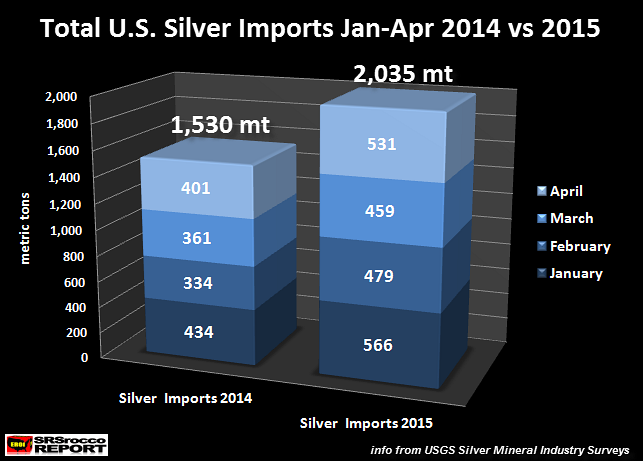

As the situation in the global financial system deteriorates, large U.S. buyers continue to stockpile silver. How do I know this? Well, according to the most recently released USGS data, U.S. silver imports surged even higher in April. How much? Let’s look at the chart below:

As we can see, U.S. silver imports surged to 531 metric tons (mt) in April, up from 459 mt in March. Total U.S. silver imports in the first four months of the year are up a stunning 505 metric tons (2,035 mt) compared to the same period last year (1,530 mt).

As I mentioned in my previous article, Why Is The U.S. Importing So Much Silver?:

Well, if we look at the three major market indicators below, we can certainly see, they don’t justify an increase in silver bullion demand:

1) U.S. Industrial silver consumption continues to decline

2) U.S. Silver Eagle sales were flat year-over-year.

3) Comex silver inventories Jan-Feb net build was only 1.3 Moz

According to the recently released 2015 World Silver Survey, U.S. industrial silver fabrication continued to fall in 2014. Total U.S. silver fabrication declined from 138 Moz in 2011, to 132.7 Moz in 2012, 127.4 Moz in 2013, and down again in 2014 to 125.4 Moz. So, if the U.S. Q1 2015 GDP growth was only 0.2%, I would imagine U.S. industrial silver consumption also declined.

Now, if we look at the change in U.S. Silver Eagle sales… this doesn’t help us either. The U.S. Mint sold a total of 8.5 million Silver Eagles in the first two months of 2014 and 2015. As we can plainly see, no need for more silver at the U.S. Mint.

The data above was just for the first two months of the year, but nothing really changed in U.S. silver demand during March or April to account for 33% more silver imports. If this trend continues, the U.S. will import over 6,000 mt of silver in 2015.

Why is this amount significant? Because U.S. annual silver imports ranged between 3,500-5,300 mt from 2009 to 2014, except for the surge in 2011 of 6,400 mt. U.S. silver imports were high in 2011 due to higher industrial silver demand as well as record physical silver investment (due to silver reaching a high of $49 in May that year).

However, industrial silver consumption in the U.S. is lower this year compared to 2011 and overall physical silver investment demand is less than it was during the same period last year when Jan-Apr U.S. silver imports were only 1,530 mt vs the 2,035 mt so far this year.

Which means, some large buyers must be acquiring a great deal of silver on the HUSH-HUSH. There has been speculation that JP Morgan is one of the big buyers. If they are, they are buying SILVER BARS, not Silver Eagles or Maples. I know this as my contacts in the industry tell me that none of the Authorized Dealers that they do business with have heard anything that would lead them to believe that JP Morgan is buying large lots of Silver Eagles or Maples.

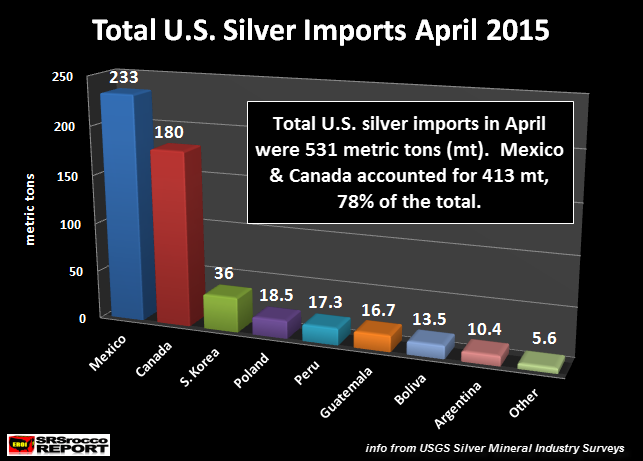

So where is all this silver coming from that the U.S. is importing? Let’s look at the chart below:

Mexico and Canada accounted for 78% (413 mt) of the total 531 mt in April. The U.S. imported a staggering 233 mt of silver from Mexico and 180 mt from Canada. Interestingly, the U.S. imported 36 mt of silver from South Korea and 18.5 mt from Poland. If we go back several years, these two countries did not export any silver to the United States. They are new (recent) sources of U.S. silver imports. The remaining silver imports were from the typical Central and South American countries.

While this information is from a few months ago, I would imagine U.S. silver imports will probably remain elevated or increase in June and July due to the financial turmoil stemming from the Greek “No” vote. I will post updates when the new data is released by the USGS.

If you haven’t checked on THE SILVER CHART REPORT, there’s a great deal of information on the Silver Industry & Market not found in any single publication on the internet. There is one chart in this report (Chart #19) that I can guarantee that 99.9% of precious metal investors haven’t seen before.

Most analysts focus on a certain area or sector of the silver market. However, the information in this report illuminates a holistic view of many sectors of the silver industry, capturing the relationships that connect many parts of the market.

Most analysts focus on a certain area or sector of the silver market. However, the information in this report illuminates a holistic view of many sectors of the silver industry, capturing the relationships that connect many parts of the market.

One of the important aspects of my work is to look at many industries and markets from a bird’s-eye view. From this perspective, we can see how industries and markets impact each other to a much larger degree than by just focusing on individual sectors.

CLICK HERE: For The Silver Chart Report

I use this bird’s-eye approach when I create my easy to understand charts. The Silver Chart Report is a collection of my top silver charts from articles published over the past six years, and includes in-depth, never-before-seen charts and content that indicate that silver is on the rise. There are 48 charts in the report, broken down in five sections.

Please check back for new articles and updates at the SRSrocco Report. You can also follow us at Twitter below: