Gold's tick higher at the 6:00 p.m. open of Globex trading in New York on Sunday evening was dealt with in the usual manner -- and from that point it was was engineered lower until 'da boyz' set its low tick at the noon silver fix in London. It ensuing and impressive rally from there got lightly stepped on twice during the New York trading session, but it still managed a positive close.

The low and high ticks in gold were recorded by the CME Group as $3,304.40 and $3,352.90 in the August contract...an intraday move of $48.50 an ounce. The August/October price spread differential in gold at the close in New York yesterday was $27.90...October/December was $28.00 -- and December/ February26 was $27.20 an ounce.

Gold was closed in New York on Monday afternoon at $3,335.50 spot...up $1.40 on the day -- and 40 bucks and a bit off its Kitco-recorded low tick. Net volume was very heavy 216,500 contracts -- and there were a bit under 19,500 contracts worth of roll-over/switch volume out of August and into future months...mostly October and December.

I saw that 142 gold, plus 352 silver contracts were traded on Friday and Monday combined -- and I'll be more than interested in how much of this shows up in tonight's Daily Delivery and Preliminary Reports.

![]()

Silver took off higher like a homesick angel at the Globex open in New York on Sunday evening -- and it took the collusive commercial traders of whatever stripe almost an hour to get its price capped and turned lower. Its engineered price decline ended, like gold's, minutes before 1 p.m. in Shanghai -- and it then chopped sideways until at or minutes before the noon silver fix in London. It was 'light's out' until noon BST -- and its ensuing rally attempt ran into 'something' at or minutes after the 10 a.m. EDT afternoon gold fix in London. From that juncture it was allowed to chop quietly higher until 4:30 p.m. in after-hours trading.

The high and low ticks in it were reported as $37.435 and $36.325 in the September contract... an intraday move of $1.11 an ounce. The July/ September price spread differential in silver at the close in New York yesterday was 28.9 cents...September/December was 45.7 cents -- and December/ March26 was 43.6 cents an ounce.

Silver was closed on Monday afternoon in New York at $36.68 spot...down 17 cents on the day. Net volume was a bit on the heavier side at around 64,300 contracts -- and there were a bit under 5,000 contracts worth of roll-over/ switch volume in this precious metal...mostly into December.

![]()

Platinum's high tick was set about forty-five minutes after the Globex trading began in New York on Sunday evening -- and the not-for-profit sellers appeared at that juncture...setting its low tick of the day at the 9:00 a.m. Zurich open. It then rallied a bit until noon CEST -- and was sold lower anew until 9:45 a.m. in COMEX trading in New York -- and it then proceeded to chop quietly higher until 4 p.m. in after-hours trading. Platinum was closed at $1,370 spot...down 22 dollars from Friday.

![]()

Palladium's price path was very similar to platinum's -- and the only real difference was that its engineered low tick was set minutes after 9 a.m. in COMEX trading in New York. Palladium was closed at 1,111 spot...down 24 dollars from Friday.

Based on the kitco.com spot closing prices in silver and gold posted above, the gold/silver ratio worked out to 90.9 to 1 on Monday...compared to 90.5 to 1 on Friday.

![]()

The dollar index closed very late on Thursday afternoon in New York [Friday's DXY price action didn't matter] at 97.18...and then opened lower by 22 basis points once trading commenced at around 7:45 p.m. EDT on Sunday evening ...which was 7:45 a.m. China Standard time on their Monday morning. After a brief dip, it began to head higher -- and that lasted until around 10:10 a.m. in London. It then wandered very quietly lower until a rally developed around 12:18 a.m. in New York, which ran out of gas minutes before 1 p.m. It then had a quiet and slightly descending down/up move that ended around 4:20 p.m. -- and it didn't do anything after that.

The dollar index finished the Monday trading session in New York at 97.48...up 30 basis points from its close on Thursday.

Here's the DXY chart for Monday...thanks to marketwatch.com as usual... Click to enlarge.

![]()

Here's the 6-month U.S. dollar index chart...courtesy of stockcharts.com as always. The delta between its close...97.36....and the close on DXY chart above, was 12 basis points below that. Click to enlarge.

![]()

U.S. 10-year Treasury: 4.3950%...up 0.0470/(+1.0810%)...as of the 1:59:52 p.m. CDT close

![]()

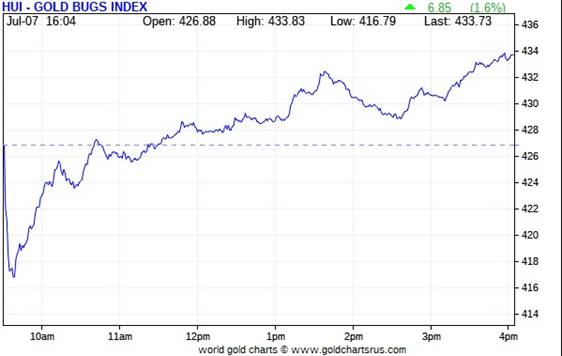

The gold stocks sold off at bit at the 9:30 opens of the equity markets in New York on Monday morning, but less than ten minutes later they were headed higher -- and their quiet and uneven rallies lasted until the markets closed at 4:00 p.m. EDT. The HUI closed up by 1.60 percent -- and virtually on its high tick of the day.

![]()

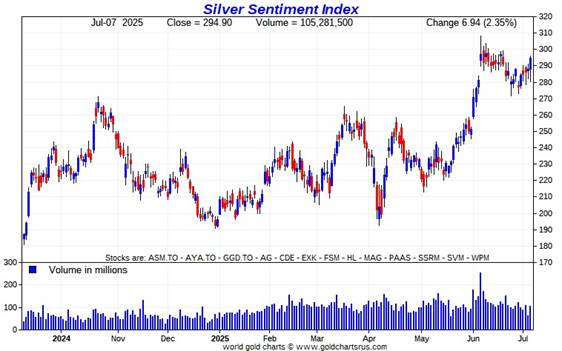

Despite the fact that silver was never allowed even a sniff of positive territory on Monday, Nick Laird's Silver Sentiment Index closed higher by an even more impressive 2.35 percent. Click to enlarge.

![]()

The star was Coeur Mining, as it closed up 4.06 percent...followed by Aya Gold & Silver, as it closed higher by 3.42 percent. The biggest underperformer -- and the only one of the silver stocks that closed down on the day, was MAG Silver...as it finished lower by 0.14 percent.

There was this news from Aya Gold & Silver after the close yesterday... along with this news from MAG Silver.

The silver price premium in Shanghai over the U.S. price on Monday was 4.95 percent.

The reddit.com/Wallstreetsilver website, now under 'new' and somewhat improved management, is linked here. The link to two other silver forums are here -- and here.

![]()

The CME Daily Delivery Report for Day 6 of July deliveries showed that 423 gold, plus 351 silver contracts were posted for delivery within the COMEX-approved depositories on Wednesday.

In gold, the only two short/issuers of the five in total that mattered were StoneX Financial -- and British bank HSBC...with the latter issuing 198 contracts out of its client account. The former issued 210 contracts in total ...194 from its house account -- and the other 16 from its client account.

There was a fairly decent list of long/stoppers -- and the three largest by far were Australia's Macquarie Futures, British bank Standard Chartered -- and JPMorgan...picking up 152, 110 and 91 contracts respectively...Standard Chartered for their house account.

In silver, the only two short/issuers of the five in total that mattered there were StoneX Financial and JPMorgan...with the latter issuing 92 contracts from their client account. StoneX issued 248 contracts in total...245 from their house account -- and the other 3 from their client account. The only long/ stopper that mattered was JPMorgan...picking up 293 contracts for clients.

In platinum, there were 7 contracts issued and stopped.

The link to yesterday's Issuers and Stoppers Report is here.

The CME Preliminary Report for the Monday and Friday trading sessions combined, showed that gold open interest in July increased by 201 contracts, leaving 507 still open...minus the 423 contracts out for delivery on Wednesday as mentioned a few paragraphs ago. Thursday's Daily Delivery Report showed that only 10 gold contracts were actually posted for delivery today, so that means that 201+10=211 more gold contract were added to July deliveries.

Silver o.i. in July dropped by 287 COMEX contracts, leaving 1,179 still around ...minus the 351 contracts out for delivery on Wednesday as per the above Daily Delivery Report. Thursday's Daily Delivery Report showed that 477 silver contracts were actually posted for delivery on Tuesday, so that means that 477-287=190 more silver contracts were added to the July delivery month.

Total gold open interest rose by a net 6,007 COMEX contracts -- and I suspect that a fairly decent amount of that had to have been those uneconomic and market-neutral spread trades being put on. All will be removed before first notice day for the scheduled August delivery month in gold. Total silver o.i. fell by a net 1,813 contracts.

[I checked the final total open interest number in gold for the Thursday trading session -- and it showed a very respectable downward adjustment...from +5,211 contracts, down to +2,084 contracts. I was very happy to see that. Total silver open interest only fell by a tiny amount...from +2,016 contracts, down to +1,957 contracts.]

Silver open interest in August declined by a net 106 contracts, leaving 2,345 still around.

![]()

![]()

There were no reported changes in either GLD or SLV on Monday...but an authorized participant added 11,882 troy ounces of gold to GLDM.

The SLV borrow rate started the Monday session at 0.72% -- and finished it at 0.71%... with 2.9 million shares available. The GLD borrow rate started the day at 0.71% -- and closed at 0.59%...with 5.4 million shares available for shorting purposes.

In other gold and silver ETFs and mutual funds on Earth on Monday... net of any changes in COMEX, GLD, GLDM and SLV activity, there were a net 18,918 troy ounces of gold added -- and 63,217 troy ounces of silver were added as well.

There was no sales report from the U.S. Mint.

![]()

![]()

There was only a bit of activity in gold over at the COMEX-approved depositories on the U.S. east coast last Thursday. Nothing was reported received -- and 68,481.630 troy ounces/2,130 kilobars were shipped out.

In the 'out' category, the largest amount were the 52,663.338 troy ounces/ 1,638 kilobars that left JPMorgan...with the remaining 492 kilobars/15,818.292 troy ounces departing Brink's, Inc.

There was no paper activity -- and the link to last Thursday's COMEX gold action is here.

There was pretty hefty silver activity, as one truckload/598,126 troy ounces were reported received -- and all of that amount ended up at Loomis International. There were 1,572,879 troy ounces shipped out...with one truckload of that amount...600,836 troy ounces...leaving Loomis International as well. The remaining 972,043 troy ounces departed JPMorgan -- and for the first time in a very long while, nothing departed HSBC USA.

The link to all of last Thursday's COMEX silver action is here.

The Shanghai Futures Exchange reported that a net 290,999 troy ounces of silver were removed from their inventories on Monday...which now stand at 42.783 million troy ounces.

![]()

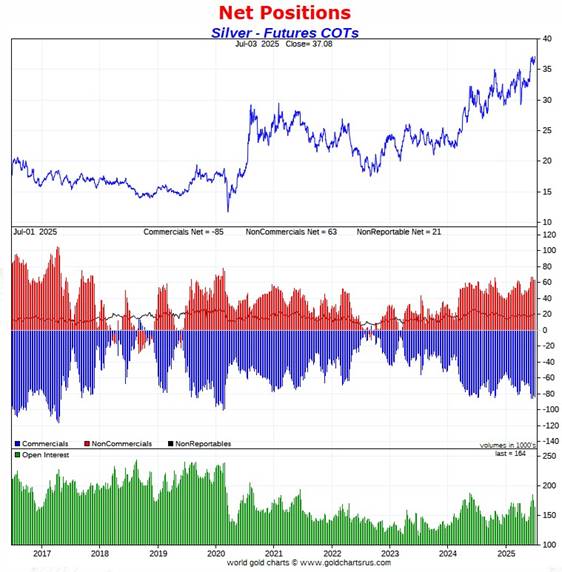

The Commitment of Traders Report, for positions held at the close of COMEX trading on Tuesday, July 1 showed rather smallish increases in the commercial net short positions in both gold and silver...but virtually all of those increases came about because of the activity surrounding Ted's raptors...the small commercial traders other that the Big 8.

In silver, the Commercial net short position rose by 2,063 COMEX contracts... 10.315 million troy ounces of the stuff.

They arrived at that number through the sale of 4,219 long contracts -- but also covered 2,156 short contracts -- and it's the difference between those two numbers that represents their change for the reporting week.

Under the hood in the Disaggregated COT Report, the Managed Money traders didn't do much...reducing their net long position by a piddling 184 COMEX contracts. But the traders in the Other Reportables and Nonreportable/small trader category both increased their net long positions...the former by 637 contracts -- and the latter by 1,610 COMEX contracts.

Doing the math: 637 plus 1,610 minus 184 equals 2,063 COMEX contracts... the change in the Commercial net short position.

The Commercial net short position in silver now stands at 84,540 COMEX contracts/422.700 million troy ounces...up those 2,063 contracts from the 82,477 COMEX contracts/412.385 million troy ounces that they were short in the last COT Report -- and obviously still off-the-charts wildly bearish.

The Big 4 shorts decreased their net short position by 462 COMEX contracts ...from 59,019 contracts, down to 58,557 contracts...which is still grotesque.

But the Big '5 through 8' shorts increased their net short position...from the 26,890 contracts in last Monday's COT Report, up to 27,152 contracts in yesterday's COT Report...an increase of 262 COMEX contracts. This is within an eyelash of the largest short position they've ever held.

The Big 8 shorts in total decreased their overall net short position from 85,909 contracts, down to 85,709 COMEX contracts week-over-week...a decrease of an inconsequential 200 COMEX contracts.

But since the Commercial net short position rose by 2,063 contracts in yesterday's COT Report -- and the Big 8 decreased their net short position by 200 contracts, this meant that Ted's raptors...the small commercial traders other than the Big 8...had to have been sellers during the reporting week -- and they were...decreasing their net long position by 2,063+200=2,263 COMEX contracts. They are only net long silver now by 1,169 COMEX contracts.

It was their selling of long contracts that had the mathematical effect of increasing the net short position...which isn't an increase at all.

Here's Nick's 9-year COT chart for silver -- updated with the above data. Click to enlarge.

It was basically a 'nothingburger' COT Report from a Big 4/8 short perspective, as it wall raptor long selling that accounted for the increase...which was only mathematical. Nothing to see here.

But, from a COMEX futures market perspective, the set-up in silver remains off-the-charts bearish in the extreme -- and whether that matters going forward, remains to be seen.

I'd been going on about those non-economic and market-neutral spread trades being removed as we headed into First Day Notice -- and that proved to be the case again this reporting week. There was a further 11,046 contract drop in total silver open interest in yesterday's report -- and of that amount 9,097 contracts were spread trade related -- and those were just the ones that were visible.

The Big 8 are short 52.4 percent of total open interest in the COMEX futures market...up a noticeable amount from that 49.2 percent they were short in last week's COT Report. The only reason for that increase [for the second week in a row] was because of the huge 11,046 contract drop in total open interest mentioned in the previous paragraph, which obviously affects the percentage calculation.

Of course if one could subtract out all the spread trades in all categories, especially those in the Producer/Merchant category, which remain deliberately hidden, the Big 8 commercial short position would most likely be a tad north of 55 percent of total open interest.

But nothing has changed with regards to that ongoing and deepening structural deficit in the physical market...which is now well into its fifth consecutive year.

Of course not to be forgotten -- and which also has a huge and negative impact on the silver price, is the outrageous and grotesque short position in SLV...now up to 41.74 million shares/troy ounces...7.94% of the total shares outstanding...as of the most recent short report that came out about ten days ago.

Not one of those ounces sold short has any physical silver backing it as their prospectus requires. The next short report, for positions held at the close of COMEX trading on Monday, June 30 will be posted on the WSJ's website Thursday evening, July 10.

Of course it's entirely within the realm of possibility that some of the big shorts in SLV are "short against the box"...so the actual short position in SLV may not be as large as it appears.

![]()

![]()

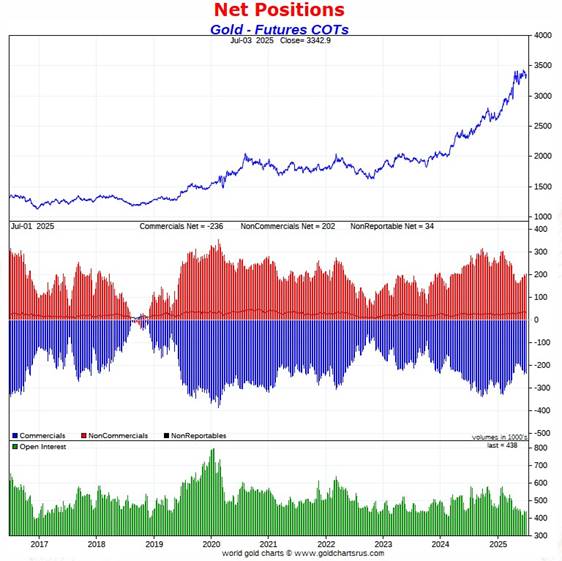

In gold, the commercial net short position increased by 5,509 COMEX contracts...550,090 troy ounces of the stuff.

They arrived at that number by reducing their long position by 4,503 contracts -- and also sold 1,006 short contracts. It's the sum of those two numbers that represents their change for the reporting week.

Under the hood in the Disaggregated COT Report both the Managed Money and Other Reportables increased their net long positions during the reporting week...the former by 5,232 contracts -- and the latter by 1,744 COMEX contracts. The traders in the Nonreportable/small traders category were sellers ...reducing their net long position by 1,467 contracts.

Doing the math: 5,232 plus 1,744 minus 1,467 equals 5,509 COMEX contracts...the change in the commercial net short position.

The commercial net short position in gold now sits at 236,069 COMEX contracts/23.607 million troy ounces of the stuff...up those 5,509 contracts from the 230,560 COMEX contracts/23.056 million troy ounces they were short in last Monday's COT Report.

The Big 4 shorts in gold increased their net short position by a tiny 384 contracts this reporting week...from the 132,227 contracts they were short in the last COT report, up to 132,611 contracts in yesterday's report. This is their largest short position since March 28...but still well below the 198,271 contracts there were net short in the January 21 COT Report.

The Big '5 through 8' shorts decreased their net short position from 75,247 contracts they were short in the last COT Report, down to 74,403 contracts held short in the current report...a decrease of only 844 COMEX contracts.

The Big 8 short position decreased from 207,474 COMEX contracts/20.747 million troy ounces in the last COT Report...down to 207,014 COMEX contracts/ 20.701 million troy ounces in yesterday's report...a decrease of an insignificant 460 COMEX contracts.

But the commercial net short position rose by 5,509 COMEX contracts during the reporting week -- and the Big 8 commercial short position fell by 460 COMEX contracts, so that meant that Ted's raptors...the small commercial traders other than the Big 8 had to have been sellers during the reporting week -- and they were. They increased their short position by a further 5,509+460=5,969 COMEX contracts.

Their short position is now back up to 29,055 contracts...from the 23,086 contract short position they held in last week's COT Report. This is the largest short position they've held since May 30...but still a very long way off the 76,723 contracts they were short back on February 14.

Here's Nick's 9-year COT chart for gold -- and updated with the above data. Click to enlarge.

Like the prior COT Report, the change in the commercial net short position in gold didn't move the needle much-- and it remains market neutral at best from a COMEX futures market perspective...not helped at all by the fact that the entire spectrum of commercial traders are net short gold...a situation that doesn't exist in silver for whatever reason.

The Big 8 collusive traders in gold are short 47.3 percent of total open interest in the COMEX futures market...down a tad from the 47.7 percent they were short in the prior COT Report. Total open interest in gold only changed by 2,704 COMEX contracts during the reporting week...so that change didn't affect this calculation much.

But once you add in the now considerable short position of Ted's raptors... 29,055 contracts... the commercial net short position in gold...all held buy bullion banks and investment houses ...represents 53.9 percent of total open interest. This, like the silver number, is an obscene and manipulative amount.

As I pointed out in The Wrap in a recent column, the unbooked margin call losses of the shorts in gold and silver is now close to $50 billion -- and despite that fact, there has been no rush to cover any of their short positions.

![]()

![]()

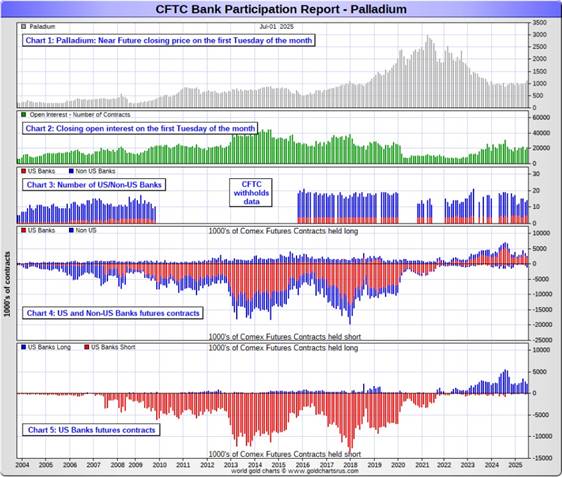

In the other metals, the Managed Money traders in palladium increased their net short position by by 462 COMEX contracts -- and remain net short palladium by 5,065 contracts. The commercial traders in the Producer/ Merchant category are net short 2,221 contracts...but the commercial traders in the Swap Dealers category are net long palladium by 5,120 contracts. The traders in the Other Reportables remain on the long side in palladium by a bit -- and the Nonreportable/small trader categories remain net long by a respectable amount.

And it shouldn't be forgotten that the world's banks remain net long 6.5 percent of total open interest in palladium in the COMEX futures market as of the July Bank Participation Report that came out yesterday...down big from the 16.6 percent they were net long in the June BPR. They obviously sold a lot of long contracts in their attempts to squelch its short covering rally.

In platinum, the Managed Money traders decreased their net long position by 3,943 COMEX contracts during the reporting week...but are still net long platinum by 13,062 COMEX contracts.

The commercial traders in the Producer/Merchant category are net short 24,326 COMEX contracts -- and the Swap Dealers in the commercial category are still on the short side by 3,810 contracts in yesterday's COT Report. The traders in the Other Reportables category are net long platinum by 9,580 COMEX contracts...while the Nonreportable/small traders are net long 5,494 contracts. Both these categories increased their net long positions during this past reporting week.

It's mostly the world's banks in the Producer/Merchant category that are 'The Big Shorts' in platinum in the COMEX futures market, as per July's Bank Participation Report that came out yesterday -- and have increased their short position in platinum by quite a bit since the June report...especially the non-U.S. banks, which is no surprise when you consider the ongoing rally in this precious metal. More on this in the Bank Participation Report further down.

In copper, the Managed Money traders increased their net long position by a further 3,541 contracts -- and are net long copper by 31,790 COMEX contracts...about 794 million pounds of the stuff as of yesterday's COT Report...up from the 706 million pounds they were net long copper in last week's COT report.

Copper, like palladium, continues to be a wildly bifurcated market in the commercial category. The Producer/Merchant category is net short 42,928 copper contracts/935 million pounds -- while the Swap Dealers are net long 5,635 COMEX contracts/141 million pounds of the stuff.

Whether this means anything or not, will only be known in the fullness of time. Ted said it didn't mean anything as far as he was concerned, as they're all commercial traders in the commercial category. This bifurcation has been in place for as many years as I've been keeping records -- and that's a very long time. However, this is now the smallest net long position that the Swap Dealers have held in a very long time. Both categories are now aggressively shorting copper's rally.

In this vital industrial commodity, the world's banks...both U.S. and foreign...are net long 4.8 percent of the total open interest in copper in the COMEX futures market as shown in the July Bank Participation Report that came out yesterday -- and unchanged from the 4.8 percent they were net long in June's.

At the moment it's mostly the commodity trading houses such as Glencore and Trafigura et al., along with some hedge funds, that are net short copper in the Producer/Merchant category, as the Swap Dealers are net long, as pointed out above.

The next Bank Participation Report is due out on Friday, August 8.

![]()

![]()

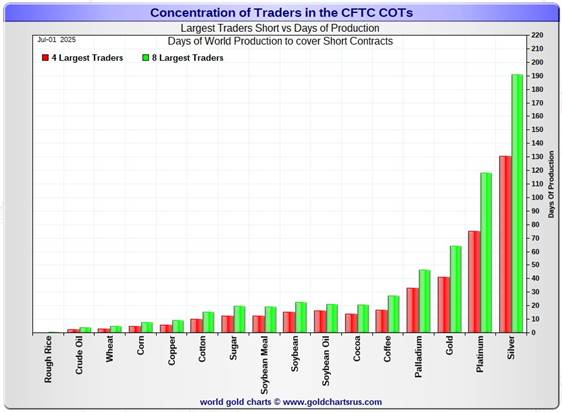

Here’s Nick Laird’s “Days to Cover” chart, updated with the COT data for positions held at the close of COMEX trading on Tuesday, July 1. It shows the days of world production that it would take to cover the short positions of the Big 4 — and Big '5 through 8' traders in every physically traded commodity on the COMEX. Click to enlarge.

In this week's data, the Big 4 traders are short 130 days of world silver production...down about 1 day from the prior COT report. The ‘5 through 8’ large traders are short an additional 61 days of world silver production ...up about 1 day from the prior COT Report, for a total of about 191 days that the Big 8 are short -- and obviously unchanged from the last COT report. These number are no surprise considering the tiny changes in the respective short positions in the above COT Report.

Those 191 days that the Big 8 traders are short, represents around 6.4 months of world silver production, or 428.545 million troy ounces/85,709 COMEX contracts of paper silver held short by these eight commercial traders...which is off-the-charts grotesque. Several of the largest of these are now non-banking entities, as per Ted's discovery a year or so ago. July's Bank Participation Report that came out yesterday, continues to confirm that this is still the case -- and not just in silver, either.

The small commercial traders other than the Big 8 shorts, Ted's raptors, were sellers this past week, dumping 2,253 long contracts. This took them from a net long position of 3,422 contracts in the last COT report -- and down to a net long position of 1,169 contracts in yesterday's COT Report.

In gold, the Big 4 are short about 41 days of world gold production... unchanged from the prior COT Report. The Big '5 through 8' are short an additional 23 days of world production...also unchanged from the last COT report...for a total of 64 days of world gold production held short by the Big 8 -- and obviously unchanged from the last COT Report.

As mentioned further up, the Big 8 commercial traders are net short 52.4 percent of the entire open interest in silver in the COMEX futures market as of yesterday's COT Report, up from the 49.2 percent they were net short in the last COT report. The only reason that the percentage is up, was because of the 11,046 contract decrease in total open interest, which obviously affects the percentage calculation.

In gold, it's 47.3 percent of the total COMEX open interest that the Big 8 are net short, down a tad from the 47.7 percent they were short last week -- as there wasn't much change in gold's total open interest week-over-week ...only 2,704 contracts.

And as I mentioned further up in the COT discussion in gold, the short position of Ted's raptors is now a significant factor once again in the total commercial net short position. Adding in their 29,055 contract current short position, increases the commercial net short position to 53.9 percent of total open interest. So their short position represents 53.9-47.3=6.6 percentage points of total open interest.

The short position in SLV now sits at 41.74 million shares as of the latest short report, for positions held at the close of COMEX trading on Friday, June 13 -- and up big from the 31.39 million shares sold short on the NYSE in the prior report. This number remains off-the-charts grotesque and obscene -- and yet another way that 'da boyz' are controlling the silver price, as I mentioned further up.

The next short report is due out Thursday, July 10...for positions held at the close of business on Friday, June 30.

In the overall, the Big 8 commercial traders didn't do anything material [for the fourth week in a row] in yesterday's COT Report. The set up in silver from a COMEX futures market perspective remains ultra bearish -- and in gold, it's market neutral at best.

As Ted Butler had been pointing out ad nauseam, the resolution of the Big 4/8 short positions will be the sole determinant of precious metal prices going forward...although that big short position in gold held by Ted's raptors is a factor once more.

![]()

![]()

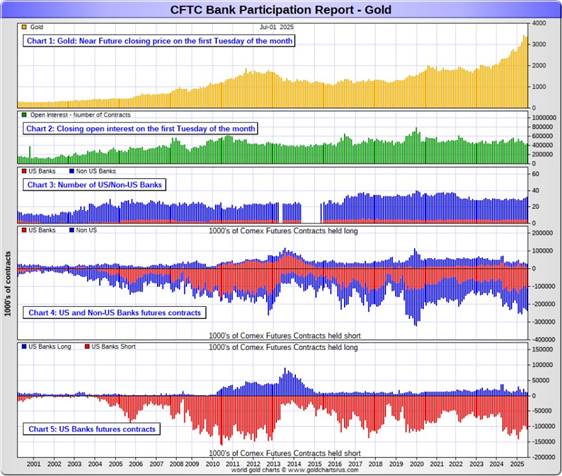

The July Bank Participation Report [BPR] data is extracted directly from yesterday's Commitment of Traders Report data. It shows the number of futures contracts, both long and short, that are held by all the U.S. and non-U.S. banks as of last Tuesday’s cut-off in all COMEX-traded products.

For this one day a month we get to see what the world’s banks have been up to in the precious metals. They’re usually up to quite a bit -- and they certainly were again this past month.

[The July Bank Participation Report covers the four-week time period from June 3 to July 1 inclusive]

In gold, 5 U.S. banks are net short 98,509 COMEX contracts, up 13,912 contracts from the 84,597 contracts that these same 5 U.S. banks were net short in the June BPR.

Also in gold, 27 non-U.S. banks are net short 112,489 COMEX contracts, down an inconsequential 766 contracts from the 113,255 contracts that 26 non-U.S. banks were short in June's BPR.

At the low back in the August 2018 BPR...these non-U.S. banks held a net short position in gold of only 1,960 contacts -- so they've been back on the short side in a gargantuan way ever since. Only a handful of these banks hold meaningful short positions in gold. The short positions of the rest are of no consequence -- and never have been.

Although a lot of the largest U.S. and foreign bullion banks are in the Big 8 short category, some of the hedge fund/commodity trading houses are short grotesque amounts of gold in that category as well. There's also the possibility that the BIS could be short gold in the COMEX futures market as well.

As of July's Bank Participation Report, 32 banks [both U.S. and foreign] were net short 48.3 percent of the entire open interest in gold in the COMEX futures market...up from the 47.5 percent that 31 banks were net short in the June BPR. This remains an obscene and manipulative short position.

Here’s Nick’s BPR chart for gold going back to 2000. Charts #4 and #5 are the key ones here. Note the blow-out in the short positions of the non-U.S. banks [the blue bars in chart #4] when Scotiabank’s COMEX short position was outed by the CFTC in October of 2012. Click to enlarge.

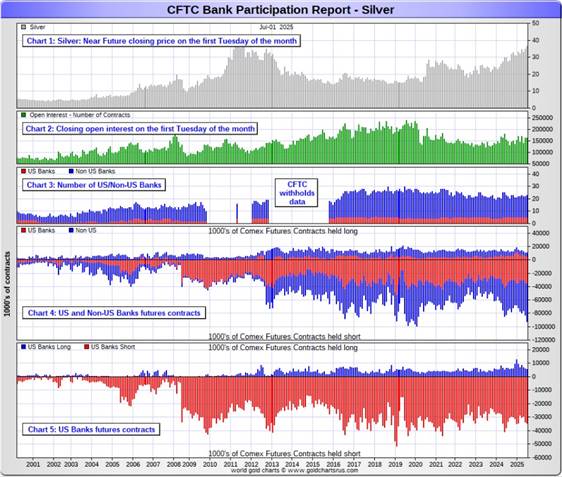

In silver, 5 U.S. banks are net short 28,918 COMEX contracts, up 1,061 contracts from the 27,857 contracts that these same 5 U.S. banks were short in the June BPR.

The five U.S. banks that are mega net short silver would be Citigroup, Wells Fargo, Bank of America, Goldman Sachs and JPMorgan.

Also in silver, 18 non-U.S. banks are net short 52,459 COMEX contracts, up 8,613 contracts from the 43,846 contracts that 17 non-U.S. banks were net short in the June BPR.

It's a given, based on silver deliveries so far this year, that HSBC, Barclays, Standard Chartered, BNP Paribas and Macquarie Futures hold by far the lion's share of the short positions of these non-U.S. banks...as do some of Canada's banks as well...with the Bank of Montreal coming to mind.

And, like in gold, the BIS could also be actively shorting silver. However, the remaining short positions divided up between the rest of the small handful of non-U.S. banks, are immaterial — and have always been so....the same as most of the 20-odd non-U.S. banks in gold as well.

As of July's Bank Participation Report, 23 banks [both U.S. and foreign] were net short a grotesque 49.7 percent of the entire open interest in silver in the COMEX futures market — up big from the 44.9 percent that 22 banks were net short in the June BPR...and up big mostly because of the huge drop in silver open interest during the four week reporting period, which affects the percentage calculation.

Here’s the BPR chart for silver. Note in Chart #4 the blow-out in the non-U.S. bank short position [blue bars] in October of 2012 when Scotiabank was brought in from the cold. Also note August 2008 when JPMorgan took over the silver short position of Bear Stearns—the red bars. It’s very noticeable in Chart #4—and really stands out like the proverbial sore thumb it is in chart #5. Click to enlarge.

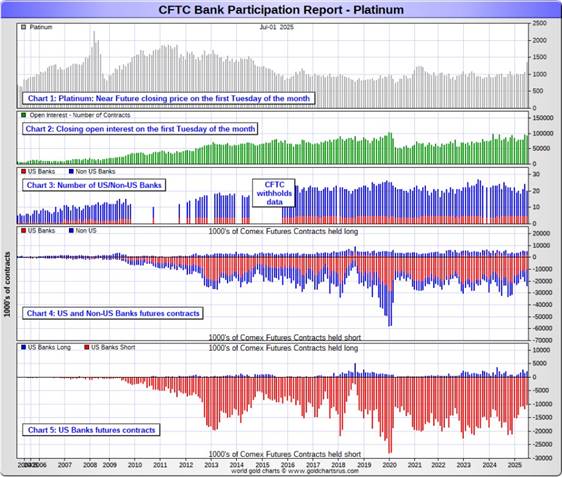

In platinum, 5 U.S. banks are net short 8,085 COMEX contracts in the July BPR, down 2,059 contracts from the 10,144 contracts that these same 5 U.S. banks were short in the June BPR. This decline in the July report reverses its increase in the June BPR.

At the 'low' back in September of 2018, these U.S. banks were actually net long the platinum market by 2,573 contracts...so they still have work to do just to get back to market neutral...if that's ever their intent.

Also in platinum, 15 non-U.S. banks increased their net short position by a whopping 5,983 contracts...from 4,977 contracts held by 19 banks in June's BPR...up to 10,960 contracts in the July BPR. In the last two months, these non-U.S. banks have added 8,517 short contracts in platinum.

Back in the December 2023 BPR, these non-U.S. banks were net short a microscopic 35 platinum contracts...so they also have more work to do if they ever want to get back to that number.

As you know, platinum remains the big commercial shorts No. 2 problem child after silver -- and there's now a long-term structural deficit in it [and palladium] as well.

And as of July's Bank Participation Report, 20 banks [both U.S. and foreign] were net short 20.9 percent of platinum's total open interest in the COMEX futures market, up from the 15.9 percent that 24 banks were net short in June's BPR.

Here's the Bank Participation Report chart for platinum. Click to enlarge.

In palladium, 5 U.S. banks are net long 2,016 COMEX contracts in the July BPR, down 423 contracts from the 2,439 contracts that these same 5 U.S. banks were net long in the June BPR.

Also in palladium, 9 non-U.S. banks are now back on the short side by 679 COMEX contracts... down from the 554 contracts that 8 non-U.S. banks were net long in the June BPR. This is the first time in many years that these non-U.S. banks have been on the short side in palladium.

And as I've been commenting on for almost forever, the COMEX futures market in palladium is a market in name only, because it's so illiquid and thinly-traded. Its total open interest in yesterday's COT Report was only 20,751 contracts...compared to 91,281 contracts of total open interest in platinum ...163,567 contracts in silver -- and 437,662 COMEX contracts in gold.

Total open interest in palladium has increased quite a bit over the last number of years, because I remember when it was less than 9,000 contracts on average. So it's nowhere near as illiquid as it used to be -- and it's also been helped along by the fact that the bid/ask is now down to only 20 bucks. It used to be $150 at one point way back when.

As I say in this spot every month, the only reason that there's a futures market at all in palladium, is so that the Big 8 commercial traders can control its price. That's all there is, there ain't no more.

As of this Bank Participation Report, 14 banks [both U.S. and foreign] are net long 6.5 percent of total open interest in palladium in the COMEX futures market...down from the 16.6 percent of total open interest that 13 banks were net long in the June BPR. So they've obviously been selling into palladium's rally too.

For the last 5 years or so, the world's banks have not been involved in the palladium market in a material way...see its chart below. And with them still net long, it's almost all hedge funds and commodity trading houses that are left on the short side. The Big 8 commercial shorts, none of which are banks, are short 41.0 percent of total open interest in palladium as of yesterday's COT Report...down from the 46.9 percent they were short in June's BPR.

Here’s the palladium BPR chart. Although the world's banks are net long at the moment, it remains to be seen if they return as big short sellers again at some point like they've done in the past. Click to enlarge.

Excluding palladium for obvious reasons, and almost all of the non-U.S. banks in gold, silver and especially platinum...only a handful of the world's banks, most likely no more than a dozen or so in total -- and mostly U.S. and U.K.-based...along with French bank BNP Paribas...continue to hold meaningful short positions in the other three precious metals...although I won't let Canada's Bank of Montreal or Scotia Capital/Scotiabank off the hook just yet...nor Deutsche Bank in gold.

As I pointed out above, some of the world's commodity trading houses and hedge funds are also mega net short the four precious metals...far more short than the U.S. banks in some cases. They have the ability to affect prices if they choose to exercise it. But it's still the collusive Anglo/American/Western bullion bank cartel in the commercial category that are at Ground Zero of the price management scheme in the COMEX futures market in the other three.

And as has been the case for a couple of decades now, the short positions held by the Big 4/8 traders is the only thing that matters...especially the short positions of the Big 4...or maybe only the Big 1 or 2 in both silver and gold. How this is ultimately resolved [as Ted kept pointing out] will be the sole determinant of precious metal prices going forward.

The collusive Big 8 commercial traders et al. continue to have an iron grip on their respective prices -- and this was as plain as day in yesterday's COT and Bank Participation Reports once again. That circumstance will continue until they either relinquish control voluntarily, are told to step aside...or get overrun. Of course closing the COMEX/LBMA would also get them out with their skins intact.

Considering the current state of affairs of the world as they stand today -- and the structural deficit in silver -- and now in platinum and palladium as well, the chance that these big bullion banks and commodity trading houses could get overrun at some point, is no longer zero -- and certainly within the realm of possibility if things go totally non-linear at some point.

But...as Ted kept reminding us...if they do finally get overrun, it will be for the very first time...which obviously wasn't allowed to happen this past month, either.

The next Bank Participation Report is due out on Friday, August 8.

I have a fairly decent number of stories, articles and videos for you today.

![]()

CRITICAL READS & VIDEOS

Big, Ugly Crisis of Confidence -- Doug Noland

Rarely, if ever, had a period so beckoned for market discipline. It took a fateful pass. I found myself this week pondering a fundamental Bubble Maxim: Bubbles must be quashed in their infancy, before becoming deeply entrenched by powerful self-sustaining dynamics including broad-based (universal?) policymaker, financial industry, business community, and public support. I was reminded again that unsound “money” is the bane of Capitalism; how the scourge of inflationism devastates societies.

July 1 – New York Times (Andrew Duehren): “Washington has not exactly won a reputation for fiscal discipline over the last few decades, as both Republicans and Democrats passed bills that have, bit by bit, degraded the nation’s finances. But the legislation that Republicans passed through the Senate on Tuesday stands apart in its harm to the budget, analysts say. Not only did an initial analysis show it adding at least $3.3 trillion to the nation’s debt over the next 10 years — making it among the most expensive bills in a generation — but it would also reduce the amount of tax revenue the country collects for decades. Such a shortfall could begin a seismic shift in the nation’s fiscal trajectory and raise the risk of a debt crisis.”

July 2 – Bloomberg (Alexandra Semenova): “Wall Street speculators have returned in full force: US stocks have snapped back from the throes of April’s tariff selloff, hovering near record highs, the pipeline of new SPACs is rebounding and Cathie Wood’s flagship fund is on a historic tear. That’s sparked a swift jump in a Barclays Plc measure of the market’s ‘irrational exuberance’ — a phrase coined by former Federal Reserve Chair Alan Greenspan for when prices exceed assets’ fundamental values. The one-month average on the proprietary gauge has swung back into the double-digits for the first time since February — reaching levels that have signaled extreme frothiness in the past.”

It is both stunning and unsurprising. The vigilantes choose a curious juncture to set up camp at the Everything’s O.K. Saloon for a moonshine bender. At this point, President Trump and Secretary Bessent have the leveraged speculating community in their back pockets. That won’t last. There were already this week noteworthy cracks suggesting a semblance of functioning global bond markets may be ready to reassert itself.

I never even checked Doug's website on Friday night/Saturday morning to see if he had a column, because I presumed he wouldn't. I was wrong. The link to it is here. Gregory Mannarino's post market close rant for Monday is linked here -- and this one runs for just about 34 minutes.

![]()

![]()

"Runaway Spending": Canada on Track for $92 Billion Deficit, Think Tank Projects

The federal government is on pace to post a $92-billion deficit this fiscal year — nearly double what was projected just four months ago, according to a new report from the C.D. Howe Institute. If accurate, it would mark the second-largest deficit in Canadian history, trailing only the $327.7-billion shortfall of 2020-21 during the pandemic, according to the National Post.

“The picture is definitely not pretty,” said Alexandre Laurin, C.D. Howe’s vice-president, who co-authored the report with William Robson and Don Drummond.

The think tank now forecasts annual deficits of over $77 billion for the next four years, far higher than the government’s projections in its most recent budget — which is now more than a year old. The report criticizes the government’s delay in tabling a new budget, saying, “Delaying a budget until the fiscal year is more than half over is never good, but Canada’s current high-spending trajectory makes this delay especially bad.”

National Post writes C.D. Howe attributes the worsening outlook to rising defence spending, Trump-era tariffs, tax cuts, and the scrapped digital services tax. It also questions whether promised revenue boosts from fines, penalties, and savings will materialize.

No surprises here, dear reader. This Zero Hedge news item was posted on their Internet site at 5:20 p.m. EDT on Monday afternoon -- and another link to it is here.

![]()

![]()

London IPO fundraising hits a three-decade low in another blow to the U.K. capital

Fundraising from London IPOs slumped to at least a three-decade low in the first half of this year, new data showed on Friday – raising fresh questions about the fading allure of the U.K. as a hub for global capital.

The five debuts on the London market in the first six months of 2025 raised a total of £160 million ($218.6 million), according to new data from Dealogic.

That’s the lowest level of London IPO funds raised in the first half of the year recorded by Dealogic since it began collecting data in 1995.

Even in the aftermath of the 2008 financial crisis, two London IPOs managed to raise £222 million in the first half of 2009, the data shows.

London’s biggest IPO so far this year was the listing of professional services company MHA, which raised £98 million at its debut on the Alternative Investment Market (AIM) in April.

The listings slump in London this year adds to the city’s struggles to hold onto its former glory as one of the top destinations for global capital.

The financial and economic situation in the U.K. is worse than dire -- and it's no wonder that their finance minister was crying openly in the House of Commons last week. The CNBC news item appeared on their Internet site on Friday -- and I thank Swedish reader Patrik Ekdahl for sending it our way. Another link to it is here.

![]()

![]()

France's Fiscal Reckoning: Is the Eurozone's Second Giant Next in Line?

France is caught in a debt spiral. Now the president of the French Court of Auditors is warning of the consequences of political inaction.

Pierre Moscovici has served as president of the French Court of Auditors for five years, overseeing regular audits of the nation's public finances. From 2012 to 2014, he was France’s finance minister and then spent five years as E.U. Commissioner for Economic and Financial Affairs, Taxation and Customs. The man knows his way around empty coffers.

On Wednesday, Moscovici called on Prime Minister François Bayrou to take urgent steps to consolidate public finances. France’s budgetary situation, he said, has spun out of control, especially in 2023 and 2024. If a turnaround is not achieved soon, the capital markets will force one. “We can still act voluntarily,” he warned the government, “but tomorrow, the markets may impose austerity.”

Once the dominoes start falling, it goes fast. Investors dump French government bonds en masse. Yields spike, prices plummet, and refinancing the country’s massive debt becomes even more costly. Already, interest payments consume 10.6% of France’s state budget—roughly the same as education spending. As debt levels rise, fiscal maneuvering space shrinks.

With sovereign debt at 114% of GDP, the trap could snap shut unexpectedly. For now, European officials still point fingers at the U.S., whose debt ratios are similar. But no one can say how long that deflection tactic will work. Credit risk materializes suddenly—usually without warning.

This worthwhile and not surprising article was posted on the Zero Hedge website at 7:00 a.m. EDT on Sunday morning -- and another link to it is here.

![]()

![]()

Four interesting and worthwhile videos

1. What's Next in Trump's War? -- Alastair Crooke

This 30-minute video interview with former U.K. diplomat and former MI6 agent Crooke was hosted by Judge Andrew Napolitano on Monday morning EDT -- and it's definitely worth your while if you have the interest. As always, I thank Guido Tricot for this -- and the link to it is here.

2. Does Europe Fear War? -- Ray McGovern

This very interesting 23-minute video interview with former CIA analyst McGovern was also hosted by the Judge on Monday morning EDT. I thank Guido for this one as well -- and the link to it is here.

3. Is Netanyahu Lobbying for More War? -- Professor Jeffrey Sachs

This 27-minute video interview with professor Sachs was also hosted by Judge Napolitano -- and was posted on the youtube.com Internet site early on Monday afternoon EDT. It's worth your while if you have the interest -- and the link to it is here. I thank Guido for this one as well...plus the one that follows.

4. Is the Ukraine Lie Collapsing? -- Scott Ritter

This very worthwhile 29-minute video with former U.S. Marine -- and former U.N. weapons inspector Ritter was hosted by Judge Andrew Napolitano around noon EDT on Monday. Scott doesn't hold anything back, as usual -- and the link to it is here.

![]()

![]()

War Is a Certainty -- Jeff Thomas

Recently, an associate offered the following observation with regard to the likelihood of war in the immediate future:

“The big guys like to play chess with the world. It’s the biggest game. The bankers need ups and downs and wars to make money. The military needs wars to exist. The politicians need both to exist.”

Whilst he was reiterating a concept we have discussed on many occasions, it occurred to me that I have never seen the subject defined so succinctly, nor so informatively.

Let’s break it down...

This very interesting and worthwhile commentary from Jeff was posted on the internationalman.com Internet site on Monday afternoon EDT -- and another link to it is here.

![]()

![]()

Value of ‘under the mattress gold’ in Türkiye estimated at $500 billion

The value of gold kept “under the mattress” in Türkiye amounts to $500 billion, according to Mustafa Atayık, president of the Istanbul Chamber of Jewelers (İKO).

He estimates that nearly 5,000 tons of gold are held in private.

“If we consider the price of gold to be approximately $107,000 per kilogram, we can estimate that the value of this gold amounts to roughly $500 billion or more,” he said.

Atayık, who argued that people continue to keep their savings at home due to “a lack of trust,” proposed the establishment of what he dubbed "Gold Bank."

This brief gold-related story, filed from Istanbul, appeared on the hurriyetdailynews.com Internet site on Monday -- and is the first of two I found on Sharps Pixley. Another link to it is here.

![]()

![]()

China snaps up mines around the world in rush to secure resources

Chinese mining acquisitions overseas have hit their highest level in more than a decade as companies race to secure the raw materials that underpin the global economy in the face of mounting geopolitical tension.

There were 10 deals worth more than $100 million last year, the highest since 2013, according to an analysis of S&P and Mergermarket data. Separate research by the Griffith Asia Institute found that last year was the most active for Chinese overseas mining investment and construction since at least 2013.

The country's huge demand for raw materials -- it is the largest consumer of most minerals -- means its mining companies have a long history of investing overseas. Analysts and investors say that the rise in deal making partly reflects China's efforts to get ahead of the deteriorating geopolitical climate, which is making it increasingly unwelcome as an investor in key countries such as Canada and the United States.

Michael Scherb, founder of private equity group Appian Capital Advisory, said there had been "more activity in the past 12 months because Chinese groups believe they have this near-term window. ...They're trying to get a lot of M&A done before geopolitics gets difficult."

The above four paragraphs are all that are posted in the clear in this story that showed up in the Financial Times of London on Sunday. The rest of it is behind their paywall. I found it in a GATA dispatch -- and another link to it is here.

![]()

![]()

China Buys Gold For 8th Straight Month

The People’s Bank of China (PBOC) increased its gold reserves for the eighth consecutive month, bringing total holdings to 73.90 million ounces, up from 73.83 million ounces at the end of May and, surreptitiously, one of the world’s largest gold reserves.

This signals a deeper strategic shift that impacts far beyond bullion vaults, especially in the cryptocurrency space, and indicates it’s about more than just a metal obsession. The ongoing gold purchases by the PBOC go well beyond the traditional maxim, “buy gold when things get shaky.”

China is subtly reducing its reliance on the U.S. dollar. It’s a gamble against potential currency fluctuations and geopolitical instability. Digital assets tell the same story: hedge your bets, protect your wealth outside traditional finance, and stay strong when fiat fails.

The value of the Chinese yuan has appreciated. Divergent global monetary policies, trade disputes, and economic slowdowns have all contributed to the decline of the currency. A reserve rich in gold provides Beijing with greater flexibility.

This news story put in an appearance on the fxleaders.com Internet site on Monday -- and I found it on Sharps Pixley. Another link to it is here.

![]()

![]()

Insuring against a catastrophe that is certain -- Brian Lundin

I occasionally give presentations on gold and silver to audiences that aren’t familiar with the sector.

So I try to include as much of the basic rationale for owning the monetary metals, stressing that there are two distinct reasons to do so — as insurance and as an investment.

To illustrate the importance of the former, I present this chart showing the depreciation of the Roman denarius silver coin through the history of the empire...

Almost without exception, their reaction is something along the lines of “That’s interesting...but it could never happen here.”...to which I respond, it already has:

The realization that the U.S. dollar has experienced a loss of purchasing power that was almost identical to that of the Roman denarius — which was directly associated with the collapse of that empire — really wakes up an audience of investors who have never been aware of what has been happening around them.

The chart of the denarius is a bit misleading, as there are a few 60-year periods that mirror the experience of the last 60 years with the U.S. dollar.

In fact, my choice of 1965 as the starting point for the dollar chart above was not arbitrary: It is the date that silver was removed from U.S. coinage.

In other words, what took centuries for the denarius, was done with one fell swoop with the dollar!

This very interesting and very worthwhile commentary from Brien put in an appearance on the goldnewsletter.com Internet site on Monday -- and I found it on the gata.org website. Another link to it is here.

![]()

MEME of the DAY

![]()

The WRAP

After capping gold's rally attempt at the Globex open in New York on Sunday evening -- and then going through all the efforts to engineer its price lower until the noon silver fix in London, it was allowed to rally back above the unchanged mark for whatever reason by the time trading ended at 5:00 p.m. in New York yesterday.

On its 6-month chart below, gold shows that it was closed down $31.30 in the August contract, but that was only because the last candle on its 6-month chart below includes Friday's trading data as well. It's sitting a hair below market neutral on its 6-month chart.

And after dealing with silver's big price spike higher at the Globex open in New York on Sunday evening, the collusive commercial traders of whatever stripe made sure that it never got anywhere near the unchanged mark after that. It would have obviously closed well up on the day if 'da boyz' hadn't stepped on its price around 10:10 a.m. in COMEX trading in New York.

I was impressed that not only did the gold shares not sell off much at the 9:30 opens in New York, but that they actually closed up on the day. And I was even more impressed with the silver equities, as they closed higher by an even more impressive amount than the gold stocks. There's obviously some serious accumulation going on by some deep-pocket buyers these days -- and has to be seen as bullish in the extreme...especially considering the 'flag' patterns that are currently being painted/engineered in both these precious metals.

Platinum and palladium were also under price pressure by the collusive commercial traders of whatever stripe -- and would have closed up on the day, if they'd been allowed to trade freely. Both are still well above any moving averages that matter.

Copper closed down a nickel at $5.10/pound -- and still remains a goodly distance above its 50-day moving average -- and even further above its 200-day.

Natural gas [chart included] closed lower by an inconsequential 4 cents -- and finished the Monday session at $3.45/1,000 cubic feet. WTIC closed down 62 cents at $66.83/barrel...taking half of last Thursday's gains with it in the process.

Here are the 6-month charts for the Big 6+1 commodities...courtesy of stockcharts.com as always and, if interested, their COMEX closing prices in their current front months on Monday should be noted -- and it should also be noted that their Monday candles are net of [or include] Friday's price data as well. Click to enlarge.

As you saw in the headline to today's column -- and in the Bank Participation Report, the West's collusive bullion banks are short 49.7% of total open interest in silver -- and 48.3% of total open interest in gold in the COMEX futures market...which is where their respective prices are set.

The situation in silver is even made even more outrageous by the fact that one or more of these most likely U.S. based bullion banks also holds the lion's share of the 41.74 million troy ounce short position in SLV.

How long they can maintain their iron grip in silver remains to be seen. Gold has rallied considerably over the last number of years, despite the short position in it...so it's move higher is obviously been carefully managed. But the share price action in silver in silver appears to indicate accumulation by 'strong hands' that are trying to be as discrete as possible. Hopefully that's a sign of positive price action in silver in the not-too-distant future.

But if the banks weren't there 'making/rigging the market'...one could only fantasize about what they're respective prices might be already. As Ted Butler pointed out on several occasions over the years...'who died and left them in charge of setting their prices?' Of course the same can be said of the rest of the commodity complex as well.

Today, at the close of COMEX trading, is the cut-off for this Friday's Commitment of Traders Report -- and like I've been doing lately, I'm going to wait until I see Tuesday's candle on their respective 6-months charts above before I offer any comments about what might be in it.

![]()

![]()

And as I put the finishing touches on this week's first column, the London/ Zurich Globex opens are less than a minute away -- and I note that gold's sharp rally attempt at 6:00 p.m. in New York on Monday evening was capped and turned lower in short order -- and its quiet sell-off ended minutes after Shanghai opened. It has been wandering very quietly sideways since -- and is down $2.00 the ounce at the moment.

The Kitco feeds for silver, platinum and palladium didn't start until minutes after the Shanghai open. After a brief dip at that time, silver has struggled a bit higher -- and is up 5 cents as London opens. Platinum's sharp rally was squashed -- and 'da boyz' have it back at unchanged currently. Ditto for palladium, but it's still up 5 dollars as Zurich opens.

Gross gold volume is a bit under 31,500 contracts -- and minus current roll-over/switch volume out of August and into future months, net HFT gold volume is a bit over 28,500 contracts. Net HFT silver volume is a bit over 7,200 contracts -- and there are a minuscule 75 contracts worth of roll-over/switch volume in this precious metal at the moment.

The dollar index closed very late on Monday afternoon in New York at 97.48 -- and then opened lower by 11 basis points once trading commenced at 7:45 p.m. EDT on Monday evening...which was 7:45 a.m. China Standard Time on their Tuesday morning. It has chopped unevenly sideways since -- and as of 7:45 a.m. BST in London/8:45 a.m. CEST in Zurich, the index is down 10 basis points. Nothing to see here.

That's it for today, which is more than enough -- and I'll see you tomorrow.

Ed