With prices above $60 an ounce, many speculate that industrial demand for silver will fall due to substitution. However, the Silver Institute projects industrial demand will rise as offtake from vital technology sectors accelerates over the next five years.

“Silver will remain an essential component across multiple high-growth sectors as industries race to embrace digital innovation and meet clean energy mandates.”

Along with green energy initiatives, including solar power and electric vehicles, AI infrastructure is expected to use increasing amounts of silver.

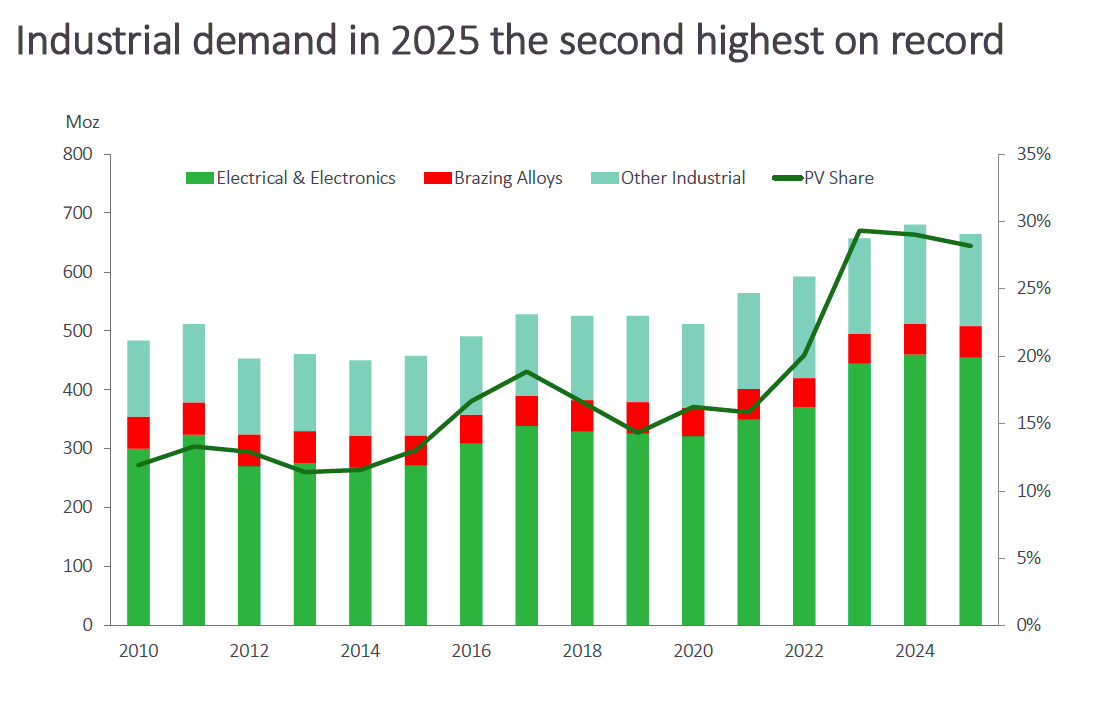

Last year, industrial demand for silver hit the highest level on record.

According to the Silver Institute, industrial demand will soften moderately this year, declining by about 2 percent due to “global economic uncertainty stemming from tariff policies and geopolitical tensions, as well as a more rapid pace of thrifting due to soaring silver prices.” However, despite the modest drop in demand, 2025 will still likely come in with the second-highest silver industrial offtake on record, and it is expected to continue growing in the near future.

Solar Energy

Silver is the best conductor of electricity of all metals at room temperature. That makes it a vital input in the production of solar panels.

Solar photovoltaic technology ranks among the most significant and fastest-growing sources of silver demand.

In 2014, the solar sector only accounted for around 11 percent of silver demand. That rose to 29 percent in 2024.

According to a research paper by scientists at the University of New South Wales, solar manufacturers will likely require over 20 percent of the current annual silver supply by 2027. By 2050, solar panel production will use approximately 85–98 percent of the current global silver reserves.

There are some potential headwinds for solar energy silver demand.

As the Silver Institute noted, although the global trajectory of PV installations remains strong, technological developments have reduced the amount of silver required in some PV cells. As the price of silver continues to rise, there will undoubtedly be increasing efforts to substitute. However, silver's superior characteristics make this a difficult prospect.

There is also the potential for a decrease in government subsidies for the solar energy sector in the near future, particularly in the U.S. However, the Silver Institute expects this will likely be offset by ambitious targets in others. For example, the European Union has set a target to deliver at least 700 gigawatts of solar capacity by 2030.

EVs

The EV revolution is driving substantial increases in silver demand.

Electric vehicles require significantly more silver than internal combustion vehicles. Each battery-electric vehicles use approximately 25-50 grams of silver, 67-79 percent more than internal combustion vehicles. Silver is critical for various EV applications, including battery management systems, power electronics, charging infrastructure, and electrical contacts.

The Silver Institute forecasts global automotive silver demand will increase at a compound annual growth rate of 3.4 percent between 2025 and 2031.

The rapid increase in EV demand and production means that EV vehicles will overtake internal combustion engine vehicles as the primary source of automotive silver demand by 2027, and account for 59 percent of the market by 2031.

Additionally, electrifying automotives increases silver demand due to the parallel need to expand charging infrastructure.

AI

The AI revolution is rapidly transforming computing. It is also driving increased silver demand as companies are rapidly expanding data centers.

Data centers provide the physical infrastructure needed to run cloud computing services, store and manage data, and power AI systems.

The Silver Institute estimates that total global IT power capacity increased by approximately 53 times, from 0.93 GW in 2000 to nearly 50 GW in 2025.

Precise silver-loading data connected with this expansion in computing is difficult to pin down, but the Silver Institute says “the link is clear.”

“A 5,252 percent increase in IT power demand translates into more computing hardware and, consequently, greater demand for silver.”

This sector should be relatively insulated from demand shocks due to rising prices or an economic contraction because governments worldwide are prioritizing data centers as “critical infrastructure.” That means AI companies enjoy policies that streamline regulation and provide incentives, including grants, tax breaks, and fast-track approvals.

According to the Silver Institute, “Initiatives in the US, UK, EU, and China aim to attract large-scale private investment, reduce barriers, and expand capacity to meet the rising demand for AI and cloud services—ultimately driving growth in materials like silver.”

The speed of digitalization and the widespread adoption of AI are expected will place growing demands on both digital and physical infrastructure.

“As AI applications diversify into media production, design, and simulation, demand for servers’ processing power and, by extension, data center infrastructure is expected to continue growing.”

Given its growing role in the global digitalization, the Silver Institute calls silver a “next-generation metal.”

With the silver market on track for its fifth straight structural market deficit, growing tech offtake will only add to demand and further pressure supply.

Given the forecast supply and demand levels, Metals Focus projects demand will outstrip supply by 95 million ounces. That would bring the cumulative 5-year market deficit to 820 million ounces, an entire year of average mine output.

Since 2010, the silver market has accumulated a supply deficit of over 580 million ounces.

This is yet another reason to be bullish on silver.

You can download the full Silver Institute report HERE.