Gold Seeker Report Issue #39 ~ This Week In Mining: Volatility, Earnings, and Weakness in Gold Stocks

This was a very volatile week for precious metals and related mining equities. On Monday, gold sold off $100/oz. on the rumor, there might be a successful vaccine for CV19. But this won’t impact gold as the bull market commenced well before the outbreak of CV19. Even if it does work, the vaccine is far from preventing CV19 as it is improbable someone would voluntarily be a guinea pig without knowing the side effects both short and long-term. There are also significant distribution issues. Even in the best-case scenario, the economy will remain at least partially shut down for the foreseeable future. It is still very likely multiple rounds of additional fiscal stimulus will be administered.

We cover most of the company's in this issue at Gold Seeker. We have published company reports for multiple companies mentioned herein. To view the in-depth analysis and valuation, sign up for your free 30-day trial @ Goldseeker.com or sign up for our free email list.

$USAS, $CXB.TO, $EQX, $FSM, $GCM.TO, $GBR.V, $MMX, $HL, $OR, $ROXG.TO, $SSRM, $TGZ.TO, $VGCX.TO, $WPM

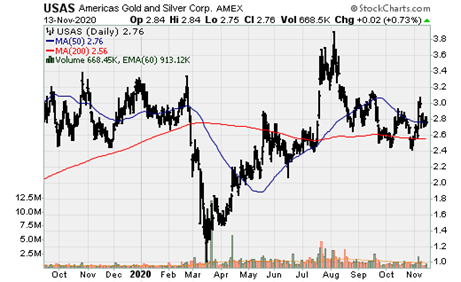

America’s Gold and Silver: Q3 and Q4 are transitional quarters for the company, with its flagship asset, Relief Canyon, on track to achieve commercial production in Q4. The Galena complex recapitalization plan is coming together with an increase in M&I and Inferred resources of 36% and 100% to 37.3m oz. Ag and 78.6m oz. Ag, which is based on just 33% of Phase I planned drilling. The advancement of these two assets is setting up for a strong 2021, assuming Relief Canyon can achieve feasibility levels of production and costs while operations at Galena should be robust and improve every year over the next several years.

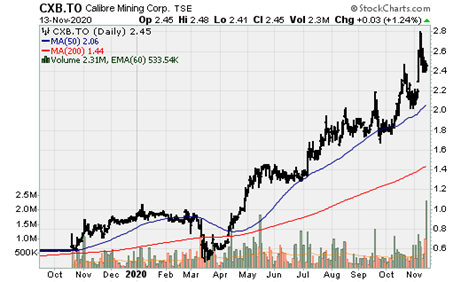

Calibre Mining: One of our favorite junior producers continues to release excellent news flow. Following an excellent quarter, the company published Infill and near-mind drill results. Highlights include:

- 3.9m @ 13.73 g/t Au (Panteon Underground)

- 6.8m @ 28.41 g/t Au (Panteon Underground)

- 4m @ 62.6 g/t Au (Panteon Underground)

- 8.6m @ 4.86 g/t Au (Panteon Underground)

- 12.2m @ 16.97 g/t Au (Limon South Open Pit)

- 1.2m @ 20.7 g/t Au (Limon South Open Pit)

- 2.9m @ 10.3 g/t Au (Limon Central Open Pit)

- 23.6m @ 11.89 g/t Au (Limon Central Open Pit)

- 12.9m @ 5.09 g/t Au (Limon North Open Pit ~ Tigra/Chapparal)

- 10.1m @ 5.28 g/t Au (Limon North Open Pit ~ Tigra/Chapparal)

- 5.6m @ 8.8 g/t Au (Jabali West Underground)

- 7.6m @ 6.3 g/t Au (Jabali West Underground)

- 3.7m @ 8.19 g/t Au (Panteon Underground)

- 14.3m @ 2.34 g/t Au (Rosario Gold Prospect ~ Libertad)

- 5.1m @ 7.96 g/t Au (Rosario Gold Prospect ~ Libertad)

- 1.5m @ 17.26 g/t Au (Nancite Gold Prospect ~ Libertad)

Read full report:

https://goldseek.com/article/gold-seeker-report-issue-39-week-mining-volatility-earnings-and-weakness-gold-stocks