The amount of fraud taking place in the major banks throughout the world is staggering to say the least. Ironically, the only market that isn’t manipulated, is the silver market… so they say. To make it seem as if the regulators are on the ball, many of the major banks have been found guilty of committing one fraud or another, paying large fines and settlements.

The most recent settlement by the criminal bankers was a cool $5.6 billion for rigging the foreign currency markets for their own financial benefit. The banks responsible for this sort of illicit behavior comes from the list of typical seedy characters; Citigroup, JP Morgan, Barclays, RBS and UBS. You can read all about it in the Wall Street Journal article.

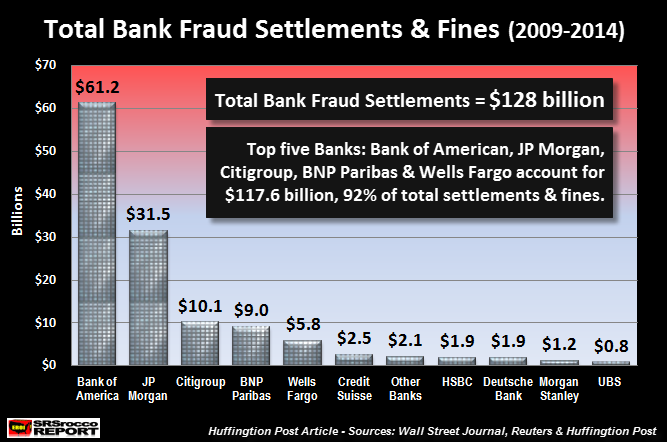

Even though $5.6 billion is a hefty figure, when we add up the total fines and settlements paid by the Banking Industry since 2009… it’s a serious amount of fiat currency. How Much? Well, if we look at the chart below, it should offer a pretty good picture:

According to a recent article by the Huffingtion Post, the major U.S. and European Banks have paid at least $128 billion in fines and settlements to regulators since 2009. As we can see, Bank of America gets the first place prize for paying a staggering $61.2 billion in fines, while JP Morgan ranks second at $31.5 billion and Citigroup taking a comfortable third, forking over $10.1 billion.

Scanning across the rest of the chart, we can see the additional fine upstanding banks that participated in criminal activity and their subsequent fines. Of course, Americans like to brag that the United States is best country in the world to live, so it’s comforting to know that four of the five top corrupt banks (in amount of fines and settlements) in the world are located in the good ole US of A.

The top five banks accounted for 92% ($117.6 billion) of the total $128 billion in fines. However, the U.S. Banks representing wholesome American icons such as baseball, hotdogs, apple pie and Chevrolet coughed up $108.6 billion of that amount. It’s certainly reassuring to see our financial institutions working hard to rank first in the world as it pertains to illegal and criminal financial activity.

Major Bank Fraud Adds Up To A Lot Of Silver

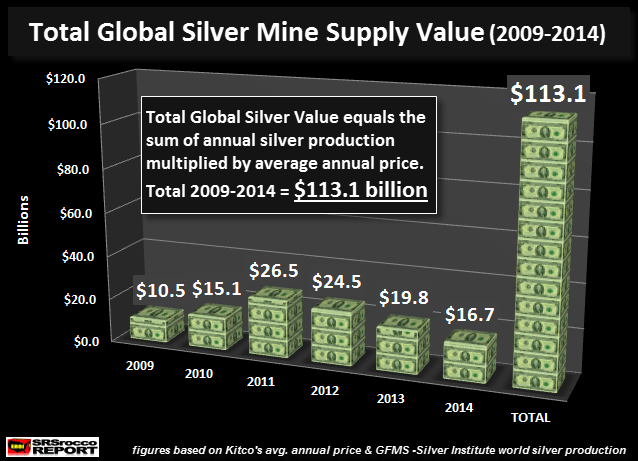

If we consider just how much the U.S. and European banks have paid in fines and settlements since 2009, turns out it could have purchased one hell of a lot of silver. In order to get an idea of the total value of global silver mine supply since 2009, I put together the following chart:

Each year in the chart represents the value of world silver mine supply calculated by multiplying total global production by the average annual price. These figures were based on price information taken from Kitco.com and global silver production figures from the Silver Institute-Thomson Reuters GFMS.

For example, this is the total value of world silver mine supply in 2014:

2014 World Silver Mine Supply Value = 877 million oz X $19.08 = $16.7 billion

If we add up the figures for each year in the chart, the total value of global silver mine supply was $113.1 billion. Well, that seems like a lot of money until you compare it to the fines and settlements paid by the major U.S. and European banking institutions:

Amazingly, the major banks paid more in fines than the cumulative value of all silver mined since 2009. Just think about that for a minute. The amount of fraud and criminal activity at these major banks forced them to pay fines greater than the value of world silver mine supply. Of course, the $128 billion in fines they paid is a great deal less than the profits they made.

According to the Huffingtion post article:

Since 2009, the American banking industry alone has racked up nearly $503 billion in profits, according to FDIC quarterly data through the first quarter of 2014.

These fines have made occasional dents in some quarterly earnings, but they’re effectively drops in the banks’ buckets compared to their greater profits.

If the bank fines are “drops in the bank’s buckets”, then it’s good for business for these institutions to continue rigging, raping, manipulating and controlling the economic and financial system. Thus, anyone at this time who still believes the gold and silver markets aren’t manipulated, needs to check oneself into a local health clinic and receive a Cat-Scan of the brain.

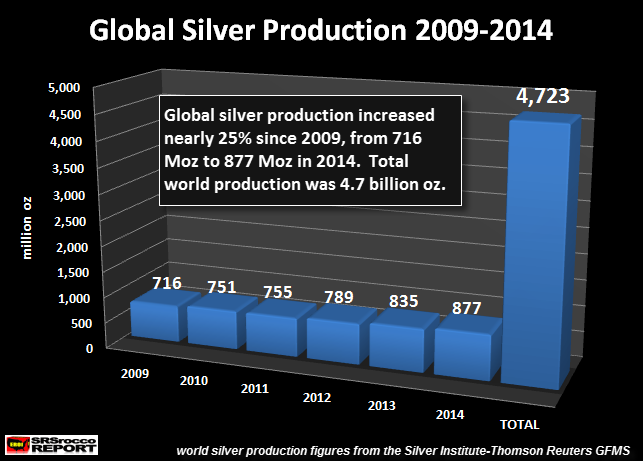

So, how much silver could have been purchased with the fines and settlements paid by the major banks? The chart below provides the answer:

The paltry $128 billion of fines paid out by the major U.S. and European banks could have purchased all the 4.7 billion ounces of silver produced by the world since 2009. However, this silver production only amounted to $113.1 billion (estimated) and if we add the remaining $15 billion left over… that’s at least another 800 million oz. at the current price. Which means, bank fraud settlements could have purchased at least 5.5 billion oz of silver, including the majority of global production in 2015.

We must remember, gold and silver are supposed to act as barometers against the U.S. Dollar and other assorted fiat currencies. If the major banks can pay $128 billion in fines (that we know about) over the past six years, how can this not impact the value of the precious metals?

Currently, it pays the banks to conduct fraudulent, criminal and illicit behavior. If the U.S. Banks forked out $110 billion in fines since 2009 while their total profits exceeded $503 billion, that’s a pretty good racket. Fortunately for the precious metal investors, all Ponzi Schemes come to an end. While this one has gone on longer than we thought, the end may arrive sooner than we expect.

Please check back for new articles and updates at the SRSrocco Report. You can also follow us at Twitter below: