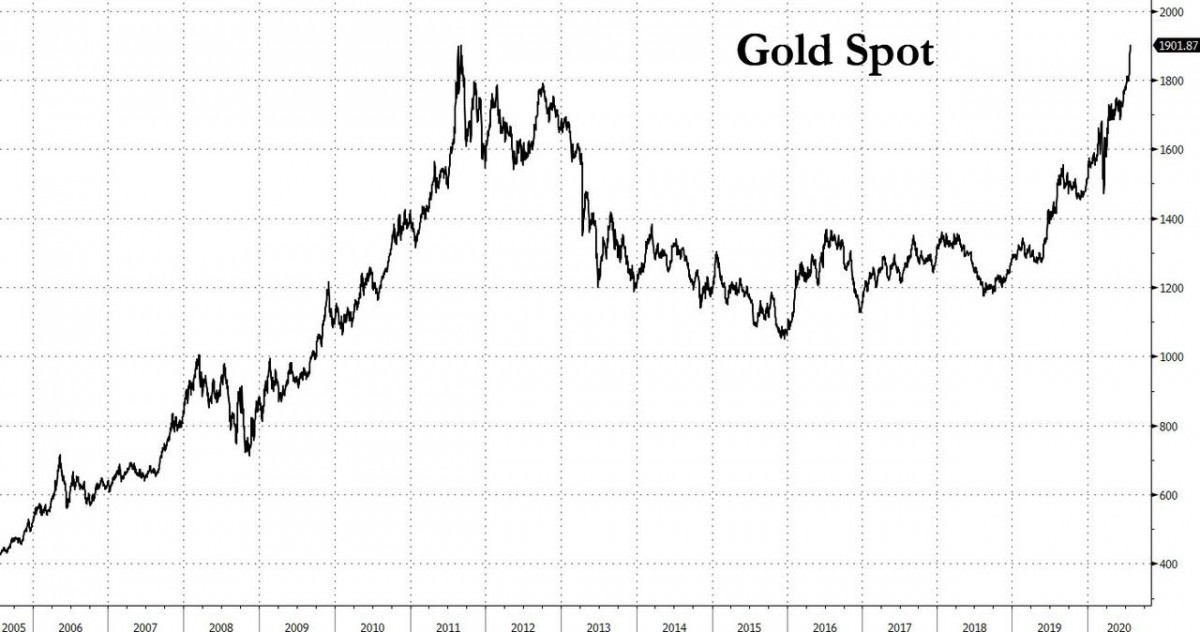

YESTERDAY in GOLD, SILVER, PLATINUM and PALLADIUM

25 July 2020 -- Saturday

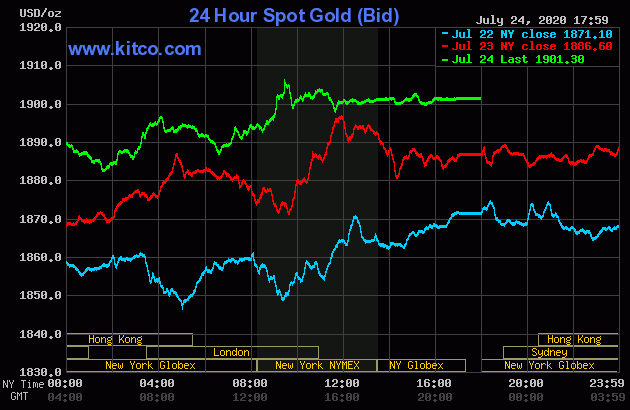

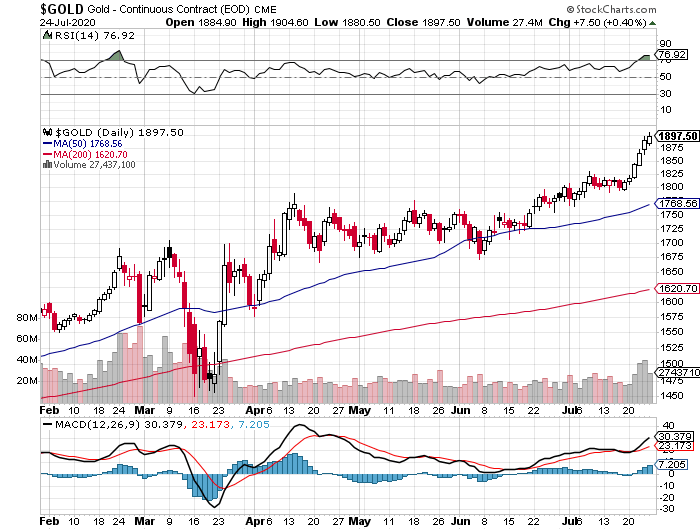

The gold price traded quietly and unevenly sideways until around noon China Standard Time on their Friday. It was sold down to its low tick of the day by shortly after 1:30 p.m. CST -- and its subsequent rally was capped just minutes after 9 a.m. in London. From that point it was sold lower until around 11:45 a.m. BST. The ensuing rally ran into 'something' at 9:30 a.m. in New York -- and it was sold lower for the next fifteen minutes. It rallied a bit from there -- and then traded mostly evenly sideways until the market closed at 5:00 p.m. EDT.

The low and high ticks in gold were recorded by the CME Group as $1,880.50 and $1,904.60 in the August contract. The August/October price spread differential at the close on Friday was $12.60... October/December was $15.10 -- and December/February was $10.60.

Gold was closed in New York on Friday afternoon at $1,901.30 spot, a new closing high for this move up, but 6 bucks off its Kitco-recorded high tick of the day. Net volume was pretty heavy at a bit under 208,500 contracts -- and there was 80,500 contracts worth of roll-over/switch volume out of August and into future months, mostly October, December and February.

|

|

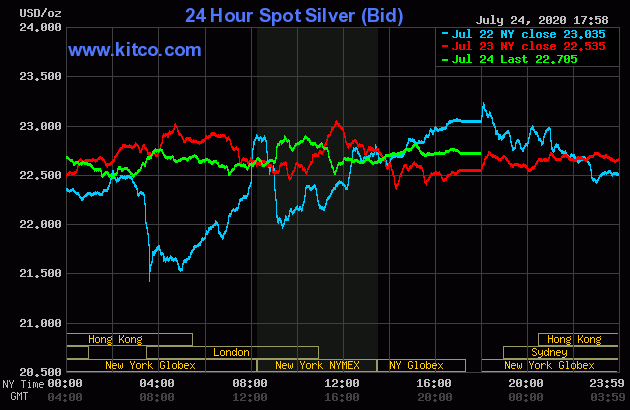

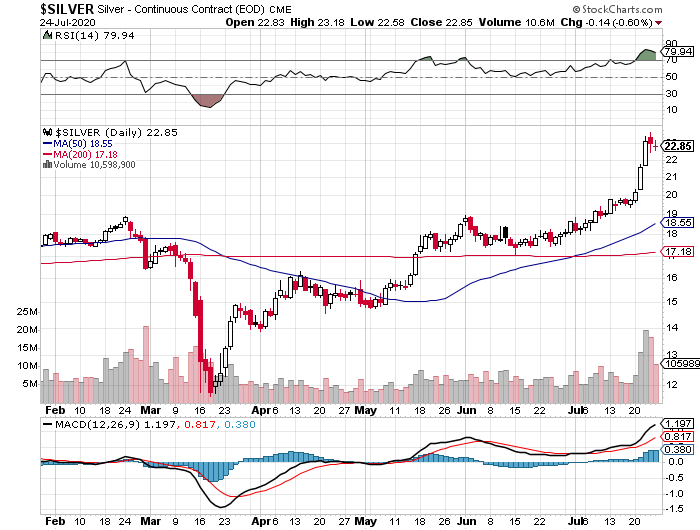

Silver certainly didn't do much yesterday...or wasn't allowed to do much...you choose -- and there's not much to see here. But I'll point out once again that it was only allowed to trade above the $23 spot mark for an instant -- and was then capped at the same time as gold, a minute or so before 9:30 a.m. in New York trading.

The low and high ticks were reported as $22.58 and $23.185 in the September contract. The September/December price spread differential in silver at the close yesterday was 23.0 cents -- and December/March was 22.4 cents.

Silver was closed on Friday afternoon in New York at $22.705 spot, up 17 cents from Thursday. Net volume was extremely heavy at a bit over 103,500 contracts -- and there was just under 7,500 contracts worth of roll-over/switch volume out of September and into future months...mostly December.

|

|

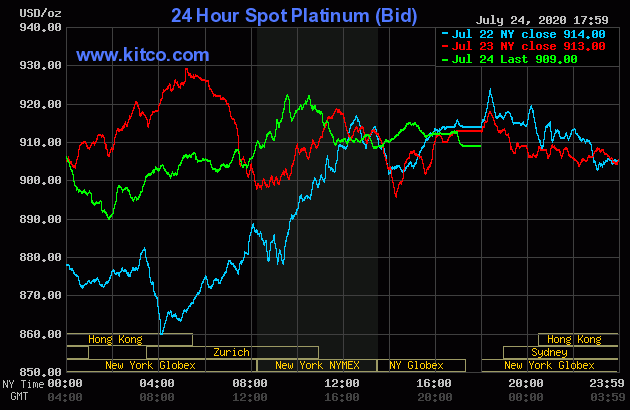

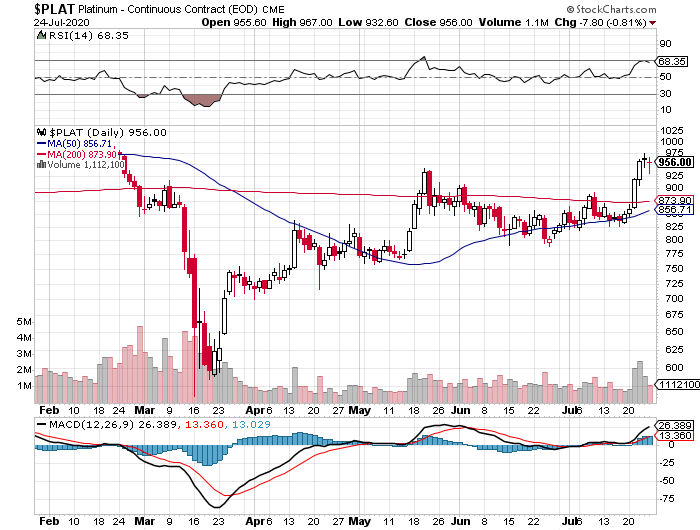

Platinum was sold lower until the low tick of the day set minutes before 2 p.m. China Standard Time on their Friday afternoon -- and it worked its way higher until it too ran into 'da boyz' minutes after 9:30 a.m. in New York. It was sold quietly lower until 11:35 a.m. EDT -- and then traded unevenly sideways until the market closed at 5:00 p.m. Platinum was closed at $909 spot, down 4 dollars on the day.

|

|

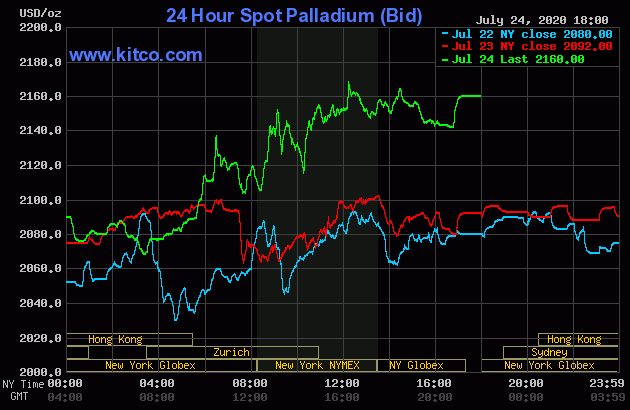

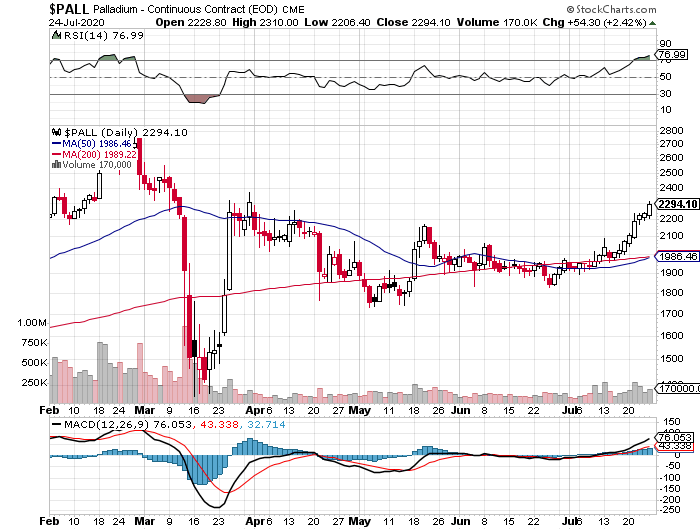

The palladium price traded unevenly sideways until shortly after the 2:15 p.m. afternoon gold fix in Shanghai on their Friday afternoon. It was sold down to its low of the day around 9:30 a.m. CEST in Zurich -- and from that juncture it rallied unevenly higher and under obvious 'resistance' until it was capped and turned sideways around 12:05 p.m. in New York. It was sold a bit lower in the very thinly-traded after-hours market, but jumped higher in the last few minutes of trading -- and finished the Friday session at $2,160 spot, up 68 bucks on the day.

Palladium traded 1,949 contracts in its current front month...September. Of that amount, there was 403 contracts worth of roll-over/switch volume...372 into December -- and 31 into March.

|

|

Based on the Kitco spot closes posted above, the gold/silver ratio worked out to a bit over 83.5 to 1...which was about the same as it worked out to on Thursday.

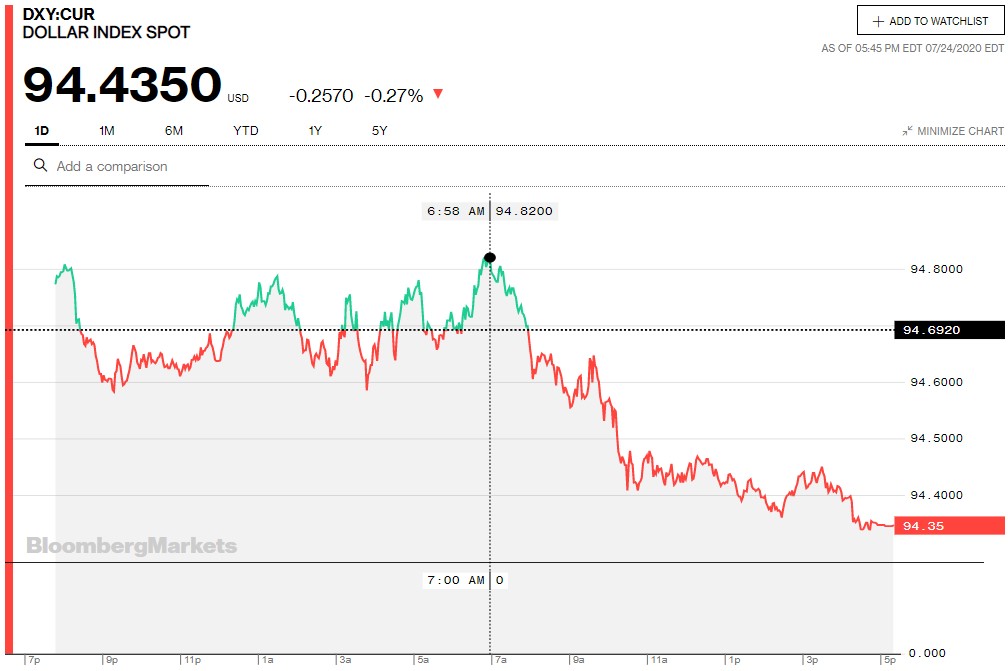

The dollar index closed very late on Thursday afternoon in New York at 94.692 -- and opened up about 8 basis points once trading commenced around 7:48 p.m. EDT on Thursday evening, which was 7:48 a.m. China Standard Time on their Friday morning. It wandered around the unchanged mark until the 94.83 high tick was set about 11:58 a.m. BST in London -- and then its fall from grace began. That lasted right into the 5:30 p.m. close in New York.

The dollar index was marked-to-close at 94.435...down 26 basis points from Thursday -- and about 9 basis points above its spot close on the DXY chart below.

And here's the DXY chart in question, courtesy of Bloomberg. Click to enlarge.

|

|

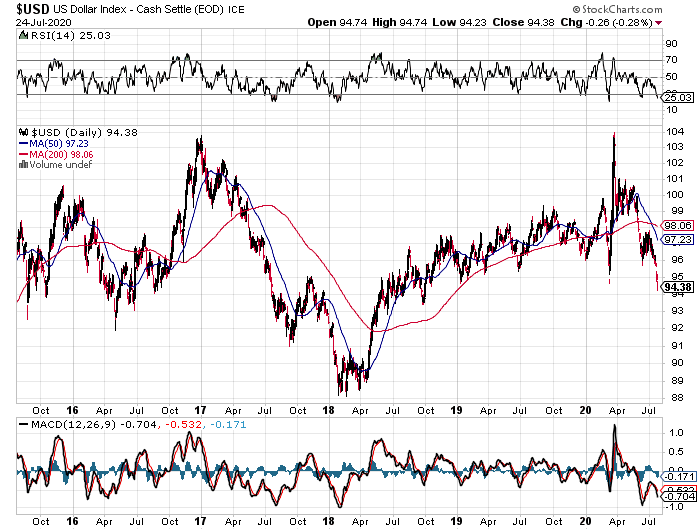

Here's the 5-year U.S. dollar index chart, courtesy of the good folks over at the stockcharts.com Internet site. The delta between its close...94.38...and the close on the DXY chart above, was about 6 basis point below its spot close on Friday. Click to enlarge as well.

|

|

The above chart is not very happy looking, is it? Could it fall further...much further, in fact -- and the answer is certainly yes. However, it is in oversold territory now -- and a counter-trend rally at some point, which could be vicious, is certainly within the realm of possibility...engineered or otherwise.

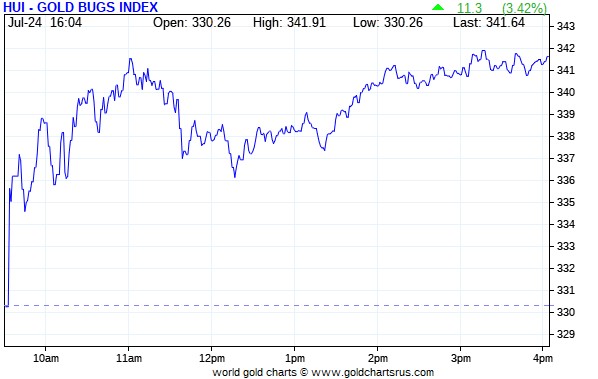

The gold shares jumped up a bit at the open -- and then rallied until the 11 a.m. EDT London close. From that point they were sold a bit lower until around 12:15 a.m. in New York trading -- and from that juncture they worked their way mostly higher until the market closed at 4:00 p.m. EDT. The HUI closed up a very respectable 3.42 percent.

|

|

Still no Intraday Silver Sentiment/Silver 7 Index chart from Nick. I computed manually, as usual -- and it showed that it closed higher by 3.18 percent.

And here's Nick's 10-year Silver Sentiment/Silver 7 Index chart, updated with Friday's doji. As you can tell, we're about half-way back to our old high which was set at the close of trading on the last Friday in April in 2011...before JPMorgan showed up for its infamous intervention two days later. Click to enlarge.

|

|

The star of the day was Peñoles for a change...up 9.15 percent on pretty big volume. Wheaton Precious Metals also put on a show yesterday...higher by 5.16 percent. The dog was First Majestic Silver...as it closed down 0.38 percent. Coeur Mining was a close second, up only 0.67 percent.

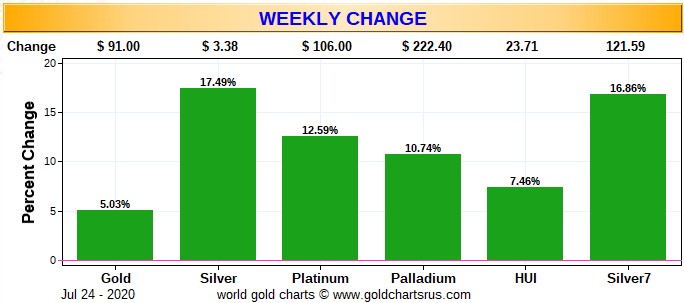

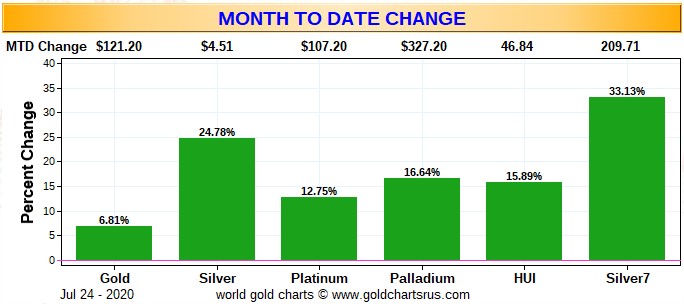

Here are the usual three charts that show up in every Saturday missive. The first one shows the changes in gold, silver, platinum and palladium for the past trading week, in both percent and dollar and cents terms, as of their Friday closes in New York - along with the changes in the HUI and the Silver 7 Index.

Here's the weekly chart -- and it's green across the board for the second week in a row...with silver and its equities outperforming. But they, like the gold stocks, are still vastly underperforming the gains in their respective underlying precious metals. That will change soon enough I would think. Click to enlarge.

|

|

Here's the month-to-date chart and everything silver continues to outperform. This trend will continue -- and accelerate once silver is released from its price shackles by JPMorgan. Click to enlarge.

|

|

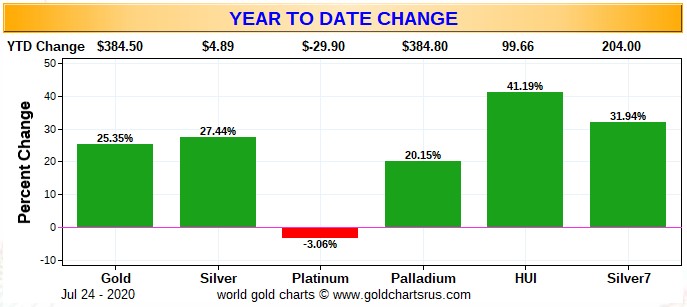

And here's the year-to-date chart -- and silver has now outpaced gold's gains year-to-date. But the underperformance of the gold stocks compared to the underlying metal itself, is just as obvious here. But this is just the beginning for silver, as far larger gains are certainly in our future. That applies to gold and its equities as well. Click to enlarge.

|

|

Although no one is happy about the underperformance of the precious metal equities, it's my opinion that the worst is behind us now -- even if we get another engineered price decline in the near or intermediate future.

As per the COT and Days to Cover discussion a bit further down, the Big 8 traders are still mega short gold and silver in the COMEX futures market -- and that situation hasn't changed from last week. But enough gold has now been brought into the COMEX that they could cover by physical delivery if that becomes necessary. But they still remain trapped in silver, or so it would appear. But that may not entirely be the case now, as Ted now has a completely new theory as to what is happening under the hood in the silver market. I've been hoping that he'll post his discovery in the public domain, but he hasn't so far.

The CME Daily Delivery Report showed that 480 gold and 92 silver contracts were posted for delivery within the COMEX-approved depositories on Tuesday.

In gold, there were nine short/issuers in total. The the three largest were, Wells Fargo Securities, with 150 contracts out of its own account -- and that's the first time I can recall ever seeing their name show up in a delivery report. Next was Dutch bank ABN Amro, with 145 contracts from their client account. And in third spot was JPMorgan, with 40 contracts out of its client account as well. There were only three long/stoppers and the only two that mattered were Morgan Stanley, with 294 contracts for its in-house/proprietary account -- and JPMorgan, with 184 for its client account.

In silver, the sole short/issuer of all 92 contracts was Morgan Stanley out of its house account. Of the eight long/stoppers, the tallest hog at the trough was JPMorgan, picking up 52 contracts for its client account. In distant second place was Goldman Sachs, with 12 contracts for its own account. In third spot was BofA Securities, stopping 8 contracts for its client account. Tied for fourth spot were, Australia's Macquarie Futures and Dutch bank ABN Amro, picking up 6 contracts each...the former for their own account -- and the latter for their client account.

The link to yesterday's Issuers and Stoppers Report is here.

So far in July, there have been 8,439 gold contracts issued/reissued and stopped -- and that number in silver is now up to 15,770 contracts. In platinum, there have been 3,835 contracts issued and stopped so far in July -- and as I've pointed out on several occasions this month, this is a record delivery month for this precious metal. I suspect that this is all short covering using the physical delivery process, rather than buying long contracts in the COMEX futures market. That would drive the price higher and increase their margin call losses of the Big 8 traders even more.

The CME Preliminary Report for the Friday trading session showed that gold open interest in July rose by an eye-opening 388 contracts, leaving 524 still around, minus the 480 contracts mentioned a few paragraphs ago. Thursday's Daily Delivery Report showed that 83 gold contracts were actually posted for delivery on Monday, so that means that 83+388=471 more gold contracts just got added to the July delivery month. Silver o.i. in July declined by 239 contracts, leaving 1,031 still open, minus the 92 mentioned a few paragraphs ago. Thursday's Daily Delivery Report showed that 296 silver contracts were actually posted for delivery on Monday, so that means that 296-239=57 more silver contracts just got added to the July delivery month.

And while on the subject of open interest...total gold open interest only rose by 1,917 contracts on Friday -- and in silver, total open interest only increased by 640 contracts. Ted will be most encouraged by these numbers, as it means that the big commercial traders are mostly sitting on their hands and not doing much. I know he'll have more to say about it in his weekly review this afternoon.

There was another deposit into GLD on Friday, as an authorized participant added 56,371 troy ounces of gold. There were no reported changes in SLV.

On Friday, the new short reports came out for both GLD and SLV. Here are the changes -- and they come courtesy of The Wall Street Journal. The short position in SLV rose from 17.47 million shares/troy ounces, up to 20.97 million shares/troy ounces, an increase of 20.04 percent. The short position in GLD rose from 877,000 troy ounces, up to 1,074,000 troy ounces...an increase of 22.52 percent. Although one never likes to see increases in the short positions of these physical metal ETFs...in the grand scheme of things -- and compared to past history, these increases and the total amounts are not significant.

In other gold and silver ETFs and mutual funds on Planet Earth on Friday, net of any changes in COMEX, GLD & SLV inventories, there was a net 199,948 troy ounces of gold added, plus a net 396,889 troy ounces of silver was added as well.

There was no sales report from the U.S. Mint on Friday -- and they sure have been dragging their feet since they went back to work in early April. Their production isn't even remotely close to demand...especially silver eagles, which is something I've pointed out several times in the last month.

Month-to-date the mint has produced 77,500 troy ounces of gold eagles -- 14,500 one-ounce 24K gold buffaloes -- and 623,500 silver eagles. And they haven't yet reported any sales of those 5-ounce 'American the Beautiful' coins yet this year, even though they're obviously making them, as I see them offered for sale.

In a case of perfect timing, here's a story about U.S. Mint production, or lack thereof, from the srsroccoreport.com Internet site that Brad Robertson sent our way late yesterday evening. It's headlined "Gold Eagle Sales Already 3X Last Year's Total & U.S. Mint Still Struggling to Produce Silver Eagles" -- and the link is here.

There was more gold action over at the COMEX-approved depositories on the U.S. east coast on Thursday. There was 201,755 troy ounces received -- and 57,870 troy ounces shipped out.

The largest 'in' amount was 192,906.000 troy ounces/6,000 kilobars [SGE kilobar weight] that ended up at JPMorgan. The remaining 8,849 troy ounces was dropped off at HSBC USA. All of the 'out' activity...57,870.000 troy ounces/1,800 kilobars [U.K./U.S. kilobar weight] departed Loomis International. There was some decent paper activity as well, as 286,773 troy ounces was transferred from the Registered category and back into Eligible...266,477 troy ounces at Brink's, Inc. -- and the remaining 20,295 troy ounces at JPMorgan's 'Enhanced Delivery' sub-depository. The link to all this, is here.

It was pretty busy in silver as well. There was 1,781,116 troy ounces reported received -- and another 1,155,917 troy ounces shipped out.

In the 'in' department, there were two truckloads...1,179,739 troy ounces...that arrived at JPMorgan...bringing their total COMEX silver stash up to 163.10 million troy ounces. Another truckload...599,332 troy ounces...was dropped off at Canada's Scotiabank. The remaining 2,045 troy ounces...two good delivery bars...found a home over at Delaware. In the 'out' category, there was 1,143,721 troy ounces, two truckloads, that departed CNT -- and the remaining 12,196 troy ounces was shipped out of Delaware. There was some paper activity, as 783,301 troy ounces was transferred from the Eligible category and into Registered over at Canada's Scotiabank...undoubtedly schedule for delivery in July. The link to all this is here.

There was some activity over at the COMEX-approved gold kilobar depositories in Hong Kong on their Thursday. They reported receiving 300 of them -- and shipped out 498. And except for the 18 kilobars shipped out of Loomis International, the remaining in/out activity was at Brink's, Inc. The link to this, in troy ounces, is here.

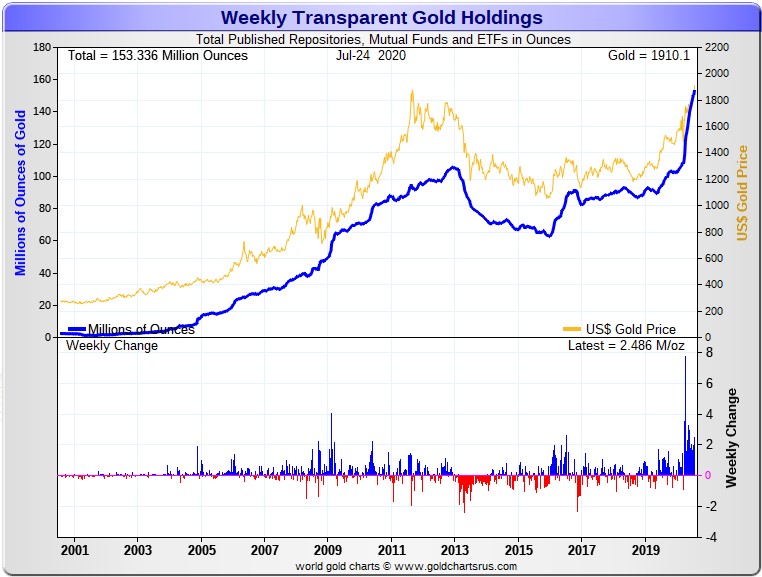

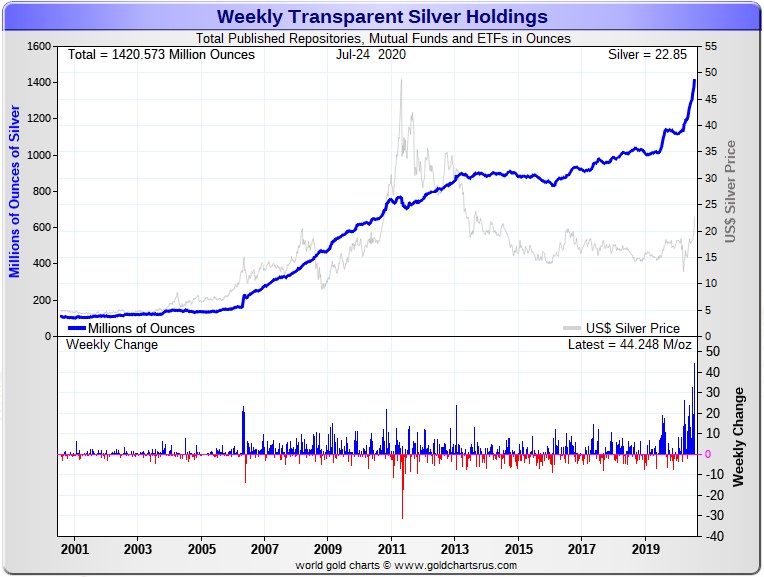

Here are the usual 20-year charts from Nick that show the amount of gold and silver going into all the known depositories, mutual funds and ETFs -- and updated with this past week's data.

For the week just past, they reported receiving 2,486,000 troy ounces of gold -- and another gargantuan and new weekly record 44,248,000 troy ounces of silver -- and virtually all of that silver comes courtesy of JPMorgan. Click to enlarge for both.

|

|

|

|

The moment that JPMorgan stops supply silver to all these various and sundry ETFs and mutual funds...mostly SLV...look out above for the silver price. Ted Butler figures that the DoJ, in part of the yet-to-be-announced settlement with JPMorgan, has instructed them to part with it. But how much of that 1 billion troy ounces that Ted says that JPMorgan has accumulated over the last twelve years since it took over Bear Stearns, remains to be seen.

And just as an aside...during the last seven working days -- and assuming that silver is being produced at its average daily rate of about 2.334 million troy ounces a day, which it most certainly isn't at the moment, only a maximum of 16.34 million troy ounces of silver was mined/smelted during the prior reporting week. The lion's share of that disappeared into various manufacturing and jewellery-making processes world-wide during that time period.

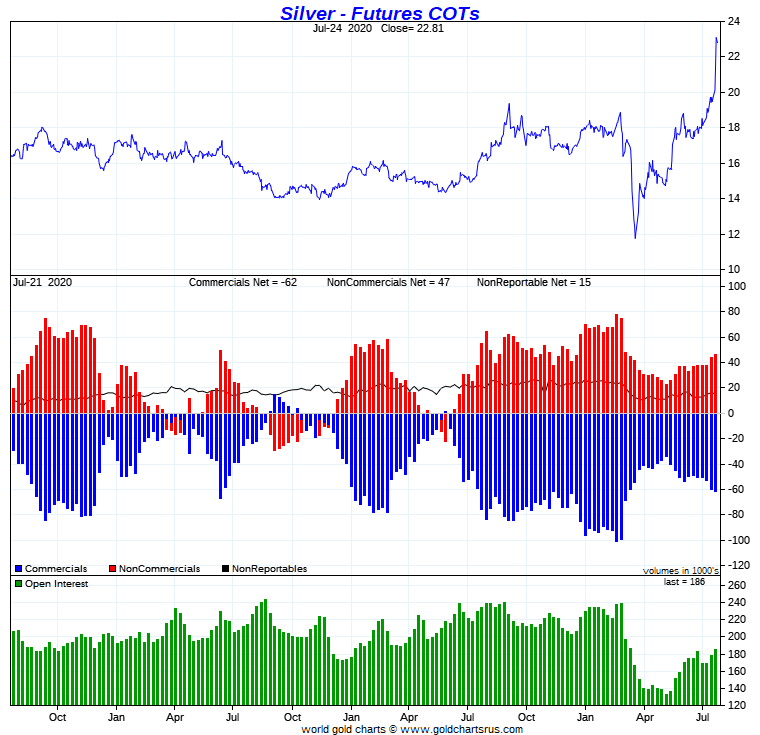

The Commitment of Traders Report, for positions held at the close of COMEX trading on Tuesday, came in exactly what Ted was hoping for...only tiny and inconsequential increases in the commercial net short positions in both silver and gold.

In silver, the Commercial net short position increased by only 1,774 COMEX contracts, or 8.9 million troy ounces.

They arrived at that number by increasing their long position by 1,399 contracts, but they also added 3,173 short contracts -- and it's the difference between those two numbers that represents their change for the reporting week.

Under the hood in the Disaggregated COT Report, it was all Managed Money traders, plus a bunch more, as they increased their net long position by a healthy 6,029 contracts. But the traders in the 'Other Reportables' and 'Nonreportable'/small trader category went in the opposite direction, as both decreased their net long position during the reporting week...the former by 3,143 contracts -- and the latter by 1,112 contracts.

Doing the math: 6,029 minutes 3,143 minus 1,112 equals 1,774 COMEX contracts...the change in the Commercial net short position.

The Commercial net short position in silver now sits at 61,969 contracts...309.8 million troy ounces. The Big 8 traders are short 75,041 contracts...375.2 million troy ounces of silver...or 121 percent of the Commercial net short position.

In last week's COT Report, the Big 8 traders were short 369.3 million troy ounces of silver, so they actually increased their short position by 5.9 million troy ounces during the reporting week. No short covering there, despite what I said in either Thursday or Friday's column on this subject.

Ted said that JPMorgan didn't do much, if anything, during the reporting week -- and feels that they're short between zero and 2-3,000 contracts on the short side, which is an inconsequential amount.

Here's Nick's 3-year COT chart for silver, updated with Tuesday's data -- and there's not much to see. Click to enlarge.

|

|

Ted was hoping for no big increase in commercial shorting by the banks, particular JPMorgan -- and he got his wish on both counts, which is quite remarkable considering the run-up in the silver price during the reporting week. He also mentioned that based on the lack of change in open interest since the Tuesday cut-off, they haven't been shorting silver since then, either. There are still two more trading days left in the next reporting week, so let's hope that trend continues.

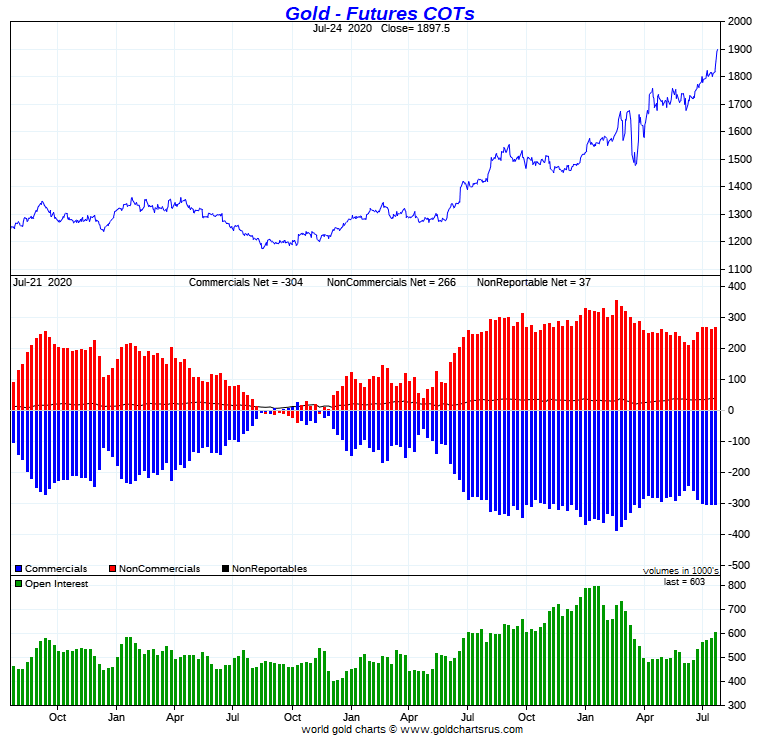

In gold, the commercial net short position only rose by 1,841 contracts, or 184,100 troy ounces of gold.

They arrived at that number by increasing their long position by 3,781 contracts -- and they also increased their short position by 5,622 contracts. It's the difference between those two numbers that represents their change for the reporting week.

Under the hood in the Disaggregated Report, it was the same story in gold as it was in silver. The Managed Money traders were the big buyers, increasing their net long position by 5,296 COMEX contracts -- and the traders in the other two categories both decreased their net long positions...the 'Other Reportables' by 1,288 contracts -- and the 'Nonreportable'/small traders by 2,167 contracts.

Doing the math: 5,296 minutes 1,288 minus 2,167 equals 1,841 contracts...the change in the commercial net short position, which it must do.

The commercial net short position in gold now stands at 30.39 million troy ounces, which is very bearish on its face, but it must be remembered that the Big 8 traders are short 22.98 million troy ounces of that amount -- and are trapped on the short side. Their short position is about 76 percent of the commercial net short position in gold. Obscene to be sure, but not as obscene as the situation that exists in silver.

In last week's COT Report the Big 8 were short 23.21 million troy ounces of gold, so they decreased their short position by an rather inconsequential 230,000 troy ounces week-over-week. No short covering worthy of the name here, either.

It was Ted's opinion that JPMorgan, along with the other traders in the Producer Merchant category, didn't do anything during the reporting week, which is exactly what he was hoping for. He figures that JPM didn't didn't add any shorts -- and their short position is pretty much zero.

Here's Nick's 3-year COT chart for gold, updated with Tuesday's data -- and there's not a lot to see here, either. Click to enlarge.

|

|

As I've been mentioning on and off during the reporting week...gold, silver and palladium are all well into overbought territory, so from a technical standpoint, they're ripe for a sell-off. But the COT Report is still very bullish in both gold and silver, although there is some "low-hanging fruit" if 'da boyz' want to go after it. But if a sell-off does come, it should be bought, as it shouldn't last overly long or be too deep. I can tell you right now that I'll be a buyer when it occurs.

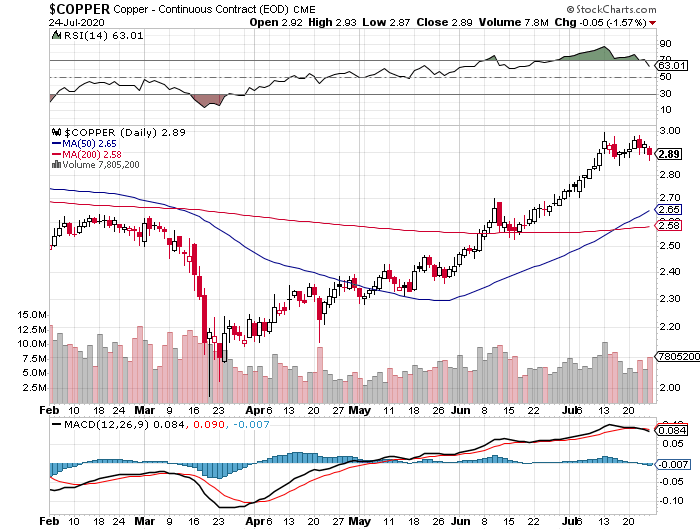

In the other metals, the Managed Money traders in palladium increased their net long position by a further 1,202 COMEX contracts during the last reporting week -- and are now net long the palladium market by 2,956 contracts...around 32 percent of the total open interest...up from 22 percent last week. As you know, the COMEX palladium futures market is a market in name only. In platinum, the Managed Money traders traders increased their net long position by a further 3,862 COMEX contracts -- and are net long the platinum market by 12,019 COMEX contracts...about 23 percent of the total open interest. The other two categories in platinum [Other Reportables/Nonreportable] continue to be mega net long against JPMorgan et al...especially the 'Other Reportables'. In copper, the Managed Money traders increased their net long position by a further 13,273 COMEX contracts during this last reporting week -- and are now net long copper by 54,966 COMEX contracts...1.37 billion pounds of the stuff...about 24 percent of total open interest, up from 19 percent from last week. It's their buying that's driving copper prices higher.

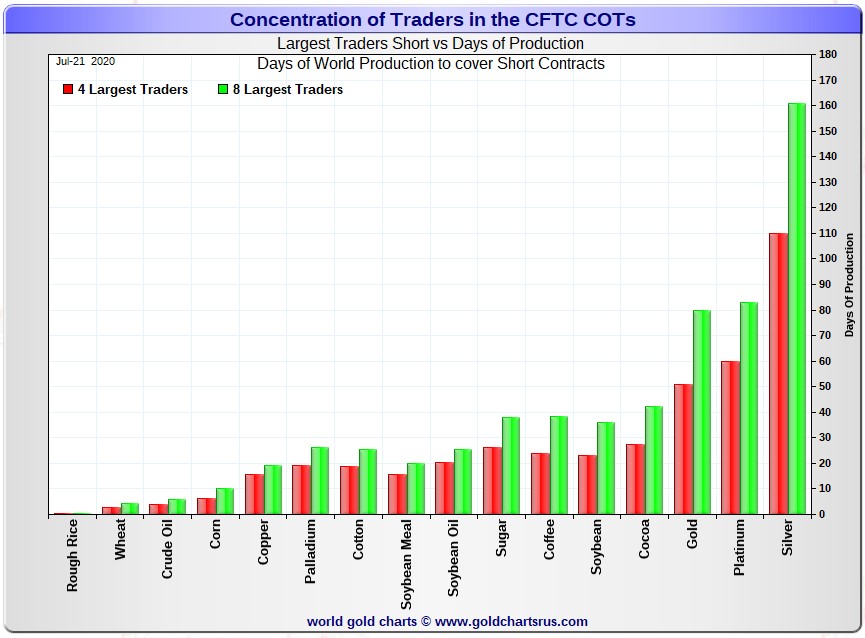

Here's Nick Laird's "Days to Cover" chart, updated with the COT data for positions held at the close of COMEX trading on Tuesday, July 21. It shows the days of world production that it would take to cover the short positions of the Big 4 - and Big '5 through 8' traders in each physically traded commodity on the COMEX. Click to enlarge.

|

|

The Big 4 traders are short about 110 days of world silver production, up 3 days from last week's report. The '5 through 8' large traders are short an additional 51 days of world silver production...unchanged from last week's COT Report - for a total of about 161 days that the Big 8 are short...up 3 days from last week's report. This represents five months and a bit of world silver production, or about 375 million troy ounces of paper silver held short by the Big 8. [In the prior reporting week, the Big 8 were short 158 days of world silver production.]

In the COT Report above, the Commercial net short position in silver was reported by the CME Group as 310 million troy ounces. As mentioned in the previous paragraph, the short position of the Big 8 traders is around 375 million troy ounces. So the short position of the Big 8 traders is larger than the total Commercial net short position by about 375-310=65 million troy ounces...which is down about 2 million ounces from last week's report.

The reason for the difference in those numbers...as it always is...is that Ted's raptors, the 31-odd small commercial traders other than the Big 8, are net long that amount -- and have been big long sellers for many weeks.

Another way of stating this [as I say every week in this spot] is that if you remove the Big 8 commercial traders from that category, the remaining traders in the commercial category are net long the COMEX silver market. It's the Big 8 [sans JPMorgan] against everyone else...a situation that has existed for over three decades in both silver and gold -- and in platinum and palladium as well.

As per the first paragraph above, the Big 4 traders in silver are short around 110 days of world silver production in total. That's about 27.5 days of world silver production each, on average...up 0.75 days from last week's report. The four big traders in the '5 through 8' category are short 51 days of world silver production in total, which is 12.75 days of world silver production each, on average...unchanged from last week.

The Big 8 commercial traders are short 40.4 percent of the entire open interest in silver in the COMEX futures market, which is down a tad from the 41.4 percent they were short in last week's COT report. And once whatever market-neutral spread trades are subtracted out, that percentage would be close to the 50 percent mark. In gold, it's 38.1 percent of the total COMEX open interest that the Big 8 are short, which is down a bit from the 40.0 percent they were short in last week's report -- a bit over 45 percent once the market-neutral spread trades are subtracted out.

In gold, the Big 4 are short 51 days of world gold production, down 1 day from last week's COT Report. The '5 through 8' are short another 29 days of world production, unchanged from last week's report...for a total of 80 days of world gold production held short by the Big 8...down 1 day from last week's COT Report. Based on these numbers, the Big 4 in gold hold about 64 percent of the total short position held by the Big 8...unchanged from last week's report.

According to Ted, JPMorgan doesn't hold a short position in gold in the COMEX futures market -- and somewhere between zero and 3,000 contracts held short in silver...an inconsequential amount.

The "concentrated short position within a concentrated short position" in silver, platinum and palladium held by the Big 4 commercial traders are about 68, 72 and 73 percent respectively of the short positions held by the Big 8...the red and green bars on the above chart. Silver is unchanged from last week's COT Report...platinum is down 3 percentage points from a week ago -- and palladium is up 5 percentage points week-over-week.

The Big 8 shorts are still hugely exposed in all four precious metal, at least in the COMEX futures market. But some things appear to have changed in that regard -- and I'm waiting for Ted to post his new findings in the public domain. So far he's managed to resist all impassioned pleas from me to do so.

I have an average number of stories, articles and videos for you today...plus I do have a long one that I've been saving for my Saturday column.

CRITICAL READS

Dollar at risk of collapse? Ex-IMF official warns 'blow-up event' could sink currency as debt mounts

With the United States expected to double down on its fiscal stimulus measures to mitigate the economic fallout from the coronavirus pandemic, and the U.S. Federal Reserve continuing its aggressive monetary policy easing, there is a rising risk of a sudden loss of confidence in the U.S. dollar, according to a former senior executive with the International Monetary Fund.

Zhu Min, who was deputy managing director of the IMF from 2011 to 2016, said the U.S. dollar's position as the dominant global currency was at risk of being eroded because of mounting U.S. government debt.

The U.S. Congress is considering a fresh round of relief to support the U.S. economy that is likely to cost at least U.S. $1 trillion on top of the more than U.S. $2 trillion passed earlier this year. Leaders of the Democratic-led House of Representatives and Republican-led Senate will have to reach a compromise on separate bills, with the House having already passed a U.S. $3 trillion package, while the Senate is expected to pass a smaller bill of about U.S. $1 trillion in the coming days.

"The concern isn't whether the U.S. dollar will see an accumulated decline of 30 percent in the future, but whether there will be a blow-up event that causes a sudden loss of confidence in the dollar and its market to collapse," said Zhu, who is head of the National Financial Research Institute at Tsinghua University in Beijing.

This article was posted on the South China Morning Post website at 7:00 a.m. HKT on their Friday morning, which was 7:00 p.m. EDT on Thursday evening in Washington -- and I found it in a GATA dispatch, but too late to make Friday's column, so here it is now. Another link to it is here.

Killing the Host -- Michael Hudson

Michael Hudson's landmark 2015 book "Killing the Host" exposed how the empires of finance, insurance and real estate captured the global economy through neo-liberalism and sold us down the road to neo-feudalism. Michael returns to the show to describe why the current global economic demise is the fruit of consummate greed, crony politics and rapacious finance - and what we must do if we are to ever get off this road.

This long interview, which is a transcript of the audio interview, was posted on the unz.com Internet site on Tuesday -- and for obvious reasons, I've been saving it for today's column. There's also a link to the audio interview -- and that's posted right at the top of the article. So take your pick. I thank Larry Galearis for sharing it with us -- and another link to 'all of the above' is here.

More Fallout from Iran/China Deal: India Loses Farzad-B -- Tom Luongo

The carnage for following President Trump's lead on ending the JCPOA continues for India.

From SputnikNews last week comes this note about the Farzad-B oil and gas field and Iran.

"Close on the heels of breaking the Chabahar-Zahedan rail project agreement, Iran appears set to deny India's state-run ONGC Videsh Limited (OVL), exploration and production rights for the key Farzad B gas field.

The granting of rights to OVL was already delayed with New Delhi moving slowly on the issue, but came to a complete standstill after the 2018 imposition of U.S. sanctions on Tehran."

Now that threat looks to be a reality.

Turkish news agency Anadolu Agency quoted India's External Affairs Ministry (EAM) as saying on Thursday Tehran would develop the Farzad-B gas field in the Persian Gulf region "on its own" and might engage India "appropriately at a later stage".

Translation: "Stop stalling for Trump's sake and make good on your promises or the project goes to China."

Because that's where this leads in light of the announced mega-deal between Iran and China worth a reported $400 billion.

This longish, but very interesting commentary from Tom was posted on his Internet site on Friday sometime -- and another link to it is here. Gregory Mannarino's post market close rant for Friday is linked here -- and it comes courtesy of Brad Robertson.

Jim Grant "Confidently Bullish" Gold & Silver Amid "Unprecedented Monetary Moment"

Jim Grant has long been skeptical of the mechanization of the Federal Reserve. He was warning about the distortions created in the markets and broader economy caused by the central bank's monetary policy long before the monetary Hail Mary it threw up in response to the coronavirus pandemic.

Last month, Grant wrote an op-ed for The Wall Street Journal headlined, "Powell Has Become the Fed's Dr. Feelgood," and he recently appeared on Fox Business to talk more about how the Fed is further distorting an already distorted economy.

In the WSJ piece, Grant asserts that the Fed's zero interest rate monetary policy is hopelessly distorting the economy and policymakers, Powell in particular, should find a bit of humility.

"Ground-scraping interest rates turn savers into speculators and quarantined millennials into day traders. They facilitate over-borrowing, suppress market signals, misdirect investment dollars and promote the dubious business of turning well-financed public companies into heavily indebted private ones. Concerning the future and its side effects, Mr. Powell should admit how little he knows - he and the rest of us."

Conventional wisdom holds that given the economic shutdowns, the central bank had to "do something." Grant takes a position similar to Peter Schiff who has said the Fed policy isn't helping and it's actually hurting. During his Fox Business interview, Grant said it was doomed from the start.

"The Fed faced kind of an insuperable difficulty, right? Without revenue, things don't work. And there is no kind of monetary policy that is designed to supplant the absence of commerce. That's what they faced in March."

The Fed may have acted with good intentions, but as Grant put it, investors aren't really concerned with "motives or necessity." All that really matters is outcomes. The outcomes won't be good.

Grant said aggressive moves by governments and central banks are unwise.

"I think what we have is a monetary moment that is unprecedented and therefore calls for extreme caution and great humility on the parts of all of us."

Grant pointed out that commodity prices are at their lowest level compared to the Dow in about 120 years. [Emphasis mine. - Ed -- and you'll read more about this in The Wrap]

"That, to me, kind of lights a light. It reminds us that there may be an extreme valuation out there that might be inviting capital rather than thought to be repelling it."

Grant said that he is "confidently bullish" on precious metals.

The link to the 4:51 minute Grant/Bartiromo video interview on Fox Business is linked at the very bottom of this Zero Hedge article that put in an appearance on their website at 1:05 p.m. on Friday afternoon EDT. I thank Brad Robertson for pointing it out -- and another link to it is here.

Doug Noland: Crossing Red Lines

It has been an alarming deterioration of U.S./China relations over recent months. Bubble markets have been content to disregard what has been a virtual collapse in relations over recent days and weeks.

The unfolding U.S./China cold war is most regrettable. The only surprise, in my eyes, is that the relationship held together as long as it did. It was destined to mature into an intense superpower rivalry. From a Bubble Analysis perspective, the boom cycle fostered the perception of an expanding economic pie. Cooperation and integration were considered mutually beneficial. It was also unsustainable.

Stark changes in perceptions and relationships are fundamental to the bursting global Bubble thesis. The economic pie is stagnating rather than expanding. It's become a zero-sum game - an inevitable new zeitgeist accelerated by COVID. Even as their respective Bubbles floundered over the past 18 months, an attitude persisted that the two sides needed to work together to ensure stability. No more.

There's no longer a shred of doubt. Beijing can blame its problems on the United States - and it will be credible to its riled citizens. The U.S. over recent weeks has been frenetically Crossing China's Red Lines (like kids skipping over cracks in a sidewalk). We're in the thick of election season - and the current administration might be short-timers. But huge - likely irreparable - damage is being wrought upon the most paramount of global relationships.

The U.S. has Crossed China's Red Lines - have U.S./China relations crossed the Rubicon? I've for years now feared this rivalry risked deteriorating into confrontation. Such analysis doesn't seem as wacko these days. And sure, U.S. stocks ended down slightly for the week, as manic markets somewhat began to take notice. It was fascinating to contrast market complacency with regard to collapsing U.S./China relations, to analysts histrionic response to the E.U. agreeing to debt mutualization (and grants to nations) as part of its COVID stimulus package.

For years now, my Credit Bubble Bulletin analysis has focused on the interdependence of historic U.S. and Chinese Bubbles. "Decoupling" has commenced - spurred on by COVID. Myriad uncertainties and fragilities ensure intense pressures on both the Fed and PBOC to keep their respective systems afloat. Crazy equities, for now, luxuriate in the thought of ultra-easy money for as far as the eye can see.

Meanwhile, the safe havens sense one hell of a crisis brewing. Ten-year Treasury yields this week traded below 0.6%, with German bund yields holding at negative 0.45%. And the metals are on fire. Gold was up 5% and silver jumped almost 16% this week. Surging industrial metals prices add further intrigue. I doubt prices are surging on economic prospects. In a world of such uncertainty and unfolding mayhem, all the metals are viewed as Stores of Value. Will future historians see this week as pivotal for Red Lines Being Crossed?

As you already know, Doug's weekly market commentary is always a must read for me. It was posted on his website in the very wee hours of Saturday morning EDT -- and another link to it is here.

Gold nears $1,900 as veteran Mobius says buy now and keep buying

Spot gold topped $1,900 an ounce for the first time since 2011 and edged closer to an all-time high with flaring geopolitical tensions and concern over global growth driving demand for haven assets.

Increasing signs that the prolonged pandemic is stalling an economic recovery and the recent spat between China and the U.S. are underpinning bullion's appeal. The metal is also getting support from a confluence of low or negative real rates and a slipping dollar amid massive liquidity injections from governments and central banks worldwide. The weaker dollar and plunging yields on government bonds lower the opportunity cost of owning gold.

Gold is heading for a seventh weekly gain, the longest stretch since 2011, while silver is poised for its biggest weekly advance in about four decades. Gold may reach the all-time high by early next week, according to a trader at RJO Futures in Chicago.

"The pace of this thing is unbelievable," Bob Haberkorn, a senior market strategist at RJO, said by phone. "People just want to buy, buy, buy, they just want to be in -- they don't want to miss it. People are preparing for more money printing, lower dollar in the future and hedging. And there's no yield on Treasuries right now, so gold is a safe spot given the circumstances of the central banks and the coronavirus."

"When interest rates are zero or near zero, then gold is an attractive medium to have because you don't have to worry about not getting interest on your gold and you see the gold price will rise as uncertainty in the markets are rising," Mark Mobius, co-founder at Mobius Capital Partners, said in a Bloomberg TV interview. "I would be buying now and continue to buy."

This gold-related Bloomberg news item showed up on their Internet site at 6:24 p.m. PDT [Pacific Daylight Time] on Thursday evening -- and was updated about seventeen hours later. The 'though police' at Bloomberg have given it a new headline as well..."Gold Tops $1,900 for First Time Since 2011, Heads Toward Record". I thank Swedish reader Patrik Ekdahl for sending it our way -- and another link to it is here.

One Bank Warns Buying Gold is the Only Hedge Left For the "Great Debasement"

As far as Bank of America is concerned, there are just two themes one needs to know to explain the current "market" (which as the same Bank of America explained last week, is now manipulated to a never before seen extent): the Great Repression and Great Debasement.

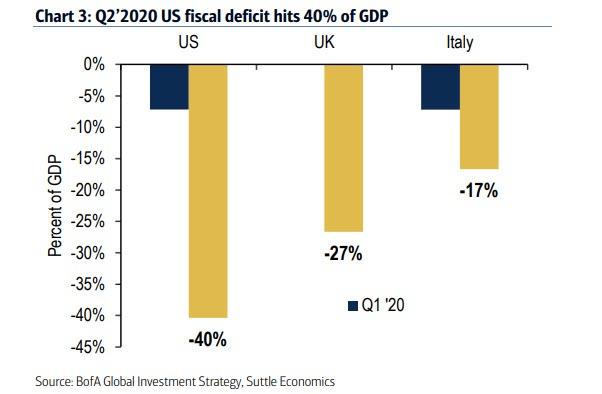

First the Great Repression - also known as "Don't fight the Fed" - which according to BofA CIO Michael Hartnett is the outcome of $8 trillion in central bank asset purchases in just three months in 2020, has crushed interest rates, corporate bond spreads, volatility & bears. The most perfect example of this repression: the US fiscal deficit soared from 7% to 40% of GDP in Q2'20...

|

|

... and less than one month later the volatility of U.S. Treasury market fell close to all-time low.

Besides volatility, central bank repression works its magic on yields: case in point Italian & Greek 10-year government bonds which are down to 1%, while U.S. Commercial Mortgage Backed Securities (CMBS) & IG corporate bonds down to 2%, meanwhile the 30-year U.S. mortgage rate just dropped to a record all time low of 3%.

It also means that BofA's recently preferred "All-weather" portfolio consisting of equal parts of all assets, i.e., 25/25/25/25 stocks, bonds, cash, gold, is up a record 18% in the past 90 days (Chart 7), which is "astounding & abnormal" given 7% historic annual average.

And yet, all good times come to an end - otherwise the Fed would have printed its way to utopia decades ago - and the with Great Repression in full force, it also means that the Fed is currently pursuing a just as Great Debasement.

Echoing something we have also said, namely that with the bond market now nationalized by the Fed and no longer providing any useful inflationary (or deflationary) signals, the only remaining asset class with any sort of discounting qualities is gold...

... Hartnett writes that interest rate repression means "investors can't hedge the inflationary risk of $11tn of fiscal stimulus via "short bonds"...so investors crowding into "short U.S. dollar", "long gold" hedges.

Which is why shorting the dollar to hedge debasement may be profitable for a while but eventually lead to catastrophic consequences.

That leaves long gold as the only natural hedge to the central bank "all in" bet of kicking the can until something breaks. That something will likely be gold exploding higher first above $2,000... then $2,500... then $3,000 at which point the Fed's control over fiat currencies, as well as the illusion that there is no inflation, and the financial regime will finally collapse.

Finally, one look at the price of gold - which just closed at an all-time high...Click to enlarge.

|

|

... and it becomes clear that it is now just a matter of time before the financial world as we know it, will end.

This worthwhile chart-filled gold-related Zero Hedge story appeared on their website at 9:05 p.m. EDT on Friday evening -- and it comes to us courtesy of Richard Saler. Another link to it is here.

Trump officials concluded Friday that a proposed gold and copper mine in Alaska - which would be the largest in North America - would not pose serious environmental risks, a sharp reversal from a finding by the Obama administration that it would permanently harm the region's prized sockeye salmon.

The official about-face regarding the bitterly contested project epitomizes the whiplash that has come to define environmental policy under President Trump, who has methodically dismantled many of his predecessor's actions on climate change, conservation and pollution.

A final environmental analysis issued Friday by the U.S. Army Corps of Engineers found that Pebble Mine - which targets a deposit of gold, copper and other minerals worth up to $500 billion - "would not be expected to have a measurable effect on fish numbers" in the Bristol Bay watershed, which supports the world's largest sockeye salmon fishery.

The Obama administration, which looked at multiple project scenarios, concluded in 2014 that a major mine in the area could cause irreparable harm.

The bitter fight over Pebble Mine has raged for nearly two decades. Halted by the last administration, the project has been fast-tracked under Trump and is poised to get final federal approval by the end of the year. But a coalition of local residents and national environmental groups will challenge the permit in court, and the next administration could block it once again if Democrats win the White House in the fall.

Having spent eight or so years in Canada's High Arctic in my youth, I completely understand the opposition to this project by the local Inuit people, as I cannot think of a more sensitive environment than barren-ground tundra, with which I am intimately familiar -- and the sockeye salmon run on which their lives depend. But despite those feelings, I've always been in favour of this project -- and I hope the mine developers tread carefully...in every sense of the word. This news item was appeared on the washingtonpost.com Internet site at 12:55 p.m. PDT on Friday afternoon -- and I found it on the gata.org Internet site. Another link to it is here.

The PHOTOS and the FUNNIES

At the end of our trip on the east side of Okanagan Lake -- and a few kilometers/miles south of Kelowna on February 16, I took the first photo overlooking the lake and a multi-million dollar cottage right on it. The road went on for another few hundred meters -- and past a couple of more of these monster cottages/homes, before running into mostly solid rock. On the way back I strapped on the 400mm telephoto -- and took the second photo of the Mission Hill Family Estate winery on top of its rock and across the lake, about 5 kilometres away. I'll retake this photo on Sunday, as my daughter and I will be spending the weekend in Kelowna -- as we look forward to redoing this road in the summer months -- and the photos will look completely different. The third photo is of a couple of mule deer that were grazing along side the road -- and both were taken with my walk-around lens. No telephoto needed here. In the third photo -- and if the resolution of your computer monitor is good enough, you can just make out the Mission Hill winery on the top of its rock in the upper left of the shot. Click to enlarge.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The WRAP

"Also, I've seen it mentioned recently, as well as over the years, the thought that all the silver going into SLV and the other silver ETFs (as well as in gold) is somehow suspect or not occurring in reality, despite serial numbers, bar weights and hallmarks being published. I don't consider these "gripes" as being legitimate, but if anyone strongly feels non-existent physical silver is being reported in SLV or any other ETF, then that person should complain to the SEC and other authorities.

As far as the silver not being physically moved into the SLV, on any given day (like on Tuesday), because the amounts seem too large to explain - that's a different matter. Not for a minute do I suspect that 25 truckloads of physical silver were moved into the vaults of SLV yesterday. But the point is that that much silver didn't need to be physically moved. There should be no question that the silver coming into SLV yesterday and over the past 4 months and into other silver ETFs as well has come from JPMorgan (since it is the only one holding that much silver) and the metal needn't be moved at all - just electronically transferred from JPM ownership to ETF ownership. I've always contended that JPMorgan kept the bulk of its 1 billion oz in London, so no real physical movement is or was necessary." -- Silver analyst Ted Butler: 22 July 2020

Today's pop 'blast from the past' is one I've posted before, but it's been a while. It's a cover of one of the greatest rock tunes of our generation. As one person commented: "If you were born after 1999, lemme explain...you are watching Rock Legends, cover Rock Gods, in front of said Rock Gods, on a night the Rock Gods are being honored for their rock godliness, choosing the Rock Gods' most famous song. And they slayed it." The link is here.

Today's classical 'blast from the past' is one I've posted before on several occasions, but not this year so far...I think -- and I'm in mood for it. It was one of the last pieces that French composer Maurice Ravel composed before illness forced him into retirement -- and it was a sensational success when it was premiered at the Paris Opéra on 22 November 1928.

If you wish to pack a concert hall -- and get an audience all wound up to a fever pitch on any given night, just schedule this work. I know from personal experience during my 11 year tenure on the programming committee of the Edmonton Symphony Orchestra, which seems like a lifetime ago now.

Here's the world renowned Vienna Philharmonic serving it up just right. Gustavo Dudamel conducts -- and the link is here...enjoy!

The gold price closed in New York at $1,904.80 in the August contract on Friday -- and whether that is a record closing high or not, is pretty a moot point at this juncture. And if that wasn't it, it matters not, as it will soon be relegated to the dustbins of history regardless.

It's also my opinion, based on Ted's new findings, that the silver price is being deliberately held in check until the select few of the Big 8 shorts being rescued, become market neutral in silver...either by physical delivery in the COMEX futures market, or by sufficient purchases of offsetting shares in the various silver mutual funds and ETFs...principally SLV.

There is now a sufficient amount of gold...and then some...that has been deposited in the various COMEX warehouses over the last three or four months to cover the outstanding short positions of all of the Big 8 traders, if that's what its ultimate purpose is.

But not to be forgotten is the precarious position that the Big 8 are short in platinum and palladium, as they hold almost the entire short positions in both these precious metals all by themselves -- and even the Swap Dealers in the commercial category are net long these two metals.

As I've been pointing out over the last few weeks, including earlier in this column, there have been record deliveries in platinum so far this month...3,835 contracts. But that is not even remotely close to what the 'select few' Big 8 traders that are short and being saved, will need to cover their current short positions. There are no inventories in platinum worth speaking of -- and the physical market in palladium has been in the danger zone for many years already. The proof of that lies in the depleting palladium inventories in all of the world's mutual funds and ETFs.

And as Ted has mentioned -- and I stated earlier, the moment that JPMorgan stops supply physical silver to all these mutual funds and ETFs, then it's game over.

All we can do now is await the day -- and the cover story that will be used to explain away the upcoming explosion in precious metal prices in particular -- and commodity prices in general. Whatever story is supplied to the main stream media will most likely be true in some respects, but the real reason won't be forthcoming -- and it will be another case of them lying by omission.

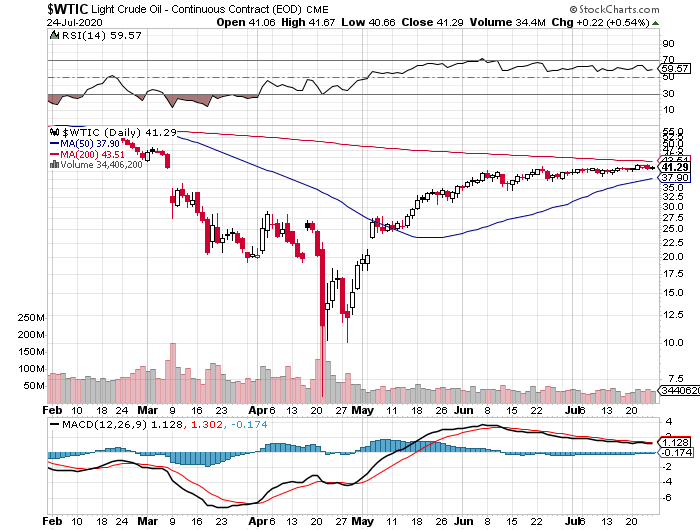

Here are the 6-month charts for the Big 6 commodities, courtesy of stockcharts.com -- and the overbought situation in both gold and silver, plus palladium...are obvious. Platinum is now out of its overbought situation by a hair. The shorts in copper have already turned that metal lower -- and appear to be in the process of harvesting profits at the expense of the Managed Money traders who have been going massively long for the last four months. WTIC didn't do much yesterday. Click to enlarge.

|

|

|

|

|

|

|

|

|

|

|

|

As I've pointed out over the last few days, the only fly in the ointment is that from a technical basis, the four precious metals are overbought -- and the U.S. dollar is oversold. This can continue for a while of course, but at some point there will be a counter-trend rally in the dollar index...most likely by design -- and 'da boyz' will use that opportunity to engineer precious metal prices lower.

As Ted mentioned very recently, there's now a lot of "low-hanging fruit" that can be harvested with ease, so don't be surprised or shocked when this scenario finally unfolds. I, for one, will use it as a buying opportunity -- and it will be my last purchase in the precious metals complex, as I'm heavily "all in"...a fact that you already know.

I'm not going to spend much time dwelling on the current state of the U.S. or global economy, interest rates, or various and sundry market interventions by massive money printing by the world's central banks, as they have been covered in various stories over the last many months already. And that includes the stories posted in today's Critical Reads section.

The difference now, is that the recommendations to buy gold are now coming so thick and fast, that you almost need a programs to keep up. These cries to buy precious metals will only accelerate as time goes on -- and not much time, either.

As Jim Grant pointed out in his interview posted in the Critical Reads section..."commodity prices are at their lowest level compared to the Dow in about 120 years".

This was never a worry until the central banks ran into this current and massive deflationary event on a world-wide scale that threatens to consume them at some point -- and it will, if they don't act quickly.

It's my firm belief that they are now preparing to play the gold/commodity card, as their attempts to bring about inflation through the printing press are not proceeding fast enough. That's mostly because of the lack of velocity of money, as the economies on Planet Earth implode -- and disposable income has vanished, except for necessities. This virus scam hasn't helped their cause either.

Ted's discovery of how the select Big 8 shorts are to be saved in silver, is the deep state/Federal Reserves attempt to save the systemic U.S. banks is the final step before they allow precious metal prices, plus all commodities to be repriced at some new level, creating all the inflation that these central banks need to save themselves.

As Jim Rickards has pointed out on numerous occasions over the last number of years, the Fed and the U.S. Treasury can get all the inflation they want by simply being buyers and seller of gold at some much higher price...say $5,000 the ounce...debasing all world currencies in the process.

But a solution such as that would be too obvious, but I'll admit that it's still a possibility. I think they have hatched a plan to allow them to do the same thing, but make it look like it's happening "naturally" -- and they'll get the same result, but the route to get there will be slightly different.

And hopefully, for the last time, I'll refer to that landmark essay by British economist Peter Warburton that he posted on the Internet back in April of 2001...almost a generation ago -- and to this day I consider that this seminal article contains the most important four paragraphs ever written about finance, economics and the current state of the world's financial system since the gold exchange standard ended back in August 1971.

It's entitled "Debasement of World Currency: It's inflation, but not as we know it"

And don't forget that as you're reading this, it was written 19 years ago.

"What we see at present is a battle between the central banks and the collapse of the financial system fought on two fronts. On one front, the central banks preside over the creation of additional liquidity for the financial system in order to hold back the tide of debt defaults that would otherwise occur. On the other, they incite investment banks and other willing parties to bet against a rise in the prices of gold, oil, base metals, soft commodities or anything else that might be deemed an indicator of inherent value. Their objective is to deprive the independent observer of any reliable benchmark against which to measure the eroding value, not only of the U.S. dollar, but of all fiat currencies. Equally, they seek to deny the investor the opportunity to hedge against the fragility of the financial system by switching into a freely traded market for non-financial assets.

It is important to recognize that the central banks have found the battle on the second front much easier to fight than the first. Last November I estimated the size of the gross stock of global debt instruments at $90 trillion for mid-2000. How much capital would it take to control the combined gold, oil, and commodity markets? Probably, no more than $200 billion, using derivatives.

Moreover, it is not necessary for the central banks to fight the battle themselves, although central bank gold sales and gold leasing have certainly contributed to the cause. Most of the world's large investment banks have over-traded their capital [bases] so flagrantly that if the central banks were to lose the fight on the first front, then the stock of the investment banks would be worthless. Because their fate is intertwined with that of the central banks, investment banks are willing participants in the battle against rising gold, oil, and commodity prices.

Central banks, and particularly the U.S. Federal Reserve, are deploying their heavy artillery in the battle against a systemic collapse. This has been their primary concern for at least seven years...[1993 dear reader]. Their immediate objectives are to prevent the private sector bond market from closing its doors to new or refinancing borrowers and to forestall a technical break in the Dow Jones Industrials. Keeping the bond markets open is absolutely vital at a time when corporate profitability is on the ropes. Keeping the equity index on an even keel is essential to protect the wealth of the household sector and to maintain the expectation of future gains. For as long as these objectives can be achieved, the value of the U.S. dollar can also be stabilized in relation to other currencies, despite the extraordinary imbalances in external trade."

That "battle between the central banks and the collapse of the financial system fought on two fronts" that Warburton so brilliantly articulated, has now now been lost -- and the world's central banks are preparing for what comes next. Getting the most important systemic banks [mostly U.S. banks] out of their massive short positions in the precious metals is what I see as the final act before they stand back and allow the inevitable to occur.

And as I have often stated over the years..."It will come either by design or circumstance -- and I suspect that the latter will be allowed to precipitate the former." I'm even more resolute in my opinion on that, at this point in world history.

All that remains unknown at this juncture, is the date of the event that will be allowed to precipitate the final collapse.

Except for massive commodity inflation and currency debasement -- and shiny new precious metal prices, what follows after that is hard to imagine. Jim Rickards has stated that it will be "chaos". Let's hope that's all it turns out to be...but in my heart and soul, I fear far worse.

"How did it come to this," I continue to wonder as time passes -- and I'm still "all in".

See you on Tuesday.

Ed