There was a huge development reported in the silver market last week and how did the precious metal community respond? They basically ignored it. Go figure. So, I will try again to get the word out by presenting it in a different fashion.

Indian silver demand was so strong this year, that it produced a significant drawdown of U.K. silver inventories. Matter-a-fact, India had to access silver from China and Russia because available supplies from the U.K. were not sufficient.

According to GFMS Silver Interim Report released on Nov 18th:

Meanwhile demand for silver bars and coins has soared in recent weeks as bargain hunting retail investors returned to the silver market after a disappointing first half of the year. Nowhere is this more evident than in India where imports of silver are up by 14% year-on-year for the January to October period and set for an annual record. With imports in the first ten months totalling a massive 169 Moz many vaults in the UK, traditionally the largest supplier to India, have seen significant drawdowns, leading to more supply flowing from China and Russia.

As you can see from GFMS statement, they even included the word “Massive” to describe the demand coming from India. I emailed Andrew Leyland, GFMS silver analyst and author of the report, to see if he could put some figures behind the declining U.K. silver inventories. He was nice enough to respond today by stating the following:

The LBMA itself doesn’t hold any silver stocks, but its member companies do. These stocks may be unallocated or allocated (often allocated to ETF holdings) and GFMS survey these stock levels once a year ahead of the silver survey in May.

What we’ve heard so far in 2014 has been anecdotal, that there have been large drawdowns in the UK of unallocated material. This has been backed up by trade data that has seen India increasingly buying from China and Russia while the UK (as the traditional lead supplier to India) has lost market share. While we can’t quantify the drawdown or stock level at this point we thought it worth mentioning the trend. In addition, for the silver survey, we’ll be trying to survey how much material from European bullion stocks is allocated. Silver ETFs holdings have been robust, in comparison to gold, and this could effectively limit available inventory to the silver market moving forward.

Unfortunately, Mr. Leyland could not provide any actual figures, but to state that there have been “LARGE DRAWDOWNS” from U.K. silver inventories is a big issue for the silver market. As stated, U.K. was India’s “traditional lead supplier” of silver. Why the big change? Why did India need to resort to acquiring silver metal from China and Russia if the low paper price signifies a SURPLUS???

Another interesting item Mr. Leyland stated in the response was that this U.K. silver metal was from “unallocated material.” Furthermore, he commented that “Silver ETF holdings have been robust, which could effectively limit silver inventory to the silver market moving forward.”

Let’s understand what we are seeing here. Many in the precious metals community do not believe some (or all) of the data put out by official sources such as GFMS, or the CPM Group. I happen to think there is very good factual data in these reports. However, that being said…. if an official source such as GFMS comes out to say that U.K. silver inventories have experienced a LARGE DRAWDOWN… I would imagine we can take this to the bank as a very reliable silver market trend-change.

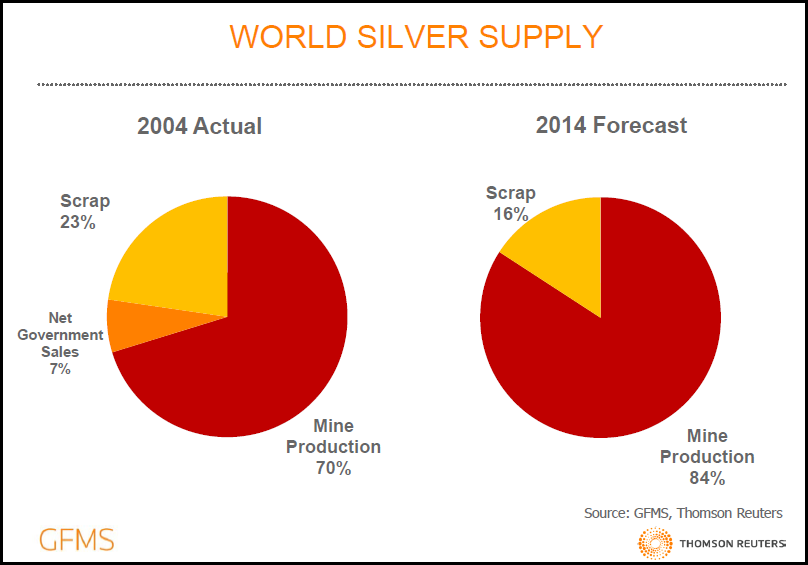

In addition, the silver that India acquired from Russia or China did not come from Government sales as shown in the GFMS chart below:

Russia, India and China have been the predominant source of net government silver sales over the past decade. But, as we can see from this chart, GFMS forecasts no silver supply from official government holdings in 2014.

Which means two things:

1) Russia & China would rather hold onto their official silver holdings, rather than sell it for peanuts

2) India purchasing silver from Russia and China signifies a lack of available inventories from the U.K. — once known as the world’s largest source of wholesale silver supply

I spoke with some people in the industry about this new market development and it may provide more insight as to why we are witnessing near record open interest in the silver market. Normally, when the price of silver falls, so does the open interest. Basically, the longs give in and the shorts cover.

So, on the way down… the open interest declines and the opposite is the case when the price increases. If look at all of this data together, it portends for a very interesting situation going forward. Why would the amount of open interest contracts remain at near record levels when the price of silver is so low?

Maybe the participants who are trading and dealing in the silver market understand that a drawdown of U.K. silver inventories may mean a REAL ACTUAL TIGHTNESS of wholesale silver (not retail) in the future.

Yes, we are speculating here as we don’t have the REAL DATA, but I believe this information is giving us a hint that physical silver demand is finally putting a large enough dent in wholesale silver supplies that is now being reported by official sources.

At some point, physical demand will overwhelm the paper markets pushing the value of silver to such levels even the most ardent precious metal investor thought unimaginable.