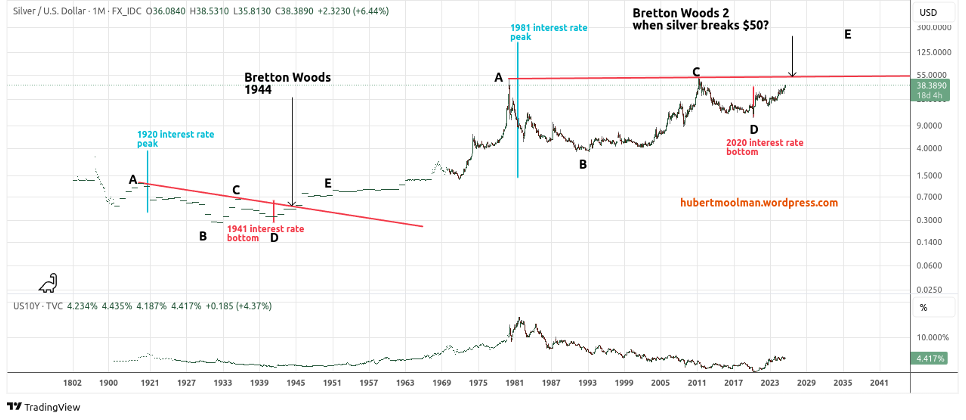

We are creeping closer to the potential for monetary reform previously pointed out. Interestingly, the famous $50 level for silver could represent the risk area for this expected reform.

It is likely that when silver crosses the $50 barrier, we officially enter reset territory based on the similarity of the silver chart to the 1940s when the Bretton Woods agreement was formed.

Both cycles start at major gold/silver ratio bottoms (or silver peaks) in 1919 and 1979, respectively. Very early in the cycles, there were major interest rate peaks (1920 and 1981).

The Bretton Woods agreement came in 1944, a few years after the interest rate bottom and Gold/Silver ratio peak, at a time when Debt-to-GDP ratios were at all-time highs. A similar point on the current pattern will likely be the $50 level (a breakout at the red line).

There is no guarantee that we will get the same timing this time, but it is something to watch. It is very likely that such an event would be triggered or preceded by a stock market crash, though.

Remember, this part of the gold and silver bull market is like a bank run on the world’s premier banker (the US dollar banking system). At some point during this bank run, as gold and silver rise, the bank will default, and a new system will be forced upon the world.

Warm regards

Hubert Moolman