Silver has reacted back as predicted in the last update about a month ago. On its 9-month chart below we can see that it broke down from an intermediate top as expected to drop back towards the important support shown, but on Friday it had a good rally which suggests that it may not drop that far, and could turn up again here. Overall this is a positive looking chart and the main question is which uptrend channel it adheres to. As we can see there has been a significant price / time correction since early July that has served to completely unwind the earlier overbought condition, so Friday’s turnaround could mark the beginning of the next upleg. Even if it should head lower again soon, it is thought unlikely that it will drop below the support at and below $18.00, especially as it is underpinned by an important channel support line. Should it drop that low silver would look most attractive.

The long-term 10-year arithmetic chart gives us a much broader perspective. This is actually a very positive chart overall, for as we can see silver’s bearmarket phase from 2011 has definitely ended. However, it has risen quite sharply in recent months to arrive at a zone of significant resistance, so the current reaction is quite normal and should set it up to break above this resistance and continue higher.

The silver optix, (optimism) readings have eased significantly from high levels that made further gains difficult. The current readings at about 56% make renewed advance much more possible.

Click on chart to popup a larger clearer version.

Chart courtesy of www.sentimentrader.com

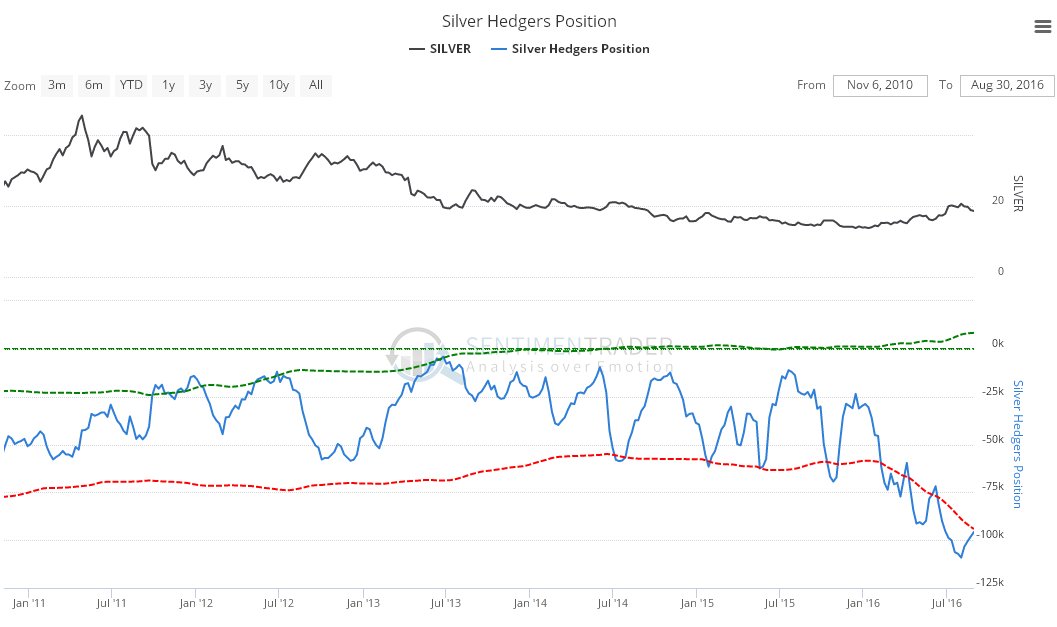

COTs and Hedgers positions continue to run at a high level and be a cause for concern, although they have eased a little in recent weeks. Such readings usually, but not always, lead to a substantial drop, so we should keep this in mind. On rare occasions they stay high as the uptrend continues. Therefore current readings won’t necessarily prevent a rally here, but can be expected to act as a restraining influence especially if they get even more extreme.

Click on chart to popup a larger clearer version.

Chart courtesy of www.sentimentrader.com