Anyone who’s followed me—or invested in precious metals long enough—knows that silver is one of the most heavily suppressed assets on the planet. I recently broke down exactly why that is and how it works in a detailed report and video presentation

Both have been going viral over the past couple of weeks and have been picked up by major precious metals websites and pundits, including Kitco, Silver Seek, John Rubino, Bill Holter, Steve Quayle, and GATA (the Gold Anti-Trust Action Committee), which specializes in exposing price manipulation in the precious metals markets. My reports have really resonated with people—many have told me it’s because I explained silver manipulation in clear, straightforward terms that anyone can understand.

Following my recent reports—which helped reignite the conversation around silver manipulation—and mounting frustration over silver being intentionally slammed down every time it nears $33 an ounce, more and more everyday people are ready to take matters into their own hands. Their strategy: buying physical silver to push prices higher and trigger a 'silver squeeze'—one that could force major bullion banks like JPMorgan and UBS, heavily exposed through naked short positions, to cover their bets.

Following my recent reports—which helped reignite the conversation around silver manipulation—and mounting frustration over silver being intentionally slammed down every time it nears $33 an ounce, more and more everyday people are ready to take matters into their own hands. Their strategy: buying physical silver to push prices higher and trigger a 'silver squeeze'—one that could force major bullion banks like JPMorgan and UBS, heavily exposed through naked short positions, to cover their bets.

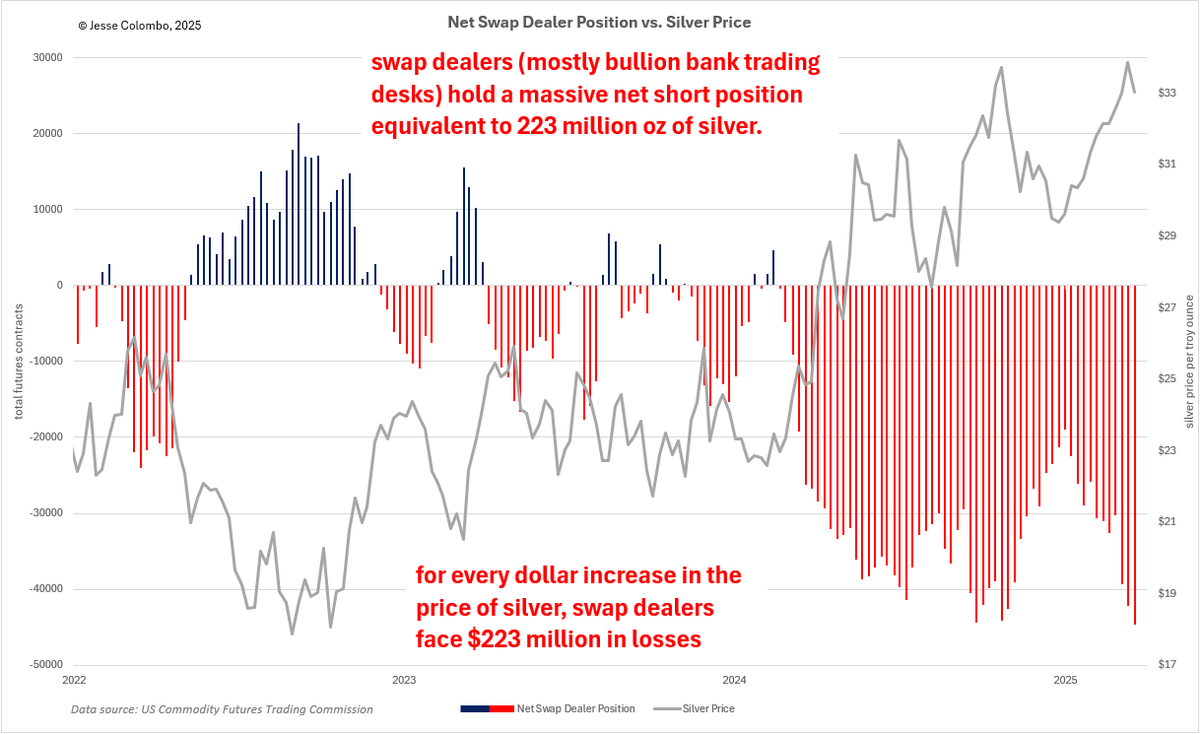

As the chart below shows, the bullion banks—while working to suppress the price of silver—have built up a massive net short position of 44,583 futures contracts. That’s equivalent to 223 million ounces of silver, or more than a quarter of the world’s annual silver production. That also means the bullion banks stand to lose approximately $223 million on their short positions for every $1 increase in the price of silver. Now, just imagine what would happen as silver climbs by $5, $10, $20, and beyond from this point!

Over the weekend, an X user named ‘Squeaky Mouse,’ known for sharing silver technical analysis charts, reached out to me and a few other influential voices in the industry. He asked if we’d help promote an upcoming event on Monday, March 31st encouraging everyone to buy as much physical silver—or the Sprott Physical Silver Trust (PSLV) through their brokerage accounts—as possible.

Over the weekend, an X user named ‘Squeaky Mouse,’ known for sharing silver technical analysis charts, reached out to me and a few other influential voices in the industry. He asked if we’d help promote an upcoming event on Monday, March 31st encouraging everyone to buy as much physical silver—or the Sprott Physical Silver Trust (PSLV) through their brokerage accounts—as possible.

I agreed and shared it with my followers, and it quickly went viral, with many people expressing strong support. A new X community called ‘SilverSqueeze’ was also launched for those taking part in the event. It quickly gained over 1,700 members, and I’ve since joined as a moderator. If you're on X, I recommend joining the conversation.

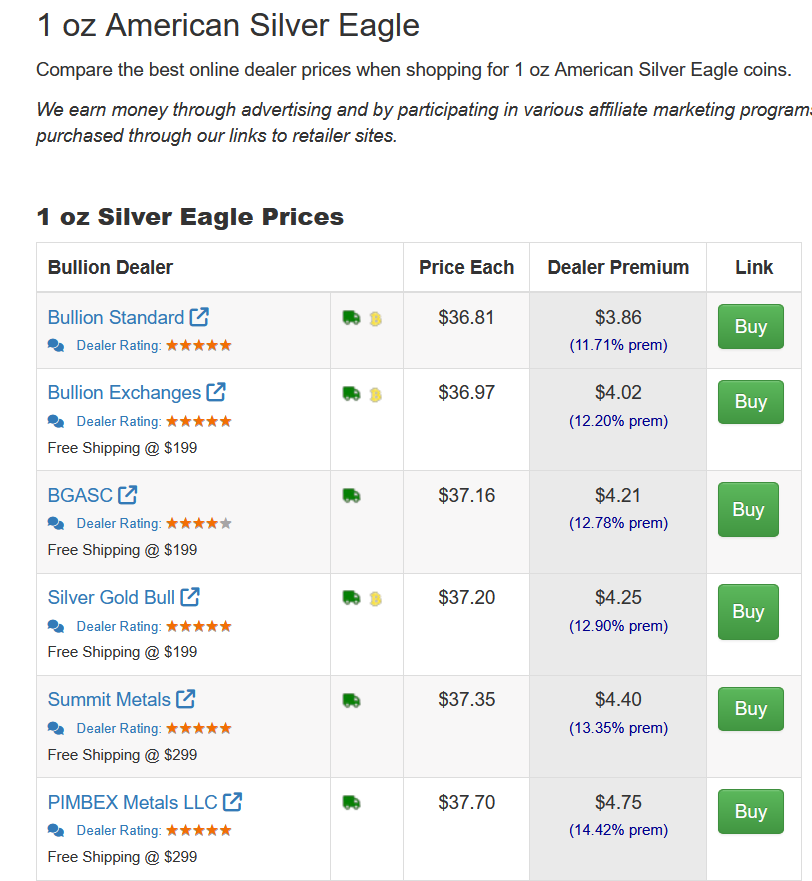

If you’re planning to participate by buying silver on March 31st, one key tip is to maximize the amount of silver you get for your money by minimizing dealer premiums—that is, the markup over the spot price. In my experience, the best way to do this is by using FindBullionPrices.com. It’s a site that tracks popular gold and silver bullion products and ranks dealers based on who offers the best prices, as shown in the example below:

In conclusion, I truly hope this initiative sparks real change—that the bullion banks finally lose their grip and are no longer able to suppress silver prices with impunity. Even beyond March 31st, the case for buying and owning silver remains strong, as I outlined in my recent report. If this resonates with you, I encourage you to take part and help spread the word. I’m optimistic that a turning point is near—and that a brighter future lies ahead for silver and those who believe in its value.

Another great way to grow your silver stack: enter my free giveaway for a shimmering 10 oz Scottsdale Mint silver bar! Click here to enter now!

Disclaimer: the information provided by Jesse Colombo on X, LinkedIn, in The Bubble Bubble Report, and elsewhere is for informational and educational purposes only and should not be construed as investment, financial, or trading advice. Nothing in this publication constitutes a recommendation, solicitation, or offer to buy or sell any securities, commodities, or financial instruments.

Disclaimer: the information provided by Jesse Colombo on X, LinkedIn, in The Bubble Bubble Report, and elsewhere is for informational and educational purposes only and should not be construed as investment, financial, or trading advice. Nothing in this publication constitutes a recommendation, solicitation, or offer to buy or sell any securities, commodities, or financial instruments.

All investments carry risk, and past performance is not indicative of future results. Readers should conduct their own research and consult with a qualified financial advisor before making any investment decisions. The author and publisher disclaim any liability for financial losses or damages incurred as a result of reliance on the information provided.