The gold price took two steps higher in early Globex trading until a few minutes after 11 a.m. in Shanghai on their Friday morning -- and from there it was forced to trade sideways until a rally began around 9:45 a.m. in London. That ran into 'da boyz' at the COMEX open in New York -- and again at its high tick, which was set minutes before 10:30 a.m. EST. It was engineered quietly lower in price from there until the market closed at 5:00 p.m.

The low and high ticks in gold were reported by the CME Group as $2,761.00 and $2,794.80 in the February contract...and intraday move of about 34 dollars. The February/April price spread differential at the close in New York yesterday was $27.60...April/June was $25.70...June/August was $23.80 -- and August/October was also $23.80 an ounce.

Gold was closed in New York on Friday afternoon at $2,770.60 spot...up only $17.80 on the day -- and 15 bucks off its Kitco-recorded high tick. Net volume was very quiet at a bit under 110,500 contracts -- and there were just about 91,000 contracts worth of roll-over/switch volume out of February and into future months...mostly April of course, but with noticeable amounts into March, June and August as well.

I saw that another 1,593 gold, plus 112 silver contracts were traded in January yesterday -- and we'll find out later tonight just how much of that shows up in the Daily Delivery and Preliminary Reports...along with who the short/issuers and long/stoppers are.

![]()

![]()

Silver's rally began at 9 a.m. China Standard Time on their Friday morning -- and continued on and off until the not-for-profit sellers/short sellers of last resort appeared in force at 8:45 a.m. in COMEX trading in New York. It was engineered lower in price until the 10 a.m. EST afternoon gold fix in London -- and then had a broad and quiet [and equally managed] up/down move centered around 11:30 a.m. EST -- and ending ten minutes or so before trading ended at 5:00 p.m. EST.

The low and high ticks in silver were recorded as $30.825 and $31.685 in the March contract...an intraday move of 86.0 cents. The March/May price spread differential in silver at the close in New York yesterday was 32.0 cents...May/ July was 29.6 cents -- and July/September was 27.9 cents an ounce.

Silver was closed on Friday afternoon in New York at $30.54 spot...up only 16.5 cents on the day -- and a hefty 51 cents off its Kitco-recorded high tick. Net volume was certainly on the lighter side at at 45,500 contracts -- and there were a bit over 4,000 contracts worth of roll-over/switch volume out of March and into future months in this precious metal...mostly into May, July and September.

![]()

Platinum's initially rally, like silver and golds', ran into 'something' around 11 a.m. in Globex trading in Shanghai -- and it then struggled a bit higher until shortly after Zurich opened. Then 'da boyz' appeared....selling it unevenly lower until it was back below unchanged by 2 bucks at its 12 o'clock noon low in COMEX trading in New York. It struggled a bit higher until the 1:30 p.m. COMEX close -- and didn't do a thing after that. Platinum was closed at $947 spot...up 3 dollars from Thursday -- and 13 bucks off its Kitco-recorded high tick.

![]()

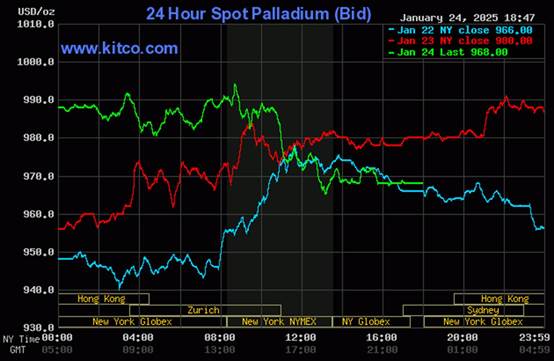

Palladium rallied five bucks or so between 10 and 11 a.m. China Standard Time in Globex trading on their Friday morning -- and then had a broad, quiet and uneven down/up move centered around 10:45 a.m. in Zurich -- and ending when 'da boyz' appeared around 8:40 a.m. in COMEX trading in New York. It was stair-stepped/engineered lower from that juncture until around 1:05 a.m. EST -- and didn't do much of anything after that. Palladium was closed at $968 spot....down 12 bucks on the day -- and 16 bucks off its Kitco-recorded high tick.

Based on the kitco.com spot closing prices in silver and gold posted above, the gold/silver ratio worked out to 90.7 to 1 on Friday...compared to 90.6 to 1 on Thursday.

Here's the 1-year Gold/Silver Ratio Chart...courtesy of Nick Laird. Click to enlarge.

![]()

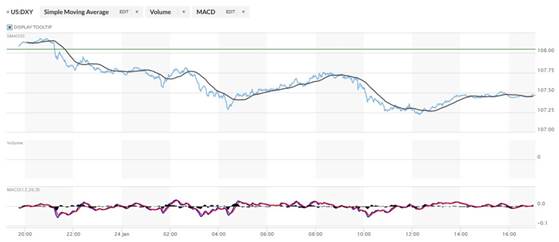

The dollar index closed very late on Thursday afternoon in New York at 108.05 -- and then opened higher by 3 basis points once trading commenced at 7:45 p.m. EST on Thursday evening, which was 8:45 a.m. China Standard Time on their Friday morning. It then proceeded to wander/stair-step its way very broadly lower until its low tick was set around 12:17 p.m. in New York on their Friday afternoon. It then crawled a bit higher until 1:50 p.m. EST -- and didn't do a whole heck of a lot after that.

The dollar index finished the Friday trading session in New York at 107.44...down 61 basis points from its close on Thursday.

Here's the DXY chart for Friday...thanks to marketwatch.com as usual. Click to enlarge.

![]()

Here's the 6-month U.S. dollar index chart...courtesy of stockcharts.com as always. The delta between its close...107.25...and the close on DXY chart above, was 19 basis points below that. Click to enlarge.

![]()

It was more than obvious that the powers-that-be weren't going to allow precious metal prices to fully reflect the decline in the dollar index -- and that price management extended into the rest of the commodities that I track as well.

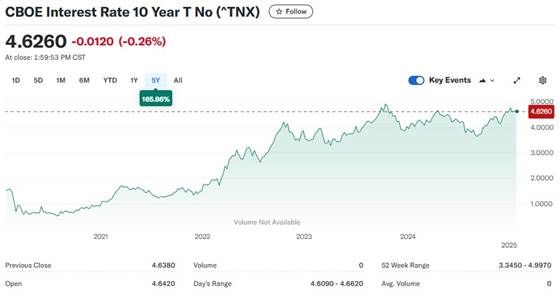

U.S. 10-year Treasury: 4.6260%...down 0.0120/(-0.2587%)...as of the 1:59:53 p.m. CST close

The ten-year closed up 17.0 basis points on the week -- but about 4 basis points off its mid-week high tick on Thursday morning...thanks to the massive intervention by the Fed once again.

Here's the 5-year 10-year U.S. Treasury chart from the yahoo.com Internet site -- which puts the yield curve into a somewhat longer-term perspective. Click to enlarge.

I'll point out once again that the 10-year hasn't been allowed to trade above its 4.92% high tick set back on October 15, 2023 -- and it's more than obvious from this chart that it will he held at something under 5% until further notice.

![]()

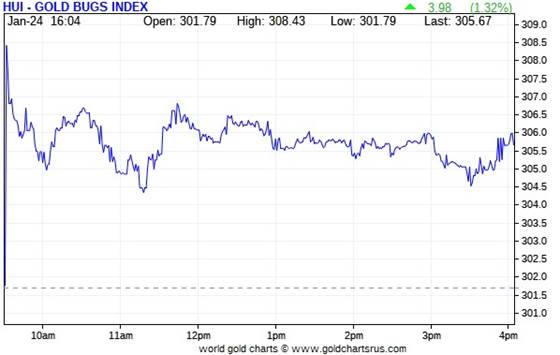

The gold shares gapped up over two percent at the 9:30 opens of the equity markets at 9:30 a.m. in New York on Friday morning, but were sold lower immediately until the 10 a.m. afternoon gold fix in London -- and despite the machinations in the gold price that followed, including its engineered price decline after that, the stocks wandered quietly sideways until the markets closed at 4:00 p.m. EST. The HUI closed higher by 1.32 percent.

![]()

Despite the engineered sell-off in silver, its associated equities performed a bit better than the gold shares, as Nick Laird's 1-year Silver Sentiment Index closed up 1.61 percent. Click to enlarge.

![]()

The star was Thursday's dog, as Silvercorp Metals closed higher by 4.00 percent. The underperformer was First Majestic Silver, closing up only 0.18 percent.

I didn't see any news yesterday on any of the now twelve silver companies that comprise the above Silver Sentiment Index.

The silver price premium in Shanghai over the U.S. price on Friday was 7.96 percent.

The reddit.com/Wallstreetsilver website, now under 'new' but not improved management, is linked here. The link to two other silver forums are here -- and here.

![]()

Here are two of the usual three charts that appear in this spot in every weekend missive. They show the changes in gold, silver, platinum and palladium in both percent and dollar and cents terms, as of their Friday closes in New York — along with the changes in the HUI and the new Silver Sentiment Index.

Here's the weekly chart -- and I'm just delighted that it's green across the board. Like was the case last week, I'm not prepared to read anything into these numbers. Click to enlarge.

Here's the month-to-date chart, which plays double-duty as the year-to-date chart for this one month only -- and like the weekly chart, I'm just happy that it's wall-to-wall green for the third week in a row. And yes, everything gold related is out performing everything silver related...but considering the beating that 'da boyz' have been laying on silver so far this year, I'm just tickled pink that they're doing as well as they are. Click to enlarge.

Of course -- and as I mention in this spot every Saturday -- and will continue to do so...is that if the silver price was sitting close to a new all-time high of $50+ dollars an ounce, like gold is now back within spitting distance of its nominal all-time high of $2,800 the ounce...it's a given that the silver equities would be outperforming their golden cousins...both on a relative and absolute basis -- and by a country mile.

![]()

The CME Daily Delivery Report for Day 18 of January deliveries showed that 1,194 gold -- and 60 silver contracts were posted for delivery within the COMEX-approved depositories on Tuesday.

In gold, there seven short/issuers in total -- and the only three that mattered were British bank HSBC, JPMorgan and Marex...issuing 620, 312 and 217 contracts out of their respective client accounts.

The largest long/stopper by far [of the seven in total] was British bank Barclays, picking up 786 contracts for its client account. The next three biggest after them were Canada's BMO [Bank of Montreal] Capital, Wells Fargo Securities and Morgan Stanley...stopping 140, 118 and 115 contracts respectively...Morgan Stanley for their client account.

In silver, the only short/issuer of the five in total that mattered was JPMorgan, issuing 49 contracts out of their client account. The two biggest long/stoppers were Wells Fargo Securities and BMO [Bank of Montreal] Capital...picking up 37 and 20 contracts for their respective house accounts.

In platinum, there were 2 contracts issued and stopped.

The link to yesterday's Issuers and Stoppers Report is here and, like it's been for a while lately, worth a look if you have the interest.

Month-to-date there have been an absolutely astonishing 17,939 gold contracts issued/reissued and stopped already. During this past week, there were an additional 5,275 gold contracts added -- and that's on top of the 5,215 contracts the week before that -- and the 3,600 gold contracts that were added in the week prior to that one.

In silver, there have been 2,168 contracts issued/reissued and stopped in January so far -- and in platinum that number is 2,670 COMEX contracts. In palladium...it's 8.

This continues to be the wildest non-scheduled delivery month I've ever seen in gold...even blowing the doors off of October last year...a 'pseudo' delivery month in it...according to Ted. However, it doesn't at all compare with the huge amounts of gold that the COMEX took in back in mid 2020.

The CME Preliminary Report for the Friday trading session showed that gold open interest in January rose by 326 COMEX contracts, leaving 2,069 contracts still around...minus the 1,194 contracts mentioned a bunch of paragraphs ago. Thursday's Daily Delivery Report showed that 1,103 contracts were actually posted for delivery on Monday, so that means that 1,103+326=1,429 more gold contracts just got added to January deliveries.

Silver o.i. in January increased by 55 contracts, leaving 66 still open...minus the 60 contracts mentioned a bunch of paragraphs ago. Thursday's Daily Delivery Report showed that only 2 silver contracts were actually posted for delivery on Monday, so that means that 55+2=57 more silver contracts just got added to the January delivery month.

Total gold open interest rose by a further and hefty 13,444 COMEX contracts...a number [like they've been all week] I was not at all happy to see. Total silver o.i. increased by 1,729 contracts...another number I wasn't happy with.

[I checked Thursday's final total open interest numbers -- and the change from the Preliminary Report in gold showed a whopping decline, from +11,129 contracts...down to +4,566 contracts. I was very happy to see that. Total silver o.i. increased by an insignificant 22 contracts...from +1,543 contracts, up to +1,565 contracts. I was hoping for a big drop.]

February open interest in silver rose by a further 117 contracts...to 1,628 COMEX contracts open -- and Februaryo.i. in gold fell by 25,424 COMEX contracts, leaving 219,463 still open.

![]()

For the second day in a row there were withdrawals from both GLD and SLV, as authorized participants removed a further 129,198 troy ounces of gold from the former...plus 683,010 troy ounces from the latter.

In other gold and silver ETFs and mutual funds on Planet Earth on Friday, net of any changes in COMEX, GLD and SLV activity, there were a net 160,238 troy ounces of gold added -- and a net 50,925 troy ounces of silver added as well.

And still nothing so far this month from the U.S. Mint.

![]()

![]()

There's no let-up in sight for the amount of gold pouring into the COMEX-approved depositories on the U.S. east coast. On Thursday, there were another 1,073,382 troy ounces of gold flown in from London -- and nothing was shipped out.

The largest 'in' amount were the 784,022 troy ounces that arrived at Brink's, Inc...with 154,761 troy ounces of that amount added to their 'Enhanced Delivery' sub-depository -- and with the remaining 629,261 troy ounces ending up in their regular depository. Next were the 257,208.000 troy ounces/ 8,000 kilobars that JPMorgan took in...with the remaining 32,151.000 troy ounces/1,000 kilobars arriving at Loomis International.

In the paper department, there were 196,624 troy ounces transferred from the Eligible category and into Registered involving five different depositories -- and the largest amount were the 80,345.349 troy ounces/2,499 kilobars that made that trip over at Malca-Amit USA.

The link to all of Thursday's incredible COMEX gold action is here.

The action in silver was just as incredible, as 4,923,208 troy ounces were flown in from London -- and nothing was shipped out. The largest amount were the 1,929,133 troy ounces that went into Loomis International...followed by the 1,230,508 troy ounces into Brink's, Inc. -- and the 1,147,332 troy ounces dropped off at JPMorgan. The remaining truckload/611,202 arrived at the Asahi depository from their refinery.

In the paper department, there were 963,228 troy ounces transferred from the Registered category and back into Eligible. There was one truckload/599,744 troy ounces that made that trip over at Asahi...with the remaining 363,483 troy ounces getting transferred in that same direction over at Manfra, Tordella & Brookes, Inc.

The link to all of this enormous COMEX silver action on Thursday is here.

And, for a change, there was no in/out activity over at the COMEX-approved gold kilobar depositories in Hong Kong on their Thursday.

The Shanghai Futures Exchange reported that a net 1,131,650 troy ounces of silver were added to their inventories on Friday, which now stands at 44.630 million troy ounces.

![]()

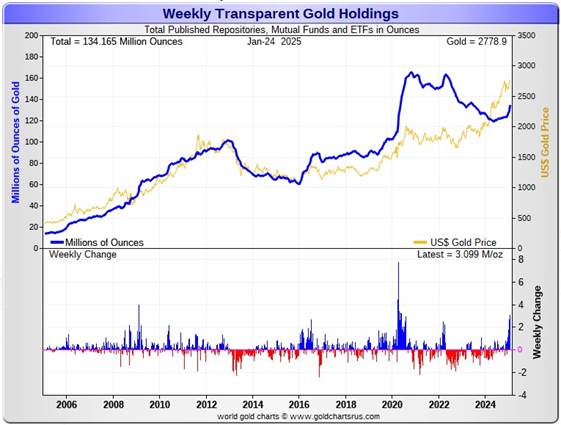

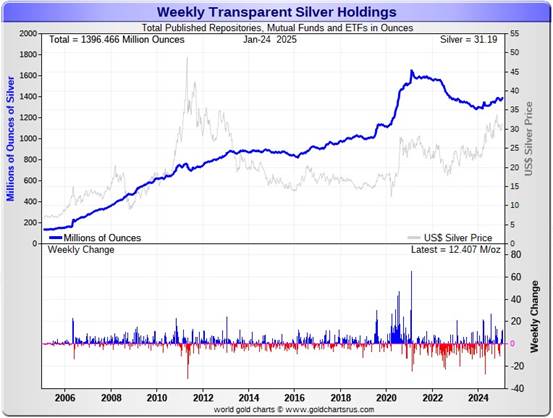

Here are the usual 20-year charts that show up in this space in every weekend column. They show the total amounts of physical gold and silver held in all known depositories, ETFs and mutual funds as of the close of business on Friday.

During the week just past, there were a net 3.099 million troy ounces of gold added...with all of that increase being COMEX related -- and a net 12.407 million troy ounces of silver were also added...virtually all into the COMEX as well. Click to enlarge.

According to Nick Laird's data on his website, a net 6.962 million troy ounces of gold were added to all the world's known depositories, mutual funds and ETFs during the last four weeks -- with virtually all of it going into either the COMEX or GLD...mostly the former. And a net 29.904 million troy ounces of silver were were also added during that same time period.

Retail bullion sales, from what I've heard from my sources, is not all that bad. Premiums remain at rock bottom -- and I haven't seen any sign that they've been raising them at all. There are some really great deals to be had out there. It remains a buyer's market for physical at the retail level, but for a limited time only I'm sure.

At some point there will be large quantities of silver required by all the ETFs and mutual funds once serious institutional buying really kicks in -- and except for what's going into the COMEX, there were few if any signs of that this past week.

But the really big buying lies ahead of us when the silver price is finally allowed to rise substantially, which I'm sure is something that the powers-that-be in the silver world are keenly aware of -- and why they're desperate in their attempts to keep it from rising. Their efforts were on full display once again this past week...but can't last forever.

And as Ted stated a while ago now, it would appear that JPMorgan has parted with most of the at least one billion troy ounces that they'd accumulated since the drive-by shooting that commenced at the Globex open at 6:00 p.m. EDT on Sunday, April 30, 2011.

They had to supply huge amounts to both India and China in 2024 -- and one has to suspect that this amount of demand will continue in 2025 as well...if not increase further. I suspect that all the silver flown into the COMEX from London so far this month, came from their stash.

The physical demand in silver at the wholesale level continues unabated -- and was beyond ginormous again this past week. The amount of silver being physically moved, withdrawn, or changing ownership continued without letup. That was on prominent display during the December delivery month, as 40.435 million troy ounces of physical silver were delivered/changed hands -- and the 10.84 million troy ounces of silver already delivered so far in January, continues to confirm that fact.

New silver has to be brought in from other sources [JPMorgan in London] to meet the ongoing demand for physical metal. That's been more than obvious on the COMEX...plus a bit in SLV and elsewhere. This will continue until available supplies are depleted...which will be the moment that JPMorgan & Friends stop providing silver to feed this deepening structural deficit, now in its fifth year.

The vast majority of precious metals being held in these depositories are by those who won't be selling until the silver price is many multiples of what it is today.

Sprott's PSLV is the third largest depository of silver on Planet Earth with 180.6 million troy ounces...unchanged for the last month --and now an even greater distance behind the COMEX, where there are 346.8 million troy ounces being held...up another 16.1 million troy ounces this past week -- and up 30.7 million oz. in the last four weeks...but minus the 103 million troy ounces being held in trust for SLV by JPMorgan.

That 103 million ounce amount brings JPMorgan's actual silver warehouse stocks down to around the 36.6 million troy ounce mark...quite a bit different than the 139.6 million they indicate they have...up another 2.9 million ounces on the week.

But PSLV is a long way behind SLV, as they are the largest silver depository, with 456.7 million troy ounces as of Friday's close...down 6.6 million troy ounces on the week.

The latest short report from a week ago [for positions held at the close of business on December 31] showed that the short position in SLV dropped by an unimpressive 7.29% from the 50.79 million shares sold short in the prior report...down to a still eye-watering 47.09 million shares in this latest report. This remains grotesque beyond description.

BlackRock issued a warning several years ago to all those short SLV, that there might come a time when there wouldn't be enough metal for them to cover. That would only be true if JPMorgan decides not to supply it to whatever entity requires it...which is most certainly a U.S. bullion bank, or perhaps more than one.

The next short report...for positions held at the close of trading on Wednesday, January 15...will be posted on The Wall Street Journal's website this Monday evening, January 27.

Then there's that other little matter of the 1-billion ounce short position in silver held by Bank of America in the OTC market...with JPMorgan & Friends on the long side. Ted said it hadn't gone away -- and he'd also come to the conclusion that they're short around 25 million ounces of gold with these same parties as well.

The latest report for the end of Q3/2024 from the OCC came three weeks ago now -- and after careful scrutiny, I noted that the dollar value of their derivative positions were up just under 20 percent on average over the last quarter...the same percentage increase as Q1/2024. I suspect that it was entirely due to the price increases in both gold and silver since the Q2 report came out.

This indicator is flawed for one very important reason, as way back 10-15 years ago, this report used to include the top dozen or so U.S. banks -- and included the likes of Wells Fargo and Morgan Stanley, amongst others...that are card-carrying members of the Big 8 shorts. Now the list is down to just four banks...so a lot of data is now hidden...which is certainly the reason that the list was shortened.

![]()

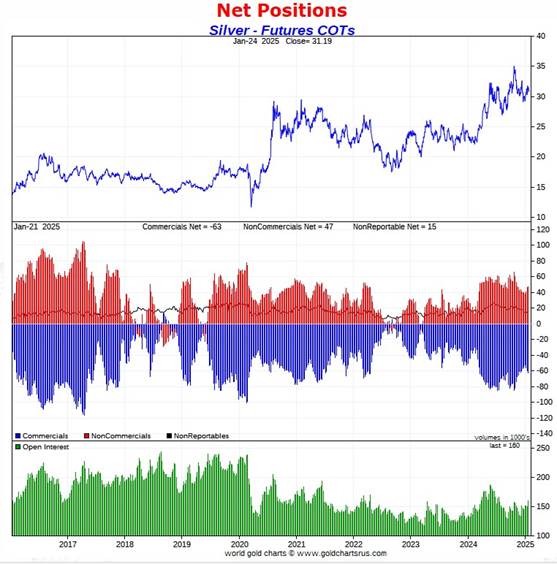

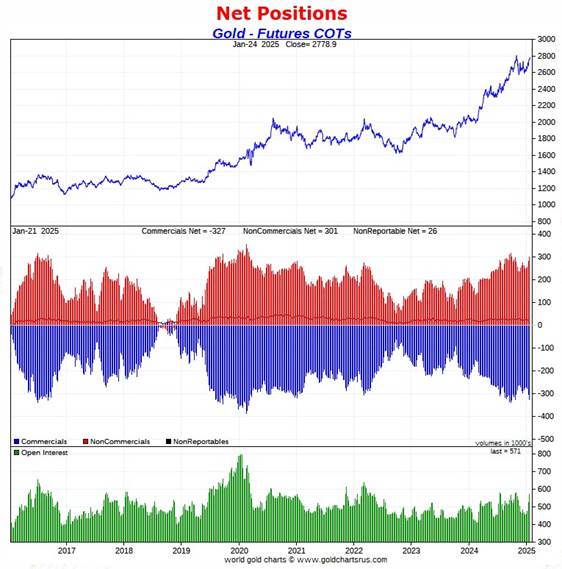

The Commitment of Traders Report, for positions held at the close of COMEX trading on Tuesday, showed the expected increases in the commercial net short positions in both silver and gold -- and far more in gold than I wanted to see.

In silver, the Commercial net short position rose by a further 3,301 COMEX contracts...16.505 million troy ounces. This is the third week in a row that the commercial net short position has risen by more than 3,000 contracts.

They arrived at that number through the purchase of 1,097 long contracts, but also added 4,398 short contracts -- and it's the difference between those two numbers that represents their change for the reporting week.

Under the hood in the Disaggregated COT Report the Managed Money traders didn't do much...decreasing their net long position by 122 COMEX contracts... which the accomplished by adding 2,516 long contracts -- and also added 2,638 short contracts.

All the action was in the Other Reportables and Nonreportable/small trader category...as both increased their net long positions...the former by 1,522 contracts -- and the latter by 1,901 COMEX contracts.

Doing the math: 1,522 plus 1,901 minus 122 equals 3,301 COMEX contracts ...the change in the Commercial net short position.

The Commercial net short position in silver now stands at 62,977 contracts /314.885 million troy ounces...up those 3,301 contracts from the 59,676 contracts/298.380 million troy ounces they were short in last Friday's COT Report.

The Big 4 shorts [most likely the Big 1 or 2] increased their net short position by a further 3,573 COMEX contracts...from 53,830 contracts, up to 57,403 contracts...and the largest short position they've held for as long as I've had records -- and monstrously bearish.

The Big '5 through 8' shorts increased their net short position by 1,557 COMEX contracts...from the 20,449 contracts in the prior COT Report, up to 22,006 contracts in yesterday's COT Report -- and very bearish...but not quite a record short position for them.

The Big 8 shorts in total increased their overall net short position from 74,279 contracts, up to 79,469 COMEX contracts week-over-week...an increase of 5,190 COMEX contracts. This is the largest Big 8 short position since July 16 of last year.

But since the Commercial net short position rose by only 3,301 contracts in yesterday's COT Report -- and the Big 8 increased their short position by 5,190 contracts, this meant that Ted's raptors...the small commercial traders other than the Big 8...had to have been buyers during the reporting week -- and they were...increasing their long position by a further 5,190-3,301=1,889 COMEX contracts.

That increased the raptor's long position from 14,603 COMEX contracts, up to 16,492 contracts. In the October 25 COT Report, they were net short silver by 7,356 COMEX contracts...so they've scarfed up a net 23,848 long contracts since then...which the Big 8 commercial shorts would have dearly love to have bought.

Here's Nick's 9-year COT chart for silver -- and updated with the above data. Click to enlarge.

It was the Big 8 to the rescue to prevent the silver price from blowing to the moon this past reporting week...with the Big 1 or 2 commercial shorts most likely doing most of the heavy lifting. And as I pointed out a bunch of paragraphs ago. The short position of the Big 4 traders is the largest its been in modern times.

They also had to go short against their fellow traders in the commercial category...Ted's raptors...to the tune of 1,889 contracts...proving that there's no honour amongst thieves at times.

The Big 8 collusive commercial traders are now net short 49.7 percent of the total open interest in silver in this week's COT Report, compared to the 49.4 percent they were net short in the last COT Report.

That number in silver would have been over 50 percent if it had not been for the 9,535 contract increase in total open interest...which obviously affects the percentage calculation.

However, no matter how you slice it or dice it, from a COMEX futures market perspective, the set-up remains off-the-charts bearish.

However, I'm slowly coming to the conclusion that the Big 8 collusive commercial shorts have no intention of ever covering any or all of their short positions -- and it's now strictly a price management tool. It's always been that way, of course...but is now institutionalized. I have more on this in The Wrap.

However, nothing has changed with regards to that ongoing and deepening structural deficit in the physical market...which The Silver Institute now estimates to be 282 million troy ounces in 2024.

The price action continues to indicate that silver wants to rise to reflect that, but it's not being allowed at the moment -- and certainly wasn't again on Friday, as the paper hangers on the COMEX made sure of that.

As it's been for decades, it only matters what the collusive Big 8 commercial traders do...all of which are bullion banks or investment houses. Right now they're sitting there like a lump -- and the cork in the bottle in the silver price as short sellers of last resort.

The proof of that lies in the fact that the net short position of the Big 8 traders has risen by 10,750 COMEX contracts over the last three weeks...53.75 million troy ounces of paper silver sold short. Looking at that number, you don't have to wonder why the silver price isn't going anywhere, regardless of what the supply/demand fundamentals are. I'll have more on this in The Wrap.

![]()

![]()

In gold, the commercial net short position rose by a further and very hefty 24,156 COMEX contracts...or 2.416 million troy ounces of the stuff -- and all three categories of commercial traders were sellers during the reporting week.

They accomplished this by through the purchase of 3,041 long contracts -- and sold a chunky 27,197 short contracts. It's the difference between those two numbers that represents their change for the reporting week.

Under the hood in the Disaggregated COT Report, all three categories were buyers during the reporting week. The Managed Money traders increased their long position by 20,247 COMEX contracts, which they accomplished through the purchase of 19,996 long contracts -- and also bought back 251 short contracts. Its the sum of those two numbers that represents their change for the reporting week.

The Other Reportables increased their net long position by 1,174 contracts -- and the Nonreportable/small traders by 2,735 contracts.

Doing the math: 20,247 plus 1,174 plus 2,735 equals 24,156 COMEX contracts, the change in the commercial net short position.

The commercial net short position in gold now sits at 326,608 COMEX contracts/32.661 million troy ounces of the stuff...up those 23,806 contracts from the 302,452 COMEX contracts/30.245 million troy ounces they were short in last Friday's COT Report -- and obviously beyond wildly bearish.

The Big 4 shorts in gold increased their net short position for the fifth week in a row, them by 7,164 contracts...from 191,107 contracts they were short in the last COT report, up to 198,271 contracts in yesterday's report -- and obviously beyond über bearish. They haven't been this short since September 27 of last year.

The Big '5 through 8' shorts also increased their net short position, them for the third week in a row -- and by 2,354 contracts...from the 61,070 contracts they were short in last Friday's COT Report, up to 63,424 contracts held short in the current COT Report...which is a bit on the bearish side for them.

The Big 8 short position in total increased from 252,177 COMEX contracts/ 25.218 million troy ounces in Monday's COT Report...up to 261,695 COMEX contracts/26.170 million troy ounces in yesterday's...an increase of 9,518 COMEX contracts. The Big 8 shorts in total haven't held a short position of this size since October 25 of last year.

But since the commercial net short position increased 24,156 COMEX contracts during the reporting week -- and the Big 8 commercial short position increased by only 9,518 COMEX contracts, that meant that Ted's raptors...the small commercial traders other than the Big 8 had to have been huge sellers during the reporting week just past as well -- and they were. They increased their grotesque short position by a further 24,156-9,518=14,638 COMEX contracts. Their short position is now 64,913 contracts...up from the 50,275 contracts they were short in last Friday's COT Report. This is now a record high short position for them.

Words, as I say in this spot every week, continue to fail me on this issue...as I cannot overemphasize just how grotesque and obscene the raptor short position in gold is on an historical basis -- and despite that huge short position, there's still no way that there's a Managed Money or Other Reportables trader in the Big '5 through 8' category in gold. This is strictly a commercial short position.

Here's Nick's 9-year COT chart for gold -- and updated with the above data. Click to enlarge.

It took all three categories of commercial traders at full battle stations to prevent the gold price from ending at Jupiter...or beyond during the past reporting week -- and since the Tuesday cut-off.

As I've been pointing out for the last month or so, back on October 20, 2023...the total commercial net short position in gold was only 128,000 contracts. In yesterday's report it was a knee-wobbling 326,608 contracts... over 2.5x that amount.

The reason for that huge disparity...besides the 65,000 contracts more short the Big 8 are at the moment, compared to back then...Ted's raptors were net long 68,933 contracts in gold back on that date...vs. being net short 64,913 contracts in yesterday's COT Report. That's a 133,846 contract swing in the raptor's position...13.385 million paper ounces of gold...plus that 65,000 contract increase in the Big 8 short position.

At some point these short positions have to be covered...especially those raptors -- and will only happen on fantastically lower prices, which ain't going to happen...not now, or ever. That's why closing the COMEX remains the only option to save the shorts from Ted's 'Bonfire'.

The Big 8 collusive commercial traders are short 45.8 percent of total open interest in the COMEX futures market...down from the 47.9 percent they were short in the prior COT Report. The reason for that decrease, rather than a big increase, was because of the 44,920 contract increase in total open interest, which obviously dilutes the calculation.

But once you add in the 64,913 contracts currently held short by Ted's raptors, the commercial net short position in gold works out to 57.2 percent of total open interest, down a bit from the 57.4 percent they were short in the prior COT Report. This short position remains grotesque and obscene beyond description.

That percentage number would have also been higher [more that 60%] than it was this week if total gold open interest hadn't risen by those just-mentioned 44,920 contracts...which obviously dilutes the calculation. Some of those are those uneconomic and market-neutral spread trades -- and all of those will disappear by the end of the month.

But make no mistake about it...the commercial traders were going massively short against every long purchased -- and that fact was mostly the reason that total open interest increased so much.

Can gold rally big from here? Of course...as can silver. But it will only come about if the big commercial shorts allow it -- and that obviously wasn't in the cards again yesterday.

But this eye-opening dichotomy between the huge raptor long position in silver vs. the monster short position held by the raptors in gold...remains unprecedented. For the most part, these small traders are all the same players in both these precious metals -- and what that means for their respective prices going forward, is anyone's guess.

To sum up, from a COMEX futures market perspective, the set-up in gold is back to being off-the-charts bearish. But, as said about silver...at some point, as Ted mentioned repeatedly over the years, what the numbers in the COT Report show, won't matter, as they will be trumped by factors beyond the control of the paper hangers in New York.

That process may be in progress now, but it's not being allowed to show up in the prices of either silver or gold. I have more on this in The Wrap.

![]()

![]()

In the other metals, the Managed Money traders in palladium decreased their net short position by a further 869 COMEX contracts -- but remain net short palladium by a whopping 10,889 contracts...57.2 percent of total open interest. The other four categories of traders are all net long palladium... especially the Swap Dealers in the commercial category.

In platinum, the Managed Money traders decreased their net long position by 5,339 COMEX contracts during the reporting week -- and are only net long platinum by 1,841 COMEX contracts at the moment.

The commercial traders in the Producer/Merchant category in platinum are meganet short a knee-wobbling 22,691 COMEX contracts -- but the Swap Dealers in the commercial category are net long platinum by 2,081 contracts. The traders in both the Other Reportables and Nonreportable/small traders categories remain net long platinum by very hefty amounts... especially the Other Reportables.

It's mostly the world's banks in the Producer/Merchant category that are 'The Big Shorts' in platinum in the COMEX futures market, as per January's Bank Participation Report...but are far less short now than they were in the December report.

In copper, the Managed Money traders increased their net long position by a further 4,749 contracts -- and are now net long copper by 19,314 COMEX contracts...about 482 million pounds of the stuff as of yesterday's COT Report ...up from the 364 million pounds they were net long copper in last Friday's COT report. Like in platinum, it was Managed Money short covering that drove the copper price higher during the reporting week...just more paper trading -- and nothing to do with supply/demand fundamentals.

Copper, like platinum, continues to be a wildly bifurcated market in the commercial category. The Producer/Merchant category is net short 42,966 copper contracts/1.074 billion pounds -- while the Swap Dealers are net long 21,237 COMEX contracts/531 million pounds of the stuff.

Whether this means anything or not, will only be known in the fullness of time. Ted said it didn't mean anything as far as he was concerned, as they're all commercial traders in the commercial category. However, this bifurcation has been in place for as many years as I can remember -- and that's a lot.

In this vital industrial commodity, the world's banks...both U.S. and foreign... are net long 8.4 percent of the total open interest in copper in the COMEX futures market as shown in the January Bank Participation Report...down a tad from the 8.9 percent they were net long in December's.

At the moment it's the commodity trading houses such as Glencore and Trafigura et al., along with some hedge funds, that are net short copper in the Producer/Merchant category, as the Swap Dealers are net long, as pointed out above.

The next Bank Participation Report is due out on Friday, February 7.

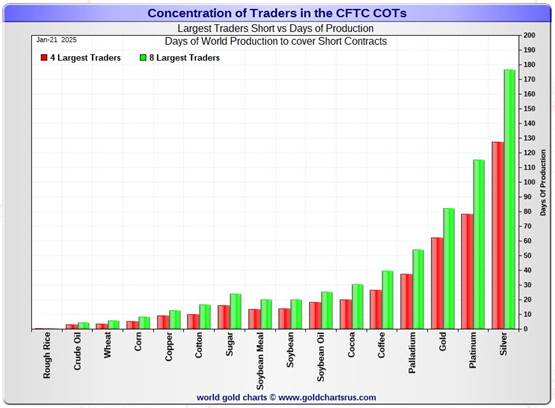

![]()

Here’s Nick Laird’s “Days to Cover” chart, updated with the COT data for positions held at the close of COMEX trading on Tuesday, January 21. It shows the days of world production that it would take to cover the short positions of the Big 4 — and Big '5 through 8' traders in every physically traded commodity on the COMEX. Click to enlarge.

In this week's data, the Big 4 traders are short 127 days of world silver production...up about 8 days from the prior COT report. The ‘5 through 8’ large traders are short an additional 49 days of world silver production ...up about 3 days from the last COT Report, for a total of about 176 days that the Big 8 are short -- and up a whopping 11 days from the last COT report.

Those 176 days that the Big 8 traders are short, represents a hair under 6 months of world silver production, or 397.345 million troy ounces/79,469 COMEX contracts of paper silver held short by these eight commercial traders. Several of the largest of these are now non-banking entities, as per Ted's discovery a year or so ago. January's Bank Participation Report continued to confirm that this is still the case -- and not just in silver, either.

As mentioned further up, the small commercial traders other than the Big 8 shorts, Ted's raptors, are net long silver by 16,492 COMEX contracts...up from the 14,603 contracts they were net long in the last COT Report.

In gold, the Big 4 are short about 62 days of world gold production...up about 2 days from the prior COT Report. The Big '5 through 8' are short an additional 20 days of world production, up about 1 day from last the last report...for a total of 82 days of world gold production held short by the Big 8 -- and obviously up 3 days from last Friday's COT Report.

The Big 8 commercial traders are net short 49.7 percent of the entire open interest in silver in the COMEX futures market as of yesterday's COT Report, down a tad from the 49.4 percent they were net short in last Friday's report. It would have been up more than that if total open interest hadn't increased by a chunky 9,535 contracts during the reporting week... which obviously affects the percentage calculation.

In gold, it's 45.8 percent of the total COMEX open interest that the Big 8 are net short, down from the 47.9 percent they were net short in the last COT Report...but only down because of the huge increase of 44,920 contracts in total open interest during the reporting week, which obviously affects the calculation in it as well.

But the total commercial net short position in gold is 57.2 percent of total open interest once you add in what Ted's raptors [the small commercial traders other than the Big 8] are short on top of that...a further 64,913 COMEX contracts. That percentage would be over 60% if total open interest hadn't increased as much as mentioned in the previous paragraphs.

Ted was of the opinion that Bank of America is short about one billion ounces of silver in the OTC market, courtesy of JPMorgan & Friends. He was also of the opinion that they're short 25 million ounces of gold as well. And the latest report from late December [for Q3/2024] shows that their positions are up 20 percent from what they were holding at the end of Q2/2024...with most of that increase most likely being price related. One wonders if Mr. Buffet is done dumping the rest of the stock he has in that company.

The short position in SLV now sits at 47.09 million shares as of the last COT Report, for positions held at the end of December...down a smallish 7.29 percent from the 50.79 million shares sold short on the NYSE in the prior report. This, as you already know, is off-the-charts grotesque -- but yet another way that 'da boyz' are controlling the silver price.

The next short report is due out this coming Monday, January 27...for positions held at the close of COMEX trading on Wednesday, January 15.

The situation regarding the Big 4/8 commercial short positions in the COMEX futures market in both silver and gold remains beyond wildly bearish in both.

As Ted had been pointing out ad nauseam, the resolution of the Big 4/8 short positions will be the sole determinant of precious metal prices going forward -- although the short positions held by Ted's raptors in gold continues to be a Sword of Damocles in its own right.

I have a fairly decent number of stories, articles and videos for you today.

![]()

CRITICAL READS

2024 U.S. Existing Home Sales Lowest Since 1995

U.S. Existing Home Sales rose for the third straight month in December (longest streak since late 2021), rising 2.2% MoM and up 9.3% YoY - the best annual shift since June 2021...

Contract closings increased in three of four U.S. regions, led by a nearly 4% rise in the Northeast.

“Home sales in the final months of the year showed solid recovery despite elevated mortgage rates,” NAR Chief Economist Lawrence Yun said in a prepared statement.

However, despite the last rebound, for all of 2024, sales reached the lowest since 1995, when the U.S. had about 70 million fewer people. Click to enlarge.

It marked the third straight annual decline, stretches only ever seen in the 2006 housing crisis as well as the recessions around the early 1980s and 1990s.

While sales volume declined, the median sale price, climbed 6% over the past 12 months to $404,400, reflecting more sales activity in the upper end of the market. That helped propel prices for the entire year to a record.

First-time buyers made up 31% of purchases in December, but NAR said the annual share was 24%, the lowest on record.

This brief 4-chart Zero Hedge news item put in an appearance on their Internet site at 10:30 a.m. on Friday morning EST -- and another link to it is here. A somewhat related ZH story from yesterday morning is headlined "U.S. Services PMI Pukes in Preliminary January Data, Manufacturing Back in Expansion" -- and linked here.

![]()

![]()

Morgan Stanley finds 'silent plurality' ready to sell dollar

Traders looking to sell the world’s reserve currency are far more common than thought even as the dollar’s dominance rips across markets, according to Morgan Stanley.

“While dollar bulls are numerous and perhaps most vocal in expressing their views, there seems to be a more ‘silent’ plurality of investors looking to sell the dollar instead,” strategists including David Adams wrote in a note. “Many have dry powder and are waiting for a sign to enter shorts.”

The catalysts may be near: inflation data leading into March may bolster the chance of a Federal Reserve rate cut, while lengthier fiscal negotiations by Congress could disappoint dollar bulls, the team said. The strategists expect a more benign outcome in trade policy, which could also weigh on the dollar, according to the note.

Morgan Stanley’s forecast for the greenback is one of the most bearish among strategists surveyed by Bloomberg. Adams sees the US Dollar Index sliding to 105 by the end of the first quarter and 101 by year-end, compared with the median forecasts of 108.7 and 106.9.

This Bloomberg story from 1:29 a.m. PST on Friday morning was picked up by yahoo.com -- and is the first of two stories that I found embedded in a GATA dispatch. Another link to it is here. Gregory Mannarino's post market close rant for Friday is linked here -- and this one runs for 30 minutes.

![]()

![]()

The world has reached the fraught “terminal phase” of a historic multi-decade super cycle. A period of profound change: monumental technological advancement, policy experimentation, financial innovation, and economic development, with the Internet fundamentally altering social and political behavior.

An unprecedented global financial Bubble unleashed destabilizing wealth inequality – within and between households, communities, regions, and nations. The Internet ensures that myriad injustices, real and perceived, are constantly in our face. Misinformation, conspiracy theories and propaganda run amok. And as traditional norms fade into oblivion, a void is filled by pernicious endeavors for sport and profit.

A jumbled “world order” is at risk of detonating. Wars and the risk of catastrophic war. Climate change, the risk of cataclysmic change, and now commonplace natural disasters. Perceptions of the future have done a disorienting 180: From a tradition of optimism to gloom and foreboding. Populations are worried. People are angry and hankering to cast blame. Mainly, there is a cloud of corrosive insecurity that has distorted how societies function.

Donald Trump and the populist MAGA movement will be studied for generations. President Trump has a unique capacity to tap into anger, bitterness, and insecurity. He is the master at pinpointing sources to blame for the injustices that so many are feeling: immigration; a dysfunctional federal government; the “establishment;” “deep state;” corruption; liberalism; cultural decay; a history of leadership unwilling to demand the world stop taking advantage of the United States; participation in global institutions and arrangements to the perceived detriment of our national interests.

At home and abroad, citizens (voters and otherwise) these days embrace “strongman” leadership. Traditional leaders and parties, unable to allay fears and insecurities, are viewed as ineffective, often incompetent, and worse. Extraordinary powers are surrendered to “strongmen” prepared to forcefully address grievance and injustice.

This interesting commentary from Doug was posted on his Internet site shortly after midnight PST on Saturday morning -- and another link to it is here.

![]()

![]()

Four Very Worthwhile Video Interviews

1. Can there be Peace with Netanyahu? -- Profesor Jeffrey Sachs

This 26-minute video interview with Professor Sachs -- and hosted by Judge Andrew Napolitano, was posted on the youtube.com Internet site on Thursday. This one, like the three that follow, all come to us courtesy of Guido Tricot. The link to this one is here.

2. The Coming World War III -- Colonel Douglas Macgregor

This wide-ranging and very worthwhile 26-minute video interview with the Colonel was also hosted by the Judge. I heard the colonel speak at the Vancouver Resource Investment Conference this past Sunday -- and it was jam packed for both his sessions -- and barely any 'standing room only' space left. The link to it is here.

3. Can U.S. and Russia Have Enduring Peace? -- Professor John Mearsheimer

This 24-minute video interview with the professor with Judge Napolitano as host, appeared on the youtube.com Internet site on Thursday -- and I thank Guido for this one as well. The link to it is here.

4. INTEL Round Table with Larry Johnson & Ray McGovern: Weekly Wrap

This very worthwhile30-minute video interview with the Judge was host posted on the youtube.com Internet site very late on Friday afternoon EST. It's from Guido too -- and the link to it is here.

![]()

![]()

Air Canada ordered to pay just $18,000 for stolen $24 million crate of gold

In the messy aftermath of the Toronto airport gold heist — that saw $24 million in gold bars and cash driven away by thieves from an Air Canada warehouse — the airline has been ordered by the Federal Court to pay Brink’s transport company just $18,600 in compensation for their huge loss because of poorly completed paperwork on the stolen shipment.

Brink’s, a U.S.-based secure transit company, sued Air Canada, the country’s largest airline, after a large crate Brink’s was moving from Switzerland to Canada was stolen from the airline’s warehouse at Pearson airport shortly after arriving on an Air Canada flight from Zurich in 2023.

Inside the shipping crate was currency from various countries being shipped from a Swiss bank to a currency exchange in Vancouver, valued at about $2,800,000 at today’s exchange rate, and gold bars from a metal refinery in Switzerland to the TD Bank in Toronto, valued at about $21,528,000.

Brink’s claimed in its lawsuit the shipment was stolen because of woeful security at the warehouse, which included the alleged involvement of Air Canada employees and equipment, and demanded direct compensation for their loss.

Air Canada responded, saying Brink’s failed to declare the shipment’s value and adequately arrange for special security, and so the only compensation is a standard rate for lost cargo based only on weight — meaning the value per kilogram is the same no matter what was inside a crate or a suitcase, whether a passenger’s dirty laundry or gold bars.

This interesting news item appeared on the nationalpost.com Internet site on Thursday -- and I found it embedded in a GATA dispatch. Another link to it is here.

![]()

![]()

Costco's Gold Bars Remain a Hot Commodity

The Costco shopping experience is now a global phenomenon, with consumers now able to enjoy the wholesale chain's bulk-shopping discounts and $1.50 hot dogs across the U.S. and in places like Taiwan, Japan and Australia.

The company continues to shake up that experience, too. Not only does it manufacture many of its own goods under the Kirkland Signature brand, but two years ago, it began selling gold bars. And since the price of the precious metal hit its all-time high in October 2024, demand for the product offering has remained strong among members.

In fact, Costco’s foray into precious metals has generated eye-popping results. The company is allegedly pulling in six figures in sales each month since its decision to begin selling gold, demonstrating that members have taken to buying gold bars alongside rotisserie chickens and bulk toilet paper. In its 2025 first-quarter report, Costco listed gold among its top sales categories. But for investors looking to gain exposure to the yellow metal, is this the best way?

During the summer of 2023, Costco made the move to start selling one-ounce gold bars at its wholesale locations. The rollout has been so successful that in 2024, the company added silver coins and platinum bars to its offerings. But so far, its gold bars have been the clear winner.

In a note to clients, Wells Fargo analysts said they expect revenue from Costco's gold sales to fall between $100 million and $200 million monthly. The Swiss-made gold bars have repeatedly been selling out since they were first offered. However, this doesn't mean the venture is profitable for Costco. The store receives a low premium on gold purchases, and it offers cash back to certain buyers who use credit cards, meaning gold sales are not contributing to any significant uptick in profits.

As for investors, now is a good time to own gold. The price of the precious metal reached its all-time high of $2,781 per ounce last October. The principal drivers for gold's current bull run are twofold. First, the surge in gold prices can be partially attributed to the Federal Reserve's interest rate policy. Gold historically has an inverse relationship with interest rates, and with the Fed cutting rates throughout the second half of last year, investors saw the precious metal's price surge.

This article put in an appearance on the money.com Internet site on Thursday -- and is the first of several that I 'borrowed' from Sharps Pixley. Another link to it is here.

![]()

![]()

China's 2024 gold consumption slumps 9.58 percent as high prices cut demand

China's gold consumption in 2024 slumped 9.58 percent on the year to 985.31 metric tons, data from the China Gold Association showed, as high gold prices curtailed jewellery demand.

Gold jewellery buying, which accounts for half of the total, plunged 24.7 percent to 532.02 tons, according to the data.

The sharp decline in retail purchasing came as the most-active gold contract on the Shanghai Futures Exchange climbed by 28 percent last year.

Meanwhile, purchases of gold bars and coins, which typically reflect safe-haven demand, jumped 24.5 percent over the year to 373.13 tons, the association said.

High prices significantly curtailed the domestic buying interest in gold jewellery, while industries such as electronics, which require gold and tin for chip production, saw relatively weak demand, said a metals derivative trader, who declined to be named due to company policy.

China's central bank also added gold to its reserves in December for a second straight month, after resuming its buys in November after a six-month hiatus, official data showed earlier this month.

This gold-related news item was posted on thestandard.com.hk Internet site on Friday -- and I found it on Sharps Pixley. Another link to it is here.

![]()

![]()

China ups gold production to 377.24 tonnes

China's domestic gold production in 2024 exceeded 377.24 metric tons, up by 2.087 tons from 2023, reflecting a year-on-year increase of 0.56 percent, according to the latest data from the China Gold Association.

However, gold consumption in the country dropped to 985.31 tons, down 9.58 percent compared to the previous year. Within this total, gold jewelry consumption fell by 24.69 percent to 532.02 tons, while demand for gold bars and coins rose by 24.54 percent to 373.13 tons. Industrial and other uses of gold saw a slight decline of 4.12 percent, totaling 80.16 tons, the association said.

In 2024, despite a sluggish gold jewelry market, Chinese gold and jewelry companies adapted by adjusting their production strategies and promoting product innovation, with trends such as traditional and "Chinese style" gold jewelry gaining traction, the association said.

Amid fluctuations in gold prices, the domestic gold market exhibited strong growth, with significant increases in both transaction volume and value, it added.

Additionally, the People's Bank of China, the country's central bank, added 44.17 tons to its gold reserves throughout the year, bringing the total to 2,279.57 tons by year-end, solidifying its position as the world's sixth-largest holder of gold reserves and marking a new historic high.

The above five paragraphs are all there is to this gold-related story that showed up on the ecns.cn Internet site on Friday -- and I found that one on Sharps Pixley as well. Another link to the hard copy is here.

![]()

QUOTE of the DAY

![]()

The WRAP

"Understand this. Things are now in motion that cannot be undone." -- Gandalf the White

![]()

Today's pop 'blast from the past' has its roots with an Italian/Canadian singer from Montreal -- and he was popular during the 1970/80 time period. Herb Alpert of A&M Records fame signed him up back in 1972 -- and he had a string of hits. This power ballad from 1978 is my favourite -- and the link is here.

Today's classical 'blast from the past' is J.S. Bach's Brandenburg Concerto No. 1 in F major, BWV 1046...which is one six he composed and presented to Christian Ludwig, Margrave of Brandenburg-Schwedt, in 1721.

Of course they are world famous -- and here is the Freiburger Barockorchester on period instruments doing the honours from the Schloss Köthen palace. The link is here.

![]()

![]()

It was another day where the short sellers of last resort/not-for-profit sellers...call them what you will...were out in force to ensure that gold, silver, along with other key commodities, were not allowed to reflect the continuing decline in the dollar index...or frantic demand for physical gold and silver.

Both were closed well off their highs -- and their respective closing prices would have been heaven only knows what price if the collusive commercial traders weren't watching over them during the entire Globex and COMEX trading sessions.

Intraday, gold came within ten bucks of its old nominal high of very late October in the February contract. But silver managed to close back above its 50-day moving average when all was said and done on Friday -- and is still c. $20 below its record high close of forever ago -- and $3.50 below its $35 high of October...more on this further down. If allowed to trade freely yesterday, it would have closed at some spectacular 3-digit number.

The frantic demand for immediate delivery in both was reflected in slight backwardation in January/February gold -- and a contango of only 3.5 cent in January/February -- and 5.0 cents in January/March in silver.

There certainly is a 'squeeze' underway in the physical markets in both these precious metals...but that wasn't allowed to be reflected in their respective prices yesterday...or over the last few weeks.

As Ted Butler pointed out on many occasions..."There are myriad reasons why gold and silver should be price far higher than they are today -- and only one reason why they're not."

Platinum blew through its 200-day moving average with ease yesterday, but those short sellers of last resort ensured that it didn't close there. Palladium was closed far below its high tick as well in its current front month.

Copper, like platinum, blew above its 200-day moving average intraday on Friday, but was also hauled lower and closed below it. Copper was closed down a penny at $4.32/pound -- and 7 cents below its high in its current front month.

Natural gas [chart included] closed lower by 2 cents. It did trade below its 50-day moving average by a bit intraday on Friday, but managed to close above it by a hair. It finished the day at $3.45/1,000 cubic feet.

WTIC rallied above its 200-day moving average intraday, but was also hauled down and closed below it. It finished the Friday trading session in New York at $74.66/barrel...up an insignificant 4 cents per.

Here are the 6-month charts for the Big 6+1 commodities...courtesy of stockcharts.com as always and, if interested, their COMEX closing prices in their current front months on Friday should be noted. Click to enlarge.

As reader John Glavin pointed out on the phone yesterday, we're back to within spitting distance of gold's old nominal high of $2,800...which was set in very late October 2024...but silver is still being held about $3.50 below its high of October 22...despite its stunning supply/demand fundamentals. That how pernicious the short selling has been in it...with the short position of the Big 4 commercial traders at a record high going back as far as I have records.

Make no mistake about it, the Big 8 shorts in silver -- and all the commercials in gold, Ted's raptors included, are moving heaven and earth in order to prevent their respective prices from blowing to the moon and beyond.

And as bad as it was in yesterday's Commitment of Traders Report, the commercial net short positions in both these precious metals has increased substantially since the Tuesday cut-off.

There's little if any precedent for what's unfolding in the precious metals world at the moment...or what will happen when 'da boyz' finally reach the end of their rope. I've stated many times over the last couple of decades that the moment that the price management system in the commodities ends, the world's financial system will be a smouldering ruin in five business days or less...as the short positions held by most major banks and investment houses will burn them to the ground, as per Ted's "Bonfire of the Silver Shorts" linked here once more.

As it stands right now, the shorts are now under water by at least $25 billion in unbooked margin call losses -- and the situation now is far worse than when Ted penned that essay back in September of 2023.

And, once more, I'll dig out that now 25-year old essay by British economist Peter Warburton for the benefit of the quite a few new subscribers that have been kind enough to sign up to my column in the last month or so.

It's headlined "The Debasement of World Currency: It is inflation, but not as we know it". Warburton penned that tome back in April 2001 -- and I stumbled across it a few months later -- and I've featured it countless times in this space since.

Under the sub-heading "Central banks are engaged in a desperate battle on two fronts"...Peter had this to say...

"What we see at present is a battle between the central banks and the collapse of the financial system fought on two fronts. On one front, the central banks preside over the creation of additional liquidity for the financial system in order to hold back the tide of debt defaults that would otherwise occur. On the other, they incite investment banks and other willing parties to bet against a rise in the prices of gold, oil, base metals, soft commodities or anything else that might be deemed an indicator of inherent value. Their objective is to deprive the independent observer of any reliable benchmark against which to measure the eroding value, not only of the U.S. dollar, but of all fiat currencies. Equally, they seek to deny the investor the opportunity to hedge against the fragility of the financial system by switching into a freely traded market for non-financial assets.

It is important to recognize that the central banks have found the battle on the second front much easier to fight than the first. Last November I estimated the size of the gross stock of global debt instruments at $90 trillion for mid-2000. How much capital would it take to control the combined gold, oil, and commodity markets? Probably, no more than $200 billion, using derivatives. Moreover, it is not necessary for the central banks to fight the battle themselves, although central bank gold sales and gold leasing have certainly contributed to the cause. Most of the world's large investment banks have over-traded their capital [bases] so flagrantly that if the central banks were to lose the fight on the first front, then the stock of the investment banks would be worthless. Because their fate is intertwined with that of the central banks, investment banks are willing participants in the battle against rising gold, oil, and commodity prices.

Central banks, and particularly the U.S. Federal Reserve, are deploying their heavy artillery in the battle against a systemic collapse. This has been their primary concern for at least seven years...[That was 1994 and earlier - Ed]. Their immediate objectives are to prevent the private sector bond market from closing its doors to new or refinancing borrowers and to forestall a technical break in the Dow Jones Industrials. Keeping the bond markets open is absolutely vital at a time when corporate profitability is on the ropes. Keeping the equity index on an even keel is essential to protect the wealth of the household sector and to maintain the expectation of future gains. For as long as these objectives can be achieved, the value of the U.S. dollar can also be stabilized in relation to other currencies, despite the extraordinary imbalances in external trade."

The reality is, of course, that this battle has been ongoing since Nixon took the U.S. off the gold exchange standard back in August of 1971 -- and in some advanced stage of its final death throes now..."slowly at first, then suddenly".

The short positions held against the precious metals and other commodities in the COMEX futures market is where the last battle in the fiat currency/hard asset war is being fought. Although bearish beyond measure -- and more so Tuesday's cut-off...I no longer have any fear of this short position, as it's sole purpose now is to prevent is a price controlling mechanism from which the only escape for the shorts is closing the COMEX.

With global demand for physical gold now off the charts, any attempt by the 'da boyz' to engineer prices lower by any amount, will be met with a massive wave of bargain hunters that will no doubt demand delivery. It's a lose-lose situation for the shorts of whatever stripe.

The financial powers-that-be can't afford to let a market-clearing short covering rally of Biblical proportions to take place in the options of futures markets. In order to save themselves from utter ruin, closing the exchanges is their only option...allowing the precious metal, along with the rest of the commodity complex to trade without options or futures attached.

When this event does transpire, there will be no precedent for it in history, as it will be a non-linear event for the ages. How the world's financial system and western governments will react when this unfolds, can only be imagined.

We are living through a pivotal moment in history -- and there's no way to know when the end will manifest itself, or what form it will take.

But end it will...either by design, or by circumstance.

![]()

Before closing, I should mention that the next FOMC meeting starts on Tuesday -- and with Trump calling for much lower interest rates, we'll see what the Fed does or doesn't do when the smoke goes up the chimney at the Eccles Building at 2 p.m. EST on Wednesday.

And in all the excitement going on in COMEX gold receipts and deliveries at the moment, not only is the end of the January delivery month coming up hard in five business days, but we also get First Notice Day numbers for February deliveries on Thursday evening EST...only four business days away.

So, by the time Tuesday's column hits your in-box, all the large traders that aren't standing for delivery in February will have to have rolled or sold their remaining February contracts by the COMEX close on Wednesday -- and all the others have to be out by the COMEX close on Thursday. And as pointed out in the previous paragraph, First Day Notice numbers for February will posted on the CME's website around 10 p.m. EST that evening.

February is a scheduled delivery month for gold...but not for silver. However, despite that fact -- and as mentioned further up, silver open interest in February has been climbing quietly but steadily all month. As of the close of trading yesterday it was 1,628 COMEX contracts...up another 117 contracts from Thursday...a truckload.

And as far as gold is concerned, total open interest in February continues to decline -- and was down to 219,463 contracts still open as of the COMEX close on Friday -- and how much of that still remains after the COMEX close next Thursday, will be of some interest...especially considering the rabid gold deliveries in January so far.

And just one more thing...the latest short report will appear on The Wall Street Journal's website sometime around 10 p.m. EST on Monday night -- and I'll be more than interested in what the short position in SLV will be. I'll have that for you in Tuesday's missive.

I'm done for the day -- and the week -- and I'll see you here then.

Ed