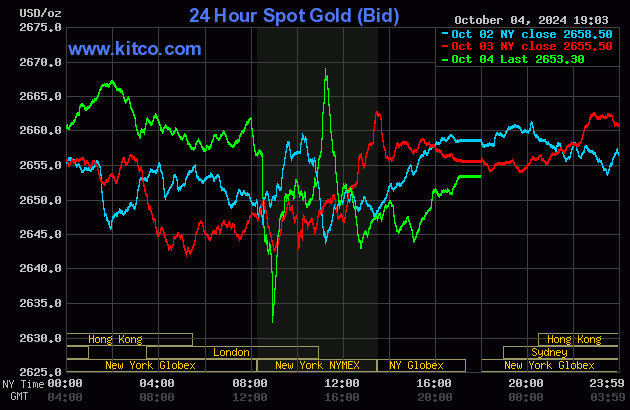

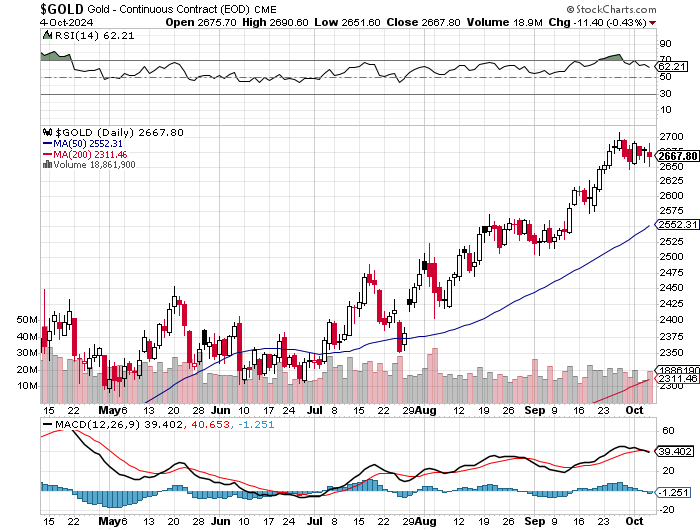

The gold price took two steps higher once Globex trading commenced at 6:00 p.m. EDT on Thursday evening in New York -- and that lasted until its price was capped at 2 p.m. China Standard Time on their Friday afternoon. It was sold quietly lower from there until 11 a.m. in London -- and then crept a bit higher until it got smacked at exactly 1:00 p.m. BST/8:00 a.m. in New York. Then the collusive commercial traders of whatever stripe showed up in force at the 8:30 a.m. EDT non-farm payroll number in Washington -- and its low tick was set about 8:59 a.m. It then rallied two enormous steps higher from there until 'da boyz' showed up anew about fifteen minutes after the 11 a.m. EDT London close. Shortly after that its price was engineered lower until 12:45 p.m. -- and then had a decent up/down move that ended at 3:01 p.m. in after-hours trading. It rallied rather smartly from there until trading ended at 5:00 p.m. EDT.

The low and high ticks in gold, both of which were set by 'da boyz' in COMEX trading in New York, were recorded by the CME Group as $2,651.60 and $2,690.60 in the December contract...an intraday move of $39. The October/ December price spread differential in gold at the close in New York yesterday was $22.00...December/February was $22.90...February/April was $19.50 -- and April/June25 was $19.60 an ounce.

Gold was closed on Friday afternoon in New York at $2,653.30 spot, down $2.20 on the day...22 dollars off its low tick -- and and 17 bucks off its Kitco-recorded high. Net volume was only a bit on the heavier side at a bit under 169,000 contracts -- and there were just about 24,000 contracts worth of roll-over/switch volume out of December and into future months on top of that.

I noted that 114 gold, plus 156 silver contracts were traded in October yesterday, so I look forward to what portion of that shows up in tonight's Daily Delivery and Preliminary Reports.

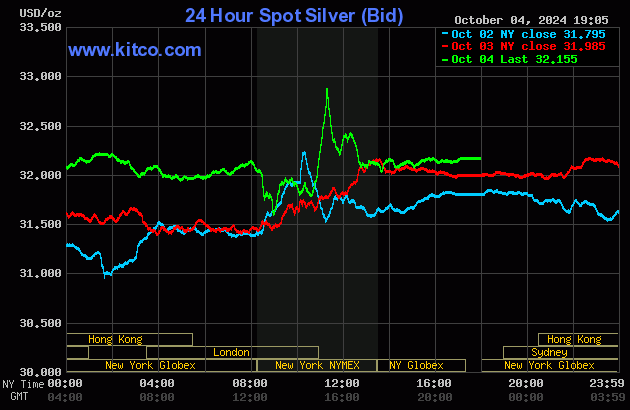

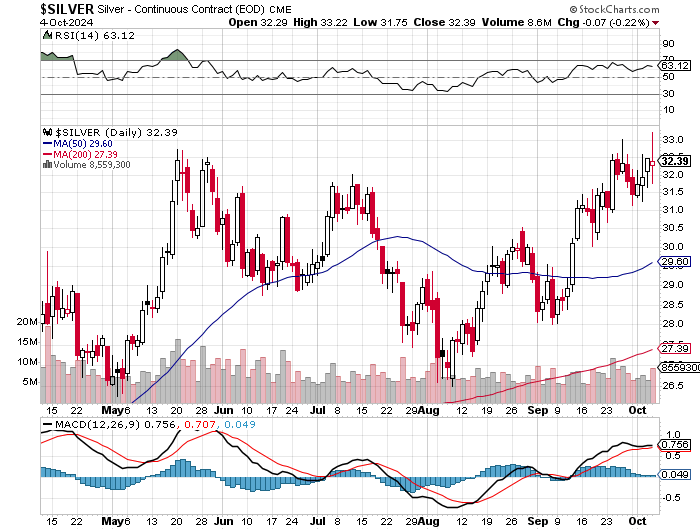

Silver's price was managed in the same fashion as gold's...including all the major and minor inflection points -- and that lasted until 'da boyz' were done with it at 12:45 p.m. in COMEX trading in New York. From that point it wandered quietly higher until around 3:55 p.m. in after-hours trading -- and didn't do much after that.

The low and high ticks in silver were reported as $31.755 and $33.225 in the December contract...and intraday move of $1.47...almost five percent. The December/March price spread differential in silver at the close in New York yesterday was 42.1 cents...March/May was 25.6 cents -- and May/July25 was 24.4 cents an ounce.

Silver was closed on Friday afternoon in New York at $32.155 spot...up 17 cents from Thursday -- and 70.5 cents off its Kitco-recorded low tick -- and 75.5 cents off its high. Net volume was pretty heavy at a bit over 81,500 contracts -- and there were a bit over 4,900 contracts worth of roll-over/switch volume out of December and into future months in this precious metal.

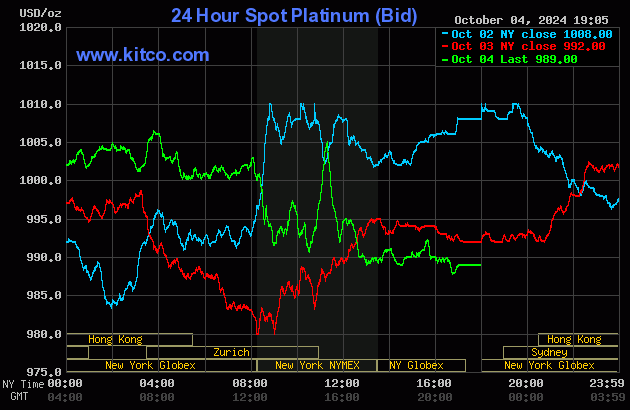

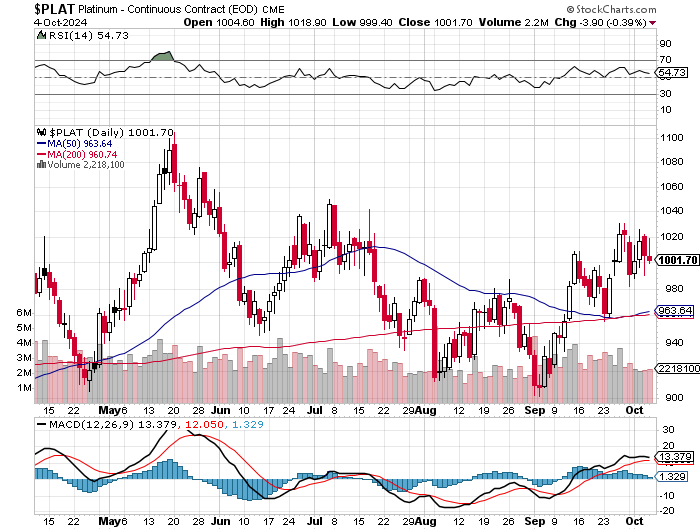

In most respects that mattered, platinum's price was also managed in a similar fashion as gold and silver...up until a minute or so before 9 a.m. in New York. It's 10:40 a.m. EDT rally in COMEX trading was all gone -- and then some, within the following two hours. It didn't do a whole heck of a lot after that. Platinum was closed at $989 spot, down 3 dollars on the day.

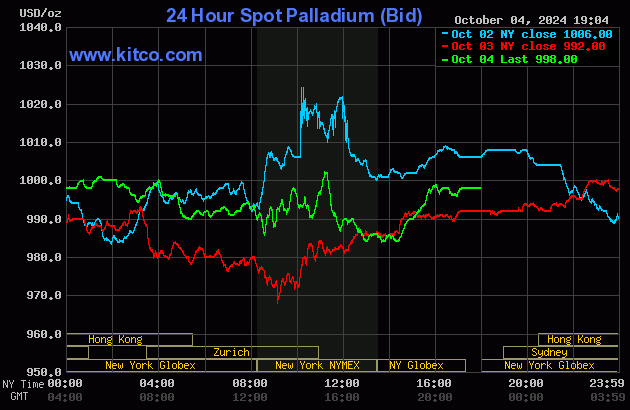

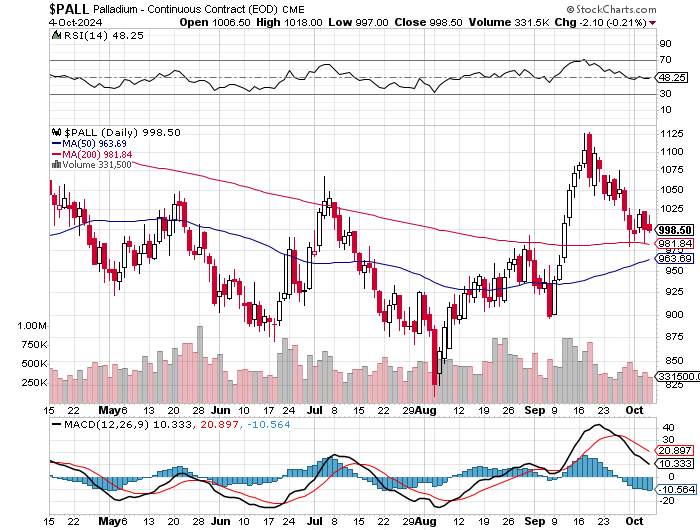

Palladium's price path was similar to the other three precious metals...but on Valium. It managed to close up 6 bucks at $998 spot.

Based on the kitco.com spot closing prices in silver and gold posted above, the gold/silver ratio worked out to 82.5 to 1 on Friday...compared to 83.0 to 1 on Thursday.

Here's the 1-year Gold/Silver Ratio Chart...courtesy of Nick Laird and, for whatever reason, the Friday data point is not on it. Click to enlarge.

![]()

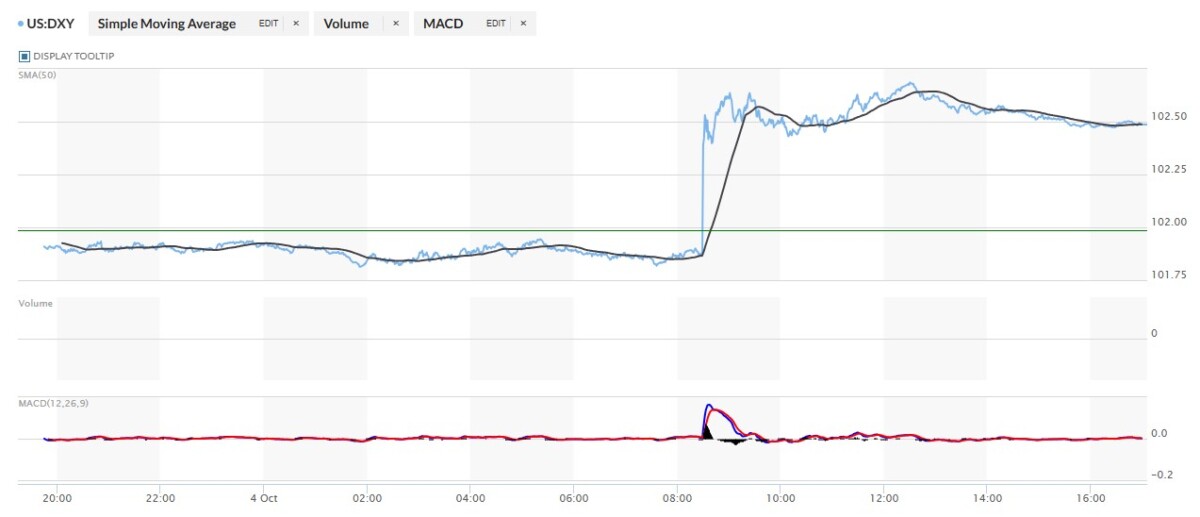

The dollar index closed very late on Thursday afternoon in New York at 101.99 -- and then opened lower by 8 basis points once trading commenced at 7:45 p.m. EDT on Thursday evening, which was 7:45 a.m. China Standard Time on their Friday morning. From that point it wandered very quietly and very broadly sideways to a bit lower until that non-farm payroll number showed up at 8:30 a.m. in New York. It went vertical at that point...lasting until 9 a.m. EDT -- and then had a quiet but bit choppy down/up move that ended at 12:30 p.m. From that juncture it was quietly down hill until around 4:05 p.m. EDT -- and didn't do a thing after that until trading ended at 5:00 p.m.

The dollar index finished the Friday trading session in New York at 102.52...up 53 basis points from its close on Thursday.

Here's the DXY chart for Friday...thanks to marketwatch.com as usual. Click to enlarge.

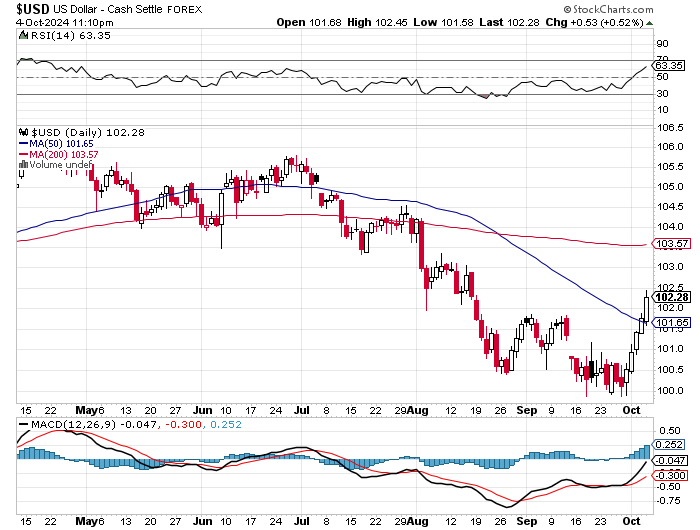

Here's the 6-month U.S. dollar index chart, courtesy of stockcharts.com as usual. The delta between its close...102.28...and the close on DXY chart above, was 24 basis points below that. Click to enlarge.

All the obvious correlation between the dollar index and precious metal prices came to us courtesy of 'da boyz' or the PPT...but they're one in the same.

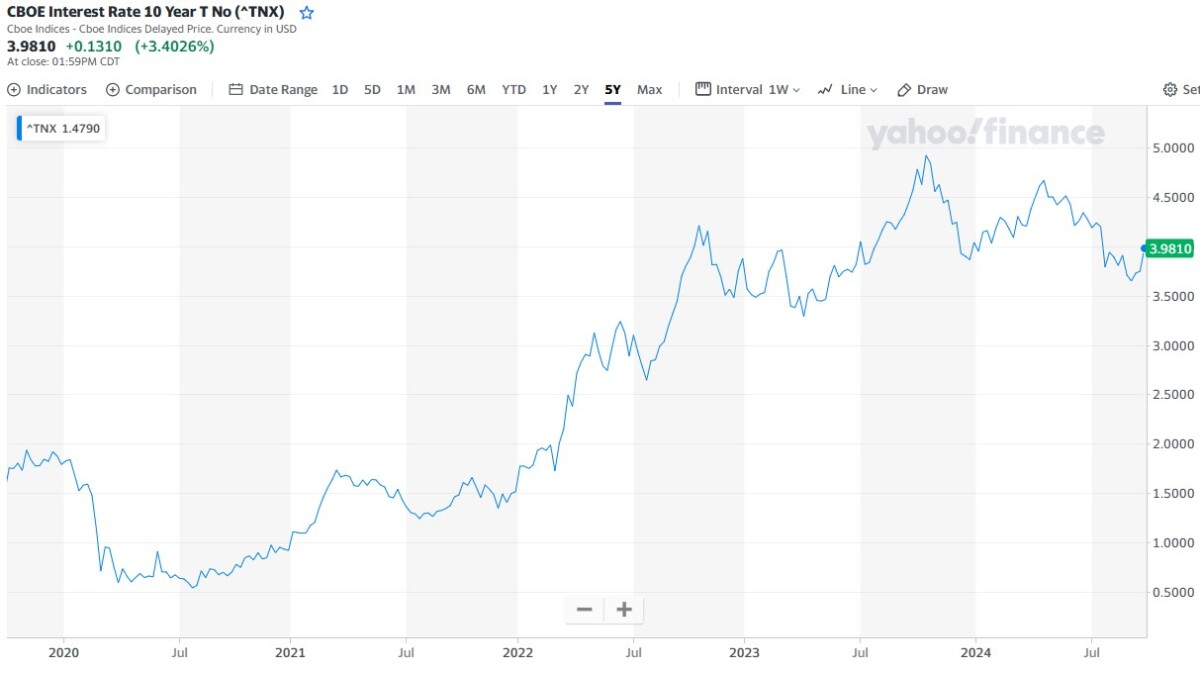

U.S. 10-year Treasury: 3.9810%...up 0.1310 (+3.4026%)...as of the 1:59 p.m. CDT close

Here's the 5-year 10-year U.S. Treasury chart from the yahoo.com Internet site -- which puts the yield curve into a somewhat longer-term perspective. Click to enlarge.

The ten-year was up 22 basis points on the week -- and 28 basis points off its Tuesday morning low tick...so it's more than obvious that Mr. Bond is far from happy.

![]()

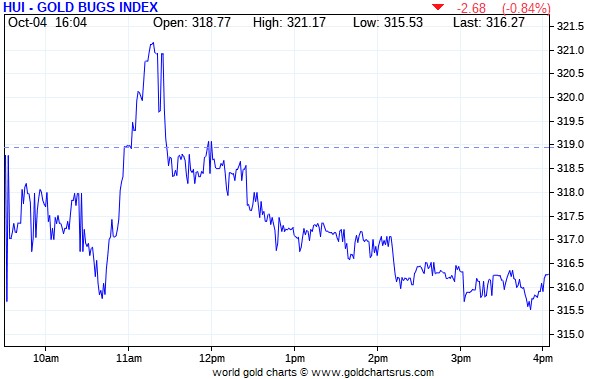

The gold shares opened down a bit once the markets opened at 9:30 a.m. in New York on Friday morning...traded sideways until 10:25 a.m. -- and then dipped a bit until 10:45. They then rallied sharply until 11:15 a.m. EDT...gold's high tick -- and were then sold lower until 3:45 p.m...then rallied a bit until the market closed at 4:00 p.m. The HUI closed lower by 0.84 percent.

The silver equities fared somewhat better, as Nick Laird's 1-year Silver Sentiment Index closed up 0.16 percent. Click to enlarge.

On this big news story yesterday...courtesy of Andre Beaulieu...the star was SilverCrest Metals...up 9.04 percent -- and the dog was Coeur Mining, down 9.46 percent on the same news.

In the interest of full disclosure, I own a decent amount of shares in both companies...as I did in that First Majestic Silver/Gatos Silver deal of a month ago. Once these deals close, I'll have to find two more silver companies to replace SilverCrest and Gatos in the above 1-year Silver Sentiment Index.

And except for that big news linked above, I didn't see any news yesterday on any of the other silver companies that comprise the above Silver Sentiment Index.

The silver price premium in Shanghai is missing in action until Tuesday because of their week-long National Day Holiday in China. It will be back to business as usual on that day.

The reddit.com/Wallstreetsilver website, now under 'new' but not improved management, is linked here. The link to two other silver forums are here -- and here.

![]()

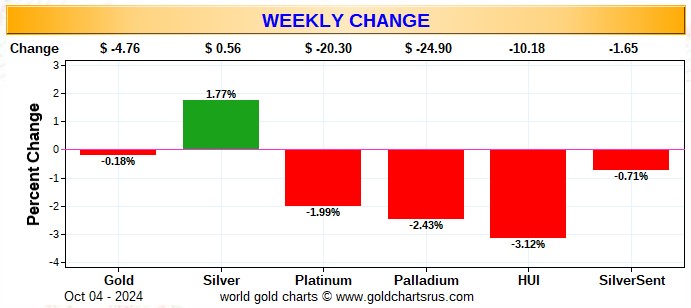

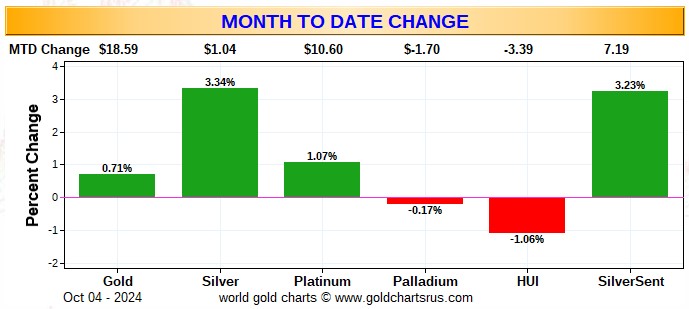

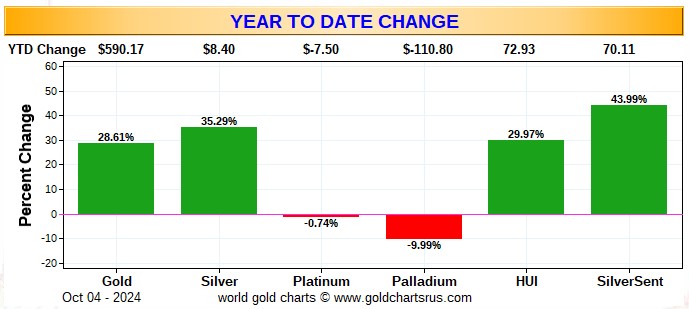

Here are the usual three charts that appear in this spot in every weekend missive. They show the changes in gold, silver, platinum and palladium in both percent and dollar and cents terms, as of their Friday closes in New York — along with the changes in the HUI and the new Silver Sentiment Index.

Here's the weekly chart. It's pretty ugly because of the big down day we had on Monday, so not much should be read into it, except to note that silver was the only thing that finished in the green this week. Click to enlarge.

Here's the month-to-date chart...and it's only four days old -- and I'm not inclined to read much into it, either...although everything silver-related remains the standout feature.

Here's the year-to-date chart -- and silver's outperformance remains. However, the most glaring thing about this chart is the ongoing underperformance of the precious metal equities vs. the gains posted by their underlying precious metals. I'm sure that will change over time...but as for how much time that will be, is anyone's guess. And as I pointed out in this space last week, the silver shares in Nick's 1-year Silver Sentiment Index are up almost 100 percent since their lows of March. I don't know about you, but it's made one heck of a difference to my portfolio. Click to enlarge.

Of course -- and as I mention in this spot every Saturday -- and will continue to do so...is that if the silver price was sitting close to a new all-time high of $50+ dollars an ounce, like gold is currently close to its new all-time high...it's a given that the silver equities would be outperforming their golden cousins by an absolute country mile -- and most likely by two or three.

![]()

The CME's Daily Delivery Report for Day 6 of September deliveries showed that 241 gold -- and 30 silver contracts were posted for delivery within the COMEX-approved depositories on Tuesday.

In gold, there was a fairly impressive list of short/issuers, with Stonex Financial being the largest, issuing 79 contracts out of its client account. They were followed by Citigroup and ADM, issuing 47 and 43 contracts...Citigroup out of their house account. The last two of the large short/issuers were Marex Spectron Markets and Japanese trading house Mizhuo, issuing 38 and 25 contracts out of their respective client accounts.

There was an equally impressive list of long/stoppers, lead by Stonex Financial, picking up 71 contracts for clients. The two biggest after them were Marex Capital Markets and ADM, stopping 44 and 39 contracts -- and for their respective client accounts as well. The list goes on and on...

In silver, the three short/issuers were Morgan Stanley, JPMorgan and Advantage, issuing 17, 8 and 5 contracts out of their respective client accounts. The only two long/stoppers that mattered out of the three in total were JPMorgan and Wells Fargo Securities, picking up 15 and 14 contracts... the latter for their house account.

In platinum, there were 47 contracts issued and stopped.

The link to yesterday's Issuers and Stoppers Report is here.

Month-to-date there have been 11,304 gold contracts issued/reissued and stopped -- and that number in silver is 1,272 contracts. In platinum it's 734 contracts -- and in palladium...3.

For a non-scheduled delivery month, those numbers for both gold and silver are very impressive...gold in particular.

The CME's Preliminary Report for the Friday trading session showed that gold open interest in October fell by 147 contracts, leaving 320 still around, minus the 241 contracts mentioned a bunch of paragraphs ago. Thursday's Daily Delivery Report showed that 239 gold contracts were actually posted for delivery on Monday, so that means that 239-147=92 more gold contracts just got added to October deliveries.

Silver o.i. in October dropped by 65 contracts, leaving 40 still open, minus the 30 contracts mentioned a bunch of paragraphs ago. Thursday's Daily Delivery Report showed that 87 silver contracts were actually posted for delivery on Monday, so that means that 87-65=22 more silver contracts were added to October deliveries.

Total gold open interest rose by 1,425 COMEX contracts -- and total silver o.i. also rose, it by 1,074 contracts. Both are subject to some revisions [almost always downwards] by the time the final figures are posted on the CME's website later on Monday morning CDT -- and I'll be reporting on these 'revisions' only if they're out of line. [I checked Thursday's numbers -- and the revisions were normal...down a bit in both]

![]()

After a decent deposit into GLD on Thursday, there was a withdrawal yesterday, as an authorized participant removed 36,958 troy ounces of gold -- and after a withdrawal from SLV on Thursday, an a.p. added 684,068 troy ounces of silver on Friday.

In other gold and silver ETFs and mutual funds on Planet Earth on Friday, net of any changes in COMEX, GLD and SLV inventories, there were a net 93,778 troy ounces of gold taken out...but a net 2,237,393 troy ounces of silver were added, with virtually all of it...2,087,031 troy ounces...going into iShares/SSLN.

There was no sales report from the U.S. Mint yesterday -- and nothing month-to-date, either.

![]()

There was no in/out activity in gold over at the COMEX-approved depositories on the U.S. east coast on Thursday -- and no paper activity, either.

But there was very decent silver action once again, as two truckloads/ 1,185,621 troy ounces were dropped off at Loomis International -- and 90,915 troy ounces departed Brink's, Inc. There was no paper activity in silver, either -- and the link to this is here.

There was a bit of activity over at the COMEX-approved gold kilobar depositories in Hong Kong on their Thursday...all of it at Brink's, Inc. as usual. Nothing was reported received -- but 701 kilobars were shipped out. The link to this, in troy ounces, is here.

![]()

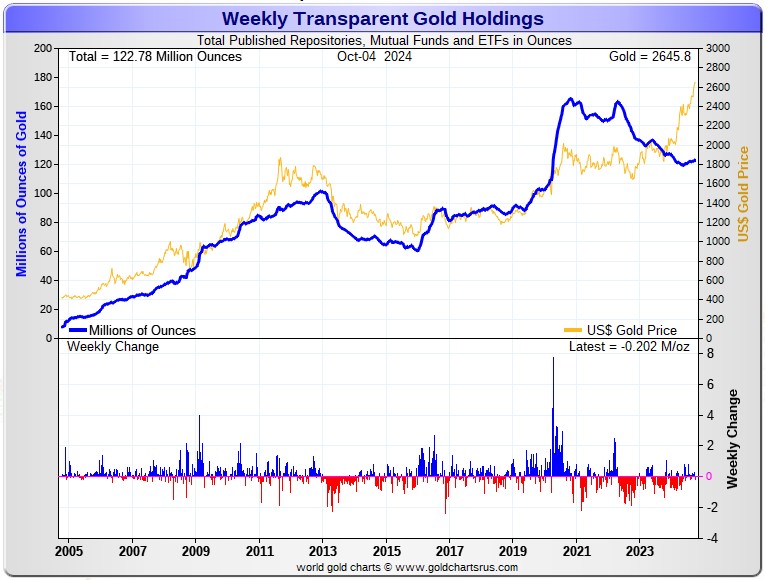

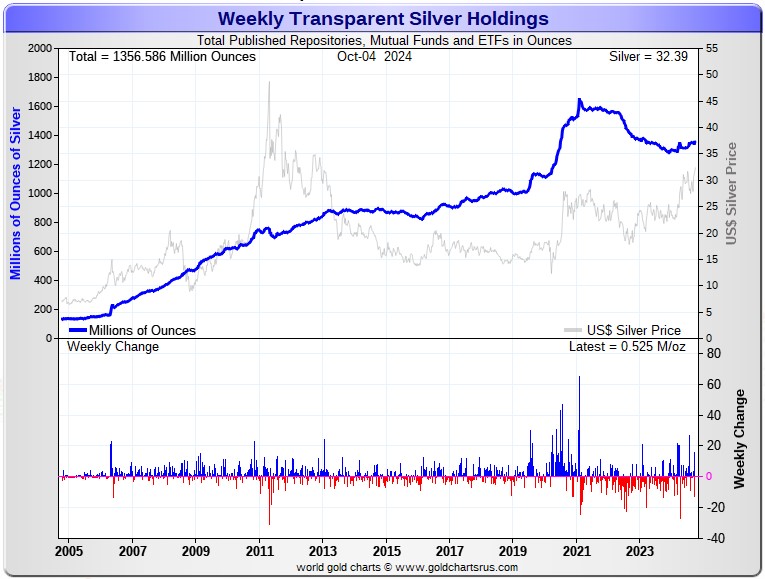

Here are the usual 20-year charts that show up in this space in every weekend column. They show the total amounts of physical gold and silver held in all know depositories, ETFs and mutual funds as of the close of business on Friday.

During the week just past, there were a net 202,000 troy ounces of gold removed...but a net 525,000 troy ounces of silver were added. Click to enlarge.

According to Nick Laird's data on his website, there were a net 515,000 troy ounces of gold added to all the world's known depositories, mutual funds and ETFs during the last four weeks...which isn't a whole heck of a lot considering the price action. And a net 6.847 million troy ounces of silver were added during that same time period -- and mostly because of those big additions into iShares/SSLN and Sprott.

Retail bullion sales have shown signs of life. But one still has to wonder about those 1,652,000 silver eagles that the mint reported selling in September. Who bought those? Premiums vary, depending on the dealer. They're very high at Kitco...but somewhat to much lower in most other places -- and most are the lowest they've been in ages.

At some point there will be huge quantities of silver required by all the silver ETFs and mutual funds once institutional buying finally kicks in. There's been the odd sign of it this past month, as there's been a net 22 million oz. down/ up swing in SLV over that time period, plus we've seen very decent deposits into the rest of the world's silver ETFs the odd time during this past week as well. But the really big buying lies ahead of us when the silver price is finally allowed to rise substantially, which I'm sure that's something that keeps the powers-that-be in the silver world awake at night.

And as Ted stated a while ago now, it would appear that JPMorgan has parted with most of the at least one billion troy ounces that they'd accumulated since the drive-by shooting that commenced at the Globex open at 6:00 p.m. EDT on Sunday, April 30, 2011. They had to part with a bunch more again this week...with that 2.087 million ounce into iShares/SSLN yesterday being top of mind.

If they continue in this vein, they are going to have to cough up even more ounces to feed this year's ongoing structural deficit...another 215 million of them according to that latest report from The Silver Institute...which I'm sure didn't include the approximately 120 million ounces that India purchased during Q1/2024...plus most of the 13.9 million ounces that China imported in June -- and the 5.6 million ounces that India bought in July...plus the 45 million that India purchased in August.

The physical demand in silver at the wholesale level continues unabated -- and was over the top again this past week. The amount of silver being physically moved, withdrawn, or changing ownership is still ongoing. This frantic in/out activity, as Ted had been pointing out for years, is a sure sign that 1,000 oz. good delivery bars are getting ever harder to come by.

New silver has to be brought in from other sources [JPMorgan] to meet the ongoing demand for physical metal. This will continue until available supplies are depleted...which will be the moment that JPMorgan & Friends stop providing silver to feed this deepening structural deficit, now in its fourth year.

The vast majority of precious metals being held in these depositories are by those who won't be selling until the silver price is many multiples of what it is today.

Sprott's PSLV is the third largest depository of silver on Planet Earth with 178.4 million troy ounces...unchanged from last week -- but some distance behind the COMEX, where there are 306.6 million troy ounces being held...up 2.1 million ounces on the week...minus the 103 million troy ounces mentioned in the next paragraph.

It's now been proven beyond a shadow of a doubt that 103 million troy ounces of that amount in the COMEX is actually held in trust for SLV by JPMorgan according to a letter Ted received from the CFTC earlier this year. That brings JPMorgan's actual silver warehouse stocks down to around the 32 million troy ounce mark...quite a bit different than the 135.00 million they indicate they have...exactly unchanged for the fourth week in a row.

But PSLV is still some distance behind SLV, as they are the largest silver depository, with 466.5 million troy ounces as of Friday's close...up 8.7 million troy ounces that were added this past week.

The latest short report showed that the short position in SLV rose by 19.07 percent...from 15.25 million shares sold short in the prior short report...up to 18.16 million shares in last week's report.

BlackRock issued a warning several years ago to all those short SLV, that there might come a time when there wouldn't be enough metal for them to cover. That would only be true if JPMorgan decides not to supply it to whatever entity requires it...which is most certainly a U.S. bullion bank, or perhaps more than one.

The next short report will be posted on The Wall Street Journal's website very early on Wednesday evening on October 9.

Then there's that other little matter of the 1-billion ounce short position in silver held by Bank of America in the OTC market...with JPMorgan & Friends on the long side. Ted said it hadn't gone away -- and he'd also come to the conclusion that they're short around 25 million ounces of gold with these same parties as well. I have more on this in the Days to Cover data further down.

The latest report for the end of Q2/2024 from the OCC came out yesterday -- and after carefully scrutiny, I noted that the dollar value of their derivative positions were up just under 20 percent...but suspect that it was entirely due to the price increases in both since the prior report came out.

![]()

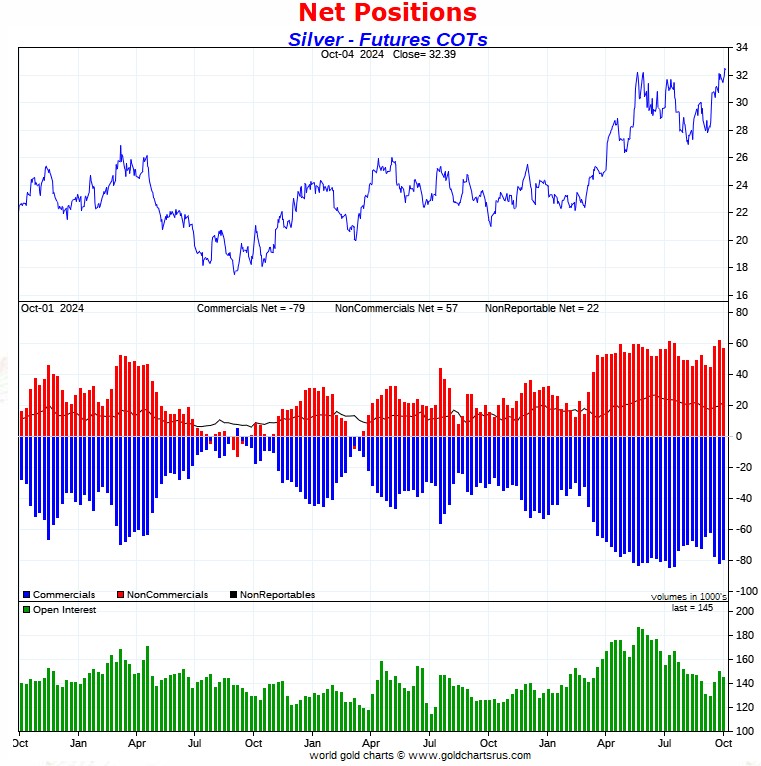

The Commitment of Traders Report, for positions held at the close of COMEX trading on Tuesday showed decreases in the commercial net short position in both silver and gold -- and in the latter, a lot more than expected -- and in former, a lot less than expected.

In silver, the Commercial net short position dropped by only 2,612 COMEX contracts -- and I just mentioned, I was expecting a number far larger than that...but it is what it is.

They arrived at that number by selling 321 long contracts -- and also reduced their short position by 2,933 contracts. It's the difference between those two numbers that represents their change for the reporting week.

Under the hood in the Disaggregated COT Report it was all Managed Money traders -- and much more, as they reduced their net long position by a hefty 5,837 COMEX contracts...which they accomplished by reducing their long position by 3,586 contracts -- and also added 2,251 short contracts. It's the sum of those two numbers that represents their change for the reporting week.

The Other Reportables and Nonreportable/small traders were both buyers, as the former increased their net long position by 563 COMEX contracts -- and the latter by 2,662 contracts.

Doing the math: 5,837 minus 563 minus 2,662 equals 2,612 COMEX contracts...the change in the Commercial net short position.

The Commercial net short position in silver now stands at 79,200 COMEX contracts/396.100 million troy ounces...down those 2,612 contracts from the 81,832 COMEX contracts/409.160 million troy ounces they were short in the September 27 COT Report.

The Big 4 shorts decreased their net short position by a tiny 245 contracts... down to 55,731 contracts during the reporting week...from the 55,976 contracts they were short in last Friday's COT Report...which is still monstrously bearish.

The Big '5 through 8' shorts also decreased their net short position, them by 1,077 contracts ...from the 22,211 contracts in last Friday's COT Report, down to 21,134 contracts in yesterday's COT Report. That's about 9,000 contracts more than they 'normally' hold short -- and obviously very bearish as well.

The Big 8 commercial shorts in total decreased their overall net short position from 78,187 contracts, down to 76,865 COMEX contracts week-over-week...a decrease of 1,322 COMEX contracts.

That 76,85 contract short position held by the Big 8 is wildly bearish when you consider the fact that they were short only 53,041 contracts in the October 27, 2023 COT Report.

Making up the difference between the change in the commercial net short position...2,612 contracts -- and what the Big 8 traders did...1,322 contracts... Ted's raptors, the small commercial traders other than the Big 8, were also buyers during this past reporting week... decreasing their short position by 2,612-1,322=1,290 COMEX contracts -- and are now short silver by only 2,355 COMEX contracts.

Here's Nick's 9-year COT chart for silver. Click to enlarge.

The drop in the short position of the Big 8 traders wasn't as much as I hoped for. The last time it was this large was back on 23 July. So there was improvement, but it wasn't a lot -- and from a COMEX futures market perspective, has to be seen as still wildly bearish.

The Big 8 collusive commercial shorts in silver, minus their uneconomic and market-neutral spread trades, remain short 53.1% of the entire open interest in silver in the COMEX futures market...up a tad from last week. The reason that percentage concentration rose was because total open interest in silver decreased by 5,314 COMEX contracts during the week, which obviously affects the percentage calculation.

The commercial net short position in silver held by these collusive commercial traders of whatever stripe is 54.7 percent of total open interest once you include the short positions held by Ted's raptors...the small commercial traders other than the Big 8.

If all those above-mentioned spread trades in all categories were eliminated, it would most likely show that the commercial net short position in silver if something just under 60% of total open interest.

But as Ted had mentioned on many occasions over the years, at some point what the numbers show in the above COT Report won't matter, as the drumbeat of that structural supply/demand deficit continues unabated.

![]()

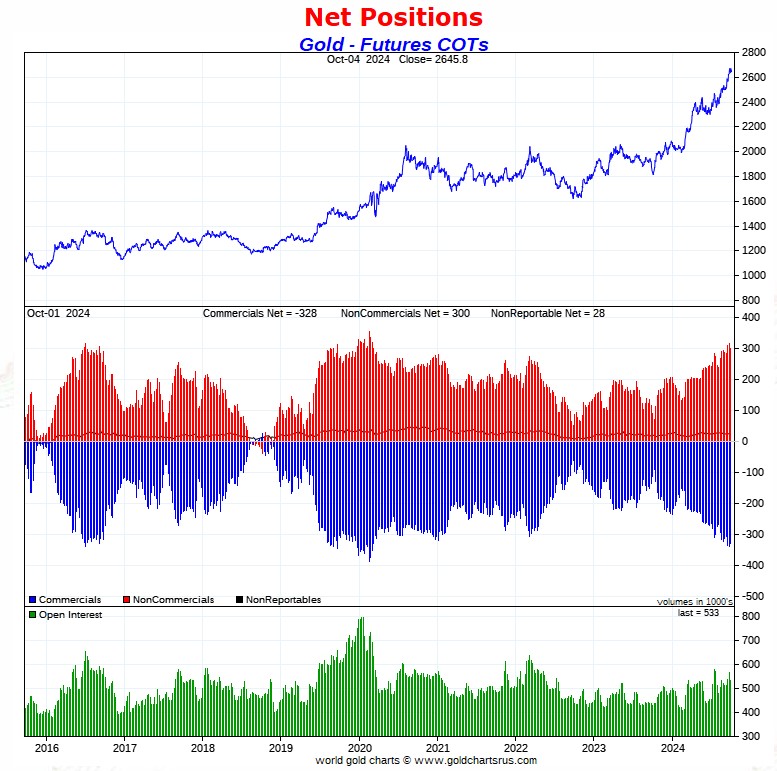

In gold, the commercial net short position fell by 12,182 COMEX contracts, or 1.218 million troy ounces of the stuff.

They arrived at that number by reducing their long position by 9,614 contracts, but also reduced their short position by 21,796 COMEX contracts -- and it's the difference between those two numbers that represents their change for the reporting week.

Under the hood in the Disaggregated COT Report, the Managed Money traders were sellers, just like they were in silver, but not by anywhere near as much ...reducing their net long position by 4,567 contracts...which they accomplished by selling 8,568 long contracts -- and also reduced their short position by 4,011 COMEX contracts. It's the difference between those two numbers that represents their change for the reporting week.

The Other Reportables were also sellers -- and hugely so, as they decreased their net long position by 10,892 contracts. This meant that that traders in the Nonreportable/small trader category had to be buyers -- and they were, as they increased their net long position by 3,277 contracts...mostly through the buy-back of 3,530 short contracts.

Doing the math: 4,567 plus 10,892 minus 3,277 equals 12,182 COMEX contracts, the change in the commercial net short position.

The commercial net short position in gold now sits at 327,524 COMEX contracts/32.752 million troy ounces of the stuff...down those 12,182 contracts from the 339,706 COMEX contracts/33.971 million troy ounces they were short in the September 27 COT Report.

The Big 4 shorts in gold reduced their short position for the second week in a row, them by 8,876 contracts...from 206,658 contracts they were short last week, down to the 197,782 contracts in yesterday's report -- and still ultra bearish.

The Big '5 through 8' shorts also decreased their net short position, them by 9,433 contracts...from the 83,002 contracts they held short in last Friday's COT Report, down to 73,569 contracts held short in the current COT Report ...which is the lowest its been in a couple of months.

The Big 8 short position decreased from 289,660 COMEX contracts/28.966 million troy ounces in last week's COT Report...down to 271,351 contracts/ 27.135 million troy ounces in yesterday's...a drop of 18,309 contracts.

But since the change in the commercial net short position showed an decrease of only 12,182 COMEX contracts during the reporting week -- and the Big 8 short position fell by 18,309 contracts, that meant that Ted's raptors...the small commercial traders other than the Big 8...were big sellers for the third week in a row...to the tune of 18,309-12,182=6,127 COMEX contracts! They are now short gold by an unworldly 56,173 COMEX contracts...another new record high short position for them -- and by even more light years that it was last week. What are these guys smoking...or what do they know that we don't...yet?

Here's Nick Laird's 9-year COT Report chart for gold...updated with the above data. Click to enlarge.

The Big 8 short position is now down to what it was early in August, but remains ultra bearish.

As I pointed out in this space last week, this is uncharted territory from a raptors/small commercial traders perspective in gold -- and have emerged as a force to be reckoned with on the short side...which they hardly ever were before, because I don't remember them ever being short more than around 10,000 contracts.

The Big 8 alone are short 50.9 percent of total open interest in the COMEX futures market. But once you add in the short position of Ted's raptors, the small commercial traders other than the Big 8, the collusive commercial net short position in totality represents a whopping 61.4 percent of total open interest in the COMEX futures market. It certainly more than that if the non-economic and market-neutral spread trades in the Producer/Merchant category could be subtracted out.

There's still no sign whatsoever that the collusive commercial shorts are loosening their iron grip on precious metal prices.

![]()

In the other metals, the Managed Money traders in palladium decreased their net short position by a further and hefty 1,770 COMEX contracts during the reporting week...but remain net short palladium by 7,771 contracts... 42.1 percent of total open interest. The only other group of traders that are net short palladium are the Other Reportables by a tiny bit.

In platinum, the Managed Money traders increased their net long position by a further 3,630 COMEX contracts during the reporting week -- and are net long platinum by 18,690 COMEX contracts. The commercial traders in the Producer/Merchant category are meganet short 29,230 COMEX contracts -- and the Swap Dealers in the commercial category are now net short for the second week in a row...but only by 4,488 COMEX contracts. The traders in both the Other Reportables and Nonreportable/small traders categories remain net long platinum by very decent amounts as well...the Other Reportables in particular.

It's mostly the world's banks in the Producer/Merchant category that are 'The Big Shorts' in platinum in the COMEX futures market, as per yesterday's Bank Participation Report...which I'll get into in a bit.

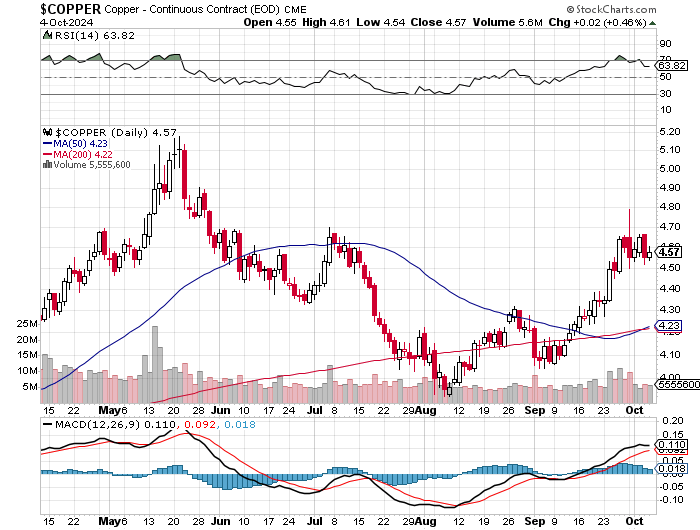

In copper, the Managed Money traders increased their net long position by a further 5,157 COMEX contracts -- and are net long copper by 38,005 COMEX contracts...about 950 million pounds of the stuff as of yesterday's COT Report ...up from the 821 million pounds they were net long copper in last Friday's report. It was their buying of these long contracts the drove copper prices higher during this past reporting week.

Copper, like platinum, continues to be a wildly bifurcated market in the commercial category. The Producer/Merchant category is net short 66,257 copper contracts/1.656 billion pounds -- while the Swap Dealers are net long 15,417 COMEX contracts/385 million pounds of the stuff.

Whether this means anything or not, will only be known in the fullness of time. Ted said it didn't mean anything as far as he was concerned, as they're all commercial traders in the commercial category. However, this bifurcation has been in place for as many years as I can remember -- and that's a lot.

In this vital industrial commodity, the world's banks...both U.S. and foreign... are net long 8.8 percent of the total open interest in copper in the COMEX futures market as shown in the October Bank Participation Report that came out yesterday...down from the 11.1 percent they were net long in September's.

At the moment it's the commodity trading houses such as Glencore and Trafigura et al., along with some hedge funds, that are net short copper in the Producer/Merchant category, as the Swap Dealers are net long, as pointed out above.

The next Bank Participation Report is due out on Friday, November 8.

![]()

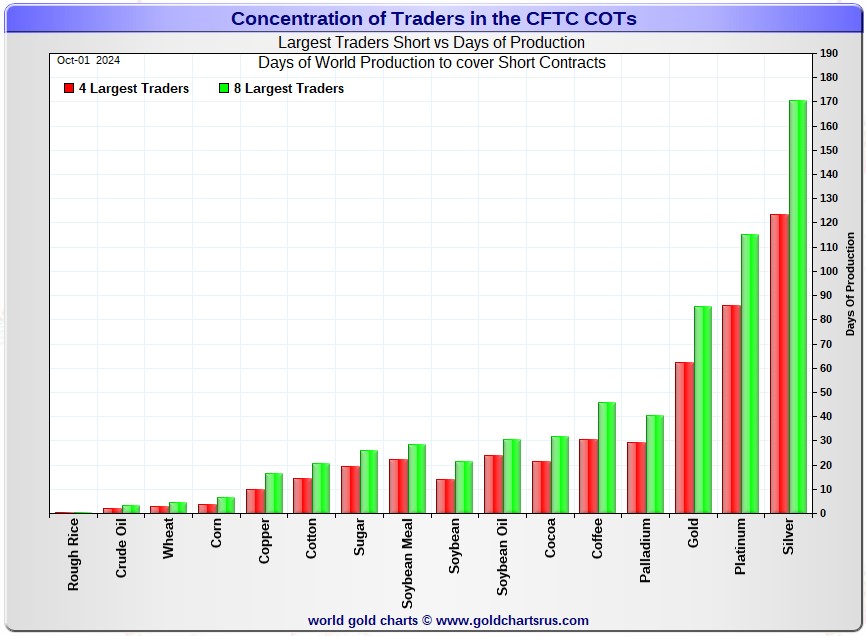

Here’s Nick Laird’s “Days to Cover” chart, updated with the COT data for positions held at the close of COMEX trading on Tuesday, October 1. It shows the days of world production that it would take to cover the short positions of the Big 4 — and Big '5 through 8' traders in every physically traded commodity on the COMEX. Click to enlarge.

In this week's data, the Big 4 traders are short about 124 days of world silver production... about unchanged from the last COT report. The ‘5 through 8’ large traders are short an additional 47 days of world silver production... down about 3 days from last Friday's COT Report, for a total of about 171 days that the Big 8 are short -- and obviously down 3 days from last week.

Those 171 days that the Big 8 traders are short, represents about 5.7 months of world silver production, or 384.325 million troy ounces/76,865 COMEX contracts of paper silver held short by these eight commercial traders. Several of the largest of these are now non-banking entities, as per Ted's discovery a year or so ago. Yesterday's October's Bank Participation Report continues to confirm that this is still the case -- and not just in silver, either.

The small commercial traders other than the Big 8 shorts, Ted's raptors, are net short silver by an additional 2,355 COMEX contracts...down from the 3,645 contracts they were short in last week's report.

So when you add that in to what the Big 8 are short, the collusive commercial traders of whatever stripe are net short 79,200 COMEX contracts/396.10 million troy ounces of silver...just under 176 days of world silver production...a bit under six months.

In gold, the Big 4 are short about 62 days of world gold production...down 3 days from last Friday's COT Report. The '5 through 8' are short an additional 23 days of world production, also down about 3 days from last week...for a total of 85 days of world gold production held short by the Big 8 -- and obviously down 6 days from the prior COT Report.

The Big 8 commercial traders are short 53.1 percent of the entire open interest in silver in the COMEX futures market as of yesterday's COT Report, up a bit from the 52.1 percent that they were short in last Friday's COT Report -- and a tad higher than that mark once their market-neutral spread trades are subtracted out. But once you include the short positions of Ted's raptors in that number, the collusive commercial traders of whatever stripe are short 54.7 percent of the entire open interest in silver.

The non-economic and market-neutral spread trades are not reported in the Producer/ Merchant category by the CFTC -- and the reason as Ted had said was very simple. This is where the world's banks hide out. If one knew how many spread trades they had on, then you could calculate, to the contract, exactly how short they were in every COMEX commodity that they trade in -- and those numbers are closely guarded secrets by both the CFTC and the CME Group.

In gold, it's 50.9 percent of the total COMEX open interest that the Big 8 are short, down a bit from the 51.3 percent they were short in last Friday's COT Report -- and a whopping 61.4 percent of total open interest once you add in what Ted's raptors [the small commercial traders other than the Big 8] are short on top of that...a further 56,173 COMEX contracts. This remains the very definition of egregious.

Ted was of the opinion that Bank of America is short about one billion ounces of silver in the OTC market, courtesy of JPMorgan & Friends. He was also of the opinion that they're short 25 million ounces of gold as well. And with the latest report [for Q2/2024] from the OCC now in hand, I see that their positions are up 20 percent from what they were holding at the end of Q1/2024...with most of that increase most likely being price related.

I've noted stories over the last few months about Warren Buffet starting to unload his BofA shares, the latest being this Zero Hedge offering from a week ago Wednesday headlined "Buffett Dumps More BofA Shares As Stake Nears Key 10% Non-Reporting Level" -- and linked here. Once he gets below that reporting requirement, he'll most likely dump the rest PDQ. If you're a Gregory Mannarino fan, he has always been of the firm belief that BofA will fail at some point.

The short position in SLV now sits at 18.16 million shares as of last short report that came out over a week ago...up a hefty 19.07 percent from the 15.25 million shares sold short in the prior report. The next short report is due out on Wednesday, October 9.

The situation regarding the Big 4/8 commercial short position in gold and silver remains obscene and grotesquely bearish -- and that's despite the 'improvements' in yesterday's COT Report.

As Ted had been pointing out ad nauseam, the resolution of the Big 4/8 short positions will be the sole determinant of precious metal prices going forward -- although the short positions held by Ted's raptors in gold, are now a factor as well.

![]()

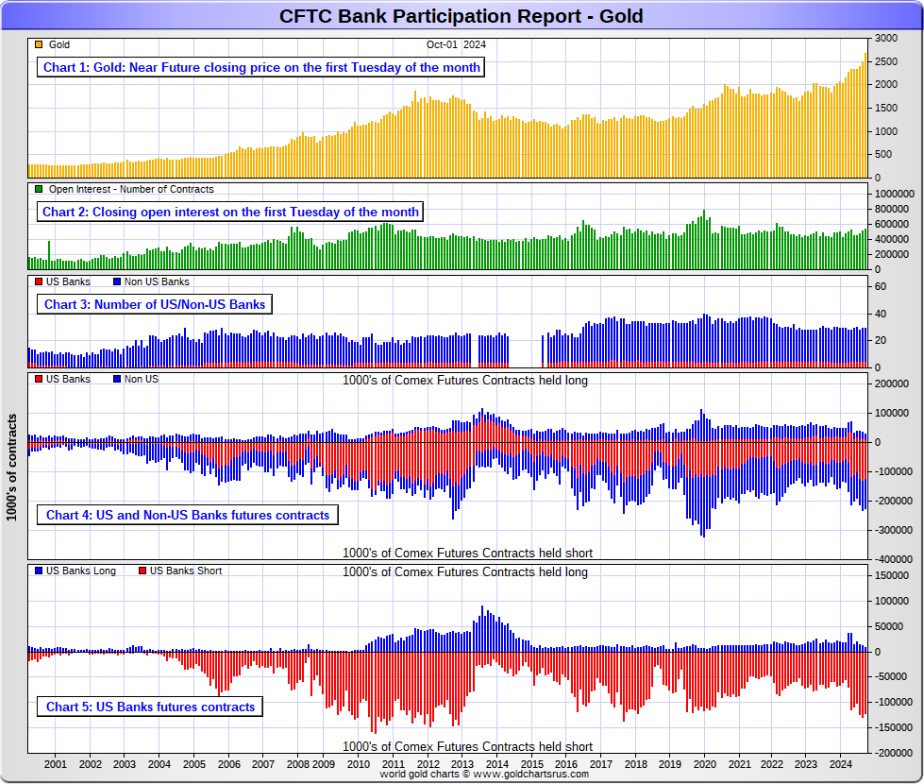

The October Bank Participation Report [BPR] data is extracted directly from yesterday's Commitment of Traders Report data. It shows the number of futures contracts, both long and short, that are held by all the U.S. and non-U.S. banks as of this past Tuesday’s cut-off in all COMEX-traded products.

For this one day a month we get to see what the world’s banks have been up to in the precious metals. They’re usually up to quite a bit -- and they certainly were again this past month.

[The September Bank Participation Report covers the four-week time period from September 3 to October 1 inclusive]

In gold, 5 U.S. banks are net short 113,137 COMEX contracts, down 2,950 contracts from the 116,087 contracts that these same 5 U.S. banks were short in September's BPR. This is the second largest short position that the U.S. banks have held since September 2017. It's still obscene.

Also in gold, 24 non-U.S. banks are net short 83,886 COMEX contracts, up 1,292 contracts from the 82,594 contracts that these same 24 non-U.S. banks were short in September's BPR.

At the low back in the August 2018 BPR...these non-U.S. banks held a net short position in gold of only 1,960 contacts -- so they've been back on the short side in an enormous way ever since.

Although some of the largest U.S. and foreign bullion banks are in the Big 8 short category in gold, some of the hedge fund/commodity trading houses are short even more grotesque amounts of gold than the banks in that category. It's also a strong possibility that the BIS could be short gold in the COMEX futures market as well.

I was very surprised that the these 29 banks actually decreased their short positions month-over-month, because I was expecting a huge increase because the gold price had risen so much during the reporting month. But now that I think about it, the reason is very simple -- and that's because Ted's raptors, the small and collusive commercial traders of whatever stripe other than the Big 8, had increased their short position in gold by 38,700 COMEX contracts during that same time period, which took huge pressure off the banks. This was certainly a turn of events I wasn't expecting -- and something I'll be keeping an eye on as time moves along.

As of October's Bank Participation Report, 29 banks [both U.S. and foreign] are net short 37.0 percent of the entire open interest in gold in the COMEX futures market...down from the 38.9 percent that 28 banks were net short in the September BPR.

Here’s Nick’s BPR chart for gold going back to 2000. Charts #4 and #5 are the key ones here. Note the blow-out in the short positions of the non-U.S. banks [the blue bars in chart #4] when Scotiabank’s COMEX short position was outed by the CFTC in October of 2012. Click to enlarge.

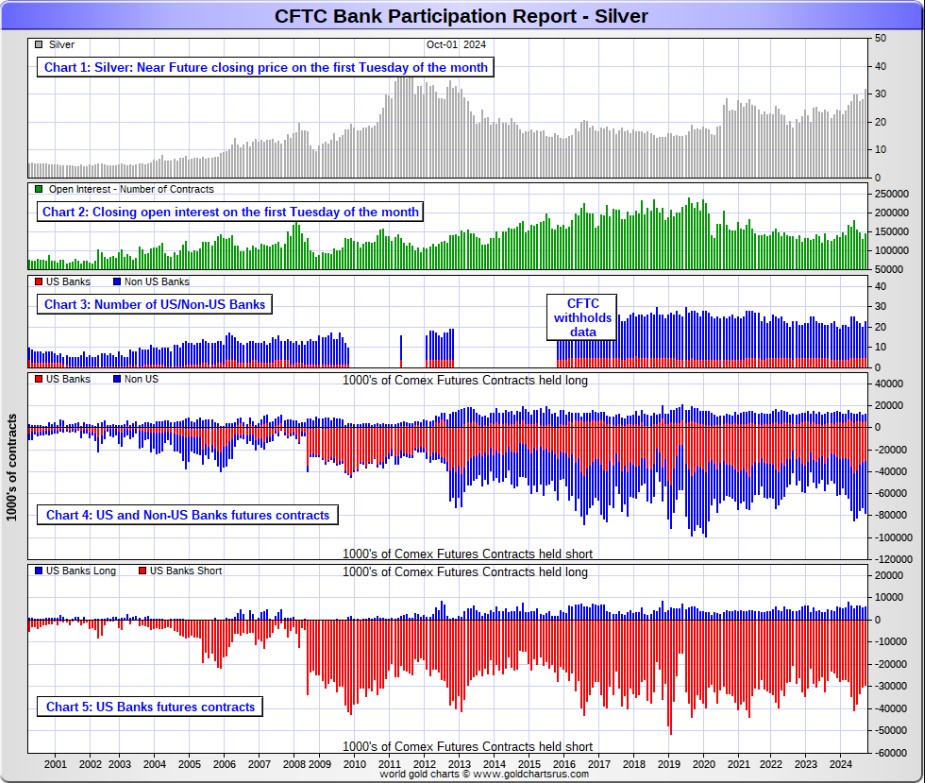

In silver, 5 U.S. banks are net short 23,456 COMEX contracts, down a further 1,087 contracts from the 24,543 contracts that these same 5 U.S. banks were short in the September BPR. This is the fourth month in a row that these U.S. banks have reduced their short position in silver.

The biggest short holders in silver of the five U.S. banks in total, would be Citigroup, Wells Fargo, Bank of America -- and maybe JPMorgan from time to time.

Also in silver, 18 non-U.S. banks are net short 42,334 COMEX contracts, up a further 5,158 contracts from the 37,176 contracts that 15 non-U.S. banks were short in the September BPR...their largest short position since March 2020...when they were short 42,666 COMEX contracts.

I would suspect that HSBC, Barclays and Standard Chartered hold by far the lion's share of the short position of these non-U.S. banks...as do some of Canada's banks as well. And, like in gold, the BIS could also be actively shorting silver. The remaining short positions divided up between the other 13 or so non-U.S. banks are immaterial — and have always been so. The same can be said of most of the 24 non-U.S. banks in gold.

As of October's Bank Participation Report, 23 banks [both U.S. and foreign] were net short 45.4 percent of the entire open interest in silver in the COMEX futures market...which is outrageous — but down from the 47.1 percent that 20 banks were net short in the September BPR.

Here’s the BPR chart for silver. Note in Chart #4 the blow-out in the non-U.S. bank short position [blue bars] in October of 2012 when Scotiabank was brought in from the cold. Also note August 2008 when JPMorgan took over the silver short position of Bear Stearns—the red bars. It’s very noticeable in Chart #4—and really stands out like the proverbial sore thumb it is in chart #5. Click to enlarge.

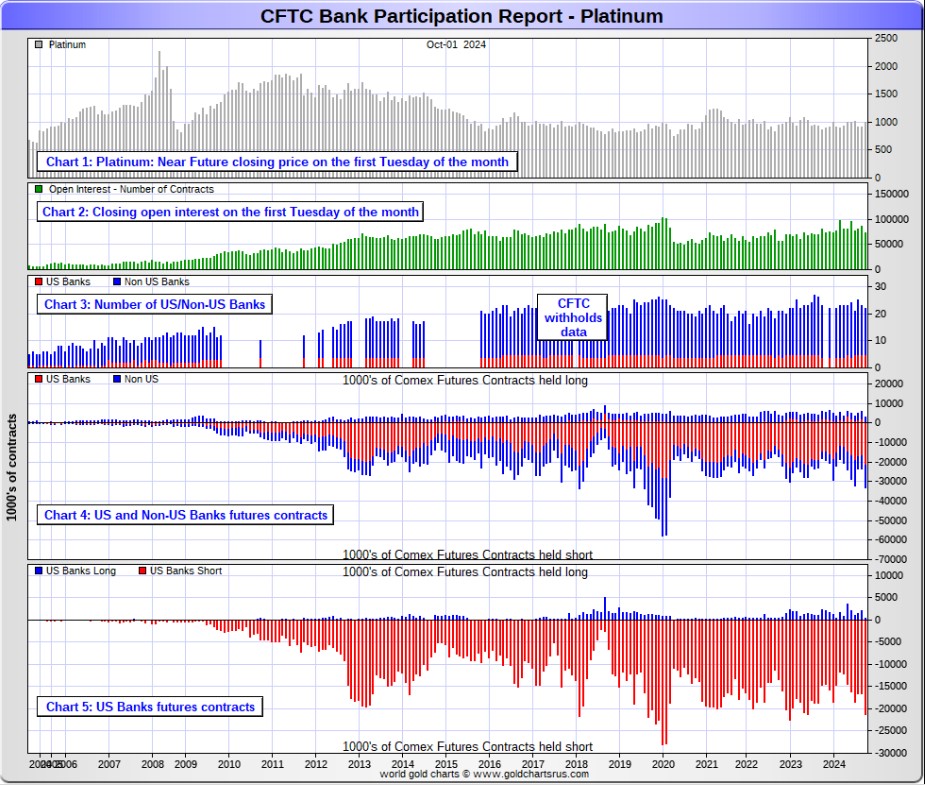

In platinum, 5 U.S. banks are net short 20,842 COMEX contracts in the October BPR, up a hefty 6,447 contracts from the 14,395 contracts that these same 5 U.S. banks were short in the September BPR -- and their third largest short position on record.

This is the largest short position that the U.S. banks have held in platinum since February 2020...when they were short 27,115 COMEX contracts.

At the 'low' back in September of 2018, these U.S. banks were actually net long the platinum market by 2,573 contracts. So they have a very long way to go just to get back to market neutral in platinum...if they ever intend to, that is. They look permanently stuck on the short side to me, a fact that I point out regularly.

Also in platinum, 17 non-U.S. banks increased their net short position by an equally hefty 6,008 contracts...up to 9,101 contracts, from the 3,093 contracts that 18 non-U.S. banks were net short in the September BPR. This isn't even close to a record high for them, as they were short 26,150 COMEX contracts in platinum back in January of 2020.

Back in the December 2023 BPR, these non-U.S. banks were net short a microscopic 35 platinum contracts...so they've got some work to do if they ever want to get back to that number.

Platinum remains the big commercial shorts No. 2 problem child after silver. How it will ultimately be resolved is unknown, but most likely in a paper short squeeze, as the known stocks of platinum are minuscule compared to the size of the short positions held -- and that's just the short positions of the world's banks I'm talking about here.

Of course there's now a structural deficit in it [and palladium] as well.

And as of October's Bank Participation Report, 22 banks [both U.S. and foreign] were net short an eye-watering 41.2 percent of platinum's total open interest in the COMEX futures market, up huge from the 20.1 percent that 23 banks were net short in September's BPR.

Here's the Bank Participation Report chart for platinum. Click to enlarge.

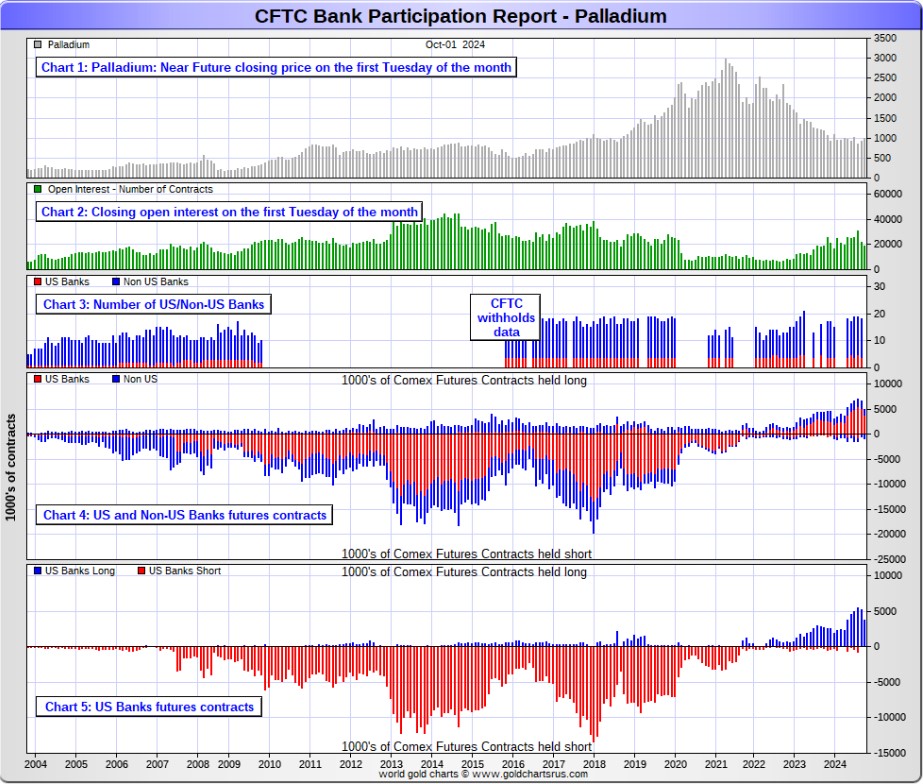

In palladium, 3 U.S. banks are gross long 3,796 COMEX contracts in the October BPR, down 1,404 contracts from the 5,200 contracts that 4 U.S. banks were gross long in the September BPR. For the second month in a row the U.S. banks don't hold a single short contract in palladium...that's why it's called a 'gross long' position.

Also in palladium, 13 non-U.S. banks are net long 163 COMEX contracts, down from the 769 contracts that 14 non-U.S. banks were net long in the September BPR.

It's obvious that the banks sold contract for two reasons...firstly, for huge profits, but most importantly to control the price rise in this precious metal -- and it doesn't take too many contracts bought or sold to move this market.

And as I've been commenting on for almost forever, the COMEX futures market in palladium is a market in name only, because it's so illiquid and thinly-traded. Its total open interest in yesterday's COT Report was only 18,462 contracts...compared to 72,633 contracts of total open interest in platinum...144,757 contracts in silver -- and 533,107 COMEX contracts in gold.

But I should point out that open interest in palladium has been on a slow but uneven increase over the last few years, because I remember when it was less than 9,000 contracts. So it's nowhere near as illiquid as it used to be -- and it's also been helped along by the fact that the bid/ask is now only 40 bucks.

As I say in this spot every month, the only reason that there's a futures market at all in palladium, is so that the Big 8 commercial traders can control its price. That's all there is, there ain't no more.

As of this Bank Participation Report, 16 banks [both U.S. and foreign] are net long 21.4 percent of total open interest in palladium in the COMEX futures market...down from the 27.0 percent of total open interest that 18 banks were net long in the September BPR.

For the last 3+ years, the world's banks have not been involved in the palladium market in a material way. And with them still net long, it's all hedge funds and commodity trading houses that are left on the short side. The Big 8 commercial shorts, none of which are banks, are short 40.8 percent of total open interest in palladium as of yesterday's COT Report.

Here’s the palladium BPR chart. Although the world's banks are net long at the moment, it remains to be seen if they return as big short sellers again at some point like they've done in the past. Click to enlarge.

Excluding palladium for obvious reasons, and almost all of the non-U.S. banks in gold, silver and platinum...only a small handful of the world's banks, most likely no more than 5 or so in total -- and mostly U.S.-based...along with the BIS...continue to hold meaningful short positions in the other three precious metals.

As I pointed out above, some of the world's commodity trading houses and hedge funds are also mega net short the four precious metals...far more short than the U.S. banks in some cases. They have the ability to affect prices if they choose to exercise it...which I'm sure they're doing at times. But it's still the collusive bullion banks in the commercial category that are at Ground Zero of the price management scheme.

And as has been the case for years now, the short positions held by the Big 4/8 traders is the only thing that matters...especially the short positions of the Big 4...or maybe only the Big 1 or 2 in both silver and gold. How this is ultimately resolved [as Ted kept pointing out] will be the sole determinant of precious metal prices going forward.

The Big 8 commercial traders continue to have an iron grip on their respective prices -- and it will remain that way until they either relinquish control voluntarily, are told to step aside...or get overrun.

Considering the current state of affairs of the world as it stands today -- and the structural deficit in silver -- and now in platinum and palladium as well, the chance that these big bullion banks and commodity trading houses could get overrun at some point, is no longer zero -- and certainly within the realm of possibility if things go totally non-linear, as they just might.

But...as Ted kept reminding us from time to time...if they do finally get overrun, it will be for the very first time...which obviously wasn't allowed to happen this past week, either.

The next Bank Participation Report is due out on Friday, November 8.

I have a lot of stories, articles and videos for you today.

![]()

CRITICAL READS

U.S. job creation roared higher in September as payrolls surged by 254,000

The U.S. economy added far more jobs than expected in September, pointing to a vital employment picture as the unemployment rate edged lower, the Labor Department reported Friday.

Nonfarm payrolls surged by 254,000 for the month, up from a revised 159,000 in August and better than the 150,000 Dow Jones consensus forecast. The unemployment rate fell to 4.1%, down 0.1 percentage point.

With upward revisions from previous months, the report eases concerns about the state of the labor market and likely locks in the Federal Reserve to a more gradual pace of interest rate reductions. August’s total was revised up by 17,000, while July saw a much larger addition of 55,000, taking the monthly growth up to 144,000.

Strength in job creation spilled over to wages, as average hourly earnings increased 0.4% on the month and were up 4% from a year ago. Both figures were ahead of respective estimates for gains of 0.3% and 3.8%. The average workweek nudged lower to 34.2 hours, down 0.1 hour.

Another number that appears highly cooked to perfection, dear reader. This CNBC news item showed up on their Internet site at 8:30 a.m. EDT on Friday morning -- and it comes to us courtesy of Swedish reader Patrik Ekdahl. Another link to it is here. The Zero Hedge spin on this is headlined "Behind Today's Stunning Jobs Report: A Record Surge in Government Workers" -- and linked here.

![]()

Reality Check for Bonds -- Doug Noland

It’s worth noting that money market fund assets rose another $39 billion the past week. Money market fund assets have surged $329 billion, or 31% annualized, over the past nine weeks – to a record $6.463 TN. The ongoing inflation of money fund deposits is nothing short of monumental.

When it comes to the ongoing extraordinary growth in money market funds, repos and the “basis trade,” it’s radio silence from the Federal Reserve. For now, it seems only the unemployment rate matters. This week, the Bank of England said the quiet part out loud.

October 2 – Financial Times (Martin Arnold): “The Bank of England has warned of rising ‘vulnerabilities’ in the financial system stemming from increased bets by hedge funds against U.S. government bonds, which reached a record high of $1tn in recent months. The BoE said… that if hedge funds unwound these ‘short’ positions it would have ‘the potential to amplify the transmission of a future stress’. These short bets are often part of so-called basis trades, where hedge funds aim to profit from small discrepancies between prices of U.S. Treasuries and futures contracts linked to them. A period of volatility in global financial markets in August ‘illustrates the potential vulnerabilities in market-based finance to amplify shocks’, the BoE said in a report… The… ‘the current period of elevated geopolitical risk and uncertainty… could place further pressure on sovereign debt levels and borrowing costs’… The net short positioning of hedge funds in U.S. Treasury futures markets hit a new high of $1tn in recent months, up from a previous peak of $875bn. ‘Relative to the size of the U.S. treasury market, this was larger than the previous high reached in 2019…’ A rapid deleveraging of these short positions could be triggered by a number of factors, including ‘if repo market functioning were to deteriorate materially; if counterparty credit risk were to increase; or if investors in the basis trade were to take losses on their positions’.”

Ten-year Treasury yields jumped 22 bps this week, with yields rising to an almost two-month high. Two-year yields surged 36 bps to 3.92%, and benchmark MBS yields rose 34 bps to 5.22%. The market ended the week pricing a 4.28% Fed funds rate at the Fed’s December 18th meeting, up 22 bps this week. This implies 55 bps of rate reduction by year end. For the end of 2025, the market is pricing a 3.29% fed funds rate – up a notable 44 bps this week. This implies 154 bps of rate reduction by the end of 2025.

Doug's abbreviated commentary this week was posted on this Internet site around 1 a.m. PDT on Saturday morning -- and another link to it is here. Gregory Mannarino's post market close rant for Friday is linked here -- and this one runs for 45 minutes.

![]()

This 24-minute video interview is definitely worth your while if you have the interest. As usual, I thank Guido Tricot for sending it along -- and another link to it is here.

![]()

Kuwait suspends electronic banking for 60,000 with biometrics unregistered

Following the September 30 deadline for Kuwaiti citizens to undergo biometric fingerprinting, the Public Authority for Civil Information (PACI) has provided the list of unregistered individuals to the Kuwait Banking Association. In response, banks have accelerated the process of freezing accounts, in line with a new directive that sets a final deadline of November 1.

There were almost 60,000 Kuwaitis unregistered when the deadline passed, Arab Times reports. As of last week, Zawya reported that approximately 110,000 Kuwaitis and 790,000 expatriates have yet to complete the procedure. However, expatriates, who make up over 65 percent of the country’s population, have until December 31, 2024, to fulfill the requirement.

The number of individuals visiting fingerprinting centers has significantly increased, with an average of 6,000 Kuwaitis per day, compared to the previously reported 600 daily.

The Ministry of Interior has announced that citizens who are abroad, such as students on scholarships, patients receiving treatment abroad, diplomats, and workers in foreign offices, are temporarily exempt from the deadline. However, as reported by Al-Seyassah Daily, they will need to complete the biometrics at the airport upon their return.

Individuals who have not completed the biometric process are subjected to immediate account freezing and banking transaction suspension. By mid-October, bank cards issued by Knet, Visa, and MasterCard will be deactivated. By November 1, non-compliant individuals will no longer be able to withdraw funds even through in-person visits to the banks.

Let's hope this doesn't spread too far, dear reader. This news item appeared on the biometricupdate.com Internet site on Tuesday -- and I thank Judy Sturgis for pointing it out. Another link to it is here.

![]()

PACE hearing on Julian Assange's detention and conviction and their chilling effects on human rights

Julian Assange, accompanied by his wife Stella, took part in a parliamentary hearing on his detention and conviction - and their chilling effect on human rights - on 1 October 2024 ahead of a full plenary debate on this topic by the Parliamentary Assembly of the Council of Europe (PACE).

In his first public remarks since his release from detention at Belmarsh Prison in the U.K., Mr. Assange told parliamentarians: "I want to be totally clear. I am not free today because the system worked. I am free today because after years of incarceration I pleaded guilty to journalism. I pleaded guilty to seeking information from a source, and I pleaded guilty to informing the public what that information was."

He added: "It’s good to be back. It’s good to be amongst people who – as we say in Australia – who give a damn. It’s good to be amongst friends."

This youtube.com video from 30 September 2024 starts at the 16:25 minute mark -- and is a must watch up until about the 41-minute mark. There's a couple of minutes of preamble first -- and then Julian speaks for 22 minutes after that. It's definitely worth watching -- and I thank Roy Stephens for sharing it with us. Another link to it is here.

![]()

Golden Flack Jacket -- Bill Bonner

CBS asks:

Does gold investing make sense with the price high? Here's what experts say.

"In recent years, gold has caught investors' eyes, especially since the start of 2024. The price of gold has been on a steady climb and even hit a new all-time high of $2,672 per ounce in September. This surge has pulled in even more investors, fueling further price increases. But now with gold prices at record levels, many are asking: Is it still smart to buy gold? Or should investors wait for a pullback?"

Given the risks of war and inflation, most see gold as a ‘safe haven.’ Many expect that it is an ‘investment’ that will pay off.

But gold is not an investment. Warren Buffet is right; it will never give an investment return. It has no factories nor sales outlets. It doesn’t make payroll or a profit. It hasn’t been souped up with AI. It doesn’t do anything... but just sit there.

It doesn’t grow bigger. But it doesn’t shrink either. Its purpose is merely to avoid an investment loss... notably the Big Loss that would knock you out of the game.

But gold has its moods too. Right now, it is relatively expensive. It wouldn’t be surprising to see the price go down – shaking recent passengers off the bus – before it resumes its drive to its ultimate destination, under 5 ounces to the Dow.

The Dow/Gold macro model is not a straitjacket. It’s a flak jacket. It helps protect you from the Big Loss.

This gold-related commentary from Bill put in an appearance on his website on Friday morning EDT -- and I thank Roy Stephens for sending it our way. Another link to it is here.

![]()

The Stage Is Set -- John Hathaway

We believe the stage is set for a powerful advance in gold mining equities. While the 27.71% year-to-date advance in the bullion price could (but won’t necessarily) take a breather for the rest of 2024, significant catch-up potential for deeply undervalued gold miners has been barely exploited.

With gold trading at all-time highs, precious metals mining shares are just beginning to stir. GDX (VanEck Vectors Gold Miners ETF1 and a proxy for gold mining shares) has increased 28.41% year-to-date, only slightly more than the metal’s year-to-date gain of 27.71% (as of 9/30/2024). Looking at the five-year total return comparison (10/1/2019 to 9/30/2024), mining stocks gained 58.71%, distantly lagging gold’s 78.92% rise.

We have addressed the disconnect between gold bullion and gold equities in previous commentaries. Gold stocks, in our opinion, are coiling for a sharp advance during the remainder of 2024. At the time of writing, GDX is breaking out above a five-year trading range that looks very similar, with a six-month lag, to gold’s breakout earlier this year.

This worthwhile commentary from John showed up on the sprott.com Internet site on Tuesday -- and another link to it is here.

![]()

Polish central bank increases gold reserves

Adam Glapiński told reporters that the National Bank of Poland, "on behalf of all Poles, has already accumulated over 400 tonnes of gold" in its reserves.

"Specifically, we now hold 420 tonnes," Glapiński said, adding that Poland "has thus entered the exclusive club of the world's largest gold reserve holders."

He announced plans to continue purchasing gold, with the goal of reaching 20 percent of the country's foreign exchange reserves.

"We are aiming for 20 percent of our currency reserves to be in gold," Glapiński said at a news conference in Warsaw.

"Once we achieve this, we will join the ranks of the world's top economies," he predicted.

He told the media that Poland's gold reserves have now surpassed those of Britain.

This gold-related news item showed up on the polskieradio.pl Internet site on Thursday -- and is the first of several story that I lifted from the Sharps Pixley website. Another link to it is here.

![]()

Russia Set to Boost Silver Reserves in Major Precious Metals Strategy Shift

Russia may be poised to make a notable shift in its precious metals strategy, with silver potentially emerging as a key asset in the country’s expanding State Fund. According to a report released by Interfax this week and cited by Bloomberg, Russia’s Draft Federal Budget outlines plans to significantly bolster its holdings in precious metals over the coming years. Notably, the budget includes plans to acquire gold, platinum, palladium, and, for the first time, silver.

The inclusion of silver in the State Fund's acquisition strategy marks a departure from recent trends. While central banks around the globe, particularly Russia, have set records in gold purchases following international sanctions, silver has largely remained off their radar. This latest development suggests that silver’s role in Russia’s financial strategy may be evolving.

Russia’s move comes as part of an ongoing response to economic sanctions that have isolated the country from the SWIFT banking system. Since then, Russia has increasingly focused on diversifying its reserves with highly liquid assets, like gold. However, the mention of silver in this latest budget is significant, as it represents the first time any central bank has explicitly included silver in its purchasing plans during the current bull market for precious metals.

Details about the volume of silver Russia plans to acquire remain scarce. While we don’t yet know what percentage of the funds will be allocated to silver, the announcement itself signals a potential shift in the global perception of silver as a strategic asset.

This development raises questions about whether central banks and governments are beginning to rethink silver's place in their reserves. Gold, once treated with a degree of skepticism by some governments, has become a safe haven asset, particularly in times of economic uncertainty. Could silver follow a similar trajectory?

This very interesting article showed up on The Jerusalem Post on Friday -- and I thank Tim Gorman for bringing it to our attention. I'll have more on this in The Wrap. Another link to it is here.

![]()

China's largest jewelry market sees gold buying spree as National Day holiday gets underway

China's largest gold jewelry manufacturing and trading hub in Shenzhen has seen a consumer spending spree as the seven-day National Day holiday gets underway, with processing plants at full capacity to catch up with orders.

This year's National Day holiday runs from October 1 to 7. Known as the "Golden Week," the annual holiday is also a peak wedding season nationwide.

In China, gold jewelry is traditionally part of the betrothal gift given by the groom's family to the bride. A lot of soon-to-be married Chinese people have taken advantage of the week off to buy wedding gold at Shuibei area in Shenzhen, in south China's Guangdong Province.

"I have received more than 100 groups of customers today. The turnover has increased about 40 percent, with the customer volume up by 30 percent," said Zhou Jiaxin, a merchant.

Although the international gold price remains high now, the processing fee is much lower at Shuibei market, making it an attractive place for younger consumers who are more sensitive to prices. This, coupled with the large number of shops offering a dazzling variety of designs, makes this area very competitive on a national scale.

During the National Day holiday, tourists from other parts of the country have become the main buyers of gold in this Shenzhen market.

This gold-related news item appeared on the bastillepost.com Internet site on Thursday -- and I found it on Sharps Pixley. Another link to it is here.

![]()

Analysts warn of ‘peak gold production’ by 2026, say junior miners are the answer

Gold has shined bright in 2024 as rising demand from central banks and retail investors has pushed the yellow metal to multiple new record highs, and it could potentially continue to see its fortunes rise for years to come as one analyst warns that the gold supply is at risk due to scarce and smaller gold discoveries.

According to a report from S&P Global analyst Paul Manalo, there have only been five major gold discoveries since 2020, totaling 17 Moz of gold.

S&P’s annual analysis of major gold discoveries found that there were 350 deposits discovered between 1990 and 2023, containing 2.9 billion ounces of gold in reserves, resources and past production. A major gold discovery is one defined as one containing at least 2 million ounces in reserves, resources, and past production.

“While the number of major discoveries and the total amount of gold continue to grow each year, it is important to note that most of the assets added to the list were discovered decades ago and only recently met the criteria of having at least 2 million ounces of gold in reserves, resources and past production,” wrote Manalo. “Since 2020, there have been only five major discoveries with a total of 17 Moz of gold, accounting for just 22% of the additional 79 Moz of gold added in the 2024 update.”

Manalo said the recent discoveries “are scarce and smaller in size, with an average of 3.5 Moz compared to the 5.5 Moz average from 2010 to 2019. None of the discoveries made in the last 10 years have entered the list of the largest 30 gold discoveries, supporting our long-held view that the decade-long focus on older and known deposits limits the chance of finding huge discoveries in early-stage prospects.”

Manalo warned that “The lack of quality discoveries in the recent decade does not bode well for the gold supply.”

This interesting gold-related article put in an appearance on the kitco.com Internet site back on September 27 -- and another link to it is here.

![]()

Silver: So Much Bigger Than 2011

I remember the 2011 silver bull market like it was yesterday.

We had already experienced two rounds of money printing (QE) by then, and the bank bailouts were still fresh on everyone’s mind.

Silver prices shot up from $9.40 per ounce in October 2008 to over $49 in April 2011.

It was a beautiful run, but ended much too quickly for my liking. Silver stayed above $30 for almost two more years, but as the economy improved, investors lost interest for a time.

Investment demand for silver petered out and the supply deficit never got too serious, as we’ll see below.

In today’s bull market, I see none of these issues. Silver’s current move is set to be far more durable and stronger than in 2011. And today is the perfect time to explore why.

Like most populist commentators about silver on the Internet, this author has no real understanding of what has been the driving force behind precious metal prices [silver in particular] for the last 50+ years. But regardless of its shortcomings, this article from yesterday is worth your while. I found it on the dailyreckoning.com Internet site -- and another link to it is here.

![]()

The untold history of gold rushes in the United States

The discovery of gold in the United States profoundly shaped the nation’s economic and social development, especially during the 19th century.

These gold rushes transformed regional economies, spurred massive population movements, led to the establishment of new towns, and influenced U.S. territorial expansion.

While the California Gold Rush is the most famous, other significant gold discoveries across the country played an equally vital role in the nation's history. This article explores the key gold rushes and the famous figures that emerged from them.

This longish but very interesting article by Joshua Glawson was posted on the moneymetals.com Internet site on Wednesday -- and I found it embedded in a GATA dispatch. Another link to it is here.

![]()

Long-lost shipwreck packed with gold discovered in the African desert

One of the most significant shipwreck finds of recent times was made in an ostensibly unlikely place: a southwest African desert.

The Bom Jesus (The Good Jesus), a Portuguese ship, set sail for India from Lisbon on 7 March, 1533, when it got caught up in a devastating storm.

The vessel, which was laden with treasures, seemed to disappear without a trace until, in 2008, its remains were finally discovered along with around $13 million-worth of gold coins.

It was unearthed by diamond miners in a desert on the coast of Namibia, who had drained a man-made lagoon in the area.

Dr. Dieter Noli, chief archeologist of the Southern Africa Institute of Maritime Archaeological Research, said he had expected miners to one day come across a shipwreck.

Indeed, the Namibian miners, who worked for the diamond company De Beers, called Dr. Noli as soon as they made the find, since he had been telling them for more than a decade what to look for.

This interesting article appeared on the msn.com Internet site. The discovery was made some time ago, but it's the first I'd heard of it. Another link to it is here.

![]()

QUOTE, MEME & CARTOON

![]()

The WRAP

"Understand this. Things are now in motion that cannot be undone." -- Gandalf the White

![]()

Today's pop 'blast from the past' was one that popped into my head a few days ago -- and I just can't get rid of it. It was written for the 1960 Broadway version of a 1958 British play. The Beatles recorded a slightly altered version of it for their 1963 debut album, 'Please Please Me'. But the most famous version of it came out in 1965 on their album 'Whipped Cream & Other Delights'. It won four Grammy Awards -- and the link is here. Surprisingly enough, there's a bass cover for this -- and it's far busier than I thought it would be. That's linked here.

Today's classical 'blast from the past' is one that I've only featured once in the last eight years -- and it's more than time to make amends for that. It's without doubt Beethoven's most famous symphony -- and also without doubt the best known of all classical compositions of any composer...his 5th, in C Minor, Op. 67 which he composed between 1804 and 1808. Beethoven was in his mid-thirties during this time -- and his personal life was troubled by increasing deafness.

First performed in a mammoth concert held in Vienna's Theater an der Wien on 22 December 1808, the work achieved its prodigious reputation soon afterward.

Here's the Berlin Philharmonic under the baton of the late great Maestro Herbert Von Karajan -- and it does not get any better than this. The link is here.

![]()

Without doubt, the powers-that-be/PPT were in every market they had to be yesterday -- and obviously in the precious metals....both in Globex trading overseas -- and particularly during the COMEX trading session in New York.

There certainly wasn't anything free market about what happened on Friday.

Although 'da boyz' only managed to close gold down $2.20 in the spot market, it was closed lower by $11.40 in December, its current front month -- and considering the price action, net gold volume wasn't all that heavy. However, it's downward price trend on its 6-month chart below remains intact.

The moment that silver broke above $33 on the 'ask' side on its big price spike on Friday, it was capped and sold down hard. Although it was allowed to close up 17 cents -- and back above $32 spot, it was closed down 10 cents in December, its current front month.

And because of the huge price 'volatility' on Friday, net volume on it was pretty heavy -- and as for why there was such a dichotomy between its volume and gold's, is something that I don't have an answer for.

Platinum, like gold and silver, would have certainly closed up on the day, if allowed and, not surprisingly, it was closed lower in its current front month as well. Although palladium was allowed to close higher on the day in the spot market, it was closed down on the day by $2.10 in its current front month, which is also December.

And after getting smacked around a bit on Thursday, copper closed up 2 cents at $4.57/pound yesterday. I also made note of the fact that its 50-day moving average crossed above it 200-day yesterday...not that means anything in such a managed market as copper.

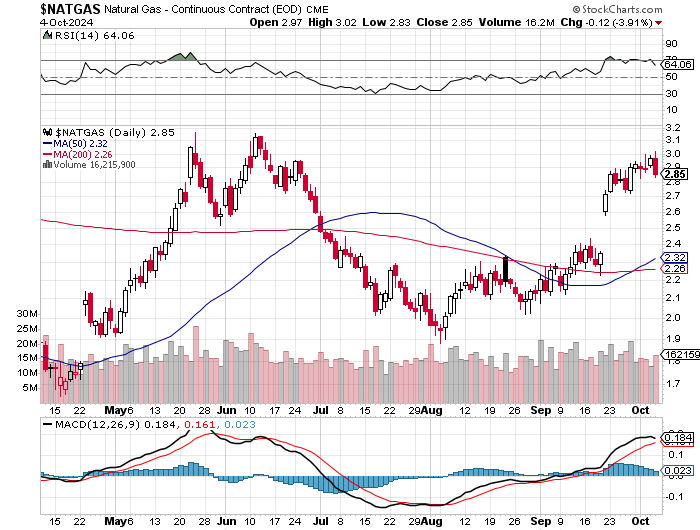

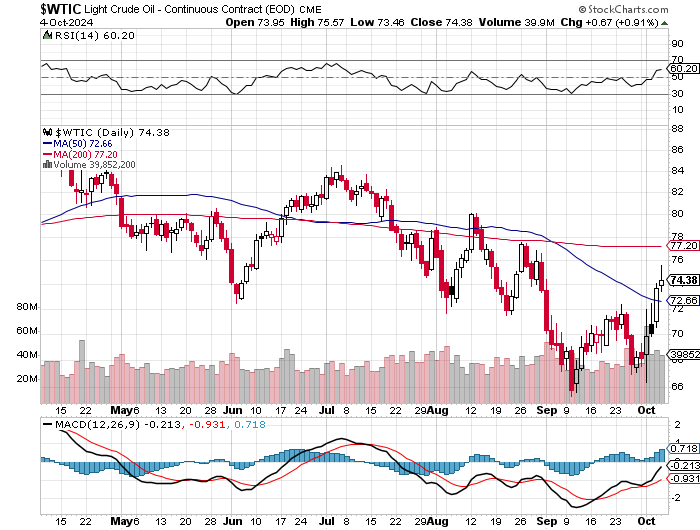

Natural gas [chart included] got hit for 12 cents/3.91% on Friday...taking back all of this week's gains in the process...such as they were. It finished the day at $2.85/1,000 cubic feet -- and is now back below overbought by a bit on its RSI trace. WTIC managed a 67 cent gain, as it finished the week at $74.38/ barrel, but some distance off its $75.57 intraday high tick on Friday.

Here are the 6-month charts for the Big 6+1 commodities...courtesy of stockcharts.com as always and, if interested, their COMEX closing prices in their current front months on Friday should be noted. Click to enlarge.

It was yet another week where the powers-that-be were at the ramparts preventing everything that wanted to melt down from doing so -- and stepping on the prices of everything that wanted to blow sky high...the precious metal prices in general, silver in particular. But despite their best efforts, they couldn't keep Mr. Bond from voicing his concern as the days rolled by... especially yesterday.

Although there was improvement in the commercial net short positions in both gold and silver in yesterday's COT Report, they still remain just below their all-time highs...joined this past month by platinum, where yesterday's Bank Participation Report showed that the world's banks...led by the U.S...hold their largest short positions in that precious metal since Q1/2020.

There's no sign that the collusive commercial traders of whatever stripe are backing off -- and this is particularly true in gold...where every commercial traders is now mega short -- and I'm still trying to wrap my head around that new record high short position now held by Ted's raptors, the small commercial traders other than the Big 8. They're hardly small and inconsequential now, as they hold a short position of 56,173 COMEX contracts between them. Their short positions combined would put them in the Big 4 short category, which is unprecedented.

But something has to give at some point -- and it's either a massive and coordinated engineered 'wash, rinse & spin' cycle, which is sure to be ugly... but short. Then we blast higher. Or things go nonlinear to the upside right from where we stand today -- and 'da boyz' get overrun in that Biblical short covering rally of the ages that I keep going on about -- and Ted's "Bonfire of the Silver Shorts" comes to pass. It's one or the other...a point that Ted made on several occasions before he passed -- and that situation hasn't change one iota since, except its far more extreme now than it was then.

That article in the Critical Reads section headlined "Russia Set to Boost Silver Reserves in Major Precious Metals Strategy Shift" certainly caught my attention -- and if true, it remains to be seen how long before such a strategy is implemented.

But these photos of silver bars inside the vaults of The Central Bank of the Russian Federation taken several years ago, may indicate that the process has been underway for a while already -- and that they, plus their sovereign wealth fund, are just waiting to go public at an opportune moment with what they already own -- and what they intend to purchase in the future. Click to enlarge for all.

Russia announced a month ago that they were about to make some rather significant additions to their foreign exchange holdings, plus their gold reserves during September -- and whatever they purchased that month won't be know until their central bank updates their website with that data on Friday, October 18.

Each month when I check their website for the changes in their gold reserves, I check the .xls file for any sign that they've quietly added silver to their reserves, but so far nothing.

But with the BRICS conference in Kazan only a bit over two weeks away now, a surprise announcement about a huge add to their gold reserves...plus a public announcement of their current silver holdings, would be a good way to start things off.

And as I pointed out last Saturday in this missive, it would also be an opportune time for China to step up to the plate and announce their true gold holdings...which both Alasdair Macleod and I believe to something well north of 20,000 tonnes.

Of course there are those that say that most pundits are expecting way too much from this meeting -- and others are sure that the framework for a new international payment scheme backed by gold and other commodities, will be the cornerstone of the conference.

I'm certainly wishing them great success...but the fact of the matter is that nobody knows for sure what will be carved in stone by the time the conference ends. Nothing much will be decided at the meeting, as everything that's set for approval will have already been worked out in advance -- and in as much secrecy as possible. All that will be required from the attendees is their public stamps of approval.

But the fact that gold...now a Tier 1 asset with the BIS...is being discussed and its use implemented on a global scale in one form or another, will be a sure sign that the end of the 50+ year experiment in fiat currencies will be in sight.

If Russia throws silver into the mix, it could prove to be the ultimate financial weapon of mass destruction against the western banking system...as I commented on in The Wrap of a column posted in the public domain on the silverseek.com Internet site in early July -- and linked here.

Of course the world has to survive until that BRICS meeting later in July -- and with the Middle East about to go up in flames...with the timing of this being no accident in my opinion...the road between now and then, not even taking into account a false flag event of some kind, could be ugly.

But I'm still "all in" -- and will remain so to whatever end.

See you here on Tuesday.

Ed