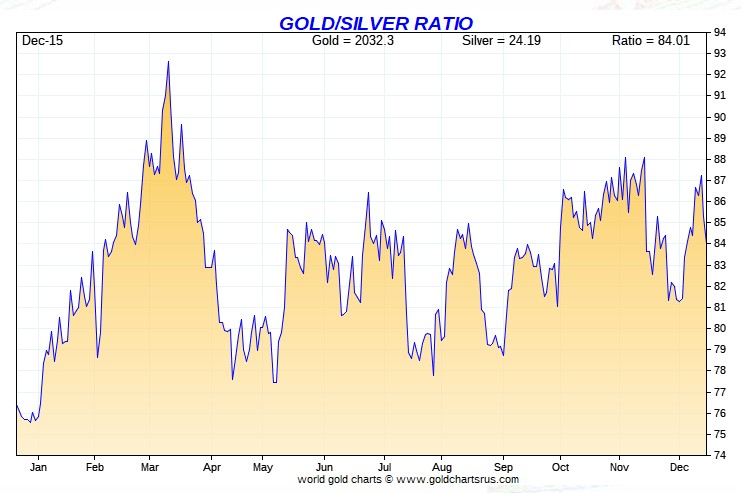

Based on the kitco.com spot closing prices in silver and gold posted above, the gold/silver ratio worked out to 84.6 to 1 on Friday...compared to 84.3 to 1 on Thursday.

Here's Nick's 1-year Gold/Silver Ratio chart updated with this past week's data and, as always, Friday's data point is not on it. Click to enlarge.

The dollar index closed very late on Thursday afternoon in New York at 101.96 -- and then opened higher by 13 basis points once trading commenced at 7:45 p.m. EST on Thursday evening, which was 8:45 a.m. China Standard Time on their Friday morning. It headed very quietly lower from there until around 12:43 p.m. CST, which was its low tick of the day. From that juncture it took three very broad and somewhat uneven steps higher until its high tick was set around 1:55 p.m. in New York -- and from that point it had a quiet down/up move until the market closed at 5:00 p.m. EST.

The dollar index finished the Friday trading session in New York at 102.55...up 59 basis points from its close on Thursday.

Here's the DXY chart for Friday, thanks to marketwatch.com as usual. Click to enlarge.

And here's the 5-year U.S. dollar index chart that appears in this spot every Saturday, courtesy of stockcharts.com as always. The delta between its close...102.18...and the close on the DXY chart above, was 37 basis points below its spot close. Click to enlarge.

The correlation in the dollar index and gold, silver and platinum prices was only obvious when they were forced to do so -- and that only occurred at 8:30 a.m. in New York. They refused to fall further, despite the ongoing 'rally' in the DXY...so the commercial traders were forced to step in again at 1:15 p.m. EST.

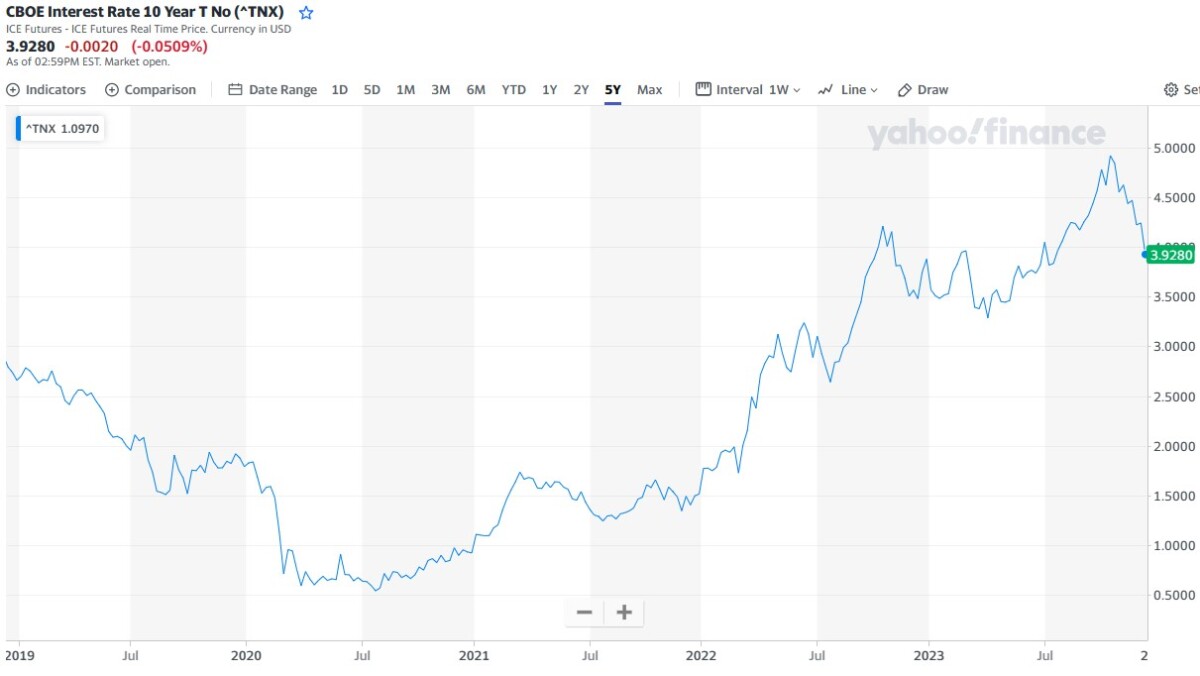

U.S. 10-year Treasury: 3.9280%...down 0.0020 (-0.0509%)...as of 02:59 p.m. EST

And here's the 5-year 10-year U.S. Treasury chart from the yahoo.com Internet site -- which puts the yield curve into a somewhat longer-term perspective. Click to enlarge.

With the 10-year now below 4%...I suspect that the Fed will keep putting lipstick on this pig for as long as they can, now the U.S. Presidential election cycle is looming.

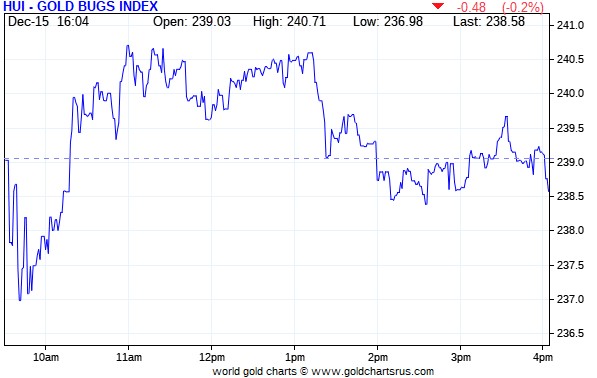

The gold stocks chopped a bit lower as soon as the markets opened at 9:30 a.m. EST in New York on Friday morning -- and that sell-off lasted for ten minutes. They then chopped higher, with their respective highs coming at 11 a.m. They then had a quiet but choppy down/up move until 'da boyz' appeared at 1:15 p.m. in the COMEX futures market when the blasted gold lower. The gold shares chopped rather reluctantly lower from that point until around 2:35 p.m. EST -- and then chopped quietly and very unevenly higher until the markets closed at 4:00 p.m. The HUI finished the Friday trading session down only 0.20 percent.

Computed manually, the new Silver Sentiment/Silver 12 Index finished down 1.41 percent.

Here's Nick's old 1-year Silver Sentiment/Silver 7 Index chart, updated with Friday's candle. Click to enlarge.

The star on Friday, was Thursday's dog...SSR Mining, as it closed up on the day by 1.99 percent. The two biggest underperformers were Aya Gold & Silver -- and MAG Silver, as they closed down 3.18 and 3.06 percent respectively.

Once again the precious metal stock, particularly the gold shares, held up rather well considering the lickin' that 'da boy' laid on silver and gold prices yesterday.

The reddit.com/Wallstreetsilver website, now under 'new' but not improved management, is linked here. The link to two other silver forums are here -- and here.

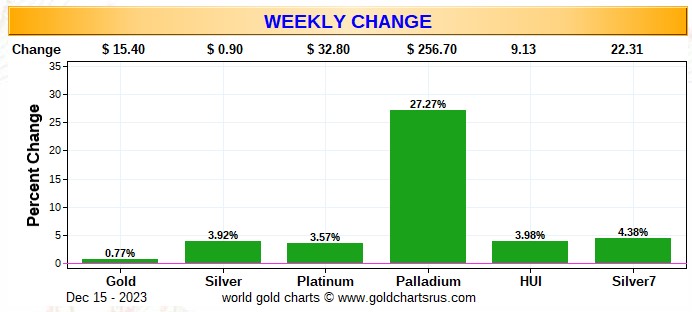

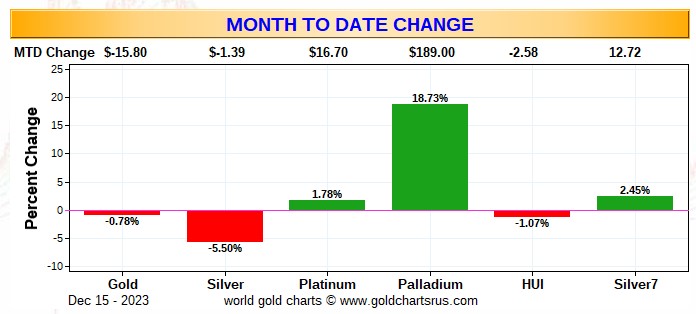

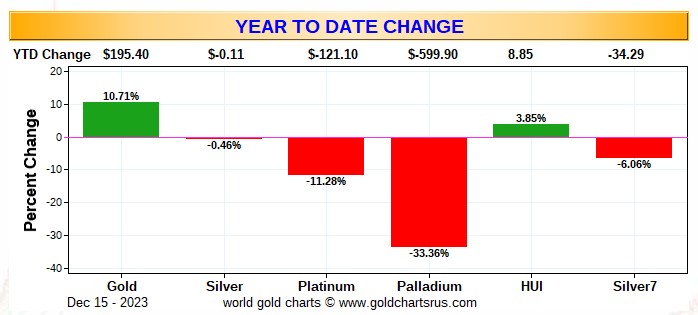

Here are the usual three charts that appear in every weekend missive. They show the changes in gold, silver, platinum and palladium in both percent and dollar and cents terms, as of their Friday closes in New York — along with the changes in the HUI and the old Silver 7 Index.

Here's the weekly chart -- and we're back to wall-to-wall green...but nothing to write home about, or comment on...except for palladium's big gain because of short covering by the managed money traders et al.

Here's the month-to-date chart -- with everything silver-related, handily outperforming everything gold-related. Even platinum and palladium are now up month-to-date...so far. Click to enlarge.

Here's the year-to-date graph -- and we're back to only gold and its associated equities being up since the beginning of 2023. As has been the case all year, the equities continue to perform horridly vs. their underlying precious metals. The engineered price decline in palladium all year long continues to amaze -- and that's despite the improvement of this past week, with platinum's engineered decline...the U.S. bullion banks' No. 2 problem child...very noticeable as well.

Of course -- and as I mention in this spot every Saturday -- and will continue to do so...is that if the silver price was sitting within 2 or so percent of its old high of $50 the ounce...like gold is currently sitting within 2 or so percent of its old high of around $2,075...it's a given that the silver equities would be outperforming their golden cousins by an absolute country mile.

The COT Report that came out yesterday showed the expected decreases in the commercial net short positions in both gold and silver. More on that a bit further down.

The CME Daily Delivery Report for Day 13 of December deliveries showed that 190 gold -- and 2 silver contracts were posted for delivery within the COMEX-approved depositories on Tuesday.

In gold, there six short/issuers in total -- and the two largest were Morgan Stanley and Advantage, as they issued 86 and 53 contracts from their respective client accounts. Next were ADM and Marex Capital Markets, issuing 20 contracts each out of their respective client accounts.

There were seven long/stoppers, the largest of which was Canada's Scotia Capital/Scotiabank, as they picked up 90 contracts for their house account. The next three biggest after them were Canada's BMO Capital Markets, JPMorgan and Marex Spectron Capital Markets, as they stopped 39, 25 and 20 contracts respectively...JPMorgan for its client account.

In silver, the sole short/issuer was ADM -- and BofA Securities and JPMorgan stopped 1 contract each...the former for their house account.

In palladium, there were 4 contracts issued and stopped.

The link to yesterday's Issuers and Stoppers Report is here.

Month-to-date there have been 13,910 COMEX gold contracts issued/reissued and stopped -- and in silver that number is 2,954 contracts. In platinum it's 47 contracts -- and in palladium it's 153.

The CME Preliminary Report for the Friday trading session showed that gold open interest in December dropped by 130 contracts, leaving 358 still open, minus the 190 contracts mentioned several paragraphs ago. Thursday's Daily Delivery Report showed that 310 gold contracts were actually posted for delivery on Monday, so that means that 310-130=180 more gold contracts just got added to the December delivery month.

Silver o.i. in December declined by 9 contracts, leaving 654 still around, minus the 2 contracts mentioned a few paragraphs ago. Thursday's Daily Delivery Report showed that 9 silver contracts were actually posted for delivery on Monday, so that means that the change in open interest and deliveries match for once.

Total gold open interest at the close on Friday fell by 2,303 COMEX contracts -- and total silver o.i. dropped by 830 contracts. Both these numbers are subject to some revision by the time the final figures are posted on the CME's website later on Monday morning CST.

Gold open interest in January dropped by 74 contracts, leaving 3,259 still around -- but silver o.i. in January rose by 13 contracts, leaving 1,808 still open.

After a smallish withdrawal on Wednesday, there was a decent deposit into GLD on Thursday, as an authorized participant added 64,880 troy ounces of gold...but there were 824,167 troy ounces of silver removed from SLV.

In other gold and silver ETFs and mutual funds on Planet Earth on Friday, net of any changes in COMEX, GLD and SLV inventories, there were a net 139,998 troy ounces of gold added -- and a net 1,455,341 troy ounces of silver were added as well, with the two largest amounts...1,341,508 added to iShares/SVR -- and the 410,338 troy ounces that ended up at BullionVault.

There was finally a sales report from the U.S. Mint...the first one for December -- and maybe the last one for the year as well. They sold 14,000 troy ounces of gold eagles -- 12,500 one-ounce 24K gold buffaloes -- and 368,000 silver eagles.

There was very little activity in gold over at the COMEX-approved depositories on the U.S. east coast on Thursday. Nothing was reported received -- and only 12,047 troy ounces were shipped out...7,031 troy ounces at Brink's, Inc. -- and 5,015.556 troy ounces/156 kilobars from the International Depository Services of Delaware.

There was some paper activity -- and the only two amounts that mattered were the 17,416 troy ounces transferred from the Registered category and back into Eligible over at HSBC USA...with the remaining 12,687 troy ounces transferred from the Eligible and into Registered over at Manfra, Tordella & Brookes, Inc.

The link to Thursday's COMEX action in gold, is here.

But it was far busier in silver, as two truckloads/1,184,315 troy ounces were reported received. One truckload/599,170 troy ounces arrived at Brink's, Inc. -- and the other one...585,144 troy ounces...was dropped off at CNT.

There were 8,199 troy ounces/eight good delivery bars shipped out of Delaware -- and that was all the 'out' activity there was. There was no paper action -- and the link to 'all of the above' in silver, is here.

It was another big day over at the COMEX-approved gold kilobar depositories in Hong Kong on their Thursday, as 5,575 kilobars were received -- and 65 were shipped out. Except for the 56 kilobars that arrived at Loomis International, the remaining in/out activity took place over at Brinks', Inc. as always. The link to this, in troy ounces, is here.

And just as a note here, I read in this story I found on Sharps Pixley yesterday that..."Russia's gold reserves decreased by about 16 tonnes to 2,315 tonnes in November." But since The Central Bank of the Russian Federation doesn't update their website with November's data until next Wednesday, I'm wondering how they know that. Maybe the data is available somewhere else that I'm not aware of. The proof will be in the pudding in next Thursday's missive.

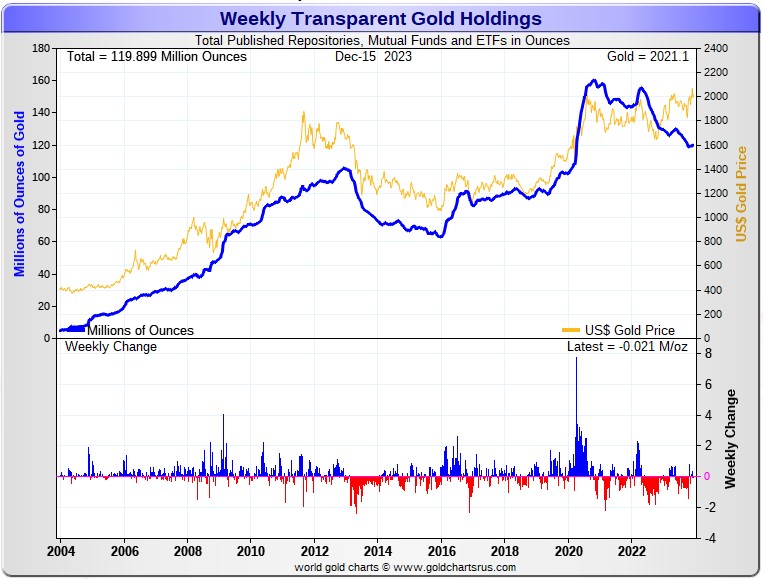

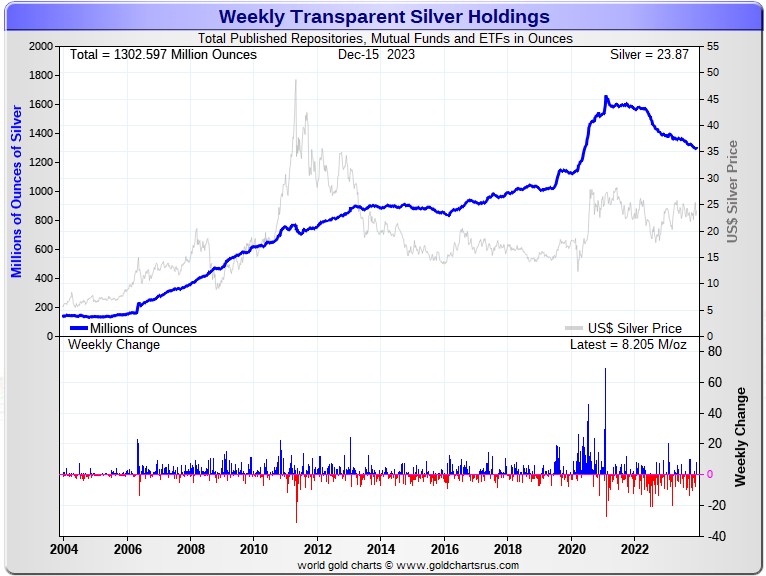

Here are the usual 20-year charts that show up in this space in every Saturday column. They show the total amounts of physical gold and silver held in all know depositories, ETFs and mutual funds as of the close of business on Friday.

During the week just past, there were a net 21,000 troy ounces of gold removed -- but a net 8.205 million troy ounces of silver was added ....which was almost entirely due to that 7.33 million troy ounces deposited in SLV this past Tuesday. Click to enlarge for both.

According to Nick Laird's data on his website, there were a net 459,000 troy ounces of gold added -- but a net 2.983 million troy ounces of silver were withdrawn from all the world's known depositories, mutual funds and ETFs during the last four weeks.

In gold, the only two showing deposits worthy of the name were the COMEX and Deutsche Bank, as they added a net 897,000 and 191,000 troy ounces respectively during that time period. The big gain in COMEX gold was mostly kilobars into Hong Kong. In very distant third place were the net 39,000 troy ounces added to Japan's Physical AU ETF. The largest 'out' amount by far were the 340,000 troy ounces that left XetraGold -- and in second place were the 161,000 troy ounces that departed iShares/SGLN. The rest showed much smaller in/out [mostly out] amounts.

In silver, the only two 'in' amounts that mattered were the COMEX, as they received 2.485 million troy ounces -- and the net 1.330 million troy ounces added to iShares/SVR. The largest 'out' amounts were the 1.511 million troy ounces taken out of Source/SSLV...followed by the 1.248 million troy ounces that departed ETF Securities/SIVR. In third and fourth place were the 1.084 and 844,000 troy ounces that were shipped out of SLV and Bullion Vault respectively. The list goes on and on...

Retail bullion sales are still in the toilet, although I'm sure it has picked up this past week...although it varies quite a bit between dealers. At the moment, dealers have lot of inventory of everything. But when retail investment demand really gets serious once again, we will be back to shortages/back orders and high premiums in very short order. And that's not taking into account the mind-boggling quantities of silver that will be absorbed by all the silver ETFs and mutual funds.

Where will all this physical metal come from in the face of this ongoing and accelerating physical shortage, one wonders? It's one of the things that the powers-that-be fear most I suspect, as it just won't be there at some point... although JPMorgan & Friends are sitting on a goodly amount of the stuff according to Ted. And as he stated very recently, it would appear that JPM & Co. have parted with about 500 million troy ounces of silver over the last three years, of the one billion troy ounces that they'd accumulated since 2011.

SLV received that 7.33 million troy ounces on Tuesday, but Ted said that they're owed a lot more -- and whether the authorized participants have gone short in lieu of depositing physical metal, won't be know until the new short report comes out on Wednesday, December 27.

The physical demand in silver at the wholesale level continues unabated -- and shows absolutely no signs of slowing down. Almost all of what's left in the various public ETFs and mutual funds is not available for sale...including the COMEX, where new silver has to be brought in from other sources [JPMorgan] to meet the ongoing demand for physical metal...like the two truckloads that arrived on Thursday. This will continue until available supplies are depleted... which will be the moment that JPMorgan stops selling into the deficit.

The vast majority of precious metals being held in these depositories are by those who won't be selling until the silver price is many multiples of what it is today. That's particularly true of shareholders in PSLV. But during the last four weeks, there have been a net 275,283 troy ounces of silver withdrawn from it.

Sprott's PSLV is the third largest depository of silver on Planet Earth with 171 million troy ounces -- and some distance behind the COMEX, where there are 269 million troy ounces being held. [However, as Ted Butler mentions from time to time, it's most likely that 103 million troy ounces of that amount is actually held in trust for SLV -- and his letter to the SEC and CFTC of five weeks ago on this issue remains answered. He may have something new to say about it in his weekly review for his paying subscribers this afternoon.] But PSLV is still some distance behind SLV, as they are the largest silver depository, with 440 million troy ounces as of Friday's close.

The latest short report from Monday, December 11th showed that the short position in SLV rose by a further 8.48%...up to 18.34 million shares held short. If you remember, BlackRock issued a warning a couple of years ago to all those short SLV, that there might come a time when there wouldn't be enough metal for them to cover. That time appears to be long past now.

And as I mentioned above, the next short report will be posted on The Wall Street Journal's website on Wednesday, December 27 -- and the cut-off for that report was at the close of trading yesterday.

Then there's that other little matter of the 1-billion ounce short position in silver held by Bank of America in the OTC market...with JPMorgan & Friends on the long side. Ted says it hasn't gone away -- and he's also come to the conclusion that they're now short around 30 million ounces of gold with these same parties as well...down 7 million oz. from the 37 million they were short in the June OCC Report. The latest report from the OCC for Q3/2023 came out earlier this week -- and based on what was in it, Ted hasn't changed his opinion one bit.

The Commitment of Traders Report, for positions held at the close of COMEX trading on Tuesday, showed the expected declines in the commercial net short positions in both gold and silver. I was rather disappointed with the silver number, considering the fact that 'da boyz' closed it below both its 50 and 200-day moving averages during the reporting week...but there was a reason for that.

In silver, the Commercial net short position fell by only 4,518 COMEX contracts...22.590 million troy ounces of the stuff -- and most of that amount came about because of Ted's raptors buying long contracts.

They arrived at that number by reducing their long position by 3,124 contracts -- and also reduced their short position by 7,642 contracts. It's the difference between those two numbers that represents their change for the reporting week.

Under the hood in the Disaggregated COT Report, it was [not surprisingly] all Managed Money traders -- and a whole bunch more, as they reduced their net long position by a monstrous 12,863 COMEX contracts. They arrived at that number by selling 10,380 long contracts and 2,483 short contracts -- and its the sum of those two numbers that represents their change for the reporting week.

The other two categories were big buyers, as the Other Reportables and Nonreportable/small traders increased their net long positions by 5,018 and 3,327 contracts respectively.

The aggressive buying by these two categories was the sole reason why the commercial traders didn't cover as many short positions as they should/could have.

Doing the math: 12,863 minus 5,018 minus 3,327 equals 4,518 COMEX contracts, the change in the Commercial net short position.

The Commercial net short position in silver now stands at 47,496 COMEX contracts/237.480 million troy ounces...down those 4,518 contracts from the 52,014 COMEX contracts/260.070 million troy ounces they were short in the December 8 COT Report.

The Big 4 shorts decreased their short position by only 1,499 contracts to 43,641 contracts, down from the 45,140 contracts they were short in last Friday's COT Report.

The Big '5 through 8' shorts actually increased their net short position during the reporting week...by 224 contracts...from the 18,307 contracts in last week's report, up to 18,531 in this week's COT Report.

Ted is still of the opinion that there's a Managed Money traders in the No. 7 or 8 spot...most likely the latter -- and that they may have added a couple of hundred more short contracts, putting them short around 3,200 COMEX contracts.

The Big 8 shorts in total decreased their net short position from 63,447 contracts, down to 62,172 COMEX contracts week-over-week...a drop of only 1,275 contracts. But the Big 8 commercial shorts number is overstated by those approximately 3,200 contracts held by that Managed Money short, so that has to be subtracted out...leaving the Big 8 traders short around 60,00 contracts. The Big 8 short position is now back to just about what it was in the December 1 COT Report -- and still some distance above its low of late October.

Ted's raptors, the small commercial traders other than the Big 8, net of that managed money trader, added about 3,000 long contracts during the reporting week. They are net long about 11,000 COMEX contracts.

Their buying of long contracts has the mathematical effect of decreasing the Commercial net short position by that amount, which isn't a decrease at all.

Don't forget, that despite their small size, they're still commercial traders in the commercial category -- and all in the Swap Dealers category.

Here's Nick's 3-year COT Reportfor silver, updated with the above data. Click to enlarge.

The Managed Money traders did exactly what they were tricked into doing...selling aggressively on that engineered price decline, especially since both key moving averages were penetrated to the downside during the reporting week.

The surprise was how aggressive the Other Reportables and Nonreportable traders were on the buy side...as the Big 4 shorts didn't accomplish much -- and I'm not sure if that was by design, or by circumstance.

Of course, as you already know, the price action since the Tuesday cut-off makes Friday's COT Report very much 'yesterday's news'.

But the real story since the cut-off was the big drop in silver open interest on that monster rally on the Fed news on Wednesday afternoon. Both Ted and myself were expecting a big blow-out in total open interest for obvious reasons...maybe as much as 10,000 contracts...but that didn't happen. As a matter of fact, the final figure from the CME Group showed an even bigger drop than the preliminary number...as total open interest on Thursday fell by 4,990 COMEX contracts. I'll have more on this 'man bites dog' moment in The Wrap.

On its face, the set-up in silver from a COMEX futures market perspective appears to be still bearish...but that may have changed by a lot since the Tuesday cut-off for aforesaid mentioned reason.

In gold, the commercial net short position fell by 14,137 COMEX contracts, or 1.414 million troy ounces of the stuff...a decent chunk of which was Ted's raptors loading up on the long side.

They arrived at that number by adding 2,517 long contracts -- and also covered 11,620 short contracts -- and it's the sum of those two numbers that represents their change for the reporting week.

Under the hood in the Disaggregated COT Report, it was almost all Managed Money traders on the sell side, as they reduced their net long position by 13,859 COMEX contracts. They accomplished this by reducing their long position by 10,273 contracts -- and also sold 3,586 short contracts.

The Other Reportables were also sellers, reducing their net long position by 1,452 contracts. But the Nonreportable/small traders were buyers, increasing their net long position by 1,174 contracts.

Doing the math: 13,859 plus 1,452 minus 1,174 equals 14,137 COMEX contracts, the change in the commercial net short position.

The commercial net short position in gold now sits at 212,808 contracts/ 21.281 million troy ounces of the stuff...down those 14,137 contracts from the 226,945 contracts/22.695 million troy ounces they were short in the December 8 COT Report.

The Big 4 shorts decreased their net short position by 8,710 contracts, from 163,789 contracts, down to 155,079 contracts...which is slightly less than they were short back on December 1.

The Big '5 through 8' shorts decreased their net short position from the 72,633 contracts they held short in the December 8 COT Report, down to 71,901 contracts held short in the current COT Report...a decrease of only 732 COMEX contracts.

The Big 8 commercial short position declined from 236,422 contracts/ 23.642 million troy ounces, down to 226,980 contracts/22.698 million troy ounces...a decrease of 9,442 COMEX contracts.

Ted's raptors, the small commercial traders other than the Big 8, not surprisingly, added 4,695 long contracts during the reporting week, as they increased their long position from 9,477 COMEX contracts, up to 14,172 contracts.

[So, if you add the 4,695 long contracts that the raptors bought, to the 9,442 long contracts the Big 8 shorts purchased, the total comes to 14,137 COMEX contracts...the change in the commercial net short position. As I keep pointing out, this ain't rocket science.]

Their buying of long contracts had the mathematical effect of decreasing the commercial net short position by that amount which, as you already know, isn't an decrease at all. It's only what the Big 4/8 commercial short do that matters, which is something you already know. Ted was disappointed that they didn't do more during the reporting week.

Don't forget that despite their small size, the raptors are still commercial traders in the commercial category -- and are in direct competition with the Big 4/8 shorts for the longs that the Managed Money traders et al. were dumping in a panic. That applies to silver as well.

Here's Nick Laird's 3-year COT Report chart for gold, updated with the above data. Click to enlarge.

Of course -- and like for silver, yesterday's COT Report is basically irrelevant considering what's happened since the Tuesday cut-off and the big rally on the Fed news.

And also like in silver, total open interest on Thursday, which includes the data from that rally, only rose by a net 3,800 COMEX contracts. On a rally that size, total open interest would normally have blow out by 25-30,000 contracts or more, as the Managed Money traders poured onto the long side -- and the commercials went short against them. Not this time and, like for silver, I'll have more on this in The Wrap.

Of course the set-up in gold still remains bearish -- and would appear to be even more so since the cut-off...but appearances can be deceiving.

Ted has always said that there would come a time when what the COT Report showed wouldn't matter -- and whether we've reached that stage or not, remains to be seen.

So we wait some more.

In the other metals, the Managed Money traders in palladium decreased their net short position by 571 COMEX contracts -- and remain net short palladium by a monstrous 10,052 contracts...47 percent of total open interest. But after the huge rallies on Thursday and Friday, its a given that they've reduced that short position by a huge amount. The commercial traders remain very net long palladium in both categories...especially the Swap Dealers. The traders in the Other Reportables and the Nonreportable/small traders are also net short palladium by small amounts from a COMEX futures market perspective...mostly the former.

In platinum, the Managed Money traders decreased their net short position by 1,157 COMEX contracts during the reporting week -- and are now net short platinum by only 723 COMEX contracts. The Producer/Merchant category remains the only other category net short platinum at the moment -- and they are mega net short to the tune of 22,815 contracts -- and are mostly U.S. bullion banks as per last Friday's Bank Participation Report. The rest of the categories are net long by very decent amounts...including the Swap Dealers in the commercial category.

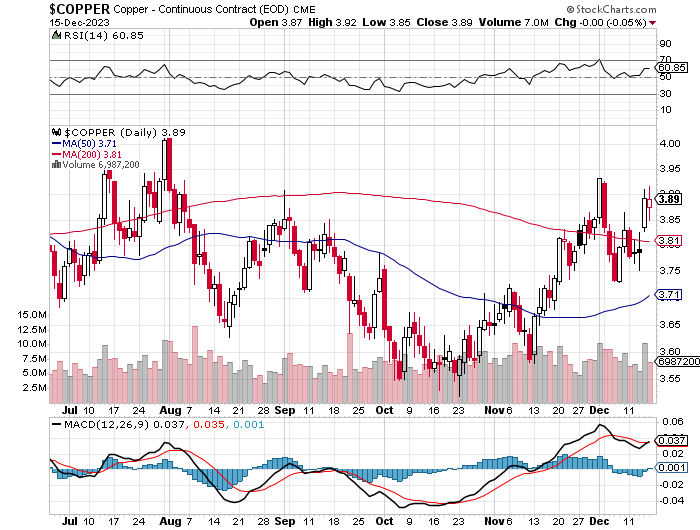

In copper, the Managed Money traders decreased their net long position by a piddling 875 contracts -- and are net long copper by 6,300 COMEX contracts... about 175 million pounds of the stuff as of the December 15 COT Report... compared to the 179 million pounds they were net long in last Friday's COT Report.

Copper, like platinum, continues to be a wildly bifurcated market in the commercial category. The Producer/Merchant category is net short 24,861 copper contracts -- and the Swap Dealers are net long 29,992 COMEX contracts.

Whether this means anything or not, will only be known in the fullness of time. Ted says it doesn't mean anything as far as he's concerned, as they're all commercial traders in the commercial category.

In this vital industrial commodity, the world's banks...both U.S. and foreign...are net long 12.5 percent of the total open interest in copper in the COMEX futures market as shown in the December Bank Participation Report that came out last Friday...up from the 10.6 percent they were net long in November's. At the moment it's the commodity trading houses such as Glencore and Trafigura et al., along with some hedge funds, that are net short copper in the Producer/Merchant category, as the Swap Dealers are mega net long, as pointed out above.

The next Bank Participation Report is due out on Friday, January 5.

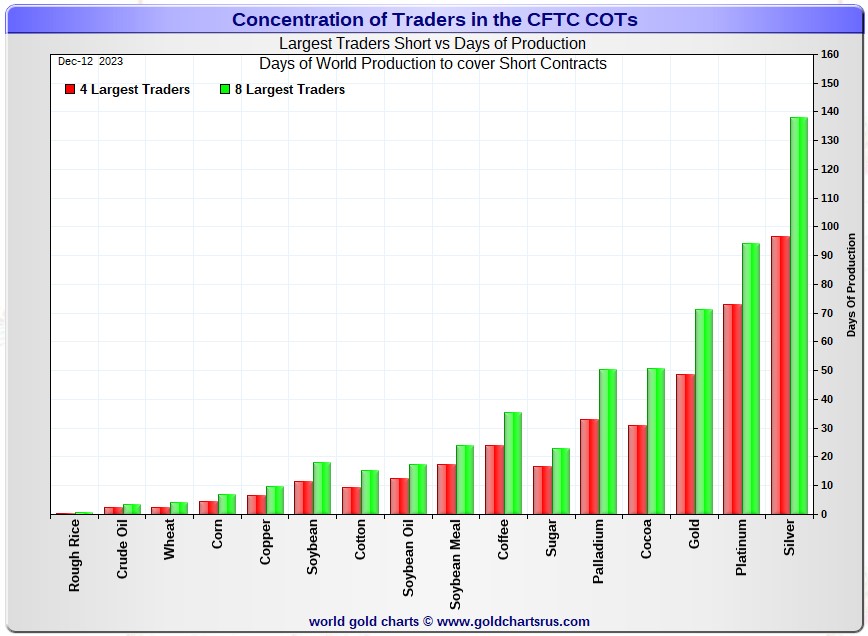

Here’s Nick Laird’s “Days to Cover” chart, updated with the COT data for positions held at the close of COMEX trading on Tuesday, December 12. It shows the days of world production that it would take to cover the short positions of the Big 4 — and Big '5 through 8' traders in every physically traded commodity on the COMEX. Click to enlarge.

In this week's data, the Big 4 traders are short about 97 days of world silver production...down about 3 days from last week. The ‘5 through 8’ large traders are short an additional 41 days of world silver production ...unchanged from last week, for a total of about 138 days that the Big 8 are short -- and obviously down 3 days from last week's report.

Those 138 days that the Big 8 traders are short, represents about 4.6 months of world silver production, or 310.86 million troy ounces/62,172 COMEX contracts of paper silver held short by these eight mostly all commercial traders. Several of the largest of these are now non-banking entities, as per Ted's discovery in last December's Bank Participation Report. This December's Bank Participation Report continues to confirm that this is still the case -- and not just in silver, either.

Ted's raptors, the small commercial traders other than the Big 8, increased their long position up to 11,676 COMEX contracts. But the roughly 3,200 contract short position held by that Managed Money trader that continues to contaminate the Big '5 through 8' category, has to be subtracted out. Once that is done, the raptors purchased about 3,000 long contracts during the reporting week.

In gold, the Big 4 are short about 49 days of world gold production...down 2 days from last week's COT Report. The '5 through 8' are short 22 days of world production, down about 1 day from last week...for a total of 71 days of world gold production held short by the Big 8 -- and down about 3 days from last Friday's COT Report.

The Big 8 commercial traders are short 46.3 percent of the entire open interest in silver in the COMEX futures market as of yesterday's COT Report, up a bit from the 45.4 percent that they were short in the December 8 COT Report. And once whatever market-neutral spread trades they have on are subtracted out, that percentage would be something close to the 55 percent mark. In gold, it's 48.3 percent of the total COMEX open interest that the Big 8 are short, down an insignificant amount from the 48.5 percent they were short in the December 8 COT Report -- and most likely a bit over the 55 percent mark once their market-neutral spread trades are subtracted out.

And as also mentioned earlier, Ted is still of the opinion that Bank of America is short about one billion ounces of silver in the OTC market, courtesy of JPMorgan & Friends. He's also of the opinion that they're short 30 million troy ounces of gold as well. And with the latest OCC Report in hand for Q3/2023 that came out this week...he hasn't changed his mind one bit on that.

The short position in SLV now sits at 18.34 million shares as of this past Monday's short report...up from 16.91 shares sold short in the prior report.

Earlier this week there were 7.33 million troy ounces of silver added to SLV -- and whether that was added to cover an existing short position, won't be know until the next short report comes out on Wednesday, December 27.

The situation regarding the Big 4/8 commercial short position in gold and silver is still obscene -- and whether that has improved or worsened, won't be known with any degree of certainty until next Friday's COT Report -- and there are still two more reporting days until the Tuesday cut-off.

As Ted has been pointing out ad nauseam forever, the resolution of the Big 4/8 short positions will be the sole determinant of precious metal prices going forward -- which is now obvious to all, except for those whose jobs/careers and so-called 'reputations' depend upon them not seeing it.

I don't have all that many stories, articles or videos for you today.

CRITICAL READS

Guard Down, Towel Tossed -- Doug Noland

History will be the judge. This period will be examined, analyzed, discussed, and debated for at least the next century. My task after a week like this is to provide some facts and contemporaneous analysis to help future analysts and historians foil the revisionists.

What a difference 12 days makes. Chair Powell on December 1st: “Premature to speculate on when policy may ease” and “Fed prepared to tighten more if it becomes appropriate.”

To be sure, the Powell Pivot doused nitro on the Everything Squeeze, the Everything Rally, and the Everything “Melt-Up.” And everyone is absolutely overjoyed – a holiday gift pack beyond imaginations. As such, there is today sparse insightful market debate or push back. I’ll say it: the emperor is buck naked.

Did Powell even mean to signal “the great monetary pivot of 2024”? If not, we witnessed Wednesday afternoon a communications cluster-snafu of historic significance. If all went as planned, a line needs to be inserted in the top section of the list of major Fed policy blunders.

Parallels to the late twenties only get more unnerving. Milton Friedman, Ben Bernanke, and other history revisionists point to Fed monetary tightening (all the way into the summer of 1929) as a primary explanation of the stock market crash and subsequent Great Depression. The relative neophyte Federal Reserve was belatedly “leaning against the wind” of a conspicuously out of control speculative Bubble. Exuberant market players, however, remained more focused on the inevitability of the Fed again coming to the market’s defense. We now better appreciate the dynamics of markets turning hopelessly oblivious to risk.

Note to future historians: don’t pin blame on Fed tightening for an eventual financial crash. Years of loose finance, Federal Reserve (central bank) accommodation, and resulting speculative Bubbles (and economic maladjustment) were the culprits.

This worthwhile commentary from Doug showed up on his website just after midnight on Saturday morning PST -- and another link to it is here.

Underestimating debt traps -- Alasdair Macleod

The sharp decline in U.S. Treasury bond yields anticipates a pivot in Fed policy, which appeared to be justified this week by Chairman Powell’s dovish tone. But in truth, the Fed is not in control of events.

Given that it was U.S. monetary policy which led the way up in interest rates, the dollar was strong against other currencies, creating opportunities for interest rate arbitrage. There is no knowing its scale, but we can expect it to be unwound post-pivot and should not be surprised at continuing dollar weakness. In short, a floor is being put under US price inflation through the exchange rate.

The far greater problem is that the monetary conditions of the 2020s are turning into a repetition of 1970s, but with added vengeance. This article explains the dynamics leading to higher interest rates in the coming years, higher bond yields and the threat of hyperinflation — all evident in the years following the Bretton Woods Agreement suspension.

In 1971, U.S. government debt to GDP was only 34%. Today it is over 120% It is principally in this difference that the catastrophic consequences for the dollar lie, being firmly gripped in a debt trap. Furthermore, with the single exception of Germany, the other G7 nations are similarly ensnared.

These dynamics are not openly discussed in official circles, but by their actions in accumulating as much gold as is available, non-U.S. central banks are fully aware and frightened by the likely consequences.

This short and rather dry novel from Alasdair is a bit on the thick side in spots as well. It was posted on the goldmoney.com Internet site on Wednesday -- and I found it embedded in a GATA dispatch. Another link to it is here. Gregory Mannarino's post market close rant for yesterday is linked here -- and runs for about 27 minutes.

They Will Create a 50% Stock Market Crash to Usher in CBDCs in 2024 Warns Edward Dowd

Daniela Cambone sits down with Edward Dowd, founder of Phinance Technologies, to discuss the potential for a financial breakdown in 2024 and the role of central bank digital currencies. He highlights the unraveling of the banking system and the need for sound money. Dowd also explores the impact of political factors, particularly in an election year, on the stock market and the overall economy.

This very worthwhile 20-minute video interview was posted on the brighteon.com Internet site on Wednesday -- and I thank Roy Stephens for sending it our way. Another link to it is here.

The Great Taking -- David Rogers Webb

The shattering documentary produced by David Rogers Webb, based on his book, alerts us all to the privately controlled Central Banks’ preparations for the inevitable financial collapse.

Former Hedge Fund Manager and author, David Rogers Webb, announces “The Great Taking,” premiering exclusively on CHD.TV on Saturday, December 9th at 8 p.m. ET. The not-for-profit documentary exposes the scheme by Central Bankers to subjugate humanity by taking all securities, bank deposits and property financed with debt. Running time is 71 minutes. The film is produced by Webb and Executive Produced by Vera Sharav, Holocaust Survivor and director of the 5-part docuseries Never Again Is Now Global. Webb takes us on a 50-year journey of how the Central Banking systems have secretly put collateral confiscation schemes in place, making everyone from all walks of life vulnerable when the inevitable financial collapse comes. The fine print is revealed in this shattering documentary. As Webb outlines, “It is now assured that in the implosion of the derivatives complex, collateral will be swept up on a vast scale. The plumbing to do this is in place. Legal certainty has been established that the collateral can be taken immediately and without judicial review, by entities described in court documents as ‘the protected class’. Even sophisticated professional investors, who were assured that their securities are ‘segregated’, will not be protected.”

This very worthwhile 71-minute documentary put in an appearance on the childshealthdefense.org Internet site last Saturday. I know it's long...but its definitely worth your time. I thank Mike Easton for sharing it with us -- and another link to it is here.

Costco sold $100 million in gold bars last quarter

Gold bars continue to be a hit at Costco.

The company sold $100 million worth of one-ounce gold bars in its most recent quarter, CFO Richard Galanti said Thursday during an earnings call.

When asked what consumer trends Costco was seeing this holiday season, he quipped, "They're buying gold."

Galanti previously said the company sells out of its gold inventory "within a few hours" of the products being listed online.

Costco's website shows one-ounce bars of 24-karat gold from South Africa's Rand Refinery and from Swiss supplier PAMP Suisse. Orders from each refiner are limited to two per membership.

The company ended the quarter with 72 million paid memberships.

Pricing is not available as neither product is currently in stock, but gold was trading at $2,035 per ounce at the time of the call.

This interesting gold-related news item showed up on the msn.com Internet site on Thursday -- and another link to it is here.

The Photos and the Funnies

Still on the service road along the high voltage line right-of-way on June 4. Normally power lines are the bane of my existence, but since there was no way to avoid having these ones in the photos, I tried to show them off as best I could against the grasslands of the Thompson Plateau. Continuing on down the dirt track in photo three would have taken us to the Nicola substation about six kilometers away...but we didn't go that far. Click to enlarge.

The WRAP

"Understand this. Things are now in motion that cannot be undone." -- Gandalf the White

Released in March of 1966...fifty-seven years ago...today's pop 'blast from the past' is by an American 'sunshine pop' band. They had a string of hits over the next few years after this one...but this was by far the biggest of them all. The link is here. Of course there's a bass cover to this -- and that's linked here.

After the enormous success of his second piano concerto in 1901, Sergei Rachmaninoff was in the difficult position of deciding, literally, what he could do for an encore. The result was his third piano concerto in D minor, Op. 30...which he completed in the fall of 1909.

The work has the reputation of being one of the most technically challenging piano concertos in the standard classical piano repertoire -- and deservedly so.

Owing to its difficulty, the concerto is respected, even feared, by many pianists. Josef Hofmann, the pianist to whom the work is dedicated, never publicly performed it, saying that it "wasn't for" him. Gary Graffman lamented he had not learned this concerto as a student, when he was "still too young to know fear".

But there's no fear in this performance by 22-year young Russian pianist extraordinaire, Alexander Malofeev. He's accompanied by the Frankfurt Radio Symphony orchestra -- and Maestro Alain Altinoglu conducts. The performance dates from 15 September 2022 -- and he just slays it. It doesn't get any better than this -- and you just know how great he is when even the orchestra is applauding him. The link is here.

Whatever passed for economic 'news' at 8:30 a.m. in New York yesterday allowed the commercial traders of whatever stripe to lay the lumber to gold, silver and platinum prices -- and they made sure that all three closed well down on the day when they showed up again fifteen minutes before the COMEX close.

And as I mentioned earlier, the precious metal equities held up rather well...all things considered.

Both silver and gold remain well above any moving average that matters...but they closed platinum, their No. 2 problem child, back below its 200-day m.a...the day after it closed above that mark for the first time since since the last week of May.

Palladium had another boomer day to the upside, which was short covering by the managed money traders et al. But even its rally was capped at 1 p.m. in COMEX trading, so it appears that 'da boyz' don't want it to get too far out of hand. And even though it remains a very long way below its 200-day moving average, it's already approaching overbought.

Copper traded in a 7 cent range on Friday, but it was closed unchanged at $3.89/pound -- and is till above any moving average that matters by a decent amount.

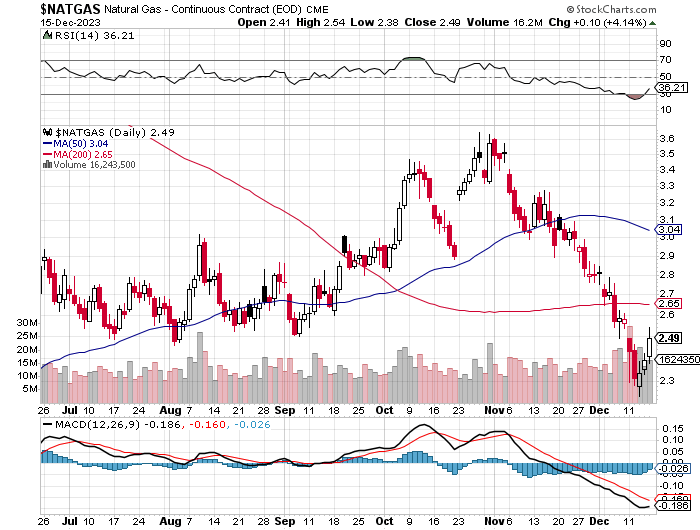

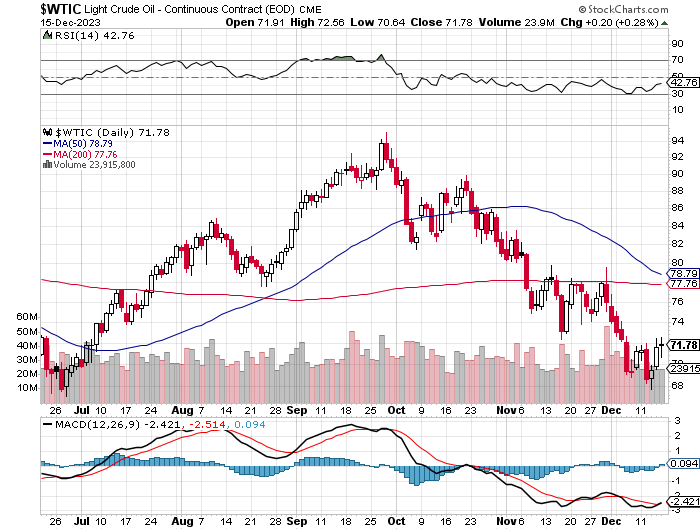

Natural gas [chart included] had its third winning session in a row after being horridly oversold. It finished the Friday trading session at $2.49/1,000 cubic feet...up 10 cents per. WTIC also closed higher on the day...up a measly 20 cents at $71.78/barrel -- and still a long way below any moving average that matters.

Here are the 6-month charts for the Big 6+1 commodities, courtesy of stockcharts.com as always and, if interested, their COMEX closing prices in their current front months on Friday should be noted. Click to enlarge.

The title to Friday's column "An Unexpected Drop in Total Silver Open Interest" was at the top of the list of things that Ted I spoke about on the phone yesterday afternoon.

Wednesday's big rally on the Fed news at 2:00 p.m. EST on Wednesday came after the COMEX close that day...so all of that rally volumes didn't show upon the CME's website until well after 10 p.m. CST on Thursday evening -- and this is what I had to say about it in Friday's missive...

"Total gold open interest at the close on Thursday increased, but only by a net 4,298 COMEX contracts-- and total silver o.i. actually fell by a net 4,667 contracts...a total surprise. Both these numbers are subject to some revision by the time the final figures are posted on the CME's website later on Friday morning CST."

When I got out of bed yesterday, I checked the final numbers...which something I rarely ever do, but because the silver number [and gold's] was so extraordinary and unexpected, the final numbers were something that I had to see with my own eyes, just to ensure that I hadn't been mistaken.

I wasn't.

As I found out from Ted when speaking with him, he actually got up in the wee hours of Friday morning to check himself, as he feared the worst -- and for good reason...as a 10,000+ contract increase in the commercial net short position in silver -- and a 30,000+ increase in gold would not have been out of the question considering the size, strength and trading volumes involved. This would have been the result of the Managed Money traders going massively long -- and their counterparties in the commercial category going short against them, contract for contract.

But that didn't happen.

And the news got even better when I saw the final total change in open interest numbers yesterday morning, as both had shown even further improvements from the preliminary numbers...which is almost always the case when the final numbers are posted, so this is not a big deal in and of itself.

The increase in total open interest in gold had shrunk from the preliminary number of 4,298 contracts, down to 3,800 contracts -- and the decline in total open interest in silver was just as impressive...from 4,667 contracts, down to 4,990 contracts.

Those preliminary and now final total open interest numbers were literally light years from what Ted and I were expecting to see -- and that would normally occur during a standard 'wash, rinse & spin' cycle. As Ted has said...this falls squarely into the 'man bites dog' category.

Ted raised the possibility of them being those uneconomical and market-neutral spread trades getting removed, but it's awful early in the month for that -- and the traders in these things don't normally unwind these positions in such large quantities all in one day. Besides which, this process wouldn't start in gold until January -- and February in silver. But, having said all that, I'll be more than interested in Ted's thoughts for his paying subscribers this afternoon, now that he's had a chance to 'sleep on it'.

And in my concluding remarks on this in Friday's column, I added this..."Both numbers suggest that maybe, just maybe the Big 4/8 commercial traders were short covering on the Fed news -- and Ted's raptors [the small commercial traders other than the Big 8] may have been selling to them...Ted's 'dream' scenario. Because the thought of the managed money traders selling into that rally is preposterous on its face."

In yesterday's COT Report it showed that Ted's raptors, the small commercial traders other than the Big 8, held a long position of around 14,000 contracts... net of that managed money trader that he says currently contaminates the Big 8 commercial short position. These same raptors are also long 14,000 contracts in gold as well.

Those 14,000 long contracts in silver would be far more crucial for the big commercial shorts to buy, than the longs held by the raptors in gold.

If the managed money traders did sell their longs to the biggest commercial short holders, it was most likely prearranged -- and even more collusive and criminal than anything else we've see to date.

It didn't dawn on me until now as I was writing all this stuff, that Ted's 'dream scenario' is one that would occur as a last act before they allow prices to blow higher. That's wild-ass speculation on my part, but I'm of the opinion that this scenario is not something that could or would be repeated.

I would pay a pretty penny for a look at a COT Report as of the COMEX close on Friday -- and I sure look forward to what Ted has to say bout this in his weekly review for his paying subscribers this afternoon.

Looking overseas to the Middle East, I saw in a Zero Hedge story on Thursday that the White House wants Netanyahu to 'wrap things up' in Gaza by the end of the year -- and I'm sure that's going down well over there. That story is linked here. Then there's this news item from yesterday headlined "Pentagon orders U.S. aircraft carrier to remain in Mediterranean near Israel" -- and linked here. And lastly, this ZH article from Friday headlined "Two More Ships Struck By Houthi Missiles as Maersk Diverts All Tankers From Red Sea" -- and linked here.

You'll excuse me for continuing to believe that the situation over there is far from winding down, especially when one knows that the U.S. power elite/ military/industrial complex is aiding and abetting the whole thing.

The set-up remains ripe for a false flag operation, or more than one...either over there, or even in the continental U.S...or both.

And as I keep saying, if this price management scheme is scheduled to end soon, it won't be happening in a news vacuum.

I'm still 'all in' -- and I'll see you here on Tuesday.

Ed