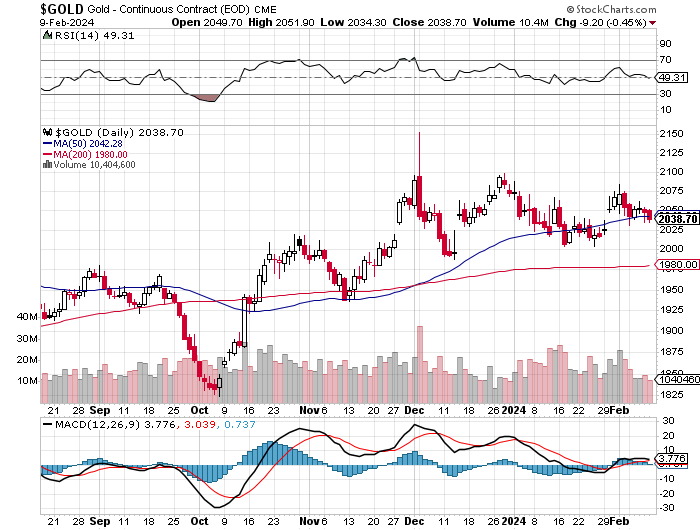

The gold price chopped quietly sideways to a bit lower in Globex trading overseas on Friday, but the sell-off became more serious staring around 11:20 a.m. GMT in London. It was engineered forcefully lower from there, with its low tick set around 11:05 a.m. EDT...five minutes after the London close. It was allowed to wander a bit higher from there until 1:10 p.m. -- and then crept quietly and a bit unevenly sideways until the market closed at 5:00 p.m. EST.

The high and low ticks were reported as $2,051.90 and $2,034.30 in the April contract. The February/April price spread differential in gold at the close in New York yesterday was $15.40...April/June was $19.90...June/August was $17.90...August/October was $17.00 -- and October/December was $16.70 an ounce.

Gold was closed on Friday afternoon in New York at $2,024.40 spot, down $9.90 on the day. Net volume was ultra low at a bit over 100,500 contracts -- and there were a bit under 15,500 contracts worth of roll-over/switch volume on top of that...mostly into June and August.

I noted that 62 gold and 7 silver contracts were traded in February yesterday -- and it remains to be see what that translates into when the CME posts their updated Daily Delivery and Preliminary Reports later this evening.

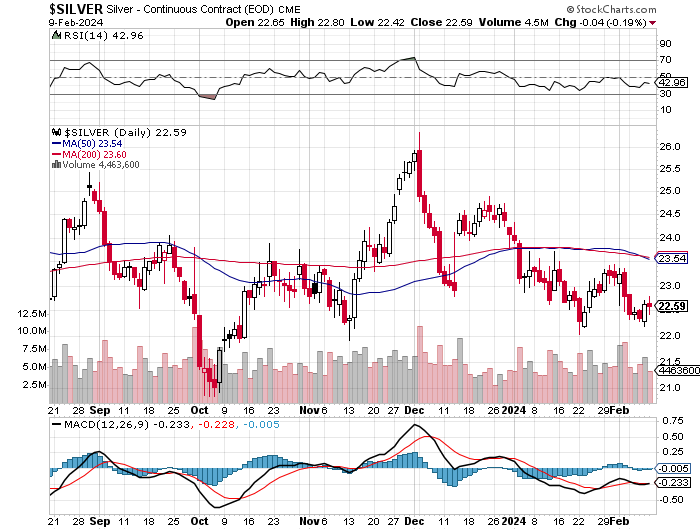

Silver took about three quiet steps higher in early Globex trading on Friday, with its high tick coming minutes after the 8:00 a.m. London open. It then had a quiet down/up move that ended at or minutes after the 12 o'clock noon GMT afternoon gold fix -- and it was rather brutally engineered lower from there until 'da boyz' set its low tick at the same time as gold's...five minutes after the 11 a.m. EST London close. From that juncture it stair-stepped its way steadily higher until about ten minutes before trading ended at 5:00 p.m. EST.

The high and low ticks in silver were recorded by the CME Group as $22.795 and $22.420 in the March contract. The March/May price spread differential in silver at the close in New York on Friday was 21.5 cents...May/July was 21.4 cents...July/September was 16.4 cents -- and September/December was also 16.4 cents an ounce.

Silver was closed in New York on Friday afternoon at $22.59 spot, up 6 cents from Thursday -- and 30 cents off its Kitco-recorded low tick. Net volume was very light at a hair under 36,500 contracts -- and there were a bit over 13,000 contracts worth of roll-over/switch volume out of March and into future months in this precious metal...mostly May, but with noticeable amounts into the other three scheduled delivery months of this year as well.

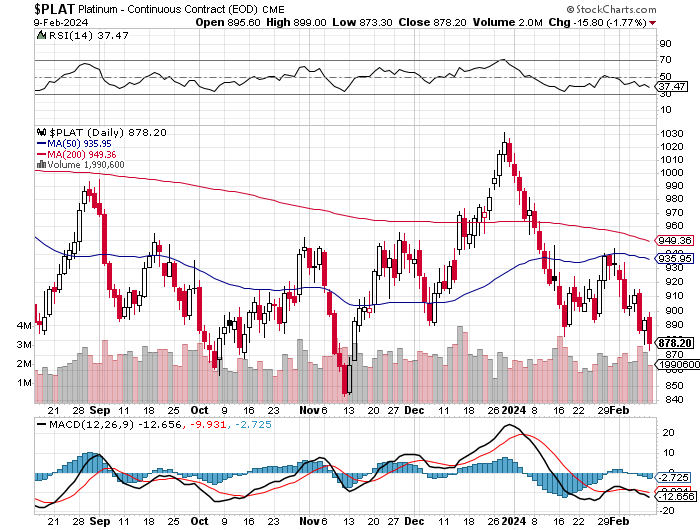

Platinum had a very quiet and broad up/down move that lasted until the commercial traders of whatever stripe appeared minutes after the Zurich open in Globex trading overseas. They set its low around 11:35 a.m. in COMEX trading in New York -- and its ensuing rally was allowed to last until around 2:45 p.m. in after-hours trading. It didn't do anything after that. Platinum was closed at $874 spot...down 14 bucks from Thursday.

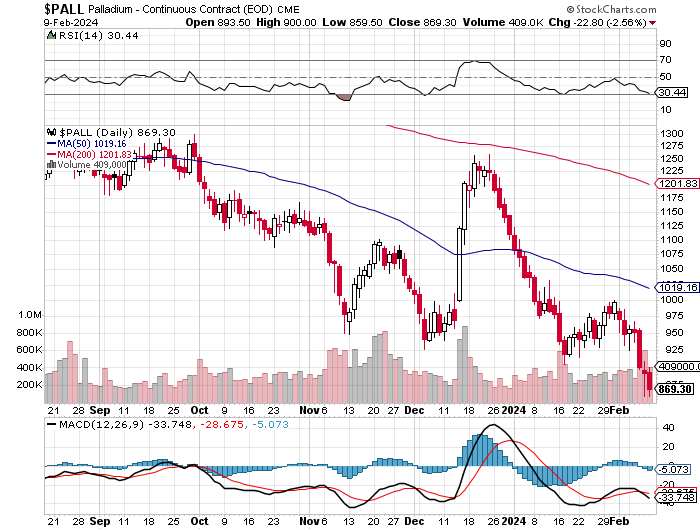

Palladium's very quiet and broad up/down move ended around 3:10 p.m. China Standard Time on their Friday afternoon -- and it broad down/up move after that ran into 'something' at 2 p.m. CET in Zurich/8 a.m. EST in New York. 'Da boyz' set its low tick a few minutes before the 11 a.m. EST Zurich close -- and its ensuing rally attempt was capped at 12 o'clock noon on the dot. Once the COMEX closed it was sold quietly lower until trading ended at 5:00 p.m. EST. Palladium was closed at $847 spot down another 27 dollars.

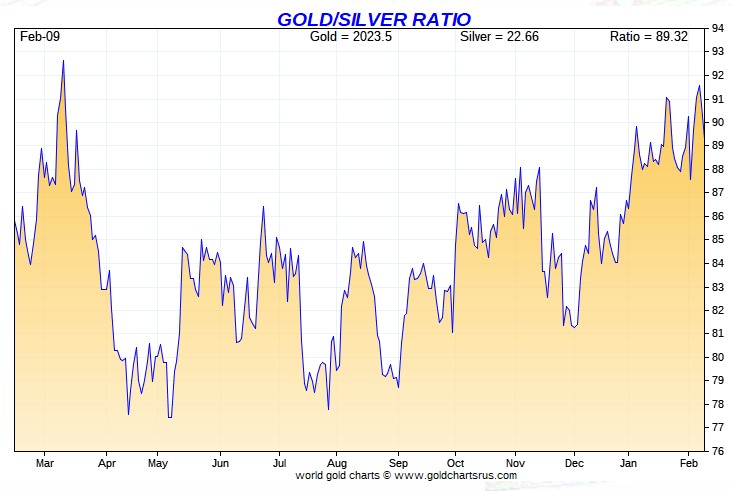

Based on the kitco.com spot closing prices in silver and gold posted above, the gold/silver ratio worked out to 89.6 to 1 on Friday...compared to 90.3 to 1 on Thursday.

Here's the 1-year Gold/Silver Ratio Chart, thanks to Nick Laird and, as always, the Friday data point is not on it for whatever reason. Click to enlarge.

The dollar index closed very late on Thursday afternoon in New York at 104.17 -- and then opened lower by 3 basis points once trading commenced at 7:34 p.m. EST on Thursday evening, which was 8:34 a.m. China Standard Time on their Friday morning. It then wandered/chopped quietly sideways to a bit higher until around 12:50 p.m. in London. Then, at 8:30 a.m. in New York, it took a bit of a header...recovered half of that in short order -- and from there wandered very quietly sideways until the market closed at 5:00 p.m. EST.

The dollar index finished the Friday trading session in New York at 104.11...down 6 basis points from its close on Thursday.

Here's the DXY chart for Friday, thanks to marketwatch.com as usual. Click to enlarge.

And here's the 5-year U.S. dollar index chart that appears in this spot every Saturday, courtesy of stockcharts.com as always. The delta between its close...103.99...and the close on the DXY chart above, was 12 basis points below its spot close. Click to enlarge.

Good luck finding any correlation between the currencies and precious metal prices yesterday...as they were being managed in the usual fashion by the Big 4/8 shorts in the Globex/COMEX futures market.

U.S. 10-year Treasury: 4.1870%...up 0.0170 (+0.4077%)...as of 02:59 p.m. EST

And here's the 5-year 10-year U.S. Treasury chart from the yahoo.com Internet site -- which puts the yield curve into a somewhat longer-term perspective. Click to enlarge.

Despite the Fed's interventions over the last few years, the trace on this chart continue to rise from "lower left, to upper right" as Dennis Gartman used to say.

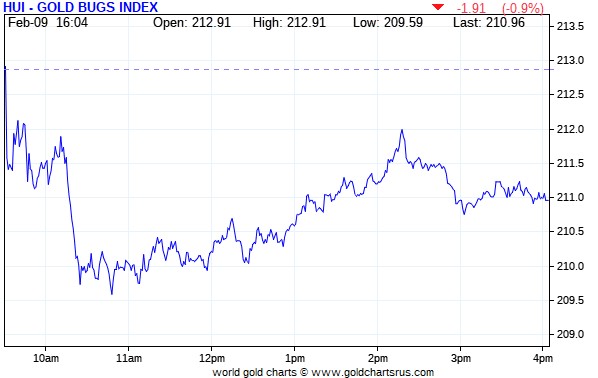

The gold stocks took two steps lower starting as soon as trading began in New York at 9:30 a.m. on Friday morning -- and that lasted until minutes before 10:30 a.m. EST. They then chopped quietly higher until 2:15 p.m. -- and then sold off a bit until the market closed at 4:00 p.m. EST. The HUI closed down another 0.90 percent.

Computed manually, the new Silver Sentiment/Silver 12 Index finished the day down 0.16 percent.

Here's Nick's old 1-year Silver Sentiment/Silver 7 Index chart, updated with Friday's candle. Click to enlarge.

The hands-down star was Silvercorp Metals, closing higher by 5.78 percent -- and the biggest underperformer was Aya Gold & Silver once again, closing down 3.47 percent.

The new short report came out on Friday evening -- and it showed that the short position in First Majestic Silver rose by a tiny 1.87 percent to 18.57 million shares sold short on the NYSE...6.63% of the float.

The reddit.com/Wallstreetsilver website, now under 'new' but not improved management, is linked here. The link to two other silver forums are here -- and here.

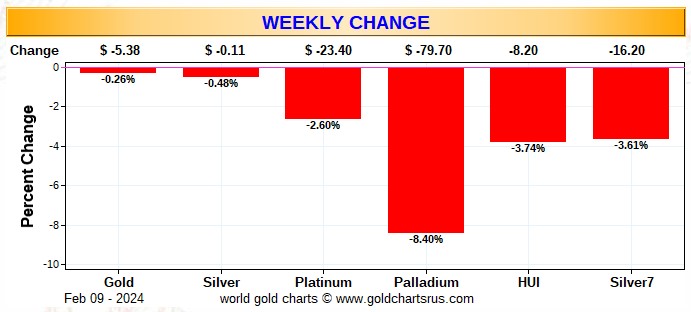

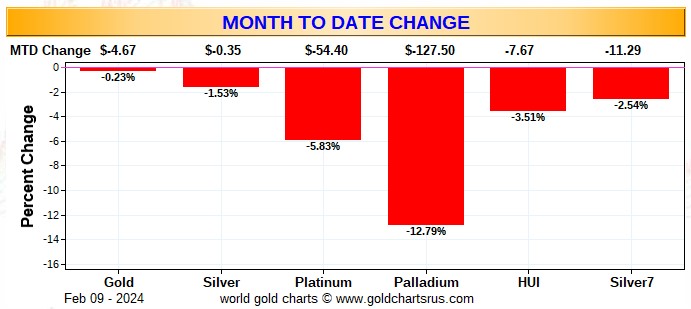

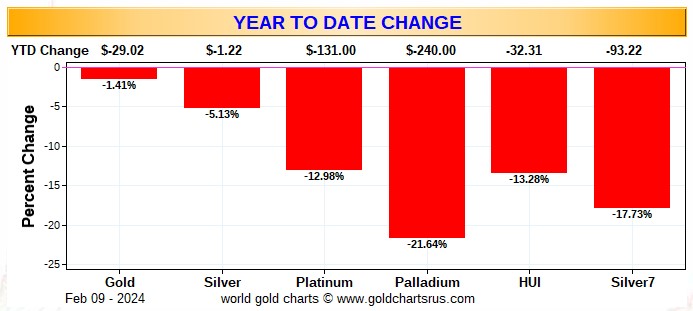

Here are the usual three charts that appear in every weekend missive. They show the changes in gold, silver, platinum and palladium in both percent and dollar and cents terms, as of their Friday closes in New York — along with the changes in the HUI and the old Silver 7 Index.

Here's the weekly chart -- and I hope red is your favourite colour, as there's this...plus two more further down that look the same. I was somewhat surprised by the small net changes in both silver and gold...but the bid drops in platinum and palladium...especially the latter...were no surprise. Click to enlarge.

Here's the month-to-date chart...but it only has two more business days worth of data compared to the weekly chart, so it doesn't look much different, except that the pounding that platinum and palladium are getting are far more pronounced. Click to enlarge.

Here's the year-to-date chart -- and it's wall-to-wall red like it has been almost all year. There's not much to be said about this, except to point out that it comes to us investors and the precious metals miners, courtesy of the commercial traders of whatever stripe...mostly the Big 4/8 shorts. Click to enlarge.

Of course -- and as I mention in this spot every Saturday -- and will continue to do so...is that if the silver price was sitting within 3 percent or so of its old high of $50 the ounce...like gold is currently sitting within 3 percent or so of its old high of around $2,075...it's a given that the silver equities would be outperforming their golden cousins by an absolute country mile.

The CME Daily Delivery Report for Day 10 of February deliveries showed that 25 gold -- and zero silver contracts were posted for delivery within the COMEX-approved depositories on Tuesday.

In gold, the only short/issuer that mattered was Advantage, with 24 contracts out of its client account -- and the only one of the five long/stoppers that mattered was Wells Fargo Securities, picking up 17 contracts for its house account.

In palladium, there were 14 contracts issued and stopped.

The link to yesterday's Issuers and Stoppers Report is here.

Month-to-date there have been 16,507 gold contracts issued/reissued and stopped -- and that number in silver is 1,066 contracts. In platinum it's 137 contracts -- and in palladium...18.

The CME Preliminary Report for the Friday trading session showed that gold open interest in February fell by 33 contracts, leaving 413 still around, minus the 25 contracts mentioned a few paragraphs ago. Thursday's Daily Delivery Report showed that 41 gold contracts were actually posted for delivery on Monday, so that means that 41-33=8 more gold contracts just got added to the February delivery month.

Silver o.i. in February declined by 3 contracts, leaving 244 still open. Thursday's Daily Delivery Report showed that 8 silver contracts were actually posted for delivery on Monday, so that means the 8-3=5 more silver contracts were added to February deliveries.

Total gold open interest at the close on Friday fell by a net 2,847 COMEX contracts -- and total silver o.i. declined by a net 900 contracts.

Both these numbers are subject to some minor revisions by the time the final figures are posted on the CME's website later on Monday morning CST.

And after a deposit into GLD on Thursday, there was a withdrawal on Friday, as an authorized participant removed 55,788 troy ounces of gold -- and after that small deposit into SLV on Thursday, there was a very decent withdrawal, as an a.p. took out 1,921,563 troy ounces of silver.

And whether that was a conversion of shares for physical...or a withdrawal because it was needed more urgently elsewhere, is impossible to know... although I suspect the latter.

The new short report was posted on The Wall Street Journal's website early on Friday evening -- and it showed that the short position in SLV cratered by 25.13 percent...from 16.84 million shares sold short, down to 12.61 million shares. The short position in GLD also fell, but only by 2.41 percent...from 860,000 shares sold short, down to 839,000 shares sold short.

And whether that short position reduction came about through the repurchase of the shorted shares, or by depositing physical metal, is above my pay grade. But regardless of that, this development has to be seen as very bullish -- and I look forward to what Ted has to say about it in his weekly review for his paying subscribers this afternoon.

The short position in SLV is still too high, but is far less worrying than it was last year when it was sky high. The short position in GLD is of no concern.

In other gold and silver ETFs and mutual funds on Planet Earth on Thursday, net of any changes in COMEX, GLD and SLV inventories, there were a net 132,196 troy ounces of gold taken out...but a net 78,798 troy ounces of silver was added.

There was no sales report from the U.S. Mint.

Month-to-date the mint has only sold what I reported earlier this week... 5,000 troy ounces of gold eagles -- 500 one-ounce 24K gold buffaloes -- and 850,000 silver eagles.

There was a bit of activity in gold over at the COMEX-approved depositories on the U.S. east coast on Thursday. Nothing was reported received -- and 30,865 troy ounces were shipped out.

The largest 'out' amount were the 29,610 troy ounces that left JPMorgan, with the remaining 1,253.889 troy ounces/39 kilobars departing Manfra, Tordella & Brookes, Inc.

But the big activity was in the paper category, as 154,505 troy ounces were transferred from the Registered category and back into Eligible, involving six different depositories in total. The largest amount by far were the 98,558 troy ounces that made that trip over at HSBC USA...with the second largest amount being the 37,423 troy ounces over at Manfra, Tordella & Brookes, Inc.

The link to all of Thursday's COMEX gold action is here.

But there was huge activity in silver, as 2,238,528 troy ounces were reported received -- and 657,243 troy ounces were shipped out.

In the 'in' category, the largest amount by far were the 1,758,560 troy ounces/three truckloads that were dropped off at Asahi...with the remaining 479,968 troy ounces finding a new home over at Brink's, Inc.

In the 'out' category, the largest amount were the 576,248 troy ounces that departed CNT...followed by the 80,000 troy ounces out of HSBC USA. The remaining 993 troy ounces/one good delivery bar was shipped out of Delaware.

There was no paper action -- and the link to Thursday's impressive silver activity is here.

There wasn't much activity over at the COMEX-approved gold kilobar depositories in Hong Kong on their Thursday. There were 500 kilobars reported received -- and 21 kilobars were shipped out. Except for the 12 kilobars that left Loomis International, the remaining in/out activity took place over at Brink's, Inc. as always. The link to this, in troy ounces, is here.

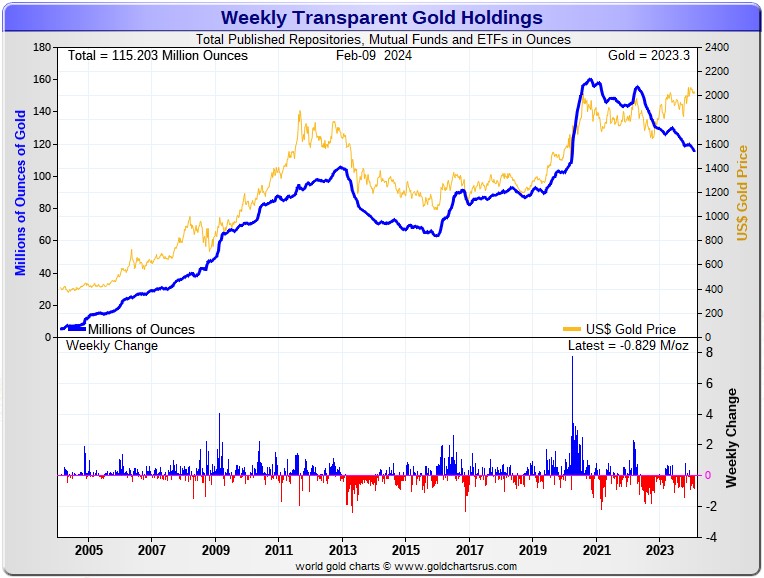

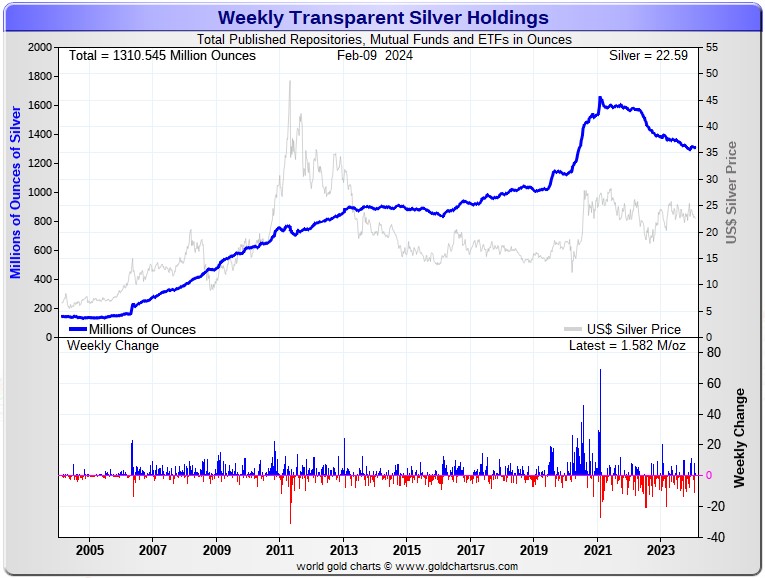

Here are the usual 20-year charts that show up in this space in every Saturday column. They show the total amounts of physical gold and silver held in all know depositories, ETFs and mutual funds as of the close of business on Friday.

During the week just past, there were a net 829,000 troy ounces of gold removed -- but a net 1.582 million troy ounces of silver were added.

According to Nick Laird's data on his website, there were a net 2.657 million troy ounces of gold removed -- plus a net 3.491 million troy ounces of silver were were also removed from all the world's known depositories, mutual funds and ETFs during the last four weeks.

In gold, the only ETF showing deposits worthy of the name was Japan's Physical AU fund, as they added 17,024 troy ounces during that time period, unchanged from last week -- and hardly worthy of mention. The largest 'out' amount were the 1.356 million troy ounces that left the COMEX...with the lion's share of that [once again] being kilobars shipped out of Hong Kong. In second place was GLD...shedding 695,000 troy ounces. In third place was XetraGold...showing 189,000 troy ounces removed. The 'out' list goes on and on...

In silver, the largest two 'in' amounts were SLV, as they received a net 4.618 million troy ounces -- and the 500,000 troy ounces added to BullionVault. In third place were the 218,000 troy ounces deposited at iShares/SVR. The largest 'out' amount were the 5.860 million troy ounces taken out of the COMEX. In second and third spots were the 1.541 million troy ounces and 805,000 troy ounces that were shipped out of ETF Securities/SIVR and Sprott's Central Fund/CEF respectively. Then there were the 193,000 and 136,000 troy ounces that left GoldMoney and Source/SSLV.

Retail bullion sales remain comatose for the most part. At the moment, the dealer have lots of inventory in everything. But when retail investment demand picks up for real once again, it will be back to shortages/back orders and high premiums very quickly. And that's not taking into account the mind-boggling quantities of silver that will be required by all the silver ETFs and mutual funds.

Where will all this physical metal come from in the face of this ongoing and deepening structural physical deficit, one has to wonder, as it just won't be there at some point...although JPMorgan & Friends are sitting on a goodly amount of the stuff according to Ted.

And as he stated very recently, it would appear that they have parted with at least 500 million troy ounces of silver over the last three years, of the one billion troy ounces that they'd accumulated since 2011.

If they continue in this vein, they are going to have to cough up more ounces to feed this year's deficit...another 176 million of them according to that latest report from The Silver Institute.

The physical demand in silver at the wholesale level continues unabated. Not only is it not showing any signs of slowing down, it appears to be accelerating. That was more than evident again this past week.

Almost all of what's left in the various public ETFs and mutual funds is not available for sale...including the COMEX and SLV, where new silver has to be brought in from other sources [JPMorgan] to meet the ongoing demand for physical metal, as just mentioned. This will continue until available supplies are depleted...which will be the moment that JPMorgan & Friends stop selling into the ongoing structural deficit.

The vast majority of precious metals being held in these depositories are by those who won't be selling until the silver price is many multiples of what it is today. That's particularly true of shareholders in PSLV.

Sprott's PSLV is the third largest depository of silver on Planet Earth with 170 million troy ounces -- and some distance behind the COMEX, where there are 274 million troy ounces being held. [However, it's now a near certainty that 103 million troy ounces of that amount is actually held in trust for SLV by JPMorgan according to Ted -- and his letter to the SEC and CFTC of more than three months ago now on this issue, has received a noncommittal response from the SEC -- and nothing at all from the CFTC.] But PSLV is still some distance behind SLV, as they are the largest silver depository, with 438 million troy ounces as of Friday's close.

The latest short report from yesterday showed that the short position in SLV fell by a hefty 25.13%...down to 12.61 million shares sold short. BlackRock issued a warning a few years ago to all those short SLV, that there might come a time when there wouldn't be enough metal for them to cover. That would only be true if JPMorgan decides not to supply it to whatever entity requires it.

The next short report will be posted on The Wall Street Journal's website on Tuesday, February 27.

Then there's that other little matter of the 1-billion ounce short position in silver held by Bank of America in the OTC market...with JPMorgan & Friends on the long side. Ted says it hasn't gone away -- and he's also come to the conclusion that they're also short around 30 million ounces of gold with these same parties as well...down 7 million oz. from the 37 million they were short in the June OCC Report. The latest report from the OCC for Q3/2023 came out about two months ago now -- and based on what was in it, Ted hasn't changed his mind on this one iota.

The Commitment of Traders Report for positions held at the close of COMEX trading on Tuesday showed the expected decrease in the Commercial net short position in silver -- and an increase in the commercial net short position in gold.

In silver, the Commercial net short position declined by 4,295 COMEX contracts, which works out to 21.475 million troy ounces of the stuff.

They arrived at that number by increasing their long position by 5,059 contracts -- and also increased their short position by 764 COMEX contracts. It's the difference between those two numbers that represents their change for the reporting week.

Under the hood in the Disaggregated COT Report, it was all Managed Money traders plus a whole bunch more, as they reduced their long position by 739 contracts -- and also added a whopping 8,191 short contracts, for a total change of 8,930 contracts. In doing so, they are now back net short silver by 4,599 COMEX contracts.

That meant that the other two categories had to be buyers during the reporting week -- and they were. The Other Reportables increased their net long position by 4,384 contracts -- and the Nonreportable/small traders by 251 contracts.

Doing the math: 8,930 minus 4,384 minus 251 equals 4,295 COMEX contracts...the change in the Commercial net short position.

The Commercial net short position in silver now stands at 33,483 COMEX contracts/167.42 million troy ounces...down those 4,295 contracts from the 37,778 COMEX contracts/188.89 million troy ounces they were short in the February 2 COT Report.

From hereon in, things get a bit more interesting -- and even more wildly bullish.

Looking at the counterintuitive changes [increases] in the Big 4/8 short positions in this week's report -- and the huge 8,191 increase in the gross short position by the Managed Money traders mentioned above, Ted pointed out that the one Managed Money trader holding around 4,000 short contracts in the Big '5 through 8' category for the last month or so, has increased their short position to around 8,000 contracts...which now puts them as the smallest member of the Big 4 shorts. This means that the commercial trader that was in the No. 4 spot in the Big 4 category, got bumped down to the No. 5 spot in the Big '5 through 8' category.

That new managed money trader now in the Big 4 category had a larger short position than the short that it replaced -- and that's why the short position of the Big 4 shorts increased during the reporting week. The short position of the '5 through 8' traders also increased, as the short that was previously in the Big 4 category, dropped into the Big '5 through 8' category...knocking out whatever trader was in the number 8 spot.

For these reasons -- and despite the decrease in the Commercial net short position in the legacy COT Report...4,295 contracts...during the reporting week, the 'Big 4' and Big '5 through 8' categories showed increases in their net short positions as just explained.

The Big 4 shorts increased their short position by a 829 contracts to 43,021 contracts during the reporting week...up from the 42,192 contracts they were short in last Friday's COT Report.

The Big '5 through 8' shorts also increased their net short position during the reporting week...them by 1,133 contracts...from the 19,935 contracts in last week's report, up to 21,068 in this week's COT Report.

The Big 8 shorts in total increased their net short position from 62,127 contracts, up to 64,089 COMEX contracts week-over-week...an increase of 1,962 COMEX contract -- and all because of that managed money traders that now contaminates the Big 8. But the Big 8 commercial shorts number is overstated by those approximately 8,000 contracts held by that Managed Money short, so that has to be subtracted out...leaving the remaining Big 7 commercial traders short around 56,000 contracts.

Ted's raptors, the small commercial traders other than the Big 8 were buyers during the reporting week -- and always are on these engineered price declines. And netting out that 8,000 contracts held by the Managed Money trader, the raptors bought somewhere between 2,500 and 3,000 long contracts during the reporting week.

Don't forget, that despite their small size, they're still commercial traders in the commercial category -- and all in the Swap Dealers category.

Here's Nick's 3-year COT Report for silver, updated with the above data. Click to enlarge.

But despite a bit of 'fuzziness' of the number surrounding the short position held by that one managed money trader that currently contaminates the Big 4/8 commercial net short position, its very presence gives some indication of the white-hot bullish set-up that now exists in silver from a COMEX futures market perspective.

All these 8,000 or more short contracts by that managed money trader has to be covered at some point [and some of that may have happened on Thursday] -- and will just add more of Ted's 'rocket fuel' to the next rally.

And whether this one turns into his 'big one' or not, remains to be seen. And if it is, it will only happen when the key members of the Big 4/8 commercial shorts are instructed to stand aside.

In gold, the commercial net short position rose by 9,723 COMEX contracts, or 972,300 troy ounces of the stuff.

They arrived at that number by reducing their long position by 13,181 contracts -- and also reduced their short position by 3,458 COMEX contracts. It's the difference between those two numbers that represents their change for the reporting week.

Under the hood in the Disaggregated COT Report it was all Managed Money traders, as they increased their net long position by 12,045 COMEX contracts ...which they accomplished by increasing their gross long position by 6,223 contracts -- and also reduced their gross short position by 5,822 contracts.

The Other Reportables also did some buying...increasing their net long position by 1,902 COMEX contracts. The Nonreportable/small traders had to be sellers during the reporting week in order to balance things out -- and they were, to the tune of 4,224 COMEX contracts.

Doing the math: 12,045 plus 1,902 minus 4,224 equals 9,723 COMEX contracts, the change in the commercial net short position.

The commercial net short position in gold now sits at 180,241 contracts/ 18.024 million troy ounces of the stuff...up those 9,723 contracts...from the 170,518 contracts/17.052 million troy ounces they were short in the February 2 COT Report.

The Big 4 shorts only increased their net short position by an insignificant 320 contracts...from 132,541 contracts, down to 132,861 contracts...which was really good news.

But the Big '5 through 8' shorts increased their short position...from the 65,780 contracts they held short in the February 2 COT Report, up to 72,508 contracts held short in the current COT Report...a an increase of 6,728 COMEX contracts. They've never been shy about increasing their short positions when required -- and that was on full display this reporting week.

The Big 8 commercial short position increased from 198,321 contracts/ 19.832 million troy ounces, up to 205,369 contracts/20.537 million troy ounces...an increase of 7,048 COMEX contracts.

Ted's raptors, the small commercial traders other than the Big 8 shorts, were also sellers during the reporting week....decreasing their net long position by 2,674 COMEX contracts. They are now net long 25,128 contracts -- and that's after being net short 2,809 contracts just five weeks ago.

Their selling of long contracts had the mathematical effect of increasing the commercial net short position which, as I've stated on many occasions, is not an increase at all.

Don't forget that despite their small size, the raptors are still commercial traders in the commercial category -- and are in direct competition with the Big 4/8 shorts for all the contracts sold by the managed money traders et al. That applies to the silver raptors as well.

Here's Nick Laird's 3-year COT Report chart for gold, updated with the above data. Click to enlarge.

The increase in the commercial net short position during the reporting week was no surprise. The surprises were that it wasn't more -- and the really pleasant one was the fact that the Big 4 commercial shorts did virtually nothing. Plus a bit more than a quarter of that increase involved Ted's raptors selling long positions, which stated just above, is not really an increase at all.

The other good news is that because of the punk price action in gold since the Tuesday cut-off -- and was also being closed below its 50-day moving average yesterday, pretty much guarantees that this increase has all been reversed -- and then some.

However, there are still two more days left in the reporting week, so I guess guess one shouldn't count these particular chickens before they hatch.

Gold, from a COMEX futures market perspective, is still in a bullish configuration, although nowhere near as bullish as silver.

It will be interesting to see what 'da boyz' do next week with China closed for New Years. Will they press their advantage? But in a note I received from gold analyst John Brimelow yesterday...a bear raid would most certainly trigger buying from India. [There's a story about this from him in the Critical Reads section further down.]

If this in fact occurred, silver would be beaten even lower -- and India would certainly step up to the plate in that precious metal as well. It's a lose/lose situation for the big bullion banks.

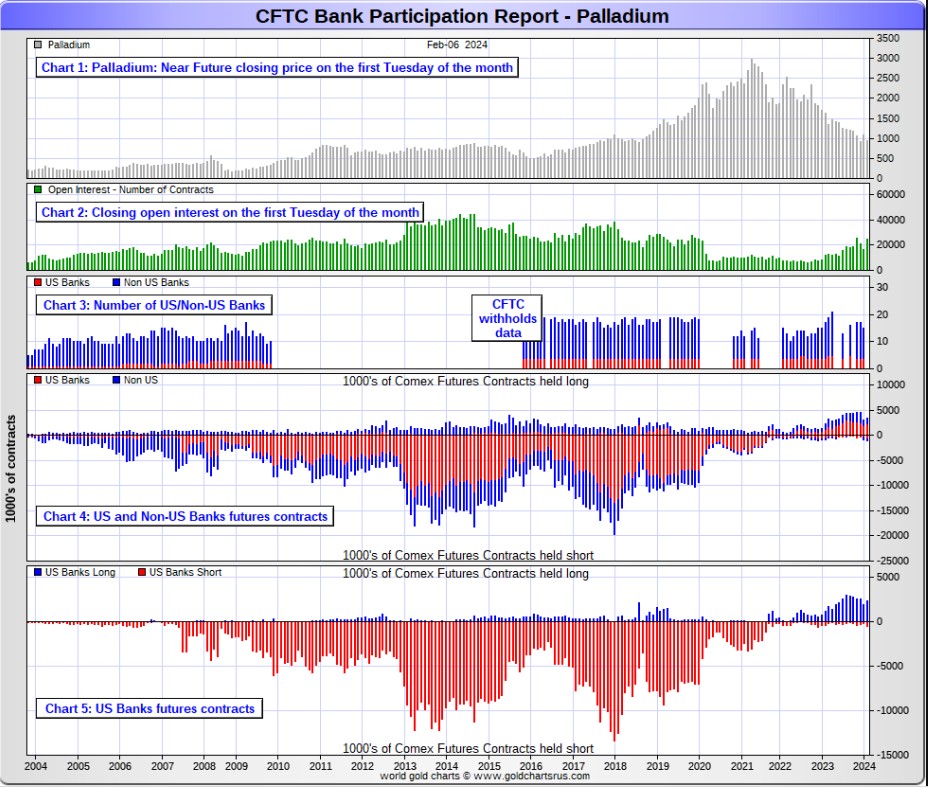

In the other metals, the Managed Money traders in palladium increased their net short position by a smallish 205 COMEX contracts...and remain net short palladium by a whopping 10,605 contracts...43 percent of total open interest. The commercial traders remain very net long palladium in both categories...especially the Swap Dealers. The traders in the Other Reportables category remain net short palladium by a bit...whereas the Nonreportable/ small traders are now back to being net long by a tiny amount.

And as I mentioned in Friday's column, the above data is "yesterday's news". The managed money traders are even more short palladium since the Tuesday cut-off.

In platinum, the Managed Money traders increased their net short position by 3,571 COMEX contracts during the reporting week -- and are now net short 4,748 contracts. They're also a good deal more short since Tuesday's cut-off. The Producer/Merchant category is mega net short 22,455 COMEX contracts -- and are the only other category net short platinum. The Swap Dealers in the commercial category are net long platinum by 6,726 contracts. The traders in the Other Reportables and Nonreportable/ small traders remain net long platinum by very decent amounts...especially the Other Reportables -- and both categories increased their net long positions further in this COT Report. It's the world's banks in the Producer/Merchant category that are 'The Big Short' in platinum, as per yesterday's Bank Participation Report.

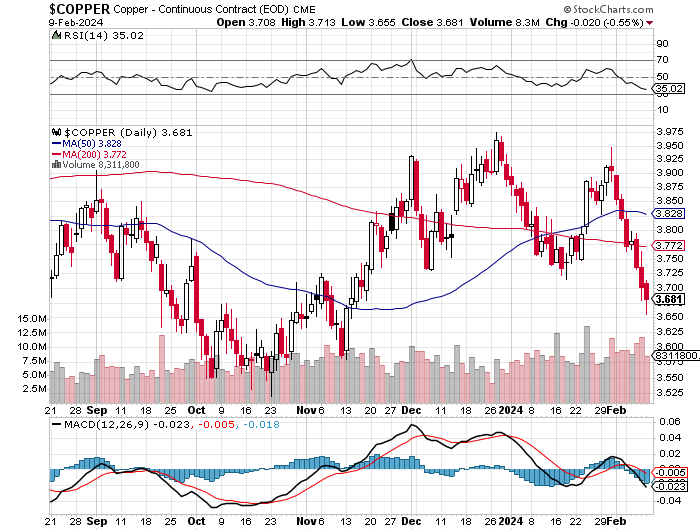

In copper, the Managed Money traders increased their net short position by a hefty 17,296 COMEX contracts -- and are now net short copper by 22,117 COMEX contracts...about 553 million pounds of the stuff as of yesterday's COT Report...compared to the 120 million pounds they were net short in last Friday's report. It's a lead-pipe cinch that they're now even more mega short since the Tuesday cut-off.

Copper, like platinum, continues to be a wildly bifurcated market in the commercial category. The Producer/Merchant category is net short 26,916 copper contracts -- and the Swap Dealers are net long 37,804 COMEX contracts.

And also like in platinum, the Producer/Merchant category is the only other category net short copper...as the Other Reportables and Nonreportable/small traders are net long copper as well.

Whether this means anything or not, will only be known in the fullness of time. Ted says it doesn't mean anything as far as he's concerned, as they're all commercial traders in the commercial category. However, this bifurcation has been in place for as many years as I can remember -- and that's a lot.

In this vital industrial commodity, the world's banks...both U.S. and foreign ...are net long 9.6 percent of the total open interest in copper in the COMEX futures market as shown in the February Bank Participation Report that came out yesterday...down from the 11.5 percent they were net long in January's.

At the moment it's the commodity trading houses such as Glencore and Trafigura et al., along with some hedge funds, that are net short copper in the Producer/ Merchant category, as the Swap Dealers are mega net long, as pointed out above.

But as I also pointed out, I'm sure the banks have a larger long position now than stated above, as copper has taken quite a beating since the Tuesday cut-off -- and the banks would certainly have been buyers.

The latest Bank Participation Report came out yesterday -- and that's covered a bit further down. The next Bank Participation Report is due out on Friday, March 8.

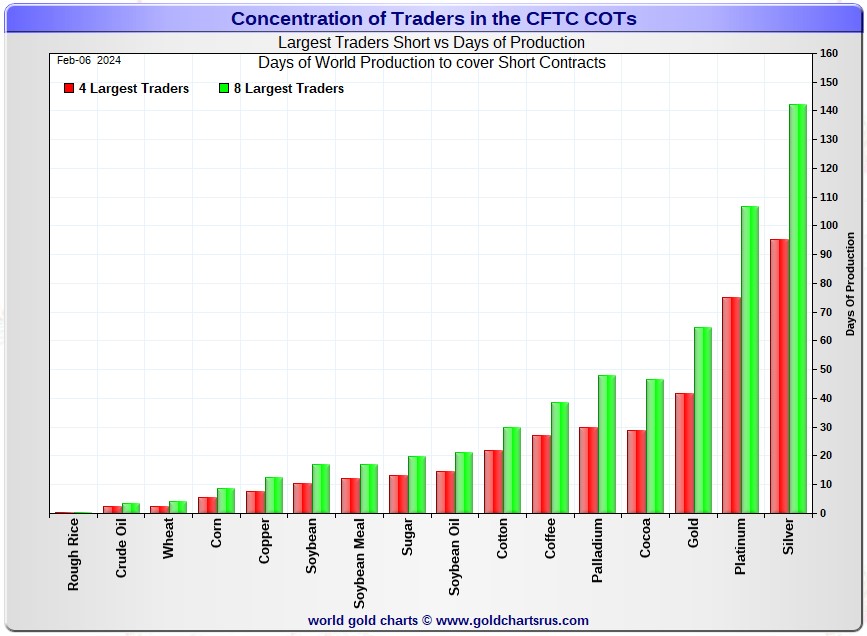

Here’s Nick Laird’s “Days to Cover” chart, updated with the COT data for positions held at the close of COMEX trading on Tuesday, February 6. It shows the days of world production that it would take to cover the short positions of the Big 4 — and Big '5 through 8' traders in every physically traded commodity on the COMEX. Click to enlarge.

In this week's data, the Big 4 traders are short about 95 days of world silver production...up about 1 day from last week's report. The ‘5 through 8’ large traders are short an additional 47 days of world silver production...up about 3 days from last week, for a total of about 142 days that the Big 8 are short -- and up about 4 days from last week's report.

Those 142 days that the Big 8 traders are short, represents about 4.7 months of world silver production, or 320.45 million troy ounces/64,089 COMEX contracts of paper silver held short by these eight mostly commercial traders. Several of the largest of these are now non-banking entities, as per Ted's discovery a year or so ago. Yesterday's Bank Participation Report continues to confirm that this is still the case -- and not just in silver, either.

Ted's raptors, the small commercial traders other than the Big 8 shorts, did what they always do on engineered price declines...they added their long positions...between 2,500 and 3,000 contracts worth.

In gold, the Big 4 are short about 42 days of world gold production... unchanged [not surprisingly] from last week's COT Report. The '5 through 8' are short 23 days of world production, up about 3 days from last week...for a total of 65 days of world gold production held short by the Big 8 -- and obviously up 3 days from last Friday's COT Report.

The Big 8 commercial traders are short 43.5 percent of the entire open interest in silver in the COMEX futures market as of yesterday's COT Report, down from the 45.5 percent that they were short in the February 2 COT Report -- and that percentage drop is almost all due to those uneconomic and market neutral spread trades that have been put on so far this month. And once those have been subtracted out, the percentage they are short silver would be a bit over 50 percent of total open interest. In gold, it's 49.0 percent of the total COMEX open interest that the Big 8 are short, up a lot from the 46.1 percent they were short in the February 2 COT Report -- and a bit over the 55 percent mark once their market-neutral spread trades are subtracted out.

The reason for that big percentage increase in gold was entirely due to the fact that total gold open interest fell by 11,207 contracts during the reporting week...which affects the above calculation. The reason gold open interest fell was entirely delivery-related...as both the long and short sides of each contract disappears once the deliveries have taken place.

Ted is still of the opinion that Bank of America is short about one billion ounces of silver in the OTC market, courtesy of JPMorgan & Friends. He's also of the opinion that they're short 30 million troy ounces of gold as well. And with the latest OCC Report in hand for Q3/2023 that came out recently...he hasn't changed his mind one bit on that.

As reported further up, the short position in SLV now sits at 12.61 million shares as of yesterday's short report...down 25.13% from the 16.84 million shares sold short in the prior report.

The next short report is due out on Tuesday, February 27.

The situation regarding the Big 4/8 commercial short position in gold and silver is still obscene -- and not much changed, except for some of the players, in yesterday's COT Report.

As Ted has been pointing out ad nauseam forever, the resolution of the Big 4/8 short positions will be the sole determinant of precious metal prices going forward -- which should be totally obvious to all, but obviously isn't.

And [as I keep mentioning] if it is obvious to most, which I believe it is, it just means that they don't have the gonads to speak the words in public...after being wrong for decades. It's a sad state of denial that the entire precious metals world lives in -- and I've experienced it first hand on countless occasions in the more than 25 years I've been involved in it.

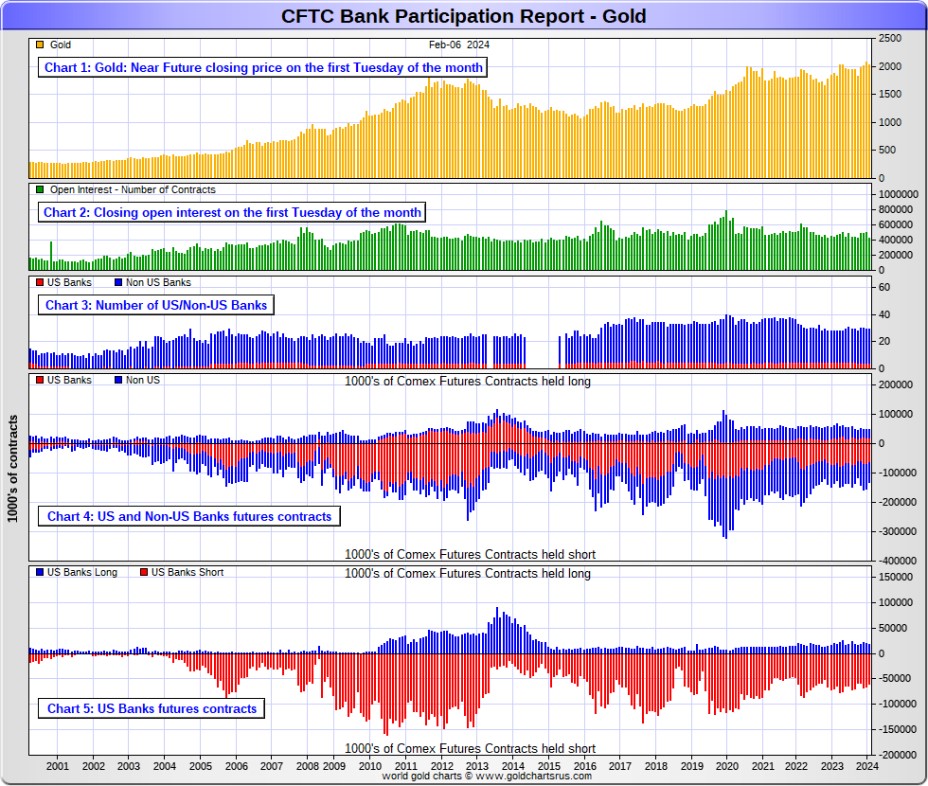

The February Bank Participation Report [BPR] data is extracted directly from yesterday's Commitment of Traders Report. It shows the number of futures contracts, both long and short, that are held by all the U.S. and non-U.S. banks as of this past Tuesday’s cut-off in all COMEX-traded products.

For this one day a month we get to see what the world’s banks have been up to in the precious metals. They’re usually up to quite a bit -- and they were...with the standout being gold.

[The February Bank Participation Report covers the four-week time period from January 2 to February 6 inclusive]

In gold, 4 U.S. banks are net short 41,635 COMEX contracts, down 5,888 contracts from the 47,523 contracts that these same 4 U.S. banks were short in January's BPR.

Also in gold, 25 non-U.S. banks are net short 40,945 COMEX contracts, down a hefty 16,039 contracts from the 56,984 contracts that these same 25 non-U.S. banks were short in January's BPR...the second monthly decrease in a row.

At the low back in the August 2018 BPR...these same non-U.S. banks held a net short position in gold of only 1,960 contacts -- so they've been back on the short side in an enormous way ever since.

Although some of the largest U.S. and foreign bullion banks are in the Big 8 short category in gold, some of the hedge fund/commodity trading houses are short equal if not more grotesque amounts of gold than the banks...as mentioned further down. It's also a strong possibility that the BIS could be short gold in the COMEX futures market as well.

As of February's Bank Participation Report, 29 banks [both U.S. and foreign] are net short only 19.8 percent of the entire open interest in gold in the COMEX futures market...down from the 20.2 percent that these same banks were net short in the January BPR.

That 19.8 percent is a fairly small number.

But it should be pointed out that the Big 8 commercial traders in gold are short 49.0% of total open interest between them...so that leaves some non-banking entities in that category short the remaining [49.0 minus 19.8] = 29.2 percentage points....which is even more obscene than the 19.8% held short by the largest banks in the Big 8 category.

Here’s Nick’s BPR chart for gold going back to 2000. Charts #4 and #5 are the key ones here. Note the blow-out in the short positions of the non-U.S. banks [the blue bars in chart #4] when Scotiabank’s COMEX short position was outed by the CFTC in October of 2012. Click to enlarge.

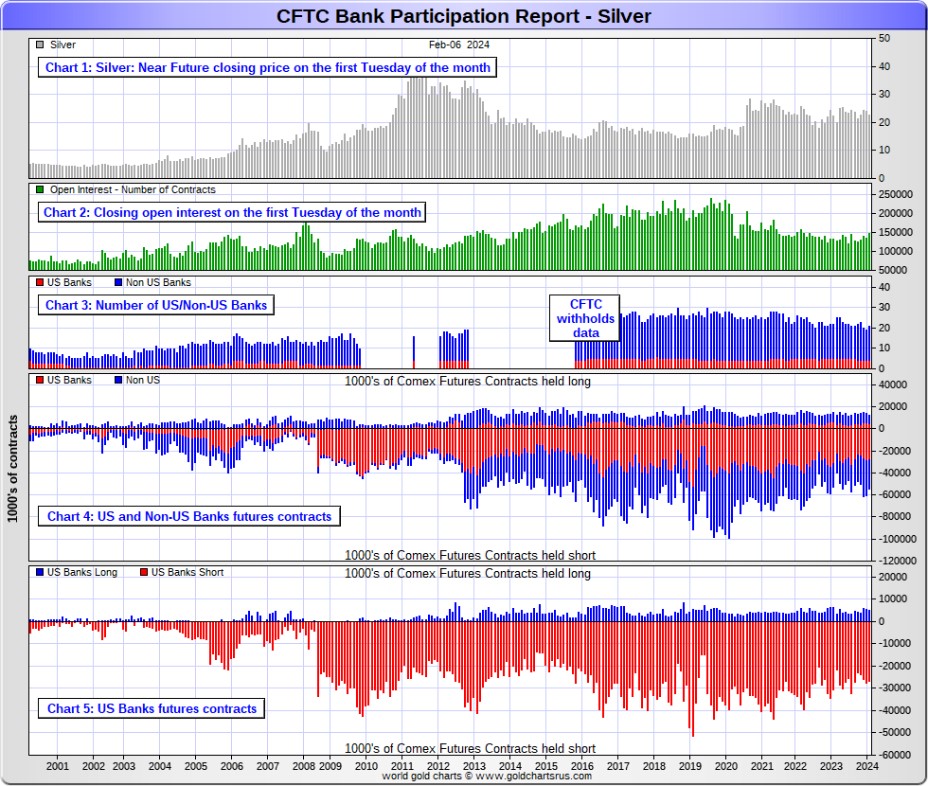

In silver, 4 U.S. banks are net short 21,171 COMEX contracts, down a tiny 433 contracts from the 22,204 contracts that these same 4 U.S. banks were short in the January BPR.

The biggest short holders in silver of the five U.S. banks in total, would be Citigroup, Wells Fargo, Bank of America, Morgan Stanley...maybe Goldman Sachs -- and also JPMorgan from time to time.

And, like in gold, I have my suspicions about the Exchange Stabilization Fund's role in all this...although, also like in gold, not directly.

Also in silver, 17 non-U.S. banks are net short 20,036 COMEX contracts, down 3,746 contracts from the 23,782 contracts that 15 non-U.S. banks were short in the January BPR.

I would suspect that HSBC, Barclays and Standard Chartered hold by far the lion's share of the short position of these non-U.S. banks...as does Canada's Scotiabank/Scotia Capital still. And, like in gold, the BIS could also be actively shorting silver as well. The remaining short positions divided up between the other 12 or so non-U.S. banks are immaterial — and have always been so. The same can be said of most of the 25 non-U.S. banks in gold as well.

As of February's Bank Participation Report, 21 banks [both U.S. and foreign] are net short 28.4 percent of the entire open interest in the COMEX futures market in silver — down from the 34.1 percent that 19 banks were net short in the January BPR.

That 28.4 percent is a larger number than the 19.8 percent in gold. The Big 8 are short 43.5 percent of the total open interest in silver...so the hedge funds and trading houses are only short [43.5 minus 28.4 equals 15.1 percentage points] of total open interest between them, which is still a decent amount.

But, unlike gold, the short positions of the banks in silver are almost three times as large as those held by the hedge funds and commodity trading houses.

Here’s the BPR chart for silver. Note in Chart #4 the blow-out in the non-U.S. bank short position [blue bars] in October of 2012 when Scotiabank was brought in from the cold. Also note August 2008 when JPMorgan took over the silver short position of Bear Stearns—the red bars. It’s very noticeable in Chart #4—and really stands out like the proverbial sore thumb it is in chart #5. Click to enlarge.

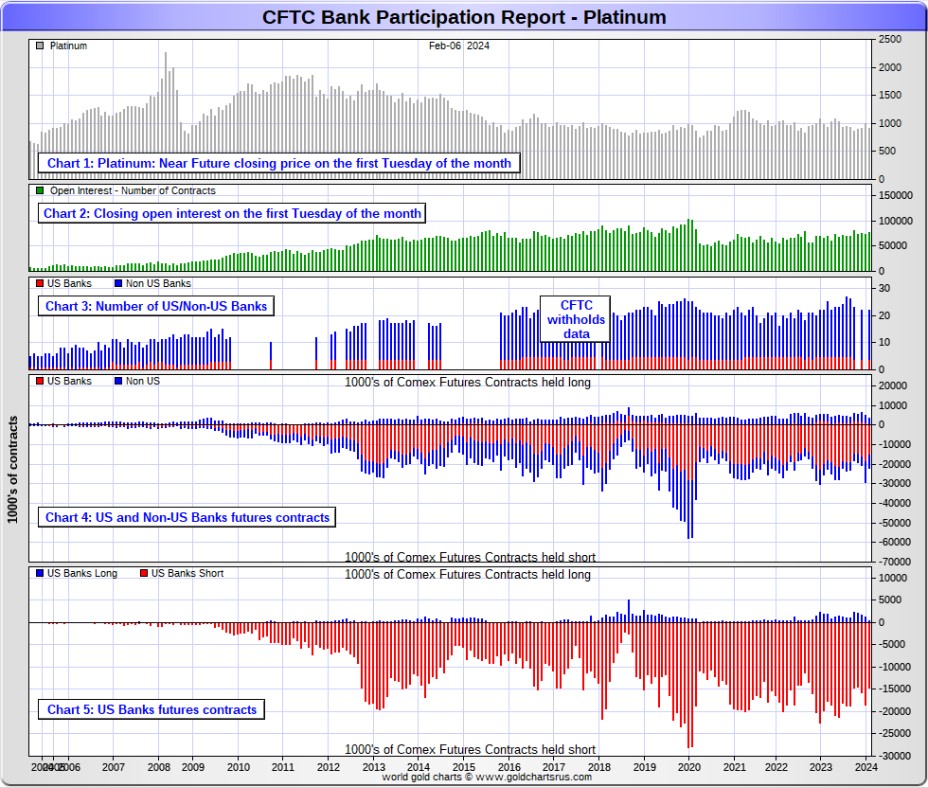

In platinum, 4 U.S. banks are net short 14,166 COMEX contracts in the February BPR, down a hefty 2,975 contracts from the 17,141 contracts that 3 U.S. banks were short in the January BPR.

At the 'low' back in September of 2018, these U.S. banks were actually net long the platinum market by 2,573 contracts. So they have a very long way to go to get back to just market neutral in platinum...if they ever intend to, that is. They look permanently stuck on the short side to me, a fact that I point out regularly.

Also in platinum, 18 non-U.S. banks decreased their net short position by 2,754 contracts...down to 4,777 contracts from the 7,231 contracts that 19 non-U.S. banks were net short in the January BPR.

And since the Tuesday cut-off, it's a good bet that these bullion banks have reduced their net short position in platinum even further.

Platinum remains the big commercial shorts No. 2 problem child after silver...but a very distant No. 2 down the list. How it will ultimately be resolved is unknown, but most likely in a paper short squeeze, as the known stocks of platinum are minuscule compared to the size of the short positions held -- and that's just the short positions of the world's banks I'm talking about here.

And as of February's Bank Participation Report, 18 banks [both U.S. and foreign] were net short 24.2 percent of platinum's total open interest in the COMEX futures market, which is down a fair amount from the 33.0 percent that 22 banks were net short in January's BPR.

Here's the Bank Participation Report chart for platinum. Click to enlarge.

In palladium, 3 U.S. banks are net long 1,791 COMEX contracts in February's BPR, up a piddling 75 from the 1,716 contracts that 4 U.S. banks were net long in the January BPR.

Also in palladium, 15 non-U.S. banks are net long 606 COMEX contracts, up from the 435 contracts that 15 non-U.S. banks were net long in the January BPR.

And like for platinum [and copper] the world's banks have certainly added to their long positions in palladium since the Tuesday cut-off.

And as I've been commenting on for almost forever, the COMEX futures market in palladium is a market in name only, because it's so illiquid and thinly-traded. Its total open interest in yesterday's COT Report was only 24,581 contracts...compared to 77,077 contracts of total open interest in platinum...147,333 contracts in silver -- and 419,121 COMEX contracts in gold.

But I should point out that open interest in palladium has been on a slow but steady increase over the last year and a bit, because I remember times when it was less than 10,000 contracts.

As I say in this spot every month, the only reason that there's a futures market at all in palladium, is so that the Big 8 commercial traders can control its price. That's all there is, there ain't no more.

As of this Bank Participation Report, 15 banks [both U.S. and foreign] are net long 9.8 percent of the entire COMEX open interest in palladium ...down from the 13.2 percent of total open interest that 17 banks were net long in the January BPR. The reason the percentage dropped in this report instead of rising, was the huge increase in total open interest...which dilutes the percentage calculation.

For the last 3+ years, the world's banks have not been involved in the palladium market in a material way. And with them still net long, it's all hedge funds and commodity trading houses that are left on the short side. The Big 8 commercial traders, none of which are banks, are short 36.2 percent of total open interest in palladium as of yesterday's COT Report.

Here’s the palladium BPR chart. Although the world's banks are net long at the moment, it remains to be seen if they return as big short sellers again at some point like they've done in the past. Click to enlarge.

Excluding palladium for obvious reasons, and almost all of the non-U.S. banks in gold and silver...only a small handful of the world's banks, most likely no more than 5 or so in total -- and mostly U.S.-based, except for HSBC, Barclays, Standard Chartered -- and most likely the BIS...continue to have meaningful short positions in the other three precious metals.

As I pointed out above, some of the world's commodity trading houses and hedge funds are also mega net short the four precious metals...far more short than the U.S. banks in some cases. They have the ability to affect prices if they choose to exercise it...which I'm sure they're doing at times. But it's still the big bullion banks at Ground Zero of the price management scheme.

And as has been the case for years now, the short positions held by these Big 4/8 traders, is the only thing that matters...especially the short positions of the Big 4...or maybe only the Big 1 or 2. How this is ultimately resolved [as Ted said earlier] will be the sole determinant of precious metal prices going forward.

The Big 8 commercial traders, along with Ted's raptors...the small commercial traders other than the Big 8 commercial shorts...continue to have an iron grip on their respective prices -- and it will remain that way until they either relinquish control voluntarily, or are told to step aside.

However, considering the current state of affairs of the world's banking and financial system as it stands today -- and the structural deficit in silver -- the chance that these big bullion banks and commodity trading houses could get overrun at some point, is not zero -- and certainly within the realm of possibility if things go totally non-linear.

And as Ted keeps reminding us from time to time, if they do finally get overrun...it will be for the very first time...which obviously wasn't allowed to happen this past week, either.

I have a very decent number of stories, articles and videos for you today...including quite a few that I've been saving for today's column for length and/or content reasons.

CRITICAL READS

80 Percent of CMBS Office Loans At Risk of Default or Workout in 2024

Roughly 80 percent of the $15.2 billion of commercial mortgage-backed securities (CMBS) office loans expected to mature this year are at risk of failing to refinance, according to a new report from Moody’s Analytics.

Moreover, approximately $5.6 billion in CMBS office maturities from 2023 were extended into 2024, of which $3.1 billion is either being worked out or has already defaulted.

The jarring status of CMBS office debt comes from a Moody’s Analytics report authored by Matt Reidy, Christopher Rosin, Kevin Fagan and Twinkle Roy. The economists found that only 35 percent of 2023’s $8.1 billion in office CMBS maturities were paid off at par, and 2024 is expected to experience similar rates of defaults or modifications as even more debt reaches maturity.

“It’s a big number, especially when you add that onto the maturities that were already scheduled for 2024,” Reidy, director of CRE research at Moody’s, told CO. “Everything is just sort of hanging out there and isn’t paying off.”

Unquestionably, size is the determining factor in whether a loan can be expected to be paid off at maturity. Of the 66 CMBS office loans below $10 million that matured in 2023, 88 percent were paid off at maturity; compare that to the 21 CMBS loans over $100 million that matured in 2023 and saw only 29 percent pay off at maturity.

This not overly surprising news story appeared on the commercialobserver.com Internet site on Wednesday -- and I found it in the Friday edition of the King Report. Another link to it is here. Gregory Mannarino's post market close rant for yesterday is linked here -- and runs for about 17 minutes.

Deflation & Inflation -- Doug Noland

[I]t’s no coincidence that China’s Bubble deflates while the U.S. Bubble wildly inflates. An apt Friday evening Bloomberg headline: “Stock Mania Rages On as S&P500 Closes Above 5,000.” To go along with record corporate debt issuance, there was a flurry of new all-time highs to end the equities trading week – S&P500, S&P1500, Nasdaq100, NASDAQ Composite, NASDAQ Transportation, NASDAQ Insurance, Philadelphia Semiconductor (SOX), NYSE Healthcare, Russell 1000, Russell 3000, NYSE Arca Computer Technology, NYSE Arca Institutional, and other indices.

There will be no backing down on my part. I’m convinced that extending “Terminal Phase Excess” - in history’s greatest Bubble - is so fraught with peril. While central to the bullish market narrative, waning consumer price inflation is today detrimental to system stability. At this point, it’s a full-fledged mania. Speculation and speculative leverage are running wild.

It is critical that financial conditions tighten. The Powell Fed’s December “dovish pivot” only stoked financial excess. Not only will the eventual Bubble deflation be more destabilizing for the markets and economy. But today’s raging Bubble will disregard more hawkish Fed push-back. Markets today have no fear whatsoever that the Fed might interrupt the party with tighter conditions.

The Fed can celebrate mission accomplished in their dual mandate of full employment and price stability. Meanwhile, I see nothing but acute price instability, especially in the asset markets. Our central bank has over recent decades repeatedly ignored William McChesney Martin’s sage teachings: It’s the Fed’s job to take away the punch bowl just as the party gets going. Having spiked the punch a number of times to ensure the good times keep rolling, our central bank is content today to sheepishly walk away and disavow responsibility for the drunken mess.

This somewhat longish, but worthwhile commentary from Doug was posted on his Internet site close to midnight last night -- and another link to it is here.

Unbelievable Connection Between LTCM, The GFC and What Lies Ahead in 2024 -- Jim Rickards

This conversation wasn’t just an inside account of LTCM and a recall of history at of those famous crossroads, Jim Rickards and Jeff ruminate over the implications from the affair which are still reverberating through time right up to this day. The struggles to contain the fallout from the debacle are every bit as relevant now as it was shocking way back then.

Well, dear reader, in my conversations with Jim over the years, he revealed to me that he was the source of much of what was in Roger Lowenstein's classical novel..."When Genius Failed: The Rise and Fall of Long-Term Capital Management"...as he was their legal council, so was up to his neck in it from start to finish.

This fascinating interview goes down that proverbial rabbit hole a bit and, unfortunately, there's a Part 2 to this interview, but it's hidden behind the host's pay wall. But the 28-minute interview you can watch here, shows just how rotten the current financial system was back then -- and still is now. It appeared on the youtube.com Internet site back on January 14 -- and another link to it is here.

Putin on the U.S. -- Bill Bonner

Tucker Carlson’s interview with Vladimir Putin was a hot story all over the world yesterday. It began with a partial transcript, sent around in the morning; the video followed in the evening.

This was important for several reasons.

First, Carlson seems to have bolted from the Democratic/Republican juggernaut. The two mainstream parties, along with the whole Establishment of universities, press, Wall Street, Pentagon, and the federal government itself – all have embraced a childish ‘good guys vs. bad guys’ narrative. Russia, in their minds, is a bad guy.

Second, he has also broken ranks with the media itself. The American press operates as a propaganda arm for the government. Press releases from the White House and the Pentagon are passed along as ‘news.’ Enemies are identified…and then described as ‘brutal’…’terrorists’…who make ‘unprovoked’ attacks and are often ‘backed’ by even more evil opponents.

The last thing the U.S. press will do is go to the source and get an alternative opinion.

Third, real journalism could even get you put in jail. Newsweek magazine reported that the European Union might block Carlson’s visit since he could be seen as ‘assisting’ a ‘war criminal.’ [Putin].

This longish but very worthwhile commentary from Bill showed up on his website on Friday -- and comes to us courtesy of Roy Stephens. Another link to it is here.

Tucker Madness is Good for America -- Scott Ritter

The former Fox News talk show host-turned independent media phenomenon, Tucker Carlson, is in Moscow, where he has committed the mortal sin of interviewing Russian President Vladimir Putin. The interview is scheduled to air at 6 pm eastern time on Thursday, February 8. Let there be no doubt—Tucker Carlson has pulled off one of the most memorable journalistic accomplishments in modern history, and when the interview does air, it will—literally and figuratively—break the internet.

As someone who has travelled to Russia twice in the past year to engage in “people’s diplomacy” designed to advocate for better U.S.-Russian relations, I applaud Tucker Carlson’s decision to go to Moscow and get this interview. The American people have been infected with a virulent case of Russophobia transmitted to them via a political and economic elite who have built a model of American relevance predicated on the need for an enemy capable of sustaining a military industrial and congressional complex by justifying an expansive budget that leaves America weaker and shareholders wealthier.

Rampant Russophobia threatens American security by creating a false sense of danger around which policies that could lead to a military confrontation with Russia—and nuclear war—are formulated and implemented. If the American people are to have any hope of surviving the next decade, then an antidote to the disease of Russophobia must be administered. This antidote is not difficult to acquire—it consists of fact-based truth grounded in a realistic understanding of the world we live in, inclusive of a sovereign Russia. The real issue is administering this antidote because the traditional vectors for the dissemination of information in America—the so-called mainstream media—have long since been corrupted by the very political and economic elites who are promoting Russophobia to begin with.

Love him or hate Tucker Carlson (I am guilty of having done both; I currently count Tucker as one of the “good guys”), he represents a massive media presence that operates outside the span of control of the informational elite in America, a social media-based presence which, given its association with Elon Musk’s “free speech” platform, X (the former Twitter), cannot be shut down or silenced.

This interesting and very worthwhile commentary from Scott was posted on his Internet site on Wednesday -- and comes courtesy of Roy Stephens. Another link to it is here. The full Putin/Carlson video interview is linked here -- and runs for a bit over two hours.

Glenn Greenwald: Breaking Down the Tucker-Putin Interview

Glenn Greenwald is a journalist, constitutional lawyer, and author of four New York Times best-selling books on politics and law. His most recent book, “No Place to Hide,” is about the U.S. surveillance state and his experiences reporting on the Snowden documents around the world.

This 30-minute video critique is linked here and, like the Putin interview itself, I've had no time to watch it, but will make amends this weekend. I thank Judy Sturgis for bringing it to our attention.

Gold intervention via BIS fell by 4 tonnes in January -- Robert Lambourne

The January statement of account for the Bank for International Settlements was published this week -- and allows an estimate to be made of the volume of gold swaps undertaken by the BIS at the month end: 117 tonnes, a 4-tonne reduction from the swaps volume as of the end of December.

Hence January appears to have been a quiet month in BIS gold swaps. Four tonnes is one of the smallest changes uncovered since GATA commenced its review of these transactions in 2018.

A more detailed report on the use of gold swaps by the BIS was published last week to cover transactions in December 2023.

That report and previous ones said that these swaps are undertaken by the BIS or one or more of their central bank customers, with the swapped gold being accounted for as being held in a BIS-registered sight account at a central bank.

This is most certainly factual, dear reader...but ground zero of the price management scheme remains centered around the Big 4/8 commercial shorts in the COMEX futures market -- and until that changes, nothing changes. This article put in an appearance on the gata.org Internet site yesterday -- and another link to it is here.

Central Banks Taking All the Gold -- Alasdair Macleod

The interview starts off with the current bank crisis in the U.S. -- and expands from there...including the current goings-on in the Middle East, which Macleod has very decent knowledge of. Then the conversation turns to gold.

The level of interest in gold is way down, says Alasdair Macleod, head of research at Gold Money and https://alasdairmacleod.substack.com. But recent developments in the banking system and geopolitical conflicts should lead to much more gold demand. Portfolios are extremely under-weighted in gold investments, he says. While the central banks have been purchasing gold en masse, individual investors have less than 1% invested in the sector. There is simply not enough gold for individual investors to achieve even a minor increase in their allocation, says Macleod..unless the gold price rises much higher.

The interview runs for about 43 minutes -- and it dates from very late in January. I started it at the 1:15 minute mark to get you past the commercial. Another link to it is here. A related Zero Hedge story from the SchiffGold.com Internet site is headlined "World Gold Council: "Blistering Central Bank Buying" Fuels Strong Gold Demand" -- and linked here. I thank Brad Robertson for that one.

Asia Gold India flips to premium, Lunar New Year sparks buying in other hubs

Physical gold dealers in India charged premiums this week for the first time in four months encouraged by a pick-up in purchases as local prices eased, while the approaching Lunar New Year festival boosted activity in China and elsewhere.

"Demand, especially for coins and bars, has seen a slight uptick due to the price correction," said Ashok Jain, proprietor of Mumbai-based gold wholesaler Chenaji Narsinghji.

Local gold prices were around 62,400 rupees per 10 grams on Friday after hitting a record high of 65,040 rupees earlier this month.

The pickup in demand prompted dealers to charge premiums of up to $2 an ounce over official domestic prices - inclusive of 15% import and 3% sales levies - versus last week's $4 discounts.

Wedding season demand has slowly started gaining momentum, encouraging some jewellers to make purchases, said a Mumbai-based bullion dealer with a private bank.

This Reuters story, showed up on their Internet site at 3:13 a.m. PST on Friday morning -- and comes to us courtesy of gold premium expert John Brimelow...who had this comment about it..."Physical gold dealers in India charged premiums this week for the first time in four months $2 vs. (-$4) last week. China $36-$48 amid reports of imports...which I doubt. Chinese Lunar New Year closure February 10th-17th. Often triggers NY raid: India likely to contain." Another link to it is here.

Welcome Stranger' Gold Nugget Anniversary

This week marks the 152nd anniversary of the discovery of Welcome Stranger, the largest alluvial gold nugget ever found. Discovered 1869 in Moliagul, Victoria, Australia, the Welcome Stranger nugget had a calculated refined weight of 3,123 troy ounces and measured 2 feet by 1 foot in size.

The mid 1850s in Australia was a period of great excitement. Just as in California, gold had been discovered, and thousands traveled to Victoria looking to make their fortune. In September of 1852 gold was found in the area of Moliagul – an area which would later become famous for the discovery of Welcome Stranger.

John Deason, a former tin dresser, and Richard Oates were two of the many miners who rushed to the area to make their fortune. Originally from Cornwall, England they had both staked claims in the area of Moliagul and set up small farms to support their operations. Deason was breaking the soil on his claim plot around the roots of a tree in Bulldog Gully near Moliagul in February of 1869 when he struck something hard about 3 cm below the soil.

Originally thinking it was a rock, he hit it a second, then a third time. Finally clearing away the soil he discovered the massive gold nugget. Deason’s son quickly ran to the farm of Oates, his father’s partner, who was plowing his nearby paddock. Oates came over and helped cover up the nugget and they waited until dark when it would be safer to remove it. After they dug out the nugget, they held a party in order to reveal Welcome Stranger to their friends and neighbors.

Deason and Oates took the nugget into the town of Dunolly protected by a bodyguard composed of friends and sold the nugget at the London Chartered Bank of Australia for 10,000 pounds, or around $3-4 million in todays money. At that time there weren’t any scales capable of weighing this large of a nugget, so they had Dunolly based blacksmith Archibald Walls break the nugget into three pieces. The nugget was then melted down and the gold sent to Melbourne as ingots to be forwarded on to the Bank of England, leaving Australia on February 21st. The original nugget is believed to have weighed 241 lbs before being trimmed.

This longish, photo-filled and very interesting article appeared on the georarities.com Internet site way back on February 8, 2021. I thank reader Mark Thomas for sharing it with us -- and is one of the many stories that had to wait until Saturday's column for length reasons. Another link to it is here.

The Photos and the Funnies

Continuing southeast down Peter Hope Road on the Thompson Plateau on July 30, I took these three photos as we approached the tree line. Partially hidden in the center of the second photo is a fairly impressive house...which I suspect is owned by the Douglas Lake Cattle Company, as they own all this land that we'd be driving on for the last while. The third shot, looking mostly west and back in the direction we'd just come, shows that wildfire burning out of control between Merritt and Kamloops. Click to enlarge.

The WRAP

"Understand this. Things are now in motion that cannot be undone." -- Gandalf the White

Today's pop 'blast from the past' dates from 1965 -- and features a 21-year young Diana Ross as lead singer. The song and the group need no introduction -- and the link is here.

Today's classical blast from the past features Sir Edward Elgar's most popular and recognized work -- and as much as I love his Violin Concerto and Enigma Variations...this composition from 1901 was by far his biggest hit. And it really doesn't matter what nationality you are, you pretty much have to dead from the neck up not to get caught up in the spirit of it. It's always the last number performed at the Proms in the Royal Albert Hall every year -- and the audience awaits it with great anticipation and enthusiasm. The link is here.

Gold volume has been shockingly low all week, with Friday being the lowest of them all -- and I've been somewhat surprised that the Big 4/8 shorts haven't been more aggressive than they've been...although they did finally close gold back below its 50-day moving average in the April contract yesterday.

Silver's volume has been pretty light as well -- and although it did close higher by 6 cents in the spot market on Friday, it was closed down 4 cents in its current front month, which is March. It remains just about a dollar below both its 50 and 200-day moving averages...which are only 6 cents apart at the moment.

The other thing quite different about the last two trading session in silver and gold, is that the former has outperformed the latter from a price perspective both days. I'm not sure what should be read into that, if anything...but it is an unusual trading pattern.

Platinum continues to get worked over -- and 'da boyz' now have it 58 bucks below its 50-day moving average, which it was never allowed to close above during the brief rally that it was allowed last month.

And then there's palladium. It was closed at another new low going back to late 2018. It's now $150 below its 50-day -- and an eye-watering 333 bucks below its 200-day -- and back within an eyelash of being oversold.

Copper has been in free-fall since it touched $3.95/pound back at the end of January. It was closed down another 2 cents on Friday at $3.681/pound -- and now far below any moving average that matters.

Along with platinum and palladium, the managed money traders are now mega short copper as well -- and also net short silver as I pointed out in my comments in the COT Report further up.

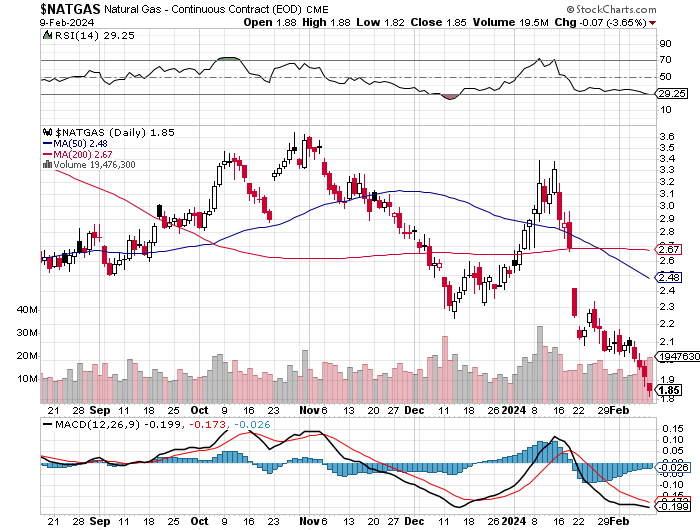

Natural gas [chart included] touched $3.38/1,000 cubic feet in mid January, but was closed at $1.85/1,000 cubic feet by the end of the day on Friday... down another 7 cents -- and 45% below that aforesaid mentioned high. It's now in oversold territory by a bit.

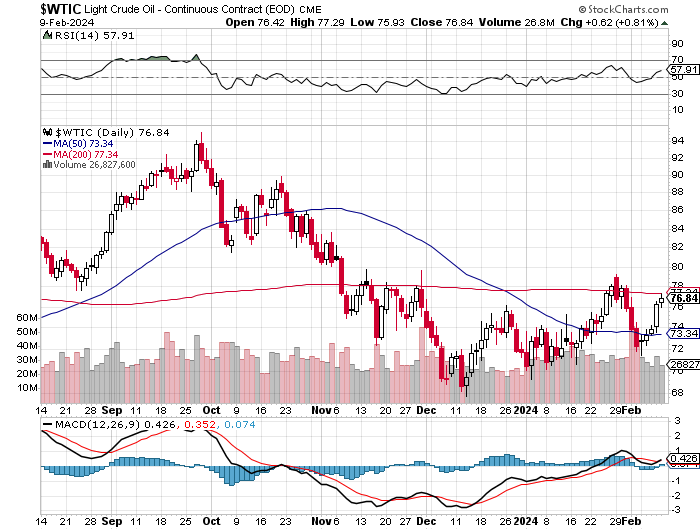

WTIC was the only one of the Big 6 commodities allowed to close higher on the day...up a meagre 62 cents at $76.84/barrel. At its high tick on Friday it was allowed to come within 50 cents of its 200-day moving average. It remains to be seen if it will be allowed to break above that mark.

Here are the 6-month charts for the Big 6+1 commodities...courtesy of stockcharts.com as always and, if interested, their closing prices in their current front months on Friday should be noted. Click to enlarge.

I still have some concern that the commercial traders of whatever stripe are going to go after gold's 200-day moving average. And as I've already mentioned, I'm surprised that they haven't been more aggressive than they have this past week.

At the moment they seem to be having their difficulties with its 50-day moving average, so the the 200-day may prove to a bridge too far. But, as Ted points out from time to time, one must never underestimate their treachery.

However, as John Brimelow mentioned in today's column, any bear raid in gold [and by extension, silver] by the London/New York crowd while China is closed, will arouse more than the usual amount of interest from Indian buyers -- and in the case of silver's current price, it may have already.

And while on the silver subject, it was another frantic week of in/out physical movement in that precious metal...with most of the big action occurring in the COMEX depositories in New York -- and in SLV in London.

Then there are silver deliveries so far this month. On First Day Notice for February, which were posted on the CME's website on January 30...there were 707 silver contracts still open. But so far in February there have already been 1,066 silver contracts delivered, with 244 contracts still open. So that means that another 600 silver contracts have been added to February deliveries during the last seven business days, with about another three weeks left to go.

February isn't a scheduled delivery month for silver...either in the full 5,000 oz. contract, or in the 1,000 oz. mini silver contract...but you'd never know it looking at the numbers so far this month.

And while on the subject of that mini silver contract in February, there have already been 460 of these contracts [1,000 ounce bars] issued and stopped so far this month -- and there are still 416 contracts of open interest still showing. That's 876 one-thousand ounce good delivery bars in total...175 full COMEX contracts.

It's turning out like what happened in January, which is not a scheduled delivery month in either silver or gold, as deliveries in both...particular the latter...were extremely heavy. A lot of buyers didn't want to wait around until February to get gold -- and it looks like some who want silver, don't want to wait until March, its upcoming scheduled delivery month.

I was also somewhat surprised to see the mint produce 850,000 silver eagles so far this month. Who bought those? It wasn't John Q. Public that's for sure. Where did that silver come from to make them.

With the ongoing and deepening structural deficit in silver, it remains to be seen how long the largess of JPMorgan & Friends continues. Ted says that they're the only entity on the planet that has physical silver in size -- and as I mention in every Saturday column, once they back away from filling the supply/demand gap...it's all over, regardless of what the paper hangers in the COMEX futures market in New York do.

Then the silver fox will be amongst the pigeons for sure. Remember that this is a structural deficit. Supply from the mines is a fixed amount -- and will take at least a decade if not longer for supply to catch up to current demand. No other supplies will become available from investors until its price is many, many multiples of what it is now.

But in order for the mining community to do the exploration, drill out the ore bodies and build the mines, far higher prices will be required.

Far higher prices will set a fire under retail and institutional investment demand that will be impossible to satisfy in the short, intermediate or long term, as the physical metal just doesn't exist to fill it.

But if higher prices are allowed by the Big 4/8 shorts, it will set off a short covering rally of Biblical proportions in the COMEX futures market, driving its price [and investment demand] to the moon and stars. One can only fantasize as to what heights investment demand will be driven to then.

The silver price has to be allowed to rise...but from the silver shorts point of view it can't be allowed to. This is a 'Catch 22' situation for the ages that has no solution...none...unless they literally crash the world economy.

JPMorgan can continue to supply physical silver at these stupid cheap prices to meet demand down to the very last good delivery bar if they wish to. But knowing their greed, they'll want to profit big just like the rest of us, their largess will end at some point. It's a given that the powers-that-be know that too -- and one of those powers-that-be is Jamie Dimon.

And as I've been saying regularly for the past twenty years, when this repricing event is allowed to happen, it won't take place in a news vacuum. That's why I'm watching developments in the Middle East and the Persian Gulf as closely as I am. The U.S. power elite et al. haven't gone away -- and I'm just waiting for the next shoe to drop.

For that reason, along with many other, I'm still 'all in' -- and, as always, will remain that way to whatever end.

I'm done for the day -- and the week -- and I'll see you here on Tuesday.

Ed